A credit card grace period is the days between the billing date and the due date. During this period, no interest is charged on purchases if you pay your balance in full.

The grace period is typically given to newly purchased products rather than to services such as cash advances and transfers. For any of these purchases, interest will be charged from the date of occurrence unless they qualify for a particular 0 percent APR tease.

What is a Credit Card Grace Period?

The Credit Card Grace Card refers to the period between the issuance of a credit card statement and the due date, during which the consumer bears no interest for any purchase made on the card.

The grace period is the time that elapses between the time a consumer makes purchases through his/her credit card in the previous billing cycle and the time he/she is required to pay interest on the outstanding balance made during the current billing cycle.

It is only applicable if the consumer cleared his or her last credit card balance in full and timely and did not roll over a balance for any part of the preceding billing cycle.

Note: It is advisable to read the terms and conditions of your credit card and find out if it has a grace period.

How Long is a Typical Grace Period for a Credit Card?

A grace period normally ranges from 21 days to 55 days. Remember that having a credit card grace period does not mean that you have more time until the due date.

When you make partial payments, fail to make the necessary minimum payment on your credit card, or pay your bill after the due date, your credit card company will start charging interest on your balance.

In addition, you will incur late penalties if you fail to make a payment or make it after the due date.

To prevent interest payments, you must pay off your credit card balance in full before the payment due date. At the absolute least, you must make the minimum payment, and you will then be charged interest on any balance carried over to the next month.

| Tip: To maintain your grace period, make sure to pay your bills in full and on time each month. If you pay in full for some months but not others, you may lose your grace period for the month in which you do not pay in full and the following month. |

If you pay off your credit card amount every month during this grace period, you will avoid incurring interest on your purchases. However, the grace period usually only applies to new purchases, not cash advances, balance transfers, or special promotional deals.

Example of Credit Card Grace Period

| Let’s understand this with an example: If your billing cycle ends on May 31, your credit card statement detailing the amount due is issued on the same day. Assuming a 30-day grace period, your payment due date would be June 30. By paying the full balance within this timeframe, you can avoid any interest charges. |

How Long is the Grace Period On Credit Card?

Credit card lenders or companies must send cardholders their bills at least 21-25 days before payment is due. Sometimes, some credit cards consider those 21 days, as well as the time between when you made your purchases inside the billing cycle, to be a grace period if you have paid your previous balance in full. This means grace periods might last nearly two months.

How Does the Credit Card Grace Period Work?

To fully enjoy a grace period, you must understand the credit card’s billing cycle, the expense of carrying a debt, and how the lender charges interest on your purchases.

These key concepts assist in clarifying how grace periods work:

- Billing Cycle

Your credit card company establishes a billing cycle, which is typically one month long. Finally, your purchases are totaled and presented in a statement.

- Statement Generation

Your credit card provider generates a statement of your purchases at the end of each billing cycle that summarises the transactions completed during that time.

- Grace Period

The grace period begins on the day your statement is generated and normally lasts 21-25 days, depending on the credit card provider.

- Interest Fee

If you pay off your credit card amount in full by the due date during the grace period, you will not be charged interest on your transactions.

- Interest on Unpaid Balances

If you fail to pay the entire balance by the due date, the remaining balance will start to accrue inte

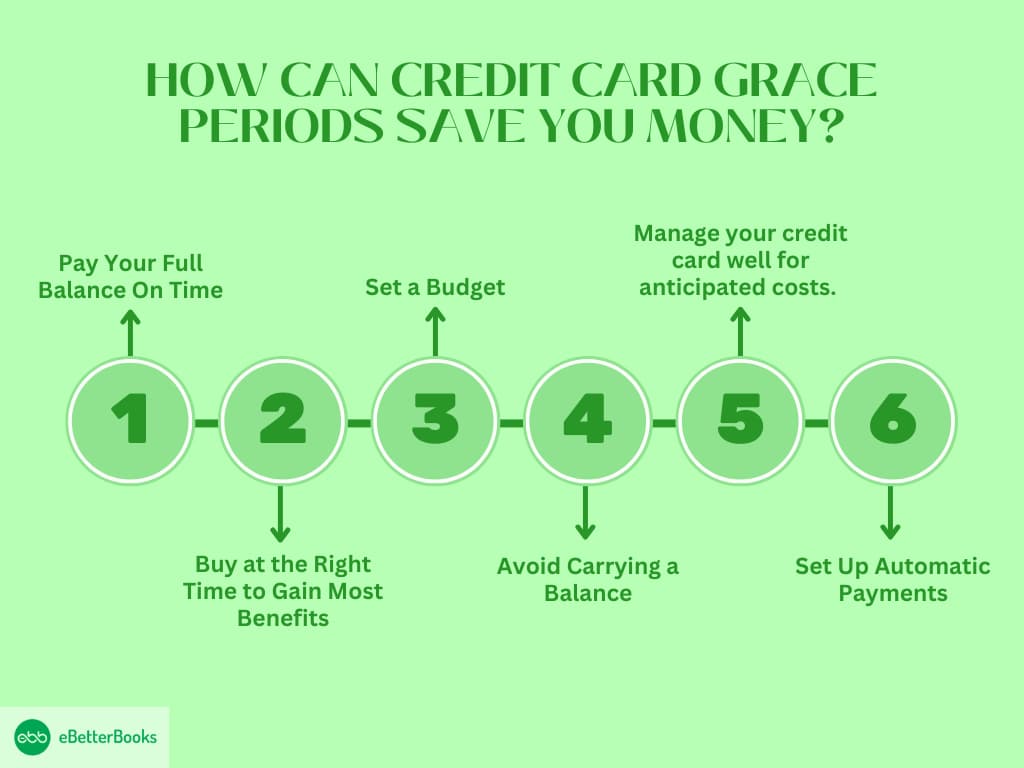

How Can Credit Card Grace Periods Save you Money?

If you are keen on maintaining your credit card balance, it is very important to make the most out of the grace period. If done with some thought, one can manage their cash flow and make the right usage of the credit card.

Here’s how to get the most out of your grace period:

1. Pay Your Full Balance On Time

The simplest way to avoid interest charges is to always make full payments for the amount charged on your statement by the due date. If you are unable to contribute the total amount, ensure that you contribute at least the minimum.

The balance will then attract an interest rate, as will any other purchase made after this. If you transfer lesser balances, then the interest you will be charged will also be reduced.

Example:

If your statement balance is $500 and your due date is the 25th of the month, by the due date, you must pay $500. Thus, you avoid interest charges that could come along the way if you have a line of credit.

However, if you pay only $250, interest will be charged on that amount and all purchases made after the date of the statement.

2. Buy at the Right Time to Gain Most Benefits

To maximize your grace period further, make your purchases at the start of a billing cycle. However, if you want to take much more time, you will have a full cycle with interest and a grace period.

For bigger purchases, this strategy could allow you to go up to two months without accruing interest.

Example:

Your account’s billing cycle ends on the 10th of the following month. If you purchase $200 and have the records that it reflects in your statement, the purchase attracts an interest-free period of 25 days from the 5th to the 30th.

For example, if you make the same $200 purchase on the 20th, those will count in your next cycle, and you get a full month + the interest grace period.

3. Set a Budget

Having a budget will allow you to control your purse strings well, enabling you to manage your credit card balance correctly. It is best to think of your credit card as an interest-free loan.

If the grace period is understood correctly, complete payment should be made on the statement balance before the grace period expires.

Example:

Let’s assume that you have $500 that you can spend as you please in a month. Thus, tracking your expenses allows you to use your credit card only for purchases within this limit and make a payment in full before the due date.

For instance, when you buy groceries worth $100 using your credit card, and you buy 200 worth of gas, you will be charged $300 in a statement, which can be paid by the due date to minimize interest charges.

4. Avoid Carrying a Balance

The key to making good use of the grace period is paying your bill in full every month. Even if you continue into the next month with a balance remaining, you may lose your grace period, and thus, interest will be added to any new purchases.

That only happens when you pay off your balance, which lets you retain the grace period you negotiated on your credit card.

Example:

Let’s say your statement balance is $300, but you manage to pay $100; the remaining balance is $200, which will be carried over to the next month. This balance will start incurring interest, and you will lose your grace period for new purchases.

On the other hand, paying up to $300 in full means that in the next cycle, you will not incur any additional interest on the balance or new products.

5. Effectively Manage your Credit Card for Expected Expenses

If you cannot control your urge to spend, it would be ideal to only use your credit card in situations where you already know you can pay up before the due date.

By sticking to the planned amount for each category, you will maximize your payments, ensuring they clear their balance, and you will not be charged any interest.

Example:

For instance, you might be considering a $400 plane ticket at the beginning of the month and are aware that you can afford to pay for it on the due date.

This enables its holder to charge any item that he or she wants on the credit card and make the full and timely repayment before the due date, hence avoiding any interest.

However, if you use the card to make random purchases, as you do not need to, your chances of repaying it in full may be strained.

6. Set Up Automatic Payments

To avoid being devoid of a grace period, it is prudent to make arrangements for auto payments of your statement balance.

This ensures that you pay your outstanding amount in full every month, even if you forget or are occupied.

Example:

If you know your statement balance is $400 and your due date is the 25th, automatic payment means that your card issuer will pay the stated balance before the due date.

This prevents you from forgetting to make a payment, so there is no need to incur extra interest charges.

How Can Grace Periods Maximize Your Credit Card Rewards?

The grace period comes between 21 to 25 days from the last date of your billing cycle and allows you to clear your balance before it starts to attract interest charges.

Here’s how you can use this feature to your advantage:

- Don’t Charge and Optimize Profit

Paying off your balance in full if you have the cash during the grace period helps prevent interest charges from devaluing your rewards.

For example, utilizing an incentive card like the Chase Sapphire Preferred® Card, which pays 3X points on Dining and 2X Points on Travel, earns you valuable points while keeping your spending interest-free if you pay off the balance before the due date.

- Time Big Purchases Wisely

Whenever you are planning a big purchase, try to time it until the billing cycle commences. This gives you the maximum time to pay it off within the grace period. This basically assists in giving the maximum time within the grace period to pay off what has been borrowed.

More easily, using credit cards like the Citi® Double Cash Card, which offers 2% cash back, 1% when you buy, and 1% when you pay, could double the rewards when using this strategy.

- Link Grace Periods with introductory APR Offers

Some cards, like the Wells Fargo Active Cash® Card, have no annual fees and include 0% APR introductory periods.

You also get 2% back on every purchase. By following the grace period curve to ensure the introductory APR has ended, you can always reap from those points without being charged interest.

- Optimize Category Rewards

Cards with bonus categories that change each quarter, such as the Discover it® Cash Back, enable their holders to charge up to 5% on certain items, such as groceries, gas, or even dining.

No value erodes for these rewards through interest charges when your balance is paid fully within the grace period.

- Redeem Points From Daily Purchases

Merchant purchases, such as food and electricity bills, can also contribute to the accrual of rewards, and charges apply if they settle before the grace period.

The Blue Cash Preferred® Card offers an enrollment bonus of $150 once you spend $1,000 in the first three months of opening the account. It also offers the following rewards: 6% cash back on up to $6,000 per year at US supermarkets.

This way, it becomes possible to protect all those bonuses, remain profitable, and pay the balance on time.

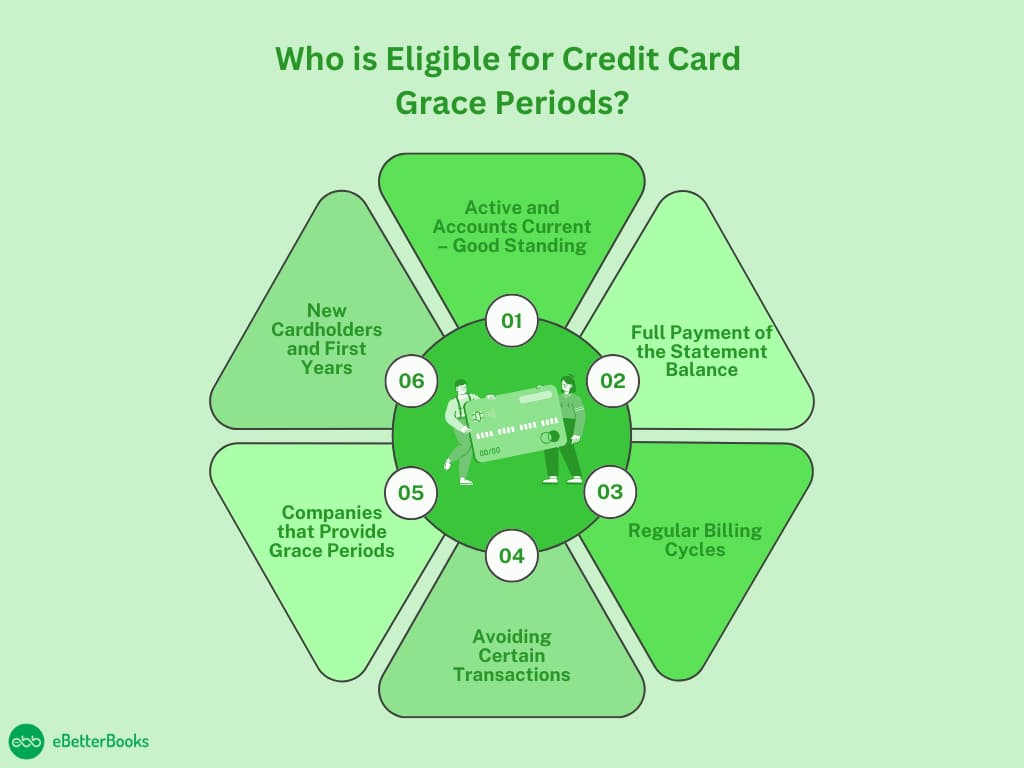

Who is Eligible for Credit Card Grace Periods?

A credit card grace period is one of the privileges that enable users to make purchases without accruing interest on the purchases so long as they pay the amounts owed before the due date. However, only some people are entitled to this kind of benefit right away. Not all cards are issued with a grace period, and here are factors that will determine if you are a beneficiary or not:

1. Active and Accounts Current – Good Standing

The first qualification for eligibility is that the credit card account you are qualifying must be open and not in default. As a result, you have to maintain an active, unblocked credit card with no overdue payments or complications, including chargebacks or defaults.

In this case, if your card is suspended or closed, for instance, due to non-payment or other issues, you are eliminated from accessing the grace period. It is also very important that you don’t go overboard with spending over your credit limit.

2. Full Payment of the Statement Balance

To be eligible for the grace period, you need to make your minimum statement balance payment by the stated date. The grace period only kicks in if you start a billing cycle with a $0 balance on your account.

If you leave any balance unpaid, you forfeit your grace period right, and interest begins to be charged on new purchases as soon as they are made. The consequence of paying only the minimum amount or of keeping a balance over the month will be interest charges.

3. Regular Billing Cycles

Most credit card companies go for monthly statements, and where your specific card operates within these regular cycles, you are allowed the grace period.

An ideal billing cycle is between 28 and 31 days, and from the close of the cycle, you are afforded some grace period between 21 and 25 days, within which you should pay your bill before incurring interest.

This is a supremacy of most credit card companies mandated by federal statute, though it is only valid when one does not carry over a balance from the previous cycle.

4. Avoiding Certain Transactions

It’s important to remember that grace periods do not include balance transfers, cash advances, or any other special occasions. Many of these transactions begin charging interest immediately while you are still in the grace period on new cash advances.

If you transfer a balance or get a cash advance, interest will be charged from the date of the transaction or the date the card was issued. Any grace period you may have for new purchases will not apply to this.

5. Companies that Provide Grace Periods

It is important to note that some credit cards do not allow a grace period. This feature, however, is not universal: most major credit card issuers offer it; however, some specific types of cards, like high-risk or secure credit cards, do not.

So, it’s wise to go through the terms and conditions of any credit card that you wish to apply for some time and check to ascertain whether the Credit card offers a grace period.

If the card does not have this feature, interest starts to be charged on the purchase as soon as one is made.

6. New Cardholders and First Years

Most consumers are eligible for the grace period when they sign up for a new credit card, but they should review the disclosures of introductory periods. Certain card companies are likely to provide an initial 0% APR on purchases for a set amount of months, in which you would not be charged any interest.

Yet the rules change after the first month, and as with any other credit card, the standard grace period applies. During this period, one must make a complete payment of the balance to avoid interest.

Here are the types of transactions and the grace period eligibility criteria…

| Types of Transactions | Eligible for Grace Period | Notes |

| New Purchase | Yes | There is no interest if the full balance is paid on time. |

| Cash Advance | No | Interest starts immediately. |

| Balance Transfer | No | It often has its own interest rates. |

| Special Promotion | Card Specific | Check specific terms. |

What Can Cause You to Lose Your Grace Period?

There are several reasons you may lose eligibility for a grace period, including:

- Carrying a Balance: If you can’t clear the amount in full, the grace period is removed, and any new purchases will attract interest charges immediately.

- Late Payments: Failure to make the payment or paying an amount below the minimal required sum initiates the grace period and penalties, such as fees for lateness.

- Certain Transactions: It is important to note that balance transfers, cash advances, and similar operations do not usually qualify for this grace period, and they attract interest from the day the transfer is made.

The Impact of Grace Periods on Other Debt

Grace periods are useful for many types of debt because they imply that the debtor has a certain period during which he/she does not need to make payments.

These periods allow borrowers more time to make the payments without attracting penalties or having their credit rating affected. However, they may be different, as they depend on the kind of debt one has and the policies of the credit company.

Student Loans

Grace Period: 6 months (for federal loans usually)

Details: Federal student loans allow, for example, a grace period of six months after graduation. Indeed, during this period, borrowers do not have to pay back any loans. This time provides an opportunity for graduates to get a job or make other preparations before starting to pay back the loans. Nevertheless, interest may continue to be charged on certain loans (such as unsubsidized federal loans).

Mortgages

Grace Period: 10-15 days

Details: Most mortgage creditors offer a brief period of forbearance, which ranges between 10 and 15 days after the due date. This means that if a mortgage payment is made during this period, no penalty charge is added. Nonetheless, the borrower should be cautious that even during the grace period, interest continues to build up, and payments in default after the grace period are deemed past due.

Auto Loans

Grace Period: 10-15 days

Details: Like mortgages, auto loans are normally accompanied by a brief grace period. Borrowers can be offered a grace period of 10 to 15 days before they are charged for late payment. Although this may help, it slows, and interest keeps piling up. Once the grace period is over, the loan is deemed past due.

Personal Loans

Grace Period: 15-30 days

Details: A personal loan may also include a grace period, usually 15 – 30 days, depending on the nature of the loan. If a payment is made during this period, no penalty fee is incurred. However, interest does not cease to grow, and the grace period is aimed only at sparing borrowers from immediate consequences.

Payday Loans

Grace Period: Varies (may offer extensions)

Details: Some payday lenders allow the borrower to roll over the loan or give extra time to pay it. However, such extensions always attract other costs in addition to having a relatively high interest rate. Payday loans are often short-term, and if the amount borrowed is not repaid at the agreed-upon time, then the lender will roll it over, but this will be at a higher interest rate.

Situations Where Your Credit Card Grace Period Pays You Off!

| Situations | Example | How the Grace Period Works |

Buying Smart for Large Purchases | If you buy a $1200 laptop during the start of the billing bicycle, you have a 25-day grace period to pay off your bill. | The grace period here helps you pay off your laptop bill in 2 months so that you can avoid interest and allow extra time to gather funds. |

Managing a Tight Month | The bills for the month are higher than expected, and you need to wait until the next month’s paycheck. | The 25-day grace period allows you to cover immediate needs now and pay next month, avoiding interest and maintaining flexibility for urgent expenses. |

Covering Emergency Expenses | Your car was hit by an accident, and you need an emergency fund of $700 for replacement purposes. | The grace period lets you cover the repair now and pay off the balance by the due date, avoiding stress and interest on an unexpected expense. |

Maximizing Cash Flow | You booked a $1000 vacation during the billing cycle, and then you have 25 days of grace period. | This allows you to pay off the vacation cost after you return, giving you nearly two months to enjoy your trip and budget without immediate out-of-pocket costs. |

The Bottom Line

It is important to be aware of how grace periods and credit card rewards are useful so that you can take advantage of some key benefits. Paying your balance in full within that grace period means that you can avoid interest charges while getting reward points for charges.

This strategy not only adds more value to the rewards you offer but also plays an important role in improving your creditworthiness.

The golden rule when using the card is to avoid hasty payments and take full advantage of the grace period to understand your debts on the credit card.

Frequently Asked Questions

What happens if you don’t pay your entire balance?

If you are unable to make the whole payment by the due date, you must make at least the minimum payment—or more, if possible. If you lose the grace period, you have to pay interest, but you won’t pay a late fee.

How long is the grace period for your credit card?

The grace period for a credit card typically lasts from 21 days to 25 days. You can ask for your grace period by checking your cardholder agreement. The grace period duration comes with the fee and annual percentage rate (APR). Apart from checking your agreement, you can also call your lender’s helpline and ask about the grace period directly.

Does a grace period work with credit card cash advances?

The credit card grace period is only applicable with purchases. Cash advances do not qualify for the grace period. Cash advances can incur with the interest immediately when in use.

Which credit card does have a grace period?

Whether it is the major credit card issuer or the smaller one, it gives you a grace period at the time of paying your statement balance in full by the due date. This is mandatory to provide a grace period to the cardholder.

To fix QuickBooks Payroll 12000-series errors such as 12002, 12007, 12029, and 12031, ensure stable internet connectivity, re-configure Internet Explorer and SSL/TLS settings, and allow…

How to Fix QuickBooks Payroll Error PSXXX Series: A Complete Step-by-Step Guide to Resolve Configuration and Setup Issues

To fix the QuickBooks Payroll PSXXX series error such as PS033, PS036, PS058, PS101, and PS107, turn off User Account Control (UAC) settings in Windows,…

Best Way to Get Support With QuickBooks Desktop Subscription

The most effective way to get QuickBooks Desktop subscription support is through in-product help, which uses your license and version to route you to context-aware…

How Can I Contact QuickBooks Desktop Upgrade Support?

Upgrading QuickBooks Desktop is a crucial step for maintaining optimal performance, accessing the latest features, and ensuring data security. Connecting with the right QuickBooks Desktop…

How to Fix Incorrect Address or Details on Printed Payroll Checks in QuickBooks Desktop Pro/Premier

To fix incorrect addresses or details on printed payroll checks in QuickBooks Desktop Pro/Premier Payroll, update employee profiles with accurate mailing information, verify the company…

How Can I Contact QuickBooks Desktop Error Support?

QuickBooks Desktop errors are unexpected issues that slow down business operations, compromise data accuracy and disrupt the normal functioning of the accounting software. These problems…

How to Contact QuickBooks Data Conversion Support?

Migrating your financial data in QuickBooks is more than a routine technical task. It’s about ensuring your business records remain accurate, secure, and uninterrupted. A…

Best Way to Get Help With QuickBooks Desktop Payroll Support

To get the QuickBooks Payroll Support, the best is to use the in-product Help menu or live chat for immediate assistance with paycheck issues, tax…

How Can I Contact QuickBooks Desktop Support?

QuickBooks Desktop is a trusted accounting solution for small and mid-sized businesses, equipped with powerful tools for managing finances, processing payroll, tracking expenses, and ensuring…

QuickBooks Desktop Integration Support – Connect Apps Seamlessly

QuickBooks Desktop Integration Support Struggling with errors after upgrading QuickBooks Desktop or worried about losing data during the transition? Whether you’re moving to a newer…

QuickBooks Desktop Update Support – Fix & Install Updates Easily

QuickBooks Desktop Update Error Support Struggling with stalled updates or patch failures in QuickBooks Desktop? Whether you’re seeing error codes like 15271, update freezes, or…

QuickBooks Desktop Backup-Restoration Support – Secure Your Financial Data Now

QuickBooks Desktop Backup-Restoration Support Worried about lost or corrupted company files in QuickBooks Desktop? Whether your backup won’t restore, the .QBB file is damaged, or…

QuickBooks Desktop Credit Card Setup Support – Secure Processing

QuickBooks Desktop Credit Card Setup Support Facing issues syncing your credit card with QuickBooks Desktop? Whether transactions aren’t importing, card feeds are broken, or reconciliation…

QuickBooks Desktop Installation Support – Quick Setup Assistance

QuickBooks Desktop Installation Support Facing errors while installing QuickBooks Desktop? Whether it’s .NET issues, admin rights, system incompatibility, or frozen setup wizards, eBetterBooks offers expert…

QuickBooks Desktop Reconciliation Support – Balance Accounts Fast

QuickBooks Desktop Reconciliation Support Bank or credit card balances not matching in QuickBooks Desktop? If you’re stuck with unreconciled entries, duplicate transactions, or data discrepancies,…

QuickBooks Desktop Upgrade Support – Safe & Hassle-Free Upgrade

QuickBooks Desktop Upgrade Support Upgrading QuickBooks Desktop can be risky without expert oversight — from failed data migrations and version errors to broken payroll, inventory,…

QuickBooks Desktop Multi-User Mode Support – Instant 24/7 Expert Help

QuickBooks Desktop Multi-User Support Data not syncing? Company file locked by another user? Our QuickBooks-certified experts are available 24/7 to fix any multi-user mode issue—fast.…

Can’t Assign Vendor Bills to Accounts Payable in QuickBooks Desktop Premier 2024?

Hi Riscanda, You’re not the only one stuck in this frustrating situation where QuickBooks Desktop Premier 2024 refuses to let you assign vendor bills to…

QuickBooks Desktop Error Support – Fix Any Issue Instantly

QuickBooks Desktop Error Support Frustrated with error codes like 6000, 3371, or H202? Is QuickBooks crashing, freezing, or refusing to open your company file? You’re…

QuickBooks Desktop Printing Support – Resolve Print & PDF Issues

QuickBooks Desktop Printer Support Printer not responding in QuickBooks? PDF not generating? These issues can block essential tasks like invoicing, check printing, and report filing.…

qb-support

Need help with QuickBooks? Whether it’s for bookkeeping, payroll, or resolving technical issues, contacting QuickBooks support is easy. By logging into your account and using…

Why Isn’t QuickBooks Time (TSheets) Syncing with QuickBooks Desktop Enterprise?

Hi Catherine, You’re not the only one dealing with this frustrating payroll disruption where QuickBooks Time (formerly TSheets) just won’t sync hours into QuickBooks Desktop…

Why Is My Payroll Data Missing for the Last Pay Period in QuickBooks Desktop? Causes & Solutions

Hey Ann, Thank you for reaching out. I can imagine how worrying this must be for you. You opened QuickBooks Desktop to finish payroll, and…

Can I Limit User Access in QuickBooks Desktop 2024 Without Compromising My Financial Data?

Hi Anuja, It sounds like you’re in a bit of a tough spot right now with QuickBooks Desktop 2024. You’ve hired a new team member…

QuickBooks 2024 Fails to Open After Clicking Icon? Here’s How to Fix It

Hi Susan Picarillo, You’re not the only one stuck in this frustrating situation where QuickBooks Desktop Pro Plus 2024 just won’t open without any warning…

Why Can’t I Print Cheques or Switch Printers in QuickBooks Desktop?

Hi Terrinoan, You’re not the only one stuck in this frustrating situation where QuickBooks Desktop suddenly stops printing cheques and refuses to recognize a new…

Why Can’t I Copy Customer and Vendor Lists to a New Company File in QuickBooks Desktop (Premier & Enterprise)

Hi Derek McParlane, Thanks for sharing your situation and it’s completely understandable to feel stuck. You’re in the process of setting up a second business…

Why Are Payroll Taxes Not Withholding in QuickBooks Desktop Premier Plus?

Hi Sylvia, Thanks for reaching out to us. I can completely understand how stressful it must be to suddenly see taxes not being withheld while…

Can’t Remove or Delete a Payment from the Make Deposits Window in QuickBooks Desktop?

Hi Gary Black, You’re not the only one stuck in this situation. Many QuickBooks users run into this exact issue where an incorrect or duplicate…

Why Won’t QuickBooks Connect to My Bank Anymore?

Hi Reymon, You’re definitely not the only one dealing with this. Many QuickBooks users encounter frustrating connectivity issues, even when everything appears to be in…

Why Won’t QuickBooks Online Let Me Create Invoices After Setup?

Hi Uillen, It sounds like you’re currently facing a major roadblock in QuickBooks Online every time you try to create an invoice, the system either…

Why Can’t I Reset My Forgotten Or Rejected Payroll PIN in QuickBooks Desktop Pro?

Hi Alvaro Flores, Thanks for reaching out and I truly understand how urgent and stressful this situation must be. You’re in the middle of running…

Why Won’t QuickBooks Desktop Pro 2024 Restore My .QBB Backup After Reinstall?

Hi Glenn Thomson, You’ve already taken all the right steps, saved your backup locally and externally, reinstalled QuickBooks Desktop Pro 2024, and tried restoring the…

How to Reset Auto-Numbering and Lock Past Journal Entries in QuickBooks Desktop Enterprise 2024?

Hi Don Giorgio, Thank you for reaching out and I truly understand how frustrating and concerning this situation must be. When a system you rely…

QuickBooks Desktop Payroll Support – Expert Setup & Error Fix

QuickBooks Desktop Payroll Support Struggling with QuickBooks Desktop Payroll errors or tax table update failures? Whether you’re unable to send payroll, install updates, or facing…

Why Can’t I Update an Employee’s Legal Name in QuickBooks Online Payroll?

Hi Jessica Miller, You’re definitely not the only one facing this. Many QuickBooks Online Payroll users run into this frustrating issue where you update an…

Why isn’t my QuickBooks Online bank syncing even after refreshing or clearing the cache?

Hi Shawn, You’re not the only one stuck in this situation. Many QuickBooks Online users rely on daily automatic bank syncs to keep their books…

Why Am I Unable to Send Emails With PDF Attachments in QuickBooks Desktop Pro 2024?

Hey James Brown, I totally understand how frustrating and disruptive this issue must be for you. You’ve already done all the right things, your email…

Can I Reinstall QuickBooks Desktop Mac + 2024 on a New Mac After My System Crashed?

Hey Richard Bignell, Thank you for reaching out. I’m sorry to hear about your Mac crash and the disruption it’s caused to your workflow. Losing…

Why Can’t I Print Checks in QuickBooks Online?

Hi David Diaz, You’re not alone in facing this frustrating situation. Many QuickBooks Online users run into problems where checks either don’t print, print blank,…

Can I Cancel My QuickBooks Desktop Enterprise Cloud Hosting and Download Data Securely?

Hi Tara Michael, Thank you for explaining your situation so clearly. You’ve already made a smart and intentional decision to move away from QuickBooks Desktop…

Can I Cancel My QuickBooks Desktop Enterprise Cloud Hosting and Download Data Securely?

Hi Tara Michael, Thank you for explaining your situation so clearly. You’ve already made a smart and intentional decision to move away from QuickBooks Desktop…

How to Stop QuickBooks Desktop Accountant from Resetting Check Alignment Settings Every Time You Log In?

Hi Donna, you’re not the only one facing this frustrating issue. Many QuickBooks Desktop Accountant users find that even after aligning their checks perfectly, top…

Why Can’t I Edit Incorrect Pay Dates in QuickBooks Desktop Enterprise 2024?

Hi Jacob, Thank you for sharing such a clear and detailed explanation of the issue—you’ve already taken some thoughtful troubleshooting steps, which really helps narrow…

Why Can’t I Connect My Bank Account in QuickBooks Online?

Hi Kevin, You’re not alone in this. Many QuickBooks Online users run into a frustrating issue where the system shows a “Something went wrong. Try…

Why Can’t I Reconnect My UPS Account to Shipping Manager in QuickBooks Desktop Pro Plus 2024?

Hi Shawn Willson, Thanks for explaining your situation in such detail, it really helps in pinpointing what’s going wrong. It’s clear you’ve already taken several…

How to Reassign Employee Hours to the Right Project in QuickBooks Online Without Disrupting Payroll or Job Costing?

Hi Dennis Lee, You’re not the only one running into this issue. Many QuickBooks Time users accidentally tag hours to the wrong project, often due…

Why Am I Unable to Process a Vendor Payment Via Direct Deposit in QuickBooks Desktop 2024?

Hi Shawna, Thank you for reaching out—and I completely understand how stressful it can be when the system freezes without warning and your vendor is…

Why Is QuickBooks Desktop Enterprise 2024 Asking Me to Reboot When Opening Payroll Centre?

Hi Liggett, You’re not alone in this. Many QuickBooks Desktop Enterprise 2024 users encounter a frustrating pop-up on payroll day that says: “Please restart your…

Why Can’t I Re-submit Or Reprocess the Direct Deposit in QuickBooks Desktop Enterprise 2024?

Hey Jessica Johnson, Hats off to you for catching the issue early and jumping into action. You did everything a responsible payroll manager should: submitted…

What to Do If QuickBooks Online Combines Multiple Customer Payments into One Deposit?

Hi Roussana, you’re not the only one running into this issue. Many QuickBooks Online users experience confusion when trying to reconcile customer payments, especially when…

Should I Stay on QuickBooks Desktop Pro Plus or Upgrade to Premier, Enterprise, or Online?

Hi Gary, You’re asking exactly the kind of questions more business owners should be asking — and you’re definitely not alone. With QuickBooks Desktop Pro…

QuickBooks Freezes or Won’t Open on One Computer After Windows Update

This article helps users resolve an issue where QuickBooks Desktop freezes or won’t open on one computer after a Windows update. It explains how system…

Why QuickBooks Desktop Won’t Let Me Access 941 Forms for 2024

This article addresses the issue where QuickBooks Desktop users are unable to access 941 tax forms for 2024 due to automatic updates that replace prior-year…

Fix QuickBooks Error H202 Due to Network Communication Barriers

QuickBooks Error H202 occurs when a user tries to open a company file in multi-user mode, but QuickBooks can’t reach the server due to a…

What to Do If I Am Getting Repeated QuickBooks Desktop Upgrade Notifications?

If you’re repeatedly getting QuickBooks Desktop upgrade notifications despite having an active subscription and supported version, there’s no need to worry. These alerts are routine…

Why can’t you get the 50% Discount When Resubscribing to QuickBooks Online?

If you’re not receiving the 50% discount when resubscribing to QuickBooks Online, it’s because the offer is strictly for new users. The system flags returning…

QuickBooks Online Not Sending Contractor Payments? Here’s Why It Happens and How to Fix It

If QuickBooks Online isn’t sending 1099 contractor payments, it’s often due to browser glitches, incomplete contractor setup, or hidden backend holds. This guide helps users…

Why Did QuickBooks Desktop Ask Me to Log Out?

QuickBooks Desktop may prompt unexpected logouts due to file corruption, background updates, remote access conflicts, or permission issues. This article helps users identify the root…

Why QuickBooks Desktop 2024 Asking Me to Reactivate Payroll Even If My Subscription is Active?

If QuickBooks Desktop 2024 is prompting you to reactivate payroll despite an active subscription, the issue likely stems from sync failures, outdated files, or license…

How to Clean Up Duplicate Transactions in QuickBooks Online?

This article addresses the common issue of duplicate transactions in QuickBooks Online, typically caused by combining manual CSV uploads with bank feed syncing. It guides…

How to Fix the “PDF Component Missing” Error in QuickBooks Desktop 2024?

Experiencing the “PDF Component Missing” error in QuickBooks Desktop 2024? This guide directly addresses the root causes—like broken PDF converters, disabled XPS writers, or printer…

How to Fix Negative Balances in QuickBooks Desktop (Step-by-Step)

If your QuickBooks Desktop reports show unexpected negative balances, it’s likely due to mismatched invoice and payment dates, incorrect report filters, or broken links between…

Missing Bank Account in QuickBooks Online? Here’s What to Check First

If your bank account has vanished from QuickBooks Online but still shows in past reports, it’s likely due to a visibility glitch, sync failure, or…

System Requirements for QuickBooks Desktop Mac 2012

If you’re planning to install QuickBooks Desktop Mac (2012) on your macOS 10.7 (Lion) or later system, it’s critical to make sure your device meets…

System Requirements for QuickBooks Desktop Enterprise 2012

If you’re planning to install QuickBooks Desktop Enterprise (2012) on your Windows 7 SP1 (Pro/Enterprise), Windows 8.1 (Update 1), Windows 10 (unofficial support) system, it’s…

System Requirements for QuickBooks Desktop Accountant Bookkeeper Edition 2012

If you’re planning to install QuickBooks Desktop Accountant Bookkeeper Edition (2012) on your Windows 7 SP1 (32/64-bit), Vista SP2 (32/64-bit), Server 2008 (32/64-bit), Server 2008…

System Requirements for QuickBooks Desktop Accountant 2012

If you’re planning to install QuickBooks Desktop Accountant (2012) on your Windows XP, Vista, 7, 8, Server 2003/2008/2012 (native), may need Win 7 compatibility mode…

System Requirements for QuickBooks Desktop Premier 2012

If you’re planning to install QuickBooks Desktop Premier (2012) on your Windows 7, Vista SP1+, XP SP2+ (32/64-bit), natively installed system, it’s critical to make…

System Requirements for QuickBooks Desktop Pro 2012

If you’re planning to install QuickBooks Desktop Pro (2012) on your Windows 7, 8/8.1, 10 (32/64-bit), natively installed system, it’s critical to make sure your…

System Requirements for QuickBooks Desktop Mac 2013

If you’re planning to install QuickBooks Desktop Mac (2013) on your Mac OS X v10.7 or later system, it’s critical to make sure your device…

System Requirements for QuickBooks Desktop Enterprise 2013

If you’re planning to install QuickBooks Desktop Enterprise (2013) on your Windows XP SP3, Vista SP1+, Windows 7 (64-bit supported) system, it’s critical to make…

System Requirements for QuickBooks Desktop Accountant Bookkeeper Edition 2013

If you’re planning to install QuickBooks Desktop Accountant Bookkeeper Edition (2013) on your Windows XP, Vista, 7, 8 system, it’s critical to make sure your…

System Requirements for QuickBooks Desktop Accountant 2013

If you’re planning to install QuickBooks Desktop Accountant (2013) on your Windows XP, Vista, 7, 8 (64-bit recommended) system, it’s critical to make sure your…

System Requirements for QuickBooks Desktop Premier 2013

If you’re planning to install QuickBooks Desktop Premier (2013) on your Windows XP SP3, Vista SP1+, Windows 7 (Win 10 unofficial) system, it’s critical to…

System Requirements for QuickBooks Desktop Pro 2013

If you’re planning to install QuickBooks Desktop Pro (2013) on your Windows XP, Vista, 7, 8 system, it’s critical to make sure your device meets…

System Requirements for QuickBooks Desktop For Mac 2014

If you’re planning to install QuickBooks Desktop For Mac (2014) on your macOS 10.7 (Lion), 10.8 (Mountain Lion), 10.9 (Mavericks), 10.10 (Yosemite) system, it’s critical…

System Requirements for QuickBooks Desktop Enterprise 2014

If you’re planning to install QuickBooks Desktop Enterprise (2014) on your Windows Vista SP1 (UAC on), Windows 7 (UAC on), Windows 8 (UAC on), Windows…

System Requirements for QuickBooks Desktop Accountant 2014

If you’re planning to install QuickBooks Desktop Accountant (2014) on your Windows 8, 7, Vista SP1+ (all editions incl. 64-bit) — Not compatible with Win…

System Requirements for QuickBooks Desktop Premier 2014

If you’re planning to install QuickBooks Desktop Premier (2014) on your Windows Vista (SP1 or later), Windows 7, Windows 8 (incl. 64-bit) system, it’s critical…

System Requirements for QuickBooks Desktop Pro 2014

If you’re planning to install QuickBooks Desktop Pro (2014) on your Windows Vista SP1, Windows 7, Windows 8 system, it’s critical to make sure your…

System Requirements for QuickBooks Desktop Mac 2011

If you’re planning to install QuickBooks Desktop Mac (2011) on your macOS 10.6 system, it’s critical to make sure your device meets the minimum system…

System Requirements for QuickBooks Desktop Mac 2015

If you’re planning to install QuickBooks Desktop Mac (2015) on your macOS 10.9 (Mavericks), macOS 10.10 (Yosemite) system, it’s critical to make sure your device…

System Requirements for QuickBooks Desktop Enterprise 2011

If you’re planning to install QuickBooks Desktop Enterprise (2011) on your Windows XP (SP2+), Vista (UAC on), Windows 7 (UAC on), Server 2003/2008, Small Business…

System Requirements for QuickBooks Desktop Enterprise 2015

If you’re planning to install QuickBooks Desktop Enterprise (2015) on your Windows 8, 7 SP1, Vista SP2 (all editions, 64-bit); Windows Server 2012, 2011, 2008…

System Requirements for QuickBooks Desktop Accountant 2011

If you’re planning to install QuickBooks Desktop Accountant (2011) on your Windows XP (SP2+), Vista, Windows 7 (UAC on), Server 2003, Server 2008, SBS 2008…

System Requirements for QuickBooks Desktop Premier 2011

If you’re planning to install QuickBooks Desktop Premier (2011) on your Windows XP (SP2+), Vista, Windows 7, Server 2003, Server 2008, Small Business Server 2008…

System Requirements for QuickBooks Desktop Pro 2011

If you’re planning to install QuickBooks Desktop Pro (2011) on your Windows XP (SP2+), Vista (UAC on), 7 (UAC on), Server 2003, Server 2008, SBS…

System Requirements for QuickBooks Desktop Accountant 2015

If you’re planning to install QuickBooks Desktop Accountant (2015) on your Windows Vista SP1+, 7, 8 (U.S. version, English region & keyboard only) system, it’s…

System Requirements for QuickBooks Desktop Premier 2015

If you’re planning to install QuickBooks Desktop Premier (2015) on your Windows Vista SP1+, 7, 8 (all editions, 64-bit) system, it’s critical to make sure…

System Requirements for QuickBooks Desktop Pro 2015

If you’re planning to install QuickBooks Desktop Pro (2015) on your Windows 8, 7, Vista SP1 (64-bit) system, it’s critical to make sure your device…

System Requirements for QuickBooks Desktop Mac 2016

If you’re planning to install QuickBooks Desktop Mac (2016) on your R5 or earlier: Mac OS X 10.10 Yosemite, 10.11 El CapitanR6+: 10.11 El Capitan,…

System Requirements for QuickBooks Desktop Enterprise 2016

If you’re planning to install QuickBooks Desktop Enterprise (2016) on your Windows 8.1, 10; Server 2012 (R2), 2016, 2019 system, it’s critical to make sure…

System Requirements for QuickBooks Desktop Pro 2024

If you’re planning to install QuickBooks Desktop Pro (2024) on your Windows 10/11 system, it’s critical to make sure your device meets the minimum system…

System Requirements for QuickBooks Desktop Premier 2024

If you’re planning to install QuickBooks Desktop Premier (2024) on your Windows 11 system, it’s critical to make sure your device meets the minimum system…

System Requirements for QuickBooks Desktop Accountant 2024

If you’re planning to install QuickBooks Desktop Accountant (2024) on your Windows 11 system, it’s critical to make sure your device meets the minimum system…

System Requirements for QuickBooks Desktop Enterprise 2024

If you’re planning to install QuickBooks Desktop Enterprise (2024) on your Windows 11 system, it’s critical to make sure your device meets the minimum system…

System Requirements for QuickBooks Desktop Pro 2023

If you’re planning to install QuickBooks Desktop Pro (2023) on your Windows 10/11, Server 2016–2022 system, it’s critical to make sure your device meets the…

System Requirements for QuickBooks Desktop Premier 2023

If you’re planning to install QuickBooks Desktop Premier (2023) on your Windows 10/11, Server 2016–2022 system, it’s critical to make sure your device meets the…

System Requirements for QuickBooks Desktop Accountant 2023

If you’re planning to install QuickBooks Desktop Accountant (2023) on your Windows 10 or later (64-bit), Windows Server 2016/2019/2022. Not supported: Windows 8.1, 10 S…