Buy Now, Pay Later (BNPL) is a type of payment model that divides the customer’s purchases into multiple payments, allowing them to make the payment over time, simply defined as – get it now, pay for it later.

Buy Now Pay Later is a type of financing focused on granting short-term credit. It is often interest-free when customers make the payment on time and in full, giving consumers more purchasing power. However, there are additional charges for missed payments.

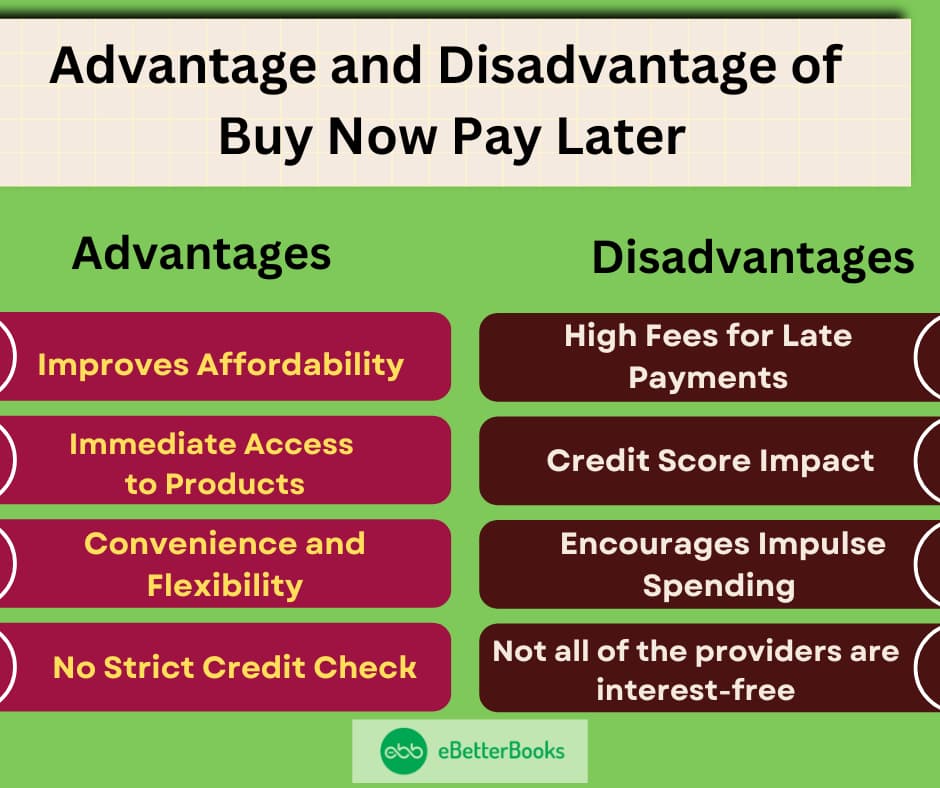

Using the “Buy Now Pay Later” financing can be beneficial for some while challenging for others if not used responsibly.

At the time of payment, choose your preferred method of payment, such as BNPL service. Now, pick a payment plan that works for you, whether it’s interest-free instalments or a longer-term option. Make sure to pay on time to avoid late fees or interest charges.

BNPL (Buy Now, Pay Later) allows customers to pay for purchases in instalments without impacting their credit scores.

Credit Cards, on the other hand, offer customers flexible payment options and periods, rewards programs, and the ability to build credit, but they may have higher interest charges if not cleared in full.

What is Buy Now, Pay Later?

Buy Now, Pay Later or BNPL is an alternative payment method that allows customers to buy items and take up to 12 months to pay for them , that too interest free (if instalment payments are made on time).

The BNPL programs have different terms and conditions and they offer short term loans with fixed payment, no additional charges and no interest.

This means that you know your entire payment amount, and each payment is the same. You can make the purchase using a BNPL application, or you might find BNPL incorporated into or offered by your credit card company.

When it comes to BNPL, you get to buy a product from an appropriate store, and at the time of purchase, you get to select the BNPL payment system. If the credit is granted, you are expected to pay a token amount equivalent to 25% of the cost of the products. You then take a cash loan and pay back the rest in equal installments without interest, often within weeks or months.

You can make the payments using a debit card, bank account, or credit card, and the amount to be paid can be obtained from your account card. You can occasionally pay through check or bank transfer, but the Consumer Financial Protection Bureau (CFPB) says that most BNPL lenders do not even offer consumers an option other than autopay.

The only major difference between the BNPL and a credit card is that interest is charged to the credit card balance, which is carried over to the next month. Although some credit cards provide interest-free of charge for a given period, they, in fact, range from zero percent APR.

Some Prominent BNPL Service Providers

- After Pay: After pay started as an Australian financial technology company that allows consumers to pay in four instalments over six weeks without interest.

- PayPal: PayPal Credit service is an online payment that allows consumers to split the payment into four interest-free instalments or to buy something.

- Sezzle: Sezzle is a payment option that offers interest-free early pay installments, with four payments spread over six weeks.

- Affirm: Affirm is a financial services tool that offers options that have no interest or longer options that have interest.

- Klarna: Klarna is a Swedish fintech company that allows consumers to choose between different payment methods. It also has an app that shows price comparisons as well as special shopping promotions.

- Zip: Zip is a digital financial service that allows consumers to pay in four instalment without interest. It has a clean app and wide acceptance with merchants, both online and physical stores.

| BNPL Service Providers | |||

| Interest | Repayment Terms | Fees | |

| Afterpay | Pay – in- four = 0%Monthly financing = 6.99%-35.99% | Pay in four instalments, due every two weeks. Pay monthly, with terms of six or 12 months, for online purchases over $400. | Late fee: Up to $8 |

| PayPal | Pay – in- four = 0%Monthly financing = 9.99%-35.99% | Pay in four instalments, due every two weeks. Pay monthly, with terms of six, 12 or 24 months, for online purchases of $199 or more. | No fees |

| Sezzle | Pay – in- four = 0%Pay – in – two = 0%Monthly financing = 5.99%-34.99% | Pay in four instalments, due every two weeks. Pay in two instalments, due two weeks apart. Pay monthly, with terms of three to 48 months. | Payment rescheduling fee: First is free, then up to $7.50. Failed payment fee: Up to $5. Late fee: Up to $15. Convenience fee: Up to $2.50. |

| Affirm | Pay – in- four = 0%Monthly financing = 0%-36% | Pay in four instalments, due every two weeks. Pay monthly, with terms of three to 60 months. | No fees |

| Klarna | Pay – in- four = 0%Pay – in – full = 0%Monthly financing = 0%-33.99% | Pay in four instalments, due every two weeks. Pay in full in 30 days. Pay monthly, with terms up to 24 months | Late fee: Up to $7.May charge a payment rescheduling fee. May charge a service fee when you use a one-time card at a non partner retailer. |

| Zip | 0% | Pay in four installments, due every two weeks. | Instalment fee: Up to $7.50. Late fee: Up to $7. Payment rescheduling fee: First is free, then $2. |

BNPL in Brands

Top Brands under various categories which accept BNPL Services in US

| Brands Name | Accepted BNPL Services |

| Beauty Brand | |

| Charlotte Tilbury | Klarna |

| MAC Cosmetics | Afterpay |

| Sephora | PayPal , Afterpay , Klarna |

| Supermarket, Hypermarket, Grocery Stores | |

| Walmart | Affirm, PayPal , One Pay |

| Target | Sezzle, Affirm |

| Sam’s Club | Zip, Afterpay |

| Clothing | |

| Urban Outfitters | Afterpay, Klarna |

| H&M | Klarna, Afterpay, Zip |

| Tommy Hilfiger | Klarna, Apple Pay, PayPal, Afterpay |

| Electronics | |

| Electronic Express | Zip, Affirm |

| Apple | Apple Pay, PayPal, Zip |

| Best Buy | Zip |

| E-commerce | |

| Etsy | Zip, Klarna |

| Amazon | Affirm, Zip, Afterpay / Klarna ( single use ) |

| eBay | PayPal, Apple Pay, Afterpay, Affirm |

How Does “Buy Now, Pay Later” Work?

On the payment page, you get several choices regarding how you would like to make the payment. In addition to cash, credit cards, and debit cards, there is an option to buy now and pay later.

Every time a customer buys something, they select “Buy Now, Pay Later” under the payment form. Then, they are forwarded to the provider’s app or site to either login or create an account. On the other side of the home page, customers are prompted to log in or register.

If the customer is a new customer, the provider requests basic information, such as name, email address, telephone number, etc. After that, the BNPL provider will perform a soft credit check, which will not affect your credit rating, and give you an approval or refusal within a few seconds.

Now, customers can select the repayment plan, agree to its terms, and complete the purchase. The repayment plan can be based on bi-weekly or monthly instalments.

Bearing these features in mind, after a purchase is concluded, businesses get the full amount to be paid excluding the fees. Consumers make their instalments to buy now and pay later suppliers, usually with no interest and no penalty when they make the subsequent payments on time.

How do you select a buy now, pay later provider?

Choosing the most appropriate buy now, pay later service providers depends on the nature of the items and the customizable payment experience.

When evaluating providers, consider the following:

- Credit Limits

Some buy now, pay later providers set minimum and maximum credit limits, while others have different spending limits that may include usage, credit, and repayment history. Always review your average order value and choose a provider that gives customers sufficient credit to make a purchase. Additionally, not all BNPL services are accepted at every retailer, so make sure the BNPL provider you choose partners with the stores where you frequently shop.

- Repayment Terms

Buy now, pay later companies offer a wide variety of installment plan offerings that can last from several weeks to multiple years. If your business regularly records large order values, consider buy now, pay later companies that allow for long repayment periods, such as offering customers to make monthly installments every six months. Companies that sell products with an average order value will be able to complete installations within a shorter time than companies with a high average order value.

- Interest Rates

While many Buy Now, Pay Later (BNPL) services offer interest-free payments, some may charge interest or impose fees for late payments. It is essential to read the terms and conditions carefully to understand any potential costs involved.

- Payment Flexibility

Different BNPL providers offer varying payment plans and schedules, so customers should select a service that offers payment flexibility that aligns with their financial situation and preferences. Always choose the buy now, pay later provider, which is simply the market leader.

What are the Benefits of Buy Now, Pay Later Services?

Interest-Free Payments

Most ‘Buy now, pay later’ schemes are interest-free, provided the amount is paid in full before a certain period elapses. This feature makes them a better option than credit cards, most of which attract very high interest rates.

Financial Flexibility

BNPL services offer consumers certain financial freedom. They can buy products or services that they cannot afford due to their inability to afford large sums of money at once. This may be especially helpful during the holiday rush or for products like electronics and furniture.

Easy Approval Process

It is important to note that the approval process for BNPL services normally ranges from minutes to a couple of days. Unlike other traditional credit products that may involve a credit check, which means users risk seeing their credit scores pulled down, BNPL providers conduct a soft credit check.

Budget Management

The cost of the BNPL refinancing development is unreasonably high, but consumers can avoid such expensive consumption at the point of purchase by making small purchases for greater efficiency in meeting financial obligations. This can ease the kind of pressure it would impose on one to part with a huge amount of money at once.

How Can Buy Now, Pay Later (BNPL) Affect Your Credit Score?

Many BNPL providers don’t run a full credit check; instead, they perform a ‘soft’ check, which does not impact your credit rating. However, sometimes people may pull a ‘hard copy’ on your credit file, and this will likely reduce your score slightly over time.

BNPL loans are only reported to one or more of the three major credit bureaus [Equifax, Experian, and Trans Union] for delayed or nonpayment. They can appear on credit reports and affect credit ratings.

Always ensure that your BNPL loan is within reasonable limits so that you can make the monthly instalments on time. Pay the agreed monthly instalment to avoid defaulting on your loan, as this will affect your credit history and report.

Risks Associated with Buy Now, Pay Later Apps

First, you need to know the repayment terms you’re agreeing to since BNPL financing is not as regulated as credit cards.

The repayment terms of Buy Now and Pay Later are not similar to the credit card repayment policy. The terms can differ greatly. Some organizations may make you clear the remaining balance through installments by breaking down the installments into two weeks within a month, while others may offer you anywhere from three to six months and even more time to repay your purchases.

It also helps to find out how your payments will work so you can budget for them properly. This means you can easily make your payments on time and avoid extra charges, but still customers get pointed out that when they fail to meet repayment on the Buy Now, Pay Later deals.

Stale payments with business partners are reported to credit bureaus, which could also lead to a poor credit score.

Even when you return the purchased item, you still need to wait for BNPL providers to accept the return process. For instance, there are chances that a merchant might permit you to return the item, but you’re enabled to cancel the buy now, pay later arrangement unless you give proof that the return of the item has been processed or accepted.

Advantage and Disadvantage of Buy Now, Pay Later (BNPL) for Consumers and Businesses

| Advantage of BNPL | Disadvantage of BNPL |

| Improves Affordability Immediate Access to Products Convenience and Flexibility No Strict Credit Check | High Fees for Late Payments Encourages Impulse Spending Credit Score Impact Not all of the providers are interest-free |

Advantage of BNPL

- Convenience and Flexibility: It enables consumers to pay for instalments over a certain period of time, irrespective of the amount charged for the purchase. They can be interest-free if the payment is made on time, according to the provider’s terms.

- Immediate Access to Products: It helps customers acquire needed merchandise or services without parting with all the cash at once, which makes it effective for large expenditures.

- Improves Affordability: It assists the consumer in planning his or her buying capacity without affecting the cash reserves.

- No Strict Credit Check: Most BNPL providers offer only soft credit checks, meaning that people with low or no credit histories can effortlessly apply for credit.

Disadvantages of BNPL

- High Fees for Late Payments: Failure to pay the monthly costs on time may attract penalties, which, when stacked on, make the service costly.

- Encourages Impulse Spending: Consumers enjoy easy access to goods and services and may end up buying items they cannot afford.

- Credit Score Impact: Some of the BNPL services are not reported to credit, while others will report on occasion which negatively impacts the user’s credit rating.

- Not all of the Providers are Interest-Free: While some BNPL providers charge interest, especially in the long-term repayment tenure, the total amount of repayment is slightly higher than the price of the product.

Tips on how to use buy now, pay later responsibly

- Do not use the buy now, pay later approach to buying items you do not really need. Before buying any particular item, a person should ask themselves if they require it.

- Ensure you pay your instalments before the due date to avoid charges like interest on the amount. Payments are recommended to be made automatically if you want to remember all due dates.

- When planning to purchase a product and finance it through a BNPL service, ensure you set a budget to avoid struggling to make payments. Do not buy things on the spur of the moment that you may not be able to afford.

- BNPL users should be encouraged to open only one or two accounts. They should avoid signing up multiple accounts with the BNPL. Using multiple BNPL accounts is costly, as you will realize it is complicated to organize payments and manage money well.

- When using a BNPL service, it is important that you fully comprehend the terms and conditions. One should be careful regarding charges, rates of interest, and terms of payment, among other things.

What are the other alternatives to buy now, pay later?

Credit Cards

Buying a credit card is simple, but this process should not be often used because its interest rates are high. If customers have above-average credit scores [ 690 or above ], then customers could get the 0 % Intro APR period, for 15 to 21 months. This could enhance your credit score, and you might get a signup bonus or some other rewards.

Personal Loans

You can go ahead and opt for personal loans when you have a good credit score and you qualify for a low interest rate. You can make the payment monthly based along with some interest, but with longer terms, which fits more comfortably in your budget.

In-store Financing

Popular stores usually offer ‘credit’ deals, where you can get the products you need regardless of the cash you have to purchase them. However, it should be noted that sometimes, the interest rates on these loans are relatively high.

Conclusion

BNPL provides a convenient and flexible payment system, which means that this special type of financing will be convenient for consumers with a limited budget and businesses that need to increase sales volumes.

Due to its simple structures, BNPL is easy to approach, and interest-free options make it easily accessible to young buyers. However, appropriate usage is necessary to prevent over-expansion and financial load indicators and make BNPL useful rather than making it a “Phantom Debt.”

Frequently Asked Questions

Are there interest or fees on BNPL plans?

Over three-fourths of BNPL plans have zero interest but charge a fee for payment made after the due date or if financing is stretched to multiple instalment.

Does BNPL hurt credit score?

Most BNPL providers do not run a tough credit check, meaning your score will not be affected initially. However, the penalty can include reporting the lack of payments to credit bureaus that harm credit.

Is BNPL safe to use?

Yes, there is safety in BNPL since reputable product providers ensure safe payment. However, make sure that you only apply its conditions to prevent you from overspending or going into a lot of debt.

Which type of products and services can retailers offer through BNPL?

Retail, travel, healthcare, and even home improvement are the types of products and services retailers offer through BNPL.

Can I pay off my BNPL balance early?

Many providers allow early payments without penalties, but make sure to check your agreement for specific terms.

How does BNPL affect credit score?

Buy Now, Pay Later (BNPL) services have become a popular payment option, allowing consumers to make purchases and pay in installments. However, the way BNPL affects your credit score depends on how the provider reports your payment activity and how responsibly you manage your BNPL payments.