A financial setback can occur for many reasons, such as unforeseen expenses, loss of job, medical bills, or other financial difficulties, which will affect a person’s ability to repay financial obligations.

These setbacks will impact your credit score negatively, and it becomes more difficult to get loans, rent an apartment, or even receive good insurance rates. Repairing credit takes time and strategy.

This manual will guide you through the key steps to evaluate your current credit status, Dispute errors, and develop a plan to restore financial stability.

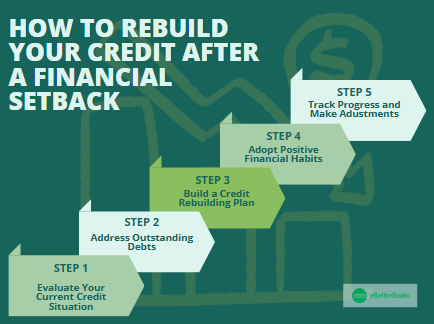

It majorly consists of 5 steps, which will help you to rebuild your credit score after a financial setback or bankruptcy, which are as follows:

- Step: Evaluate Your Current Credit Situation

- Step: Address Outstanding Debts

- Step: Build a Credit Rebuilding Plan

- Step: Adopt Positive Financial Habits

- Step: Track Progress and Make Adjustments

Step 1: Evaluate Your Current Credit Situation

Before moving to rectify your credit, you need to know where you stand in terms of your finances. This involves checking your credit report, determining errors, seeing the effect of your downfall, and assessing the available funds.

1. Obtain Your Credit Report

The initial step is to get a copy of your credit report from one of the big credit bureaus: Experian, Equifax, and TransUnion.

| Quick Tip: You are legally entitled to a free credit report every year from AnnualCreditReport.com. |

Important Things to Know:

- Range of Credit Scores: Credit Scores usually fall between 300 to 850. A credit score of more than 700 is good, and a score of less than 600 can restrict financial opportunities.

- Credit Report Sections: Your report has account history, payment information, credit inquiries, and outstanding amounts.

- Factors Impacting Your Score: The most important factors are payment history (35%), credit utilization (30%), credit age (15%), new credit (10%), and credit mix (10%).

2. Inspect for Disputes and Errors

Any errors on your credit report have the potential to harm your credit score. The inspection of your report for errors is essential.

Most Common Errors to Check For Include:

- Fraudulent accounts or charges you do not recognize.

- Incorrect personal data (e.g., incorrect address or name).

- Outdated debts that must have been deleted.

- Duplicate accounts or payments incorrectly noted as late.

How to Dispute Errors?:

- File a dispute online via the credit bureau’s website (Experian, Equifax, or TransUnion).

- Include supporting documentation (e.g., bank statements and proof of payment).

- Track changes since disputes may take upto 30 days to resolve.

Fixing mistakes will greatly increase your credit score and eradicate unnecessary financial weight.

To learn more about how to protect and maintain your credit score, read our in-depth guide: Credit Bureaus and Credit Reports – How to Monitor and Protect Your Credit Score.

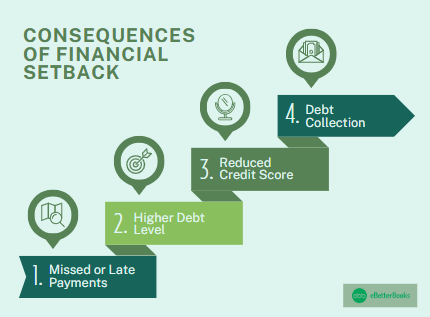

3. Identify the Consequences of Your Financial Setback

Knowing the immediate effects of your financial failure may assist you in developing a recovery plan.

Main Consequences:

- Missed or Late Payments: These harm your payment history, which is the most important aspect of your credit score.

- Higher Debt Level: If you used credit cards or loans during the setback, outstanding interest may increase your debt-to-income ratio.

- Reduced Credit Score: The lower the score, the more difficult it is to get a new credit card or a lower interest rate.

- Debt Collection: Unpaid accounts can be sent to collections, which can further hurt your credit.

4. Know Your Financial Resources

An honest assessment of your financial situation can assist you in planning better.

Important Areas to Evaluate:

| Other Sources of Income | Income and Job Status | Savings and Assets |

|---|---|---|

| Look at side jobs, freelance work, or selling off unused assets to enhance your financial status. | Find out if your present employment brings financial stability or if you have to look for other sources of income. | Check through any savings, emergency fund, or investment that can assist in paying off debts. |

Step 2: Address Outstanding Debts

Reducing your overall debt is essential for improving your financial health and rebuilding your credit.

1. Calculate Your Total Debt

Before making a payment plan, you must know the amount you owe and to whom. Here’s what you need to do:

- Collect all your debt documents (credit card bills, loan papers, medical expenses, collection notices).

- Make a list of all debts, their balances, interest rates, and minimum payments.

- Pay off debts in terms of urgency and expense:

- Secured loans (e.g., mortgages, car loans) require timely payment to avoid losing assets.

- High-interest accounts (like credit cards) are to be paid off first in order to minimize long-term expenses.

- Past-due loans must be taken care of to prevent additional penalties.

2. Negotiate with Creditors

If you’re having trouble paying, try negotiating with creditors for alternatives:

- Ask for Lower Interest Rates: Some lenders will lower interest rates if you have a history of good payments.

- Ask About Hardship Programs: Most lenders provide temporary assistance, such as deferred payments or lowered interest rates.

- Negotiate Settlements: If you have a lump sum, some creditors will take part of the payment as a complete settlement.

- Consider Debt Consolidation: Consolidating several debts into one lower-interest loan can make payments easier and cheaper.

3. Formulate a Debt Repayment Strategy

Selecting the correct repayment plan can encourage you and enable you to make consistent progress:

- The Snowball Method: Pay off small debts first to build momentum and confidence.

- The Avalanche Approach: Pay the highest-interest debt first to accumulate the most savings in the long run.

- Debt Consolidation Loans: Merge several debts into a single manageable monthly payment.

- Balance Transfer Credit Cards: Transfer high-interest balances to a lower-interest card (if you’re approved).

By making regular payments and lowering your debt load, you will increasingly enhance your credit score and financial health.

Step 3: Build a Credit Rebuilding Plan

After your debts are in check, the next thing to do is to rebuild your credit by building good money habits. Consistent and responsible use of credit and timely payment will show lenders that you are able to handle credit well.

1. Lower Credit Utilization

Credit utilization, the amount of available credit you’re using, accounts for a significant portion of your credit score.

Try to:

- Request a credit limit increase (if financially responsible) to lower your utilization ratio without increasing debt.

- Keep it below 30% (preferably below 10%).

- Pay off credit balances as soon as possible.

2. Build New Credit Accounts Responsibly

Opening new credit accounts can help rebuild your score, but only if used wisely.

1. Select the Best Credit Card for Credit Rebuilding

Not all credit cards are good for credit rebuilding. Choose one that fits your needs:

- Secured credit cards: Perfect for people with bad or no credit history. Comes with a refundable deposit and reports to big credit bureaus. (For example: Capital One Secured Mastercard, Discover it® Secured.)

- Credit cards for bad or fair credit: These are Perfect for people with credit scores ranging from 550 to 650. (For example: Petal 2 Visa, Credit One Bank Platinum Visa.)

- Store cards: These are easier to accept but can have high interest rates. It will work best for you if you frequently shop in a specific store and pay cash back in full.

- Being an authorized user: A member of your family or a trusted friend can list you as being on their account, allowing you to take advantage of their good credit history.

- Credit-builder loans: These are designed to improve credit scores through small, manageable loan payments.

To know which credit card will suit you best for rebuilding credit, read our in-depth guide: Most Used Credit Cards in the USA for Building Credit.

2. Best Practices to Rebuild Credit Using Credit Cards

Below are a few best practices you should maintain:

- Pay all bills on time; one missed payment can damage your score.

- Use less than 30% of your available credit. It is better to use less than 10%.

- Use your credit card for small expenses and settle them in full.

- Refrain from applying for numerous new credit cards at the same time to avoid multiple hard inquiries that decrease your score.

3. Set Up Automatic Payments & Alerts

Late payments can significantly hurt your credit score.

To stay on track:

- Enable automatic payments for at least the minimum balance.

- Use budgeting apps or calendar reminders for payment due dates.

- Pay more than the minimum whenever possible to reduce interest charges.

Step 4: Adopt Positive Financial Habits

Building credit is not solely about repairing mistakes in the past—it’s also about cultivating lasting habits that create financial stability. By increasing income, prudently managing expenditures, and balancing your credit portfolio, you will be able to build a firm financial footing for the future.

1. Enhance Your Income and Stability

A steady income will enable you to keep up with your bills and not slide back into debt.

Try these tips:

- Seek More Lucrative Job Prospects: Upskilling or changing careers can enhance your income.

- Gain a Side Income: Freelancing, online work, or part-time employment can earn you more money to settle debt quicker.

- Create an Emergency Fund: Having money for rainy-day expenses keeps you from relying on credit in times of financial crisis.

- Automate Savings Deposits: Small, frequent deposits into a savings account can accumulate over time.

2. Spend and Budget Management

A budget that is well thought out is the key to avoiding overspending and making timely debt payments. Utilize these budgeting techniques:

- Adhere to the 50/30/20 rule:

- 50% for necessities (housing, food, utilities).

- 30% for discretionary spending (dining out, entertainment).

- 20% for savings and paying off debt.

- Monitor Spending: Utilize budgeting tools such as Mint or YNAB to keep tabs on where you are spending your money.

- Eliminate Unnecessary Expenses: Cancel unused services, downgrade to cheaper services, and minimize impulse purchases.

- Use cash or Debit Cards Instead of Credit Cards: This prevents unnecessary debt buildup.

3. Have a Credit Account Mix

Maintaining a diverse array of credit types can better your credit score and show you are handling credit responsibly:

- Revolving credit (such as credit cards) indicates your ability to handle short-term borrowing.

- Installment loans (such as auto loans, student loans, and mortgages) indicate your capacity for handling long-term financial obligations.

- Don’t open multiple new accounts simultaneously. Hard inquiries temporarily lower your credit score, so only apply for credit when you have to.

Step 5: Track Progress and Make Adjustments

Rebuilding credit is not a one-time task. Following your progress makes sure that you’re headed in the correct direction and making those adjustments as you go along.

1. Keep an Eye on Your Credit Score

Practice the following to stay updated:

- Keeping an eye on your credit score allows you to monitor your progress and catch problems early.

- Make use of free credit monitoring tools such as Credit Karma, Experian, or Equifax.

- Obtain your full credit report at least once a year at AnnualCreditReport.com.

- Establish improvement goals, like raising your score by a specific amount within a certain period.

2. Detect Fraud and Identity Theft

Identity theft and fraud can hurt your credit.

Protect yourself by:

- Monitoring bank statements and credit reports for suspicious activity to catch any unusual transactions.

- Placing fraud alerts or credit freezes if you see unauthorized accounts or transactions.

- Having strong passwords and turning on two-factor authentication on financial accounts.

3. Adapt Financial Plans as Necessary

Your finances can fluctuate, and you need to be adaptable when it comes to your credit-repair strategies:

- Change debt payoff methods if one is not giving the desired result. For instance, if the avalanche method takes too long, use the snowball method.

- Make larger payments whenever you can to pay off debt quicker and increase your utilization.

- Get professional assistance if necessary. Credit counseling agencies can provide one-on-one advice on managing debts and rebuilding credit.

Conclusion

Restoring credit following a financial loss is an ongoing process involving discipline, persistence, and patience. The major steps involve determining your financial situation, paying off outstanding debts with strategic repayment tactics, and following good credit habits like keeping the credit utilization rate low and making timely payments.

In addition, a diversified mix of credit, good budgeting, and tracking your progress will support your long-term financial well-being. Although building your credit score is not an overnight process, the efforts made consistently pay off in terms of getting favorable loan approvals, reduced interest charges, and financial security.

Get your credit rebuilt today by going through your credit report and adopting these well-tested tips.

| Quick Tip: You are legally entitled to a free credit report every year from AnnualCreditReport.com. |

FAQs

How to recover from a financial setback?

Recovering from financial loss starts by evaluating your immediate financial circumstances, developing an attainable budget, and knowing your priority debts. Begin by renegotiating debt agreements with the creditors to work out a reasonable repayment schedule, reduce overspending, and procure more sources of income, if required. Having a ready emergency fund would also help you avoid recurring money troubles.

How long does it take to rebuild credit?

The amount of time it takes to restore credit will vary with past problems’ severity, consistency of payments, and the debt volume. Generally speaking, changes are noticeable between six months to a year, while moving up a higher tier (e.g., from poor to good) would take 1- 3 years, stretching through regular prudent credit behavior.

How to rebuild credit after debt settlement?

Once debts have been settled, work on re-establishing your credit by making timely payments on any outstanding accounts, keeping credit utilization low, and acquiring a secured credit card or credit-builder loan. Getting added as an authorized user to a responsible individual’s credit card can also positively impact your score. Also, check your credit report regularly to make sure settled debts are correctly reported.

What’s the fastest way to improve my credit score?

The fastest method to increase your credit score is paying off debts with high interest rates, lowering your credit utilization to less than 30% (ideally 10%), making all payments on time, and not taking unnecessary hard inquiries from applying for several credit cards. Also, asking for a credit limit increase (if you are financially responsible) will improve your utilization ratio.

Can I get a credit card with bad credit?

Yes, people with poor credit can get secured credit cards, which involve a refundable deposit that is used as the credit limit. There are also credit cards for bad or fair credit offered by some lenders, which come with higher interest rates but can be used to rebuild credit if paid responsibly. Store credit cards and being an authorized user on a family member’s credit card are also possibilities.

How long does it take to rebuild credit from 500 to 700?

It may take one to two years to raise a credit score from 500 to 700, depending on spending habits and debt repayment methods. Making payments on time, keeping utilization rates low, carrying a variety of credit accounts, and reviewing credit reports for errors quarterly can speed up the process. Good money management and perseverance are the keys to long-term credit health.