A credit card grace period is the days between the billing date and the due date. During this period, no interest is charged on purchases if you pay your balance in full.

The grace period is typically given to newly purchased products rather than to services such as cash advances and transfers. For any of these purchases, interest will be charged from the date of occurrence unless they qualify for a particular 0 percent APR tease.

What is a Credit Card Grace Period?

The Credit Card Grace Card refers to the period between the issuance of a credit card statement and the due date, during which the consumer bears no interest for any purchase made on the card.

The grace period is the time that elapses between the time a consumer makes purchases through his/her credit card in the previous billing cycle and the time he/she is required to pay interest on the outstanding balance made during the current billing cycle.

It is only applicable if the consumer cleared his or her last credit card balance in full and timely and did not roll over a balance for any part of the preceding billing cycle.

Note: It is advisable to read the terms and conditions of your credit card and find out if it has a grace period.

How Long is a Typical Grace Period for a Credit Card?

A grace period normally ranges from 21 days to 55 days. Remember that having a credit card grace period does not mean that you have more time until the due date.

When you make partial payments, fail to make the necessary minimum payment on your credit card, or pay your bill after the due date, your credit card company will start charging interest on your balance.

In addition, you will incur late penalties if you fail to make a payment or make it after the due date.

To prevent interest payments, you must pay off your credit card balance in full before the payment due date. At the absolute least, you must make the minimum payment, and you will then be charged interest on any balance carried over to the next month.

| Tip: To maintain your grace period, make sure to pay your bills in full and on time each month. If you pay in full for some months but not others, you may lose your grace period for the month in which you do not pay in full and the following month. |

If you pay off your credit card amount every month during this grace period, you will avoid incurring interest on your purchases. However, the grace period usually only applies to new purchases, not cash advances, balance transfers, or special promotional deals.

Example of Credit Card Grace Period

| Let’s understand this with an example: If your billing cycle ends on May 31, your credit card statement detailing the amount due is issued on the same day. Assuming a 30-day grace period, your payment due date would be June 30. By paying the full balance within this timeframe, you can avoid any interest charges. |

How Long is the Grace Period On Credit Card?

Credit card lenders or companies must send cardholders their bills at least 21-25 days before payment is due. Sometimes, some credit cards consider those 21 days, as well as the time between when you made your purchases inside the billing cycle, to be a grace period if you have paid your previous balance in full. This means grace periods might last nearly two months.

How Does the Credit Card Grace Period Work?

To fully enjoy a grace period, you must understand the credit card’s billing cycle, the expense of carrying a debt, and how the lender charges interest on your purchases.

These key concepts assist in clarifying how grace periods work:

- Billing Cycle

Your credit card company establishes a billing cycle, which is typically one month long. Finally, your purchases are totaled and presented in a statement.

- Statement Generation

Your credit card provider generates a statement of your purchases at the end of each billing cycle that summarises the transactions completed during that time.

- Grace Period

The grace period begins on the day your statement is generated and normally lasts 21-25 days, depending on the credit card provider.

- Interest Fee

If you pay off your credit card amount in full by the due date during the grace period, you will not be charged interest on your transactions.

- Interest on Unpaid Balances

If you fail to pay the entire balance by the due date, the remaining balance will start to accrue inte

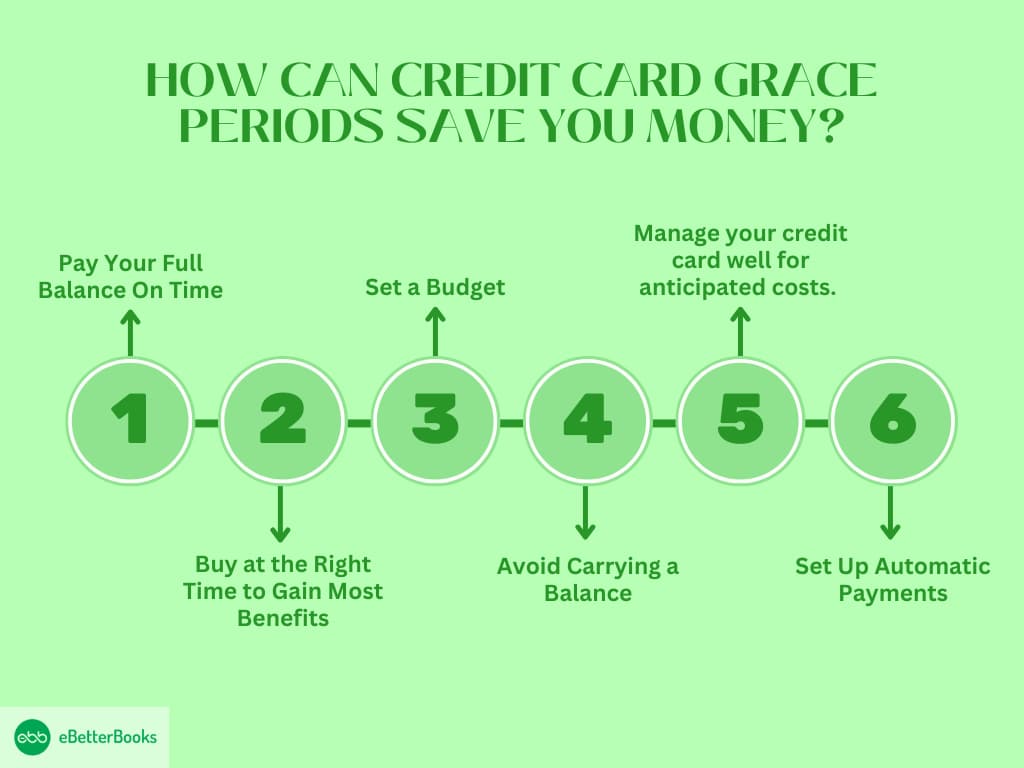

How Can Credit Card Grace Periods Save you Money?

If you are keen on maintaining your credit card balance, it is very important to make the most out of the grace period. If done with some thought, one can manage their cash flow and make the right usage of the credit card.

Here’s how to get the most out of your grace period:

1. Pay Your Full Balance On Time

The simplest way to avoid interest charges is to always make full payments for the amount charged on your statement by the due date. If you are unable to contribute the total amount, ensure that you contribute at least the minimum.

The balance will then attract an interest rate, as will any other purchase made after this. If you transfer lesser balances, then the interest you will be charged will also be reduced.

Example:

If your statement balance is $500 and your due date is the 25th of the month, by the due date, you must pay $500. Thus, you avoid interest charges that could come along the way if you have a line of credit.

However, if you pay only $250, interest will be charged on that amount and all purchases made after the date of the statement.

2. Buy at the Right Time to Gain Most Benefits

To maximize your grace period further, make your purchases at the start of a billing cycle. However, if you want to take much more time, you will have a full cycle with interest and a grace period.

For bigger purchases, this strategy could allow you to go up to two months without accruing interest.

Example:

Your account’s billing cycle ends on the 10th of the following month. If you purchase $200 and have the records that it reflects in your statement, the purchase attracts an interest-free period of 25 days from the 5th to the 30th.

For example, if you make the same $200 purchase on the 20th, those will count in your next cycle, and you get a full month + the interest grace period.

3. Set a Budget

Having a budget will allow you to control your purse strings well, enabling you to manage your credit card balance correctly. It is best to think of your credit card as an interest-free loan.

If the grace period is understood correctly, complete payment should be made on the statement balance before the grace period expires.

Example:

Let’s assume that you have $500 that you can spend as you please in a month. Thus, tracking your expenses allows you to use your credit card only for purchases within this limit and make a payment in full before the due date.

For instance, when you buy groceries worth $100 using your credit card, and you buy 200 worth of gas, you will be charged $300 in a statement, which can be paid by the due date to minimize interest charges.

4. Avoid Carrying a Balance

The key to making good use of the grace period is paying your bill in full every month. Even if you continue into the next month with a balance remaining, you may lose your grace period, and thus, interest will be added to any new purchases.

That only happens when you pay off your balance, which lets you retain the grace period you negotiated on your credit card.

Example:

Let’s say your statement balance is $300, but you manage to pay $100; the remaining balance is $200, which will be carried over to the next month. This balance will start incurring interest, and you will lose your grace period for new purchases.

On the other hand, paying up to $300 in full means that in the next cycle, you will not incur any additional interest on the balance or new products.

5. Effectively Manage your Credit Card for Expected Expenses

If you cannot control your urge to spend, it would be ideal to only use your credit card in situations where you already know you can pay up before the due date.

By sticking to the planned amount for each category, you will maximize your payments, ensuring they clear their balance, and you will not be charged any interest.

Example:

For instance, you might be considering a $400 plane ticket at the beginning of the month and are aware that you can afford to pay for it on the due date.

This enables its holder to charge any item that he or she wants on the credit card and make the full and timely repayment before the due date, hence avoiding any interest.

However, if you use the card to make random purchases, as you do not need to, your chances of repaying it in full may be strained.

6. Set Up Automatic Payments

To avoid being devoid of a grace period, it is prudent to make arrangements for auto payments of your statement balance.

This ensures that you pay your outstanding amount in full every month, even if you forget or are occupied.

Example:

If you know your statement balance is $400 and your due date is the 25th, automatic payment means that your card issuer will pay the stated balance before the due date.

This prevents you from forgetting to make a payment, so there is no need to incur extra interest charges.

How Can Grace Periods Maximize Your Credit Card Rewards?

The grace period comes between 21 to 25 days from the last date of your billing cycle and allows you to clear your balance before it starts to attract interest charges.

Here’s how you can use this feature to your advantage:

- Don’t Charge and Optimize Profit

Paying off your balance in full if you have the cash during the grace period helps prevent interest charges from devaluing your rewards.

For example, utilizing an incentive card like the Chase Sapphire Preferred® Card, which pays 3X points on Dining and 2X Points on Travel, earns you valuable points while keeping your spending interest-free if you pay off the balance before the due date.

- Time Big Purchases Wisely

Whenever you are planning a big purchase, try to time it until the billing cycle commences. This gives you the maximum time to pay it off within the grace period. This basically assists in giving the maximum time within the grace period to pay off what has been borrowed.

More easily, using credit cards like the Citi® Double Cash Card, which offers 2% cash back, 1% when you buy, and 1% when you pay, could double the rewards when using this strategy.

- Link Grace Periods with introductory APR Offers

Some cards, like the Wells Fargo Active Cash® Card, have no annual fees and include 0% APR introductory periods.

You also get 2% back on every purchase. By following the grace period curve to ensure the introductory APR has ended, you can always reap from those points without being charged interest.

- Optimize Category Rewards

Cards with bonus categories that change each quarter, such as the Discover it® Cash Back, enable their holders to charge up to 5% on certain items, such as groceries, gas, or even dining.

No value erodes for these rewards through interest charges when your balance is paid fully within the grace period.

- Redeem Points From Daily Purchases

Merchant purchases, such as food and electricity bills, can also contribute to the accrual of rewards, and charges apply if they settle before the grace period.

The Blue Cash Preferred® Card offers an enrollment bonus of $150 once you spend $1,000 in the first three months of opening the account. It also offers the following rewards: 6% cash back on up to $6,000 per year at US supermarkets.

This way, it becomes possible to protect all those bonuses, remain profitable, and pay the balance on time.

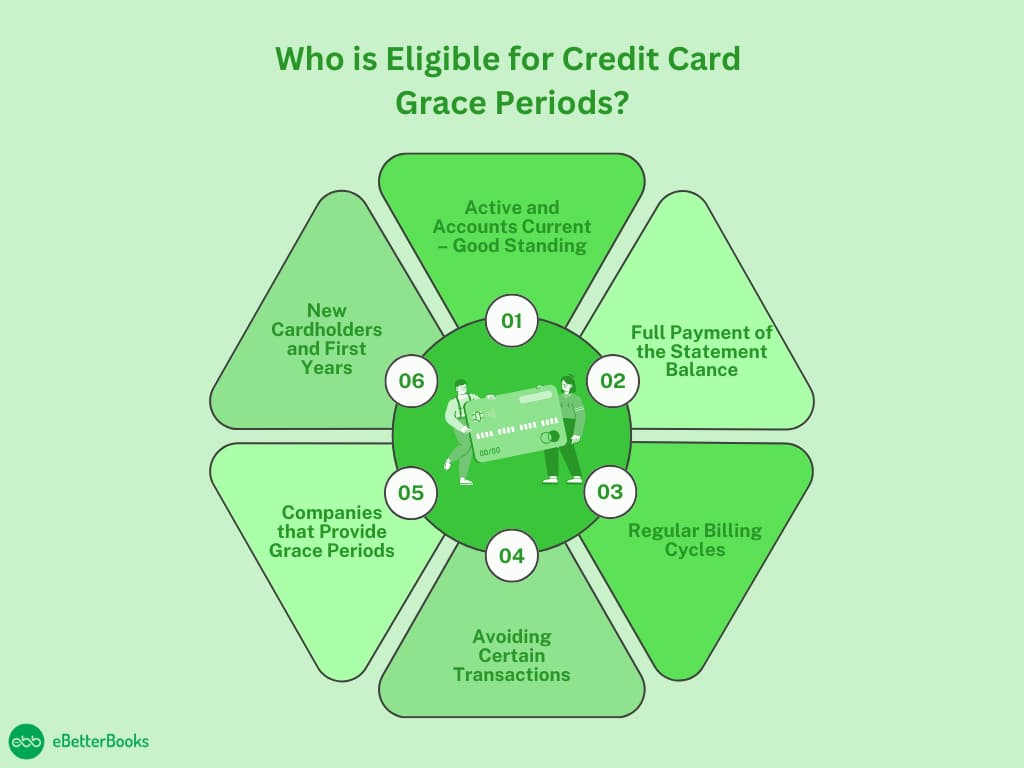

Who is Eligible for Credit Card Grace Periods?

A credit card grace period is one of the privileges that enable users to make purchases without accruing interest on the purchases so long as they pay the amounts owed before the due date. However, only some people are entitled to this kind of benefit right away. Not all cards are issued with a grace period, and here are factors that will determine if you are a beneficiary or not:

1. Active and Accounts Current – Good Standing

The first qualification for eligibility is that the credit card account you are qualifying must be open and not in default. As a result, you have to maintain an active, unblocked credit card with no overdue payments or complications, including chargebacks or defaults.

In this case, if your card is suspended or closed, for instance, due to non-payment or other issues, you are eliminated from accessing the grace period. It is also very important that you don’t go overboard with spending over your credit limit.

2. Full Payment of the Statement Balance

To be eligible for the grace period, you need to make your minimum statement balance payment by the stated date. The grace period only kicks in if you start a billing cycle with a $0 balance on your account.

If you leave any balance unpaid, you forfeit your grace period right, and interest begins to be charged on new purchases as soon as they are made. The consequence of paying only the minimum amount or of keeping a balance over the month will be interest charges.

3. Regular Billing Cycles

Most credit card companies go for monthly statements, and where your specific card operates within these regular cycles, you are allowed the grace period.

An ideal billing cycle is between 28 and 31 days, and from the close of the cycle, you are afforded some grace period between 21 and 25 days, within which you should pay your bill before incurring interest.

This is a supremacy of most credit card companies mandated by federal statute, though it is only valid when one does not carry over a balance from the previous cycle.

4. Avoiding Certain Transactions

It’s important to remember that grace periods do not include balance transfers, cash advances, or any other special occasions. Many of these transactions begin charging interest immediately while you are still in the grace period on new cash advances.

If you transfer a balance or get a cash advance, interest will be charged from the date of the transaction or the date the card was issued. Any grace period you may have for new purchases will not apply to this.

5. Companies that Provide Grace Periods

It is important to note that some credit cards do not allow a grace period. This feature, however, is not universal: most major credit card issuers offer it; however, some specific types of cards, like high-risk or secure credit cards, do not.

So, it’s wise to go through the terms and conditions of any credit card that you wish to apply for some time and check to ascertain whether the Credit card offers a grace period.

If the card does not have this feature, interest starts to be charged on the purchase as soon as one is made.

6. New Cardholders and First Years

Most consumers are eligible for the grace period when they sign up for a new credit card, but they should review the disclosures of introductory periods. Certain card companies are likely to provide an initial 0% APR on purchases for a set amount of months, in which you would not be charged any interest.

Yet the rules change after the first month, and as with any other credit card, the standard grace period applies. During this period, one must make a complete payment of the balance to avoid interest.

Here are the types of transactions and the grace period eligibility criteria…

| Types of Transactions | Eligible for Grace Period | Notes |

| New Purchase | Yes | There is no interest if the full balance is paid on time. |

| Cash Advance | No | Interest starts immediately. |

| Balance Transfer | No | It often has its own interest rates. |

| Special Promotion | Card Specific | Check specific terms. |

What Can Cause You to Lose Your Grace Period?

There are several reasons you may lose eligibility for a grace period, including:

- Carrying a Balance: If you can’t clear the amount in full, the grace period is removed, and any new purchases will attract interest charges immediately.

- Late Payments: Failure to make the payment or paying an amount below the minimal required sum initiates the grace period and penalties, such as fees for lateness.

- Certain Transactions: It is important to note that balance transfers, cash advances, and similar operations do not usually qualify for this grace period, and they attract interest from the day the transfer is made.

The Impact of Grace Periods on Other Debt

Grace periods are useful for many types of debt because they imply that the debtor has a certain period during which he/she does not need to make payments.

These periods allow borrowers more time to make the payments without attracting penalties or having their credit rating affected. However, they may be different, as they depend on the kind of debt one has and the policies of the credit company.

Student Loans

Grace Period: 6 months (for federal loans usually)

Details: Federal student loans allow, for example, a grace period of six months after graduation. Indeed, during this period, borrowers do not have to pay back any loans. This time provides an opportunity for graduates to get a job or make other preparations before starting to pay back the loans. Nevertheless, interest may continue to be charged on certain loans (such as unsubsidized federal loans).

Mortgages

Grace Period: 10-15 days

Details: Most mortgage creditors offer a brief period of forbearance, which ranges between 10 and 15 days after the due date. This means that if a mortgage payment is made during this period, no penalty charge is added. Nonetheless, the borrower should be cautious that even during the grace period, interest continues to build up, and payments in default after the grace period are deemed past due.

Auto Loans

Grace Period: 10-15 days

Details: Like mortgages, auto loans are normally accompanied by a brief grace period. Borrowers can be offered a grace period of 10 to 15 days before they are charged for late payment. Although this may help, it slows, and interest keeps piling up. Once the grace period is over, the loan is deemed past due.

Personal Loans

Grace Period: 15-30 days

Details: A personal loan may also include a grace period, usually 15 – 30 days, depending on the nature of the loan. If a payment is made during this period, no penalty fee is incurred. However, interest does not cease to grow, and the grace period is aimed only at sparing borrowers from immediate consequences.

Payday Loans

Grace Period: Varies (may offer extensions)

Details: Some payday lenders allow the borrower to roll over the loan or give extra time to pay it. However, such extensions always attract other costs in addition to having a relatively high interest rate. Payday loans are often short-term, and if the amount borrowed is not repaid at the agreed-upon time, then the lender will roll it over, but this will be at a higher interest rate.

Situations Where Your Credit Card Grace Period Pays You Off!

| Situations | Example | How the Grace Period Works |

Buying Smart for Large Purchases | If you buy a $1200 laptop during the start of the billing bicycle, you have a 25-day grace period to pay off your bill. | The grace period here helps you pay off your laptop bill in 2 months so that you can avoid interest and allow extra time to gather funds. |

Managing a Tight Month | The bills for the month are higher than expected, and you need to wait until the next month’s paycheck. | The 25-day grace period allows you to cover immediate needs now and pay next month, avoiding interest and maintaining flexibility for urgent expenses. |

Covering Emergency Expenses | Your car was hit by an accident, and you need an emergency fund of $700 for replacement purposes. | The grace period lets you cover the repair now and pay off the balance by the due date, avoiding stress and interest on an unexpected expense. |

Maximizing Cash Flow | You booked a $1000 vacation during the billing cycle, and then you have 25 days of grace period. | This allows you to pay off the vacation cost after you return, giving you nearly two months to enjoy your trip and budget without immediate out-of-pocket costs. |

The Bottom Line

It is important to be aware of how grace periods and credit card rewards are useful so that you can take advantage of some key benefits. Paying your balance in full within that grace period means that you can avoid interest charges while getting reward points for charges.

This strategy not only adds more value to the rewards you offer but also plays an important role in improving your creditworthiness.

The golden rule when using the card is to avoid hasty payments and take full advantage of the grace period to understand your debts on the credit card.

Frequently Asked Questions

What happens if you don’t pay your entire balance?

If you are unable to make the whole payment by the due date, you must make at least the minimum payment—or more, if possible. If you lose the grace period, you have to pay interest, but you won’t pay a late fee.

How long is the grace period for your credit card?

The grace period for a credit card typically lasts from 21 days to 25 days. You can ask for your grace period by checking your cardholder agreement. The grace period duration comes with the fee and annual percentage rate (APR). Apart from checking your agreement, you can also call your lender’s helpline and ask about the grace period directly.

Does a grace period work with credit card cash advances?

The credit card grace period is only applicable with purchases. Cash advances do not qualify for the grace period. Cash advances can incur with the interest immediately when in use.

Which credit card does have a grace period?

Whether it is the major credit card issuer or the smaller one, it gives you a grace period at the time of paying your statement balance in full by the due date. This is mandatory to provide a grace period to the cardholder.

-

Small Business Expense Tracking in 11 Easy Steps

Understanding Business Expenses Every small business owner should understand and use expense monitoring efficiently since it helps them find cost savings opportunities and maintain a…

-

Burden Cost: Definition, Usage, Formula & Examples

What is Burden Cost? The burden cost refers to all indirect costs associated with employing or maintaining employees or inventory beyond direct compensation. It typically…

-

Break-Even Point: Definition, Formula & Examples

What is Break Even Point? A business’s break-even point is when the total revenue and total costs are equal, creating a situation of no profit…

-

Bookkeeping vs. Accounting: Differences & Examples

Bookkeeping involves recording financial transactions, while accounting analyzes financial data to provide business insights. Bookkeeping is a routine task and involves daily classifying and recording…

-

What are Billable Hours, and How to Track Them?

What are Billable hours? Billable hours refer to the time spent on work tasks for a client who is bound to compensate or pay according…

-

Bad Debt Expense: Definition & Reporting Methods

What is Bad Debt Expense? Bad debt expense is a significant component in financial statements as it addresses uncollectible debts. Recognizing bad debt expense, including…

-

Automated Bookkeeping: What is it? Pros & Cons

What is Automated Bookkeeping? Automated bookkeeping means using software, bots, or other technologies to automate repetitive, manual, routine, and rule-based recording of financial transactions. Automation…

-

How to Recover or Reset the QuickBooks Desktop Pro/Premier Payroll PIN

QuickBooks Desktop Pro/Premier Payroll PIN Recovery and Reset procedures are essential for maintaining secure and uninterrupted payroll processing and direct deposit authorization. The process is…

-

Why is QuickBooks Pro or Premier Payroll Subscription Suspended?

To restore your suspended payroll subscription in QuickBooks Pro or Premier, begin by verifying and updating your billing information. Ensure there are no license mismatches…

-

How to Fix QuickBooks Desktop Pro/Premier Payroll Access Denied Due to File Corruption or Service Errors?

To resolve QuickBooks payroll access denied errors due to file corruption, use Verify and Rebuild Data or QuickBooks File Doctor; for service errors, run QuickBooks…

-

Unable to Print QuickBooks Desktop Enterprise Payroll Forms or Reports

Printing payroll forms and reports in QuickBooks Desktop Enterprise often fails because of damaged company files, incompatible printer drivers, or outdated system components. These issues…

-

How to Renew QuickBooks Enterprise Payroll Subscription?

Renewing the QuickBooks Payroll subscription requires precise coordination between the desktop software and the Intuit online management portals to prevent the service from becoming inactive.…

-

QuickBooks Enterprise Payroll Subscription has Expired

To restore access to QuickBooks Enterprise Payroll after your subscription has expired, visit the Customer Account Management Portal (CAMPs) by signing in to the Intuit…

-

Fix Direct Deposit Issues in QuickBooks Desktop Pro/Premier Payroll After Payroll Info Update

To fix direct deposit issues in QuickBooks Desktop Pro/Premier Payroll after updating payroll information, update and verify all billing details, re-validate payroll subscription, and review…

-

How to Handle Employee Pay Adjustments or Negative Net Pay in QuickBooks Desktop Pro/Premier Payroll

To handle employee pay adjustments or negative net pay in QuickBooks Desktop Pro/Premier Payroll, run a payroll checkup diagnostic tool, access the tool under the…

-

Increase or Fix Direct Deposit Limits in QuickBooks Desktop Pro/Premier Payroll

Direct deposit limits in QuickBooks Desktop Payroll define the maximum Automated Clearing House (ACH) debit amount allowed per payroll run. Intuit establishes these limits based…

-

Fix Incorrect or Missing Employee Payroll Deductions in QuickBooks Desktop Enterprise Payroll

QuickBooks Desktop Enterprise Payroll (QBD Enterprise Payroll) manages employee payroll deductions, including health insurance, pension plans, 401(k), and garnishments. Deduction errors often arise from incorrect…

-

QuickBooks Desktop Pro/Premier Payroll Update Fails Due to File Size or System Configuration

Payroll update failure affects payroll calculations, tax table synchronization, and software stability in QuickBooks Desktop Pro/Premier. The failure results from large company file sizes that…

-

QuickBooks Enterprise Payroll Subscription Reached the Limits

To resolve “QuickBooks Enterprise Payroll Subscription Reached the Limits”, upgrade the payroll subscription plan, check your payroll service, refresh your payroll service, and make your…

-

How to Fix Incorrect Address or Details on Printed Payroll Checks in QuickBooks Desktop Enterprise Payroll

Incorrect addresses or details on printed payroll checks in QuickBooks Desktop Enterprise Payroll can delay payments, trigger tax filing discrepancies, and increase compliance risk which…

-

How to Delete or Void a Processed Payroll in QuickBooks Desktop Pro/Premier Payroll?

QuickBooks Desktop Pro/Premier Payroll is the central payroll-processing system that manages paycheck creation, direct deposit transmission, tax calculation, and payroll reporting. The system applies void…

-

Payroll Tax Discrepancies in QuickBooks Desktop Enterprise Payroll Due to File Size Limits or Corruption

To fix payroll tax discrepancies in QuickBooks Desktop Enterprise Payroll, particularly those arising from file size limits or data corruption: Payroll tax discrepancies often occur…

-

How to Fix Direct Deposit Errors in QuickBooks Desktop Pro/Premier Payroll

To fix direct deposit errors in QuickBooks Desktop Pro or Premier Payroll, update QuickBooks and the payroll tax table > check the employee’s bank details…

-

How to Fix Payroll Update Errors in QuickBooks Desktop Pro or Premier Subscription

Payroll updates in QuickBooks Desktop Pro or Premier can fail due to outdated software, expired Intuit sessions, damaged company files, inactive subscriptions, incorrect system settings,…

-

QuickBooks Enterprise Payroll Subscription Not Working

If your QuickBooks Enterprise Desktop payroll subscription isn’t working, you won’t be able to run payroll, file taxes, or send direct deposits. These interruptions may…

-

How To Activate QuickBooks Desktop Pro or Premier Payroll Subscription

To activate a QuickBooks Desktop Pro or Premier Payroll subscription, purchase the payroll subscription online, by phone, or at a retail store. You will receive…

-

Payday Loan vs Personal Loan: Which Is the Better Choice?

If you require a small sum of money for an emergency and it is possible for you to repay it by your next paycheck then…

-

Fix QuickBooks H202 Error Due to Hosting & Network Configuration Issues

To fix the QuickBooks H202 error, first ensure only the server hosts the company file by checking hosting settings, then use the QuickBooks Tool Hub…

-

Form 1099-R: Reporting Retirement Benefit Distributions to the IRS

What Is Form 1099-R? Form 1099-R is an IRS information return used to report the payment of $10 or more from pensions, annuities, retirement or…

-

Cancel QuickBooks Desktop Pro or Premier Payroll Subscription

To cancel a QuickBooks Desktop Payroll subscription (Pro or Premier), sign in using admin credentials to the Intuit account, access the Customer Account Management Portal…

-

How to Cancel Payroll Service in QuickBooks Desktop Enterprise?

Learn the necessary steps and critical consequences of deactivating payroll service in QuickBooks Desktop, particularly for Enterprise editions. The guide emphasizes that only the Primary…

-

1099-INT: Reporting Taxable Interest to the IRS

What Is Form 1099-INT? IRS Form 1099-INT depicts the breakdown of the total interest an individual earned in the previous taxable year. This form is…

-

2025 IRS Standard Mileage Rates: How to Calculate & Claim Deductions

The IRS standard mileage rate is an annual rate applied to calculate deductible vehicle expenses without accounting for actual costs. It’s derived from an annual…

-

IRS Services

-

Akounto

-

How to Record Deferred Revenue in QuickBooks Online/Desktop?

Deferred revenue, also known as unearned revenue, represents advance payments received for goods or services yet to be delivered, requiring strict adherence to the Revenue…

-

How to Undo A Reconciliation in QuickBooks Desktop

Reversing a reconciliation in QuickBooks Desktop is a complex accounting procedure required to correct errors like incorrect opening balances, miscategorized transactions, or bank statement discrepancies.…

-

Neobank Failures: What Happens When a Digital Bank Shuts Down?

Neobank failures can disrupt consumer access to funds, damage trust in digital banking, and lead to economic consequences. Challenges like regulatory issues, cybersecurity risks, and…

-

Best Neobanks for Businesses & Freelancers: Features, Fees & Benefits Compared

Neo-banks are becoming increasingly popular among businesses and freelancers, they rely on advanced technology to offer a smooth, convenient, and inexpensive banking experience. In contrast…

-

Neobanks & Credit: Do Digital Banks Offer Loans & Credit Cards?

Neobanks are digital-only fintechs with no physical branches, offering credit products like microloans, credit cards, bank overdrafts, etc. Neobanks are challenger banks that help underserved…

-

Neobank Regulations: How Digital Banks Stay Compliant in Different Countries

Neobanks are regulated via Anti-Money Laundering (AML), Know Your Customer (KYC), and indirect regulations to which traditional banks are subjected. Neobanks operate in a highly…

-

What Are NeoBanks? Understanding the Future of Banking

What are Neobanks? Neobanks, also known as “challenger banks,” is a digital-only fintech company that operates without any traditional physical location and relies on technology…

-

Finance Services

-

How to Re-Activate QuickBooks Desktop Pro or Premier Payroll Subscription?

Reactivating a QuickBooks Desktop Pro or Premier Payroll subscription is a critical procedure that ensures uninterrupted payroll processing and tax compliance. The initial step is…

-

Activate QuickBooks Desktop Enterprise Payroll Subscription

Activating QuickBooks Desktop Enterprise Payroll requires meticulous adherence to a multi-step process, beginning with the purchase and retrieval of a 16-digit service key. Upon activation,…

-

Renew QuickBooks Pro or Premier Payroll Subscription

Renewing a QuickBooks Desktop Pro or Premier Payroll subscription requires users to first verify the service version, which dictates the renewal method. The self-service option…

-

QuickBooks Desktop Subscription Support

QuickBooks Desktop Subscription Support Subscription not activating? Renewal failing? Multi-user setup not syncing? Our QuickBooks-certified experts are available 24/7 to troubleshoot and resolve any subscription-related…

-

How Can I Use My Credit Card Like a Debit Card?: Smart Spending for Maximum Benefits

Financing purchases with a credit card as a debit card implies spending what you can afford while enjoying the advantages of credit. Numerous individuals opt…

-

Should I Cash in Stocks to Pay Off a High Credit Card Balance?

The decision to sell stocks to pay off a high credit card balance can be a difficult one. Credit card debt rapidly increases and can…

-

What is Your Best ‘Catch-All’ Credit Card and Why?

Catch-all credit cards are the best option if you want to earn points without having to deal with the hassle of tracking categories. These cards…

-

What is the Best 2% Catch-All Credit Card in Your Opinion?

Introduction A 2% catch-all credit card is a card that provides an across-the-board 2% cashback (or similar reward points) on all purchases regardless of what…

-

Affordable Small Business Bookkeeping in South Lawndale, Chicago

In South Lawndale, Chicago, eBetterBooks provides professional bookkeeping services to help local businesses stay financially organized and compliant. Whether you run a restaurant, retail shop,…

-

Expert Small Business Bookkeeping in Near West Side, Chicago

In the dynamic Near West Side of Chicago, eBetterBooks offers expert bookkeeping services tailored to meet the needs of local businesses. From small startups and…

-

Reliable Tax & Bookkeeping Services in North Dallas

For businesses in North Dallas, eBetterBooks offers expert financial solutions that ensure seamless bookkeeping, tax-ready reports, and real-time insights. Whether you run a medical practice,…

-

Trusted Tax & Bookkeeping Services in Oak Cliff, Dallas

For businesses in Oak Cliff, eBetterBooks provides expert bookkeeping solutions tailored to the area’s diverse industries, including local restaurants, creative studios, boutique shops, and service-based…

-

Expert Tax & Bookkeeping Services in Old East Dallas

For businesses in Old East Dallas, eBetterBooks provides reliable bookkeeping solutions tailored to local industries, including cafes, boutique shops, creative agencies, and service-based businesses. Our…

-

Reliable Tax & Bookkeeping Services in Oak Lawn, Dallas

For businesses in Oak Lawn, eBetterBooks provides expert bookkeeping solutions tailored to local industries, including restaurants, salons, fitness studios, and professional service firms. Our seamless…

-

Expert Tax & Bookkeeping Services in Lakewood, Dallas

For businesses in Lakewood, eBetterBooks offers comprehensive bookkeeping solutions designed to support the area’s thriving industries, including boutique retail, family-owned restaurants, medical practices, and creative…

-

Professional Tax & Bookkeeping Services in Downtown, Dallas

For businesses in Downtown, Dallas, eBetterBooks offers expert bookkeeping solutions tailored to local industries, including law firms, finance companies, hospitality businesses, and tech startups. Our…

-

Accurate Tax & Bookkeeping Services in Pleasant Grove, Dallas

For businesses in Pleasant Grove, eBetterBooks offers reliable bookkeeping solutions tailored to local industries, including small retail shops, restaurants, service providers, and construction businesses. We…

-

Advanced Tax & Bookkeeping Services in Deep Ellum, Dallas

For businesses in Deep Ellum, eBetterBooks offers customized bookkeeping solutions designed for the area’s unique industries, including live music venues, bars, restaurants, art studios, and…

-

Top-Rated Tax & Bookkeeping Services in South Dallas

For businesses in South Dallas, eBetterBooks provides professional bookkeeping solutions designed for local industries, including restaurants, retail shops, construction companies, and service-based businesses. Our seamless…

-

Trusted Tax & Bookkeeping Services in Cedar Crest, Dallas

For businesses in Cedar Crest, eBetterBooks offers professional bookkeeping solutions tailored to local industries, including small retail shops, restaurants, service providers, and construction businesses. Our…

-

Professional Bookkeeping Services in Maryvale, Phoenix

Running a business in Maryvale comes with its own set of financial challenges, from managing daily transactions to staying compliant with Arizona’s tax regulations. At…

-

Trusted Bookkeeping Services in Deer Valley, Phoenix

In the heart of Phoenix’s Deer Valley, a hub for industries like advanced manufacturing, semiconductor suppliers, and logistics companies, businesses require precise financial management to…

-

Accurate Bookkeeping Services in Camelback East, Phoenix

When you operate a business in Camelback East, eBetterBooks ensures you can focus on what you do best, whether you’re in healthcare, hospitality, or retail.…

-

Small Business Bookkeeping Services in South Mountain, Phoenix

Whether you’re running a construction firm, a retail business, or a healthcare service, South Mountain offers unique growth opportunities. eBetterBooks provides comprehensive bookkeeping solutions, tax-ready…

-

Advanced Bookkeeping Services in Estrella, Phoenix

In Estrella, businesses can take advantage of its industrial zones and strategic location. Whether you’re in manufacturing, retail, or logistics, eBetterBooks offers seamless bookkeeping, tax…

-

Accurate Small Business Bookkeeping Services in Encanto, Phoenix

Encanto is known for its historic neighborhoods and central location, making it an ideal area for businesses in healthcare, education, or retail. eBetterBooks helps businesses…

-

Dedicated Bookkeeping Services in North Gateway, Phoenix

North Gateway is a key commercial area with growing opportunities in manufacturing, logistics, and retail. eBetterBooks offers expert bookkeeping services, tax preparation, and financial insights…

-

Professional and Accurate Bookkeeping Services in Edgewood

Edgewood, Atlanta, is a growing neighborhood with a thriving mix of small businesses, startups, and creative ventures. With its close proximity to commercial hubs and…

-

Eldridge / West Oaks Bookkeeping Solutions for Small Enterprises

Eldridge/West Oaks, located in West Houston’s Energy Corridor, is a vibrant community known for its upscale residences, gated subdivisions, and plentiful green spaces. This area…

-

Sharpstown, established in the 1950s as Houston’s first master-planned community, offers a rich blend of residential, educational, commercial, and recreational spaces. Its strategic location between…

-

Professional Bookkeeping in Greater Uptown for Business Success

Greater Uptown, Houston, is a bustling economic center, home to thriving businesses in retail, real estate, hospitality, and professional services. With its fast-paced growth, maintaining…

-

Professional Bookkeeping in Golfcrest / Bellfort / Reveille for Business Success

Golfcrest / Bellfort / Reveille in Houston is a thriving community with a diverse mix of small businesses, local retailers, and service providers. Keeping accurate…

-

Greater Heights Bookkeeping – Smart Solutions for Small Businesses

Greater Heights, Houston, is a vibrant and rapidly growing area, home to a diverse mix of local businesses, boutiques, restaurants, and professional services. With such…

-

Professional and Accurate Bookkeeping Services in Westwood

Westwood, Houston, is a vibrant neighborhood characterized by its diverse community and bustling business landscape. With a population of approximately 20,838 residents, the area boasts…

-

Professional and Accurate Bookkeeping Services in Greater Fifth Ward

Greater Fifth Ward, Houston, is a historic neighborhood renowned for its rich cultural heritage and resilient community. Established in the late 1800s, it has evolved…

-

Professional and Accurate Bookkeeping Services in Midtown

Midtown, Atlanta, is a dynamic business hub with endless opportunities. With over 82,000 jobs in just 1.2 square miles, businesses here need strong financial management…

-

Any Drawbacks to Using Credit Card for All Purchases

Using a credit card for all purchases can lead to debt and high fees if mismanaged. You can use credit cards for traveling, grocery, gas,…

-

Credit Score Ranges Explained: What Your Score Means for Loans & Credit

Your credit score range can be excellent, good, fair, or poor, reflecting different levels of creditworthiness, ranging from 300 to 850. The credit score shows…

-

Credit Card Loan EMI: How to Convert Your Loan into Easy Monthly Payments

Converting credit card purchases to EMIs can lead to reduced interest rates and easier repayment, but look out for processing costs, limited credit limits, and…

-

Credit Card Cash Advance Vs. Credit Card Loan: What’s the Difference?

In financial emergencies, credit cards offer two options for getting immediate cash: cash advances and credit card loans. Even though both promise instant access to…

-

Credit Card Loan vs. Personal Loan: Which One Should You Choose?

Credit card loans offer ongoing access to specified amounts, while personal loans lend a lump sum of money upfront to the borrowers. Credit Card loans…

-

Hard vs Soft Credit Inquiry: How They Impact Your Credit Score

Hard inquiries impact credit scores; soft inquiries don’t. Hard checks are for in-depth due diligence; soft inquiries check credit scores. A hard credit inquiry, or…

-

How to Rebuild Your Credit After a Financial Setback

A financial setback can occur for many reasons, such as unforeseen expenses, loss of job, medical bills, or other financial difficulties, which will affect a…

-

25 Best Credit Card for Travel Rewards in 2025

A credit card for travel rewards helps you earn points or miles on your purchases, which can be redeemed for flights, hotels, and more. These…

-

Local Small Business Bookkeeping Services in Edgewater, Chicago

In the thriving business community of Edgewater, Chicago, eBetterBooks provides reliable bookkeeping services tailored to local entrepreneurs, retail shops, and growing startups. We offer precise…

-

Comprehensive Small Business Bookkeeping in Uptown, Chicago

In the dynamic Uptown neighborhood of Chicago, eBetterBooks offers expert bookkeeping services designed to support local businesses, from thriving entertainment venues to bustling restaurants and…

-

Reliable Bookkeeping in Humboldt Park for Small and Medium Businesses

In the culturally rich and entrepreneurial hub of Humboldt Park, Chicago, eBetterBooks provides expert bookkeeping services to help local businesses thrive. Whether you run a…

-

Most Used Credit Cards for Everyday Use in the USA

The everyday use of credit cards is an excellent method to handle everyday costs while collecting rewards, improving credit, and providing extra protection. When used…

-

Secured Credit Cards with No Annual Fee in 2025

No annual fees and secured credit cards can be a powerful tool for credit building as these cards help you to establish an improved credit…

-

A Comprehensive Guide to Credit Card Security and Fraud Prevention

Fraudulent charges on your credit card result in financial loss, affect your credit score and create problems when applying for loans. For business owners, credit…

-

Best Balance Transfer Credit Cards with Low-Interest Rates in the USA for 2025

A balance transfer credit card can assist you in saving money on interest and settling your debt quicker by transferring your balance to a 0%…

-

Revolving Vs. Installment Credit – How Different Types of Credit Impact Your Score

Revolving credit allows you to borrow, repay, and borrow again within a set period; installment credit offers a predetermined loan with EMIs over a particular…

-

Top 10 Credit Score Myths Debunked

Credit score myths may guarantee you quick improvements, yet they often cause more harm than good. A credit score is important for your financial well-being,…

-

Credit Bureaus and Credit Reports – How to Monitor and Protect Your Credit Score?

Credit Bureaus Credit bureaus or Credit Reporting Agencies, like Equifax, Experian or TransUnion gather individuals’ credit information to generate credit scores and are regulated under…

-

How Does Your Credit Score Affect Loans and Job Opportunity?

A credit score helps you get cheaper loans, better offers, lower interest rates, and longer repayment options. Credit score can influence your job opportunities, too.…

-

How to Improve Your Credit Score Fast – Proven Strategies That Work

You can improve your credit easily in a few months by paying bills on time, minimizing debt, monitoring your credit report, and taking advantage of…

-

Credit Score Breakdown: How Each Factor Impacts Your Score

A credit score is a number calculated based on several factors, such as payment history, credit utilization, credit history length, credit mix, and new credit…