To fix QuickBooks Payroll Liabilities not showing in the Pay Taxes section, make sure that you have set the correct payment frequency for each liability and they are properly linked to the appropriate accounts in the Chart of Accounts.

Some common quick-fixes and tips to resolving payroll liabilities not showing error:

- Repair the data and install payroll tax table updates.

- Rebuild tools in your QuickBooks.

- Try updating the QuickBooks Desktop Application.

- Check your payroll liability report and create liability adjustments.

- Try deleting prior recorded tax liability payments.

- Verify the payment schedules of liabilities.

- Set payment frequencies for unpaid taxes.

- Review the payment details problem and solution messages sent by the Agency.

What Gives Rise to QuickBooks Payroll Liabilities Not Showing? TL:DR

Inactive or incorrectly configured payroll accounts, outdated software or tax tables, and data-file issues can all hide or remove your payroll liabilities from view. When a liability account is inactive or the payroll factor points to the wrong account, QuickBooks won’t list those dues; selecting the wrong date range or payment frequency similarly prevents liabilities from appearing. If you’ve skipped the latest payroll tax update, upgraded QuickBooks without repairing your company file, or let your payroll subscription lapse, underlying data damage or missing liability records can also break the Pay Liabilities display. As a result, you may miss upcoming payments, incur late fees, and lose visibility into your true payroll obligations. In most cases, simply reactivating the correct liability account, verifying payroll dates and frequencies, updating QuickBooks and its tax tables, and repairing your company file will restore proper liability tracking. To help you fix the issue, here are the key causes with solutions you should check first:

QuickBooks Payroll Liabilities Not Showing Error with Solutions

| Error Cause | Reason | Solution |

|---|---|---|

| Inactive QuickBooks Payroll Liability Account | It could be possible that your liability account is not active. | You need to ensure that your liability account is active. |

| Wrong Payroll Dates | The incorrect date range has been selected while making the payments. | It is required to check the date range before making payments. |

| Lost or Missing QuickBooks Payroll Liabilities | It may occur due to lost or missing liabilities after upgrading QuickBooks software. | Locating and viewing the missing QuickBooks Payroll Liabilities . |

| Outdated Payroll Tax Table | If your QuickBooks account or payroll tax table is not updated to the most recent release. | Update your QuickBooks Payroll Tax Table to the most recent version. |

| Uncategorized QuickBooks Payroll List | You may have damaged the company file. | Re-sort your QuickBooks list and make it organized. |

| Payroll Factor is Inaccurately Set Up to Another Liability Account | If the QB payroll is not properly set to another Liability Account | You must edit all the payroll items to properly set up payroll factors to another liability account. |

Fixing QuickBooks Payroll Liabilities not Showing: Step-by-Step Guide

Case 1: When Your Liability Account is Not Active

In this case, you must ensure the Liability Account is active. To make your liability account active, follow the below mentioned steps:

- Step: Access the Chart of Accounts

- For this, hit the Lists menu option. Now, choose the Chart of Accounts from the drop-down menu.

2. Step: Check for Inactive Accounts

- Must check that the inactive is selected from the list.

3. Step: Activate the Liability Account

- Choose the Edit option if your liability account has a large X marked on its left side. After this, hit the Make Account Active tab..

4. Step: Complete the process

- To finish, select the Chart of Accounts.

Note: If you fail to click the Inactive option, do not proceed, as there are no inactive accounts. However, if you can select Inactive, then proceed.

Case 2: When QuickBooks Payroll Liabilities Dates are Incorrect

You can prevent payroll liabilities from not being shown in the future if you choose the right date range while making payments.

To correct the Payroll Liabilities Dates, follow the below mentioned steps:

- Step: Open the Payroll Center

- To begin with, navigate to the Employees menu in the QuickBooks account and then choose the Payroll Center.

2. Step: Access Liability Transactions

- Now, hit the Transaction tab. You need to select the Liability checks.

3. Step: Set the Correct Date Range

- Choose Date and also, edit the range to This Calendar Year from the drop-down menu.

4. Step: Verify and Edit the Paid Through Date

- Thereafter, check the Paid Through Date. If editing is required, click on the line with the liability check twice to open it.

Case 3: When QuickBooks Payroll Liabilities are Missing or Lost

If your liabilities are missing, follow the below mentioned steps below to review them:

- Step: Access Payroll Taxes and Liabilities

- Head to the Employees menu and choose the Payroll taxes and liabilities option.

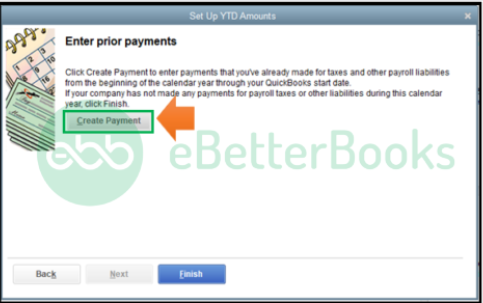

2. Step: Create Custom Liability Payments

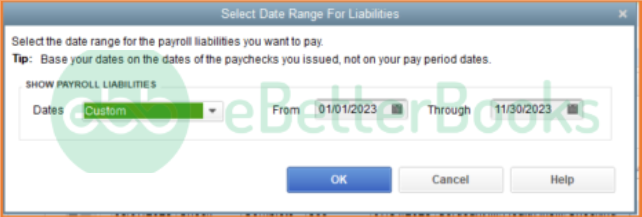

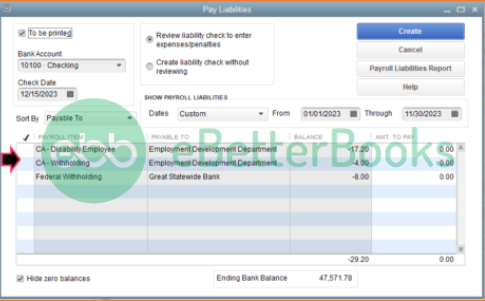

- After this, click Create Custom Liabilities Payments. Select the liability period and then press OK.

3. Step: Review Liabilities

- A new window will open up and show the liabilities that you have to pay.

4. Step: Address Potential Data Damage

- In case of any data damage, you are recommended to run the Verify and Rebuild Data in the QuickBooks account.

Case 4: When your QuickBooks Payroll Tax Table is Not Updated

Updating your tax table to the latest release is important to troubleshoot QuickBooks Payroll Liabilities, not Showing issues.

Follow the steps to update the tax table in your QuickBooks:

- Step: Initiate the Update Process

- The initial step is to click on Update QuickBooks from the Help menu. Navigate to the Update Now icon.

2. Step: Download Updates

- After this, choose the Get Updates option. Hit File and then press Exit.

3. Step: Restart QuickBooks

- At last, restart your QuickBooks Desktop.

Case 5: When the QB Payroll List is Not Categorized

You are supposed to re-sort your QB Payroll list if it’s unorganized.

To re-sort the payroll list , follow the below mentioned steps:

- Step: Choose the Payroll List

- Firstly, choose the list under the Lists menu you need to re-sort.

2. Step: Include Inactive Items

- Now, tickmark the “Include Inactive” checkbox. If it’s greyed out, there are no inactive names.

3. Step: Re-Sort the List

- Hover over the View menu and then select Re-sort Lists; now, click OK.

4. Step: Finalize the Changes

- In the end, close and reopen your company file.

Case 6: When the Payroll Factor is Improperly Set to Another Liability Account

To rectify this, you need to edit the payroll items. Below are the steps you need to implement for the same:

- Step: Access the Payroll Item List

- Go to the List menu and then select the Payroll Item List option.

2. Step: Choose and Edit the Item

- Now, you must choose the item added and then right-click on it. Hit the Edit Payroll Item icon.

3. Step: Update the Liability Account

- Press the Next button and change the account for the liability.

4. Step: Save Changes

- Once done, click Next again and then Finish.

Case 7: When Payment Method for New Employees is Not Displayed, the Payroll Liabilities in QuickBooks is Not Visible

Payroll liabilities like child care support and other perks are needed to be scheduled and mapped to your payroll accounts for every new employee and also the payment schedule is needed to be configured.

Follow the steps to set the payment schedule for payroll liabilities:

- Step: Access the Payroll Center

- Go to the Payroll Center

2. Step: Change Payment Method

- Click on the Change Payment Method option under the Pay Liabilities tab.

3. Step: Navigate to Benefits and Other Payments

- Go to Benefits and Other Payments, then Continue.

4. Step: Edit Child Support

- Highlight the Child Support, then click Edit.

5. Step: Assign the Correct Payment Schedule

- Assign the correct payment schedule.

6. Step: Finalize the Changes

- Click Finish to save your changes.

Case 8: When the Payroll Liability Payment Frequency is Incorrect

In QuickBooks Desktop (QBDT), you need to correct the payment frequency to resolve this error.

Follow the instructions below to set your payment frequency:

1. Step: Access the Payroll Center

- Go to Employees and select the Payroll Center.

2. Step: Manage Payment Methods

- Click Manage Payment Methods.

3. Step: Select Payment Schedule

- Tick the Schedule Payments box.

4. Step: Edit Payroll Liability

- Select the payroll liability you wish to update, then click Edit.

5. Step: Set the Correct Payment Frequency

- Choose the correct frequency in the Payment (Deposit) Frequency field.

6. Step: Save Changes

- Click Finish to apply the changes.

Types of Payroll Liabilities

Payroll liabilities are the amounts a business owes to employees, tax authorities, or other entities related to payroll operations. They consist of various components related to the remuneration of the employees, which include taxes, salaries, and deductions, if any. These obligations must be accurately tracked and reported to maintain compliance and ensure smooth business operations.

Employee Compensation

Employers pay wages to employees and may also offer bonuses and commissions.

There are several ways to calculate liability for a specific pay period:

- Salary Employees: The portion of annual salary owned for the pay period, plus bonuses and other incentive compensation.

- Hourly Workers: The Liability is a multiplication of the total worked hours and the hourly pay rate, including overtime hours. The workers who work on an hourly basis may also earn incentive compensation.

- Freelancers Workers (Independent Contractors): Amounts owed based on an hourly rate agreement or a flat fee.

Based on the information from Form W-4, you must retain taxes on employee pay, as taxes are not deducted from the compensation of independent contractors.

Payroll Taxes and Insurance

Taxes are retained from pay-to-fund income tax, Social Security, and Medicare tax liabilities.

Employers spend some amount for such taxes:

- Federal Income Tax withholdings: The specific amount is deducted from the worker’s annual income and filing status (married, single, etc.).

- Income Taxes: Employers generally withhold federal income tax from employee pay, and many states and localities charge additional income taxes.

- FICA (Federal Insurance Contribution Act) Taxes: The taxes assembled to fund Social Security and Medicare taxes. Employers withhold these taxes from wages and match the amount, except for Additional Medicare Tax, which is only withheld.

- State Income Taxes: Each state has different requirements for withholding and paying state income tax, and some don’t levy a state income tax.

- FUTA (Federal Unemployment Tax Act) and SUTA (State Unemployment Tax Act): When the employee is not at fault, both acts were passed to provide temporary income for the workers who lose employment. Businesses pay unemployment insurance taxes with the help of a joint program between the federal government and the states, and only employers pay FUTA taxes.

- Workers Compensation Insurance: All businesses may have to purchase workers’ compensation insurance based on state requirements. If a worker is injured on the job, the insurance policy will pay medical costs and lost wages due to injury. The employer generally pays workers’ compensation premiums, and the cost is decided by the number of employees and the organization where you work.

- Wage Garnishments: A garnishment is a court-ordered requirement to retain employee pay and send the amounts to a third party.

Once your business starts growing, you may offer benefit plans to appreciate employees. Workers can select to voluntarily withhold payroll dollars to fund benefit plans.

Why are My Payroll Liabilities Not Showing Up in QuickBooks Desktop?

There can be multiple reasons why Payroll liabilities may not appear in QuickBooks, such as using an outdated version, incorrect payroll settings, or issues with your payroll subscription.

In QuickBooks desktop, payroll tax dues will not show up in the Pay Liabilities section if:

- They Have Already Been Paid – Once liabilities are settled, they no longer appear as due.

- Payment Frequencies are Not Set Up – If the payment schedule isn’t configured for certain taxes, the system won’t track them in the Pay Liabilities section.

- Your QuickBooks version is outdated.

- Your payroll subscription is inactive or not updated.

Both conditions must be addressed to ensure accurate liability tracking.

To fix the payroll liabilities issue, follow the below steps:

- Step: Voluntary Employee Deductions: These deductions come from an employee’s paycheck and help pay for things like health insurance, retirement plans, and other benefits. The costs that employers pay for these benefits are considered payroll expenses.

- Step: Retirement Plans: Worker’s contributions are deducted from their pay and are not employer expenses. The employer’s share of contributions is a portion that counts as a payroll expense.

- Step: Health, Dental, Vision, and Life Insurance Premiums: Premiums generally paid by the employer are not retained from pay and are included as business expenses. The worker’s share of premiums, deducted from pay, is not a payroll expense.

- Step: Union Dues: Dues are deducted from worker’s pay and sent to the federal on worker behalf. If an employee is repaying a loan from the employer, the loan payments are not included in payroll expenses or liabilities. Instead, these payments affect the employer’s cash and reduce their loan-receivable account.

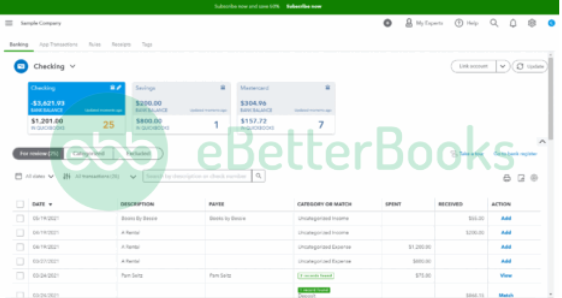

- Update your QuickBooks Desktop to the newest version.

- Review your Payroll Settings.

- Get Intuit Assistance.

Under the Payroll Centre or the Create Custom Liability Window, if the Liability does not appear, adhere to the following actions:

- Step: Select Lists > Payroll Item List to access the payroll item.

- Step: Now, click on the appropriate payroll item list.

- Step: Choose Payroll and then hit the Edit tab.

- Step: After this, press the Next button and make all the necessary changes to the payroll item name and the Liability/Expense Account related to the items.

- Step: Hit the Next button until you reach the Finish icon.

How to Adjust Payroll Liabilities in QuickBooks?

To adjust incorrect payroll liabilities in QuickBooks go to Employees, and open “Payroll Taxes and Liabilities”, and then click on “Adjust Payroll Liabilities”. Now, enter the adjustment details, such as date, employee name, payroll item, and memo, and choose the affected accounts.

- Step: Navigate to Payroll Liabilities: Go to Employees > Payroll Taxes and Liabilities.

- Step: Select Adjustment: Click Adjust Payroll Liabilities.

- Step: Set Dates: Choose the last paycheck date of the affected month or quarter for both Date and Effective Date.

- Step: Choose Adjustment Type: Select Employee Adjustment and then pick the employee’s name. Do this even for company-paid items.

- Step: Adjust Payroll Item: Under Item Name, select the item to adjust. Enter the adjustment amount:

- Positive if under-withheld.

- Negative if over-withheld.

- Step: Update Wage Base: Enter any changes in the Income Subject to Tax column if needed.

- Step: Add Memo: Enter a note for reference in the Memo field.

- Step: Choose Accounts:

- Select Do not affect accounts if you only want to update year-to-date amounts.

- Select Affect liability and expense accounts if you want to adjust the balances in these accounts.

- Step: Finalize Adjustment: Click OK to close the window. Select Next Adjustment if you have more to enter, or OK to save.

How to Zero Out Payroll Liabilities in QuickBooks?

If you need to clear out payroll liabilities in QuickBooks Desktop, you can either remove a scheduled payroll liability or adjust payroll liabilities.

Option 1: Remove a Scheduled Payroll Liability

- Step: Go to Employees > Payroll Center

- Step: Click on the Pay Liabilities tab

- Step: Open the Other Activities drop-down and select Change Payment Method

- Step: Choose Benefit and Other Payments > Schedule Payments

- Step: Double-click the payroll item you want to edit

- Step: Under Payment Frequency, select I don’t need a regular payment schedule

- Step: Click Finish twice to save.

Option 2: Adjust Payroll Liabilities

- Step: Run a Payroll Check-Up or Payroll Summary Report

- Step: Navigate to Employees > Payroll Taxes and Liabilities

- Step: Select Adjust Payroll Liabilities

- Step: Choose the last paycheck date of the affected month/quarter

- Step: Select Employee Adjustment and pick the employee’s name

- Step: Select the payroll item and enter the adjustment amount

- Step: Run a Payroll Summary Report and Payroll Liability Balances Report to confirm the changes.

Conclusion

To fix payroll liabilities not showing in QuickBooks Desktop under the ‘Pay Taxes’ section, start by verifying the payroll setup and employee information, then proceed by checking account settings and ensuring transactions are properly categorized. Regularly updating to QuickBooks and payroll can help prevent these issues in the future. By following these steps, you can maintain accurate payroll liabilities and ensure smooth financial management for your business.

Frequently Asked Questions!

What are Payroll Liabilities?

Payroll liabilities refer to the amount the company owes but hasn’t yet paid. The amount is related to the Payroll, including taxes withheld, employee compensation, taxes, and other deductions.

What to Do if QuickBooks Payroll Liabilities are Not Showing Up?

While doing any payroll-related activity, if you get QuickBooks Payroll Liabilities not showing error, you are recommended to ensure your liability account is active and the date range when you make payments must be accurate. Also, try updating your Payroll tax table to the most recent release if it is outdated. However, if the issue persists, categorize and edit your QB Payroll items.

Why Do QuickBooks Payroll Liabilities Not Show Up?

Several reasons prevent QuickBooks Payroll Liabilities from being shown up, including if:

- Instead of the Current Liability Account, you have set up the liability.

- The liability account is in inactive mode.

- An Incorrect date range has been selected while making the payments.

- Your QuickBooks account or payroll tax table is not updated to the latest release.

- You may have damaged the company file and need to re-sort your QuickBooks list.

- If your QuickBooks Payroll Liabilities are missing or lost somewhere.

Can I Manually Enter Payroll Liabilities in QuickBooks?

Yes, you can manually enter payroll liabilities in QuickBooks. Go to the “Employees” menu, select “Payroll Taxes and Liabilities,” and then choose “Create Custom Liability Payments.” From there, you can manually enter the liability amounts, payment dates, and accounts to ensure accurate tracking of payroll obligations.

Disclaimer: The information outlined above for “Fix QuickBooks Payroll Liabilities Not Showing in the Pay Taxes” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.