A credit card grace period is the days between the billing date and the due date. During this period, no interest is charged on purchases if you pay your balance in full.

The grace period is typically given to newly purchased products rather than to services such as cash advances and transfers. For any of these purchases, interest will be charged from the date of occurrence unless they qualify for a particular 0 percent APR tease.

What is a Credit Card Grace Period?

The Credit Card Grace Card refers to the period between the issuance of a credit card statement and the due date, during which the consumer bears no interest for any purchase made on the card.

The grace period is the time that elapses between the time a consumer makes purchases through his/her credit card in the previous billing cycle and the time he/she is required to pay interest on the outstanding balance made during the current billing cycle.

It is only applicable if the consumer cleared his or her last credit card balance in full and timely and did not roll over a balance for any part of the preceding billing cycle.

Note: It is advisable to read the terms and conditions of your credit card and find out if it has a grace period.

How Long is a Typical Grace Period for a Credit Card?

A grace period normally ranges from 21 days to 55 days. Remember that having a credit card grace period does not mean that you have more time until the due date.

When you make partial payments, fail to make the necessary minimum payment on your credit card, or pay your bill after the due date, your credit card company will start charging interest on your balance.

In addition, you will incur late penalties if you fail to make a payment or make it after the due date.

To prevent interest payments, you must pay off your credit card balance in full before the payment due date. At the absolute least, you must make the minimum payment, and you will then be charged interest on any balance carried over to the next month.

| Tip: To maintain your grace period, make sure to pay your bills in full and on time each month. If you pay in full for some months but not others, you may lose your grace period for the month in which you do not pay in full and the following month. |

If you pay off your credit card amount every month during this grace period, you will avoid incurring interest on your purchases. However, the grace period usually only applies to new purchases, not cash advances, balance transfers, or special promotional deals.

Example of Credit Card Grace Period

| Let’s understand this with an example: If your billing cycle ends on May 31, your credit card statement detailing the amount due is issued on the same day. Assuming a 30-day grace period, your payment due date would be June 30. By paying the full balance within this timeframe, you can avoid any interest charges. |

How Long is the Grace Period On Credit Card?

Credit card lenders or companies must send cardholders their bills at least 21-25 days before payment is due. Sometimes, some credit cards consider those 21 days, as well as the time between when you made your purchases inside the billing cycle, to be a grace period if you have paid your previous balance in full. This means grace periods might last nearly two months.

How Does the Credit Card Grace Period Work?

To fully enjoy a grace period, you must understand the credit card’s billing cycle, the expense of carrying a debt, and how the lender charges interest on your purchases.

These key concepts assist in clarifying how grace periods work:

- Billing Cycle

Your credit card company establishes a billing cycle, which is typically one month long. Finally, your purchases are totaled and presented in a statement.

- Statement Generation

Your credit card provider generates a statement of your purchases at the end of each billing cycle that summarises the transactions completed during that time.

- Grace Period

The grace period begins on the day your statement is generated and normally lasts 21-25 days, depending on the credit card provider.

- Interest Fee

If you pay off your credit card amount in full by the due date during the grace period, you will not be charged interest on your transactions.

- Interest on Unpaid Balances

If you fail to pay the entire balance by the due date, the remaining balance will start to accrue inte

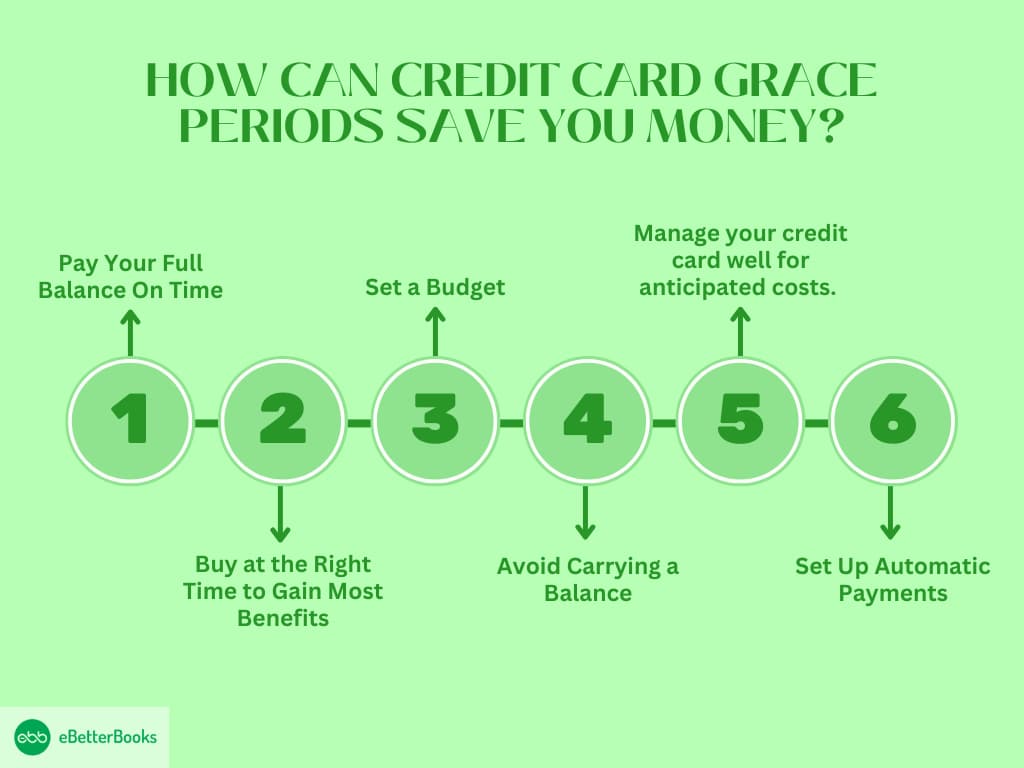

How Can Credit Card Grace Periods Save you Money?

If you are keen on maintaining your credit card balance, it is very important to make the most out of the grace period. If done with some thought, one can manage their cash flow and make the right usage of the credit card.

Here’s how to get the most out of your grace period:

1. Pay Your Full Balance On Time

The simplest way to avoid interest charges is to always make full payments for the amount charged on your statement by the due date. If you are unable to contribute the total amount, ensure that you contribute at least the minimum.

The balance will then attract an interest rate, as will any other purchase made after this. If you transfer lesser balances, then the interest you will be charged will also be reduced.

Example:

If your statement balance is $500 and your due date is the 25th of the month, by the due date, you must pay $500. Thus, you avoid interest charges that could come along the way if you have a line of credit.

However, if you pay only $250, interest will be charged on that amount and all purchases made after the date of the statement.

2. Buy at the Right Time to Gain Most Benefits

To maximize your grace period further, make your purchases at the start of a billing cycle. However, if you want to take much more time, you will have a full cycle with interest and a grace period.

For bigger purchases, this strategy could allow you to go up to two months without accruing interest.

Example:

Your account’s billing cycle ends on the 10th of the following month. If you purchase $200 and have the records that it reflects in your statement, the purchase attracts an interest-free period of 25 days from the 5th to the 30th.

For example, if you make the same $200 purchase on the 20th, those will count in your next cycle, and you get a full month + the interest grace period.

3. Set a Budget

Having a budget will allow you to control your purse strings well, enabling you to manage your credit card balance correctly. It is best to think of your credit card as an interest-free loan.

If the grace period is understood correctly, complete payment should be made on the statement balance before the grace period expires.

Example:

Let’s assume that you have $500 that you can spend as you please in a month. Thus, tracking your expenses allows you to use your credit card only for purchases within this limit and make a payment in full before the due date.

For instance, when you buy groceries worth $100 using your credit card, and you buy 200 worth of gas, you will be charged $300 in a statement, which can be paid by the due date to minimize interest charges.

4. Avoid Carrying a Balance

The key to making good use of the grace period is paying your bill in full every month. Even if you continue into the next month with a balance remaining, you may lose your grace period, and thus, interest will be added to any new purchases.

That only happens when you pay off your balance, which lets you retain the grace period you negotiated on your credit card.

Example:

Let’s say your statement balance is $300, but you manage to pay $100; the remaining balance is $200, which will be carried over to the next month. This balance will start incurring interest, and you will lose your grace period for new purchases.

On the other hand, paying up to $300 in full means that in the next cycle, you will not incur any additional interest on the balance or new products.

5. Effectively Manage your Credit Card for Expected Expenses

If you cannot control your urge to spend, it would be ideal to only use your credit card in situations where you already know you can pay up before the due date.

By sticking to the planned amount for each category, you will maximize your payments, ensuring they clear their balance, and you will not be charged any interest.

Example:

For instance, you might be considering a $400 plane ticket at the beginning of the month and are aware that you can afford to pay for it on the due date.

This enables its holder to charge any item that he or she wants on the credit card and make the full and timely repayment before the due date, hence avoiding any interest.

However, if you use the card to make random purchases, as you do not need to, your chances of repaying it in full may be strained.

6. Set Up Automatic Payments

To avoid being devoid of a grace period, it is prudent to make arrangements for auto payments of your statement balance.

This ensures that you pay your outstanding amount in full every month, even if you forget or are occupied.

Example:

If you know your statement balance is $400 and your due date is the 25th, automatic payment means that your card issuer will pay the stated balance before the due date.

This prevents you from forgetting to make a payment, so there is no need to incur extra interest charges.

How Can Grace Periods Maximize Your Credit Card Rewards?

The grace period comes between 21 to 25 days from the last date of your billing cycle and allows you to clear your balance before it starts to attract interest charges.

Here’s how you can use this feature to your advantage:

- Don’t Charge and Optimize Profit

Paying off your balance in full if you have the cash during the grace period helps prevent interest charges from devaluing your rewards.

For example, utilizing an incentive card like the Chase Sapphire Preferred® Card, which pays 3X points on Dining and 2X Points on Travel, earns you valuable points while keeping your spending interest-free if you pay off the balance before the due date.

- Time Big Purchases Wisely

Whenever you are planning a big purchase, try to time it until the billing cycle commences. This gives you the maximum time to pay it off within the grace period. This basically assists in giving the maximum time within the grace period to pay off what has been borrowed.

More easily, using credit cards like the Citi® Double Cash Card, which offers 2% cash back, 1% when you buy, and 1% when you pay, could double the rewards when using this strategy.

- Link Grace Periods with introductory APR Offers

Some cards, like the Wells Fargo Active Cash® Card, have no annual fees and include 0% APR introductory periods.

You also get 2% back on every purchase. By following the grace period curve to ensure the introductory APR has ended, you can always reap from those points without being charged interest.

- Optimize Category Rewards

Cards with bonus categories that change each quarter, such as the Discover it® Cash Back, enable their holders to charge up to 5% on certain items, such as groceries, gas, or even dining.

No value erodes for these rewards through interest charges when your balance is paid fully within the grace period.

- Redeem Points From Daily Purchases

Merchant purchases, such as food and electricity bills, can also contribute to the accrual of rewards, and charges apply if they settle before the grace period.

The Blue Cash Preferred® Card offers an enrollment bonus of $150 once you spend $1,000 in the first three months of opening the account. It also offers the following rewards: 6% cash back on up to $6,000 per year at US supermarkets.

This way, it becomes possible to protect all those bonuses, remain profitable, and pay the balance on time.

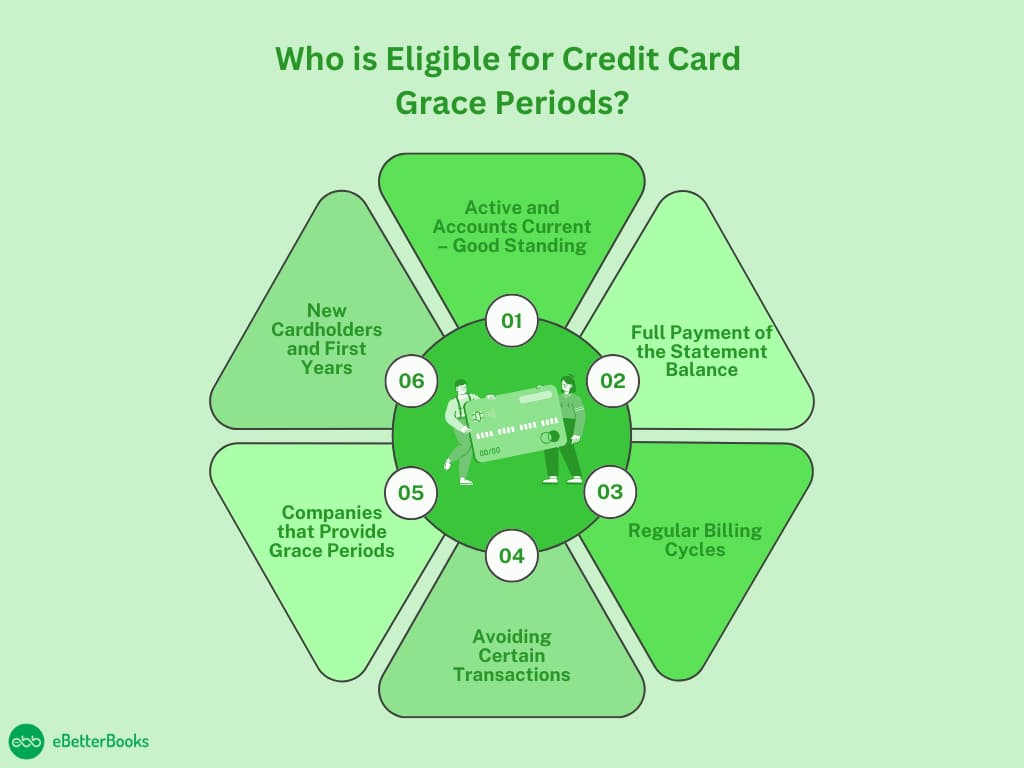

Who is Eligible for Credit Card Grace Periods?

A credit card grace period is one of the privileges that enable users to make purchases without accruing interest on the purchases so long as they pay the amounts owed before the due date. However, only some people are entitled to this kind of benefit right away. Not all cards are issued with a grace period, and here are factors that will determine if you are a beneficiary or not:

1. Active and Accounts Current – Good Standing

The first qualification for eligibility is that the credit card account you are qualifying must be open and not in default. As a result, you have to maintain an active, unblocked credit card with no overdue payments or complications, including chargebacks or defaults.

In this case, if your card is suspended or closed, for instance, due to non-payment or other issues, you are eliminated from accessing the grace period. It is also very important that you don’t go overboard with spending over your credit limit.

2. Full Payment of the Statement Balance

To be eligible for the grace period, you need to make your minimum statement balance payment by the stated date. The grace period only kicks in if you start a billing cycle with a $0 balance on your account.

If you leave any balance unpaid, you forfeit your grace period right, and interest begins to be charged on new purchases as soon as they are made. The consequence of paying only the minimum amount or of keeping a balance over the month will be interest charges.

3. Regular Billing Cycles

Most credit card companies go for monthly statements, and where your specific card operates within these regular cycles, you are allowed the grace period.

An ideal billing cycle is between 28 and 31 days, and from the close of the cycle, you are afforded some grace period between 21 and 25 days, within which you should pay your bill before incurring interest.

This is a supremacy of most credit card companies mandated by federal statute, though it is only valid when one does not carry over a balance from the previous cycle.

4. Avoiding Certain Transactions

It’s important to remember that grace periods do not include balance transfers, cash advances, or any other special occasions. Many of these transactions begin charging interest immediately while you are still in the grace period on new cash advances.

If you transfer a balance or get a cash advance, interest will be charged from the date of the transaction or the date the card was issued. Any grace period you may have for new purchases will not apply to this.

5. Companies that Provide Grace Periods

It is important to note that some credit cards do not allow a grace period. This feature, however, is not universal: most major credit card issuers offer it; however, some specific types of cards, like high-risk or secure credit cards, do not.

So, it’s wise to go through the terms and conditions of any credit card that you wish to apply for some time and check to ascertain whether the Credit card offers a grace period.

If the card does not have this feature, interest starts to be charged on the purchase as soon as one is made.

6. New Cardholders and First Years

Most consumers are eligible for the grace period when they sign up for a new credit card, but they should review the disclosures of introductory periods. Certain card companies are likely to provide an initial 0% APR on purchases for a set amount of months, in which you would not be charged any interest.

Yet the rules change after the first month, and as with any other credit card, the standard grace period applies. During this period, one must make a complete payment of the balance to avoid interest.

Here are the types of transactions and the grace period eligibility criteria…

| Types of Transactions | Eligible for Grace Period | Notes |

| New Purchase | Yes | There is no interest if the full balance is paid on time. |

| Cash Advance | No | Interest starts immediately. |

| Balance Transfer | No | It often has its own interest rates. |

| Special Promotion | Card Specific | Check specific terms. |

What Can Cause You to Lose Your Grace Period?

There are several reasons you may lose eligibility for a grace period, including:

- Carrying a Balance: If you can’t clear the amount in full, the grace period is removed, and any new purchases will attract interest charges immediately.

- Late Payments: Failure to make the payment or paying an amount below the minimal required sum initiates the grace period and penalties, such as fees for lateness.

- Certain Transactions: It is important to note that balance transfers, cash advances, and similar operations do not usually qualify for this grace period, and they attract interest from the day the transfer is made.

The Impact of Grace Periods on Other Debt

Grace periods are useful for many types of debt because they imply that the debtor has a certain period during which he/she does not need to make payments.

These periods allow borrowers more time to make the payments without attracting penalties or having their credit rating affected. However, they may be different, as they depend on the kind of debt one has and the policies of the credit company.

Student Loans

Grace Period: 6 months (for federal loans usually)

Details: Federal student loans allow, for example, a grace period of six months after graduation. Indeed, during this period, borrowers do not have to pay back any loans. This time provides an opportunity for graduates to get a job or make other preparations before starting to pay back the loans. Nevertheless, interest may continue to be charged on certain loans (such as unsubsidized federal loans).

Mortgages

Grace Period: 10-15 days

Details: Most mortgage creditors offer a brief period of forbearance, which ranges between 10 and 15 days after the due date. This means that if a mortgage payment is made during this period, no penalty charge is added. Nonetheless, the borrower should be cautious that even during the grace period, interest continues to build up, and payments in default after the grace period are deemed past due.

Auto Loans

Grace Period: 10-15 days

Details: Like mortgages, auto loans are normally accompanied by a brief grace period. Borrowers can be offered a grace period of 10 to 15 days before they are charged for late payment. Although this may help, it slows, and interest keeps piling up. Once the grace period is over, the loan is deemed past due.

Personal Loans

Grace Period: 15-30 days

Details: A personal loan may also include a grace period, usually 15 – 30 days, depending on the nature of the loan. If a payment is made during this period, no penalty fee is incurred. However, interest does not cease to grow, and the grace period is aimed only at sparing borrowers from immediate consequences.

Payday Loans

Grace Period: Varies (may offer extensions)

Details: Some payday lenders allow the borrower to roll over the loan or give extra time to pay it. However, such extensions always attract other costs in addition to having a relatively high interest rate. Payday loans are often short-term, and if the amount borrowed is not repaid at the agreed-upon time, then the lender will roll it over, but this will be at a higher interest rate.

Situations Where Your Credit Card Grace Period Pays You Off!

| Situations | Example | How the Grace Period Works |

Buying Smart for Large Purchases | If you buy a $1200 laptop during the start of the billing bicycle, you have a 25-day grace period to pay off your bill. | The grace period here helps you pay off your laptop bill in 2 months so that you can avoid interest and allow extra time to gather funds. |

Managing a Tight Month | The bills for the month are higher than expected, and you need to wait until the next month’s paycheck. | The 25-day grace period allows you to cover immediate needs now and pay next month, avoiding interest and maintaining flexibility for urgent expenses. |

Covering Emergency Expenses | Your car was hit by an accident, and you need an emergency fund of $700 for replacement purposes. | The grace period lets you cover the repair now and pay off the balance by the due date, avoiding stress and interest on an unexpected expense. |

Maximizing Cash Flow | You booked a $1000 vacation during the billing cycle, and then you have 25 days of grace period. | This allows you to pay off the vacation cost after you return, giving you nearly two months to enjoy your trip and budget without immediate out-of-pocket costs. |

The Bottom Line

It is important to be aware of how grace periods and credit card rewards are useful so that you can take advantage of some key benefits. Paying your balance in full within that grace period means that you can avoid interest charges while getting reward points for charges.

This strategy not only adds more value to the rewards you offer but also plays an important role in improving your creditworthiness.

The golden rule when using the card is to avoid hasty payments and take full advantage of the grace period to understand your debts on the credit card.

Frequently Asked Questions

What happens if you don’t pay your entire balance?

If you are unable to make the whole payment by the due date, you must make at least the minimum payment—or more, if possible. If you lose the grace period, you have to pay interest, but you won’t pay a late fee.

How long is the grace period for your credit card?

The grace period for a credit card typically lasts from 21 days to 25 days. You can ask for your grace period by checking your cardholder agreement. The grace period duration comes with the fee and annual percentage rate (APR). Apart from checking your agreement, you can also call your lender’s helpline and ask about the grace period directly.

Does a grace period work with credit card cash advances?

The credit card grace period is only applicable with purchases. Cash advances do not qualify for the grace period. Cash advances can incur with the interest immediately when in use.

Which credit card does have a grace period?

Whether it is the major credit card issuer or the smaller one, it gives you a grace period at the time of paying your statement balance in full by the due date. This is mandatory to provide a grace period to the cardholder.

-

QuickBooks Error Code 195 – Solve Easily!

QuickBooks Error Code 195 occurs when the software fails to connect with your bank’s online servers, preventing transaction updates and synchronization. This issue often stems…

-

Troubleshooting QuickBooks Error Code 80070057 (The Parameter is Incorrect)

QuickBooks Error 80070057 disrupts workflows when trying to open a company file, usually due to network communication issues or insufficient permissions. This article guides you…

-

How to Fix QuickBooks Company File Incorrect Password Issues?

The QuickBooks company file incorrect password issue represents a significant access barrier, typically caused by incorrect credential entry, administrative password changes, or network conflicts. To…

-

Fix “Error Connection Has Been Lost in QuickBooks”

The “Connection Has Been Lost” error in QuickBooks disrupts access to your company file, causing potential data loss. This issue can arise due to file…

-

How to Fix QuickBooks Unable to Backup Company File Error?

If you’re facing issues backing up your QuickBooks company file, it could be due to various factors like incorrect file path, large file size, corrupted…

-

Most Common QuickBooks Company File Errors & Issues – Process of Fixing Them

This article addresses common QuickBooks company file issues, such as password problems, file corruption, and backup errors, which can disrupt your business operations. It guides…

-

How To Undo A Reconciliation In QuickBooks Online?

Reversing a faulty reconciliation in QuickBooks Online is a controlled process required when recorded balances do not match financial statements, impacting the account’s beginning balance…

-

How to Resolve QuickBooks is Unable to Verify the Financial Institution Information?

If you’re encountering the error “QuickBooks is unable to verify the Financial Institution Information,” it usually means that QuickBooks is unable to recognize a bank…

-

Fix QuickBooks Unable to Connect with HSBC Bank?

The article helps resolve the issue of QuickBooks failing to connect with HSBC Bank, preventing the smooth entry of your financial data. It offers practical…

-

How to Resolve the QuickBooks Online Error 101 – Banking Connection Error?

QuickBooks Online Error 101, often caused by issues with web applications, outdated Windows components, or poor internet connectivity, can block your bank feeds. This article…

-

Fix Error 9999 When Updating Bank Transactions in QuickBooks Online

QuickBooks Banking Error 9999 disrupts the connection between your bank and QuickBooks Online, preventing bank transactions from updating. This error is often caused by poor…

-

How to Resolve QuickBooks Error OLSU 1013 Bank Feed Not Working?

QuickBooks Error OLSU 1013: Problem and Solution The article addresses QuickBooks Error OLSU 1013, a banking error that disrupts connections between QuickBooks and financial institutions,…

-

How to Troubleshoot QuickBooks Error 108 (Online Banking Error)?

QuickBooks Error 108 is a banking issue that arises when your bank blocks the connection with QuickBooks due to unresolved notifications, incorrect credentials, or technical…

-

How to Fix QuickBooks Error 103 Due to An ID or password Issue?

QuickBooks Error 103 occurs when your banking credentials in QuickBooks Online (QBO) fail to match those of your financial institution, disrupting transaction updates and bank…

-

How to Fix QuickBooks Banking Error 185: Simple 4 Ways?

QuickBooks Error 185 arises due to multi-factor authentication requirements or connectivity issues, impacting secure access to financial data. This guide helps users troubleshoot effectively, offering…

-

QuickBooks Banking Error Code 105 – How to Fix It?

QuickBooks Error 105 occurs when the software fails to connect with your bank’s server, disrupting transaction retrieval and financial workflows. This issue stems from server…

-

Rectify QuickBooks Banking Error 102 with Simple Solutions

QuickBooks Error 102 disrupts banking integration by failing to connect with the bank’s server due to server maintenance, connectivity issues, or incorrect credentials. To resolve,…

-

How to Fix QuickBooks Bank Feeds Not Working Issue?

Facing issues with QuickBooks Bank Feeds can disrupt accurate financial tracking, leading to incorrect bank balances and decision-making errors. This guide addresses problems like outdated…

-

How to Resolve QuickBooks Bank Feed Not Working After Upgrade Issue?

QuickBooks Bank Feed simplifies bank transaction management by connecting your bank accounts to QuickBooks, automating data synchronization, and categorizing transactions to ensure accurate records. This…

-

QuickBooks Bank Reconciliation Problems & Issues

The article addresses common QuickBooks reconciliation issues, helping users resolve problems like unmatched bank balances, unreconciled months, missing transactions, or discrepancies in beginning balances. It…

-

How to Fix Lowe’s Synchrony Card Login Issues in QuickBooks?

Login and connectivity issues between the Lowe’s Synchrony Bank Card and QuickBooks often stem from bank-side security protocol changes or the card’s specific account type…

-

Most Common Banking Issues with QuickBooks Software & Process of Fixing Them

Resolving persistent QuickBooks banking errors, such as Error 9999 (temporary server) or Error 103 (login credentials), requires a systematic approach focusing on validation outside of…

-

QuickBooks Errors & Their Support

This article addresses a comprehensive range of QuickBooks errors—update issues, company file problems, printing errors, multi-user mode challenges, payroll discrepancies, installation issues, and more. It…

-

How to Install and Use QuickBooks Database Server Manager (QBDSM)?

The QuickBooks Database Server Manager (QBDSM) is a critical utility installed exclusively on the host server machine to enable multi-user access for QuickBooks Desktop. Its…

-

How to Run & Use Quick Fix My Program

Quick Fix My Program, part of the QuickBooks Tool Hub, is designed to quickly resolve common errors preventing QuickBooks from running properly. It addresses issues…

-

How to Download and Run the QuickBooks Refresher Tool?

The QuickBooks Refresher Tool is designed to quickly address issues within QuickBooks Desktop, including unresponsiveness, installation errors, and performance lags. It saves time by efficiently…

-

Recover Data Using QuickBooks Auto Data Recovery Tool

QuickBooks Auto Data Recovery Tool helps recover lost business data by using transaction log files (.TLG) and backup files (.QBW). It efficiently restores recent transactions,…

-

Reinstall QuickBooks Desktop Using QuickBooks Clean Install Tool

Reinstalling QuickBooks Desktop using the Clean Install Tool is the definitive, expert-level solution for persistent installation and corruption errors that a standard uninstall cannot resolve.…

-

Resolve Company File & Network Errors with QuickBooks File Doctor Tool

The QuickBooks File Doctor is a vital tool for resolving errors and network issues within QuickBooks. It repairs damaged company files and addresses common errors…

-

How to Download and Install QuickBooks File Doctor Tool Using Tool Hub?

The QuickBooks File Doctor Tool is a critical diagnostic utility designed by Intuit to resolve common issues in QuickBooks Desktop, particularly company file data damage,…

-

How to Download & Install QuickBooks Connection Diagnostic Tool?

The QuickBooks Connection Diagnostic Tool is a must-have for QuickBooks desktop users facing network-related issues, such as errors when accessing company files or database connectivity…

-

Fix Installation Errors with QuickBooks Install Diagnostic Tool

Fixing QuickBooks installation errors often requires the use of the specialized QuickBooks Install Diagnostic Tool, which is designed to automate the repair of core system…

-

Complete Guide to QuickBooks Tool Hub – Download, Installation, and Use

The QuickBooks Tool Hub is an essential, free, centralized application developed by Intuit to resolve common technical issues encountered in QuickBooks Desktop, including company file…

-

FreeAgent to QuickBooks Data Conversion

eBetterBooks simplifies the transition from FreeAgent to QuickBooks, providing precise, secure, and seamless data migration for businesses. By automating accounting tasks, QuickBooks enhances efficiency, reduces…

-

Foundation to QuickBooks Conversion

Streamline your transition from Foundation to QuickBooks with eBetterBooks, ensuring precise, secure, and efficient data migration. Gain access to QuickBooks’ user-friendly interface, robust features, and…

-

How to Convert QuickBooks Desktop to Online

The article addresses the problem of transitioning from QuickBooks Desktop to QuickBooks Online, offering step-by-step guidance for seamless data migration. It highlights the benefits of…

-

Epicor to QuickBooks Data Conversion Service

Seamlessly migrate from Epicor to QuickBooks to resolve complex ERP challenges with a user-friendly interface, enhanced reporting, and robust inventory management. QuickBooks offers scalable, industry-specific…

-

Macola to QuickBooks Data Conversion Service

Switch from Exact Macola to QuickBooks with eBetterBooks’ seamless data conversion services, designed to enhance business financial management. Gain control over finances with QuickBooks’ advanced…

-

DacEasy To QuickBooks Data Conversion Service

Switch seamlessly from DacEasy to QuickBooks with eBetterBooks’ expert data conversion services. This solution addresses DacEasy’s limitations, including discontinued support and restricted features, by offering…

-

Convert Cougar Mountain to QuickBooks

Switch seamlessly from Cougar Mountain to QuickBooks with eBetterBooks, resolving complex data migration challenges efficiently. By simplifying financial processes, QuickBooks enhances bookkeeping, invoicing, and reporting…

-

Sage Business Works to QuickBooks Conversion

Effortlessly transition from Sage BusinessWorks to QuickBooks with eBetterBooks’ data conversion services. Addressing compatibility issues and manual effort, this solution ensures seamless migration, retaining crucial…

-

Adagio to QuickBooks Conversion Service

The article focuses on solving the problem of transitioning from Adagio accounting software to QuickBooks. It highlights how QuickBooks offers better workflow automation, advanced financial…

-

Accpac to QuickBooks Data Conversion

If you’re looking to transition from ACCPAC to QuickBooks, eBetterBooks offers a fast, secure, and cost-effective data conversion service. Migrate essential financial data like transactions,…

-

Acumatica to QuickBooks Conversion

Migrate your business data effortlessly from Acumatica to QuickBooks with eBetterBooks, ensuring optimized growth and financial accuracy. This seamless transition allows you to retain key…

-

System Requirements For All QuickBooks Desktop Versions (Pro, Premier, Enterprise & Mac)

Ensuring system compatibility is crucial for stable and optimal performance across all QuickBooks Desktop (QBDT) versions, including Pro, Premier, and Enterprise. Recent versions, such as…

-

QuickBooks Desktop Pro 2024 (Download, Up-to 3 Users)

QuickBooks Desktop Pro 2024 is a comprehensive accounting solution designed for businesses needing robust local control over their finances, handling core functions like invoicing, expense…

-

Sage 100 to QuickBooks Conversion

Migrating from Sage100 to QuickBooks simplifies your financial management with a seamless data transfer process, ensuring minimal downtime. Enjoy advanced features like customizable integrations, powerful…

-

Migrate Data From FreshBooks To QuickBooks

Switch from FreshBooks to QuickBooks with eBetterBooks for a seamless and reliable data conversion experience. QuickBooks offers advanced accounting features, customizable tools, robust inventory management,…

-

QuickBooks Online to Desktop Conversion

If you’re looking to transition from QuickBooks Online to QuickBooks Desktop, this guide offers an easy and efficient way to migrate your data. With QuickBooks…

-

QuickBooks Server & Network Issues & Process of Fixing Them

This page addresses common QuickBooks server and network issues, helping users troubleshoot problems like email configuration errors, synchronization failures, and installation or update issues. By…

-

QuickBooks Desktop Support Services | Data Conversion, Payroll, Integration, Errors & More

Need help with QuickBooks? Whether it’s for bookkeeping, payroll, or resolving technical issues, contacting QuickBooks support is easy. By logging into your account and using…

-

Upgrade Your QuickBooks Version to QuickBooks Desktop 2024 (Pro, Premier, Accountant, Enterprise)

This guide provides clear instructions for upgrading to QuickBooks Desktop 2024, offering users enhanced features like better cash flow management, faster performance, and team collaboration…

-

QuickBooks Desktop 2024 : New Features, Pricing, Benefits and Integration

QuickBooks Desktop 2024 enhances accounting efficiency with upgraded features designed to streamline tasks for businesses of all sizes. It improves data security, boosts productivity, and…

-

Download QuickBooks Desktop 2024 : (Pro, Premier, Accountants & Enterprise)

Successful deployment of QuickBooks Desktop 2024 requires a preparatory review of system specifications and a clear understanding of the installation process specific to the business…

-

Download QuickBooks Desktop – Upgrade to a New Desktop Version

QuickBooks Desktop 2024 introduces a significant architectural shift to 64-bit processing, delivering enhanced data security and up to 38% faster performance for complex accounting tasks.…

-

Peachtree to QuickBooks Conversion

If you’re looking to migrate your data from Peachtree to QuickBooks, eBetterBooks offers a hassle-free solution. We ensure smooth, accurate data conversion, covering key business…

-

Sage MAS 90 to QuickBooks Conversion

Seamlessly transition from Sage MAS 90 to QuickBooks with accurate data conversion tailored to meet your business growth needs. This process ensures minimal disruption while…

-

AccountEdge to QuickBooks Conversion

Migrate from AccountEdge to QuickBooks for a seamless transition to automated payment reminders, better inventory management, customized access, and enhanced financial reporting. QuickBooks offers superior…

-

MYOB to QuickBooks Conversion

Switch from MYOB to QuickBooks with eBetterBooks for a seamless and secure data migration. Enjoy advanced automation, flexible inventory management, robust reporting, and easy integration…

-

Xero to QuickBooks Data Conversion

Switching from Xero to QuickBooks with eBetterBooks ensures a seamless, accurate, and hassle-free data migration. This service solves the challenge of transitioning accounting systems by…

-

Microsoft Dynamics to QuickBooks Data Conversion

Seamlessly migrate from Microsoft Dynamics to QuickBooks with eBetterBooks’ expert data conversion services. Our team ensures secure data transfer, tailored to your business needs, and…

-

Wave to QuickBooks Conversion Service

Switch from Wave to QuickBooks to streamline financial management and empower your business growth. QuickBooks offers enhanced efficiency with automation, insightful reporting, seamless integration, scalability,…

-

Sage 50 to QuickBooks Data Conversion

Effortlessly convert your Sage 50 data to QuickBooks with eBetterBooks’ expert services, ensuring a smooth, fast, and accurate transition. Our team ensures precise mapping and…

-

NetSuite to QuickBooks Data Conversion Services

Migrate from NetSuite to QuickBooks for a cost-effective, user-friendly accounting solution. QuickBooks offers seamless integration, advanced reporting, and customizable features for businesses of all sizes.…

-

Fix QuickBooks Error 3371 Status Code 11118 – Could Not Load the License Data

QuickBooks Error 3371 Status Code 11118 occurs when the software cannot load its license configuration due to corrupted or missing entitlement files such as EntitlementDataStore.ecml…

-

How to Resolve QuickBooks Error 7149 (Runtime Error)?

QuickBooks Error 7149 disrupts the software’s performance, often due to registry issues, corrupted files, malware, or conflicting programs. To resolve this, you can repair or…

-

How to Fix QuickBooks Error 1601 – Java Error 1601 Windows 7

QuickBooks Error 1601 occurs when the Windows Installer service becomes inaccessible, preventing the installation or update of QuickBooks Desktop. This issue generally arises from corrupted…

-

How to Fix QuickBooks Update Error 1603? [Install or Update HTML Error]

QuickBooks Error 1603 typically arises due to installation or update file issues, often caused by system crashes, improper shutdowns, or missing components like Microsoft .NET…

-

How to Fix QuickBooks Error 1904 IcWrapper.dll Failed to Register?

QuickBooks Error 1904 (IcWrapper.dll failed to register) occurs during the installation of QuickBooks Desktop when critical system components such as Microsoft Visual C++ Redistributable, Microsoft…

-

How to Fix QuickBooks Sync Manager Not Working Error? – Resolved

Addressing the “QuickBooks Sync Manager Not Working Error” involves specific, file-level troubleshooting applicable only to legacy, unsupported versions of QuickBooks Desktop, as the Sync Manager…

-

How to Resolve QuickBooks Error 1935?

QuickBooks Error 1935 occurs during installation when the required .NET framework is missing or corrupted. This error can disrupt your QuickBooks setup and performance, often…

-

How to Resolve QuickBooks Error Code 404 – Page Not Found Error

QuickBooks Error Code 404 is a runtime and network synchronization error that occurs when QuickBooks Desktop fails to establish a stable connection with Intuit servers…

-

How to Fix Unrecoverable Error in QuickBooks Desktop – [Updated Methods]

Fixing the QuickBooks Unrecoverable Error, a severe system exception marked by a 10-digit code, requires a systematic troubleshooting approach to isolate the root cause, which…

-

How to Resolve QuickBooks Error 1712 Due to Missing Windows Components?

QuickBooks Error 1712 occurs during the installation of QuickBooks Desktop, often due to damaged files or missing system components. This error can lead to installation…

-

How to Fix QuickBooks Error 4120?

QuickBooks Error 4120 can disrupt your workflow due to corrupted files, malware, or improper installation. This guide walks you through practical solutions like clearing system…

-

How to Fix QuickBooks Error Code 1406 (An Installation Issue)?

QuickBooks Error 1406 disrupts installation and updates due to issues like insufficient system permissions, corrupted registries, or interference from antivirus software. To resolve this, disable…

-

How to Fix QuickBooks Update Error Code 1328 While Updating File?

QuickBooks Error 1328 can disrupt your update, installation, or repair processes due to corrupt files or system issues. This article provides actionable solutions, such as…

-

How to Fix QuickBooks Error Code C=1327 (Invalid Drive Letter)

QuickBooks Error 1327 occurs during installation, typically caused by issues with storage devices, corrupted .NET Framework, or incorrect registry settings. This error prevents successful installation…

-

How To Fix QuickBooks Script Error While Accessing QB Desktop?

QuickBooks Script Error can disrupt your workflow, preventing access to essential web pages and causing performance issues in QuickBooks. This error, often linked to Internet…

-

How to Resolve QuickBooks Runtime Error?

Struggling with QuickBooks Runtime Error while using the software? This article offers quick, effective solutions to fix it, including renaming the QBW.INI file, rebooting your…

-

How to Fix QuickBooks Error 3008 Due to an Unknown Malware Attack on the System?

QuickBooks Error 3008 occurs due to issues like invalid or corrupted certificates caused by malware, disrupting user access to company files and essential features. This…

-

How to Fix QuickBooks Error 1722 – System Error Code

QuickBooks Error 1722 typically arises during payroll updates or installation, causing issues like program crashes or system freezes. This error often points to incomplete installations,…

-

QuickBooks Data Conversion

Looking to switch to QuickBooks? Our expert Data Conversion Services ensure a seamless transition from any platform to QuickBooks, eliminating the hassle. With dedicated support,…

-

Refund Policy

Our annual subscription ensures full support for all services. If you face any issues within the first 7 days, we’ll work to resolve them, and…

-

Tools

QuickBooks offers powerful troubleshooting tools to resolve common technical issues and optimize your accounting experience. From the Conversion Tool that simplifies data migration to the…

-

Bookkeeping Services Charlotte

eBetterBooks provides affordable, reliable bookkeeping services in Charlotte, ensuring your financial records are accurate and up-to-date. With monthly reports, tax filing, and real-time updates, their…

-

Outsourced Bookkeeping Services San Antonio

eBetterBooks provides reliable outsourced bookkeeping services in San Antonio, offering accurate financial reporting, tax preparation, and cloud-based data storage. With services starting at $49/month, businesses…

-

Bookkeeping Services San Diego

eBetterBooks offers affordable, reliable bookkeeping services in San Diego, designed to streamline your finances and tax preparation. Starting at just $49 per month, their services…

-

Bookkeeping Services San Jose

eBetterBooks offers efficient, cloud-based bookkeeping services in San Jose to help small businesses stay organized and stress-free. Their services include monthly bookkeeping, tax filing, and…

-

Bookkeeping Services Jacksonville

eBetterBooks provides affordable and professional bookkeeping services in Jacksonville, helping small businesses with monthly bookkeeping, tax preparation, and financial reporting. Their advanced software ensures accuracy…

-

Bookkeeping Services Columbus

eBetterBooks provides reliable, affordable bookkeeping services in Columbus, OH, helping small businesses manage their finances efficiently. With services starting at just $49/month, they offer real-time…

-

Bookkeeping Services Indianapolis

eBetterBooks offers affordable, accurate bookkeeping services in Indianapolis to help businesses stay organized and tax-ready. With plans starting at $49/month, they provide general ledger, balance…

-

Bookkeeping Services Seattle

eBetterBooks offers reliable bookkeeping services in Seattle, simplifying financial management for small businesses. With monthly bookkeeping, tax filing, and real-time data syncing, eBetterBooks ensures accurate…

-

Bookkeeping Services Detroit

eBetterBooks offers professional, cloud-based bookkeeping services in Detroit, helping businesses efficiently track financial transactions and make informed decisions. With features like real-time data updates, tax-coded…

-

Bookkeeping Services Phoenix

eBetterBooks offers affordable and accurate bookkeeping services in Phoenix for small businesses. Their cloud-based solutions provide seamless access to financial data, ensuring timely and accurate…

-

Bookkeeping Services San Francisco

eBetterBooks provides efficient, cloud-based bookkeeping services in San Francisco for small businesses, offering automatic transaction updates and tax-ready financials. Their services streamline accounting, payroll, and…

-

Bookkeeping Services Washington DC

eBetterBooks offers seamless and efficient bookkeeping services in Washington, DC, designed to simplify financial management for businesses of all sizes. Their automated process pulls transaction…

-

Outsourced Bookkeeping Services Austin

eBetterBooks offers top-notch outsourced bookkeeping services in Austin, providing real-time financial management solutions tailored to your business. By automating processes, ensuring accurate monthly reports, and…

-

Bookkeeping Services Philadelphia

eBetterBooks offers professional bookkeeping services in Philadelphia, providing solutions tailored to small businesses and individuals. Their services include financial reporting, tax preparation, and accounts management,…

-

Bookkeeping Services Nashville

eBetterBooks offers affordable, efficient bookkeeping services in Nashville, designed to help small businesses save time and money. With real-time, cloud-based accounting, tax-ready books, and expert…