Accurately recording and managing customer deposits and retainers in both QuickBooks Desktop and QuickBooks Online is critical for maintaining precise financial health and ensuring tax compliance. These advance payments must be treated strictly as liabilities (unearned revenue) upon receipt, not as immediate income, to avoid overstating profits and tax obligations according to GAAP and IRS guidelines. The central workflow involves creating a specific liability account, such as “Trust Accounts – Liabilities,” and a linked deposit item. Users must then correctly record the initial payment via a sales receipt and, upon service completion, apply the deposit as a negative line item against the final invoice to officially convert the liability into earned income. For users maintaining separate trust accounts, a final bank transfer must be documented to move the earned funds into the main operating account. Following these steps and regularly reconciling the liability account helps businesses prevent common errors, such as misstating revenue on cash basis reports, and provides a clear, audit-ready paper trail for all client funds.

Highlights (Key Facts & Solutions)

- Classification: Customer deposits and retainers must be classified as an Other Current Liability (specifically, Trust Accounts – Liabilities in QBO) upon receipt, not as income, to comply with GAAP and avoid overstating revenue.

- Workflow Core: The process requires setting up a dedicated liability account and a linked retainer item before recording the payment via a Sales Receipt or invoice.

- Conversion to Income: The liability is converted to income only when the service is delivered by applying the deposit amount as a negative line item on the customer’s final invoice.

- QBD Reconciliation: QuickBooks Desktop users should utilize the Undeposited Funds account as a holding area before creating a single bank deposit to ensure bank statements match QuickBooks records exactly.

- QBO Trust Accounts: If a separate bank account is used, a formal Transfer transaction is required to move earned funds from the Trust Liability Bank Account to the Operating Bank Account after the liability has been converted to income.

- Refund Process: To issue a refund, users must generate a Credit Memo using the liability item, which then triggers the option to Give a refund, ensuring the liability is correctly reversed.

- Reporting Caution: Cash basis reports will not show the deposit as income until the final application is completed because the initial receipt is correctly posted to a liability account, not an income account.

Retainers in QuickBooks

Retainers and deposits are defined as advance payments which are made by the clients to secure the services or products which you provide. In QuickBooks, controlling these payments ensures correct accounting and maintains trust with the clients.

Points to Consider Before Recording a Customer Deposit

When recording customer deposits in QuickBooks, whether using the Desktop or Online version, there are several important points to consider to ensure accurate financial management.

- Ensure that all entries match your actual cash flow to maintain accurate records.

- Regularly reconcile your accounts to make sure that your records align with bank statements which helps identify discrepancies early.

- When invoicing customers later, apply these deposits against their invoices to convert them from liabilities into income.

- Ensure that you have tracking options enabled for expenses and items by customer. This setting is crucial for accurate reporting and management of deposits.

How to Record a Customer Deposit in QuickBooks Desktop?

If you receive upfront deposits or retainers for products or services, you must take many steps to account for that money. To record a customer deposit in QuickBooks Desktop, first set up a liability account and create an item for the deposit. Record the deposit via “Enter Sales Receipts,” then create invoices and apply deposits as credits or line items on those invoices.

Following the step-by-step information below:

Step 1: Set up an account for upfront deposits or retainers

When you accept the upfront deposits or retainers prior, you’re required to set up a current liability account for them. This step needs to be taken before as the upfront deposits and retainers are defined liabilities, not income, even though you deposit your money into a bank account.

To create a liability account, follow the steps mentioned below:

- First, from the transactions menu, choose the Chart of Accounts.

- Now, in the Chart of Account window, right-click and choose New from the pop-up menu.

- Then, choose Other Current Liability as the Account Type.

- After this, enter the name of the account you choose ( for example, Upfront Deposit) in the Name field.

Note: You need to set up an account with a zero opening balance, except you are tracking the existing upfront deposits or retainers.

- Lastly, click on the OK option.

Once the account is created, then you need to create an item to utilize when recording the upfront deposits or retainers.

Step 2: Create an upfront deposit item

To receive the upfront deposits or retainers, you should set up an item to use when you enter the associated transactions.

This item is related to the liability account you have to set up to record upfront deposits correctly.

To create an item, follow the steps mentioned below:

- First, from the Lists section, choose Item List.

- Now, from the Item List window, right-click and choose New from the pop-up menu.

- Then, in the Type drop-down menu, choose the purpose of the deposits you collect. You can choose Service if you gather upfront deposits for the services or Other Charge if you gather upfront deposits for products.

- After this, enter a name of your choice for the item (for example, Upfront Deposit) in the Item Name/Number field.

- Choose the Upfront Deposit liability account that you’ve created from the Account drop-down list.

- Lastly, clock on the OK option.

Now, you have the choice to utilize this item to note upfront deposits or retainers you receive.

Step 3: Record upfront deposits or retainers you receive

When you accept an upfront deposit or retainer from a customer, you are supposed to record it.

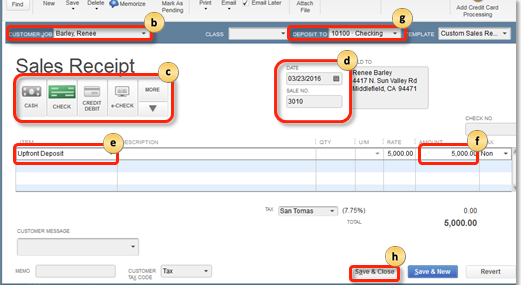

- First, from the Customers section, choose Enter Sales Receipts.

- Now, from the Customer: Job drop-down menu, choose the customer or job.

- Then, if the deposit To field is displayed, choose the account into which to deposit the funds. If the field is not displayed, the funds will be recognized as Undeposited Funds and can be deposited at a later point.

- Choose the Payment method.

- After this, enter the relevant information, like Date and Sale No, in the appropriate fields.

- In the Details menu, choose the Upfront Deposit item you have created from the Item drop-down list.

- Now, from the Amount menu, enter the amount of the deposit or retainer.

- Lastly, choose the Save and Close option.

The deposit and retainer are recorded as a liability.

Step 4: Create invoices

When you accept a retainer or an upfront deposit for a product or service, you’re supposed to make an invoice for that product or service.

To create an invoice, follow the steps mentioned below:

- First, from the Customers section, choose Create Invoices.

- Now, from the Customer: Job drop-down menu, choose the customer or job.

- Then, enter the relevant information, like the Date, Invoice, Bill to/Sold to, and Terms, in the suitable fields on the form.

- After this, from the Detail menu, select the items (products or services) to add to the sale.

- Lastly, choose the Save and Close option.

Step 5: Apply upfront deposits or retainers to invoices

When you offer the product or service for which you’ve received the upfront deposit or retainer, and it’s time to collect payment, you have the option to apply the upfront deposit or retainer as payment on the invoice. This shifts the deposit from the liability account to your income account. There are two ways you can do this.

- Record the upfront deposit or retainer as a line item on the invoice

- Apply the upfront deposit or retainer as a credit

The sections below provide the steps for each method. Choose the method best suited for your business.

Option A: Enter upfront deposits or retainers as line items

You can add an upfront deposit or retainer as a line item to a customer’s invoice, which will subtract the deposit amount from the invoice’s total.

Follow the mentioned step below to enter an upfront deposit or retainer as a line item on an invoice:

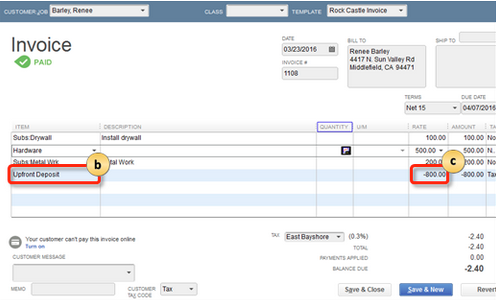

- First, open the customer invoice.

- Now, from the Detail menu, in the next available line, choose the Upfront Deposit item you made from the Item drop-down list.

- Then, enter the amount of the deposit that is being applied to the invoice in the Amount section.

- Lastly, choose the Save and Close option.

On the invoice, the deposit is entered, and the amount due is decreased.

If the deposit that is applied is for the full amount of the invoice, then the transaction is marked as paid.

Option B: Apply upfront deposits or retainers as credits

If you’ve applied an upfront deposit or retainer to a customer’s invoice, then you can apply the upfront deposits or retainer as a credit towards paying the invoice by following the steps below:

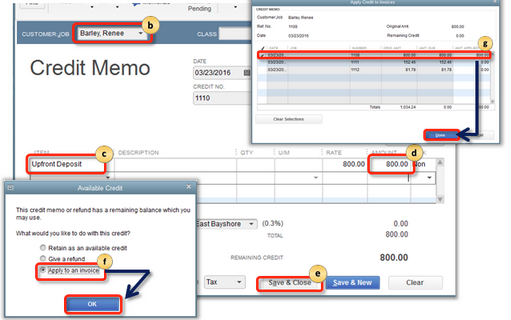

- First, in the Customer field, choose Create Credit Memos/Refunds.

- Now, in the Customer: Job drop-down list, choose the customer or job.

- Then, from the Detail menu, choose the Upfront Deposit item you created from the Item drop-down list.

- After this, from the Amount section, enter the amount of the deposit or retainer.

- Choose the Save and Close option.

- In the Available Credit pop-up dialog box, choose Apply to an Invoice and select OK.

- In the Apply Credit to Invoice dialog box that appears, select the invoice to where you intend to apply the upfront deposit or retainer and choose the Done option.

The upfront deposit or retainer is credited to the specified invoice.

Refunding of Upfront Payment or Retainer on No-delivery of Service

To handle a cancelled job with an upfront deposit, either retain part or all of it by creating an invoice with a negative deposit amount, or issue a full refund via a credit memo. Suppose a customer cancels a job for which you’ve received an upfront deposit or retainer; the deposit doesn’t stay as a liability.

There are two options through which you can handle initial deposits or retainers for cancelled orders, depending on your business process:

- Retain all or part of the deposit

- Repay the whole deposit to the customer

The following points give the detailed steps for each option.

Option A: Retain all or part of the deposit of an upfront deposit or retainer

To keep all or a section of the deposit after a job or order gets cancelled:

- First, create an invoice for the customer.

- Now, from the Detail section, choose the relevant item for the cancelled project or job from the Item drop-down menu.

- Then, from the next available line, choose the item that you’ve created for Upfront Deposits in the Item drop-down menu.

- After this, enter the amount of the deposit that you’re keeping as a negative value in the Amount field.

- In the Description menu, include a note to make it simple to track this transaction in reports. (Optional step)

- Choose the Save and Close option.

The section of the upfront deposit or retainer you keep is recorded as income, and the part you don’t keep is recorded as refunded to the customer.

Option B: Repay an upfront deposit or retainer

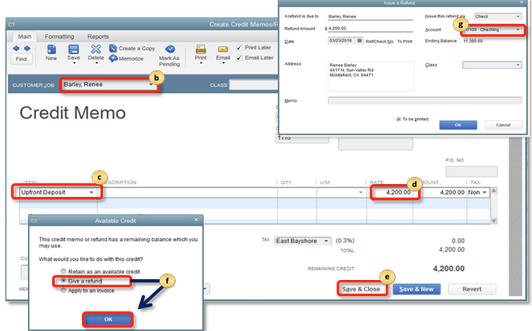

Follow the steps mentioned below to issue a refund:

- First, in the Customer menu, choose Create Credit Memos/Refunds.

- Now, in the Customer: Job drop-down menu, choose the customer or job.

- Then, from the Detail menu, select the Upfront Deposit item you’ve created from the Item drop-down menu.

- After this, enter the amount which will be refunded in the Amount menu.

- Choose Save and Close.

- In the Available Credit pop-up dialog box, choose Give a refund and choose OK to close the dialog.

- In the Issue, a Refund dialog box appears. Select the bank account where the upfront deposit or retainer was initially deposited from the Account drop-down menu and choose OK to close the dialog box.

You have the option to specify how to refund the customer utilizing the options on the Issue this refund via drop-down section.

- Lastly, choose the Save and Close option.

The refund is provided for the full amount of the upfront deposit or retainer.

How to Record a Customer Deposit in QuickBooks Online?

Some businesses collect retainers or deposits from customers before performing any services. When they invoice customers for services, the money from the deposits is used to pay the invoices.

You can establish a deposit or retainer process for your company in QuickBooks Online. The retainer or deposit is recorded as a liability to indicate that, although your business is holding the money from a deposit or retainer, it will be used to pay for the services. Upon invoicing the customer and receiving payment, you will convert the liability into income.

To record a customer deposit in QuickBooks Online, first create a liability account and a retainer item. Then, record the deposit via a sales receipt or invoice, and convert it to income upon invoicing. If using a separate trust account, transfer funds to your operating account once income is recognized.

Following the step-by-step information below:

Step 1: Create a liability account

First, you must create a liability account to keep track of the money you’ve received from your customers.

- Navigate to Settings, then choose Charts of Accounts.

- Now, choose New.

- Then, from the Account Type drop-down menu, choose Other Current Liabilities.

- After this, from the Detail Type drop-down menu, choose Trust Accounts Liabilities.

- Enter a Name for the account of your choice (for example, Trust Liabilities) or accept the suggested name.

- Choose a Default Tax Code, then an Unpaid balance, and an as-of-date.

- Lastly, choose the Save and Close option.

Step 2: Create a retainer item

- First, navigate to Settings, then choose the Products and Services option.

- Now, choose New.

- Then, from the Product/ Service information panel, choose the Service option.

- Enter the name of the new product or service item (for example, retainer).

- After this, from the Income account drop-down menu, choose the liability account that was created in Step 1.

- Choose the Save and Close option.

The retainer item can be selected when generating an invoice or sales receipt to document a deposit or retainer payment.

Step 3: Establish a trust liability bank account (Often Optional)

Only some people are required to complete this step, so follow this step only if you keep the money from customer retainers and deposit it in a different trust account.

If you keep your money in an operating account, then this method is unnecessary. When you’re in doubt, try to reflect on your real-world situation as much as possible.

- Navigate to Settings, then choose Charts of Accounts.

- Choose New.

- Now, from the Account Type drop-down menu, Choose Bank.

- Then, from the Detail Type drop-down menu, choose Trust Account.

- Enter the name of the account of your choice (for example, Trust Liability Bank Account) or accept the suggested name.

- Choose a Default Tax Code, then enter a Balance and an as-of-date.

- Choose the Save and Close option.

Step 4: Generate sales receipt or invoice for deposits or retainers

Once the account is set up and the retainer or deposit item, you can start making the Sales receipts for the deposits or retainers you receive.

If you would like to invoice customers for deposits or retainers rather than receiving them directly, jump to Option 2.

Option 1: Create a sales receipt

- First, choose + New.

- Now, choose the Sales receipt option.

- Choose the Customer name from the drop-down menu.

- After this, from the deposit to drop-down menu, select the account trust liability bank you created, your main operating account, or the account where this money will be kept.

- Now, from the Product/Services column, choose the Retainer or Deposit item that you have set up.

- Then, enter the amount that is received from the retainer or deposit in the Rate or Amount column.

- Choose the Save and Close option.

Moreover, adding the retainer or deposit amount to the specified bank account increases the amount in your liability account to appear that the funds are not yet yours and should not be treated as income until a later time.

Option 2: Invoice customers for deposits or retainers

Rather than creating Sales receipts, you also have the option to invoice customers. Here’s how.

All the steps are similar to creating a Sales receipt, except you will select a Deposit to account once you receive payment against the invoice.

Note: Cash-basis reports will not reflect deposits/retainers considered received until the invoice is paid in full. Consult with your accountant regarding a workaround that includes a journal entry.

- First, choose + New.

- Now, choose an invoice.

- Then, choose the Customer name from the drop-down list.

- After this, from the Product/Service column, choose the Retainer or Deposit item that you’ve set up.

- Enter the amount that you’ve received from the retainer or deposit in the Rate or Amount column.

- Click on the Save and Close option.

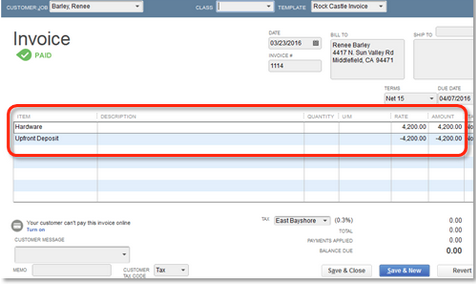

Step 5: Convert retainers into credits on invoices

When you charge for the services you’ve performed for your customers, you can turn the retainer or deposit you’ve previously received as a credit on an invoice and accept it as payment.

- First, make an invoice for your customers which lists the services or goods you’ve provided.

- Now, from the last line of the invoice, in the Product/Service section, choose the Retainer or Deposit item.

- Then, enter the retainer amount as negative to subtract it from the invoice. You’re not allowed to enter an amount greater than the invoice total.

Note: An invoice can have a zero total, but it cannot have a negative one.

- Choose the Save and Close option.

This reduces the amount in your liability account and credits it towards your customer’s invoice, making it into income. The money becomes yours.

Step 6: Move funds from your trust liability account to your operating account

If you’ve created a different trust liability account to hold retainers or deposits, once the retainer is turned into income, you can move that money to your operating bank account.

- First, select + New.

- Now, select Transfer.

- Then, from the Transfer Funds From the drop-down menu, choose your trust liability bank account.

- After this, from the Transfer Funds To drop-down menu, choose your operating bank account.

- Enter the amount that you’ve received as payment for the invoice.

- Select the Save and Close option.

The funds are documented as transferred from the designated trust account to your business’s operating account.

Comprehensive Guide to Recording Customer Deposits in QuickBooks Desktop and Online

Recording customer deposits accurately is essential for maintaining precise financial records and building client trust. QuickBooks Desktop and Online offer tailored tools to manage deposits and retainers efficiently. This guide walks you through essential steps to set up liability accounts, record deposits, apply them to invoices, and handle refunds. By following these practices, businesses can avoid common accounting errors, ensure compliance, and improve cash flow management. Whether you’re new to QuickBooks or looking to refine your process, this guide equips you with clear, actionable insights for seamless deposit management.

Importance of Differentiating Between Deposits and Retainers in Accounting

Customer deposits and retainers differ in purpose, timing, and accounting treatment. Deposits are funds given before delivery of goods or services. Retainers are advance payments to secure ongoing services. Properly distinguishing these helps avoid misclassifying liabilities and income, ensuring accurate financial reporting. For example, deposits must be tracked as liabilities until service completion, while retainers may be recognized as income over time. According to accounting standards, mixing these can cause tax errors, mislead stakeholders, and complicate audits. In 70% of small businesses, unclear deposit handling leads to cash flow issues. Clear differentiation supports compliance, improves transparency, and builds client trust.

Common Mistakes to Avoid When Recording Customer Deposits in QuickBooks

Many businesses make five common mistakes when recording customer deposits in QuickBooks. First, 60% fail to set up a separate liability account, mixing deposits with income. Second, 45% forget to apply deposits to invoices, causing overstated liabilities. Third, 50% do not reconcile deposits regularly, leading to discrepancies. Fourth, 30% neglect tracking deposits by customer, reducing reporting accuracy. Lastly, 40% incorrectly refund deposits without proper documentation. Avoiding these errors ensures precise financial records, simplifies audits, and improves cash flow visibility. Proper training reduces mistakes by 70%, helping businesses maintain trust and compliance effortlessly.

Customizing Liability Accounts for Different Types of Deposits

Customizing liability accounts in QuickBooks helps track various deposit types accurately. For example, 3 main categories are customer deposits, retainers, and security deposits. Assigning separate accounts for each enhances clarity and financial control. Businesses using 2-5 liability accounts report 30% fewer reconciliation errors. This practice simplifies month-end closing and audit preparation. Tailored accounts allow detailed reporting by deposit type, improving decision-making. For companies handling over 100 deposits monthly, customization boosts efficiency by 40%. Clear segregation prevents misstatements, aligns with accounting standards, and builds stronger client confidence through transparent records.

Handling Partial Deposits and Retainers in QuickBooks

Managing partial deposits and retainers accurately in QuickBooks is critical for cash flow and client relations. Around 35% of businesses receive partial payments, requiring clear tracking to avoid revenue confusion. Recording partial deposits as liabilities until service completion ensures precise financial statements. Applying portions of retainers against invoices prevents double counting and maintains balance accuracy. QuickBooks lets you split payments, improving transparency and reporting by 25%. Clear documentation of partial payments reduces disputes and accelerates payment reconciliation by up to 30%. Efficient handling supports better forecasting, client trust, and compliance with accounting principles.

Best Practices for Reconciling Customer Deposits at Month-End

Reconciling customer deposits monthly prevents errors and ensures accurate financial records. Best practices include matching 100% of deposit entries with bank statements to catch discrepancies early. Use QuickBooks reports to verify deposit liabilities and confirm they align with invoices. Around 80% of businesses that reconcile monthly avoid cash flow misstatements. Set reminders to perform reconciliation within 5 days of month-end closing. Document any adjustments with explanations to support audits. Consistent reconciliation improves financial visibility, reduces errors by 40%, and builds stakeholder confidence. Automating reconciliation can save up to 3 hours weekly, boosting efficiency.

Strategic Insights for Enhancing Customer Deposit Management in QuickBooks

Managing customer deposits effectively is critical for maintaining financial accuracy, ensuring regulatory compliance, and building long-term trust with clients. In QuickBooks, whether using the Desktop or Online version, deposits and retainers must be handled with strategic foresight — not just recorded as transactions, but aligned with broader cash flow, reporting, and client management goals. This guide offers strategic insights into optimizing the deposit process, minimizing common accounting pitfalls, and leveraging QuickBooks features to transform deposit handling into a streamlined, audit-ready, and client-friendly operation. By refining your deposit management strategy, you not only protect your business from financial misstatements but also position it for scalable, client-centric growth.

Using Reports to Monitor Customer Deposit Liabilities in QuickBooks

Monitoring customer deposit liabilities through QuickBooks reports ensures accurate financial oversight and accountability. QuickBooks offers specialized liability and customer reports that track deposits in real-time. About 75% of businesses using these reports detect discrepancies early, reducing errors by 40%. Regularly reviewing the “Accounts Receivable Aging” and “Liability Account” reports helps reconcile deposits with invoices efficiently. Customizing report filters allows tracking deposits by customer, date, or job, improving cash flow analysis. Using these reports monthly supports timely decision-making, audit preparedness, and strengthens client trust by demonstrating transparent accounting practices.

Automating Deposit Tracking with QuickBooks Integrations

Automating deposit tracking with QuickBooks integrations streamlines accounting and reduces manual errors by up to 50%. Tools like payment processors and CRM software sync deposits directly into QuickBooks, updating liability accounts instantly. Over 60% of businesses report saving 3+ hours weekly by automating deposit entries. Automated workflows improve accuracy in applying deposits to invoices, preventing double entries. Integration also enables real-time cash flow visibility, helping businesses forecast more reliably. By reducing administrative tasks, automation allows finance teams to focus on strategy and compliance, enhancing overall operational efficiency.

Impact of Customer Deposits on Business Cash Flow Management

Customer deposits play a crucial role in managing business cash flow by providing upfront working capital. Approximately 65% of small businesses rely on deposits to fund operational expenses before service delivery. Properly recorded deposits ensure liquidity, reduce reliance on credit lines, and improve budgeting accuracy. Mismanagement of deposits can cause cash shortages and disrupt vendor payments. Tracking deposits as liabilities helps distinguish between available cash and owed income. Timely conversion of deposits into revenue, after service fulfillment, strengthens cash flow forecasting and financial stability, supporting sustainable business growth and client trust.

Tax Implications of Customer Deposits and Retainers

Customer deposits and retainers have distinct tax implications that businesses must handle carefully. Deposits are not taxable until goods or services are delivered, while retainers may be taxable based on contract terms. Misreporting can lead to penalties, with 40% of small businesses flagged during audits due to incorrect timing of income recognition. Recording deposits as liabilities delays tax liability until conversion to income. Consulting a tax professional ensures alignment with local laws and GAAP standards. Accurate classification helps avoid double taxation, ensures compliance, and protects the business from legal and financial risks during audits.

Training Your Team to Properly Manage Deposits and Retainers in QuickBooks

Training your team to handle deposits and retainers in QuickBooks boosts accuracy, compliance, and efficiency. Businesses that implement structured training reduce entry errors by 55% and improve reconciliation speed by 35%. Staff should learn to set up liability accounts, record payments correctly, and apply them to invoices without misclassifying income. Using real-world scenarios in training ensures clarity and retention. Regular refresher sessions help teams stay updated with QuickBooks updates and tax regulations. Clear internal procedures supported by training minimize miscommunication, ensure audit readiness, and enhance client satisfaction through reliable financial practices.

In Conclusion

Recording customer deposits in QuickBooks is very easy and helpful. By constantly recording these payments, businesses can improve their cash flow management and can promote strong client relationships.

FAQ

Why must I use a Liability Account instead of an Income Account for customer deposits?

Under generally accepted accounting principles (GAAP), a customer deposit or retainer is classified as a liability because it represents an unfulfilled obligation to the customer.

- The Funds Are Not Yet Earned: Your business has received cash, but you have not yet delivered the goods or performed the services.

- The Funds Are Subject to Refund: If the service is canceled or the product is not delivered, you have an obligation to return the money.

- Revenue Recognition Principle: Revenue is recognized (counted as income) only when it is earned, which occurs upon the delivery of the goods or services. Recording it as income prematurely would misstate your current revenue and potentially overstate your tax liability.

When transferring funds from my Trust Liability Account to my Operating Account in QuickBooks Online, what accounts do I use on the transfer form?

The transfer transaction in QuickBooks Online should only involve your bank accounts, as the accounting adjustment (converting the liability to income) is completed on the customer invoice.

The required steps are:

- Step 1 (Invoicing): The liability is reduced when you apply the retainer item as a negative amount on the customer’s final invoice. This action converts the liability balance to earned income.

- Step 2 (Transfer): You then record the physical transfer of funds:

- Transfer Funds From: Select your dedicated Trust Liability Bank Account (the bank account holding the client’s money).

- Transfer Funds To: Select your main Operating Bank Account (your business checking account).

What is the correct Account Type and Detail Type for the liability account in QuickBooks Online?

Using the correct Account Type and Detail Type ensures your deposit account is properly classified on your Balance Sheet as a current obligation.

The required setup in QuickBooks Online is:

- Account Type: Other Current Liabilities

- Detail Type: Trust Accounts – Liabilities

This classification places the account in the Liabilities section of your Balance Sheet, correctly indicating money owed to others, and not in the Income section of your Profit & Loss report.

What is the best way to handle the Undeposited Funds account when recording a deposit in QuickBooks Desktop?

The recommended workflow involves using the Undeposited Funds asset account as a temporary holding area to ensure your books exactly match your bank statements.

The best practice workflow is:

- Receive Payment/Sales Receipt: When recording the initial customer deposit payment, select Undeposited Funds as the “Deposit To” account.

- Make Deposit: Go to the Banking menu and select Make Deposits. Select the individual payments from the Undeposited Funds account that physically match the single, bundled deposit you made at the bank.

Goal: This method prevents reconciliation errors because the single amount recorded in QuickBooks via the “Make Deposits” window will perfectly match the single deposit line item on your bank statement.

If a customer cancels and I must issue a full refund, how do I accurately reverse the liability in QuickBooks Desktop?

You must use the Create Credit Memos/Refunds function to reverse the original liability and generate the refund check in a single, auditable process.

The correct procedure is:

- Create Credit Memo: Go to Customers and select Create Credit Memos/Refunds. Select the customer and use the Upfront Deposit item (which points to your liability account). Enter the full deposit amount.

- Issue Refund: After saving the Credit Memo, when prompted by the Available Credit dialog box, choose Give a refund.

- Finalize: Select the bank account from which the money will be paid and choose the refund method (Check, Cash, etc.).

This process ensures the liability account balance is reduced by the refund amount, and the bank account accurately reflects the outflow of cash.

What reporting risk do I face if I do not regularly reconcile my customer deposit liability account?

The primary risk is misstated financial health due to an inflated Balance Sheet.

Failing to reconcile means:

- Overstated Liability: The account balance will be inflated because it includes deposits that should have been applied (converted to income) on final invoices but were missed. Your Balance Sheet will incorrectly show a higher amount owed to clients.

- Income/Tax Misstatement: If you forget to apply a deposit to the final invoice, the income for that sale is understated. This can lead to inaccuracies in gross profit calculation and, critically, incorrect tax reporting.

- Audit Failure: You cannot prove during an audit that the large balance in the liability account is genuinely owed to current clients.

Why do my QuickBooks cash basis reports show zero income for a deposit I just received and recorded?

This is the correct, intended behavior under cash basis accounting when the deposit is properly recorded as a liability.

The cause and effect are:

- Cash Basis Rule: Cash basis reports recognize income only when cash is received and that cash is posted to an Income Account.

- Deposit Recording: When you receive the deposit, you post the transaction to the Other Current Liabilities account. Since this is a liability account (not an income account), the cash basis report ignores it.

Disclaimer: The information outlined above for “How to Record a Customer Deposit in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.