Revolving credit allows you to borrow, repay, and borrow again within a set period; installment credit offers a predetermined loan with EMIs over a particular amount of time.

Both kinds impact your credit score. Having a diverse range of credit accounts will improve your credit score, which will help you acquire better interest rates and be granted loans more easily.

However, it’s crucial to manage them wisely. For instance, carrying a large credit card debt or missing payments can significantly lower your credit score, potentially hindering your borrowing possibilities.

What is Revolving and Installment Credit?

Revolving and Installment credit are two distinct types of credit accounts that allow you to make financial purchases. Understanding the differences in their borrowing and repayment terms will equip you with the knowledge to make informed credit decisions.

Revolving Credit

Revolving credit is usually offered by credit cards and Lines of Credit (LOC). These accounts come with a predetermined credit limit, which is the maximum amount you can borrow.

As long as you stay within this limit, you are free to access your account to borrow more loans whenever you choose. It is a flexible option for people who want continual access to finances due to its capacity to borrow and repay repeatedly.

Typical examples include credit cards and credit lines. With revolving credit, you may carry a balance from month to month, with interest usually charged on the due part. However, if you don’t pay the remaining amount in full, excessive interest rates may build up rapidly.

Your available credit lowers as you borrow and grows as you repay, directly affecting your credit usage ratio. Keeping your credit use low might help your credit score, but high utilization can hurt it, making it more difficult to get loans at good rates.

Revolving credit is most beneficial when you want immediate access to funds for unexpected bills or emergencies. However, the simplicity of borrowing might drive consumers to overspend, causing financial distress if not managed properly.

Types of Revolving Credit

Revolving credit allows users to access a specific amount of cash on a regular basis as long as they follow the conditions of their credit arrangement.

Common types of revolving credit are:

| Credit Cards | Personal Lines of Credit (PLOCs) | Home Equity Lines of Credit (HELOCs) |

|---|---|---|

| Credit cards are the most common type of revolving credit, providing users with a credit limit to make purchases, pay bills, or acquire cash advances. Borrowers must make at least the minimum monthly payments, and any outstanding amounts will accumulate interest. | Like credit cards, they are unsecured loans that let borrowers access money up to a pre-approved limit. Money can be accessible online or by personal checks, or it can be moved to a bank account. Borrowers are required to make minimum monthly payments during the draw period, and interest is only assessed on the borrowed amount. | These loans, which are backed by the borrower’s home equity, provide a revolving credit line that may be used for a number of things, including high costs or home remodeling. Usually, the value of the house minus any unpaid mortgage balances determines the credit limit. During the draw period, borrowers can take out as much money as they need to pay down the debt or make interest-only payments. |

Installment Credit

These credits have a fixed term, called the loan term, throughout which you make regular payments to return the borrowed funds.

Installment credit is the major benefit of having fixed EMIs (Equated Monthly Installments), which makes budgeting simpler because you know exactly how much you must pay each month.

Usually included in the loan agreement is an amortization plan, which is a schedule that shows how the amount due is progressively reduced with each payment, helping you understand how your payments are reducing your debt over time.

Another advantage is that installment loans often have lower interest rates than revolving credit, which makes them an affordable choice for long-term financing.

Installment credits are frequently used for store financing plans, home improvement loans, and layaway plans. A predetermined repayment time and fixed monthly installments are features of these loans.

Lenders take into account your credit mix when assessing your creditworthiness, and having installment credit in addition to revolving credit might increase it. Should you want more money, you will need to apply for a new loan.

Types of Installment Loans

Installment credit is borrowing a certain amount of money and repaying it in fixed, regular installments over a set period.

Common types of installment credit are:

These loans are used to buy or refinance properties that are generally repaid over a 15 to 30-year period.

Financing for new or used vehicles, with payback durations typically ranging from 36 to 72 months.

These are funds borrowed to pay for school expenditures, such as tuition and housing, with payback durations of up to 25 years.

These loans are unsecured loans that can be used for a variety of purposes, such as home renovations or medical expenses, and have periods ranging from 12 to 60 months.

Real-World Examples of Revolving Credit

John owes $200,000 on his outstanding mortgage on a $400,000 property. A lender may grant him a $100,000 credit limit on a Home Equity Line of Credit (HELOC) based on the equity in his house.

This enables John to take out loans against the equity in his house for things like home renovations or schooling costs.

It’s crucial to remember that interest on a HELOC is only tax deductible if the loan is utilized for significant home repair, per the Tax Cuts and Jobs Act of 2017.

Like a credit card, but backed by the equity in his house, this revolving credit option gives John the freedom to access money as required, pay it back, and take out new loans.

Let’s say John borrows $50,000 for 60 days at an interest rate of 8% to demonstrate how interest functions on a HELOC.

Using the formula for revolving credit:

| Interest Costs = Credit Amount x Interest Rate x Days of Use ÷ 365 Days |

| Interest Costs = 50,000 x 8% x 60 ÷ 365 = 50,000 x 0.08 x 60 ÷ 365 = 657.53 |

This means John would owe $657.53 in interest for using $50,000 for two months.

Real-World Examples of Installment Credit

Emma wants to get a laptop from an electronics store for $1,500. With an annual interest rate of 10%, the shop provides a 12-month installment credit plan. She decides to make equal monthly payments rather than paying the entire sum at once.

Given the data,

| Principal (P) | Interest Rate Per Year | Term (n) of Loan | Interest Rate (r) Per Month |

|---|---|---|---|

| $1,500 | 10% | 12 months | 10% ÷ 12 ÷ 100 = 0.00833 (or 0.833% monthly) |

Applying the EMI Formula:

| EMI = P x r x (1 + r)n ÷ (1 + r)n – 1 |

| EMI = 1500 x 0.00833 x (1 + 0.00833)12 ÷ (1 + 0.00833)12 – 1 |

Let’s figure out Emma’s precise monthly payment.

In 12 months, Emma’s monthly payment (EMI) on the $1,500 laptop will be around $131.87.

This indicates that she will pay $1,582.44 ($131.87 × 12), which includes interest of $82.44.

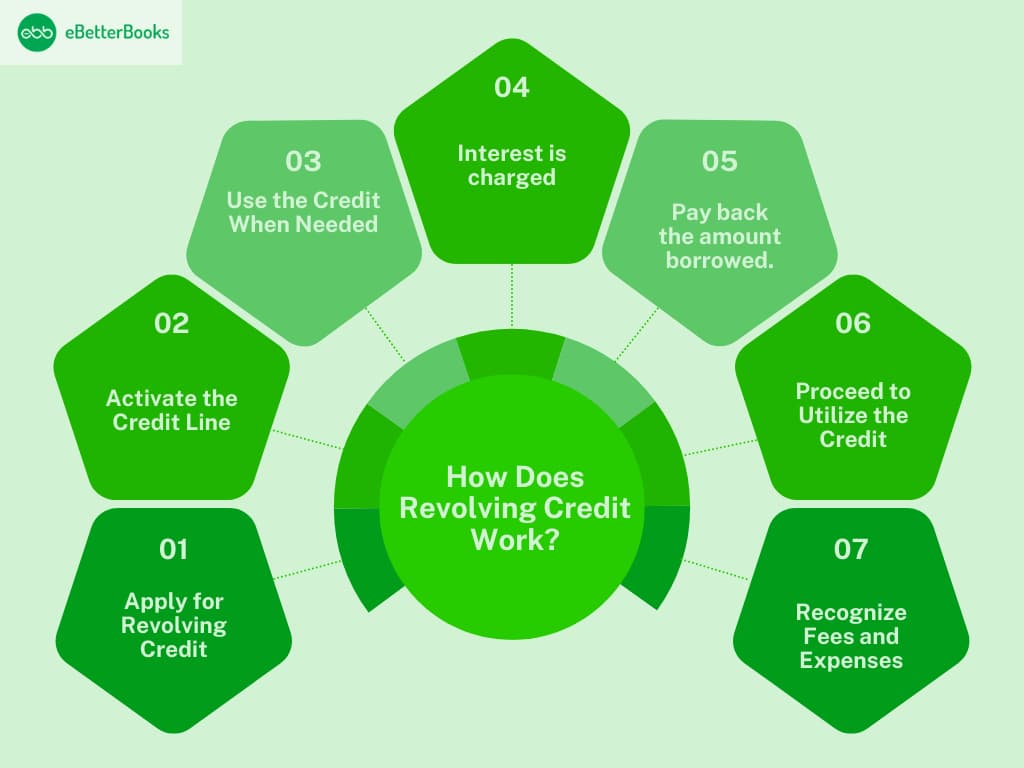

How Does Revolving Credit Work?

Revolving credit is a loan that renews automatically when the debt is paid. When you create a revolving credit account, you will be assigned a credit limit, which is the maximum amount you may spend on the account.

At the end of each payment cycle, you’ll receive a statement that includes a balance or the total amount that you owe.

This is how revolving credit works:

Apply for Revolving Credit

- The account holder makes an application to the bank.

- The bank assesses their creditworthiness using details such as income, credit history, and financial stability.

- If accepted, the bank assigns a credit limit, which sets the maximum amount that can be overdrawn.

- An interest rate is determined for any borrowed funds.

Activate the Credit Line

- The revolving credit stays dormant until the account holder spends more than their available balance.

- If they withdraw or make payments that exceed their balance, the revolving credit is immediately triggered.

- The account balance becomes negative, allowing them to spend the credit up to the allowed limit.

Use the Credit When Needed

- Expenses like unforeseen invoices, payments, or urgent liquidity demands can all be covered by the money.

- The usage of the credit is unrestricted, unlike fixed loans, provided that it remains within the limit.

Interest is Charged

- The total credit limit is not subject to interest; just the amount used is.

- Every day, interest is computed and usually taken out of the account once a month.

- Generally speaking, the interest rate is more than that of other credit choices, such as personal loans.

Pay Back the Amount Borrowed

- The account holder may choose to pay back the balance in full or in installments, depending on their financial circumstances.

- There are no set repayment plans, so they may choose how and when they make their payments.

- No further interest is assessed once the outstanding sum is paid off and the account goes back to positive.

Proceed to Utilize the Credit

- After the amount is recovered, the revolving credit can still be used in the future.

- The account holder has the option to overdraw the account up to the credit limit if they want money again.

- As long as the account is in good standing, this cycle can continue.’

Recognize Fees and Expenses

- Certain banks may impose commitment fees or penalties for going above the credit limit in addition to interest.

- To prevent unforeseen fees, the account holder should carefully read the terms and conditions.

- Interest expenses can be reduced by using cash deposits to settle the outstanding debt.

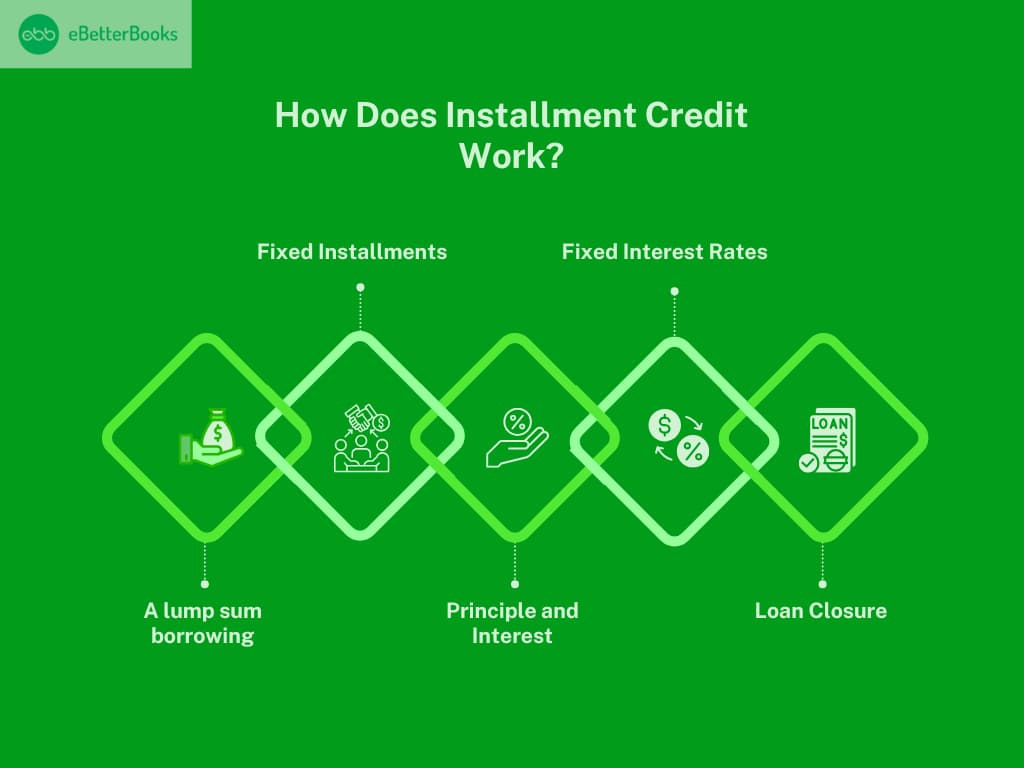

How Does Installment Credit Work?

Installment credit is taking out a fixed loan amount upfront and paying it back in regular, fixed installments over a certain time frame, usually each month, until the total amount owed, principal and interest included, is paid.

You are able to handle your finances better because you are aware of your monthly debt thanks to this well-organized payback plan.

It works as follows:

A Lump Sum Borrowing

The lender makes a one-time payment to you, which is the loan amount. Installment loans might be a more affordable credit option since they frequently offer lower interest rates than revolving credit.

Fixed Installments

You commit to paying back the loan over a predetermined period (such as 12 months, 24 months, or more) in regular installments, often made once a month. Financial discipline is maintained with the aid of a well-organized repayment plan.

Principle and Interest

The principle, or the amount borrowed, and the interest associated with the loan are partially covered by each installment payment. In contrast to revolving credit, where amounts might change depending on consumption, this implies that your debt will gradually diminish over time.

Fixed Interest Rates

Installment loans frequently have fixed interest rates, which means that they don’t change throughout the loan. Because of this steadiness, borrowers are able to make better financial plans.

Loan Closure

The loan has been considered paid off, and the account is normally closed when you have completed all the necessary payments. You will have to apply for a new loan, though, if you wish to borrow more money. It’s also important to remember that not all loans benefit from early repayment; some have prepayment penalties, which might incur extra expenses.

When Should You Use Revolving Credit?

Revolving credit is commonly used in the following scenarios:

| Managing Day-to-Day Expenses | Handling emergencies | Short-Term Cash Flow Needs |

|---|---|---|

| Revolving credit accounts, such as credit cards, provide convenience for everyday expenses by allowing you to borrow, repay, and borrow again as required. | Because revolving credit allows for rapid access to finances, it is excellent for dealing with unforeseen bills or crises. | If you have a momentary cash need, revolving credit can assist in bridging the gap until your next paycheck. |

However, it is crucial to realize that revolving credit often has higher interest rates than installment loans, and there is a danger of overspending if not adequately handled.

When Should You Use Installment Credit?

Installment credit is commonly used in the following scenarios:

- Financing Large, One-Time Purchases: Installment loans give a lump sum that you repay over a certain length of time with monthly payments. Examples include purchasing a car or a property.

- Predictable payback Structure: Because installment loans have a regular payback schedule, you can budget more easily because you know exactly how much money is due each month.

- Installment loans offer lower interest rates than revolving credit, particularly when collateral is required, lowering the overall cost of borrowing.

It’s worth noting that while installment loans provide consistency, they lack the flexibility of revolving credit. Furthermore, taking out a new installment loan will temporarily reduce your credit score, and certain loans may have prepayment fees if you pay them off early.

How Revolving Credit Accounts Can Impact your Credit Scores?

Revolving credit, such as credit cards and lines of credit, can have a significant impact on your credit score due to many main factors.

Making timely payments on your revolving credit accounts has a positive effect on your credit score. In contrast, late or missing payments can lower your credit score.

This ratio indicates how much of your available revolving credit you are using. It is computed by dividing your current revolving debt by your total credit available. For example, if you have a $1,000 credit limit and a $300 load, your credit usage ratio is 30 percent. Experts suggest keeping this percentage around 30% to preserve a good credit score.

The length of your credit history is influenced by how long you have held your revolving credit accounts. Your credit score can be raised by creating accounts with a history of on-time payments.

Your credit score may benefit from having a variety of credit accounts, such as both installment and revolving loans. Lenders see a diverse credit mix as a sign of effective credit management.

When you apply for new revolving credit accounts, your credit report may receive hard queries. This may impact your credit score. Limiting the number of new credit applications in a short period is advised.

How installment credit accounts can impact your credit scores?

Installment credit is used to describe loans, such as mortgages, auto loans, and personal loans, that are paid back over a predetermined length of time with fixed monthly installments.

By exhibiting regular payment patterns and adding to a varied credit mix, properly managing these loans may boost your credit score.

- Payment History (35% of FICO Score): Your credit score is positively impacted if you regularly make installment loan payments on time. On the other hand, late or missing payments may have adverse consequences.

- Credit Mix (10% of FICO Score): Your credit profile may be improved by having a range of credit kinds, such as installment loans and revolving credit (such as credit cards). A diverse credit mix is seen positively by lenders as it shows that you can handle various credit types sensibly.

- Debt Amounts (30% of FICO Score): Adding additional installment debt raises your total debt burden, which might lower your credit score. Over time, though, your score may improve as you pay back the loan and lower the sum.

- Length of Credit History (15% of FICO Score): Getting a new installment loan may lower your credit score at first by reducing the average age of existing credit accounts. As the loan ages and you continue to make on-time payments, it may improve your credit history.

- Impact of Paying Off Installment Loans: Although paying off an installment loan lowers your debt, your credit score may temporarily drop as a result. This happens because it is considered less dangerous to have a low balance-to-loan amount ratio than to have no active installment loans at all.

The Bottom Line

Installment and revolving credit are both essential to your financial well-being. Building a solid credit score via knowledge of how they operate and prudent management can result in reduced interest rates and better loan approvals.