Loan refinancing is the process of replacing an existing debt with a new one, often to secure better terms that help to reduce monthly payments or total interest costs over the life of the loan.

What does Loan Refinancing mean?

Loan refinancing replaces an existing debt to secure more favorable terms such as obtaining a lower interest rate by extending the repayment period or reducing multiple debts into a single loan. Borrowers often pursue debt refinancing when market conditions change or their financial situations improve, such as an increase in credit score.

Individuals can reduce their monthly payments with the help of loan refinancing. It also helps them to decrease the overall interest paid over the life of the loan, or access equity in their assets, such as a home.

The debt refinancing process usually involves applying for a new loan with a lender who evaluates the borrower’s creditworthiness and financial situation. Once the loan is approved the new loan will be used to pay off the total balance of the original loan.

Various types of refinancing options are available for the borrowers, such as rate-and-term refinancing, cash-out refinancing, and debt consolidation refinancing. Each type of refinancing process serves different financial goals, such as lowering interest costs or providing immediate cash access while retaining ownership of an asset.

Types of Business Loans that can be Refinanced

1. Term Loans

Term loans are traditional loans provided by banks or financial institutions having a fixed repayment schedule and interest rate. These debts can be refinanced to secure better terms such as lower interest rates or extended repayment periods. Term loan refinancing can help businesses reduce monthly payments and improve cash flow.

2. SBA Loans Refinancing Programs

SBA loans that are funded by the Small Business Administration, offer favorable terms for small businesses. Loan refinancing options under SBA programs often include lower interest rates and longer repayment terms that makes them an attractive choice for business owners looking to consolidate debt or improve their financing conditions. However, the SBA refinancing loan process involves strict eligibility criteria and documentation requirements.

3. Merchant Cash Advances (MCAs)

Merchant Cash Advances provide businesses with upfront capital and in exchange they ask for a percentage of future sales. While refinancing an MCA can extend repayment terms and reduce daily payments, it often leads to higher overall costs due to the high factor rates associated with these advances. Businesses should approach refinancing MCAs cautiously, as it can result in paying interest on previously accrued interest.

4. Lines of Credit

It offers flexibility that allows businesses to borrow up to a certain limit as needed. Refinancing a line of credit can involve negotiating better terms or consolidating multiple lines into one. This can help streamline payments and potentially lower interest rates, improving overall cash flow management.

5. Working Capital Loans

Working capital loans are those refinancing debts that are designed to cover short-term operational expenses. These loans can be refinanced to obtain better rates or terms, which can alleviate cash flow pressures. Refinancing might involve switching to a longer-term loan that offers lower monthly payments.

6. Equipment Loans

Equipment loans are used to finance the purchase of machinery or equipment utilised in the business. Refinancing these loans can help businesses to secure lower interest rates or extend payment periods by making it easier to manage the cash flow while still utilizing essential equipment.

7. Commercial Real Estate Loans

These loans help to finance the purchase or renovation of business properties. Refinancing these loans can lead to lower interest rates, improved terms, or accessing equity in the property. This can free up capital for other business needs while reducing overall debt costs.

8. Microloans

Microloans, typically offered by non-profit organizations or community lenders, provide small amounts of capital to startups and small businesses. These loans can be refinanced to secure better terms or consolidate smaller debts into one manageable payment. This is particularly beneficial for businesses looking to grow without incurring high-interest debt.

Business Loan Refinancing VS Debt Consolidation

| Feature | Business Loan Refinancing | Debt Consolidation |

| Definition | Business loan refinancing involves replacing an existing debt with a new one with better terms such as a lower interest rate or extended repayment period. This process allows businesses to adjust their financial obligations to better align with their current economic situation. | Debt consolidation combines the multiple debts into a single loan which simplifies the repayment process. This allows businesses to manage their finances more effectively by reducing the number of payments they need to make each month. |

| Purpose | The purpose of debt refinancing is to improve the terms of an existing loan which may lead to lower monthly payments or reduced interest costs. | The purpose of debt consolidation is to simplify debt management by merging various debts into one loan with a single payment. This is particularly helpful for businesses struggling with multiple creditors and varying interest rates. |

| Benefits | It potentially lowers interest rates, reduces monthly payments, and customize repayment terms that better fit the business’s cash flow. It also improves the financial stability by lowering the overall cost of borrowing and providing more favorable conditions for repayment. | The benefits of debt consolidation include simplified financial management due to having only one payment to track which reduces the risk of missed payments and late fees. It may also result in lower cumulative interest rates compared to maintaining multiple debts. |

| Ideal For | It is ideal for companies that have experienced improved credit scores or financial performance since taking out their original loan. Business loan refinancing is also suitable for businesses who are looking to take advantage of favorable market conditions that allow them to secure better financing terms. | Debt consolidation is best suited for businesses that are overwhelmed by multiple debts and find it challenging to keep track of various payment schedules. It’s particularly beneficial for those looking to streamline their finances and reduce stress associated with managing several loans simultaneously. |

| Impact on Credit | Refinancing can positively impact a business’s credit score if it leads to better payment terms and consistent repayment behavior. However, applying for new credit may temporarily affect the score due to hard inquiries. Improved payment history can significantly enhance creditworthiness with time. | Debt consolidation improves a business’s credit profile by reducing the number of open accounts and lowering overall credit utilization ratios. However, the credit score is initially affected with a new debt due to inquiries and changes in credit mix but responsible management post-consolidation can lead to long-term benefits. |

| Long-term Advantages | The long-term advantages of refinancing include decreased total loan costs through lower interest rates and adjusted repayment terms that align with the business’s financial goals. | Long-term advantages of debt consolidation include easier tracking of finances with consistent payment dates and potentially lower overall interest costs compared to maintaining multiple debts. |

| Risks | Risks associated with refinancing include potential fees for early repayment of existing loans and the possibility that new terms may not yield significant savings if market conditions change unfavorably after refinancing occurs. | The risks of debt consolidation include the possibility that new loan terms may not be as favorable as expected or could extend repayment periods that results in higher total interest costs over time. There’s also a risk of accumulating more debt if businesses do not change their spending habits after consolidating existing debts into one loan. |

How to Refinance A Business Loan

There are 8 steps to follow which help business owners to Refinance a Business Loan:

Step 1: Review Your Current Loan

Analyze Loan Details: Start the refinancing process by examining your existing loan’s terms such as the balance, interest rate, monthly payment, and remaining payment schedule. Understanding these details will help you identify what you want to change through refinancing.

Step 2: Determine Your Refinancing Goals

Identify Objectives: Understand your refinancing goals clearly, which define why you want to refinance. Some common goals are:

- Lowering the interest rate

- Reducing monthly payments

- Changing the loan term (shorter or longer)

- Consolidating multiple loans into one.

Step 3: Check Eligibility

- Assess Creditworthiness: Lenders will evaluate your personal and business credit scores. Ensure your credit score is in a favorable range, as this will influence your eligibility and the terms offered.

- Review Financial Health: Gather information on your business’s annual revenue and profitability, as lenders will consider these factors when assessing risk.

Step 4: Gather Required Documentation

Prepare Financial Documents: Compile necessary paperwork, which may include:

- Profit-and-loss statements

- Tax returns

- Bank statements

- Business licenses

- Balance sheets

- Proof of collateral (if applicable)

Step 5: Compare Lenders and Loan Options

Research Lenders: Decide whether to refinance with your current lender or seek a new one.

Compare offers based on:

- Interest rates

- Processing fees

- Repayment terms

- Lender reputation

Prequalification: Consider lenders that allow prequalification checks without affecting your credit score.

Step 6: Apply for Refinancing

- Submit Application: Once you’ve selected a lender and loan type, complete the application process. This typically involves providing the documents gathered earlier and filling out an application form.

- Negotiate Terms: If possible, negotiate terms such as interest rates and repayment schedules to ensure they align with your financial goals.

Step 7: Review New Loan Terms

Understand the New Agreement: Carefully review the new loan agreement before signing. Ensure that it meets your refinancing objectives and that you understand all terms and conditions, including any penalties for prepayment of the old loan.

Step 8: Close on the New Loan

Finalize the Process: Complete any final paperwork required by the lender after agreeing to the new terms. The new loan will be used to pay off your existing loan, effectively replacing it with potentially better terms.

Pros and cons of refinancing business loans

Refinancing business loans can be a strategic move for many entrepreneurs, but it comes with both pros and cons. Business owners can make informed decisions after understanding both of them.

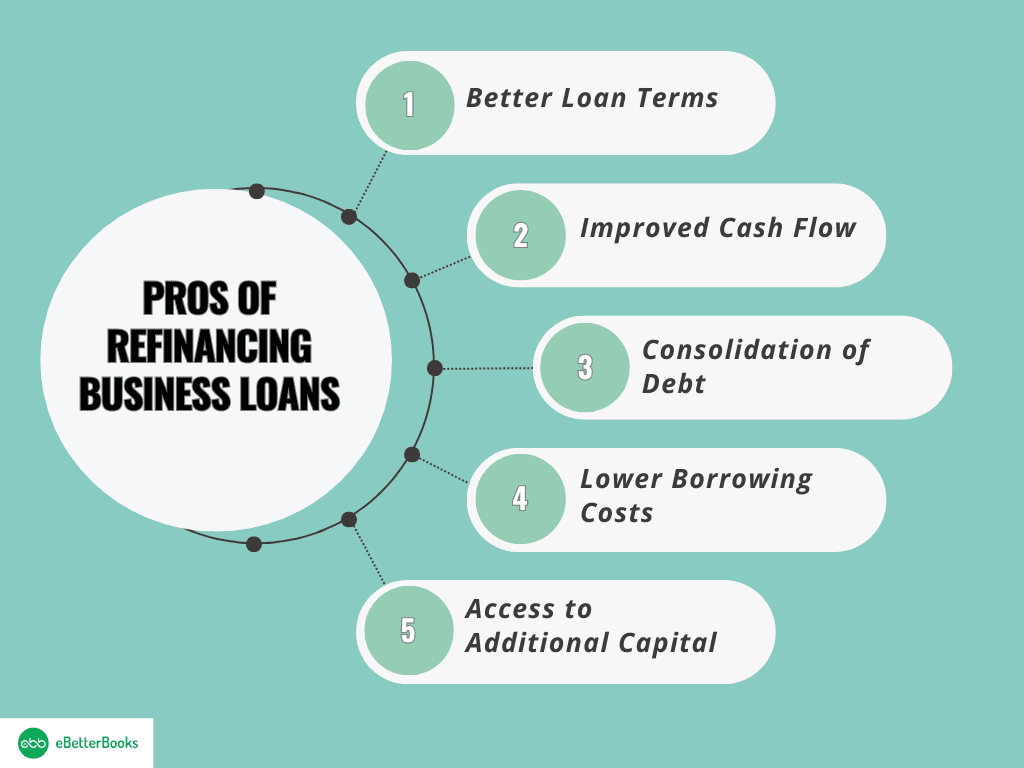

Pros of Refinancing Business Loans

- Better Loan Terms

Refinancing can provide better loan terms with the access to improved interest rates, especially if the business’s financial situation has strengthened since the original loan was taken out. It lead to lower total borrowing costs.

- Improved Cash Flow

Lower monthly payments resulting from refinancing can enhance cash flow. Improved cash flow helps business owners to allocate their funds more effectively by potentially taking new opportunities or covering operational costs.

- Consolidation of Debt

Refinancing can enable businesses to reduce multiple loans into a single payment by simplifying financial management and potentially securing better terms overall.

- Lower Borrowing Costs

Businesses can decrease the cost of capital by securing a loan with reduced interest rates or favorable terms which can positively impact the profitability and attractiveness to investors.

- Access to Additional Capital

Loan refinancing may allow businesses to get equity or increase loan amounts for expansion or operational needs by providing necessary liquidity.

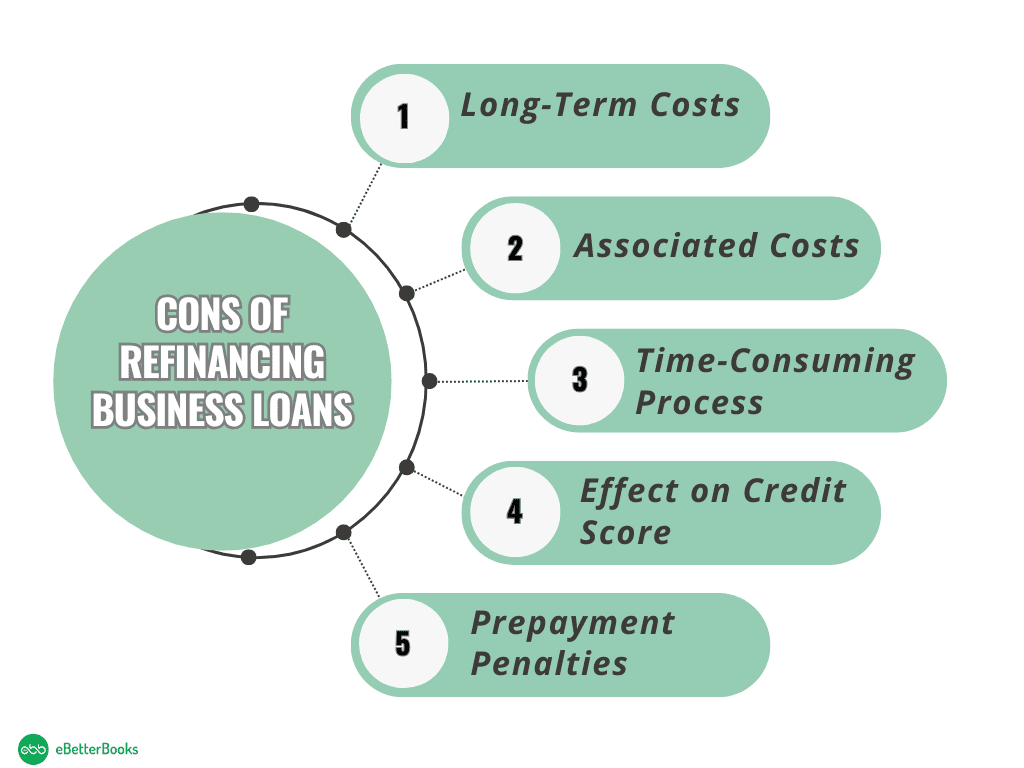

Cons of Refinancing Business Loans

- Long-Term Costs

Lowering monthly payments can be attractive but the extension of the loan term can lead to higher total interest payments over time. This means that even with lower monthly obligations, the overall cost of the loan may increase.

- Associated Costs

The loan refinancing process often incurs various costs such as appraisal fees, origination fees, and closing costs. These expenses can diminish the immediate financial benefits of refinancing.

- Time-Consuming Process

The debt refinancing process can be lengthy and complex that requires significant documentation and negotiation with lenders. If the savings are minimal the effort may not justify the outcome.

- Effect on Credit Score

The process of refinancing involves a hard inquiry on credit reports which can temporarily lower the credit scores. This is particularly concerning for businesses that are already managing tight credit conditions.

- Prepayment Penalties

There are some existing loans that may have prepayment penalties that could offset the benefits of refinancing, especially if switching lenders or loan types.

When to consider business loan refinancing

There are several scenarios in which a business owner may consider refinancing their debts.

Here are some of the circumstances that can indicate the right time to refinance:

- Stronger Loan Qualifications: If your business is experiencing growth that leads to an improved credit score, increased annual revenue, or a longer operational history, you may qualify for loans with better terms and lower interest rates. This improvement can make refinancing beneficial for you by reducing debt burden and improving cash flow.

- Falling Interest Rates: Loan refinancing can allow you to secure a lower rate, if market interest rates have dropped since you took out your original loan. This can reduce your monthly payments and overall interest costs.

- High Existing Loan Payments: If your current loan has high monthly payments that strain your cash flow, refinancing could help lower these payments. This is particularly useful if you can switch from a variable interest rate to a fixed rate, which provides more predictable financial outflow.

- Multiple Loans: If you manage several loans with varying interest rates and terms by reducing them into a single loan through refinancing can simplify your financial management. This approach often leads to lower cumulative interest rates and easier payment tracking.

- Cash-Out Refinancing: If the value of your collateral (such as property) has increased, you might consider cash-out refinancing. This allows you to take out a new loan for more than what you owe on the existing one, giving you access to extra cash for business expansion or improvements while still retaining ownership of the asset.

- Flexible Repayment Terms: Loan refinancing can provide more favorable repayment terms that align better with your current business needs. For instance, you might negotiate longer repayment periods or smaller monthly payments that ease financial pressure during slow business months.

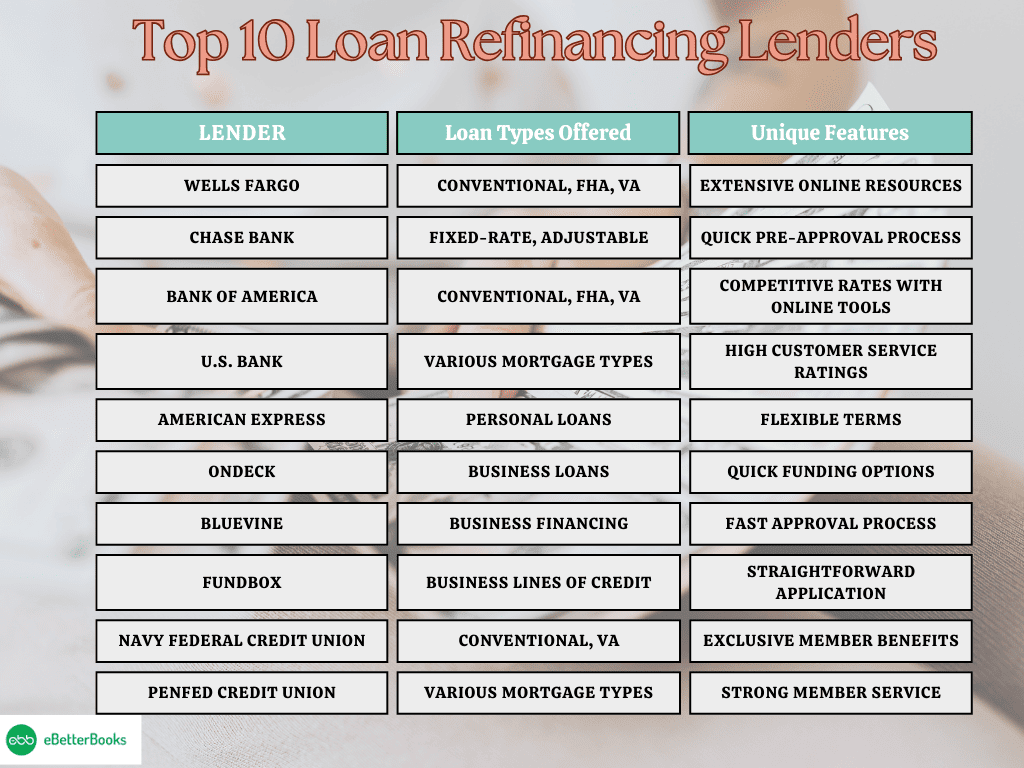

Top 10 Loan Refinancing Lenders

- Wells Fargo

Wells Fargo offers competitive rates to borrowers and different loan types such as conventional, FHA, and VA loans. They provide tools such as a mortgage calculator and personalized rate estimates that help customers to evaluate potential savings. The cash-out refinance options they offer allow homeowners to access equity for major expenses. However, borrowers should also be aware of associated costs including closing fees and origination charges.

- U.S. Bank

U.S. Bank offers competitive rates and a direct online application process for the borrowers. It also provides various mortgage refinancing options customized to meet diverse borrower needs. U.S. Bank’s refinancing services include cash-out options and the ability to switch from an adjustable-rate loan to a fixed-rate mortgage. Their customer support is considered as a strong point that guides clients through the complexities of refinancing.

- American Express

American Express mainly focuses on personal loans rather than traditional loans refinancing but it does offer options for debt consolidation through personal loans. Their offerings are designed for quick access to funds with competitive interest rates by making them an attractive choice for those who are looking to refinance personal debts rather than home mortgages. The application process for the loan refinancing is simplified as it allows fast approval.

- PenFed Credit Union

PenFed Credit Union provides multiple debt refinancing options with competitive rates aimed at both military personnel and civilians. They offer different loan types with flexible terms that focus on better customer service during the application process. It also features educational resources that help borrowers to make informed decisions about their refinancing needs while potentially waiving certain fees for eligible members.

- OnDeck

OnDeck specializes in small business loans that provides refinancing options that specifically cater to small business owners. It offers flexible repayment terms and quick funding processes that are crucial for businesses who require immediate capital. OnDeck’s technology-driven approach simplifies the application process by making it accessible for more small business owners who are looking to refinance their existing loans or consolidate debt.

- Bank of America

Bank of America offers a complete set of refinancing products that focuses on flexibility and customer support. It provides options for both conventional and government-backed loans such as FHA, and VA and a user-friendly online platform for applications. Bank of America has a refinancing process that includes personalized rate assessments and educational resources that help borrowers to understand their choices properly.

- Fundbox

Fundbox is another loan refinancing lender that provides financing solutions primarily aimed at small businesses by offering lines of credit that can be used for refinancing existing debts or overcoming the challenges of cash flow management. Their platform allows for quick applications and approvals, catering to businesses in need of immediate financial relief. Fundbox’s focus on transparency in fees and repayment terms makes it an appealing option for entrepreneurs looking to refinance.

- BlueVine

BlueVine focuses on small business financing, offering lines of credit and invoice factoring as part of their refinancing solutions. It provide services that help businesses to manage cash flow effectively while providing quick access to funds. BlueVine emphasizes transparency in fees and terms, making it easier for business owners to understand their financing options when considering refinancing.

- Navy Federal Credit Union

Navy Federal Credit Union offers competitive debt refinancing options exclusively for military members and their families. It provides personalized service and flexible terms to meet the unique needs of military members. Their refinancing products include various loan types with favorable rates and potential fee waivers for eligible borrowers. The credit union is known for its strong member support throughout the refinancing process.

- Chase Bank

Chase bank provides various debt refinancing options such as fixed and adjustable-rate mortgages. It emphasizes a simplified online application process and offers various techniques for estimating payments. It also allows borrowers to consolidate debt through refinancing by potentially lowering monthly payments. Chase Bank has responsive customer service that assists clients throughout the refinancing journey.

Refinance With the Same Lender VS a New Lender

| Feature | Refinancing With the Same Lender | Refinancing With a New Lender |

| Ease of Process | Typically easier as the lender already has your information on file, which can speed up the application process. | May require more documentation and a longer application process since the new lender needs to verify your financial history. |

| Potential Savings | It can be beneficial due to lower fees or rate discounts offered to existing customers potentially saving money on closing costs. | Comparing different loans can help you find better interest rates and terms which may lead to significant long-term savings compared to your current loan. |

| Flexibility in Terms | Limited flexibility if your current lender does not offer competitive rates or favorable terms; you may miss out on better options. | Greater chance of finding more favorable refinancing terms such as lower interest rates or different loan structures customized according to your current financial situation. |

| Customer Service Experience | Familiarity with the same lender can lead to a smoother experience but service quality may vary depending on the lender’s policies. | A new lender may provide better customer service or innovative features that your current lender lacks by enhancing your overall experience. |

Conclusion

Loan refinancing can be a powerful source for small businesses who want to improve their financial health. Businesses can lower their monthly payments by replacing existing debts with new loans that offer better terms, reduce overall interest costs, and enhance cash flow. Debt refinancing is important for business owners to carefully evaluate their refinancing goals and the associated costs as well as the potential impact on their credit scores. Refinancing can lead to significant long-term benefits that allow businesses to take new opportunities and navigate financial challenges more effectively.