The SBA 504 Debt Refinance Program allows small businesses to refinance various types of debt, such as commercial mortgages and other business loans.

What is SBA 504 Loans to Refinance Business Debt

The SBA 504 Loan Program offers a strategic way for small businesses to refinance their existing debt, especially for those who want to improve their financial standing without expanding their businesses.

The SBA 504 Loan Program allows businesses to refinance “Qualified Debt,” which must have been used primarily for eligible fixed assets such as land, buildings, or equipment. Recently, the government made regulatory changes, effective from November 13, 2023, that made the SBA 504 Loan program more accessible by adjusting the definition of “substantially all” from 85% to a more favorable threshold, thus broadening the scope of eligible refinancing options.

The SBA 504 Loan Program helps businesses to refinance up to 90% of the current appraised value of their property and even cash out up to 20% for operational expenses.

The refinancing process of business debt under the SBA 504 structure involves a collaboration between a commercial bank and a Certified Development Company (CDC), which facilitates a second mortgage through the SBA. This arrangement typically allows for lower equity contributions from borrowers which is normally as low as 10%, thus freeing up capital for other business needs.

Additionally, businesses must demonstrate that their existing debt was incurred at least six months prior and that it was originally used for purchasing or improving fixed assets. The program enables lower monthly payments through fixed interest rates amortized over 20 to 25 years. It also supports job creation by requiring that one job be retained for every $75,000 guaranteed under the loan.

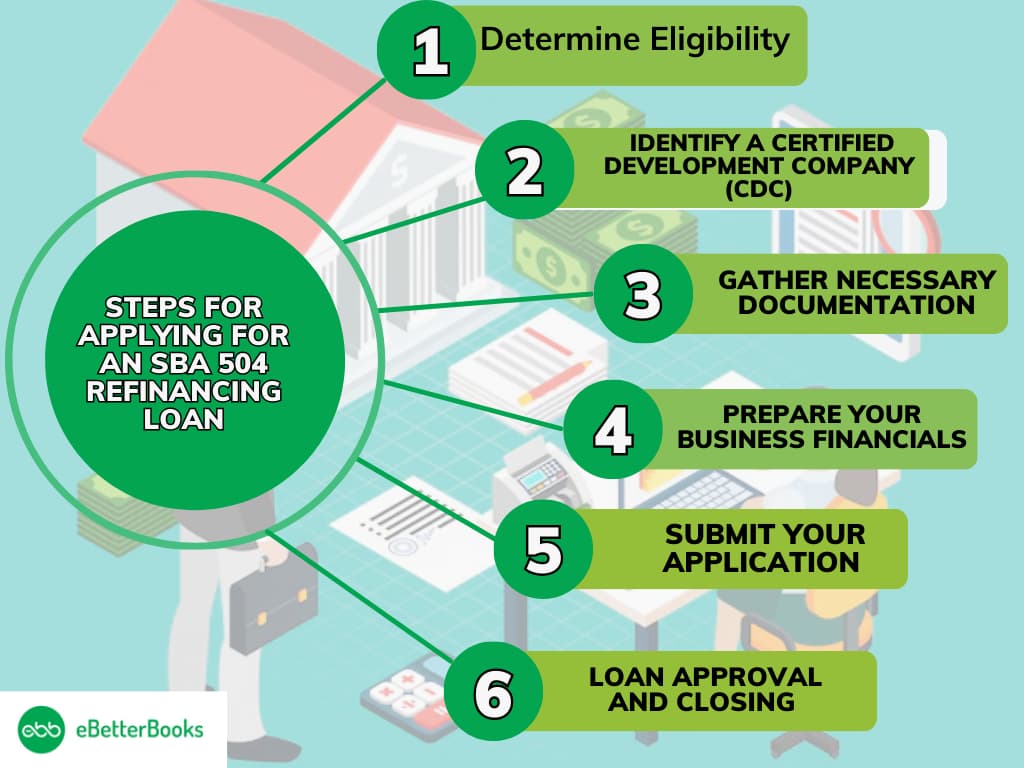

Steps for Applying for an SBA 504 Refinancing Loan

It is important to understand the detailed steps involved in the SBA 504 loan refinancing application process and the necessary documentation and preparation tips.

STEP 1: Determine Eligibility

- Your business must be operational for at least two years.

- The existing mortgage debt you wish to refinance must be at least six months old.

- At least 75% of the original loan proceeds must have been used for eligible SBA 504 purposes (e.g., purchasing fixed assets).

STEP 2: Identify a Certified Development Company (CDC):

- Locate a local CDC that will assist in structuring your loan. The SBA’s search tool can help you find one near you.

STEP 3: Gather Necessary Documentation:

Compile all required documents, which typically include:

- A copy of the existing recorded mortgage agreement and deed.

- Payment transcripts for the past 12 months from your current lender.

- Documentation of your business’s operating expenses if you plan to use equity from the refinance.

STEP 4: Prepare Your Business Financials:

- Ensure your business meets financial criteria that must have a tangible net worth of less than $15 million and an average net income of less than $5 million after taxes over the last two years.

- You should be prepared to show the ability to repay the debt and provide a realistic business plan.

STEP 5: Submit Your Application:

- Work with your CDC to complete and submit the application. The submission of the application will include all gathered documentation and financial statements.

STEP 6: Loan Approval and Closing:

- Once the loan is approved, you will go through the closing process, during which all terms will be finalized, and funds will be disbursed.

Necessary Documentation while Applying for Loan

You must ensure to have the following documents ready while applying for an SBA 504 refinancing loan:

- A copy of the recorded mortgage agreement, including any amendments.

- Monthly statements from your current mortgage lender that show the payment history and balances over the past year.

- Detailed records of your business’s operating expenses that are eligible for refinancing, such as salaries, rent, utilities, etc., are crucial if you intend to utilize some equity for working capital.

Preparation Tips to Follow Before Applying

- Understand Loan Terms: Get familiar with SBA 504 loan terms, including fixed interest rates and long repayment periods (10-25 years).

- Evaluate Financial Health: Assess your business’s financial health to ensure you meet eligibility criteria before applying.

- Consult with Professionals: Consider working with professional financial advisors or accountants to prepare your documents and strengthen your application for the SBA 504 loan refinancing process.

You can simplify the SBA 504 loan refinancing process and increase your chances of securing favorable financing terms for your business by following these steps and preparing adequately.

Eligibility Criteria for SBA 504 Loan Refinancing

Businesses must meet specific eligibility criteria to qualify for SBA 504 loan refinancing which can be categorized into business eligibility and types of debt eligible for refinancing.

Business Eligibility

- For-Profit Status: The business must operate as a for-profit entity within the U.S.

- Operational History: The company must have been in operation for at least two years before applying for refinancing.

- Financial Stability:

- The business should have a tangible net worth of less than $15 million.

- The average net income after federal taxes must not exceed $5 million over the previous two years.

- Businesses are also required to demonstrate their ability to repay the debt and provide evidence of management expertise and a feasible business plan.

- Occupancy Requirement: The owner should occupy at least 51% of the property that is being refinanced.

- Debt Status: The debts being refinanced must be at least six months old, and businesses can qualify even if they are not current on all payments for the loan they wish to refinance, provided they have made payments for at least the last 12 months.

Types of Debt Eligible for Refinancing

The SBA 504 loan refinancing program allows businesses to refinance various types of existing debt, including:

- Commercial Mortgages: This includes existing loans used to purchase or improve commercial real estate.

- Equipment Loans: Businesses can refinance loans taken out for machinery or equipment that meets the program’s criteria.

- Government Loans: Existing SBA loans, such as 7(a) loans or other 504 loans, can also be refinanced under the new rules, provided they meet specific conditions regarding how the original loan proceeds were used (at least 75% for eligible purposes).

- Debt Consolidation: Businesses can consolidate multiple loans into one 504 refinance loan, which can help improve cash flow and reduce payment stability risks.

Understanding SBA 504 Loan Refinancing Terms and Conditions

You should understand the terms and conditions of the SBA 504 refinancing program, as it is important for businesses to take advantage of lower interest rates and favorable repayment structures.

Maximum Loan Amounts and Allowable Refinancing Amounts

- Maximum Loan Amount: The SBA 504 refinancing program allows businesses to refinance up to $5.5 million for qualifying projects. This includes the refinancing of existing debts incurred for owner-occupied commercial real estate, land, or equipment purchases.

- Allowable Refinancing Amounts:

- Businesses can refinance up to 100% of eligible expenses related to prior fixed-asset projects. This is a significant increase from previous limits, which allowed only 50% refinancing.

- Additionally, businesses can cash out up to 20% of the appraised property value for working capital needs, provided the loan does not exceed 85% of the appraised value in total.

Typical Interest Rates, Fees, and Repayment Structures

- Interest Rates: SBA 504 loans typically feature fixed interest rates that are below market rates. Current rates can vary but are generally around 3%, significantly lower than traditional loans which may range from 5% to 8%.

- Fees: While specific fees can vary by lender, borrowers should expect standard closing costs associated with loans, which may include appraisal fees, legal fees, and other processing costs.

- Repayment Structures:

- The repayment terms for SBA 504 loans can extend up to 25 years, providing businesses with a long-term repayment option that helps manage monthly cash flow.

- Monthly payments are often reduced compared to conventional loans due to the lower interest rates and extended repayment periods.

Strategies to Maximize Savings with SBA 504 Loan Refinancing

Refinancing an SBA 504 loan can lead to significant savings, particularly for businesses looking to improve their cash flow and reduce interest expenses. Borrowers should consider reducing existing debts into a single SBA 504 loan to maximize these savings, which can lower monthly payments and improve financial management.

The maximum SBA loan limit for manufacturing or energy efficiency projects is advantageous for businesses, as it allows them to upgrade their funds and further reduce operational costs. Maintaining a strong credit profile and shopping around for the best rates can also yield favorable refinancing terms.

There are various ways to achieve the lowest possible interest rates and effectively combine refinancing with expansion, leading to the maximization of your savings with SBA 504 loan refinancing.

Achieving the Lowest Possible Interest Rate

- You should stay informed about recent interest rate trends. For instance, the recent Federal Reserve rate cuts have already lowered borrowing costs for small businesses by making it an opportune time to refinance.

- Use the SBA’s Lender Match tool to connect with lenders who offer competitive rates customized according to your business needs. This can help you identify lenders that are actively seeking borrowers for SBA 504 loans.

- Ensure your business has a solid credit history and financial statements. Lenders are expected to offer lower rates to businesses with strong financial performance and creditworthiness.

- You should opt for longer loan terms (up to 25 years) as they often come with lower monthly payments and fixed interest rates which can improve your business’s cash flow management.

- An SBA 504 refinance program allows you to reduce the existing debts at lower rates, provided that the debt qualifies under SBA guidelines (e.g., at least 85% used for fixed assets). This can significantly reduce your overall interest burden.

Combining Refinancing with Business Expansion

1. Understand Eligibility Requirements:

Ensure that your business meets all the eligibility requirements for the SBA 504 refinancing loans to successfully combine refinancing with expansion, which includes acquiring or improving fixed assets such as real estate or equipment.

2. Calculate Total Project Costs:

When applying for an SBA 504 loan, include both the refinancing of existing debt and the costs associated with your expansion project to establish a comprehensive project cost. For instance, if your expansion costs $1 million, you can refinance up to $1 million of existing qualified debt, totaling a $2 million project.

3. Document Substantial Benefits:

The SBA requires that refinancing provides a “substantial benefit,” typically defined as at least a 10% reduction in monthly payments on the refinanced portion. Prepare documentation that clearly illustrates these savings.

4. Utilize Existing Equity:

You can leverage equity in your current property as part of your down payment for the new project, which can help reduce upfront costs and improve financing terms.

5. Engage with Certified Development Companies (CDCs):

Work closely with CDCs that are knowledgeable about the SBA 504 program. They can help you navigate complex regulations and ensure that all eligibility criteria are met for both refinancing and expansion projects.

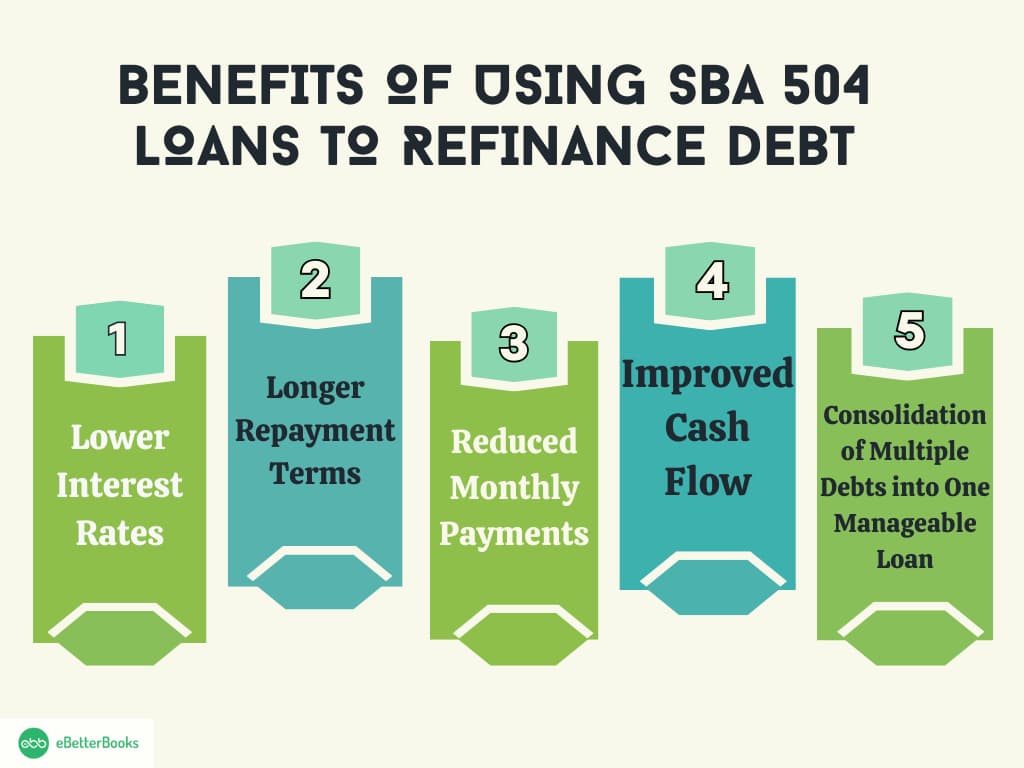

Benefits of Using SBA 504 Loans to Refinance Debt

SBA 504 loans to refinance business debt offer various benefits for businesses looking to refinance existing debt.

1. Lower Interest Rates

SBA 504 loans have fixed interest rates that are often quite lower than conventional loan rates. SBA 504 loans are backed by the U.S. Small Business Administration (SBA) which allows lenders to offer competitive rates to the individuals that can be as low as 2.08% to 2.18% above the relevant U.S. Treasury Index.

The lower cost of borrowing leads to substantial savings over the life of the loan by making it an attractive option for businesses seeking to refinance higher-interest debt.

2. Longer Repayment Terms

SBA 504 loans come with extended repayment terms of up to 25 years. This feature is the other benefit of SBA 504 loans that allows businesses to spread out their payments over a longer period by reducing the financial burden on cash flow and making it easier for businesses to manage monthly obligations.

Longer terms also mean that businesses can plan for larger projects without feeling overwhelmed by immediate repayment pressures.

3. Reduced Monthly Payments

The combination of lower interest rates and longer repayment terms results in reduced monthly payments for borrowers. For instance, instead of facing high monthly costs associated with traditional loans, businesses can benefit from more effortless payments by freeing up cash for other operational needs or investments. Reduced monthly expenses significantly enhance a business’s overall financial health.

4. Improved Cash Flow

With lower monthly payments and interest rates, businesses experience improved cash flow management. This is important for small businesses that often operate on tight margins.

Improved cash flow allows companies to allocate more resources toward growth initiatives by refinancing their existing debt into an SBA 504 loan, such as hiring new employees or investing in marketing efforts. Enhanced cash flow also provides a buffer against unexpected expenses or economic downturns.

5. Consolidation of Multiple Debts into One Manageable Loan

SBA 504 loans allow businesses to consolidate multiple debts into a single loan by simplifying financial management. While the SBA guidelines specify that these loans cannot be used solely for debt consolidation, they can be part of a broader refinancing strategy that includes consolidating existing debts into one manageable payment structure.

Consolidating multiple debts helps simplify accounting processes and reduces the complexity associated with managing multiple loan payments.

What Debt Can and Cannot Be Refinanced with SBA 504 Loans?

The SBA 504 loan program has specific guidelines regarding what types of debt can and cannot be refinanced using these loans.

| Debt Can Be Refinanced | Debt Cannot Be Refinanced | |

| Definition | Under the SBA 504 loan program, only secured debts directly tied to fixed asset purchases are eligible for refinancing. This includes existing loans on commercial properties or equipment with useful lives of at least 10 years. | Unsecured debts, such as credit card balances and personal loans, cannot be refinanced through the SBA 504 program. Additionally, debts incurred for working capital or speculative investments are also excluded. |

| Purpose | Finance the acquisition or improvement of fixed assets, such as real estate and long-term equipment, that are essential for business operations. | Cover ongoing operational expenses or short-term financing needs, which are not eligible under the SBA 504 program. |

| Loan Terms | They are long-term and fixed-rate financing, typically up to 10-25 years. | Generally, they are shorter terms with variable rates. |

| Examples | – Existing mortgages on commercial real estate- Loans for machinery and equipment- Financing used to purchase land or buildings- Debt related to the construction or renovation of facilities | – Credit card debts- Unsecured personal loans- Business lines of credit- Debt incurred for working capital- Loans for speculative investments |

FAQs

What is an SBA 504 Loan?

The SBA 504 loan program provides long-term, fixed-rate financing for small businesses to acquire major assets. It typically involves a combination of funding sources, including a conventional loan covering 50% of the project cost, a 40% SBA-backed loan, and a minimum down payment of 10% from the borrower.

Can you Use SBA 504 for Business Acquisition?

Yes, SBA 504 loans can be used for business acquisitions, but they are primarily intended for purchasing fixed assets such as real estate or equipment. The loan can also cover improvements to the acquired property.

Can you Use SBA 504 to Refinance?

SBA 504 loans can be utilized to refinance existing commercial debt, but this typically needs to be part of a larger project that includes acquiring or improving fixed assets. The refinancing must also be combined with a bank loan.

What is the Maximum SBA 504 Loan Amount?

The maximum amount for an SBA 504 loan is generally $5 million per project. However, this limit increases to $5.5 million for specific projects related to manufacturing or energy efficiency improvements.

Can you Refinance a Home with an SBA Lien?

No, SBA loans are specifically designed for business financing and do not allow for personal home refinancing under their terms. If a business has an SBA lien on its assets, it cannot use those assets to refinance personal home loans. The SBA’s focus is on supporting business growth rather than personal financing.

When Can SBA 504 Loans be Paid Off?

Borrowers can pay off their SBA 504 loans early; however, there may be prepayment penalties during the first half of the loan term. For example, if you have a 25-year term loan, prepayment penalties apply during the first ten years but are eliminated in year eleven. In general, there is no penalty if you pay off your loan during the second half of its term.

Can I Renegotiate an SBA Loan?

Renegotiating an existing SBA loan is generally not standard practice. However, borrowers may discuss options with their lenders regarding modifications or restructuring based on changing financial circumstances. Any changes would need to comply with SBA guidelines and lender policies.