A credit card grace period is the days between the billing date and the due date. During this period, no interest is charged on purchases if you pay your balance in full.

The grace period is typically given to newly purchased products rather than to services such as cash advances and transfers. For any of these purchases, interest will be charged from the date of occurrence unless they qualify for a particular 0 percent APR tease.

What is a Credit Card Grace Period?

The Credit Card Grace Card refers to the period between the issuance of a credit card statement and the due date, during which the consumer bears no interest for any purchase made on the card.

The grace period is the time that elapses between the time a consumer makes purchases through his/her credit card in the previous billing cycle and the time he/she is required to pay interest on the outstanding balance made during the current billing cycle.

It is only applicable if the consumer cleared his or her last credit card balance in full and timely and did not roll over a balance for any part of the preceding billing cycle.

Note: It is advisable to read the terms and conditions of your credit card and find out if it has a grace period.

How Long is a Typical Grace Period for a Credit Card?

A grace period normally ranges from 21 days to 55 days. Remember that having a credit card grace period does not mean that you have more time until the due date.

When you make partial payments, fail to make the necessary minimum payment on your credit card, or pay your bill after the due date, your credit card company will start charging interest on your balance.

In addition, you will incur late penalties if you fail to make a payment or make it after the due date.

To prevent interest payments, you must pay off your credit card balance in full before the payment due date. At the absolute least, you must make the minimum payment, and you will then be charged interest on any balance carried over to the next month.

| Tip: To maintain your grace period, make sure to pay your bills in full and on time each month. If you pay in full for some months but not others, you may lose your grace period for the month in which you do not pay in full and the following month. |

If you pay off your credit card amount every month during this grace period, you will avoid incurring interest on your purchases. However, the grace period usually only applies to new purchases, not cash advances, balance transfers, or special promotional deals.

Example of Credit Card Grace Period

| Let’s understand this with an example: If your billing cycle ends on May 31, your credit card statement detailing the amount due is issued on the same day. Assuming a 30-day grace period, your payment due date would be June 30. By paying the full balance within this timeframe, you can avoid any interest charges. |

How Long is the Grace Period On Credit Card?

Credit card lenders or companies must send cardholders their bills at least 21-25 days before payment is due. Sometimes, some credit cards consider those 21 days, as well as the time between when you made your purchases inside the billing cycle, to be a grace period if you have paid your previous balance in full. This means grace periods might last nearly two months.

How Does the Credit Card Grace Period Work?

To fully enjoy a grace period, you must understand the credit card’s billing cycle, the expense of carrying a debt, and how the lender charges interest on your purchases.

These key concepts assist in clarifying how grace periods work:

- Billing Cycle

Your credit card company establishes a billing cycle, which is typically one month long. Finally, your purchases are totaled and presented in a statement.

- Statement Generation

Your credit card provider generates a statement of your purchases at the end of each billing cycle that summarises the transactions completed during that time.

- Grace Period

The grace period begins on the day your statement is generated and normally lasts 21-25 days, depending on the credit card provider.

- Interest Fee

If you pay off your credit card amount in full by the due date during the grace period, you will not be charged interest on your transactions.

- Interest on Unpaid Balances

If you fail to pay the entire balance by the due date, the remaining balance will start to accrue inte

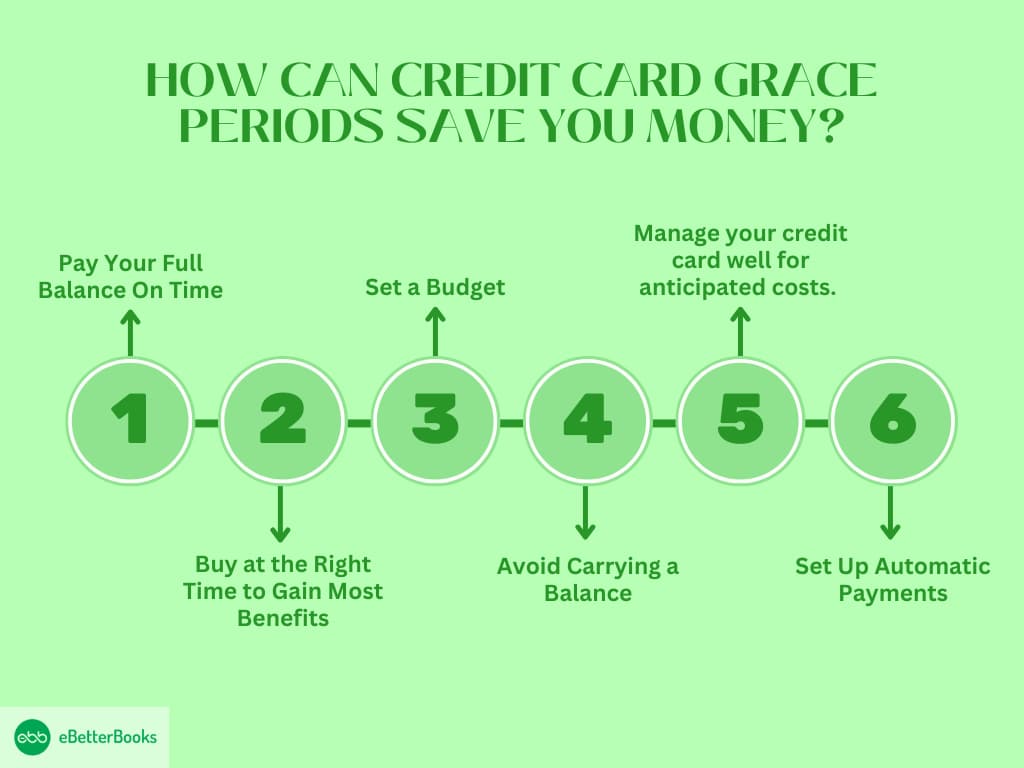

How Can Credit Card Grace Periods Save you Money?

If you are keen on maintaining your credit card balance, it is very important to make the most out of the grace period. If done with some thought, one can manage their cash flow and make the right usage of the credit card.

Here’s how to get the most out of your grace period:

1. Pay Your Full Balance On Time

The simplest way to avoid interest charges is to always make full payments for the amount charged on your statement by the due date. If you are unable to contribute the total amount, ensure that you contribute at least the minimum.

The balance will then attract an interest rate, as will any other purchase made after this. If you transfer lesser balances, then the interest you will be charged will also be reduced.

Example:

If your statement balance is $500 and your due date is the 25th of the month, by the due date, you must pay $500. Thus, you avoid interest charges that could come along the way if you have a line of credit.

However, if you pay only $250, interest will be charged on that amount and all purchases made after the date of the statement.

2. Buy at the Right Time to Gain Most Benefits

To maximize your grace period further, make your purchases at the start of a billing cycle. However, if you want to take much more time, you will have a full cycle with interest and a grace period.

For bigger purchases, this strategy could allow you to go up to two months without accruing interest.

Example:

Your account’s billing cycle ends on the 10th of the following month. If you purchase $200 and have the records that it reflects in your statement, the purchase attracts an interest-free period of 25 days from the 5th to the 30th.

For example, if you make the same $200 purchase on the 20th, those will count in your next cycle, and you get a full month + the interest grace period.

3. Set a Budget

Having a budget will allow you to control your purse strings well, enabling you to manage your credit card balance correctly. It is best to think of your credit card as an interest-free loan.

If the grace period is understood correctly, complete payment should be made on the statement balance before the grace period expires.

Example:

Let’s assume that you have $500 that you can spend as you please in a month. Thus, tracking your expenses allows you to use your credit card only for purchases within this limit and make a payment in full before the due date.

For instance, when you buy groceries worth $100 using your credit card, and you buy 200 worth of gas, you will be charged $300 in a statement, which can be paid by the due date to minimize interest charges.

4. Avoid Carrying a Balance

The key to making good use of the grace period is paying your bill in full every month. Even if you continue into the next month with a balance remaining, you may lose your grace period, and thus, interest will be added to any new purchases.

That only happens when you pay off your balance, which lets you retain the grace period you negotiated on your credit card.

Example:

Let’s say your statement balance is $300, but you manage to pay $100; the remaining balance is $200, which will be carried over to the next month. This balance will start incurring interest, and you will lose your grace period for new purchases.

On the other hand, paying up to $300 in full means that in the next cycle, you will not incur any additional interest on the balance or new products.

5. Effectively Manage your Credit Card for Expected Expenses

If you cannot control your urge to spend, it would be ideal to only use your credit card in situations where you already know you can pay up before the due date.

By sticking to the planned amount for each category, you will maximize your payments, ensuring they clear their balance, and you will not be charged any interest.

Example:

For instance, you might be considering a $400 plane ticket at the beginning of the month and are aware that you can afford to pay for it on the due date.

This enables its holder to charge any item that he or she wants on the credit card and make the full and timely repayment before the due date, hence avoiding any interest.

However, if you use the card to make random purchases, as you do not need to, your chances of repaying it in full may be strained.

6. Set Up Automatic Payments

To avoid being devoid of a grace period, it is prudent to make arrangements for auto payments of your statement balance.

This ensures that you pay your outstanding amount in full every month, even if you forget or are occupied.

Example:

If you know your statement balance is $400 and your due date is the 25th, automatic payment means that your card issuer will pay the stated balance before the due date.

This prevents you from forgetting to make a payment, so there is no need to incur extra interest charges.

How Can Grace Periods Maximize Your Credit Card Rewards?

The grace period comes between 21 to 25 days from the last date of your billing cycle and allows you to clear your balance before it starts to attract interest charges.

Here’s how you can use this feature to your advantage:

- Don’t Charge and Optimize Profit

Paying off your balance in full if you have the cash during the grace period helps prevent interest charges from devaluing your rewards.

For example, utilizing an incentive card like the Chase Sapphire Preferred® Card, which pays 3X points on Dining and 2X Points on Travel, earns you valuable points while keeping your spending interest-free if you pay off the balance before the due date.

- Time Big Purchases Wisely

Whenever you are planning a big purchase, try to time it until the billing cycle commences. This gives you the maximum time to pay it off within the grace period. This basically assists in giving the maximum time within the grace period to pay off what has been borrowed.

More easily, using credit cards like the Citi® Double Cash Card, which offers 2% cash back, 1% when you buy, and 1% when you pay, could double the rewards when using this strategy.

- Link Grace Periods with introductory APR Offers

Some cards, like the Wells Fargo Active Cash® Card, have no annual fees and include 0% APR introductory periods.

You also get 2% back on every purchase. By following the grace period curve to ensure the introductory APR has ended, you can always reap from those points without being charged interest.

- Optimize Category Rewards

Cards with bonus categories that change each quarter, such as the Discover it® Cash Back, enable their holders to charge up to 5% on certain items, such as groceries, gas, or even dining.

No value erodes for these rewards through interest charges when your balance is paid fully within the grace period.

- Redeem Points From Daily Purchases

Merchant purchases, such as food and electricity bills, can also contribute to the accrual of rewards, and charges apply if they settle before the grace period.

The Blue Cash Preferred® Card offers an enrollment bonus of $150 once you spend $1,000 in the first three months of opening the account. It also offers the following rewards: 6% cash back on up to $6,000 per year at US supermarkets.

This way, it becomes possible to protect all those bonuses, remain profitable, and pay the balance on time.

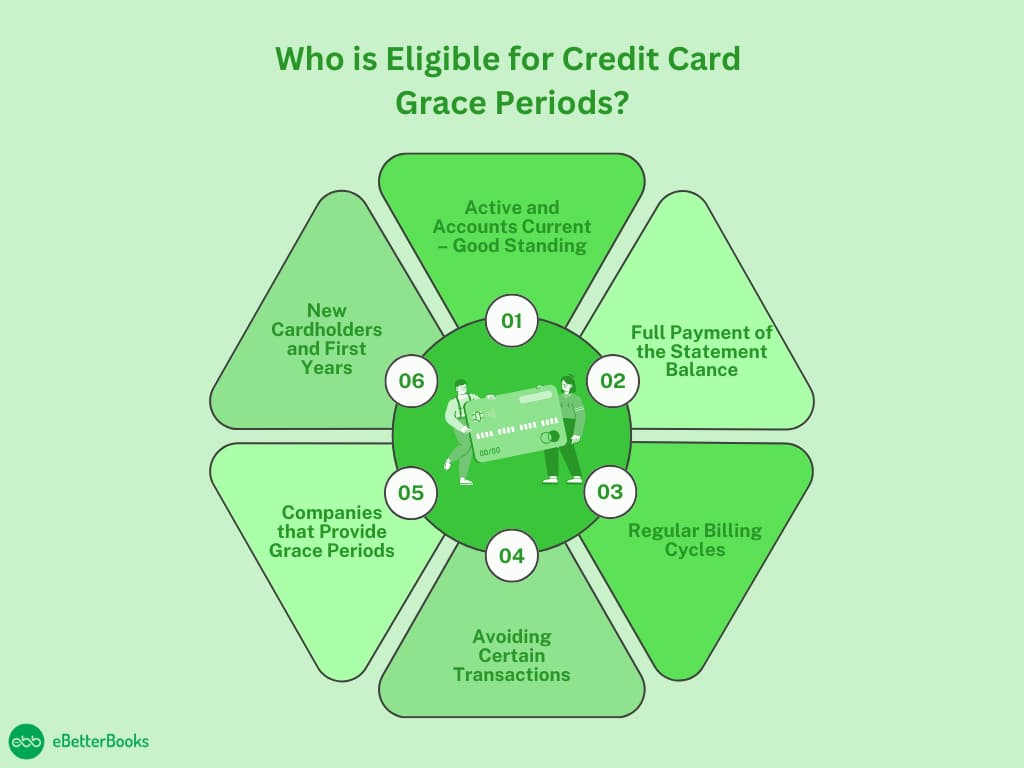

Who is Eligible for Credit Card Grace Periods?

A credit card grace period is one of the privileges that enable users to make purchases without accruing interest on the purchases so long as they pay the amounts owed before the due date. However, only some people are entitled to this kind of benefit right away. Not all cards are issued with a grace period, and here are factors that will determine if you are a beneficiary or not:

1. Active and Accounts Current – Good Standing

The first qualification for eligibility is that the credit card account you are qualifying must be open and not in default. As a result, you have to maintain an active, unblocked credit card with no overdue payments or complications, including chargebacks or defaults.

In this case, if your card is suspended or closed, for instance, due to non-payment or other issues, you are eliminated from accessing the grace period. It is also very important that you don’t go overboard with spending over your credit limit.

2. Full Payment of the Statement Balance

To be eligible for the grace period, you need to make your minimum statement balance payment by the stated date. The grace period only kicks in if you start a billing cycle with a $0 balance on your account.

If you leave any balance unpaid, you forfeit your grace period right, and interest begins to be charged on new purchases as soon as they are made. The consequence of paying only the minimum amount or of keeping a balance over the month will be interest charges.

3. Regular Billing Cycles

Most credit card companies go for monthly statements, and where your specific card operates within these regular cycles, you are allowed the grace period.

An ideal billing cycle is between 28 and 31 days, and from the close of the cycle, you are afforded some grace period between 21 and 25 days, within which you should pay your bill before incurring interest.

This is a supremacy of most credit card companies mandated by federal statute, though it is only valid when one does not carry over a balance from the previous cycle.

4. Avoiding Certain Transactions

It’s important to remember that grace periods do not include balance transfers, cash advances, or any other special occasions. Many of these transactions begin charging interest immediately while you are still in the grace period on new cash advances.

If you transfer a balance or get a cash advance, interest will be charged from the date of the transaction or the date the card was issued. Any grace period you may have for new purchases will not apply to this.

5. Companies that Provide Grace Periods

It is important to note that some credit cards do not allow a grace period. This feature, however, is not universal: most major credit card issuers offer it; however, some specific types of cards, like high-risk or secure credit cards, do not.

So, it’s wise to go through the terms and conditions of any credit card that you wish to apply for some time and check to ascertain whether the Credit card offers a grace period.

If the card does not have this feature, interest starts to be charged on the purchase as soon as one is made.

6. New Cardholders and First Years

Most consumers are eligible for the grace period when they sign up for a new credit card, but they should review the disclosures of introductory periods. Certain card companies are likely to provide an initial 0% APR on purchases for a set amount of months, in which you would not be charged any interest.

Yet the rules change after the first month, and as with any other credit card, the standard grace period applies. During this period, one must make a complete payment of the balance to avoid interest.

Here are the types of transactions and the grace period eligibility criteria…

| Types of Transactions | Eligible for Grace Period | Notes |

| New Purchase | Yes | There is no interest if the full balance is paid on time. |

| Cash Advance | No | Interest starts immediately. |

| Balance Transfer | No | It often has its own interest rates. |

| Special Promotion | Card Specific | Check specific terms. |

What Can Cause You to Lose Your Grace Period?

There are several reasons you may lose eligibility for a grace period, including:

- Carrying a Balance: If you can’t clear the amount in full, the grace period is removed, and any new purchases will attract interest charges immediately.

- Late Payments: Failure to make the payment or paying an amount below the minimal required sum initiates the grace period and penalties, such as fees for lateness.

- Certain Transactions: It is important to note that balance transfers, cash advances, and similar operations do not usually qualify for this grace period, and they attract interest from the day the transfer is made.

The Impact of Grace Periods on Other Debt

Grace periods are useful for many types of debt because they imply that the debtor has a certain period during which he/she does not need to make payments.

These periods allow borrowers more time to make the payments without attracting penalties or having their credit rating affected. However, they may be different, as they depend on the kind of debt one has and the policies of the credit company.

Student Loans

Grace Period: 6 months (for federal loans usually)

Details: Federal student loans allow, for example, a grace period of six months after graduation. Indeed, during this period, borrowers do not have to pay back any loans. This time provides an opportunity for graduates to get a job or make other preparations before starting to pay back the loans. Nevertheless, interest may continue to be charged on certain loans (such as unsubsidized federal loans).

Mortgages

Grace Period: 10-15 days

Details: Most mortgage creditors offer a brief period of forbearance, which ranges between 10 and 15 days after the due date. This means that if a mortgage payment is made during this period, no penalty charge is added. Nonetheless, the borrower should be cautious that even during the grace period, interest continues to build up, and payments in default after the grace period are deemed past due.

Auto Loans

Grace Period: 10-15 days

Details: Like mortgages, auto loans are normally accompanied by a brief grace period. Borrowers can be offered a grace period of 10 to 15 days before they are charged for late payment. Although this may help, it slows, and interest keeps piling up. Once the grace period is over, the loan is deemed past due.

Personal Loans

Grace Period: 15-30 days

Details: A personal loan may also include a grace period, usually 15 – 30 days, depending on the nature of the loan. If a payment is made during this period, no penalty fee is incurred. However, interest does not cease to grow, and the grace period is aimed only at sparing borrowers from immediate consequences.

Payday Loans

Grace Period: Varies (may offer extensions)

Details: Some payday lenders allow the borrower to roll over the loan or give extra time to pay it. However, such extensions always attract other costs in addition to having a relatively high interest rate. Payday loans are often short-term, and if the amount borrowed is not repaid at the agreed-upon time, then the lender will roll it over, but this will be at a higher interest rate.

Situations Where Your Credit Card Grace Period Pays You Off!

| Situations | Example | How the Grace Period Works |

Buying Smart for Large Purchases | If you buy a $1200 laptop during the start of the billing bicycle, you have a 25-day grace period to pay off your bill. | The grace period here helps you pay off your laptop bill in 2 months so that you can avoid interest and allow extra time to gather funds. |

Managing a Tight Month | The bills for the month are higher than expected, and you need to wait until the next month’s paycheck. | The 25-day grace period allows you to cover immediate needs now and pay next month, avoiding interest and maintaining flexibility for urgent expenses. |

Covering Emergency Expenses | Your car was hit by an accident, and you need an emergency fund of $700 for replacement purposes. | The grace period lets you cover the repair now and pay off the balance by the due date, avoiding stress and interest on an unexpected expense. |

Maximizing Cash Flow | You booked a $1000 vacation during the billing cycle, and then you have 25 days of grace period. | This allows you to pay off the vacation cost after you return, giving you nearly two months to enjoy your trip and budget without immediate out-of-pocket costs. |

The Bottom Line

It is important to be aware of how grace periods and credit card rewards are useful so that you can take advantage of some key benefits. Paying your balance in full within that grace period means that you can avoid interest charges while getting reward points for charges.

This strategy not only adds more value to the rewards you offer but also plays an important role in improving your creditworthiness.

The golden rule when using the card is to avoid hasty payments and take full advantage of the grace period to understand your debts on the credit card.

Frequently Asked Questions

What happens if you don’t pay your entire balance?

If you are unable to make the whole payment by the due date, you must make at least the minimum payment—or more, if possible. If you lose the grace period, you have to pay interest, but you won’t pay a late fee.

How long is the grace period for your credit card?

The grace period for a credit card typically lasts from 21 days to 25 days. You can ask for your grace period by checking your cardholder agreement. The grace period duration comes with the fee and annual percentage rate (APR). Apart from checking your agreement, you can also call your lender’s helpline and ask about the grace period directly.

Does a grace period work with credit card cash advances?

The credit card grace period is only applicable with purchases. Cash advances do not qualify for the grace period. Cash advances can incur with the interest immediately when in use.

Which credit card does have a grace period?

Whether it is the major credit card issuer or the smaller one, it gives you a grace period at the time of paying your statement balance in full by the due date. This is mandatory to provide a grace period to the cardholder.

-

Fix Incorrect Direct Deposit Amounts or Bank Information in QuickBooks Desktop Pro/Premier Payroll

If you’ve encountered incorrect direct deposit amounts or bank information in QuickBooks Desktop Pro/Premier Payroll, this guide helps you quickly correct those errors. It walks…

-

Fix Payroll Processing Delays or System Freezes in QuickBooks Desktop Pro/Premier

Experiencing payroll delays or system freezes in QuickBooks Desktop Pro/Premier? This guide addresses those critical issues—caused by outdated software, corrupted files, or system conflicts—and offers…

-

Fixing QuickBooks Desktop Enterprise Payroll E-Pay Login or Password Issues

Addressing login and password failures for QuickBooks Desktop Enterprise Payroll E-Pay is critical for maintaining tax compliance and avoiding penalties. These issues stem from a…

-

Fix W-4 or Payroll Info Errors for Employees in QuickBooks Desktop Pro/Premier Payroll

This guide helps resolve W-4 and payroll info errors in QuickBooks Desktop Pro/Premier Payroll by correcting inaccurate tax setups, filing statuses, and year-to-date figures. By…

-

Fix QuickBooks Desktop Enterprise Payroll Not Opening or Loading

If QuickBooks Desktop Enterprise Payroll fails to open or load, the issue is often caused by outdated software, corrupt files, or interference from firewalls or…

-

Fix Payroll Report Issues in QuickBooks Desktop Enterprise Payroll Desktop

This article addresses issues with payroll reports in QuickBooks Desktop Enterprise Payroll, such as missing employee data, incorrect pay totals, and report discrepancies. It guides…

-

How to Fix QuickBooks Payroll Calculations Failure in Desktop Enterprise Due to Date or Register Mismatch?

This article addresses payroll calculation failures in QuickBooks Desktop Enterprise caused by date or register mismatches, corrupted data, outdated tax tables, and misconfigured payroll items.…

-

Unable to Print QuickBooks Desktop Pro/Premier Payroll Forms or Reports

This article helps QuickBooks Desktop Pro/Premier users resolve payroll printing errors that can delay payments and disrupt operations. It guides users through verifying printer setup,…

-

How to Undo Reconciliation in QuickBooks (Online & Desktop)

This article addresses how to undo reconciliations in QuickBooks Online and Desktop, helping users fix accounting discrepancies caused by errors like incorrect balances, duplicated or…

-

Re-Activate QuickBooks Desktop Enterprise Payroll Subscription

This guide helps QuickBooks Desktop Enterprise users reactivate their payroll subscription after it becomes inactive, expired, or suspended. It resolves issues that block payroll processing—such…

-

How to Fix Payroll Update Errors in QuickBooks Enterprise?

This article helps users resolve payroll update errors in QuickBooks Enterprise by addressing common issues like incorrect service keys, inactive subscriptions, system misconfigurations, and corrupted…

-

Handle QuickBooks Desktop Pro/Premier Payroll Adjustments After System Migration

This guide addresses payroll discrepancies in QuickBooks Desktop Pro/Premier following a system migration, helping users resolve errors in tax setup, payroll items, and year-to-date balances.…

-

Resolve QuickBooks Desktop Pro/Premier Payroll Errors Due to Large or Oversized Files

QuickBooks Pro/Premier may trigger payroll errors due to oversized company files, affecting paycheck accuracy and tax filings. This guide helps users fix these issues using…

-

Is Equipment a Current Asset? Detailed Explanation

Equipment is not a current asset. In accounting, equipment is classified as ‘non-current’ or ‘fixed’ assets. More precisely, equipment is a tangible non-current asset, a…

-

Is Depreciation an Operating Expense?

Depreciation is a non-cash operation expense as the assets in use are deployed in routine business operations. Assets that are tangible are depreciated, while in…

-

Is Accounts Receivable an Asset? Learn with Example

What is Accounts Receivable? Accounts receivable (AR) are assets representing money owed to a business by customers for the goods and services taken but not…

-

Is Accumulated Depreciation an Asset?

Understanding Accumulated Depreciation Accumulated depreciation is a contra-asset account as it contains a credit balance that offsets the balance in the normal asset account with which they’re…

-

Invoice Processing: Definition & How does it Work?

Invoice processing is carried out by the accounts payable department, which involves managing supplier invoices from receipt to payment. Introduction Traditional invoice processing can be…

-

What is an Invoice? Definition, Types & Examples

What is an Invoice? Invoices are documents that itemize transactions between two parties for the products or services rendered. The purpose of an invoice is…

-

Investment Banking: Definition, Types, Functions, with Examples

What is Investment Banking? Investment banking helps corporations, investment banks, or governments raise capital and offers services for IPOs, underwriting, risk hedging, etc. Investment banking…

-

How to Fix QuickBooks Pro or Premier Payroll Subscription Not Working?

Facing payroll interruptions in QuickBooks Pro or Premier? This guide helps you resolve payroll subscription issues like expired plans, invalid service keys, or internet conflicts.…

-

Investing Activities: Definition & Examples

What are Investing Activities? Investing activities involve buying and selling assets and investments that are not part of a company’s main business operations. Cash flow…

-

Inventory Valuation: Definition, Methods & Examples

Understanding Inventory Valuation Inventory valuation helps determine the monetary value of the goods available for sale and the cost incurred in storing unsold inventory stock.…

-

International Accounting: Definition & Standards

What is International Accounting? International accounting is a branch focused on using specific accounting standards while balancing a company’s books overseas. International accounting involves keeping…

-

Internal Controls: Definition, Types & Example

What are Internal Controls in Accounting? Internal controls are accounting and audit mechanisms for risk mitigation, preventing and detecting errors, frauds, and irregularities. Internal controls…

-

Interest Expense: Definition, Formula & Example

Defining Interest Expense Interest expense represents the cost of borrowing money. This expense is associated with the interest payments on any outstanding debt obligations, such as loans…

-

Intangible Assets: Definition, Types & Examples

Definition Intangible assets like patents, goodwill, customer lists, etc., do not have a physical form and are crucial for a company’s financial health. Intangible assets…

-

Income Statement: Definition, How to Use & Examples

Introduction to Income Statement The Income Statement (Profit and Loss Statement) meticulously details the company’s revenue and expense accounts to calculate net profit or loss…

-

Governmental Accounting: Definition & Basics

What is Governmental Accounting? Governmental accounting refers to the process of recording and the management of all financial transactions incurred by a government entity. Government…

-

Goodwill in Accounting: Definition & Examples

Define Goodwill in Accounting Goodwill is an intangible asset representing a company’s reputation, brand value, customer relationships, etc., built over time. Goodwill emerges when a…

-

General Ledger: Definition, Purpose & Examples

What is a General Ledger? The general ledger is a complete record of a company’s financial transactions organized by accounts. The transaction data in a…

-

How to Transfer QuickBooks Desktop Pro/Premier Payroll Data from Client to CPA?

This guide helps clients and CPAs securely and accurately transfer QuickBooks Desktop Pro/Premier payroll data to support tax filing, compliance, and year-end reporting. It addresses…

-

GAAP: Overview & Key Accounting Principles

What are Generally Accepted Accounting Principles? US GAAP is standardized guidelines and frameworks outlining accounting practices and financial reporting standards for companies in the USA.…

-

Fix Payroll Tax Discrepancies in QuickBooks Desktop Pro/Premier Payroll Due to File Size Limits

This article helps users fix payroll tax discrepancies in QuickBooks Desktop Pro or Premier caused by company file corruption or file size limits. It guides…

-

About Form W-2, Wage and Tax Statement

What is a W-2 form? The W-2 form is also known as the Wage and Tax Statement. This is one of the most important records…

-

Forensic Accounting: Definition, History & Methods

What is Forensic Accounting? Forensic accounting is the application of accounting, auditing, and investigative techniques to examine financial statements to detect fraud, asset misappropriation, financial…

-

Flat Rate vs. Hourly:В Which is Better for You?

A flat rate payment system refers to a set price the client pays for goods or services rendered, while the hourly rate payment is based…

-

Fixed vs. Variable Cost: Differences & Examples

What are fixed and variable costs? Fixed cost is independent of production volume and remains stable, while variable cost is directly proportional to the production…

-

Fixed Cost: Definition, Calculation & Examples

Fixed costs are recurring expenses that remain constant irrespective of the business’s activity level. Fixed costs are not tied to any business process or activity…

-

Fixed Assets: Definition & Accounting Examples

Fixed assets are long-term tangible assets that a company uses to generate income. Fixed assets are not intended for sale in the normal course of…

-

Financial Modeling: Definition, Models, and Uses

What is Financial Modeling? Financial modeling is a forecasting model to evaluate business decisions, predict financial performance, calculate valuation or comparisons, etc. Financial modeling is…

-

Fix Error While Updating QuickBooks Pro or Premier Payroll Subscription

This article helps QuickBooks Desktop Pro and Premier users fix payroll subscription update errors caused by outdated software, incorrect billing info, system misconfigurations, or data…

-

Financial Audit: Definition, Importance & Types

What is an Audit in Accounting? A financial audit is an independent examination of financial information of any entity by a qualified professional to express…

-

Financial Accounting: Definition and Concept

What is Financial Accounting? Financial accounting consists of preparing financial statements to help stakeholders track financial performance at the end of the specified period. Following…

-

Fiduciary Accounting: Definition & Importance

What is Fiduciary Accounting? Fiduciary accounting or court accounting records all financial transactions of an estate, trust, guardianship, or conservatorship, etc., for a specified period…

-

Favorable Variance: Definition & Importance

A favorable variance occurs when expenses are less than the budget or actual revenue exceeds expected revenue. What Is A Favorable Variance? An organization has…

-

Fair Value Accounting: Definition & Examples

What is Fair Value Accounting? Fair value accounting refers to estimating the valuation of an asset or liability that can be sold or settled to…

-

What is Escrow? Definition, Need, Types, and Examples

Escrow is an arrangement in which a trusted, neutral third party holds assets, funds, documents, or money while the buyer and seller complete the transaction.…

-

Equity in Accounting: Definition, Types & Examples

Defining Equity Equity in accounting represents the ownership interest in a company. It is the residual interest in the company’s assets of an entity after…

-

Economic Order Quantity (EOQ): Definition & Formula

Understanding Economic Order Quantity Economic Order Quantity (EOQ) represents the ideal inventory quantity a business should order to minimize its total inventory costs. Total inventory…

-

Understanding EBTDA, EBIT, and EBITA

EBIT, EBITA, and EBITA are profitability metrics that assess a company’s profitability and operational efficiency, often used for valuation, investment analysis, etc. EBIT (Earnings Before…

-

What is EBITDA: Company’s Profitability Metric

What is EBITDA: Company’s Profitability Metric Company’s EBITDA measures operating profitability and helps in company valuation, investor analysis, and comparison within the same industry. EBITDA…

-

Double Entry Bookkeeping: Definition & Examples

Double-entry bookkeeping records all financial transactions in at least two different accounts to ensure the accuracy and completeness of financial records. The double-entry accounting system…

-

Discontinued Operations: Definition & Examples

Discontinued operations are specific product lines or parts of a business that have been terminated and are no longer in use. When a company conducts…

-

Direct Write-Off Method: Definition & Examples

What Is Direct Write-Off Method? The direct write-off method allows businesses to account for bad debts only when it is classified as uncollectible receivables. An…

-

Tax Setup Errors in QuickBooks Desktop Enterprise Payroll After Switching from Online to Desktop

This article addresses the issue of tax setup errors in QuickBooks Desktop Enterprise Payroll after migrating from QuickBooks Online. It guides users in identifying and…

-

Direct vs. Indirect Labor: Differences & Examples

Direct labor includes workers directly involved in core manufacturing operations, while indirect labor is engaged in auxiliary, supporting, and supervising roles. Although management of direct labor costs…

-

Direct Labor: Definition and Calculation Example

Introduction Direct labor refers to the labor cost directly associated with producing goods or providing services within a business. The fringe benefits and wages paid…

-

What Does Depreciable Cost Mean? Definition, Methods, and Examples

What is a Depreciable Cost? Depreciable cost is an accounting concept that refers to the part of the asset cost that can be depreciated over…

-

Debit Memo: Definition, Types & Examples

Understanding a Debit Memorandum A debit memo (debit note) is a document a seller uses to notify a buyer that their account has been debited…

-

Current Ratio: Definition, Formula & Examples

The current ratio in financial accounting measures the company’s ability to pay for its short-term loans or obligations that arise within a year. The current…

-

Fix W-4 or Payroll Info Errors for Employees in QuickBooks Desktop Enterprise Payroll

If you’re dealing with incorrect paycheck calculations, tax filing errors, or compliance risks in QuickBooks Desktop Enterprise Payroll, this guide walks you through how to…

-

Current Assets: Definition, Calculation & Examples

Current assets (liquid assets) are cash or cash equivalents that helps in meeting short-term obligations and routine business expenses within one year. What Are Current…

-

Cost Sheet: Definition, Components & Examples

What is a Cost Sheet? A cost sheet (cost statement) gives detailed elementwise cost information of a cost object for a certain volume and particular…

-

Cost Recovery Method: Definition & Examples

What is a Cost Recovery Method? The cost recovery method is a revenue recognition method where the profit is not recognized until all payments are…

-

Cost of Goods Sold: Definition & Calculation Steps

What is the Cost of Goods Sold? The cost of goods sold (COGS) includes all the direct costs incurred in manufacturing goods. The cost of…

-

Cost Accounting Standards: Definition & Importance

What is CAS (Cost Accounting Standards)? Cost Accounting Standards (CAS) are financial rules and guidelines set by the Cost Accounting Standards Board (CASB) that govern…

-

Cost Accounting: Definition, Importance & Types

What is Cost Accounting? Cost accounting is a subset of managerial accounting, which includes recording, analyzing, and reporting the cost of production and analyzing cost…

-

Corporate Accounting: Definition & Importance

What is Corporate Accounting? The branch of accounting that is in charge of preparing and consolidating the company’s general ledgers and financial statements is corporate accounting. Corporate…

-

Continuing Operations: Definition & Examples

Defining and Understanding Continuing Operations Continuing operations are the business’s ongoing and core activities that generate revenue and are expected to persist in the foreseeable…

-

Cash vs Accrual Accounting: Detailed Explanation

The accrual and cash basis of accounting has its own merits and demerits. Business owners need to record transactions and interpret the financial results that…

-

Cash Flow: Definition, Types, Importance & Examples

Cash flow constitutes cash inflow and outflow from a business, capturing its operational, investment, and financing activities. Defining Cash Flow Positive cash flow creates value…

-

How to Retrieve and Convert QuickBooks Desktop Pro/Premier Payroll Backup Data

This article addresses the critical problem of data loss, system migration, and compliance challenges related to QuickBooks Desktop Pro/Premier payroll data. It guides users on…

-

Cash Disbursement Journal: Definition & Examples

What Is Cash Disbursement In Accounting? Cash disbursement refers to the distribution of cash from a company’s funds or cash reserves to meet its financial…

-

Cash Basis Accounting Method: Definition & Examples

What is Cash Basis Accounting? Cash basis is an accounting method that records financial transactions when cash is received or paid out. In other words,…

-

Capital Lease in Accounting: Definition & Example

What is a Capital Lease? A capital lease is an agreement where the lessee gets the ownership rights of the leased asset upon completion of…

-

Why is QuickBooks Enterprise Payroll Subscription Canceled?

To fix a canceled QuickBooks Enterprise Payroll subscription, reactivate the subscription by logging into your Intuit account or directly within QuickBooks, update the software, or…

-

People

-

QuickBooks Email Problems

Get Detail Guides on QuickBooks Email Related Problems 1. Unable to Unreconcile a Month in Quickbooks Online 2. Unable to Fix Beginning Balance issues in…

-

Most Used Credit Cards in the USA for Business Expenses

Business credit cards provide advantages such as increased spending limits, incentives on purchases, and financial flexibility. The Ink Business Cash® Credit Card gives cashback, while…

-

Capital Budgeting: Definition, Methods & Examples

Defining Capital Budgeting Capital budgeting (investment appraisal) is used to evaluate potential major investments or expenditures, which include long-term investments such as the acquisition of…

-

Account Balance: Definition, Types & Examples

Account Balance: Definition, Types & Examples An account balance refers to the amount of funds available in the financial accounts at the start of an…

-

Accounting Information Systems (AIS) Introduction

What is an Accounting Information System? An Accounting Information System (AIS) collects, stores, retrieves and structurally processes financial data using sufficient information technology resources. Companies…

-

Accounting Period: Definition, Types & Examples

Accounting period is a fixed timeframe usually an year to record accounting transactions and generate business reports including final accounts and calculate income and taxes…

-

Accounts Payable: Definition, Process & Examples

Defining a Company’s Accounts Payable When a company purchases goods or services without immediate payment, it generates an accounts payable. Accounts Payable refers to the financial…

-

15 Small Business Expense Categories with Examples

What are Business Expenses? Business expenses are the costs incurred during the regular operations of a business which are necessary to ensure smooth business operations…

-

Benefits of Bookkeeping for Small Business Owners

Bookkeeping for small businesses helps streamline financial records, track financial performance, generate reports, file taxes, and do budgeting. Accounting and bookkeeping are often daunting tasks…

-

Accounting Equation: Overview, Formula & Examples

Introduction to the Accounting Equation The accounting equation, also called the basic accounting equation or balance sheet equation, is a critical concept in accounting that…

-

Accounting: Definition, Importance, Types & Cycle

What is Accounting? An Introduction Accounting is the process of recording, classifying, and summarizing business transactions and preparing reports to enable various stakeholders to interpret…

-

Accounts Receivable (AR): Definition & Examples

Defining Accounts Receivable Accounts receivable (AR) is an accounting term that refers to the money owed to a business by the customers for goods or…

-

Accounts Receivable Financing: Learn with Examples

Accounts receivable (or invoice financing) is a type of capital funding that helps companies receive early payment on their outstanding accounts receivable. What is Accounts…

-

Acid Test Ratio: Definition, Formula & Examples

Understanding Acid-Test Ratio The acid-test ratio (quick ratio) measures a company’s ability to meet its short-term liabilities using its most liquid current assets. It excludes…

-

Accrued Expenses: Definition & Examples

What are Accrued Expenses? Accrued expenses are those expenses that are incurred but not yet paid. These expenses are recorded as accrued liabilities and classified…

-

Accrual Accounting: Method Definition & Examples

What is Accrual Accounting Method? The accrual accounting method records financial transactions when revenues and liabilities are incurred, regardless of when the cash is exchanged.…

-

Actual Cost: Definition, Formula and Example

What is Actual Cost? Actual cost, also known as historical cost, is the total amount of money paid to produce, manufacture, or acquire a product…

-

Allowance for Doubtful Accounts: A Detailed Guide

What is Allowance for Doubtful Debts? Allowance for doubtful accounts is an accounting estimate of accounts receivable that a business expects to be non-collectible from…

-

Amortization vs. Depreciation: Learn with Examples

In depreciation and amortization, the cost of the acquired asset is allocated proportionately throughout the asset’s life according to the applicable accounting standards. Allocating the…

-

Are Supplies an Asset? Understand with Examples

Are Office Supplies and Equipment Treated As Current Assets? Yes, unused office supplies are considered current assets as they are consumed within a year or…

-

CAGR vs IRR: Comparing Investments for Decision-making

CAGR is helpful in comparing projects with consistent cash flows, while IRR is used when projects or investments have different cash flows. CAGR and IRR…

-

Business Expenses: Definition, Types & Examples

Understanding Business Expenses Business expenses, a fundamental concept in business operations, refer to the costs incurred by a company while conducting its operations. These costs…