QuickBooks Payroll Most Common Errors often cause significant operational delays, but they are generally resolvable by identifying the specific error series and applying targeted solutions. Errors are typically categorized by series: the 15000 and PS series indicate issues with payroll updates, tax table files, or connection and firewall settings, while the 3000 series relates to tax arrangement verification, and the H series points to multi-user network or hosting problems. Successful troubleshooting requires performing preparatory actions such as backing up data, verifying the payroll subscription status, and confirming the current QuickBooks version. Solutions range from utilizing official manufacturer tools like the QuickBooks Tool Hub to running diagnostics, or, in more severe cases, rebuilding company data or adjusting system-level settings like the User Account Control (UAC) or Internet Explorer configurations. Addressing these issues promptly is crucial to ensuring accurate and timely payroll processing and maintaining compliance.

- Common payroll errors are categorized by series, each indicating a specific problem area:

- PS and 15000 Series: Issues with downloading or applying payroll tax table updates, firewalls, or internet connection failures (e.g., PS077, 15240).

- 30159 Error: Frequently points to incorrect setup or verification of payroll tax arrangements, such as the Employer Identification Number (EIN).

- H Series: Problems accessing or hosting the company file in multi-user mode, indicating network or server issues.

- Pre-Considerations before troubleshooting are mandatory: checking the QuickBooks version, confirming the payroll subscription status, and creating a backup copy of the company file.

- General Troubleshooting Methods include:

- Running official diagnostic tools like the Quick Fix My File or QuickBooks File Doctor from the QuickBooks Tool Hub.

- Updating the QuickBooks software and downloading the latest payroll tax tables.

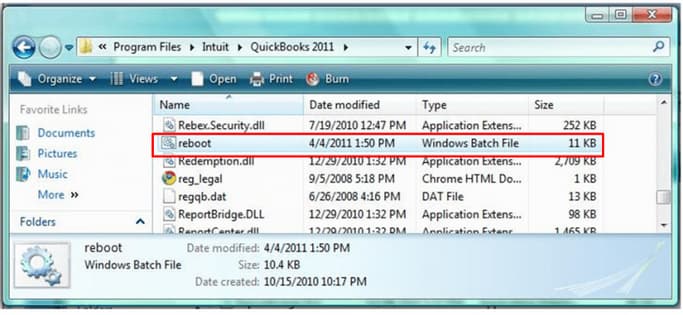

- Running the

reboot.batfile to re-register QuickBooks components. - Checking and adjusting system settings like Internet Explorer options or User Account Control (UAC) settings.

- For errors caused by oversized company files (common in Enterprise versions), advanced solutions include condensing data and verifying and rebuilding company data.

- If initial fixes fail, extreme steps may involve uninstalling and reinstalling QuickBooks or manually removing damaged installation folders.

QuickBooks Payroll – Common Functions and Features

- Tax penalty protection: QuickBooks Payroll offers tax penalty protection, helping you avoid costly fines and penalties by ensuring accurate payroll tax calculations and timely submissions.

- Direct deposit: The user needs to eliminate the need for paper checks by streamlining their payment process with QuickBooks Payroll through direct deposit, making it easier for them and their employees.

- Time tracking: You can effortlessly keep track of and manage your workers’ working hours with the help of QuickBooks Payroll’s time-tracking tool, guaranteeing correct pay and compliance with labor rules.

- 1099 e-filing: QB Payroll makes it simple to record payments made to independent contractors and other freelancers while conforming to IRS laws through the 1099 e-filing procedure.

- Contractor payments: Using QuickBooks Payroll, you can easily manage contractor payments and keep track of your independent contractors’ revenue.

- HR support: To help you manage your staff, QuickBooks Payroll provides HR support capabilities, such as time-tracking, record-keeping, and maintaining compliance with employment laws.

- Health benefits: QuickBooks Payroll makes getting health benefits easier, enabling you to provide appealing benefits packages to your staff members and boost their well-being and sense of fulfillment at work.

- 401(k) plans: QuickBooks Payroll also provides options for managing 401(k) plans, helping your employees save for retirement while easing the administrative burden of plan management for your business.

Consequences of Large Company Files in QuickBooks Desktop on Payroll Accuracy

Oversized QuickBooks Desktop files disrupt payroll processing, reduce file stability, and degrade overall system performance.

QuickBooks may freeze or become unresponsive during paycheck calculations, direct deposit submissions, and payroll report generation.

Common error messages when updating payroll, paying taxes, or opening federal and state forms include:

- “The file you specified cannot be opened”

- “The file exists”

Additional issues include:

- Delays when opening or switching between payroll reports

- Backup and data verification failures

- Higher risk of data corruption due to file size

- Inability to access or update specific employee records

- Errors when running Verify and Rebuild Data utilities

QuickBooks Users Frequently Experience Common Payroll Errors

Common payroll errors in QuickBooks may seriously harm both organizations and employees. Here is a list of several typical payroll issues in QuickBooks Desktop, along with a brief explanation of each:

QuickBooks Payroll Errors : At a Glance

| QuickBooks Payroll PS077 Error | QuickBooks cannot download payroll updates. |

| QuickBooks Desktop Payroll PS107 | Company file issues or errors while updating. |

| QuickBooks Payroll Error PS060 | Unavailable Payroll Service |

| QuickBooks Payroll Error PS058 | Payroll update problems. |

| QuickBooks Error PS032 | QuickBooks payroll service error due to issues in the company file. |

| QuickBooks Error 30159 | Error in verifying payroll tax arrangements like EIN. |

| QuickBooks Payroll Error PS033 | Obsolete or inaccurate tax table files. |

| QuickBooks Error 17337 | Issues with an internet connection, firewall or software setup causing payroll errors. |

| QuickBooks Error Code 15240 | Payroll errors due to network connection failure, firewall misconfiguration, or inaccurate system date and time settings. |

| QB Payroll Error 15102 | Payroll issues arise due to an error in the download location or access issues due to firewall settings. |

Detailed Explanation on Payroll Most Common Errors in QuickBooks

- Error in QuickBooks Payroll PS077: This issue often appears when QuickBooks cannot download payroll updates. It can be connected to problems with the tax table update or the QuickBooks company file.

- Error with QuickBooks Desktop Payroll PS107: Incorrect When someone attempting to download the most recent payroll updates, PS107 frequently happens. Issues with the company file or the updating procedure might be the cause.

- Payroll Error PS058: PS058 is another update-related error in QuickBooks Payroll. It may indicate issues with the installation of a payroll update or problems with the update files.

- Errors Related With QuickBooks Payroll Update: These are common issues with updating payroll in QuickBooks Desktop. They may include several problems that stop the program from obtaining and installing the most recent payroll updates.

- QuickBooks Error PS032: This error is related to the QuickBooks payroll service and usually arises when there is a problem with the company file or the installation of QuickBooks.

- Error 30159: This is some of the most common payroll error that causes frequent problems with payroll taxes. Establishing the EIN (Employer Identification Number) or other payroll tax arrangements are often the problems it points to.

- QB Payroll Error PS033: PS033 is a payroll-related issue that might appear while accessing a company file or downloading payroll updates in QB. It frequently has to do with obsolete or inaccurate tax table files.

- Error 17337: This issue may occur while upgrading QuickBooks Payroll. It frequently concerns problems with the internet connection or how the firewall and security software are set up.

- QuickBooks Error Code 15240: Error 15240 can pop up during the payroll update procedure and be caused by problems with the network connection, firewall configuration, or inaccurate system date and time settings.

- The QB Payroll Error 15102: It typically appears when updating a payroll service in QuickBooks Desktop fails. It might be brought on by a number of things, such as problems with the download location or firewall settings.

Businesses need to troubleshoot and resolve these issues promptly to ensure accurate and timely payroll processing.

If you encounter any of these errors, it’s advisable to consult QuickBooks Expert by calling the telephone 1-802-778-9005 for assistance in resolving the specific issue.

1

Error in QuickBooks Payroll PS077

This issue often appears when QuickBooks cannot download payroll updates. It can be connected to problems with the tax table update or the QuickBooks company file.

2

Error with QuickBooks Desktop Payroll PS107

Incorrect When someone attempting to download the most recent payroll updates, PS107 frequently happens. Issues with the company file or the updating procedure might be the cause.

3

Payroll Error PS058

PS058 is another update-related error in QuickBooks Payroll. It may indicate issues with the installation of a payroll update or problems with the update files.

4

Errors Related With QuickBooks Payroll Update

These are common issues with updating payroll in QuickBooks Desktop. They may include several problems that stop the program from obtaining and installing the most recent payroll updates.

5

QuickBooks Error PS032

This error is related to the QuickBooks payroll service and usually arises when there is a problem with the company file or the installation of QuickBooks.

6

Error 30159

This QuickBooks Payroll Most Common Errors are frequent problems with payroll taxes. Establishing the EIN (Employer Identification Number) or other payroll tax arrangements are often the problems it points to.

7

QB Payroll Error PS033

PS033 is a payroll-related issue that might appear while accessing a company file or downloading payroll updates in QB. It frequently has to do with obsolete or inaccurate tax table files.

8

Error 17337

This issue may occur while upgrading QuickBooks Payroll. It frequently concerns problems with the internet connection or how the firewall and security software are set up.

9

QuickBooks Error Code 15240

Error 15240 can pop up during the payroll update procedure and be caused by problems with the network connection, firewall configuration, or inaccurate system date and time settings.

10

The QB Payroll Error 15102

It typically appears when updating a payroll service in QuickBooks Desktop fails. It might be brought on by a number of things, such as problems with the download location or firewall settings.

Quick learning of QuickBooks Payroll Error Series:

| Errors in the 6000 Series | Difficulties accessing or using a company file. |

| 3000 Series Errors | Issues in banking services. |

| Errors in the 15000 Series | Error in QuickBooks Payroll service. |

| H Series Error | Problems with the server hosting the corporate file’s multi-user mode. |

A detailed description of the most common payroll error in QuickBooks

QuickBooks can generate different error codes and messages to show issues. These error codes are often divided into many series, each associated with a certain problem.

- Errors in the 6000 Series : This series often reflects difficulties accessing or using a company file. Problems with the file location, extension, or hosting may be involved.

- 3000 Series Errors: When utilizing online banking capabilities, these errors frequently involve synchronization or communication issues between QuickBooks and your financial institution.

- Errors in the 15000 Series: here errors are associated with difficulties with the QuickBooks Payroll service, such as upgrades or connectivity issues.

- H Series Error: his error suggests problems with the server hosting the corporate file’s multi-user mode. Typically, there are issues with network setups.

QuickBooks Payroll Errors: Causes and Issues

Common payroll errors in QuickBooks often arise from incorrect tax setups, data entry mistakes, or misclassified employees. Outdated program versions, misconfigured benefit deductions, or flawed time-off accruals can lead to miscalculations and non-compliance. Integration conflicts, reporting inaccuracies, or legislative changes may further disrupt payroll accuracy. In some cases, data corruption or incomplete employee terminations can also trigger payroll discrepancies.

Certainly, the following is a succinct list of typical problems that lead to payroll errors in QuickBooks:

- Errors in Data Entry Incorrect Tax Settings

- Program Updates

- Errors in Employee Classification

- Inadequate Training

- Extraordinary calculations

- Benefit deductions for employees

- Accruals for Sick Time and Vacation

- Employee Disputes

- Errors in Terminating Employees

- Annual and Quarterly Reporting

- Issues with Payment Processing

- Integration Issues

- Legislative Changes

- Data Corruption

How to Identify QuickBooks Payroll Errors?

Here’s how to confirm the presence of the most common payroll errors in QuickBooks software:

- Discrepancies in calculations, payroll hours, paycheck computations, taxes, etc.

- Inaccurate computations of payroll liabilities, like employer taxes, paychecks, etc.

- The payroll updates you download are not successful due to some payroll-related warnings.

- You won’t be successful when attempting to direct deposit paychecks in employees’ accounts.

- Misconfigured reconciliation, inaccurate reports, and legal and tax implications.

- Inconsistency in tax withholdings, like incorrect federal or state tax amounts getting deducted from employee paychecks.

Pre-Considerations to Fix QuickBooks Payroll Errors

Below are certain things to keep in mind before resolving QuickBooks Payroll-related errors:

- Press F2 or Ctrl + 1 in the Product Information Window to review your current QuickBooks version.

- Check for your payroll tax table updates from the Employees menu and payroll information.

- Look into your network and internet connectivity, test your connection stability, and ensure the speed is fast and robust.

- Make sure you meet the minimum system requirements to ensure compatibility between the two components.

- Confirm that you have full access permissions to the file or folder and the QuickBooks is running as an administrator to get all the payroll and tax table updates successfully.

- Review your employee information, billing details, payroll items, company preferences, and all such information.

- Confirm your QuickBooks payroll subscription status and activate it if it’s not already.

- Do not forget that your files need protection and security. For a safe side, you need to take a backup of each one.

What are the Possible Solutions to Fix QuickBooks Payroll Errors?

Solving QuickBooks Payroll Most Common Errors can be a bit complex. However, it’s important to note that specific solutions may vary depending on the nature of the error you encounter.

Here are the methods with some details on how to use them:

Method 1: Running & Repairing QuickBooks

- First of all, select the Windows key type “Control Panel,” and open it.

- Now, find the “Programs and Features” or “Uninstall a Program.”

- Search for the QuickBooks in the list of installed programs and select it.

- Choose “Repair” or “Change” and follow the on-screen instructions to repair QB.

- After the repair process is complete, restart your computer.

Method 2: Uninstallation and Re-Installation of QuickBooks

If the above-mentioned method is not helping you out, then you can try reinstalling it:

Uninstall QuickBooks:

- Go to “Control Panel”> “Programs and Features” or “Uninstall a Program.”

- Locate QuickBooks, and choose “Uninstall.”

- Follow the prompts to uninstall QuickBooks.

Now, Download and reinstall QuickBooks:

- Visit the official QuickBooks website and download the latest version.

- Install QuickBooks following the on-screen instructions.

Method 3: Fix Manually or Remove QuickBooks Installation Folders

Sometimes, The error can arise due to damaged installation files. Thus, you can manually remove installation folders:

- Close QuickBooks and all the other processes related to QB.

- Navigate to the QuickBooks installation directory (usually in C:\Program Files\Intuit.

- Rename the QuickBooks installation folder to something like “OldQuickBooks.”

- Restart your computer.

- Now, reinstall QuickBooks.

Method 4: Rename the CPS Folder in the System

The CPS (CPS.exe) folder can be a source of errors:

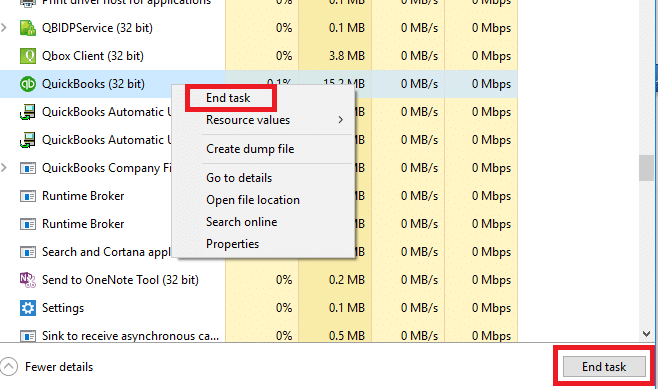

- The user must press Ctrl + Shift + Esc to open the Task Manager.

- Go to the “Processes” tab.

- Locate “CPS” or “CPS.exe” in the list of processes and end it.

- Navigate to the CPS folder location (usually in C:\Program Files\Common Files\Intuit\QuickBooks).

- Rename the CPS folder to something like “OldCPS.”

- Restart your computer.

Method 5: Disabling UAC (Disable User Account Control)

- Type “UAC” in the Windows search bar and open “Change User Account Control Settings.”

- Drag the slider to the lowest level (Never Notify).

- Click “OK” and restart your computer.

- Try running QuickBooks again.

Method 6: Run Reboot. Bat File

- Close or shutdown the QuickBooks desktop payroll.

- Open the folder where the reboot.bat file is present.

- Hit right-click on the QuickBooks icon and then select Properties.

- Choose the Open File Location option.

- Right-click on the reboot.bat file and select Run as Administrator.

Note: As per your ‘Windows Folder Option settings’, the file may appear as either bat or reboot. The command prompt windows will show up on the display with the scrolling file names. Do not close the windows manually.

- Let the process complete, the windows will close automatically.

- Reboot your system and re-open the QuickBooks desktop to check for the error status.

Method 7: Check Internet Explorer Settings

- Close all open windows and programs.

- Go to Internet Explorer and select Tools > Internet options.

- Hit the Advanced tab.

- Choose Reset from the Reset Internet Explorer Settings dialog box.

- In the window, Are you sure you want to reset all Internet Explorer settings?, click on Reset.

- When Internet Explorer finishes applying default settings, press Close, and hit OK. Then, restart your PC to save the changes.

Method 8: Close all the QuickBooks Processes

- Make sure you have an active QuickBooks subscription.

- Reset the QuickBooks desktop update.

- Check the accuracy of your payroll service key.

- Restart your system and then right-click on the Taskbar at the bottom.

- Click on Start Task Manager or press Ctrl + Alt + Delete keys on your keyboard.

- Navigate to the Processes tab and choose Image Name.

- Select the QuickBooks processes one by one including Qbwebconnector.exe, QBW32.exe, QBCFMonitorService.exe etc.

- Then, click End process.

- Make sure only QuickBooks processes are ended and then close the Task Manager.

Remember that while these methods can help resolve QuickBooks payroll most common errors, it’s crucial to back up your data before making any major changes to your system, such as reinstalling software or modifying system settings.

Additionally, for specific error codes or issues, it’s often beneficial to consult QuickBooks support or their official documentation for more tailored solutions.

Check your payroll subscription status to confirm compatibility with larger company files. The file size limit varies based on your active payroll plan in QuickBooks Desktop.

- Log in to QuickBooks Desktop company file as the Primary Admin or Payroll Admin.

- Go to Employees > Payroll Centre.

- In the Payroll tab, click Manage My Account under Subscription Status.

- In the Product Information window, review the active payroll service to ensure it supports large or oversized company files.

How to Resolve QuickBooks Desktop Enterprise Payroll Errors Caused by Large or Oversized Files?

QuickBooks Desktop Enterprise Payroll errors due to large or oversized files generally take place when your company files are too large to handle, and the payroll data they have is more than their file size limit.

Solution 1: Condense the Data

Before you condense your file, make sure to create a backup copy of your company file. A backup copy allows you to restore it to undo the changes in case any changes happen.

Keeping all transactions

Condense the data while keeping all the transactions:

- Navigate to the File menu > choose Utilities.

- Click Condense Data.

- Select Keep all transactions, but remove audit trail info to date.

- Choose the Next tab.

- Let the process complete and click Close.

Removing selected transactions

Condense the data while removing all the selected transactions:

- Go to the File menu > click Utilities.

- Select Condense Data.

- Choose Remove the transactions selected from your company file and click Next.

- Pick the transactions you’d like to remove and click the Next icon.

- Click how transactions would be summarized, and select Next.

- Select how inventory should be condensed and click Next.

- Choose the recommended transactions you want to remove and click Next.

- Opt for the List entries to be removed and choose Next.

- Click Begin Condense and wait for the process to be completed.

- Select Close when it’s done.

Solution 2: Verify and Rebuild Company Data

The verify tool finds the most common issues in a company file, and the rebuild tool fixes them.

Verify your company data

- Navigate to Windows > click Close All.

- Open the File menu > select Utilities.

- Choose Verify Data when you see:

- QuickBooks detected no problems with your data—your data is clean, and there’s nothing else to do with it.

- An error message—look for it on the QuickBooks Desktop support site for how to fix it.

- Your data has lost integrity—Data damage was found in the file. Rebuild your data to fix it.

Note: Contact the QuickBooks Support Team before you rebuild your data in case you use Assisted Payroll.

Rebuild your company file data

- Navigate to File > Utilities > select Rebuild Data.

- QuickBooks will ask to create a backup before it rebuilds your company file. Click OK. A backup is required before you rebuild.

- Choose where to save your backup and click OK. Don’t replace another backup file. Enter a new name in the File name and click Save.

- Click the OK tab when the message Rebuild has completed appears.

- Move to File > select Utilities > choose Verify Data again to check for additional damage.

- When the verify tool finds more damage, fix it manually. Look for the error(s) in the qbwin.log on the QuickBooks Desktop support site for how to fix them.

- When your error can’t be found, restore a recent backup. Go to File, then choose Open or Restore Company.

Note: Avoid replacing your existing company file and re-entering the info into your company file after the backup was created.

Solution 3: Run QuickBooks File Doctor From the Tool Hub

Before you start, create a backup copy of your company file then download and install QuickBooks Tools Hub. Run the Quick Fix My File and make use of QuickBooks File Doctor tool. This is a built-in tool that auto-detects and auto-fix data damage issues within QuickBooks.

Step 1: Run Quick Fix My File

- Download and install the most recent version (1.6. 0.8) of QuickBooks Tool Hub.

- Choose Company File Issues from the tool hub.

- Select Quick Fix My File.

- Click OK when it completes, and open your QuickBooks.

Step 2: Run QuickBooks File Doctor

- Choose Company File Issues from the tool hub.

- Select Run QuickBooks File Doctor. It may take up to one minute for the file doctor to be opened.

Note: Look for QuickBooks Desktop File Doc and open it manually in case the QuickBooks File Doctor doesn’t open.

- In QuickBooks File Doctor, choose your company file from the drop-down menu.

Note: Click Browse and search to find your file when you’re unable to see your file.

- Click on Check your file (middle option only) and select Continue.

- Enter your QuickBooks admin password and click the Next tab.

Scan time depends on the file size and usually takes 10–15 minutes. Even if the scan result shows as unsuccessful, it may still resolve underlying issues. After the scan completes, open QuickBooks and access your company file to verify the fix.

Solution 4: Create a New Company File

Creating a new company file from scratch in QuickBooks gives you full control over how your business is set up tailored exactly to your needs.

- Navigate to the File menu > choose New Company.

- Follow the wizard displayed on your screen.

- Open the original file and export your lists.

- Access the exported Intuit Interchange Files (IIF) and delete the unnecessary list entries.

- Import your clean files into the new one.

- Set up the opening balances.

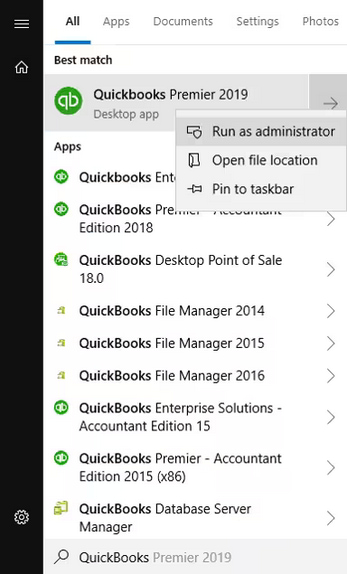

Solution 5: Run QuickBooks as an Administrator

Running QuickBooks as an administrator grants the permissions to the program and allows it to work smoothly especially when managing company files, installing updates, or accessing payroll features.

- Open the Windows Start menu.

- Enter “QuickBooks” into the search bar.

- You will see your results listed in the Search window.

- Right-click on the QuickBooks version and the year you want to open.

- Choose Run as administrator.

- Run the payroll update if required.

- Close and reopen the QuickBooks software.

Solution 6: Update QuickBooks and Payroll Tax Table

Regular updates ensure QuickBooks has the latest features, security patches, and accurate payroll tax rates so you can process payroll confidently and avoid costly mistakes. The following steps help you to download the most recent QuickBooks and payroll tax table updates.

Update QuickBooks to the latest version

To resolve this error, update your software to the latest release.

- Open QuickBooks Desktop and navigate to the Help menu.

- Choose Update QuickBooks Desktop.

- Hit the Update Now tab. Tip: Tickmark the Reset Update checkbox to clear all previous update downloads.

- Select Get Updates to start the download.

- Once done, close and reopen QuickBooks to install the update again.

Get the Payroll Tax Table Updates

To maintain compliance with the most recent tax regulations, download and install the latest Payroll Tax Table updates. These updates ensure that all payroll calculations reflect the newest federal, state, and local tax rates, deductions and benefits.

- Choose Update QuickBooks from the Help menu

- Click the Update Now tab.

- Select Get Updates.

- Go to File and click Exit.

- Restart QuickBooks Desktop.

Note: The 2024 payroll tax table updates are not available as a web patch. You must install them directly through the QuickBooks Desktop software.

Solution 7: Disable Multi-User Access

Multiple users accessing the company file at the same time causes data conflicts, file locking, and delays. QuickBooks fails to calculate paychecks, update tax tables, or process direct deposits. Switch to single-user mode to run payroll without errors and maintain file stability.

- Open your QuickBooks company file as an admin.

- Navigate to the File menu and choose Utilities.

- Move to the next workstation when the Host Multi-User Access option appears.

- Select Stop Hosting Multi-User Access instead.

Best Practices to Prevent QuickBooks Desktop Enterprise Payroll Errors From Large or Oversized Files

Consider the following best practices to avoid QuickBooks Desktop Payroll-related errors due to large or oversized files.

- Keep your software and payroll tax tables up-to-date.

- Regularly back up your company file before processing payroll.

- Turn off auto-calculations for payroll items when editing transactions manually.

- Limit simultaneous multi-user access during payroll processing.

- Double-check employee records, especially tax information and payment methods.

- Review all the payroll summaries (like employer taxes, hours worked, deductions and contributions) before submitting.

Conclusion

In the end, users will be able to fix their QuickBooks Payroll Most Common Errors and know the quick solutions.

If your issues are not solved, and you need any further assistance, then you can call us at 1-802-778-9005 and connect with the QB expert to resolve the issue. You can also schedule a meeting or write a mail to us at support@ebetterbooks.com

FAQs:

Errors in the 15000 series, such as Error 15240, typically indicate issues with downloading or installing payroll updates, often related to security settings or network connectivity. The most effective first step is to use the QuickBooks Tool Hub.

➜Solution: Run the Quick Fix My File or the specific Payroll Update Fix tool found within the Tool Hub.

➜Why it works: This utility automatically checks and repairs common file corruption, connection issues, and update components without requiring the user to manually change complex firewall or security settings.

If I encounter a PS series error (e.g., PS077 or PS033), does that mean I have a problem with my tax tables, and how can I verify them?

Yes, PS series errors often specifically point to issues with the Payroll Tax Table files, which can be obsolete, damaged, or incorrectly applied.

Verification Steps:

➜Go to the Employees menu in QuickBooks.

➜Select Get Payroll Updates.

➜Check the version number displayed in the window against the latest version posted on the Intuit Payroll Tax Table website.

➜Resolution: If the version is outdated, check the Download Entire Update box and click Download Latest Update. If the file is damaged, running the reboot.bat file may be required to re-register essential QuickBooks files.

What is the significance of the “H Series Error” (e.g., H202) in payroll processing, and what is the core issue?

The H Series Error (such as H202 or H501) indicates that the QuickBooks company file cannot establish a proper connection to the server or host computer when accessed in multi-user mode.

➜Core Issue: This error is not a payroll calculation problem but a network connectivity or server hosting issue. QuickBooks cannot securely verify the file location or communicate with the system hosting the company file data, which then prevents any data-intensive function like payroll from running.

➜Typical Cause: Misconfigured firewall settings on the server, issues with the QuickBooks Database Server Manager, or incorrect hosting settings on a workstation.

What are the major consequences of having an oversized company file on the stability and accuracy of payroll in QuickBooks Desktop Enterprise?

Oversized company files, generally those approaching or exceeding the recommended size limits for QuickBooks Desktop Enterprise (which vary but can be a few gigabytes), significantly impact payroll stability.

Consequences include:

➜Freezing: QuickBooks may freeze or become unresponsive during paycheck calculations or direct deposit submissions.

➜Data Integrity: A higher risk of data corruption, which can trigger errors when opening employee records or running tax forms.

➜Report Delays: Substantial delays when generating payroll reports, affecting compliance deadlines.

➜Utility Failure: Errors when running the essential Verify and Rebuild Data utilities, which rely on processing the entire file efficiently.

When should a user manually run the reboot.bat file, and what action does this file perform to fix payroll errors?

The reboot.bat file is a critical troubleshooting tool reserved for specific payroll update or installation problems, particularly when components are not registering correctly.

➜When to Run: Use this file after attempting basic troubleshooting, specifically for PS series errors or when a full payroll update fails to install correctly.

➜Action Performed: Running reboot.bat re-registers all necessary QuickBooks components and Dynamic Link Library (DLL) files within the Windows registry. This re-registration ensures that the program recognizes and utilizes the latest payroll update files and tax tables.

Why is it essential to check the User Account Control (UAC) settings when encountering payroll update errors in QuickBooks?

Checking and temporarily disabling the User Account Control (UAC) settings is often a required step for resolving update errors because UAC can interfere with the installation process.

➜Interference: UAC is a Windows security feature that restricts how programs, including QuickBooks, can write and modify files in protected directories, such as those where payroll components and tax tables are stored.

➜Resolution: Temporarily lowering the UAC setting allows QuickBooks to successfully download and install the update files without being blocked by Windows security prompts, ensuring the new components are fully written to the system. The UAC setting should be returned to its secure level after the installation is complete.

-

How to Fix Incorrect Address or Details on Printed Payroll Checks in QuickBooks Desktop Pro/Premier

To fix incorrect addresses or details on printed payroll checks in QuickBooks Desktop Pro/Premier Payroll, update employee profiles with accurate mailing information, verify the company…

-

QuickBooks Desktop Enterprise Payroll Update Error While Syncing Data or Downloading

Facing payroll update failures in QuickBooks Desktop Enterprise? This guide helps you resolve syncing or download issues caused by subscription errors, file damage, permission restrictions,…

-

Fix QuickBooks Desktop Pro/Premier Payroll Update Error While Syncing Data or Downloading

This guide helps QuickBooks Desktop Pro/Premier users fix payroll update errors that prevent data syncing or tax table downloads. It addresses causes like corrupted files,…

-

Fix Incorrect Direct Deposit Amounts or Bank Information in QuickBooks Desktop Pro/Premier Payroll

If you’ve encountered incorrect direct deposit amounts or bank information in QuickBooks Desktop Pro/Premier Payroll, this guide helps you quickly correct those errors. It walks…

-

Fix Payroll Processing Delays or System Freezes in QuickBooks Desktop Pro/Premier

Experiencing payroll delays or system freezes in QuickBooks Desktop Pro/Premier? This guide addresses those critical issues—caused by outdated software, corrupted files, or system conflicts—and offers…

-

Fixing QuickBooks Desktop Enterprise Payroll E-Pay Login or Password Issues

Addressing login and password failures for QuickBooks Desktop Enterprise Payroll E-Pay is critical for maintaining tax compliance and avoiding penalties. These issues stem from a…

-

Fix W-4 or Payroll Info Errors for Employees in QuickBooks Desktop Pro/Premier Payroll

This guide helps resolve W-4 and payroll info errors in QuickBooks Desktop Pro/Premier Payroll by correcting inaccurate tax setups, filing statuses, and year-to-date figures. By…

-

Fix QuickBooks Desktop Enterprise Payroll Not Opening or Loading

If QuickBooks Desktop Enterprise Payroll fails to open or load, the issue is often caused by outdated software, corrupt files, or interference from firewalls or…

-

Fix Payroll Report Issues in QuickBooks Desktop Enterprise Payroll Desktop

This article addresses issues with payroll reports in QuickBooks Desktop Enterprise Payroll, such as missing employee data, incorrect pay totals, and report discrepancies. It guides…

-

How to Fix QuickBooks Payroll Calculations Failure in Desktop Enterprise Due to Date or Register Mismatch?

This article addresses payroll calculation failures in QuickBooks Desktop Enterprise caused by date or register mismatches, corrupted data, outdated tax tables, and misconfigured payroll items.…

-

Handle QuickBooks Desktop Pro/Premier Payroll Adjustments After System Migration

This guide addresses payroll discrepancies in QuickBooks Desktop Pro/Premier following a system migration, helping users resolve errors in tax setup, payroll items, and year-to-date balances.…

-

Resolve QuickBooks Desktop Pro/Premier Payroll Errors Due to Large or Oversized Files

QuickBooks Pro/Premier may trigger payroll errors due to oversized company files, affecting paycheck accuracy and tax filings. This guide helps users fix these issues using…

-

How to Transfer QuickBooks Desktop Pro/Premier Payroll Data from Client to CPA?

This guide helps clients and CPAs securely and accurately transfer QuickBooks Desktop Pro/Premier payroll data to support tax filing, compliance, and year-end reporting. It addresses…

-

Fix Payroll Tax Discrepancies in QuickBooks Desktop Pro/Premier Payroll Due to File Size Limits

This article helps users fix payroll tax discrepancies in QuickBooks Desktop Pro or Premier caused by company file corruption or file size limits. It guides…

-

Tax Setup Errors in QuickBooks Desktop Enterprise Payroll After Switching from Online to Desktop

This article addresses the issue of tax setup errors in QuickBooks Desktop Enterprise Payroll after migrating from QuickBooks Online. It guides users in identifying and…

-

Fix W-4 or Payroll Info Errors for Employees in QuickBooks Desktop Enterprise Payroll

If you’re dealing with incorrect paycheck calculations, tax filing errors, or compliance risks in QuickBooks Desktop Enterprise Payroll, this guide walks you through how to…

-

How to Retrieve and Convert QuickBooks Desktop Pro/Premier Payroll Backup Data

This article addresses the critical problem of data loss, system migration, and compliance challenges related to QuickBooks Desktop Pro/Premier payroll data. It guides users on…

-

How to Recover or Reset the QuickBooks Desktop Pro/Premier Payroll PIN

QuickBooks Desktop Pro/Premier Payroll PIN Recovery and Reset procedures are essential for maintaining secure and uninterrupted payroll processing and direct deposit authorization. The process is…

-

How to Fix QuickBooks Desktop Pro/Premier Payroll Access Denied Due to File Corruption or Service Errors?

To resolve QuickBooks payroll access denied errors due to file corruption, use Verify and Rebuild Data or QuickBooks File Doctor; for service errors, run QuickBooks…

-

How to Handle Employee Pay Adjustments or Negative Net Pay in QuickBooks Desktop Pro/Premier Payroll

To handle employee pay adjustments or negative net pay in QuickBooks Desktop Pro/Premier Payroll, run a payroll checkup diagnostic tool, access the tool under the…

-

Increase or Fix Direct Deposit Limits in QuickBooks Desktop Pro/Premier Payroll

Direct deposit limits in QuickBooks Desktop Payroll define the maximum Automated Clearing House (ACH) debit amount allowed per payroll run. Intuit establishes these limits based…

-

Fix Incorrect or Missing Employee Payroll Deductions in QuickBooks Desktop Enterprise Payroll

QuickBooks Desktop Enterprise Payroll (QBD Enterprise Payroll) manages employee payroll deductions, including health insurance, pension plans, 401(k), and garnishments. Deduction errors often arise from incorrect…

-

QuickBooks Desktop Pro/Premier Payroll Update Fails Due to File Size or System Configuration

Payroll update failure affects payroll calculations, tax table synchronization, and software stability in QuickBooks Desktop Pro/Premier. The failure results from large company file sizes that…

-

How to Fix Incorrect Address or Details on Printed Payroll Checks in QuickBooks Desktop Enterprise Payroll

Incorrect addresses or details on printed payroll checks in QuickBooks Desktop Enterprise Payroll can delay payments, trigger tax filing discrepancies, and increase compliance risk which…

-

How to Delete or Void a Processed Payroll in QuickBooks Desktop Pro/Premier Payroll?

QuickBooks Desktop Pro/Premier Payroll is the central payroll-processing system that manages paycheck creation, direct deposit transmission, tax calculation, and payroll reporting. The system applies void…

-

Payroll Tax Discrepancies in QuickBooks Desktop Enterprise Payroll Due to File Size Limits or Corruption

To fix payroll tax discrepancies in QuickBooks Desktop Enterprise Payroll, particularly those arising from file size limits or data corruption: Payroll tax discrepancies often occur…

-

How to Fix Direct Deposit Errors in QuickBooks Desktop Pro/Premier Payroll

To fix direct deposit errors in QuickBooks Desktop Pro or Premier Payroll, update QuickBooks and the payroll tax table > check the employee’s bank details…

-

How to Fix When View My Paycheck Not Working in QuickBooks?

If you’re encountering the QuickBooks error “The file you specified cannot be opened,” this guide addresses the common causes and provides step-by-step solutions. Issues like…

-

How to Fix QuickBooks Payroll Subscription: Enhanced Payroll Subscription Renewal Error?

Resolving the QuickBooks Desktop Enhanced Payroll subscription renewal error is critical for maintaining compliance, as expiration prevents calculating new payroll and tax filings. When automatic…

-

How to Resolve QuickBooks Payroll Won’t Update Problem?

QuickBooks Desktop Payroll Update failures, indicated by errors like PS038 or 12007, disrupt crucial tax table access and prevent accurate paycheck processing. Troubleshooting requires a…

-

How to Fix QuickBooks Payroll Taxes Are Calculating Incorrectly Issue?

If QuickBooks is not calculating taxes correctly, it may be due to outdated tax tables, incorrect payroll settings, or exceeded annual limits. This article provides…

-

How to Resolve QuickBooks Payroll Setup Error (00000 XXXXX)?

If you’re facing the QuickBooks Payroll Setup Error (e.g., 00000 XXXXX), it’s typically due to issues like incorrect employee or vendor data, corrupted files, or…

-

How to Troubleshooting QuickBooks Payroll Service Server Error – Connection Error

If you’re facing the QuickBooks Payroll Service Server error, it may be due to issues like outdated tax tables, incorrect system settings, or network disruptions.…

-

How to Resolve QuickBooks Payroll Not Responding Issue?

Experiencing “QuickBooks Payroll Not Responding” can halt payroll processing, typically due to outdated software, corrupted files, or network issues. Resolving this involves updating QuickBooks, fixing…

-

The suite of QuickBooks tools is designed to provide robust financial management, focusing on both proactive cash flow management and compliance-critical payroll processing. For liquidity…

-

A Comprehensive Guide to Fix QuickBooks Payroll Item List Missing Issues

Struggling with managing your QuickBooks Payroll Item List? This article provides step-by-step solutions to address issues like missing payroll items and difficulties in adding or…

-

Fix QuickBooks Payroll Liabilities Not Showing in the Pay Taxes

If your QuickBooks Payroll liabilities are not showing, it may disrupt your payroll process and cause delays in payments. This article helps you identify the…

-

How to Fix the QuickBooks Payroll Keeps Turning Off Issue?

Is QuickBooks Payroll frequently shutting down or not working? This article provides a comprehensive guide to resolve the “QuickBooks Payroll keeps turning off” issue. It…

-

How to Fix QuickBooks Payroll Disappear?

If you’re experiencing problems with the disappearance of QuickBooks Payroll and all payroll data is missing. The chances are either QuickBooks payroll has not been…

Disclaimer: The information outlined above for “Fix QuickBooks Payroll Most Common Errors: Causes & Solutions” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.