Why in the News?

Hurricane Helen caused major destruction and left US residents grappling with issues such as lost income, destroyed properties, and financial difficulties. The storm Hurricane Helene hit Florida and other SE regions of the United States, entering as a Category 4 and damaging many on September 26, 2024.

It’s crucial to act swiftly and seek the help you need. Similar to previous disasters, Hurricanes Harvey and Sandy, Hurricane Helene has created significant challenges related to mortgages and utility bills, raising concerns among affected residents.

There is still a relief effort in progress as people and organizations rebuild the affected areas. In North Carolina, there is a State of Emergency, seven people are still missing. Ongoing approaches are applied to control the number of missing people and to provide people with the necessary facilities.

Companies such as Baxter International in North Cove are slowly coming back to operation while the local ordinance officials help those who were affected. Other Florida cities, such as Clearwater, are also recovering from the effects of Helene.

The North Carolina Department of Insurance and the North Carolina Department of Public Safety provide recovery progress. Users are urged to seek help from officials and get the most relevant information.

Thankfully, federal aid programs, such as FHA-backed mortgage relief and disaster assistance loans, are playing a crucial role in supporting survivors in their rebuilding and recovery efforts.

Disaster Loan Program by SBA

The Disaster Loan Program of the SBA provides mortgage and home repair loans for persons whose homes or houses were damaged by declared disasters. These loans are meant to help people bring their or repair or replace homes, cars, and other property that natural calamities, including hurricanes, floods, and wildfires, have destroyed.

Key details include:

- Essential Repairs or Reconstruction of Homes: The SBA offers credit to repair or construct new homes in cases of damage or loss to the homes of affected individuals and communities. These structures must conform to current universally accepted structural and safety codes.

- Personal Property Assistance: These include loans for the repair or replacement of household assets like furniture, clothing, appliances, and other vehicles that were affected by the disaster.

- Uninsured Loss Coverage: They can help homeowners and renters get money to recover from losses that insurance or other programs do not offer.

- Temporary Living Expenses: The program provides loans to pay for temporary housing costs while a home is being fixed or reconstructed.

- Mitigation Loans: Rather, these loans are used for rehabilitation efforts to mitigate future disaster losses, such as guards for doors and windows for storms or floods.

- Mortgage Refinancing Options: Residential property owners can refinance available conventional agency mortgages so as to make losses through disaster occurrence at the house easier.

- Low Interest Rates and Easy Repayments: They come with fairly cheap interest rates and, more importantly, flexibility with repayment periods spanning 30 years, hence making recovery easy.

What is a Disaster Mortgage?

The disaster mortgage is a financial relief or aid intended to assist homeowners who are unable to make their mortgage payments due to a natural or man-made disaster.

These programs are designed to prevent foreclosure and provide individuals with the time and flexibility they require to recover from the financial damage caused by natural disasters such as hurricanes, floods, earthquakes, and wildfires.

There are several types of disaster mortgage help available, including:

- Mortgage Forbearance: Lenders temporarily halt or lower your mortgage payments for a defined length of time, often 3 to 12 months, depending on the severity of the disaster and your specific financial condition. This allows homeowners the opportunity to restore or repair their homes without the obligation of making regular payments.

- Payment Deferment: In some situations, missing mortgage payments during the disaster period might be added to the loan’s termination date, extending the term rather than forcing immediate repayment.

- Loan Modification: Following the disaster, your lender may offer to modify the terms of your mortgage to make payments more manageable, such as lowering the interest rate, extending the term, or reducing the principal amount outstanding.

What is a presidentially declared disaster area?

A presidentially declared area is an area designated by the United States government if any natural disaster like a wildfire, hurricane, or flood is affecting a place.

The proclamation also specifies which areas (county, parish, municipal, and tribal government) are eligible for federal support.

FEMA may designate additional locations following the original designation. However, in order for FEMA to consider adding an area, the Governor or Governor’s Authorized Representative, or in the case of Tribal declarations, the Tribal Chief Executive must request the addition within 30 days of the declaration date or the end of the incident period, whichever comes first.

Presidentially Declared Area Declared for Hurricane Helene

A presidentially declared area: See if your state and county are listed under the declared disaster areas to find out if you are eligible for an SBA disaster loan.

- Florida

- Georgia

- North Carolina

- South Carolina

- Tennessee

- Virginia

Following Hurricane Helene, President Biden classified several counties in Florida, North Carolina, South Carolina, Tennessee, and Virginia as presidential disaster zones. This declaration provided critical federal funding for recovery for citizens and local governments in afflicted areas.

For example, in Tennessee, the declaration includes individual aid for counties such as Carter, Cocke, Greene, Hamblen, and others, allowing residents to receive funding for immediate necessities such as food, shelter, and repairs.

This federal assistance is critical in helping communities recover and rebuild in the aftermath of such catastrophic occurrences.

Mortgages Backed by the Federal Housing Administration (FHA)

The Federal Housing Administration (FHA) (a government entity that coordinates the response to a disaster that occurred in the United States) offers additional protections to homeowners with FHA-backed mortgages, including special disaster relief programs such as the FHA Disaster Loan Program.

These programs enable qualified borrowers to acquire payment deferrals, emergency loans for repairs, or restructure their existing mortgages to avoid foreclosure.

FHA loans feature a smaller minimum down payment than many conventional loans, and applicants may have lower credit ratings than what the top mortgage lenders often ask for. FHA loans are designed to assist low—to moderate-income families in achieving home ownership, and they are especially popular among first-time home buyers.

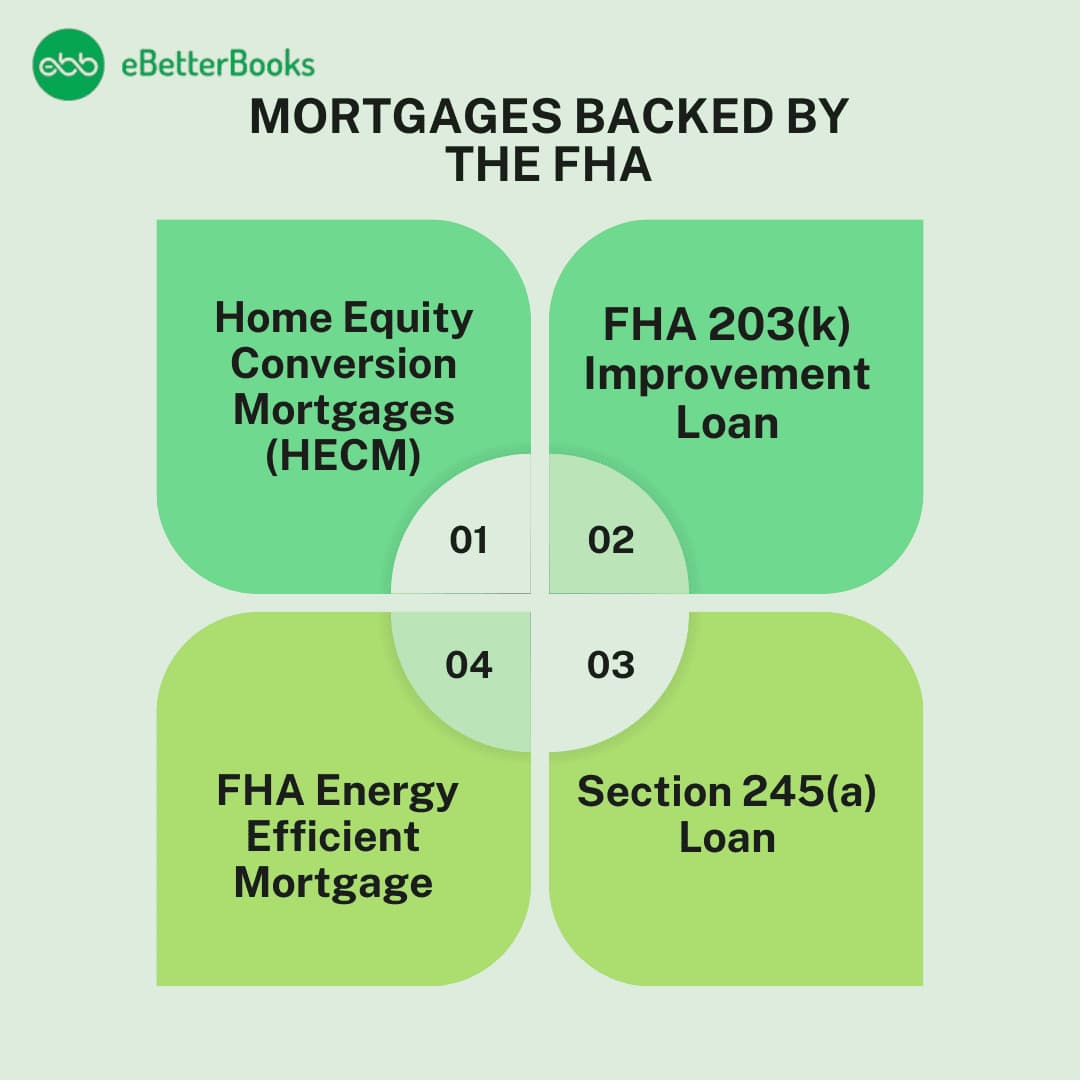

Mortgages Backed By Federal Housing Administration

These mortgages are backed by FHA:

1: Home Equity Conversion Mortgages (HECM)

This is a reverse mortgage scheme that allows homeowners aged 62 and up to turn the equity in their houses into cash while keeping the home’s title. The homeowner can get the funds in the form of a lump sum, a regular monthly payment, a line of credit, or a combination of the three.

2: FHA 203(k) Improvement Loan

This loan includes the cost of certain repairs and renovations in the amount borrowed.7 It helps those who are willing to buy a fixer-upper and put some sweat equity into their home.

3: FHA Energy Efficient Mortgage

This loan program is similar to the FHA 203(k) home improvement loan program. The major difference is that it focuses on changes that can reduce utility expenses, such as improved insulation or solar or wind energy systems.

4: Section 245(a) Loan

This program is designed for borrowers who expect their incomes to rise. The Graduated Payment Mortgage (GPM) begins with lower monthly payments that gradually grow over time. Monthly principal payments on the Growing Equity Mortgage (GEM) are planned to increase. Both promise short loan terms.

How to Apply for Mortgage Loans?

To apply for an SBA Disaster Loan for mortgage and home repair, follow these steps:

- Check Eligibility: Ensure the SBA has issued a disaster and check whether you are an affected homeowner or a renter.

- Prepare Required Documents: Anyone seeking asylum shall also have requisite documents that include documents showing ownership or occupation of property, insurance checks, financial records, earnings, and taxes.

- Submit Application: Complete your application through the SBA Disaster Loan Assistance website or complete it in person in a Disaster Loan Assistance Center.

- Loan Review and Processing: SBA will examine your application and possibly inspect the property to determine the losses.

- Apply for a Loan and get Approved: Once they are approved, the SBA will release the money, which is sometimes monthly as the repairs are being made.

- Seek Ongoing Support: Get help with or check the status of your loan by contacting the SBA customer service centre.

Types of FHA Loan in the United States

| FHA Loan Type | What is it Used for? |

| Traditional Mortgage | A mortgage that finances a primary residence for individuals or families. Suitable for first-time homebuyers. |

| Home Equity Conversion Mortgage | Reverse mortgage for homeowners aged 62 and above, allowing them to convert home equity into cash. |

| 203(k) Mortgage | A mortgage that covers additional funds to cover the cost of repairs, renovations, or home improvements. Ideal for homes that need updating. |

| Energy Efficient Mortgage (EEM) | Adds extra funds to the mortgage for energy-efficient upgrades, such as solar panels or insulation improvements. |

| Section 245(a) Loans | It offers two options: a Graduated Payment Mortgage (GPM) with lower starting payments or a Growing Equity Mortgage (GEM) with increasing payments to build equity faster. |

Pros and Cons of FHA Loans

FHA loans are frequently the best mortgage option for individuals who are unable to secure financing from private lenders. Even if they have a worse credit score and more debt, they may be able to qualify for an FHA loan.

However, because FHA borrowers are typically riskier, FHA loans have slightly higher interest rates and require borrowers to pay mortgage insurance fees both upfront and monthly. FHA loans can only be utilized for main residences and have borrowing limits.

Federal Housing Administration Loan Pros

- FHA-backed loans are available to borrowers or homeowners with lower credit scores.

- This loan comes with smaller down payments.

- The guidelines are more flexible than conventional loans.

- FHA loans allow higher debt-to-income ratios, giving more leeway for buyers with existing debt

- This is a federally backed mortgage.

Federal Housing Administration Loan Cons

- Insurance must be paid upfront and periodically.

- This loan cannot be used for second homes or investment properties.

- They have higher interest rates.

- Not all properties qualify for FHA loans.

Student loan payments or complete college after a disaster

If you are a federal student loan borrower and have been affected by a federally declared natural disaster, you may be eligible for aid. Fortunately, federal programs offer forbearance or deferment options for those impacted by federally declared disasters.

- Forbearance

If you are a borrower in repayment who has been negatively affected by a disaster and is having difficulty making payments on a federal student loan, you are eligible for administrative deferment of loan repayment for up to three months.

- In-School Status

If you are a federal student loan borrower who was unable to complete your school year due to the disaster, you will be granted an extended “in-school” status until you officially withdraw or re-enroll in the next regular enrollment period, whichever occurs first.

- School Closure

If you are a federal student loan borrower who received loan funds to attend a “closed school” and did not finish your program of study there as a result of the institution’s closure, you may be eligible for loan forgiveness.

Help with Utility bills after a disaster

Utility bill help is offered for those who are unable to pay their electricity, water, or gas bills during a calamity. Many utility companies, particularly in disaster-affected areas, provide bill forgiveness programs, postponed payments, or subsidies to help alleviate financial burdens.

For example, the Low-Income Home Energy Aid Program (LIHEAP) offers government aid to low-income households that are unable to meet heating or cooling expenditures during a disaster. Homeowners can also seek additional utility bill assistance from local nonprofits and government authorities.

Your local Low Income Home Energy Assistance Program (LIHEAP) may be able to help you pay your heating and cooling utility costs during a disaster. Each LIHEAP office has its criteria and procedures for receiving assistance following a disaster.

Contact the LIHEAP office for your state, the LIHEAP office that serves your state, or the LIHEAP office in your tribal area.

Making your auto loan payments after a disaster

Auto loan payments may become difficult to manage in the aftermath of a disaster. Many lenders offer payment forbearance for borrowers facing hardship due to a disaster.

This allows temporary suspension or reduction of payments, giving borrowers time to regain financial stability. Some lenders may even offer loan modifications or defer payments to the end of the loan term.

Here are the tips to manage your auto loan after you are suffering from a natural disaster:

- Change Your Payment Due Date:

If you are current on your payments but face an unanticipated hardship that makes it difficult to make your monthly payments—for example, a change in the date you get your paycheck—your lender may be able to reschedule the date your payment is due.

- Request a Suitable Payment Plan:

If you’ve already fallen behind in your payments, your lender may be able to offer you a payment plan to help you catch up and repay missed payments.

- Ask for a Payment Extension:

Payment extensions may be a possibility for you if you are suffering hardship that will continue longer than what a payment due date modification will help with but does not necessarily rise to the level of needing a payment plan or if you are currently and actively seeking hardship aid.

- Ask for Refinance Your Auto Loan:

Another option is to try refinancing with your vehicle lender or another lender. You may be able to obtain a reduced interest rate, which will reduce the size of your payment. You could also consider a longer loan period.

Hurricane Helen Context

Following Hurricane Helene, President Biden declared counties in Florida, North Carolina, South Carolina, Tennessee, and Virginia presidential disaster zones. This declaration provided critical federal funding for recovery for citizens and local governments in afflicted areas.

For example, in Tennessee, the declaration includes individual aid for counties such as Carter, Cocke, Greene, Hamblen, and others, allowing residents to receive funding for immediate necessities such as food, shelter, and repairs.

Wrapping Up

Life is hard to manage after a natural disaster like Hurricane Helen, but it is time to stay patient and seek available assistance. This is the time to be strong, and fortunately, there is assistance available. Some government-backed associations and private resources and companies are coming forward to help manage your mortgage, auto loans, student loans, business loans, and even utility bills.

The key is to be patient and act quickly, looking for all the available options that can help you get the best possible solution. These communities provide the best possible solution for temporarily managing all your expenses or loans and bills.

Frequently Asked Questions

What is a presidentially declared disaster area?

A presidentially declared area is the area chosen by the United States president for federal disaster assistance. It is affected by natural disasters and is eligible for significant damage caused by natural disasters such as wildfires, hurricanes, and floods. This declared area helps locals to get federal assistance for recovery and rebuilding efforts.

What kind of services are available for disaster survivors?

FEMA is providing several individuals assistance struggling from natural disasters to presidentially designated areas, such as temporary housing aids, low-interest loans, and funds to help small businesses and homeowners. FEMA also helps with basic needs for survivors, such as food, medicines, and water. You can check for assistance here… Hurricane Helene resources to help you recover from the disaster.

What areas are declared after Hurricane Helene?

Following Hurricane Helene, President Biden declared multiple counties in states like Florida, North Carolina, South Carolina, Tennessee, and Virginia as disaster zones. This allows affected individuals in these areas to apply for federal aid to recover from the damage caused by the hurricane.

How can I apply for disaster assistance?

If you live in the presidentially declared disaster area that Hurricane Helene impacted, you may be eligible for FEMA assistance.

Here are the ways you can apply for assistance:

- Visit FEMA’s assistance online through disasterassistance.gov.

- By calling FEMA’s helpline at 1-800-621-3362.

- Through using the FEMA App.

- You can also learn about other types of disaster financial assistance. For example, you could get unemployment benefits, such as help buying groceries.

- You can also check if you are eligible for an SBA Disaster Loan. These low-interest loans can help homeowners and small businesses.

How can I stop foreclosure while suffering from disaster?

The first step you have to take is to inform your loan service provider or lender so that they can help you get relief from late penalties and fines.

Here are the things you can do to stop foreclosure:

- Don’t ignore the payment. Contact your lender as soon as possible and look for facilities to avoid foreclosure.

- Consider the mortgage forbearance option. This option can help homeowners by pausing and reducing mortgage payments during hardships.

- Check repayment plans. Sometimes, you can get a good repayment plan that is set according to your income status.

- You may also look for a short refinance. With a short refinance, the lender can forgive part of your loan amount and refinance the remaining amount into a new loan.

Are there any government-backed mortgage disaster resources?

Yes, there are many government-backed mortgage disaster resources available for survivors who are affected by natural disasters:

- The Federal Housing Administration (FHA) manages the FHA disaster relief options for homeowners who can get assistance with FHA mortgage benefits.

- Housing and Urban Development (HUD) can also help you to get an FHA loan.

- Fannie Mae and Freddie Mac Assistance can also help you with a mortgage forbearance period, which allows you to pause or reduce your mortgage payments for upto 12 months.

- USDA Rural Development Loans also help you to get payment relief during the natural disaster period in the presidentially affected areas.

What documents are required for FEMA assistance?

If you are looking for FEMA assistance, you need some of the following documents:

- Personal identity, such as driving license

- Social security number

- Insurance Information

- Damage details of your property

- Contact Information

- Ownership Document of Property

What should I do if I am unable to make the payment after the disaster?

There are many options to choose from if you are unable to pay your mortgage after any natural disaster has occurred in your area. You can look for.

Can I apply for FEDA assistance if I rent a house or apartment?

Yes, you can apply for FEDA assistance even if you are living on rent. Just check that you are in a presidentially declared disaster area. Renters can get temporary house assistance, replace essential belongings, and relocate facilities if necessary.