Meaning of Cost Volume Profit Analysis

Cost Volume Profit (CVP) Analysis is a concept in financial management that enables businesses to determine the relationship between cost, volume of sales, and profit.

CVP Analysis is useful to establish sales goals, pricing schemes, and expense estimates in this analysis. It also helps in the establishment of break-even, where total sales are equivalent to total cost, and therefore, there is no profit or loss.

In general, CVP Analysis is helpful in developing the strategic plan as it allows the managers to see what will happen under certain conditions and make a proper decision to increase the level of profitability.

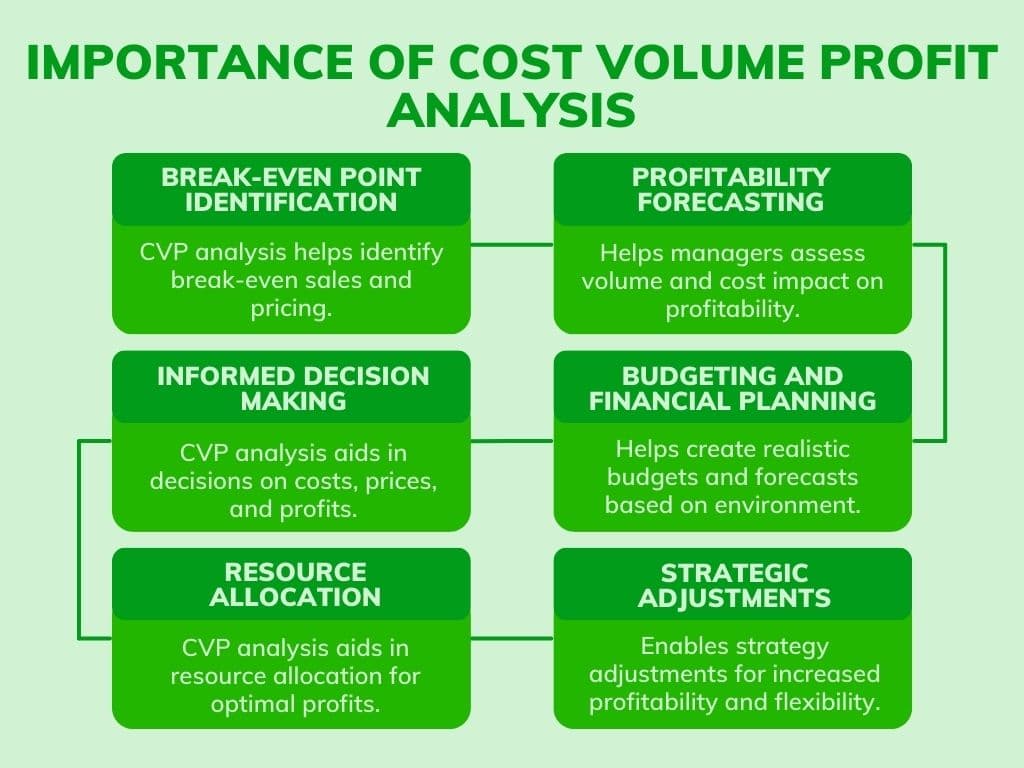

Importance of Cost Volume Profit Analysis

Analyzing the importance and purpose of CV Analysis from a business point of view:

- Break-Even Point Identification: CVP Analysis is useful in establishing a break-even point, which is the level of sales needed in order to recover all the costs. This understanding helps to define achievable sales volumes and therefore the right pricing levels.

- Profitability Forecasting: This makes it possible for business managers to determine the level of effect that changes in volume and costs have on business profitability. This assists in an analysis of the financial effect of various options.

- Informed Decision Making: CVP Analysis helps in decision-making concerning production capacities, costs, and price changes to control the impact on profit margins due to differences in costs and sales.

- Budgeting and Financial Planning: It plays a role in helping in the production of realistic budgets and forecasts based on how the existing business environment will impact financial results.

- Resource Allocation: CVP Analysis assists organizations in making good decisions on the determination of resource allocation as well as allocation so that they can gain optimum profits.

- Strategic Adjustments: It allows for the modeling of other situations and the ability to change the strategies for greater profitability, such as a change in the product or service portfolio or prices.

Objective of CVP Analysis

The objectives of CVP analysis are mentioned below:

- Determine Break Even Point: It helps determine the required sales volume that would cover the total costs, making it easier for the business to establish the minimum performance standards that need to be met to break even.

- Evaluate Profitability: Evaluate how sales and cost volumes affect company’s profitability which helps in determining right prices that can help in achieving the targeted profit margins.

- Support Pricing Decisions: It gives an analysis of how changes in price impact profitability, which helps determine the right prices that can help achieve the targeted profit margins.

- Guide Production Planning: Helps in identifying the right level of production to set by showing the various costs and revenues that are likely to be incurred in the case of different production levels.

- Analyze Cost Structures: Identifying the fixed and variable costs in order to relate them to cost behavior and financial performance in the organization so as to be able to control costs effectively.

- Facilitate Budgeting: Helps in setting realistic budget estimates revealing to what extent changes in sales and cost factors impact organizational revenues.

How to Conduct CVP Analysis?

Below is a step-by-step guide for conducting CVP analysis:

- Define Objectives: Define the purpose of the CVP Analysis all of which may include an evaluation of the profitability level or the establishment of sales targets.

- Gather Data: Gather financial information such as fixed expenses, client-variable expenses, and sales data.

- Calculate Key Metrics: It will tell us how much more or less the contribution margin per unit is than the actual contribution margin ratio, which is computed by the calculations of the break-even point in units and revenue.

- Analyze Profitability: Check for profit or loss at different levels of sales and find the margin of safety.

- Recommendations: Based on the analysis presented above, the following course of action regarding pricing, cost control, or sales promotion should be taken.

- Review Regularly: Revised the analysis when a change in business conditions or/and financial information has occurred.

Components of CVP Analysis

CVP Analysis consists of different elements which are listed below:

- Sales Revenue: The total output of sales from the sales of goods or services, which can be arrived at by multiplying the unit price by the total units sold.

- Variable Costs: Overhead costs, those costs that are likely to change in proportion to the level of production or sales, expressed as a cost per unit of production or sales multiplied by the number of units.

- Fixed Costs: Expenses that must be paid no matter the level of production or sales and may consist of rent, salaries, or insurance, among others.

- Contribution Margin: The money that is left from the total revenues earned by a firm after excluding cost that varies directly with the number of units produced or sold.

- Contribution Margin Ratio: A ratio that shows the proportion of the total sales that provides for the cover for fixed costs and the proportion that goes towards making profit.

- Break-Even Point: The predicted sales level at which total revenue equals total costs expressed in units or sales dollars.

- Profit / Loss: It is the amount of money earned or lost in business operations.

- Margin of Safety: The difference between actual or projected sales and break-even sales, which shows the probability of loss.

- Sales Mix: The ratio in which each product is sold in total production since it influences the total contribution margin and the break-even point.

- Target Profit: The amount of profit that the business tries to generate , CVP Analysis is utilities to find out the level of sales volume or revenue that is required in order to achieve the set profit.

Assumptions of CVP Analysis

This theory works on a few assumptions which are explained below:

- Linear Cost and Revenue Relationships: CVP Analysis takes it that total revenue and total costs have a linear relationship that is proportional to changes in the volume of production and sales. This means that the variable cost rate and the selling price are relatively constant.

- Constant Selling Price: The analysis also assumes that the selling price per unit is constant irrespective of the number of units that are sold. No allowance is given to the fluctuations in price that may include situations whereby some products are sold at a cheaper price as compared to others, or where large quantities of the product are sold, or where the general market price has altered significantly.

- Fixed Costs Remain Constant: Total costs also contain fixed costs which remain constant with the given range of production and sales levels of activity. These costs also have fixed nature, that is, they are not affected by the changes in the levels of production.

- Variable Costs Per Unit Remain Constant: Therefore, each of them has its limitations that need to be taken into consideration, for example, CVP Analysis assumes that the variable cost per unit is fixed with the change in the production volume. This means that the cost of raw materials, labour costs and other variable costs are relatively fixed.

- Single Product or Constant Product Mix: CVP Analysis often draws its basis on the analysis of a single product. When there are more than two products it assumes a constant product mix or sales mix proportion.

- Production Equals Sales: The analysis further assumes that the level of production equals the level of sales More precisely, Each cell represents the number of units of a particular product type produced or sold at a given point in time. In each time period all the units are sold and inventory is constant and not changed.

- No Changes in Business Structure: CVP Analysis seems to carry the notion that the business structure or the market situation cannot significantly alter the costs, prices or the manner of operations.

- Short-Term Analysis: The assumptions are mainly meant for short-term analysis depending on the business’s flow of operations. Consequently, long-term changes in costs and prices, as well as possible improvements to production capacities, do not form part of conventional CVP analysis.

- Straightforward Cost Classification: As a matter of fact, it is presumed that costs can be best divided into fixed and variable costs. These cost types are well defined and there is no confusion as well as overlapping of the two.

Formulas for CVP Analysis

The fundamental formula for Cost Volume Profit (CVP) Analysis is:

Profit = (Sales Revenue – Variable Costs) – Fixed Costs

To find the break-even point in units, use this formula:

Break-even Point (Units) = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit)

Where:

- Fixed Costs: These are expenses that include rent, power bills, salaries, and other monthly utilities that typically don’t fluctuate as much.

- Sales Price Per Unit: This represents the cost of a single item.

- Variable Costs Per Unit: These are expenses, such as labor or raw materials, that change depending on how much you are producing.

To find the break-even point in sales revenue, use the below formula:

Break-even Point (Revenue) = Fixed Costs / Contribution Margin Ratio

Where:

Contribution Margin Ratio = (Selling Price per Unit – Variable Cost per Unit) / Selling Price per Unit

What are the Steps for Calculating a Cost-Volume-Profit Analysis?

Here are the steps for calculating a cost-volume-profit analysis:

Step 1: Calculate the Sum of Fixed Costs

First, add up the expenses for marketing, payroll, rent, and insurance to determine the total fixed expenditures for the business.

Determine which costs are constant and which are variable before beginning to compute all of the production costs. Multiply the result by the quantity of units produced after deducting the production costs from the variable costs.

Fixed costs = (total cost of production − (variable cost per unit x number of units produced)

Step 2: Determine the Selling Price of the Product

You can determine whether the selling price per unit will enable the business to make the targeted profits with the aid of the cost-volume-profit analysis. By analyzing the net sales and variable costs, you may ascertain the product’s selling price. To begin, figure out the variable cost per unit by dividing the entire amount of variable costs by the number of units produced in that time frame.

Selling price per unit = Selling price per unit = variable cost per unit + contribution margin per unit.

Step 3: Calculate the Variable Cost Per Unit

Variable costs can increase or decrease. You can evaluate the following costs to find the variable costs:

- Direct labor: Direct labor is the amount that an employer pays workers on an hourly basis to produce a finished good.

- Direct Material: The raw components of the finished product are called direct material.

- Variable Overhead in Manufacturing: The company’s hourly wage for production supervisors, machinery, and shipping

The variable cost per unit can be computed by adding these expenses together.

Step 4: Calculate the Contribution Margin Ratio and Contribution Margin

The variable cost per unit is subtracted from the unit selling price to determine the contribution margin. By calculating the difference, you can determine how much profit is left over to pay for the fixed costs.

Contribution margin = variable costs per unit − unit selling price,

To find the contribution margin ratio, and divide the contribution margin by the unit selling price.

Contribution margin ratio = contribution margin/unit selling price

Step 5: Perform the Cost-Volume-Profit Analysis

Refer to the previous computations to perform the cost-volume-profit analysis. Various formulas can be used to calculate the CVP analysis and determine how many units a business needs to sell to make the required profits.

Break-even sales volume = fixed costs / (price − variable costs)

Practical Example of CVP Analysis

Scenario

A company produces and sells a product with the following details:

- Selling Price per Unit: $50

- Variable Cost per Unit: $30

- Fixed Costs: $40,000

Solution

Calculating Contribution Margin per Unit:

Contribution Margin per Unit = Selling Price per Unit – Variable Cost per Unit

= $50 – $30

= $20

Calculating break-even Point in Units:

Break-even Point (Units) = Fixed Costs / Contribution Margin per Unit

= $40,000 / $20

= 2,000 units

Calculating Contribution Margin Ratio:

Contribution Margin Ratio = Contribution Margin per Unit / Selling Price per Unit

= $20 / $50

= 0.40 or 40%

Calculating break-even Point in Revenue:

Break-even Point (Revenue) = Fixed Costs / Contribution Margin Ratio

= $40,000 / 0.40

= $100,000

Result

- The company needs to sell 2,000 units to break even.

- The break-even revenue is $100,000.

Advanced Applications of CVP Analysis

While modern technologies can provide an enormous grasp of the linkages between cost, volume, and profit, traditional CVP research still offers deep insights.

So, let’s get right to it and examine it in more detail:

Sensitivity Analysis

This method aids in determining how changes in important factors affect the results of a CVP analysis. To comprehend how small adjustments to the selling price, variable cost per unit, or fixed costs may impact the breakeven point and overall profitability, it actually poses “what-if” questions.

Margin of Safety

The margin of safety is the maximum amount a company can drop in sales before reaching the breakeven point—no profit, no loss.

It establishes the amount of “cushion” a business has between its breakeven point and sales level at now.

Finding the Margin of Safety: To find the margin of safety, subtract the current sale from the breakeven point and divide the result by the current sale.

Margin of Safety = (Current sales level – Breakeven point) / Current sales level x 100

or,

The Margin of Safety (MOS) = 1 − (Current Share Price / Intrinsic Value)

Benefits and Limitations

Benefits of Cost Volume Profit Analysis

There are several benefits of CVP analysis. Below are a few points:

- Informed Decision-Making: CVP Analysis is used to undertake an assessment of how changes to the sales volume, cost, and price impact on the business’s profitability and, therefore, guide businesses in the decision-making processes regarding prices, production capacity, and costs.

- Budgeting and Forecasting: Helps in the development of fairly good budgets and forecasts and impacts and uses it to plan the businesses profitability based on the different options available.

- Break-even Analysis: CVP Analysis is used to establish the break-even point – this is a major aspect of cost in case of sales volumes necessary to avoid loss. This information is useful for sales planning and decision on the feasibility of the business.

- Strategic Planning: It also helps in the predictive analysis of different business topological changes like changes in cost structure or in market trends which can affect business’s financial performance.

Limitations of CVP Analysis

Below are a few limitations ofthis analysis:

- Assumption of Linear Relationships: The CVP Analysis as a concept assumes constant slope of the cost line, volume and revenues which may not effectively fit into present day operating scenarios where cost and price changes occur.

- Fixed Costs Assumption: It presupposes that fixed costs are fairly stable within certain levels. In contrast, in a practical operating environment, fixed costs may vary through issues like increasing capacity or even through scaling up operations.

- Single Product Focus: Unlike the Traditional CVP Analysis, which is primarily designed for a single product or a fixed product mix, it does not tally well with multi-product organizations or organizations with fluctuating mixes.

- Short-Term Analysis: CVP Analysis is generally used in the short run, and sometimes, it may not accurately reflect trends that are expected to be realized in the long run concerning costs, market conditions, or business strategies.

CVP Analysis vs. Break-even Analysis

CVP Analysis and break-even Analysis are closely related, and there often needs to be more clarity between them.

Nevertheless, there are significant differences between them:

Scope:

- CVP Analysis: An all-embracing profit-point relationship on the cost side and sales volume that shows the concept of profit. It assists in knowing how fluctuations in cost and volume affect profits and is involved in a variety of management decisions.

- Break-Even Analysis: A subcategory of CVP Analysis that is much more specific and only analyzes if a company would only make a break-even or nt when they sell a specific number of products. It belongs to a group of CVP analysis used to determine a point where a business breaks even.

Purpose:

- CVP Analysis: Its primary objective is to facilitate an understanding of the company’s total performance based on given variations in cost, volume, and profit. Pricing decisions are well supported by the concept, specifically where costs are managed, and strategic planning occurs.

- Break-Even Analysis: Tailored made to show in units and dollars where one’s total sales equals its total expenses. It is basically applied to determine the necessary sales volume that would prevent operating at a loss.

Components:

- CVP Analysis: Take into account the various factors, some of which include overheads, variable costs, quantity of sale, price of products, and revenues. It can reveal business possibilities in various situations and the effects on business profitability.

- Break-Even Analysis: Analyzes and determines fixed cost, variable cost, or selling price and comes up with a break-even point. This involves the degree of sales volume or revenue that would be required in a business in order to recover all its costs.

Decision-Making:

- CVP Analysis: Offer more wide-ranging guidelines for decision-making regarding the prices to be charged, the changes in production quantities, and the assessment of the changes in cost and volume of sales in relation to total profitability.

- Break-Even Analysis: Analyzes and determines fixed cost, variable cost or selling price and comes up with a break-even point. This involves the degree of sales volume or revenue that would be required in a business in order to recover all its cost.

Applications:

- CVP Analysis: It is used for developing a plan of finance, besides offering a forecast of the finance required and the finance that is available for use in the formulation of organizational strategies. In modeling of different business situations and evaluating the financial outcomes it is useful.

- Break-Even Analysis: Measures are basically employed to assess the viability of a new product, an optimum price, or a business venture by ascertaining the worst acceptable performance.

Best Practices for Better CVP Analysis

Below are a few recommendations for better results:

- Accurate Cost Classification: Always make sure that you are separating fixed and variable costs so that you are not wasteful with your measurement. It is wrong to classify some costs in one account and that gives a wrong picture of the situation.

- Regular Updates: They should change cost and sales data often to match current market and organizational environment.

- Sensitivity Analysis: Analyze cost behavior patterns by using ‘what-if’ analysis, cost-volume-profit relationship, sales volume etc. University students need to embrace the principle because of several reasons as follows:

- Incorporate Realistic Assumptions: Do not implicitly assume that cost and revenues are linear; make allowances for tendency due to the scale economy effect or market factors.

- Use Relevant Data: Effort should be made to compare costs and revenues that are most relevant to the decision under consideration but avoid including overhead costs.

- Analyze Product Mix: Where a company sells several products, compute further contribution margins, and assess the effects of each product on the company’s profitability.

- Integrate CVP with Other Tools: Though CVP analysis is very useful it should be used in conjunction with market research data, competitive analysis as well as financial forecasting.

Conclusion

CVP Analysis can be defined as the analysis of costs and sales volume in relation to profitability, and it should be used in every business. Some of the important metrics include contribution margin, break-even number of units, and margin of safety, which help in making the right decisions regarding pricing, costs, and sales.

Despite the insight it provides in serving short-term planning needs, CVP Analysis has two main limitations: It assumes a linear relationship between volume activity and cost revenue as well as pretends that costs are constants. In general, CVP Analysis is a helpful device for strategic management and improves the decisions made concerning finance.

FAQs

What is the Use of Cost-Volume-Profit (CVP) Analysis?

CVP analysis is employed to ascertain whether there is an economic basis for a product’s manufacturing. The breakeven sales volume, or the quantity of units sold to pay the costs of manufacturing the product (and reach the target sales volume required to create the desired profit), is multiplied by a target profit margin. Next, in order to choose whether to manufacture the product or not, the decision maker could compare the product’s sales estimates to the goal sales volume.

What are the 3 Elements of CVP Analysis?

The 3 elements of CVP analysis are as follows:

- Selling price: The cost a consumer must pay to purchase a good or service.

- Cost: Cost is the total of all fixed and variable costs related to creating or marketing a good or service.

- Volume: Volume is the quantity of goods or services sold.

How Do Managers Use CVP Analysis to Make Decisions?

By calculating the necessary sales volume to meet certain profit targets, CVP analysis assists organizations in setting target profits. Managers can decide whether to cut expenses or boost sales in order to meet their desired profit targets by knowing how costs, sales, and profits are related to one another.

What is the Contribution Margin?

The contribution margin can be expressed as a gross or per-unit amount. It shows the additional revenue made for each product or unit sold following the deduction of the variable costs incurred by the business. It displays the percentage of sales that goes toward paying the business’s fixed expenses.

Profit is defined as any amount of revenue left over after fixed costs are paid. Therefore, the contribution margin must be greater than the total fixed costs for a business to be profitable.

What is the Formula for Cost Volume Analysis?

CVP analysis is based fundamentally on the contribution margin and the break-even point.

The key formulas are:

- Contribution Margin = Sales – Variable Costs hence Contribution Margin per Unit = Sales Price per Unit – Variable Cost per Unit

- Break Even Sales (Units) = Fixed Costs / Variable Costs per unit

- Contribution Margin Ratio = Total Sales (Revenue) ÷ Contribution Sale

- Break Even Sales = Fixed Costs ÷ Contribution Margin Ratio.

- Sales Volume for Target Profit = Total Fixed Costs + Target Profit ÷ Variable Cost per Unit

What is the PV Ratio?

The Profit-Volume (PV) Ratio also referred to as the Contribution Margin Ratio, establishes the management of sales and consisted of contribution margin. It demonstrates how many cents of every dollar of sales is spent on fixed costs and how many cents produce a profit.

Formula: PV Ratio = (Contribution Margin / Total Sales Revenues) * 100