A credit card grace period is the days between the billing date and the due date. During this period, no interest is charged on purchases if you pay your balance in full.

The grace period is typically given to newly purchased products rather than to services such as cash advances and transfers. For any of these purchases, interest will be charged from the date of occurrence unless they qualify for a particular 0 percent APR tease.

What is a Credit Card Grace Period?

The Credit Card Grace Card refers to the period between the issuance of a credit card statement and the due date, during which the consumer bears no interest for any purchase made on the card.

The grace period is the time that elapses between the time a consumer makes purchases through his/her credit card in the previous billing cycle and the time he/she is required to pay interest on the outstanding balance made during the current billing cycle.

It is only applicable if the consumer cleared his or her last credit card balance in full and timely and did not roll over a balance for any part of the preceding billing cycle.

Note: It is advisable to read the terms and conditions of your credit card and find out if it has a grace period.

How Long is a Typical Grace Period for a Credit Card?

A grace period normally ranges from 21 days to 55 days. Remember that having a credit card grace period does not mean that you have more time until the due date.

When you make partial payments, fail to make the necessary minimum payment on your credit card, or pay your bill after the due date, your credit card company will start charging interest on your balance.

In addition, you will incur late penalties if you fail to make a payment or make it after the due date.

To prevent interest payments, you must pay off your credit card balance in full before the payment due date. At the absolute least, you must make the minimum payment, and you will then be charged interest on any balance carried over to the next month.

| Tip: To maintain your grace period, make sure to pay your bills in full and on time each month. If you pay in full for some months but not others, you may lose your grace period for the month in which you do not pay in full and the following month. |

If you pay off your credit card amount every month during this grace period, you will avoid incurring interest on your purchases. However, the grace period usually only applies to new purchases, not cash advances, balance transfers, or special promotional deals.

Example of Credit Card Grace Period

| Let’s understand this with an example: If your billing cycle ends on May 31, your credit card statement detailing the amount due is issued on the same day. Assuming a 30-day grace period, your payment due date would be June 30. By paying the full balance within this timeframe, you can avoid any interest charges. |

How Long is the Grace Period On Credit Card?

Credit card lenders or companies must send cardholders their bills at least 21-25 days before payment is due. Sometimes, some credit cards consider those 21 days, as well as the time between when you made your purchases inside the billing cycle, to be a grace period if you have paid your previous balance in full. This means grace periods might last nearly two months.

How Does the Credit Card Grace Period Work?

To fully enjoy a grace period, you must understand the credit card’s billing cycle, the expense of carrying a debt, and how the lender charges interest on your purchases.

These key concepts assist in clarifying how grace periods work:

- Billing Cycle

Your credit card company establishes a billing cycle, which is typically one month long. Finally, your purchases are totaled and presented in a statement.

- Statement Generation

Your credit card provider generates a statement of your purchases at the end of each billing cycle that summarises the transactions completed during that time.

- Grace Period

The grace period begins on the day your statement is generated and normally lasts 21-25 days, depending on the credit card provider.

- Interest Fee

If you pay off your credit card amount in full by the due date during the grace period, you will not be charged interest on your transactions.

- Interest on Unpaid Balances

If you fail to pay the entire balance by the due date, the remaining balance will start to accrue inte

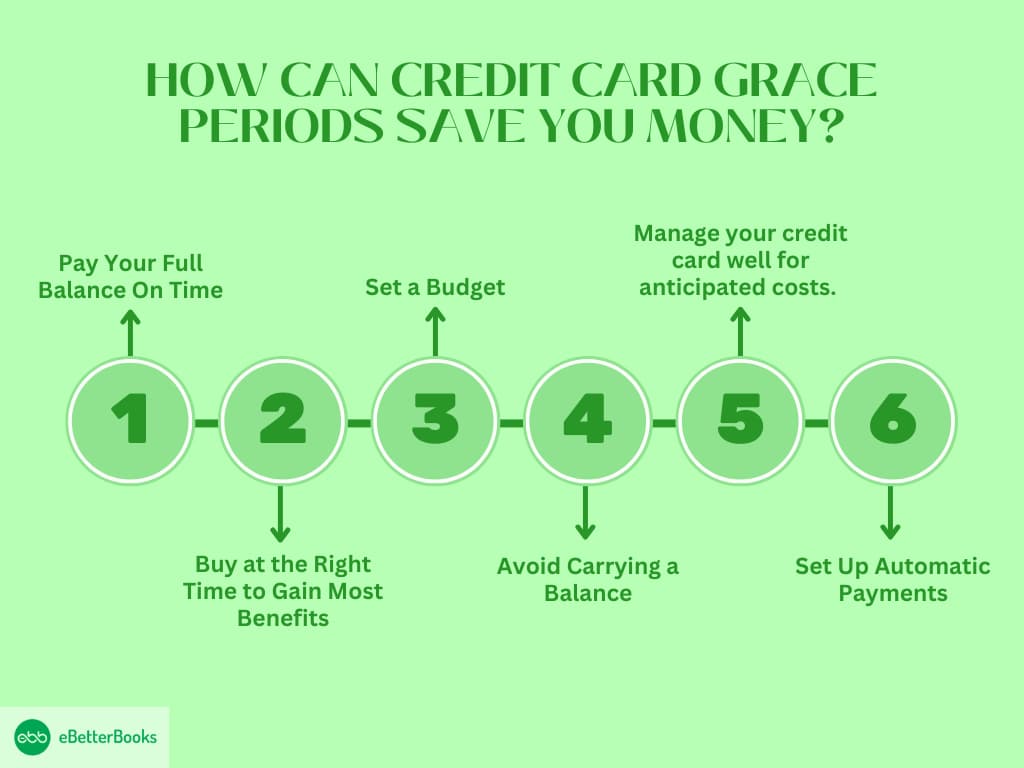

How Can Credit Card Grace Periods Save you Money?

If you are keen on maintaining your credit card balance, it is very important to make the most out of the grace period. If done with some thought, one can manage their cash flow and make the right usage of the credit card.

Here’s how to get the most out of your grace period:

1. Pay Your Full Balance On Time

The simplest way to avoid interest charges is to always make full payments for the amount charged on your statement by the due date. If you are unable to contribute the total amount, ensure that you contribute at least the minimum.

The balance will then attract an interest rate, as will any other purchase made after this. If you transfer lesser balances, then the interest you will be charged will also be reduced.

Example:

If your statement balance is $500 and your due date is the 25th of the month, by the due date, you must pay $500. Thus, you avoid interest charges that could come along the way if you have a line of credit.

However, if you pay only $250, interest will be charged on that amount and all purchases made after the date of the statement.

2. Buy at the Right Time to Gain Most Benefits

To maximize your grace period further, make your purchases at the start of a billing cycle. However, if you want to take much more time, you will have a full cycle with interest and a grace period.

For bigger purchases, this strategy could allow you to go up to two months without accruing interest.

Example:

Your account’s billing cycle ends on the 10th of the following month. If you purchase $200 and have the records that it reflects in your statement, the purchase attracts an interest-free period of 25 days from the 5th to the 30th.

For example, if you make the same $200 purchase on the 20th, those will count in your next cycle, and you get a full month + the interest grace period.

3. Set a Budget

Having a budget will allow you to control your purse strings well, enabling you to manage your credit card balance correctly. It is best to think of your credit card as an interest-free loan.

If the grace period is understood correctly, complete payment should be made on the statement balance before the grace period expires.

Example:

Let’s assume that you have $500 that you can spend as you please in a month. Thus, tracking your expenses allows you to use your credit card only for purchases within this limit and make a payment in full before the due date.

For instance, when you buy groceries worth $100 using your credit card, and you buy 200 worth of gas, you will be charged $300 in a statement, which can be paid by the due date to minimize interest charges.

4. Avoid Carrying a Balance

The key to making good use of the grace period is paying your bill in full every month. Even if you continue into the next month with a balance remaining, you may lose your grace period, and thus, interest will be added to any new purchases.

That only happens when you pay off your balance, which lets you retain the grace period you negotiated on your credit card.

Example:

Let’s say your statement balance is $300, but you manage to pay $100; the remaining balance is $200, which will be carried over to the next month. This balance will start incurring interest, and you will lose your grace period for new purchases.

On the other hand, paying up to $300 in full means that in the next cycle, you will not incur any additional interest on the balance or new products.

5. Effectively Manage your Credit Card for Expected Expenses

If you cannot control your urge to spend, it would be ideal to only use your credit card in situations where you already know you can pay up before the due date.

By sticking to the planned amount for each category, you will maximize your payments, ensuring they clear their balance, and you will not be charged any interest.

Example:

For instance, you might be considering a $400 plane ticket at the beginning of the month and are aware that you can afford to pay for it on the due date.

This enables its holder to charge any item that he or she wants on the credit card and make the full and timely repayment before the due date, hence avoiding any interest.

However, if you use the card to make random purchases, as you do not need to, your chances of repaying it in full may be strained.

6. Set Up Automatic Payments

To avoid being devoid of a grace period, it is prudent to make arrangements for auto payments of your statement balance.

This ensures that you pay your outstanding amount in full every month, even if you forget or are occupied.

Example:

If you know your statement balance is $400 and your due date is the 25th, automatic payment means that your card issuer will pay the stated balance before the due date.

This prevents you from forgetting to make a payment, so there is no need to incur extra interest charges.

How Can Grace Periods Maximize Your Credit Card Rewards?

The grace period comes between 21 to 25 days from the last date of your billing cycle and allows you to clear your balance before it starts to attract interest charges.

Here’s how you can use this feature to your advantage:

- Don’t Charge and Optimize Profit

Paying off your balance in full if you have the cash during the grace period helps prevent interest charges from devaluing your rewards.

For example, utilizing an incentive card like the Chase Sapphire Preferred® Card, which pays 3X points on Dining and 2X Points on Travel, earns you valuable points while keeping your spending interest-free if you pay off the balance before the due date.

- Time Big Purchases Wisely

Whenever you are planning a big purchase, try to time it until the billing cycle commences. This gives you the maximum time to pay it off within the grace period. This basically assists in giving the maximum time within the grace period to pay off what has been borrowed.

More easily, using credit cards like the Citi® Double Cash Card, which offers 2% cash back, 1% when you buy, and 1% when you pay, could double the rewards when using this strategy.

- Link Grace Periods with introductory APR Offers

Some cards, like the Wells Fargo Active Cash® Card, have no annual fees and include 0% APR introductory periods.

You also get 2% back on every purchase. By following the grace period curve to ensure the introductory APR has ended, you can always reap from those points without being charged interest.

- Optimize Category Rewards

Cards with bonus categories that change each quarter, such as the Discover it® Cash Back, enable their holders to charge up to 5% on certain items, such as groceries, gas, or even dining.

No value erodes for these rewards through interest charges when your balance is paid fully within the grace period.

- Redeem Points From Daily Purchases

Merchant purchases, such as food and electricity bills, can also contribute to the accrual of rewards, and charges apply if they settle before the grace period.

The Blue Cash Preferred® Card offers an enrollment bonus of $150 once you spend $1,000 in the first three months of opening the account. It also offers the following rewards: 6% cash back on up to $6,000 per year at US supermarkets.

This way, it becomes possible to protect all those bonuses, remain profitable, and pay the balance on time.

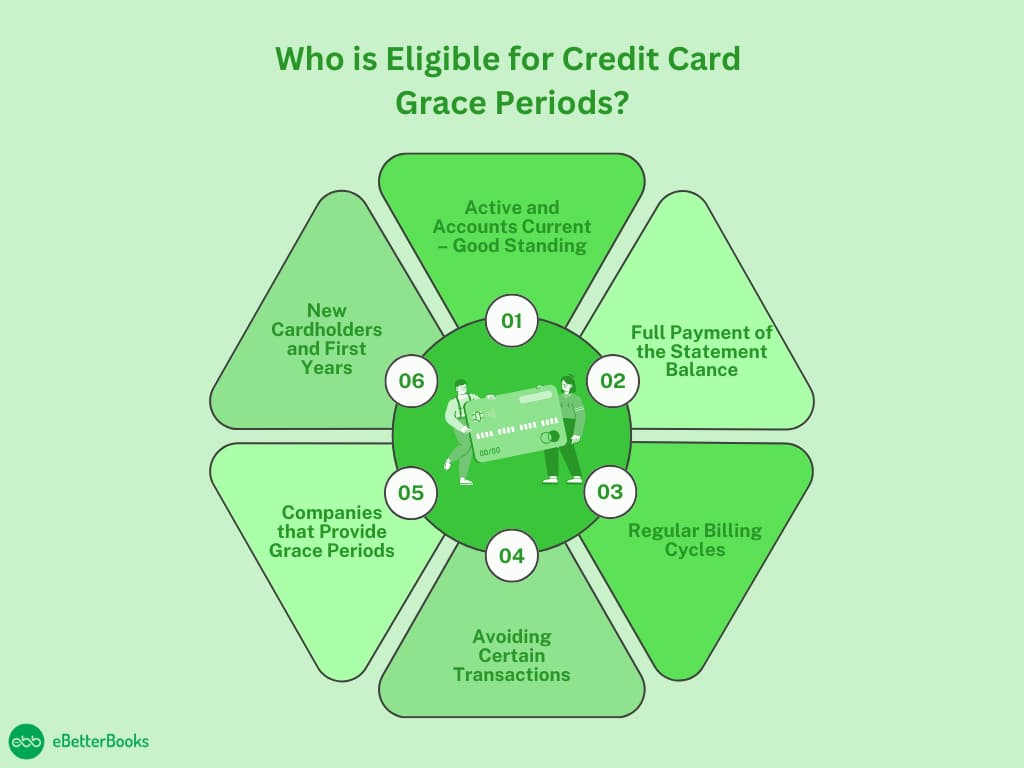

Who is Eligible for Credit Card Grace Periods?

A credit card grace period is one of the privileges that enable users to make purchases without accruing interest on the purchases so long as they pay the amounts owed before the due date. However, only some people are entitled to this kind of benefit right away. Not all cards are issued with a grace period, and here are factors that will determine if you are a beneficiary or not:

1. Active and Accounts Current – Good Standing

The first qualification for eligibility is that the credit card account you are qualifying must be open and not in default. As a result, you have to maintain an active, unblocked credit card with no overdue payments or complications, including chargebacks or defaults.

In this case, if your card is suspended or closed, for instance, due to non-payment or other issues, you are eliminated from accessing the grace period. It is also very important that you don’t go overboard with spending over your credit limit.

2. Full Payment of the Statement Balance

To be eligible for the grace period, you need to make your minimum statement balance payment by the stated date. The grace period only kicks in if you start a billing cycle with a $0 balance on your account.

If you leave any balance unpaid, you forfeit your grace period right, and interest begins to be charged on new purchases as soon as they are made. The consequence of paying only the minimum amount or of keeping a balance over the month will be interest charges.

3. Regular Billing Cycles

Most credit card companies go for monthly statements, and where your specific card operates within these regular cycles, you are allowed the grace period.

An ideal billing cycle is between 28 and 31 days, and from the close of the cycle, you are afforded some grace period between 21 and 25 days, within which you should pay your bill before incurring interest.

This is a supremacy of most credit card companies mandated by federal statute, though it is only valid when one does not carry over a balance from the previous cycle.

4. Avoiding Certain Transactions

It’s important to remember that grace periods do not include balance transfers, cash advances, or any other special occasions. Many of these transactions begin charging interest immediately while you are still in the grace period on new cash advances.

If you transfer a balance or get a cash advance, interest will be charged from the date of the transaction or the date the card was issued. Any grace period you may have for new purchases will not apply to this.

5. Companies that Provide Grace Periods

It is important to note that some credit cards do not allow a grace period. This feature, however, is not universal: most major credit card issuers offer it; however, some specific types of cards, like high-risk or secure credit cards, do not.

So, it’s wise to go through the terms and conditions of any credit card that you wish to apply for some time and check to ascertain whether the Credit card offers a grace period.

If the card does not have this feature, interest starts to be charged on the purchase as soon as one is made.

6. New Cardholders and First Years

Most consumers are eligible for the grace period when they sign up for a new credit card, but they should review the disclosures of introductory periods. Certain card companies are likely to provide an initial 0% APR on purchases for a set amount of months, in which you would not be charged any interest.

Yet the rules change after the first month, and as with any other credit card, the standard grace period applies. During this period, one must make a complete payment of the balance to avoid interest.

Here are the types of transactions and the grace period eligibility criteria…

| Types of Transactions | Eligible for Grace Period | Notes |

| New Purchase | Yes | There is no interest if the full balance is paid on time. |

| Cash Advance | No | Interest starts immediately. |

| Balance Transfer | No | It often has its own interest rates. |

| Special Promotion | Card Specific | Check specific terms. |

What Can Cause You to Lose Your Grace Period?

There are several reasons you may lose eligibility for a grace period, including:

- Carrying a Balance: If you can’t clear the amount in full, the grace period is removed, and any new purchases will attract interest charges immediately.

- Late Payments: Failure to make the payment or paying an amount below the minimal required sum initiates the grace period and penalties, such as fees for lateness.

- Certain Transactions: It is important to note that balance transfers, cash advances, and similar operations do not usually qualify for this grace period, and they attract interest from the day the transfer is made.

The Impact of Grace Periods on Other Debt

Grace periods are useful for many types of debt because they imply that the debtor has a certain period during which he/she does not need to make payments.

These periods allow borrowers more time to make the payments without attracting penalties or having their credit rating affected. However, they may be different, as they depend on the kind of debt one has and the policies of the credit company.

Student Loans

Grace Period: 6 months (for federal loans usually)

Details: Federal student loans allow, for example, a grace period of six months after graduation. Indeed, during this period, borrowers do not have to pay back any loans. This time provides an opportunity for graduates to get a job or make other preparations before starting to pay back the loans. Nevertheless, interest may continue to be charged on certain loans (such as unsubsidized federal loans).

Mortgages

Grace Period: 10-15 days

Details: Most mortgage creditors offer a brief period of forbearance, which ranges between 10 and 15 days after the due date. This means that if a mortgage payment is made during this period, no penalty charge is added. Nonetheless, the borrower should be cautious that even during the grace period, interest continues to build up, and payments in default after the grace period are deemed past due.

Auto Loans

Grace Period: 10-15 days

Details: Like mortgages, auto loans are normally accompanied by a brief grace period. Borrowers can be offered a grace period of 10 to 15 days before they are charged for late payment. Although this may help, it slows, and interest keeps piling up. Once the grace period is over, the loan is deemed past due.

Personal Loans

Grace Period: 15-30 days

Details: A personal loan may also include a grace period, usually 15 – 30 days, depending on the nature of the loan. If a payment is made during this period, no penalty fee is incurred. However, interest does not cease to grow, and the grace period is aimed only at sparing borrowers from immediate consequences.

Payday Loans

Grace Period: Varies (may offer extensions)

Details: Some payday lenders allow the borrower to roll over the loan or give extra time to pay it. However, such extensions always attract other costs in addition to having a relatively high interest rate. Payday loans are often short-term, and if the amount borrowed is not repaid at the agreed-upon time, then the lender will roll it over, but this will be at a higher interest rate.

Situations Where Your Credit Card Grace Period Pays You Off!

| Situations | Example | How the Grace Period Works |

Buying Smart for Large Purchases | If you buy a $1200 laptop during the start of the billing bicycle, you have a 25-day grace period to pay off your bill. | The grace period here helps you pay off your laptop bill in 2 months so that you can avoid interest and allow extra time to gather funds. |

Managing a Tight Month | The bills for the month are higher than expected, and you need to wait until the next month’s paycheck. | The 25-day grace period allows you to cover immediate needs now and pay next month, avoiding interest and maintaining flexibility for urgent expenses. |

Covering Emergency Expenses | Your car was hit by an accident, and you need an emergency fund of $700 for replacement purposes. | The grace period lets you cover the repair now and pay off the balance by the due date, avoiding stress and interest on an unexpected expense. |

Maximizing Cash Flow | You booked a $1000 vacation during the billing cycle, and then you have 25 days of grace period. | This allows you to pay off the vacation cost after you return, giving you nearly two months to enjoy your trip and budget without immediate out-of-pocket costs. |

The Bottom Line

It is important to be aware of how grace periods and credit card rewards are useful so that you can take advantage of some key benefits. Paying your balance in full within that grace period means that you can avoid interest charges while getting reward points for charges.

This strategy not only adds more value to the rewards you offer but also plays an important role in improving your creditworthiness.

The golden rule when using the card is to avoid hasty payments and take full advantage of the grace period to understand your debts on the credit card.

Frequently Asked Questions

What happens if you don’t pay your entire balance?

If you are unable to make the whole payment by the due date, you must make at least the minimum payment—or more, if possible. If you lose the grace period, you have to pay interest, but you won’t pay a late fee.

How long is the grace period for your credit card?

The grace period for a credit card typically lasts from 21 days to 25 days. You can ask for your grace period by checking your cardholder agreement. The grace period duration comes with the fee and annual percentage rate (APR). Apart from checking your agreement, you can also call your lender’s helpline and ask about the grace period directly.

Does a grace period work with credit card cash advances?

The credit card grace period is only applicable with purchases. Cash advances do not qualify for the grace period. Cash advances can incur with the interest immediately when in use.

Which credit card does have a grace period?

Whether it is the major credit card issuer or the smaller one, it gives you a grace period at the time of paying your statement balance in full by the due date. This is mandatory to provide a grace period to the cardholder.

-

CVP Analysis for Small Businesses – Key Benefits and Example?

Cost-volume profit analysis helps small businesses formulate pricing strategies, forecast profit when the volume of production changes, track costs related to production, and assess the…

-

Difference Between Overhead Costs and Capital Expenditures

Overhead costs are easily distinguishable from capital expenditures (CapEx), and their classification plays a significant role in operational effectiveness and compliance. Overhead costs are common…

-

QuickBooks Journal Entries for Accounts Payable and Receivable

Journal Entries (JEs) in QuickBooks should be used only as a last resort for advanced financial adjustments, specifically requiring expert knowledge of debits and credits.…

-

How To Fix QuickBooks Time Login Issue?

QuickBooks Time Login Troubleshooting is essential for quickly restoring employee time-tracking functionality, addressing issues primarily stemming from incorrect credentials, browser data conflicts, and connection problems.…

-

What is Break-Even Point, and Why Does It Matter?

The Break-Even Point is an essential financial figure that reflects the level at which a business can operate without making a profit or incurring a…

-

How To Do Profit Forecasting Using CVP Analysis?

What is CVP Analysis? CVP, or Cost-Volume-Profit Analysis, is a tool commonly used by management to understand the relationship between costs, sales volume, and profit.…

-

Adjusting QuickBooks Journal Entries at Year-End

Introduction Year-end adjustments are changes that need to be made to the balance sheet and profit and loss statement in order to ensure that the…

-

How to Fix QuickBooks Error 1723 : Windows Installer Package Issue?

QuickBooks error 1723 typically occurs during installation or uninstallation due to issues with the Windows Installer or corrupted files. This guide offers step-by-step solutions to…

-

How to View Journal Entries in QuickBooks Online and Desktop?

Accessing and managing Journal Entries (JEs) in QuickBooks is governed by the principle of double-entry accounting, ensuring debits and credits remain equal (Assets = Liabilities…

-

How to Reverse Journal Entries in QuickBooks Online and Desktop

Reversing journal entries are an optional but effective procedure for bookkeepers using QuickBooks Online and Desktop to simplify financial record-keeping by preventing the double-counting of…

-

How to Create and Manage Journal Entries in QuickBooks Desktop

Journal entries in QuickBooks Desktop function as a critical accounting tool for transferring funds between accounts and making manual adjustments that standard forms cannot record.…

-

QuickBooks Journal Entries for Employee Advances

Tracking an employee cash advance in QuickBooks requires treating the loan as a Current Asset on the balance sheet, reflecting the company’s expectation of repayment.…

-

How to Correct Journal Entries in QuickBooks

Introduction A small numerical mistake with your accounting journals may lead you to big trouble by the end of the accounting period. One calculation error…

-

How to Correct Journal Entries in QuickBooks?

Journal Entry Correction in QuickBooks is necessary to maintain accurate financial records, as even small numerical errors can cause data discrepancies and affect financial statements.…

-

QuickBooks Journal Entry

Journal Entries (JEs) are the fundamental mechanism for manually recording financial transactions in accounting systems like QuickBooks, serving as the basis for the double-entry system…

-

How to Enter Credit Card Charges in QuickBooks Online?

Managing credit card charges in QuickBooks Online requires adhering to precise accounting workflows to maintain accurate financial records and ensure successful reconciliation. While bank feeds…

-

How to Enter Bank Statements into QuickBooks?

A bank statement summarizes the monthly transactions for all your accounts and is typically sent by the Bank to the account holder every month in…

-

How to Resolve QuickBooks Reporting Problems?

If you’re struggling with QuickBooks reporting issues like inaccurate results, poor report management, or security concerns, this guide provides practical solutions to enhance your reporting…

-

How to Record Payroll Processed Outside of QuickBooks?

When payroll is handled by an external third-party service, maintaining financial accuracy in QuickBooks requires manually recording all expenses, deductions, and tax liabilities. The most…

-

How to Fix QuickBooks Export to Excel not Working Issue? -Grayed Out

QuickBooks Desktop users frequently encounter issues when attempting to export financial reports to Microsoft Excel, often manifesting as a grayed-out export button or software failures.…

-

Discontinued Operations – Definition, Reasons, and Tax Considerations

This article explains discontinued operations, their causes, and the accounting requirements for reporting them. It addresses reasons like poor financial performance, mergers, or strategic shifts…

-

Bad Credit Business Loans – Types, Terms, and How to Qualify

Business owners with poor credit scores (300-669) often struggle to secure traditional loans, but there are alternative lending options available. Bad credit business loans come…

-

Forensic Accounting Interview Preparation and Tips

This article guides prospective forensic accountants by providing valuable insights into the skills, experiences, and preparation needed for success in the field. It emphasizes the…

-

A Guide to Careers and Education in Forensic Accounting

Forensic accountants play a key role in identifying and resolving financial fraud by utilizing advanced methodologies and technologies. They investigate issues like financial fraud, tax…

-

What is SBA CAPLines Program – How It Works and Types?

SBA CAPLines provide flexible short-term working capital solutions for small businesses facing seasonal, contract, or operational funding challenges. These lines of credit allow businesses to…

-

Strategies to Pay Off Credit Card Debt Faster

Struggling with credit card debt? This guide offers practical strategies like the Snowball and Avalanche methods to help you pay off your balances faster. By…

-

The Benefits of Paying Your Credit Card Balance in Full

Paying your credit card balance in full each month helps you avoid interest charges, improves your credit score, and provides better financial flexibility. By maintaining…

-

How Does a Balance Transfer Work on a Credit Card?

A balance transfer credit card helps you move high-interest debt to a new card with a lower or 0% introductory APR, saving on interest and…

-

How Do you Get Approved for a Credit Card with Bad Credit?

If you have bad credit, getting approved for a credit card can be challenging, but it’s possible. By reviewing your credit report, paying down existing…

-

Don’t Settle for Minimum Payment – Know The Benefits of Paying More

Paying more than the minimum credit card payment helps you pay off your debt faster, reduce interest charges, and improve your credit score. By making…

-

Factors to Consider When Choosing a Travel Credit Cards

Choosing the right travel credit card can significantly enhance your travel experience by offering rewards like miles, lounge access, and exclusive perks. It’s essential to…

-

The Rise of Digital Wallets – How They Relate to Credit Cards

Digital wallets offer a secure and convenient way to store and use credit card information for both online and in-store transactions. By linking your credit…

-

Credit Card Limits – How They Are Set and How to Increase Yours

Understanding your credit card limit is crucial for managing finances, avoiding unnecessary debt, and improving your credit score. The credit limit determines how much you…

-

How BNPL Services Impact Your Credit Score?

Buy Now, Pay Later (BNPL) services can impact your credit score if payments are missed or delayed. While most BNPL providers perform soft credit checks…

-

The Dangers of Minimum Payments on Credit Cards

Relying on minimum credit card payments may seem convenient, but it significantly extends debt repayment time and increases overall costs due to high interest. This…

-

Buy Now, Pay Later (BNPL) Vs. Credit Cards – Which is Better for You?

If you’re deciding between Buy Now, Pay Later (BNPL) and credit cards, understanding their key differences can help you make an informed choice. BNPL is…

-

What is Buy Now, Pay Later (BNPL)? A Complete Guide

Buy Now, Pay Later (BNPL) allows consumers to make purchases and split payments into manageable installments, often without interest if paid on time. This payment…

-

EMV Chip Cards and Contactless Payments – How They Work in Credit Cards

EMV chip cards and contactless payments offer secure, convenient transaction methods for consumers and businesses. EMV technology reduces counterfeit fraud with one-time-use codes, while contactless…

-

What is Credit Card Churning? How Does it Work, and Affect your Credit Score

What is Credit Card Churning? Credit card churning is an act of deliberately opening the same or multiple cards in order to maximize rewards, like…

-

Late Payments on Your Credit Card – Consequences, Impacts, and Tips to Avoid Late Payments

Late payments on credit cards can lead to hefty fees, higher interest rates, and damage to your credit score. This article outlines the consequences of…

-

8 Risks of Not Paying Off Your Credit Card Bills On Time

Not paying off your credit card bills on time can lead to high interest rates, damage your credit score, and result in late fees, penalties,…

-

Credit Card Skimming – How to Protect Yourself from Card Fraud

To protect yourself, inspect card readers for tampering, use chip-enabled cards, and monitor your statements. Avoid skimmers by using your debit or credit cards at…

-

Discover Credit Cards Network – How to Apply, Types & Benefits?

Looking for a reliable credit card with cash-back rewards, low fees, and top-tier customer service? Discover Credit Cards offer multiple options, including cash-back, travel, student,…

-

Credit Card Minimum Payment – Definition, Calculation, and Risks Involved

Paying only the minimum on your credit card can seem like an easy solution, but it can lead to high interest charges and extended debt…

-

What is a Credit Card Grace Period, and How Can It Save You Money?

A credit card grace period allows you to avoid interest on new purchases by paying your balance in full before the due date. By understanding…

-

Credit Card Auto-Pay Features – How to Sing Up and Manage Your Payments?

Credit card auto-pay helps simplify bill payments by automating the process, ensuring on-time payments and avoiding late fees. It can boost your credit score by…

-

Credit Card Payment Schedule: What it is, How to Create, and Benefits

A credit card payment schedule helps you manage payments effectively, reduce debt, and improve your credit score. By organizing due dates, choosing the right payment…

-

Credit Card Pre-Approval – What Does It Mean?

Credit Card Pre-Approval means an offer for a credit card to a consumer from a credit card company after conducting a hard inquiry, and the…

-

Visa Credit Cards: Definition, Different Types, and How They Work?

A Visa credit card helps you manage your finances, build credit history, and earn rewards with each purchase. It works by allowing you to make…

-

Most Common QuickBooks Online Errors & Problems with Process of Fixing Them

This guide addresses common QuickBooks Online issues, helping users resolve login errors, payment discrepancies, synchronization failures, and browser compatibility problems. Whether dealing with login difficulties,…

-

Most Common Other QuickBooks Problems & Issues with Process of Fixing Them

If you’re facing QuickBooks issues like login errors, report generation problems, file corruption, or system crashes, this guide offers step-by-step solutions for various common errors.…

-

QuickBooks license errors are authorization faults that occur when the QuickBooks licensing system cannot validate the registration files, verification components, or hardware-identity parameters required for…

-

Most Common QuickBooks Installation Errors and Process of Fixing Them

QuickBooks installation errors disrupt software setup, often caused by system issues like damaged files, incompatible frameworks, or restricted permissions. This guide categorizes errors—Windows Installer failures,…

-

QuickBooks Cleanup Services: Financial Perfection through Data Optimization

Our QuickBooks experts at Data Cleanup specialize in not only cleaning up your data but also reconciling accounts and verifying accuracy in your QuickBooks Desktop…

-

How to Fix QuickBooks POS Error 3007 – Causes & Solutions?

QuickBooks Error 3007 occurs when the system fails to validate data, preventing proper file verification. This issue may arise from a broken installation, missing digital…

-

Lines of Credit for Small Businesses

A business line of credit provides small businesses with flexible access to short-term funding, ideal for managing cash flow, covering unexpected expenses, or financing inventory…

-

How to Enter a Closing Password in QuickBooks Desktop?

This article explains how to set up a closing date password in QuickBooks Desktop, a crucial step to protect your financial data after closing an…

-

How to Record a Bad Debt in QuickBooks Desktop and Online?

Recording bad debt in QuickBooks ensures accurate financial reporting by reflecting uncollectible invoices. This process helps businesses track and write off bad debts, reducing receivables…

-

How to Enter Inventory in QuickBooks Desktop and Online?

Managing inventory in QuickBooks, covering both Desktop and Online versions, is essential for accurate financial reporting and operational efficiency. The article provides a detailed, step-by-step…

-

How To Choose The Right Bookkeeping Services In Austin?

eBetterBooks offers efficient and affordable online bookkeeping services in Austin, providing accurate financial reports, tax filing, and data security. Their advanced software ensures real-time access…

-

14 Types of Business Loans for Small Businesses

Finding the right business loan can be crucial for small business growth or continuity. This article explores various loan options tailored to specific needs such…

-

How to Fix QuickBooks Desktop Installation Errors for Windows & Mac?

Troubleshooting installation errors for QuickBooks Desktop on Windows and Mac systems requires a structured, multi-step approach focused on isolating conflicts and repairing underlying system dependencies.…

-

Loan Refinancing for Small Businesses – A Step-by-Step Guide

Loan refinancing helps businesses reduce monthly payments, secure better loan terms, and improve cash flow by replacing existing debt with a new loan. This can…

-

How To Fix QuickBooks Runtime Errors – Microsoft Visual C++ Error Library?

Facing QuickBooks runtime errors caused by Microsoft Visual C++ conflicts or corrupt files can disrupt your workflow. This article addresses the issue by offering step-by-step…

-

How to Fix QuickBooks Online Refund Customer Overpayment Issue?

Overpayments in QuickBooks Online can result from errors like incorrect invoice amounts, duplicate payments, or processing mistakes. This guide provides clear steps to resolve overpayment…

-

How to Batch Enter Transactions in QuickBooks Online? – A Complete Guide

QuickBooks Online’s Batch Transaction Entry allows users to efficiently manage large volumes of financial data by entering multiple transactions at once. This feature saves time,…

-

Steps to Login QuickBooks Self Employed & If Unable To Login QBSE How To Fix That Error

Having trouble logging into QuickBooks Self-Employed? Whether it’s an expired link, cache issues, or browser extensions, this guide provides step-by-step solutions to get you back…

-

How to Choose Online Bookkeeping Services In Houston?

Choosing the right online bookkeeping service in Houston can streamline your business operations, ensuring accurate financial records and real-time access to your data. eBetterBooks offers…

-

How to Setup Health Reimbursement Arrangement (HRA) in QuickBooks Desktop & Online?

Setting up a Health Reimbursement Arrangement (HRA) in QuickBooks, including the Qualified Small Employer HRA (QSEHRA) and Individual Coverage HRA (ICHRA), demands precise adherence to…

-

How to Force a User to Log off in QuickBooks Enterprise? – Logging Out Users

This article addresses the issue of forcefully logging off a user from QuickBooks Enterprise, especially when managing a multi-user environment or performing tasks in Single-User…

-

SBA 7(a) Loan Program: Definition, Eligibility & Types

The SBA 7(a) loan helps small businesses secure financing for working capital, real estate, equipment, and more, offering competitive interest rates and flexible repayment terms.…

-

What is the Cash Flow Forecasting Tool in QuickBooks & How to Use It?

The QuickBooks Cash Flow Planner is a vital liquidity management tool that projects a business’s future cash position by analyzing linked bank data, open invoices,…

-

How to Download the Bank Feed Transactions in QuickBooks Desktop?

This guide outlines the steps to download bank feed transactions into QuickBooks Desktop, offering solutions via Direct Connect or Web Connect. By linking your bank…

-

Learn to Download and Use QuickBooks Conversion Tool

The QuickBooks Conversion Tool helps businesses seamlessly transfer data from various accounting software to QuickBooks Desktop, including Sage 50 and Quicken. It ensures secure migration…

-

How to Activate ViewMyPaycheck and Set Up QuickBooks Workforce?

This guide helps employers activate and set up QuickBooks’ “View My Paycheck” and “QuickBooks Workforce” features, enabling employees to securely access pay stubs and tax…

-

SBA 504 Green Loans: For Energy Efficiency and Green Projects

The SBA 504 Green Loan Program helps small businesses access financing for energy-efficient and renewable energy projects, promoting environmental sustainability. It supports investments in energy-saving…

-

SBA 504 Loans for Equipment Financing: A Comprehensive Guide

The SBA 504 loan helps small businesses finance the purchase of essential, long-term equipment with lower upfront costs. By combining contributions from private banks and…

-

How to Enter Credit Card Refund in QuickBooks Desktop & Online?

Accurately recording credit card refunds in QuickBooks is essential for maintaining a clean audit trail, ensuring precise expense tracking, and balancing account ledgers. The process…

-

SBA 504 Loans to Refinance Business Debt

The SBA 504 Debt Refinance Program offers a solution for small businesses to refinance commercial mortgages and other business loans at lower interest rates with…

-

SBA Microloan Program: A Comprehensive Guide for Requirements for Startups?

The SBA Microloan program provides small businesses, startups, and nonprofit childcare centers with loans up to $50,000 to support growth and daily operations. These loans,…

-

SBA Loan Down Payment – How Much to Pay?

The article provides an in-depth guide on SBA loan down payment requirements, explaining how the down payment varies based on factors like loan type, credit…

-

Mortgage Help and Home Repair Loans after a Natural Disaster

If you’ve been affected by Hurricane Helene, financial relief options are available to help you recover. Federal aid programs, like SBA disaster loans and FHA-backed…

-

Financial Relief for Businesses Affected by Natural Disasters

This article guides businesses and homeowners through the process of securing financial relief following natural disasters. It highlights the importance of SBA Disaster Loans, including…

-

SBA 504 Loan Program: A Definitive Guide

SBA 504 loans provide small businesses with long-term, fixed-rate financing for property and equipment purchases, with amounts up to $5 million. These loans, backed by…

-

Economic Injury Disaster Loan (EIDL)

The U.S. Small Business Administration (SBA) provides Economic Injury Disaster Loans (EIDL) to help businesses impacted by disasters like droughts, hurricanes, and other economic injuries.…

-

SBA Loans: Types, Pros and Cons, How to Apply?

SBA loans provide small businesses with access to affordable financing through low-interest rates and flexible repayment terms. These loans, backed by the U.S. Small Business…

-

How to Enter Bill for Received Items in QuickBooks Desktop and Online?

QuickBooks helps businesses track and manage bills from vendors for goods or services received on credit. By entering bills, you ensure accurate accounts payable, improved…

-

Top 9 Credit Card Companies in USA

This article helps you choose the best credit card companies in the USA by highlighting the top 8 issuers based on purchase volume and card…

-

21 Types of Credit Cards Used in United States

This article provides an overview of the 21 types of credit cards available in the United States, each designed to meet specific financial needs, such…

-

The Most Used Credit Cards in The USA?

Looking for the most popular and effective credit cards in the USA? This article highlights top credit cards that cater to different needs like cash…

-

How to Print Checks in QuickBooks Online?

Printing checks in QuickBooks Online is a crucial operational task that requires precise software setup and hardware alignment to avoid costly errors and maintain accurate…

-

What is The Difference Between Payroll Liabilities And Payroll Expenses In QuickBooks?

This article explains the key difference between payroll liabilities and payroll expenses in QuickBooks, focusing on how businesses track and record these financial elements. Payroll…

-

How To Print Journal Entries In QuickBooks Online (QBO)?

Printing journal entries in QuickBooks Online provides businesses with essential physical documentation required for professional auditing, tax compliance, and internal management reviews. While the platform…

-

From Humour to Drama: Accountants in TV Shows & Web Series

If you’re an accountant or simply love accounting dramas, this article introduces the top TV shows and web series that feature accounting professionals in action.…

-

Famous Accountants Who Changed Careers and Made History

This article highlights how renowned individuals transitioned from accounting to diverse careers, demonstrating that accounting skills can open doors to various fields. From entertainers like…

-

Cash Management During Recession for Small Businesses

This article addresses how businesses can manage financial challenges during an economic recession. It provides strategies such as cutting unnecessary costs, optimizing cash flow through…

-

Cash Disbursement: Definition, How it Works & Example?

Cash disbursement involves the payment of funds by a business to various parties, including vendors, employees, or creditors. It is crucial for maintaining accurate financial…

-

15 Best Cash Management Software: Free and Paid Software?

Cash management software helps businesses efficiently monitor, plan, and manage their cash flow. By integrating with accounting and banking systems, it provides real-time data, ensuring…

-

Cost Volume Profit Analysis – Meaning, Formula, Assumptions and Limitations?

Cost Volume Profit (CVP) Analysis helps businesses understand the relationship between cost, sales volume, and profit. It allows companies to determine break-even points, forecast profitability,…

-

Direct Vs. Indirect Cost: Difference, Examples and Importance?

Understanding the difference between direct and indirect costs is essential for accurate pricing, budgeting, and financial management. Direct costs, like raw materials and labor, are…