A credit card grace period is the days between the billing date and the due date. During this period, no interest is charged on purchases if you pay your balance in full.

The grace period is typically given to newly purchased products rather than to services such as cash advances and transfers. For any of these purchases, interest will be charged from the date of occurrence unless they qualify for a particular 0 percent APR tease.

What is a Credit Card Grace Period?

The Credit Card Grace Card refers to the period between the issuance of a credit card statement and the due date, during which the consumer bears no interest for any purchase made on the card.

The grace period is the time that elapses between the time a consumer makes purchases through his/her credit card in the previous billing cycle and the time he/she is required to pay interest on the outstanding balance made during the current billing cycle.

It is only applicable if the consumer cleared his or her last credit card balance in full and timely and did not roll over a balance for any part of the preceding billing cycle.

Note: It is advisable to read the terms and conditions of your credit card and find out if it has a grace period.

How Long is a Typical Grace Period for a Credit Card?

A grace period normally ranges from 21 days to 55 days. Remember that having a credit card grace period does not mean that you have more time until the due date.

When you make partial payments, fail to make the necessary minimum payment on your credit card, or pay your bill after the due date, your credit card company will start charging interest on your balance.

In addition, you will incur late penalties if you fail to make a payment or make it after the due date.

To prevent interest payments, you must pay off your credit card balance in full before the payment due date. At the absolute least, you must make the minimum payment, and you will then be charged interest on any balance carried over to the next month.

| Tip: To maintain your grace period, make sure to pay your bills in full and on time each month. If you pay in full for some months but not others, you may lose your grace period for the month in which you do not pay in full and the following month. |

If you pay off your credit card amount every month during this grace period, you will avoid incurring interest on your purchases. However, the grace period usually only applies to new purchases, not cash advances, balance transfers, or special promotional deals.

Example of Credit Card Grace Period

| Let’s understand this with an example: If your billing cycle ends on May 31, your credit card statement detailing the amount due is issued on the same day. Assuming a 30-day grace period, your payment due date would be June 30. By paying the full balance within this timeframe, you can avoid any interest charges. |

How Long is the Grace Period On Credit Card?

Credit card lenders or companies must send cardholders their bills at least 21-25 days before payment is due. Sometimes, some credit cards consider those 21 days, as well as the time between when you made your purchases inside the billing cycle, to be a grace period if you have paid your previous balance in full. This means grace periods might last nearly two months.

How Does the Credit Card Grace Period Work?

To fully enjoy a grace period, you must understand the credit card’s billing cycle, the expense of carrying a debt, and how the lender charges interest on your purchases.

These key concepts assist in clarifying how grace periods work:

- Billing Cycle

Your credit card company establishes a billing cycle, which is typically one month long. Finally, your purchases are totaled and presented in a statement.

- Statement Generation

Your credit card provider generates a statement of your purchases at the end of each billing cycle that summarises the transactions completed during that time.

- Grace Period

The grace period begins on the day your statement is generated and normally lasts 21-25 days, depending on the credit card provider.

- Interest Fee

If you pay off your credit card amount in full by the due date during the grace period, you will not be charged interest on your transactions.

- Interest on Unpaid Balances

If you fail to pay the entire balance by the due date, the remaining balance will start to accrue inte

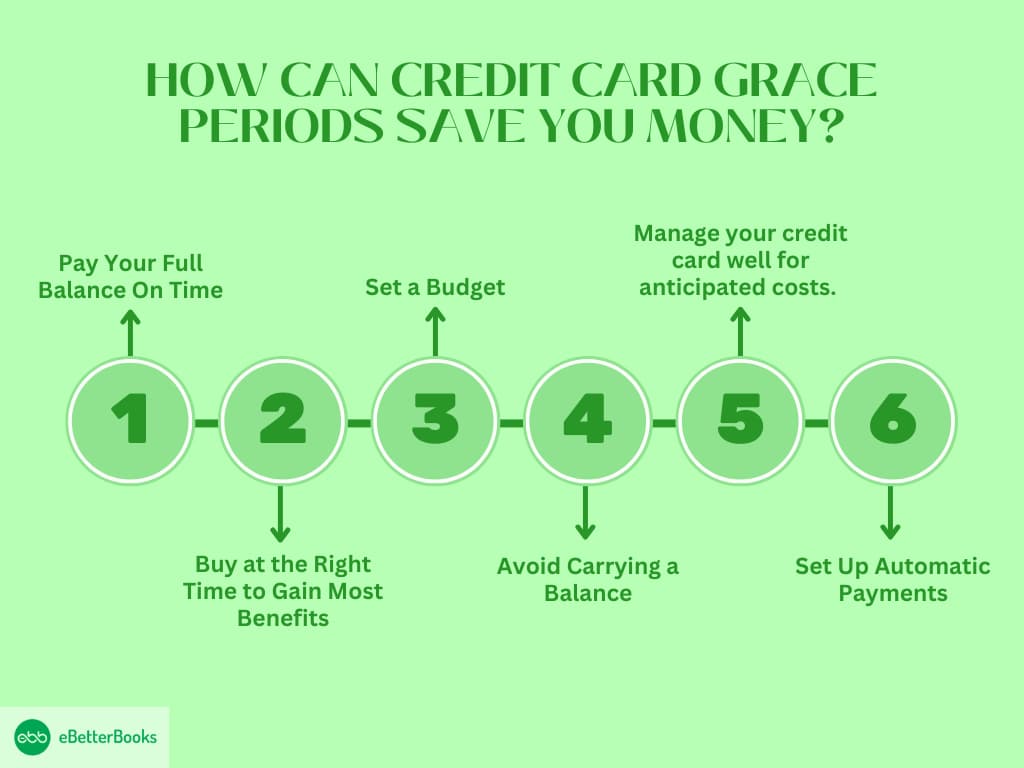

How Can Credit Card Grace Periods Save you Money?

If you are keen on maintaining your credit card balance, it is very important to make the most out of the grace period. If done with some thought, one can manage their cash flow and make the right usage of the credit card.

Here’s how to get the most out of your grace period:

1. Pay Your Full Balance On Time

The simplest way to avoid interest charges is to always make full payments for the amount charged on your statement by the due date. If you are unable to contribute the total amount, ensure that you contribute at least the minimum.

The balance will then attract an interest rate, as will any other purchase made after this. If you transfer lesser balances, then the interest you will be charged will also be reduced.

Example:

If your statement balance is $500 and your due date is the 25th of the month, by the due date, you must pay $500. Thus, you avoid interest charges that could come along the way if you have a line of credit.

However, if you pay only $250, interest will be charged on that amount and all purchases made after the date of the statement.

2. Buy at the Right Time to Gain Most Benefits

To maximize your grace period further, make your purchases at the start of a billing cycle. However, if you want to take much more time, you will have a full cycle with interest and a grace period.

For bigger purchases, this strategy could allow you to go up to two months without accruing interest.

Example:

Your account’s billing cycle ends on the 10th of the following month. If you purchase $200 and have the records that it reflects in your statement, the purchase attracts an interest-free period of 25 days from the 5th to the 30th.

For example, if you make the same $200 purchase on the 20th, those will count in your next cycle, and you get a full month + the interest grace period.

3. Set a Budget

Having a budget will allow you to control your purse strings well, enabling you to manage your credit card balance correctly. It is best to think of your credit card as an interest-free loan.

If the grace period is understood correctly, complete payment should be made on the statement balance before the grace period expires.

Example:

Let’s assume that you have $500 that you can spend as you please in a month. Thus, tracking your expenses allows you to use your credit card only for purchases within this limit and make a payment in full before the due date.

For instance, when you buy groceries worth $100 using your credit card, and you buy 200 worth of gas, you will be charged $300 in a statement, which can be paid by the due date to minimize interest charges.

4. Avoid Carrying a Balance

The key to making good use of the grace period is paying your bill in full every month. Even if you continue into the next month with a balance remaining, you may lose your grace period, and thus, interest will be added to any new purchases.

That only happens when you pay off your balance, which lets you retain the grace period you negotiated on your credit card.

Example:

Let’s say your statement balance is $300, but you manage to pay $100; the remaining balance is $200, which will be carried over to the next month. This balance will start incurring interest, and you will lose your grace period for new purchases.

On the other hand, paying up to $300 in full means that in the next cycle, you will not incur any additional interest on the balance or new products.

5. Effectively Manage your Credit Card for Expected Expenses

If you cannot control your urge to spend, it would be ideal to only use your credit card in situations where you already know you can pay up before the due date.

By sticking to the planned amount for each category, you will maximize your payments, ensuring they clear their balance, and you will not be charged any interest.

Example:

For instance, you might be considering a $400 plane ticket at the beginning of the month and are aware that you can afford to pay for it on the due date.

This enables its holder to charge any item that he or she wants on the credit card and make the full and timely repayment before the due date, hence avoiding any interest.

However, if you use the card to make random purchases, as you do not need to, your chances of repaying it in full may be strained.

6. Set Up Automatic Payments

To avoid being devoid of a grace period, it is prudent to make arrangements for auto payments of your statement balance.

This ensures that you pay your outstanding amount in full every month, even if you forget or are occupied.

Example:

If you know your statement balance is $400 and your due date is the 25th, automatic payment means that your card issuer will pay the stated balance before the due date.

This prevents you from forgetting to make a payment, so there is no need to incur extra interest charges.

How Can Grace Periods Maximize Your Credit Card Rewards?

The grace period comes between 21 to 25 days from the last date of your billing cycle and allows you to clear your balance before it starts to attract interest charges.

Here’s how you can use this feature to your advantage:

- Don’t Charge and Optimize Profit

Paying off your balance in full if you have the cash during the grace period helps prevent interest charges from devaluing your rewards.

For example, utilizing an incentive card like the Chase Sapphire Preferred® Card, which pays 3X points on Dining and 2X Points on Travel, earns you valuable points while keeping your spending interest-free if you pay off the balance before the due date.

- Time Big Purchases Wisely

Whenever you are planning a big purchase, try to time it until the billing cycle commences. This gives you the maximum time to pay it off within the grace period. This basically assists in giving the maximum time within the grace period to pay off what has been borrowed.

More easily, using credit cards like the Citi® Double Cash Card, which offers 2% cash back, 1% when you buy, and 1% when you pay, could double the rewards when using this strategy.

- Link Grace Periods with introductory APR Offers

Some cards, like the Wells Fargo Active Cash® Card, have no annual fees and include 0% APR introductory periods.

You also get 2% back on every purchase. By following the grace period curve to ensure the introductory APR has ended, you can always reap from those points without being charged interest.

- Optimize Category Rewards

Cards with bonus categories that change each quarter, such as the Discover it® Cash Back, enable their holders to charge up to 5% on certain items, such as groceries, gas, or even dining.

No value erodes for these rewards through interest charges when your balance is paid fully within the grace period.

- Redeem Points From Daily Purchases

Merchant purchases, such as food and electricity bills, can also contribute to the accrual of rewards, and charges apply if they settle before the grace period.

The Blue Cash Preferred® Card offers an enrollment bonus of $150 once you spend $1,000 in the first three months of opening the account. It also offers the following rewards: 6% cash back on up to $6,000 per year at US supermarkets.

This way, it becomes possible to protect all those bonuses, remain profitable, and pay the balance on time.

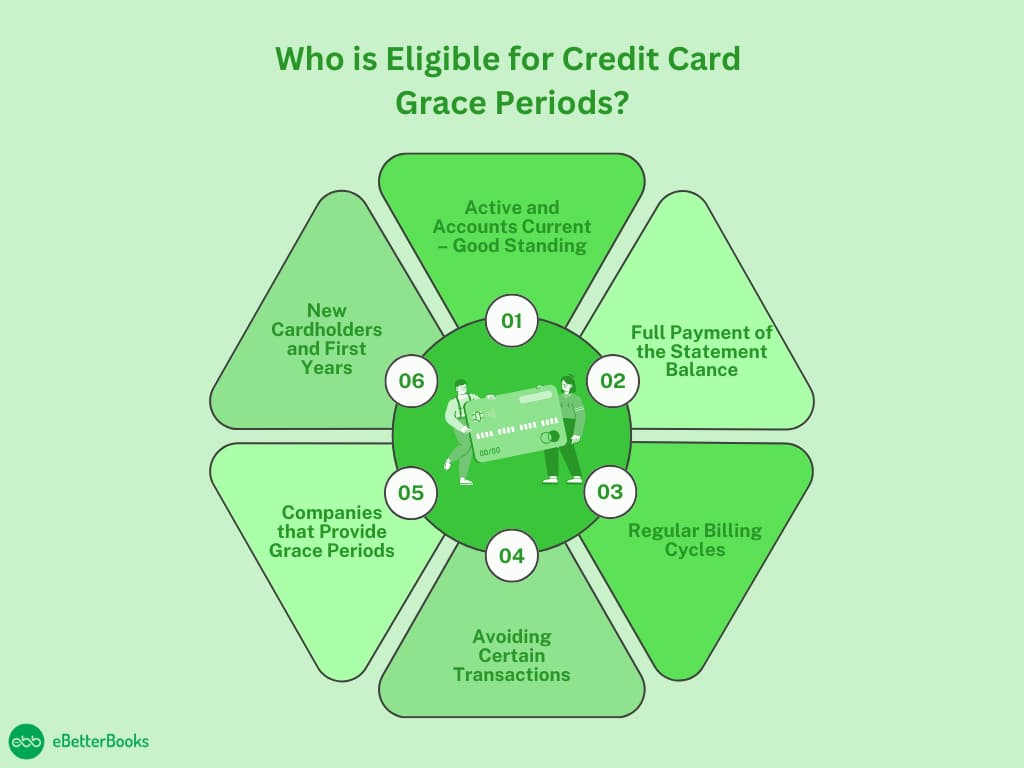

Who is Eligible for Credit Card Grace Periods?

A credit card grace period is one of the privileges that enable users to make purchases without accruing interest on the purchases so long as they pay the amounts owed before the due date. However, only some people are entitled to this kind of benefit right away. Not all cards are issued with a grace period, and here are factors that will determine if you are a beneficiary or not:

1. Active and Accounts Current – Good Standing

The first qualification for eligibility is that the credit card account you are qualifying must be open and not in default. As a result, you have to maintain an active, unblocked credit card with no overdue payments or complications, including chargebacks or defaults.

In this case, if your card is suspended or closed, for instance, due to non-payment or other issues, you are eliminated from accessing the grace period. It is also very important that you don’t go overboard with spending over your credit limit.

2. Full Payment of the Statement Balance

To be eligible for the grace period, you need to make your minimum statement balance payment by the stated date. The grace period only kicks in if you start a billing cycle with a $0 balance on your account.

If you leave any balance unpaid, you forfeit your grace period right, and interest begins to be charged on new purchases as soon as they are made. The consequence of paying only the minimum amount or of keeping a balance over the month will be interest charges.

3. Regular Billing Cycles

Most credit card companies go for monthly statements, and where your specific card operates within these regular cycles, you are allowed the grace period.

An ideal billing cycle is between 28 and 31 days, and from the close of the cycle, you are afforded some grace period between 21 and 25 days, within which you should pay your bill before incurring interest.

This is a supremacy of most credit card companies mandated by federal statute, though it is only valid when one does not carry over a balance from the previous cycle.

4. Avoiding Certain Transactions

It’s important to remember that grace periods do not include balance transfers, cash advances, or any other special occasions. Many of these transactions begin charging interest immediately while you are still in the grace period on new cash advances.

If you transfer a balance or get a cash advance, interest will be charged from the date of the transaction or the date the card was issued. Any grace period you may have for new purchases will not apply to this.

5. Companies that Provide Grace Periods

It is important to note that some credit cards do not allow a grace period. This feature, however, is not universal: most major credit card issuers offer it; however, some specific types of cards, like high-risk or secure credit cards, do not.

So, it’s wise to go through the terms and conditions of any credit card that you wish to apply for some time and check to ascertain whether the Credit card offers a grace period.

If the card does not have this feature, interest starts to be charged on the purchase as soon as one is made.

6. New Cardholders and First Years

Most consumers are eligible for the grace period when they sign up for a new credit card, but they should review the disclosures of introductory periods. Certain card companies are likely to provide an initial 0% APR on purchases for a set amount of months, in which you would not be charged any interest.

Yet the rules change after the first month, and as with any other credit card, the standard grace period applies. During this period, one must make a complete payment of the balance to avoid interest.

Here are the types of transactions and the grace period eligibility criteria…

| Types of Transactions | Eligible for Grace Period | Notes |

| New Purchase | Yes | There is no interest if the full balance is paid on time. |

| Cash Advance | No | Interest starts immediately. |

| Balance Transfer | No | It often has its own interest rates. |

| Special Promotion | Card Specific | Check specific terms. |

What Can Cause You to Lose Your Grace Period?

There are several reasons you may lose eligibility for a grace period, including:

- Carrying a Balance: If you can’t clear the amount in full, the grace period is removed, and any new purchases will attract interest charges immediately.

- Late Payments: Failure to make the payment or paying an amount below the minimal required sum initiates the grace period and penalties, such as fees for lateness.

- Certain Transactions: It is important to note that balance transfers, cash advances, and similar operations do not usually qualify for this grace period, and they attract interest from the day the transfer is made.

The Impact of Grace Periods on Other Debt

Grace periods are useful for many types of debt because they imply that the debtor has a certain period during which he/she does not need to make payments.

These periods allow borrowers more time to make the payments without attracting penalties or having their credit rating affected. However, they may be different, as they depend on the kind of debt one has and the policies of the credit company.

Student Loans

Grace Period: 6 months (for federal loans usually)

Details: Federal student loans allow, for example, a grace period of six months after graduation. Indeed, during this period, borrowers do not have to pay back any loans. This time provides an opportunity for graduates to get a job or make other preparations before starting to pay back the loans. Nevertheless, interest may continue to be charged on certain loans (such as unsubsidized federal loans).

Mortgages

Grace Period: 10-15 days

Details: Most mortgage creditors offer a brief period of forbearance, which ranges between 10 and 15 days after the due date. This means that if a mortgage payment is made during this period, no penalty charge is added. Nonetheless, the borrower should be cautious that even during the grace period, interest continues to build up, and payments in default after the grace period are deemed past due.

Auto Loans

Grace Period: 10-15 days

Details: Like mortgages, auto loans are normally accompanied by a brief grace period. Borrowers can be offered a grace period of 10 to 15 days before they are charged for late payment. Although this may help, it slows, and interest keeps piling up. Once the grace period is over, the loan is deemed past due.

Personal Loans

Grace Period: 15-30 days

Details: A personal loan may also include a grace period, usually 15 – 30 days, depending on the nature of the loan. If a payment is made during this period, no penalty fee is incurred. However, interest does not cease to grow, and the grace period is aimed only at sparing borrowers from immediate consequences.

Payday Loans

Grace Period: Varies (may offer extensions)

Details: Some payday lenders allow the borrower to roll over the loan or give extra time to pay it. However, such extensions always attract other costs in addition to having a relatively high interest rate. Payday loans are often short-term, and if the amount borrowed is not repaid at the agreed-upon time, then the lender will roll it over, but this will be at a higher interest rate.

Situations Where Your Credit Card Grace Period Pays You Off!

| Situations | Example | How the Grace Period Works |

Buying Smart for Large Purchases | If you buy a $1200 laptop during the start of the billing bicycle, you have a 25-day grace period to pay off your bill. | The grace period here helps you pay off your laptop bill in 2 months so that you can avoid interest and allow extra time to gather funds. |

Managing a Tight Month | The bills for the month are higher than expected, and you need to wait until the next month’s paycheck. | The 25-day grace period allows you to cover immediate needs now and pay next month, avoiding interest and maintaining flexibility for urgent expenses. |

Covering Emergency Expenses | Your car was hit by an accident, and you need an emergency fund of $700 for replacement purposes. | The grace period lets you cover the repair now and pay off the balance by the due date, avoiding stress and interest on an unexpected expense. |

Maximizing Cash Flow | You booked a $1000 vacation during the billing cycle, and then you have 25 days of grace period. | This allows you to pay off the vacation cost after you return, giving you nearly two months to enjoy your trip and budget without immediate out-of-pocket costs. |

The Bottom Line

It is important to be aware of how grace periods and credit card rewards are useful so that you can take advantage of some key benefits. Paying your balance in full within that grace period means that you can avoid interest charges while getting reward points for charges.

This strategy not only adds more value to the rewards you offer but also plays an important role in improving your creditworthiness.

The golden rule when using the card is to avoid hasty payments and take full advantage of the grace period to understand your debts on the credit card.

Frequently Asked Questions

What happens if you don’t pay your entire balance?

If you are unable to make the whole payment by the due date, you must make at least the minimum payment—or more, if possible. If you lose the grace period, you have to pay interest, but you won’t pay a late fee.

How long is the grace period for your credit card?

The grace period for a credit card typically lasts from 21 days to 25 days. You can ask for your grace period by checking your cardholder agreement. The grace period duration comes with the fee and annual percentage rate (APR). Apart from checking your agreement, you can also call your lender’s helpline and ask about the grace period directly.

Does a grace period work with credit card cash advances?

The credit card grace period is only applicable with purchases. Cash advances do not qualify for the grace period. Cash advances can incur with the interest immediately when in use.

Which credit card does have a grace period?

Whether it is the major credit card issuer or the smaller one, it gives you a grace period at the time of paying your statement balance in full by the due date. This is mandatory to provide a grace period to the cardholder.

-

How to Fix The QuickBooks Error H303?

QuickBooks Error H303 occurs when a system fails to access company files in multi-user mode, typically due to improper network settings, firewall restrictions, or corrupted…

-

Fix QuickBooks Error Code H202 When Switching to Multi-User Mode

QuickBooks Error H202 is a critical multi-user network failure that occurs when a workstation cannot establish a connection with the server hosting the company file.…

-

How to Fix QuickBooks Error H101 When Opening Company File?

QuickBooks Error H101 occurs when accessing a company file hosted on another system, blocking multi-user connection. This issue is often caused by incorrect host settings,…

-

How to Fix QuickBooks Error Code H505 (Multi-User Mode Access Issue)?

QuickBooks Error H505 disrupts access to company files in multi-user mode, often due to improper hosting configurations, firewall settings, or network data file issues. This…

-

A Guide to Resolve QuickBooks Abort Error Message in Multi-User Mode

Experiencing the “QuickBooks keeps aborting in multi-user mode” error can disrupt your business operations, often caused by issues like corrupted files, improper hosting, or network…

-

Fix “QuickBooks Multi-User Mode Not Working” Error

This guide addresses two critical areas of QuickBooks Desktop: network stability and tax compliance. Multi-user access failures, commonly resulting in H202 or H303 errors, stem…

-

How to Fix QuickBooks Update Error 12007

QuickBooks Error 12007 prevents updates when the software can’t connect to the internet. This often stems from issues like incorrect settings, firewall blocks, or third-party…

-

How to Fix QuickBooks Error 503– [Simple Easy Steps Solutions]

QuickBooks Error 503 disrupts payroll updates and can impede workflow, often caused by misconfigurations, corrupt files, or conflicts with system processes. To resolve this, users…

-

How to Fix QuickBooks Error 15311 – Payroll Update Error Code

QuickBooks Error 15311 typically occurs during software updates or installation, preventing users from refreshing the application and connecting to QuickBooks payroll. This issue can stem…

-

How to Fix QuickBooks Payroll Update Error 15271? (A File Cannot be Validated)

QuickBooks Error 15271 typically occurs during updates or installations, signaling issues such as corrupted files, registry problems, or incorrect SSL settings. To resolve this, users…

-

How to Resolve QuickBooks Payroll Update Error 15270?

QuickBooks Error 15270 typically arises when updating payroll, causing interruptions in QuickBooks functions like invoicing and payroll execution. This error may occur due to incomplete…

-

How to Fix QuickBooks Error 15241 When Downloading Payroll Updates?

If you’re facing QuickBooks Error 15241 while updating payroll, it’s likely due to issues with the QuickBooks File Copy Service (FCS). This error disrupts payroll…

-

How to Fix QuickBooks Error 15227 Due to Incomplete or Corrupted Installation?

QuickBooks Error Code 15227 typically arises during installation due to corrupted or incomplete QuickBooks files, damaged Windows registry, or malware. This error can cause system…

-

How to Fix QuickBooks Error 15222?(Payroll Update Error)

QuickBooks Error 15222 typically occurs during payroll updates due to conflicts with security software, digital signature issues, or browser settings. To resolve this, you can…

-

How to Fix QuickBooks Error 15215 (Maintenance Release Issue)?

QuickBooks Error 15215 typically occurs during payroll updates due to issues with verifying the digital signature, conflicts with other programs, or incorrect Internet Explorer settings.…

-

Fix QuickBooks Error 15107 (When Trying to Update Payroll)

QuickBooks Error 15107 typically occurs during payroll updates, causing disruptions due to issues like poor internet connection, corrupted files, or conflicts with third-party software. To…

-

Fix QuickBooks Error 15106 – Payroll Update Error

QuickBooks Error 15106 occurs when you attempt to update QuickBooks but encounter issues such as lacking administrator privileges or antivirus software blocking the update. This…

-

QuickBooks Error 15103 occurs during payroll updates or while downloading software updates, often due to improper installation, network issues, or incorrect settings. This guide provides…

-

How to Resolve QuickBooks Payroll Update Error 15102?

QuickBooks Error 15102 often occurs when updating QuickBooks Desktop or Payroll, caused by issues like multi-user mode or incorrect file locations. To resolve this, users…

-

Troubleshoot QuickBooks Error Code 15101 | Run-Time Error

QuickBooks Error 15101 disrupts payroll and software updates, often caused by issues with internet connectivity, missing digital certificates, or blocked access to secure sites. To…

-

Fix QuickBooks Error 1311- Source File Not Found (filename)?

To fix QuickBooks Error 1311, try these solutions: run the installer as an administrator, copy installation files from the CD or downloaded ZIP to a…

-

Fix QuickBooks Error 12157 – (Payroll Update Failed)

QuickBooks Error 12157 typically occurs due to web connectivity issues, often linked to firewall settings, internet connection problems, or incorrect system date/time. Resolving this involves…

-

How to Fix Internet Connection QuickBooks Error 12152?

QuickBooks Error 12152 prevents the software from connecting to servers, typically due to issues like misconfigured internet settings or corrupted files. This article offers practical…

-

How to Fix QuickBooks Error 12029 When Downloading Payroll Updates?

QuickBooks Error 12029 occurs when the software fails to connect to the internet during updates, often due to firewall restrictions, connectivity issues, or browser misconfigurations.…

-

How to Fix QuickBooks Desktop Update Failed Error?

The QuickBooks Desktop Update Failed Error is a common technical issue that prevents the software from downloading or installing necessary patches, often disrupting payroll and…

-

Most Common QuickBooks Update Errors & Process of Fixing Them

QuickBooks update errors, which frequently interrupt business operations, stem primarily from issues related to network connectivity, file permissions, or corrupted installation files. This troubleshooting overview…

-

How to Fix Unable to Print Invoices From QuickBooks?

Encountering printing issues in QuickBooks disrupts business operations, particularly when generating invoices. These errors often stem from incorrect printer settings, software compatibility, or misconfigured XPS…

-

How to Fix QuickBooks Unable to Locate PDF Viewer Problem?

The “QuickBooks Unable to Locate PDF Viewer” error disrupts essential tasks like viewing or printing payroll forms and reports. This issue arises from outdated PDF…

-

Troubleshooting: “QuickBooks Unable to Create PDF” Issue

The article addresses the “QuickBooks Cannot Create PDF” issue, commonly arising after Windows 10 upgrades due to outdated drivers, misconfigured ports, or missing file components.…

-

Troubleshooting QuickBooks Printer Setup Not Opening Or Not Working?

If you’re facing QuickBooks Printer Setup issues like the setup not opening, preventing you from printing invoices or reports, it may be due to incorrect…

-

Resolving QuickBooks Error: Default Double-Sided Printing

If your QuickBooks printing keeps defaulting to double-sided, it can cause delays and disrupt workflows. This issue typically occurs when a new printer is set…

-

How to Fix QuickBooks Error Code 20 Printer Not Activated?

The QuickBooks Printer Not Activated Error Code 20 typically occurs when your operating system is incompatible with your QuickBooks version, preventing you from printing invoices,…

-

QuickBooks Printing & PDF Issues – Process of Fixing Them

QuickBooks users often face printing and PDF-related issues like “Printer not activated, code 20” or problems creating invoices and reports. These errors are commonly linked…

-

How Do You Resolve The QuickBooks POS SQL Connection Error?

Fixing QuickBooks installation errors often requires the use of the specialized QuickBooks Install Diagnostic Tool, which is designed to automate the repair of core system…

-

How to Fix QuickBooks POS (Point of Sale) Failed To Open Company File?

QuickBooks Point of Sale (POS) users encountering the “Failed to Open Company File” error require an immediate, structured resolution to restore business operations. This critical…

-

How to Fix QuickBooks POS Client Cannot Connect to Server Error?

Facing the “QuickBooks POS Client Cannot Connect to Server” error can disrupt retail operations by preventing data synchronization and resource sharing. This issue, caused by…

-

How to Fix QuickBooks Point of Sale Unexpected Errors?

If you’re encountering unexpected errors with QuickBooks Point of Sale (POS), preventing you from accessing the software or processing transactions, this article helps resolve such…

-

Download the Latest Payroll Tax Table Update in QuickBooks Desktop

Ensure accurate payroll calculations by updating the payroll tax tables in QuickBooks Desktop. By downloading the latest tax updates, you access the most recent federal…

-

How to Resolve QuickBooks Unexpected Error 5?

QuickBooks Unexpected Error 5 occurs when the QuickBooks Database Service cannot access the company file due to issues like file corruption, network problems, or user…

-

How to Fix QuickBooks Error 3180 While Saving A Sales Receipt?

If you’re encountering QuickBooks Error 3180 while saving a sales receipt, this article provides essential troubleshooting steps to resolve it. The error can stem from…

-

How to Fix Error 193: 0xc1 Windows Could Not Start the QuickBooksDBXX Service?

QuickBooks Error 193 prevents users from accessing QuickBooks in multi-user mode and accessing the QuickBooks database server manager. This issue may arise from corrupted .qbt…

-

How to Fix QuickBooks Error 176109 (Invalid Product Number)?

QuickBooks POS Error 176109 occurs when an invalid product number is used, often due to issues like incorrect product codes, damaged entitlement files, or lack…

-

How to Resolve QuickBooks Error 176104? (Activation Error)

QuickBooks POS Error 176104 occurs when the software fails to activate, often due to network issues, firewall restrictions, or damaged files. To resolve this, you…

-

How to Resolve QuickBooks Point of Sale Error 1330?

QuickBooks POS Error 1330 indicates an invalid data signature, often caused by a corrupted installation, antivirus interference, or incorrect system settings. To resolve it, try…

-

How to Fix QuickBooks Point of Sale Error 100060?

QuickBooks POS Error 100060 occurs when necessary accounts cannot be created during the first financial transaction. To resolve this, ensure proper administrator permissions, reconfigure accounting…

-

How to Troubleshoot QuickBooks Error 100 POS Database Server Not Found?

QuickBooks Error 100 typically occurs due to system resource limitations or issues with the POS database manager. It disrupts the syncing process between QuickBooks POS…

-

How To Fix Error Initializing QBPOS Application Log: Best Solutions

The “Error Initializing QBPOS Application Log” occurs when there are synchronization issues between QuickBooks Point of Sale (POS) and QuickBooks Desktop, or when software conflicts…

-

QuickBooks Point of Sale Errors and Solutions

The article addresses common QuickBooks Point of Sale (POS) errors that disrupt business operations, covering unexpected, SQL connection, licensing, and data access issues. It provides…

-

How to Fix When View My Paycheck Not Working in QuickBooks?

If you’re encountering the QuickBooks error “The file you specified cannot be opened,” this guide addresses the common causes and provides step-by-step solutions. Issues like…

-

How to Fix QuickBooks Payroll Subscription: Enhanced Payroll Subscription Renewal Error?

Resolving the QuickBooks Desktop Enhanced Payroll subscription renewal error is critical for maintaining compliance, as expiration prevents calculating new payroll and tax filings. When automatic…

-

How to Resolve QuickBooks Payroll Won’t Update Problem?

QuickBooks Desktop Payroll Update failures, indicated by errors like PS038 or 12007, disrupt crucial tax table access and prevent accurate paycheck processing. Troubleshooting requires a…

-

How to Fix QuickBooks Payroll Taxes Are Calculating Incorrectly Issue?

If QuickBooks is not calculating taxes correctly, it may be due to outdated tax tables, incorrect payroll settings, or exceeded annual limits. This article provides…

-

How to Resolve QuickBooks Payroll Setup Error (00000 XXXXX)?

If you’re facing the QuickBooks Payroll Setup Error (e.g., 00000 XXXXX), it’s typically due to issues like incorrect employee or vendor data, corrupted files, or…

-

How to Troubleshooting QuickBooks Payroll Service Server Error – Connection Error

If you’re facing the QuickBooks Payroll Service Server error, it may be due to issues like outdated tax tables, incorrect system settings, or network disruptions.…

-

How to Resolve QuickBooks Payroll Not Responding Issue?

Experiencing “QuickBooks Payroll Not Responding” can halt payroll processing, typically due to outdated software, corrupted files, or network issues. Resolving this involves updating QuickBooks, fixing…

-

The suite of QuickBooks tools is designed to provide robust financial management, focusing on both proactive cash flow management and compliance-critical payroll processing. For liquidity…

-

A Comprehensive Guide to Fix QuickBooks Payroll Item List Missing Issues

Struggling with managing your QuickBooks Payroll Item List? This article provides step-by-step solutions to address issues like missing payroll items and difficulties in adding or…

-

Fix QuickBooks Payroll Liabilities Not Showing in the Pay Taxes

If your QuickBooks Payroll liabilities are not showing, it may disrupt your payroll process and cause delays in payments. This article helps you identify the…

-

How to Fix the QuickBooks Payroll Keeps Turning Off Issue?

Is QuickBooks Payroll frequently shutting down or not working? This article provides a comprehensive guide to resolve the “QuickBooks Payroll keeps turning off” issue. It…

-

Methods to Fix QuickBooks Payroll Internet Connection Error

QuickBooks Payroll Internet Connection errors can disrupt payroll operations, causing delays and inaccuracies. This issue may arise from misconfigured firewalls, incorrect system settings, outdated tax…

-

How to Fix QuickBooks Payroll Disappear?

If you’re experiencing problems with the disappearance of QuickBooks Payroll and all payroll data is missing. The chances are either QuickBooks payroll has not been…

-

Fix QuickBooks Error “The File You Specified Cannot Be Opened”

If you’re encountering the QuickBooks error “The file you specified cannot be opened,” this guide addresses the common causes and provides step-by-step solutions. Issues like…

-

Fix QuickBooks Error 15243 FCS is Not Responding While Updating Payroll

QuickBooks Payroll Update Error 15243 often occurs when updating QuickBooks Payroll due to issues like damaged QuickBooks File Copy Services or incomplete updates. This error…

-

QuickBooks Payroll Error PS060 disrupts payroll functions due to expired subscriptions or connectivity issues. This article provides solutions such as verifying billing information, ensuring server…

-

Solutions to Fix QuickBooks Desktop Payroll Update Error PS032

QuickBooks Payroll Update Error PS032 prevents users from downloading or updating payroll due to issues like corrupted payroll files, invalid billing info, or unregistered QuickBooks.…

-

Fix QuickBooks Payroll Error Code 557 – Troubleshooting Guide

QuickBooks Error Code 557 disrupts payroll updates, often after software upgrades, and can be caused by issues like incorrect service keys, slow internet, or system…

-

How to Fix QuickBooks Error PS077 Due to Corrupted Tax Table File?

QuickBooks Error PS077 prevents payroll updates due to issues like incorrect billing information, software registration problems, or corruption in payroll files. This article provides step-by-step…

-

How to Fix QuickBooks Error PS033 – QB Can’t Read Payroll Setup Files?

QuickBooks Error PS033 occurs when updating payroll or opening the company file, often due to issues like damaged CPS folders, corrupt tax tables, or system…

-

How to Fix QuickBooks Desktop Error Code 9000?

QuickBooks Error Code 9000, often related to payroll issues, occurs due to unstable internet connections, incorrect system time, or security certificate problems. This error can…

-

How to Fix QuickBooks Error 30159 [Payroll Update Error]?

Resolving QuickBooks Error 30159 is essential for restoring payroll operations that are disrupted by a validation failure between the software and the active payroll subscription.…

-

How to Fix Error Code 2107 in QuickBooks Desktop Can’t Make Direct Deposits?

QuickBooks Error 2107 prevents payroll from being processed via direct deposit, often due to system file issues, corrupted registries, or outdated software. To resolve it,…

-

Fix QuickBooks Payroll Most Common Errors: Causes & Solutions

This article addresses common payroll errors in QuickBooks, including issues with updates, company files, and tax calculations. It provides practical troubleshooting steps and solutions to…

-

How to Fix Unable to Open Company File in QuickBooks?

Unable to open your QuickBooks company file? This guide addresses common causes like outdated QuickBooks versions, incorrect file properties, network issues, and file corruption. Learn…

-

Fix “QuickBooks Unable to Communicate with the Company File”?

Facing the “Cannot communicate with the company file due to a firewall” error in QuickBooks? This issue is commonly caused by firewall settings, outdated software,…

-

Fix “QuickBooks Error Code 6189, 77” – Experts Methods

QuickBooks Error 6189 77 typically occurs when there’s an issue with accessing or opening a company file, often due to network problems, file corruption, or…

-

How to Fix QuickBooks Error 6176 When Opening Company Files?

QuickBooks Error 6176 occurs due to issues like incorrect folder permissions, firewall settings, or corrupted company files. This article provides step-by-step solutions to resolve the…

-

Learn How to Fix QuickBooks Error Code 6175

QuickBooks Error 6175, 0 occurs when the software cannot access the company file due to issues with the QuickBooks Database Server Manager. This can result…

-

Fix QuickBooks Error Code C=343? (An Expected Error)

QuickBooks Error C=343 can occur when accessing company files due to outdated software, corrupted files, or system issues. This article guides you through troubleshooting steps…

-

How to Fix QuickBooks Unexpected Error C=387 Due to Corrupted Registry Entry?

QuickBooks Error C=387, often caused by corrupted registry entries or invoice template issues, disrupts your workflow and efficiency. This guide offers several solutions, such as…

-

How to Fix QuickBooks Error 6209 Cannot Open Company File?

QuickBooks Error 6209 often occurs during installation, updates, or while accessing company files, impacting system performance and workflow. This error can be caused by outdated…

-

How to Fix QuickBooks Error 6190 816 in Desktop?

QuickBooks Error 6190 816 occurs when the company file cannot be accessed due to multi-user network issues. This prevents users from opening or modifying the…

-

Fix QuickBooks Error 6177 0 – (Cannot Use The Path)

QuickBooks Error 6177 occurs when QuickBooks can’t locate the company file, typically due to issues like incorrect file paths or network-related problems. To resolve it,…

-

Fix QuickBooks Error 6150, -1006 When Creating, Opening or Using Company Files

QuickBooks Error Code 6150, 1006 typically occurs when creating or opening a company file, often due to file corruption or malicious software. It can prevent…

-

How to Fix QuickBooks Error 6147, 0 When Opening Company Files?

QuickBooks Error 6147, 0 occurs when restoring or opening backup and company files, often due to damaged files, incorrect data, or long file names. This…

-

How to Resolve QuickBooks Error Code 6144 82?

If you’re facing QuickBooks Error 6144-82, it indicates issues with your company file, Windows registry, or network setup. This error can disrupt your workflow by…

-

6 Steps to Fix QuickBooks Error Code 6143 (Company File Issues)

If you’re facing QuickBooks Error 6143 while trying to access your company file, it may be due to a corrupted file, firewall issues, or improper…

-

Fix QuickBooks Error 6129, 0? – Database Connection Verification Failure

QuickBooks Error 6129, 0 signifies a database connection verification failure that prevents the QuickBooks Desktop application from establishing a verified connection with the company file,…

-

How to Fix QuickBooks Error 6123, 0?

QuickBooks Error 6123 typically occurs when trying to open, restore, or upgrade a company file, often in multi-user setups. It disrupts operations by indicating a…

-

How to Resolve QuickBooks Error Code 6105 While Accessing Company File?

QuickBooks Error Code 6105 disrupts access to your company file due to corruption or damage, often caused by system crashes or malware. This error impedes…

-

How to Fix QuickBooks Error Code 61 Due to Improper Installation?

QuickBooks Error Code 61 can disrupt your work due to improper installation, corrupted files, or registry issues. This guide offers clear, step-by-step solutions, including updating…

-

How to Fix QuickBooks Error 6094 0 When Accessing The Company File Located on the Server

QuickBooks Error 6094 typically occurs when antivirus or firewall software disrupts communication with the company file, often blocking QuickBooks from running. This error can be…

-

Fix QuickBooks Error 6073, 99001 – Unable to Open the Company File

QuickBooks Error Code 6073 occurs when a user tries to access a company file that’s already opened by another user in multi-user mode. This issue…

-

How to Fix QuickBooks Error -6010, -100 While Opening a Company File?

QuickBooks Error 6010, -100 occurs when accessing a company file in multi-user mode, often due to network issues, antivirus interference, or improper hosting settings. It…

-

Fix QuickBooks Error 6000 – When Opening a Company File

QuickBooks Error 6000 occurs when users are unable to access their company files, typically due to issues with .ND or .TLG files, firewall settings, network…

-

Fix “QuickBooks Error 6000 95” Due to Insufficient Permissions of Company File

Fix QuickBooks Error 6000, 95 swiftly with these expert solutions. This error, often caused by system issues or corrupted files, can disrupt your QuickBooks experience.…

-

How to Fix QuickBooks Error 6000 83 – While Restoring Company File?

QuickBooks Error 6000 83 occurs when the software is unable to access your company file, often due to file corruption, network issues, or installation problems.…

-

How To Fix QuickBooks Error 6000 80 When Accessing A Company File?

QuickBooks Error 6000 80 prevents users from accessing their company files, typically caused by data corruption, permissions issues, or improper file transfers. This guide offers…

-

How to Resolve QuickBooks Error 6000 77?

QuickBooks Error 6000 77 typically occurs when the company file is stored in an incorrect location or there are access issues due to file permissions…

-

How to Fix QuickBooks Error Code 6000 301 While Accessing the Company File?

QuickBooks Error 6000 301 typically occurs when you’re unable to open your company file due to issues like insufficient disk space, damaged files, or incompatible…

-

How to Resolve QuickBooks Desktop Error 213 (Duplicate Entry in QBWin.log)?

QuickBooks Error 213, caused by duplicate entries in the QBWIN.log file, disrupts your accounting processes. This error can occur during installation, startup, or when using…