Are you troubled with QuickBooks Error 3180 while saving a sales receipt? Go through this post to get the best solutions to fix the same.

QuickBooks users face this error when they try to save a sales receipt. They will also face errors while securing the data. Therefore, we will discuss every detail of QuickBooks status code 3180.

QuickBooks is the most popular bookkeeping and accounting software. Inuit has updated its software constantly due to changes in accounting rules and policies. However, regular updates and versions make it complex, and that’s why users also have to deal with error code 3180.

What is QuickBooks Status Error Code 3180?

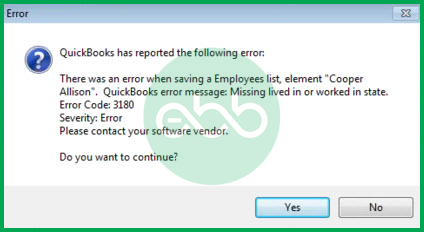

QuickBooks Error 3180 in QuickBooks POS is a series of 3000 errors. These errors occur in QuickBooks when there are financial exchanges between the QuickBooks Desktop Point of Sales application and the QuickBooks Desktop application. It appears to display a different error message, such as:

“Sales tax detail line must have a vendor,”

Or,

“There was an error when saving an Employee list, element ‘Employee, Name’”

QuickBooks Desktop Error 3180 is a sales receipt-related error. Hence, users see this error message on the screen:

When there is difficulty in saving the sales receipt or cash memo, the error 3180 may take place.

What are the Symptoms of Intuit Error Code 3180?

QuickBooks users experience these symptoms, which indicate QuickBooks Error Code 3180.

- A dialog box with the following message will pop up on your screen.

Status code 3180: There was an error when saving a Sales Receipt.

- Users have to face problems and challenges in saving their sales receipts.

- Users may face problems using keyboard and mouse commands and have trouble getting a timely response.

- If you see your windows start performing slowly or sluggishly, affecting other activities or programs as well.

- You may see that QuickBooks and QB POS have chances of crashing and closing automatically.

- The system will react slowly to inputs.

- Users are unable to save the sales receipt.

- The QB Desktop will abruptly shut down.

Why does Error Code 3180 in QuickBooks Occur?

There are several reasons why error code 3180 in QuickBooks might occur. When the QB company file is either damaged or corrupted, you may face QuickBooks Error 3180. If there is something wrong with the account mapping of the sales tax payable account.

- If you create a paid-out for the sales tax payable account.

- If your sales tax payable account has become the target account for more items on receipts.

- If there is something wrong or damaged with the type of payment item.

- The antivirus app on the system sometimes creates problems and issues.

- There might be a possibility of a damaged or corrupted QuickBooks company file causing this issue.

- Incorrect/ improper QuickBooks settings related to the tax form, sales tax, etc., as follows:

- Improper QB installation might lead to QuickBooks error-saving time tracking.

- Faults in the Windows registry can also lead to this issue.

- Your antivirus application may have hindered some QuickBooks functions.

- The vendor expense settings are incorrect.

- QB Desktop sales tax items are not properly linked to vendors.

- “Paid-out” was made using the sales tax payable account.

- There is an incorrect mapping of the sales tax payable account.

- The sales tax payable account is the target account for receipt items.

How to Fix QuickBooks Status Error Code 3180?

Given that there are multiple reasons behind the occurrence of QuickBooks Error 3180. Here, we have provided different ways to troubleshoot the same.

Solution 1: Ensuring that a Vendor is Assigned for Sales Tax Item

- Firstly, go to QB Desktop–> Lists–> Item List.

- After that, select the option of Include Inactive.

- Sort the list by choosing the Type header.

- Finally, ensure that every sales tax item has a tax agency attached to it.

Solution 2: Verifying the Tax Preference to Fix QuickBooks Status Code 3180

- Firstly, go to QuickBooks POS–> File Menu–> Preferences.

- Choose Company.

- After that, go to financial–> Accounts.

- At last, check both the basic and advanced tabs. Ensure that the QuickBooks Sales Tax Payable is listed only in the sales tax row. If this is not the case, change the scenario and run the financial exchange.

- Finally, check whether the QuickBooks Status Code 3180 has been fixed.

Solution 3: Ensure that the Sales Tax Payable is not Used for Paying the Problem Receipt

- Go to POS Home page–> Sales History.

- Right-click any column to select the customize columns option.

- Ensure that QB status is selected.

- If there are incomplete receipts paid out for sales tax payable, then select them and choose the option of Reverse Receipt.

At last, use a non-sales tax payable account to re-create the paid-out process. Finally, run the financial exchange.

Solution 4: Repair Damaged Payment Item (When you are Facing an Error while Saving a Receipt)

- Firstly, go to QB Desktop–> Lists–> Item List–> Include Inactive.

- Here, to sort the list, click the Type header.

- After that, Rename the Point-of-Sale payment items. Right-click the items with POS and choose edit items. Add OLD at the beginning of the item, and select OK.

- From the Point of Sale, choose the run financial exchange option.

- At last, in QB Desktop, merge the duplicate items by right-clicking on the payment OLD and selecting Edit Item. After that, remove the OLD and follow the prompt for merging the files.

Solution 5: When “The Posting Account Is Invalid. 140108 Payment Item Lookup Error “Xxxxxxxx” message displays.

- Firstly, open QB Desktop –> Lists –> Item List.

- Ensure that every POS item in the list is using the correct account.

- At last, run the financial exchange and check whether the QuickBooks desktop status code 3180 has been resolved.

Solution 6: Open The POS

- Firstly, go to the File menu –> Preferences –> Company –> Financial –> Accounts.

- Check all basic/ advanced tabs. Ensure correct mapping of accounts, and click the save option to secure all changes.

- Finally, run financial exchange.

Hopefully, it will resolve the QuickBooks Error 3180.

Solution 7: Recreate/ Rename All Financial Methods

- Initially, go to QB Desktop –> Lists menu –> Customer & Vendor Profile Lists –> Payment Method List.

- Here, right-click on the Cash method option to select the Edit payment method button.

- In the payment method field, add the letter X at the start and save the changes.

- Again, right-click the cash method option to select new.

- Lastly, rename it as cash and run the financial exchange. If needed, rename and recreate all payment methods.

Conclusion

The solutions provided above should fix the QuickBooks Error code 3180. However, if you experience any interruptions using any of those solutions, reach out to eBetterBooks Error Support contact number +1-802-778-9005 for immediate support. We will help you out in fixing QuickBooks status code 3180 by providing you with instantaneous technical support.

Frequently Asked Questions

How does QuickBooks Error 3180 affect integration with Point of Sale (POS) systems?

QuickBooks Error 3180 often affects integration with Point of Sale (POS) systems. This error usually happens when sales tax or payment items are not set up correctly. For instance, if the sales tax items are not linked properly or payment methods are misconfigured, you might encounter this error during POS transactions.

How can I prevent Error 3180 from happening in the future?

To prevent Error 3180 from happening again, make sure to:

- Ensure every sales tax item has a vendor assigned to it.

- Verify that your sales tax payable account is set up correctly and not being used incorrectly.

- Regularly check your payment item settings and make sure they are accurate.

How does Error 3180 impact tax filing in QuickBooks?

Error 3180 can impact tax filing in QuickBooks by causing issues with sales tax items and payment records. When this error occurs, it can prevent you from saving sales receipts correctly, leading to incorrect or incomplete sales tax information. If sales tax items are incorrectly assigned or linked to accounts, Error 3180 can disrupt tax-related transactions. This can make it challenging to file your taxes accurately and on time.

Disclaimer: The information outlined above for “How to Fix QuickBooks Error 3180 While Saving A Sales Receipt?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.