Credit Card Auto-pay features are readily accessible for fee collection services, including utilities, magazines, and club memberships. All leading banks and credit card companies, such as Chase, American Express, and Capital One, have provided auto-pay options on their websites and apps.

Now, autopay is quite common in various industries. However, its existence complicates the consumers when it comes to credit cards. Most of the time, there is the choice of paying the minimum amount, the full amount, or any amount fixed between the two. Apart from credit card payments, autopay allows you to pay subscriptions, bills, and payments for loans so that financial responsibilities do not lead to financial penalties. By automating your payments, you can avoid late fees, build your credit score, and maintain better control of your finances.

Key Highlights

- With credit card auto-pay, you don’t have to worry about missing payment deadlines or manually paying bills each month.

- On-time payments positively impact your credit score, making it easier to qualify for loans and credit card offers.

- Automate payments and ensure your credit account stays in good standing to avoid late fees and potential penalty APRs.

What is Credit Card Auto-Pay?

Autopay is a convenient service offered by most card issuers that pays for your monthly statement in full after it gets posted. It is also flexible and customizable in terms of what amount to charge and when to charge it. People facing challenges with meeting deadlines or those with concerns about missing payments have a great benefit from autopay.

Autopay for credit cards is typically available for credit card issuers or merchants who allow it. It can often be set up inside an online account portal. The payment may be debited on the due date of the bill, or you can set another date. Remember this date so that you have enough money in your account to cover the bill.

That means if you need more adequate funds in your account when the automatic payment initiates, you can be charged merchant fees and bank fees. Also, keep your banking details private, especially when a company wants to make payments automatically from your account. This is of extreme importance to ensure that a given company is okay with debiting payments directly from your account.

Auto-pay offers convenience and reliability for busy individuals who want to ensure their payments are always made on time. However, its effectiveness depends on selecting the right payment option and ensuring sufficient funds are available in your bank account.

With auto-pay, you can choose from various payment options to suit your financial goals:

| Minimum Payment | Full Statement Balance | Custom Amount |

|---|---|---|

| This covers the smallest amount required to keep your account in good condition and avoid late fees, but it may result in accruing interest on the remaining balance. | This pays off your total outstanding balance in full, helping you avoid interest charges completely. | A specific amount you set to pay each month, regardless of your actual balance. |

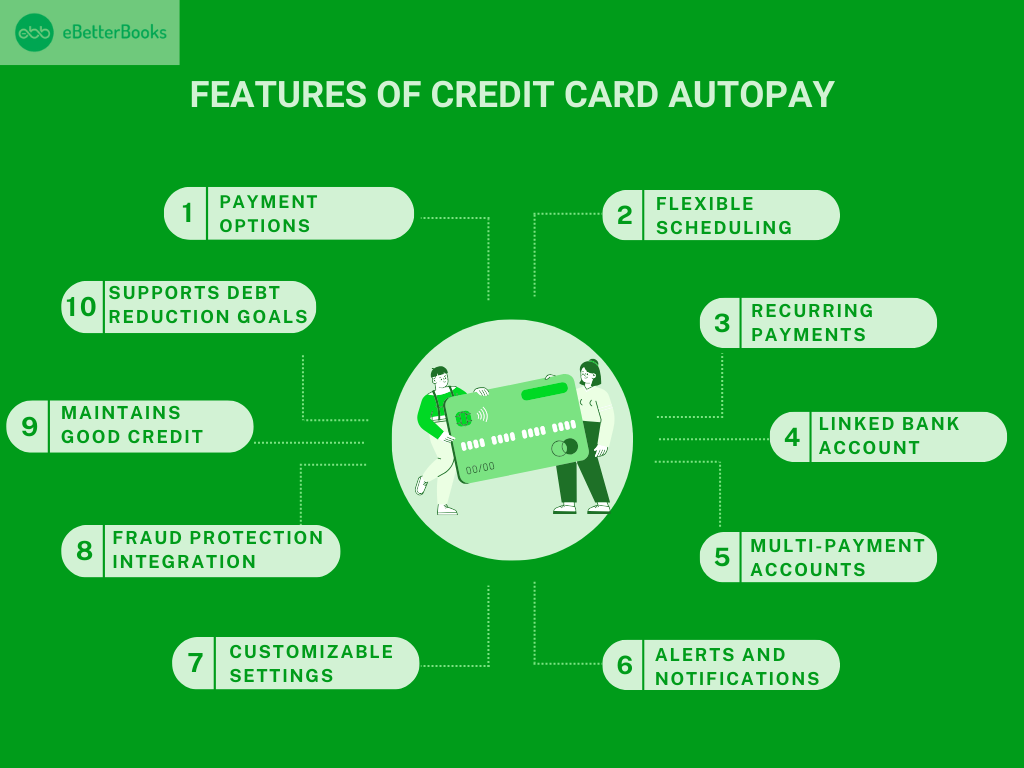

Features of Credit Card Auto-Pay

AutoPay for credit cards is a service that has other accompanying features whose aim is to ensure that payment of bills is as easy as possible.

Here are the key features of credit card autopay:

- Payment Options

Autopay allows you to choose how much to pay each month, such as:

- Minimum Payment: The smallest quantity needed to update your account balance.

- Full Statement Balance: To avoid interest, pay off your entire card balance or try to pay more than the minimum payment due.

- Custom Amount: It has to be a specific amount that you allocate according to the financial capacity you have put on your expenditure plan.

- Flexible Scheduling

You can choose the date of payment, often paying on this very date or a couple of days before that. This way, you ensure that the payments are made within your locus of control, which is your cash flow.

- Recurring Payments

It means that once configured, it can run payments in the automated mode for each billing cycle without one’s input.

- Linked Bank Account

Autopay automatically withdraws the amount owed from the checking or savings account you provide, hence making payment easier.

- Multiple Payment Accounts

Some issuers let you tie in several bank accounts or select various accounts for various payments, adding other options.

- Alerts and Notifications

Most credit card companies even send notifications for pending or successful autopay transactions so that you are aware.

- Customizable Settings

You can access the autopay options and modify the amount to be paid, the account to use, or stop autopay altogether.

- Fraud Protection Integration

Similarly to manual payments, autopay payments are shielded by fraud monitoring for your account protection.

- Helps Maintain Good Credit

Through on-time payment, autopay is useful in ensuring that one’s payment records are good and that one’s credit score will either remain or improve.

- Supports Debt Reduction Goals

Autopay can be accompanied by other manual payments for quicker aggression of the balance; thus, it is a useful tool.

Who Provides Credit Cards Auto-Pay?

| Bank/Issuer | Interest Rates (APR) | Steps to Apply for Autopay |

|---|---|---|

| Chase | Variable APR: 20.49%–29.99% | Log in to your Chase account online or via the app. Navigate to “Payments & Transfers” > “Autopay” to set preferences. |

| American Express | Variable APR: 20.49%–29.99% | Log in to your American Express account.Go to “Payments” > “Set Up Autopay” to select payment preferences. |

| Capital One | Variable APR: 19.99%–30.99% | Log in to your Capital One account. Go to “Payments” > “Set Up Autopay” to select preferences. |

| Discover | Variable APR: 16.99%–27.99% | Log in to your Discover account. Go to “Payments” > “Autopay” to set up and choose payment options. |

| Bank of America | Variable APR: 18.99%–28.99% | Log in to your Bank of America account. Go to “Bill Pay” > “Autopay” to set preferences. |

| Wells Fargo | Variable APR: 20.24%–30.24% | Log in to Wells Fargo online banking. Go to “Bill Pay” > “Autopay Setup” to configure payments. |

| Citi | Variable APR: 19.99%–29.99% | Log in to your Citi account. Under “Payments,” select “Autopay” and follow the instructions to set it up. |

How to Sign Up and Setup Credit Card Auto-Pay?

Setting up credit card auto pay is a simple process that helps you to determine whether your payments are made online. You can set up automatic payments by linking your bank account and credit card details.

To set up an automated payment, you will normally need your checking account information, such as the account number and/or routing number, to authorize the electronic withdrawal from your account.

Here’s how you can get started:

- Find Out If Your Provider Support Auto-Pay

Almost all credit card providers and processors have this auto-pay feature. Funds must be deposited into your account before the dress is available for order; contact customer service to check the status.

- Log In to Your Account

- You can either go to their website and log in to view your credit card or bank statement online or download their mobile application.

- Navigate to the section labeled Payments, Pay Bills or Auto-Pay Setup.

- Find the Autopay Option

Go to the payment details or bill section, where you tap on autopay options.

- Choose How You Will Pay

Decide how much to pay each month:

- Minimum payment

- Full statement balance

- Custom amount

- Provide Your Payment Details

Connect the bank account from which the payment will be made. Ensure there is enough money in the account to prevent overdrafts.

- Set the Payment Date

Select when the payment should be taken, for instance, on or before the due date.

- Confirm and Activate Auto-pay

Confirm your recurring payments. When you complete your automated payment, you can confirm the date, amount, and payment schedule. You should also sign up for notifications so that you may receive updates once the automated payment process has started and posted to your account.

- Review the details of your setup, including the payment date, amount, and frequency.

- Confirm your recurring payment authorization.

- Sign up to receive notifications and alerts about upcoming payments, successful transactions, or any issues with the auto-pay process.

- Monitor Your Account

While payments are made electronically, keep track of your account often to achieve ideal financial management and solve any issues that may arise.

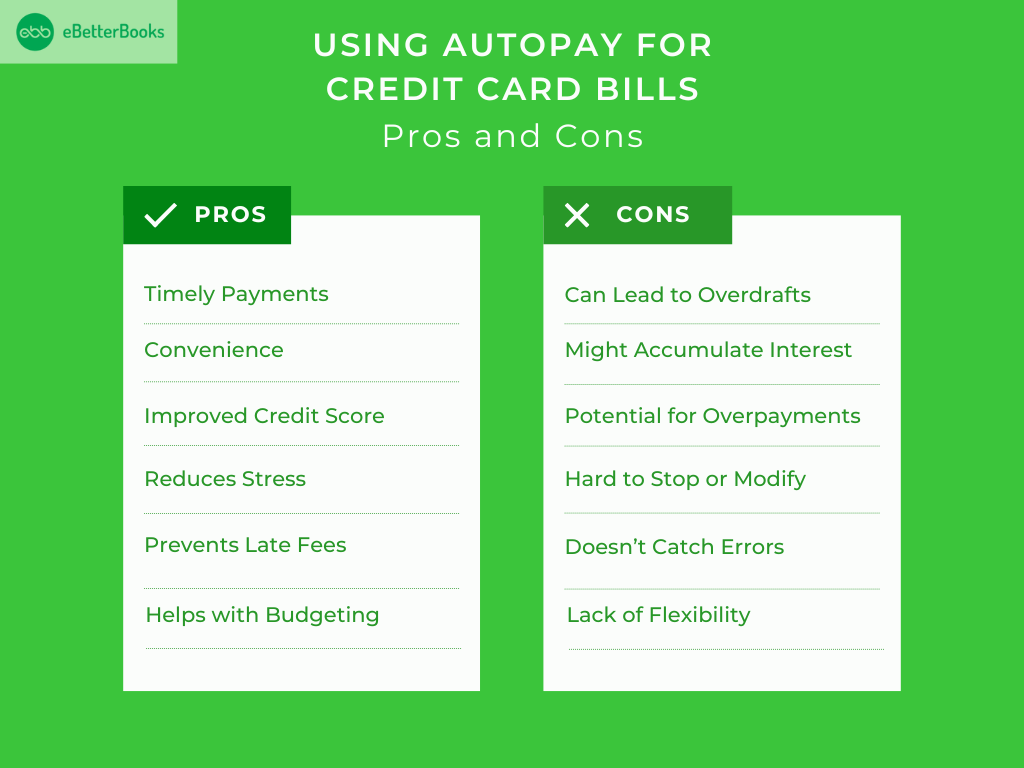

Pros and Cons of Using Auto-Pay for Credit Card Bills

Pros

- Timely Payments: Autopay ensures payments are made this way without being delayed, hence avoiding late fees and penalties.

- Convenience: Recurring payments, as the names suggest, are continuous and don’t require additional input from you once launched, which means less work every month.

- Improved Credit Score: Paying your bills regularly is likely to boost your credit score as it helps improve your payment information.

- Reduces Stress: You need not worry about forgetting due dates or missing payments for your subscription.

- Prevents Late Fees: Prepayment minimizes the chance of incurring penalties that can build up due to missed payment.

- Helps with Budgeting: With Autopay, you have the option of paying a fixed amount every month to set your monthly budget.

Cons

- Can Lead to Overdrafts: When the account balance is low, reciprocation of automatic payments can lead to overdraft charges.

- Might Accumulate Interest: However, paying only the minimum amount due through an autopay credit does not cease interest on the remaining balance.

- Lack of Flexibility: If autopay is utilized, then one may not be so concerned with credit card expenditures and the due amount.

- Potential for Overpayments: If ignored, you may find yourself programming autopay for more than the correct amount, resulting in an overpayment.

- Hard to Stop or Modify: Depending on the requirements, changing or canceling an autopay can also take time and effort.

- Doesn’t Catch Errors: Being able to make any mistake on the part of billing, such as wrong charges, will be automatically cleared if you fail to check your statements constantly.

Tips for Using Auto-Pay Effectively

Debtor should be able to evade the usual vices of auto-pay, such as incurring overdraft charges or missing out on charges, among others, while at the same time effectively tapping the opportunities that are associated with the ability.

Here are some tips for using autopay effectively:

Selecting the Right Mode of Payment

Depending on your budget, you can choose between paying the minimum, in full, or any other amount. Failing to make full payment erases the fine print of the hype: Pay the full balance, and you save yourself from the interest charges; if you are broke, then the minimum balance will do.

Check Your Balance in the Bank

Just make sure that there is always money in your account to cover autopay. This involves paying a certain amount of money to get products on credit or having transactions declined due to a lack of adequate cash, which in turn causes overdraft fees that may consequently affect one’s credit scores. You can also have low balance alerts so that you are always aware of a possible low balance.

Check Your Monthly Bills

Autopay only saves you from having to worry about when to pay your bills, as you will still have to check your credit card statements. Review your charges frequently so that you are able to determine if there are any new unauthorized or fraudulent charges. Addressing issues promptly will prevent paying for something you shouldn’t have.

Determine What to Pay

You have to develop a strategy based on your goals and behaviours. Examine the latest few credit card invoices. What is the most you’ve spent in one month? Use the minimum payment calculator to determine the payment for that amount and ensure that it is always available.

Then, decide what you’re aiming to accomplish. If you’re forgetful or busy, and money is tight, you should use automated payments as a backup, so make the minimum amount. If you’re rolling over debt, set a fixed payment as high as you can afford.

- Minimum Payment: This is ideal if funds are tight or if you only want to avoid late fees.

- Fixed Amount: Best for tackling credit card debt, ensuring a consistent, higher payment each month.

- Full Balance: Helps avoid interest charges and maintain a zero balance.

To make an informed choice, review recent credit card statements and calculate your typical monthly spending.

Properly Time the Payments

Almost every credit card comes with the right to select the due date for autopay deduction. Payments should also be planned a few days before a due date so that any likely delay in processing the payments would not affect the due date and so that there is also some room for other problems.

Use Auto-Pay along with Manual Payments

To pay credit card bills, one can always choose auto payment so that there are no charges levied for the delay, or if one wants to pay, he or she can do it individually to reduce interest. This strategy combines the best of both worlds: security and progress.

Update Payment Details When Needed

Whenever you decide to switch your bank accounts or your card provider re-evaluates its system, you need to change the autopay settings as soon as possible. It can be very embarrassing and financially ruinous to make payments using the wrong information belonging to a previous address.

Pay Attention to Alerts for the Confirmation of Payment

Most credit card companies enable you to subscribe to a receipt via email or text message for a processed auto-pay. These alerts can ensure that payments were made and allow you to stay updated with all the activities in your account. To help you keep track of your account, consider pairing autopay with alerts. You should always set up an alert to notify you if a charge exceeds a particular amount, such as $200 or whatever your typical spending limit is. This way, you may dispute a fraudulent charge and have it removed from your bill before any automatic payment is made.

- Charge Alerts: Notify you if a transaction exceeds a specific amount, helping you detect fraudulent charges early.

- Payment Reminders: Inform you when a payment is due or when it has been posted.

- Balance Updates: Keep track of your credit utilization to avoid overspending.

As a backup, consider marking your payment due dates on a physical or digital calendar.

How Does Credit Card Auto-pay Help with your Credit Score?

Autopay is an easily manageable tool that can change this score if properly employed. Through this, you save yourself from making late payments or even missing them, which are some of the most important indicators of your credit score.

Here’s how auto-pay helps improve your credit profile:

- Ensures On-Time Payments

The payment record is the greatest determinant of your credit score, contributing about 35% of it. Autopay ensures that dues are paid on time, and late payments, which are a minus to your credit rating, are eliminated.

- Eliminates the Incidence of Late Fees and Penalties

Not only does it have a negative impact on your credit score, but you will also be charged that extra amount, which in turn raises your outstanding balance. Autopay removes the potential of a lapse and makes it possible to make payments on time.

- It Helps you to Create a Good Credit History

Paying bills regularly via autopay strengthens credit history, which in turn contributes to the credit profile.

- Fosters Lower Credit Usage

If you use autopay with full balance repayments, it prevents credit card balances from reaching high credit limits. In order to maintain a healthy score, using your credit card should be minimal (less than 30% of your occupation).

- Good for Maintaining Creditworthiness in the Long Term

The creditors will definitely prefer dealing with individuals who have a total understanding of handling their financial obligations, as shown by the consistent on-time payment through the autopay option, hence enhancing a borrower’s credit score.

- Minimizes the Chances of Payment Being Forgotten

Manual payments may be erroneous or may not be easily noticed at times. By performing the process automatically, you completely rule out any possibility of delayed payments which are likely to affect your credit score.

Bottom Line

Autopay is a feature widely offered by many credit card companies. It is an automatic way to pay some or all amounts due each month without requiring the holder to take further action. When enrolling in autopay, you should be cautious to avoid an ostrich-like situation by not checking your account. Autopay does not check for errors or fraudulent charges, and you should know the required amounts in the accounts being charged every month.

Automatic credit card payment may also be a viable option, provided you can maintain a sufficient balance in the connected checking or savings account to cover the monthly payment amount chosen. If there is insufficient money in the account, you risk incurring overdraft fees and penalties.

However, automatic payments may help you boost your credit score in preparation for a large purchase, such as a new home or automobile. By using auto-pay wisely and monitoring your accounts regularly, you can enjoy its benefits while minimizing risks.