Cash management is critical to businesses for the simple reason that, through cash management, there is always liquidity to perform the corporation’s day-to-day financial activities and also optimal use of cash resources as available. Efficient cash management helps corporations keep running with smooth operations, avoiding crises and being well-prepared for growth.

Monitoring, analyzing, and controlling a company’s cash flow is important to maintaining liquidity, reducing borrowing costs, mitigating risks, and ensuring the company has enough money to operate. Strong cash management is essential to preserving a corporation’s financial health and success in today’s fast-paced and competitive business environment.

What is Cash Management?

Cash management is the process of optimizing cash flow to ensure a business has sufficient funds for daily operations while effectively investing surplus cash. The main objectives of cash management are meeting financial obligations, investing surplus cash, optimizing cash holdings, and planning for future cash needs.

Effective cash management contributes to a company’s financial stability and growth by providing visibility into cash positions, negotiating favorable payment terms, and establishing efficient collection methods.

Why is Cash Management Important for Your Business?

In many ways, cash management is very important for establishing and maintaining a company’s fiscal foundation. Being the most commonly used method of paying obligations, such as utilities and other bills, cash is the largest earning asset and hence should be managed as such. It alters the sum of future growth for the company. Another consideration that many firms deem very crucial is the ability to keep balances of cash while at the same time earning a return on such cash if it is idle.

Cash management can be linked to your company’s banking system and its associated applications that allow you and your business administrators to access funds all day long, every day of the week. If your company is directly connected with online banking, it provides better control of your cash flows and is more accessible. This flexibility is crucial since every business entity is unique and may require various cash management options and services.

Effective cash management during a recession is particularly important, as it helps businesses navigate financial challenges by optimizing liquidity and minimizing costs. Additionally, cash management is essential for students to manage limited funds which helps them to budget effectively and avoid unnecessary debt.

Cash Management at Various Stages of the Business

Depending on the stage of the firm, different cash management techniques are used. For instance, established businesses may concentrate on maximizing cash flow to support development and expansion, but startups may prioritize liquidity to meet initial operational costs. Businesses must carefully strike a balance between keeping enough working capital and investing in new prospects during a growth phase. Managing cash flow becomes even more important to ensuring survival during a recession or other economic crisis. Depending on the unique financial constraints and objectives of each phase, a customized strategy for cash management is required.

How Does Cash Management Work?

Cash management is the process which manages the company’s cash flows to make sure that there is sufficient liquidity to meet its financial obligations. This also includes tracking cash inflows and outflows, forecasting future cash requirements, and deciding how to invest surplus cash to generate returns.

Cash management includes various steps:

- Make a cash budget that will forecast cash inflows and outflows.

- Execute cash flow management strategies, such as giving discounts for early payments.

- Negotiate with your suppliers to enter into the best payment terms with them.

- Invest surplus cash in low-risk, short-term instruments such as money market funds or short-term government securities.

- Monitor cash balance regularly and also review your fund management plans.

What is the Importance of Cash Flow Statement in Cash Management

A cash flow statement is considered a very crucial aspect through which a cash flow management plan can be created.

The cash flow statement records all the cash flows of a business, including:

- Cash Flow from Operating Activities

- Cash Flow from Financing

- Cash Flow from Investing

At the bottom of the cash flow statement it is shown how much cash the business has. The statement can display negative also if there is more outflow that inflow.

A cash flow statement is a key tool which creates a cash flow management plan since it provides the business’s current cash flow performance as a baseline against which to improve.

What are the Different Types of Cash Management?

1. Cash Flow from Operating Activities

Cash management is the process of tracking, evaluating, and regulating an organization’s cash intake and outflow to ensure it has enough money to pay its debts and make the required investments. To put it briefly, it entails overseeing a company’s financial flow.

2. Free Cash Flow to Equity

The cash reserve that remains after capital is reinvested is known as the free cash flow to equity.

3. Free Cash Flow to the Company

The amount of cash generated from operations after depreciation, costs, and taxes are paid is known as free cash flow. This establishes a company’s profitability and is mostly used for financial appraisal.

4. Net Change in Cash

This displays the total cash flow change between accounting years.

What are the Functions of Cash Management?

1. Inventory Management

Inventory management assures to bring out the blockage of any stock causing trapped sales, which contributes to the higher stock on hand. Since excess stock in inventory is an indication of low liquidity, through efficient fund management, firms should endeavor to sell the existing stock, which will translate into inflows.

2. Receivables Management

In the normal course of a credit sale, a sales account has an entry of sale, whereas a collections account remains pending most of the time. Cash management corresponds to meeting all the bill payables to ensure a sufficient amount of liquid cash in the business.

3. Payable Management

Payables are the company’s liability when purchasing any items on credit. Sometimes, organizations obtain loads from lending institutions or banks and are liable to repay within a stipulated time. Hence, effective fund management ensures that the repayment is made on time, avoiding any penalties or compensatory interest.

4. Short-Term Investment

The basic concept of cash management focuses on aspects such as cash deficits and bankruptcy. However, the same account may also be utilized to purchase short-term assets, such as government securities, to increase the value of money.

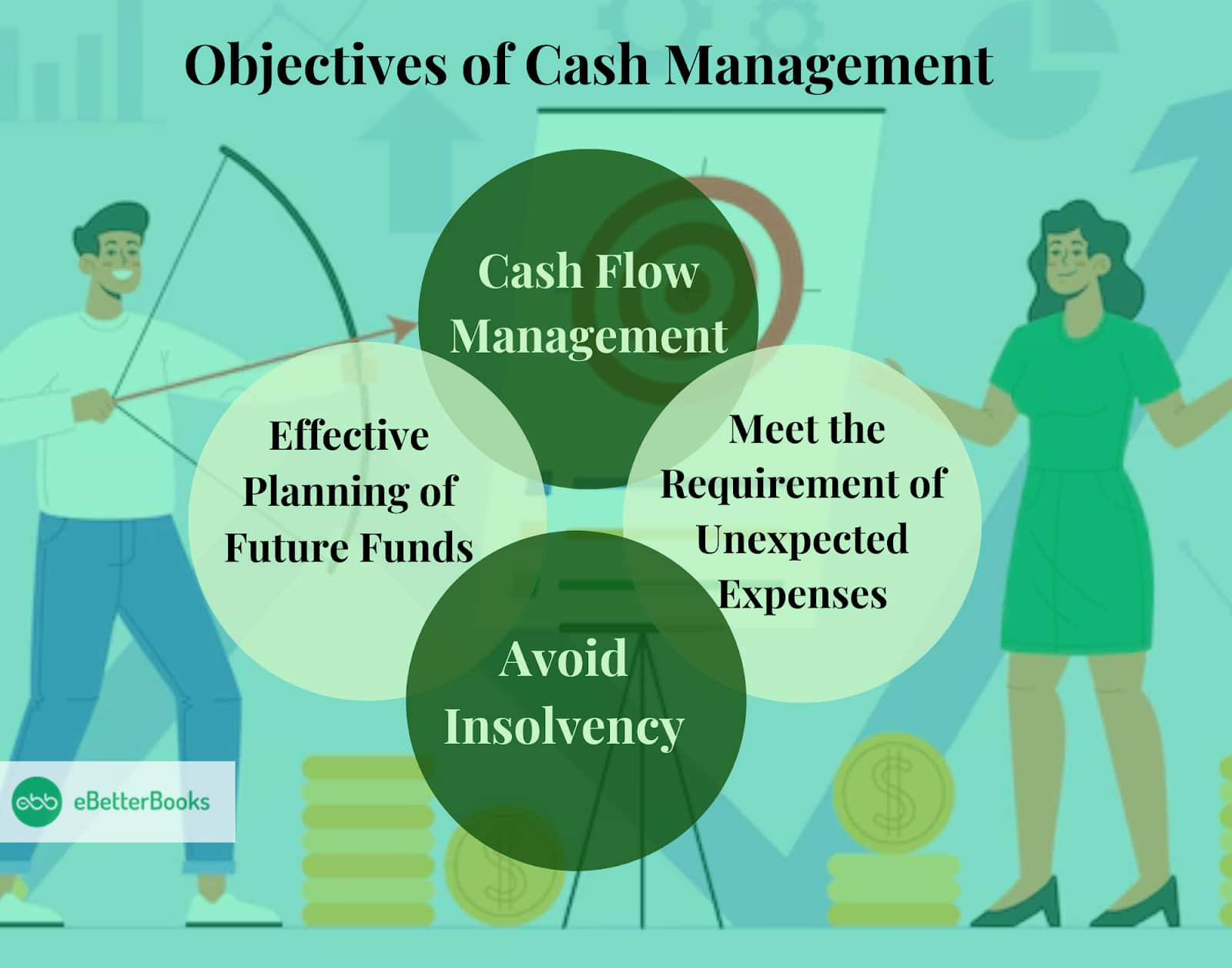

What are the Objectives of Cash Management?

1. Cash Flow Management

The major goal of cash management is, therefore, the control of cash inflows and outflows. In particular, the approach minimizes fund loss and, at the same time, facilitates inflow, therefore warranting a firm’s optimistic financial position. It controls all areas of cash expenses and, consequently, achieves measures to limit their occurrence; it reduces operating costs.

2. Effective Planning of Future Funds

It also manages cash by making more of the future cash to meet the near-future cash demands. This also helps to decide efficient capital expenditures and calculate the financial ratio analysis for debt and equity. In other words, after conducting proper planning, the company must also maintain adequate stocks of liquid cash that can be used for any unexpected necessities.

3. Meet the Requirement of Unexpected Expenses

When practicing cash management in an organization, the main goal is to ensure adequate liquid cash to handle any unexpected expenditure. This may include machinery failure or other unforeseen incidents. By maintaining a reserve of petty cash, the company can address minor, immediate expenses without dipping into surplus cash, ensuring smooth operations even in the face of unexpected costs.

4. Avoid Insolvency

Inadequate cash management will lead to a cash shortage, which will lead to failure in bill payments. This can lead to insolvency and erase the organization’s goodwill, which can pose a considerable threat to the organization.

Reasons for Poor Cash Management

Here are few reasons that result in poor cash management:

- Poor Understanding of the Cash Flow Cycle: A lack of knowledge about how cash moves in and out of a business can lead to mismanagement. A company can run out of money because it over-purchases inventory yet does not receive payment for it.

- Unpredictable Cash Flow: When a business has irregular or unpredictable income, it becomes challenging to manage cash effectively. Unexpected expenses or delays in receiving payments can quickly deplete cash reserves, leading to cash flow problems.

- Lack of Understanding of Profit Versus Cash: Many business owners confuse profitability with cash flow. Just because a business is profitable on paper doesn’t mean it has sufficient cash on hand to cover expenses. Understanding the difference between profit and cash is essential for proper cash management.

- Low Profits: If a business operates with low-profit margins, it may struggle to generate enough cash to cover expenses and invest in growth. Low profits can be caused by factors such as high costs, intense competition, or a lack of pricing power.

- Late Payments: When customers pay their invoices late, it can create cash flow problems for the business. Late payments disrupt the cash flow cycle and make it difficult to predict when cash will be available to cover expenses.

- Low Prices: Offering low prices to attract customers can be a double-edged sword. While it may increase sales volume, it can also lead to low-profit margins and insufficient cash flow to sustain the business.

- High Overhead Expenses: Excessive overhead expenses, such as rent, utilities, or administrative costs, can quickly consume a business’s cash reserves. Keeping overhead expenses under control is crucial for maintaining healthy cash flow.

- Poor Financial Planning: A lack of financial planning can lead to poor cash management. Without a clear understanding of financial goals, budgets, and forecasts, it becomes difficult to make informed decisions about cash allocation and investment.

- Poor Inventory Management: Holding too much inventory can tie up cash that could be used for other purposes, such as paying expenses or investing in growth. On the other hand, running out of inventory can lead to lost sales and dissatisfied customers.

Ways to Improve Cash Management

- Shorten the credit period by controlling the receivables through the enhancement of the billing and collection cycle.

- Increase the cash inflows by entering into lucrative negotiations with the suppliers.

- Minimize traditional payment practices and integrate variable online payment systems.

- For effectiveness, conduct a review and update of the cash management procedures and policies from time to time.

- The control should perform routine audits of cash management to determine areas requiring more attention and to observe all the relevant compliances.

- Find and track non-essential expenditures that lead to a decrease in cash expenses.

- Improve the cash management strategies to ensure that the company’s cash balances and cash transactions are more apparent.

What are the Cast Management Strategies?

1. Budgeting and Forecasting

Budgeting and forecasting are cash management techniques that involve planning for an organization’s various sources of cash inflow potential. Based on this forecasting, the accounting department develops a budget for managing operations in case of any shortfalls in meeting the forecasted amounts.

2. Negotiating Favorable Terms of Payment

When forming a contract to enter business, payment conditions must be agreed upon to ensure efficient cash inflow management. Appropriate practice standards, such as offering certain percentages off if customers pay before the agreed time, must also be developed.

3. Establishing Better Collection and Billing Methods

This is an optimistic way of cash management; thus, it is wiser to incorporate the best collection and billing method in a company. In some aspects, less complicated and time-consuming processes, such as online payment gateways, shall be applied so that there can be ease in paying the credit.

4. Lowering Expenses

As one basic approach to managing cash, organizations have to find avoidable expenses and eliminate them to preserve cash. Thus, for instance, different cost-saving measures and better contract terms with clients can regulate expenses to some extent.

5. Keeping Sufficient Cash Reserves

It helps to keep a second reserve of adequate cash for rainy days and emergencies. Such cash reserves can be used to compensate for any undesirable incidents.

Important Terms in Cash Management

Below mentioned is the list of important terms in Cash Management:

- Cash Flow: The Flow of money in and out of a business.

- Cash Flow Statement: This is an essential financial document that shows cash-related operating, investing, and financing activities.

- Accounts Receivable (AR): This is the amount of money that clients owe a business for the goods or services provided to them under credit terms.

- Accounts Payable (AP): The money that is owed to suppliers for goods or services that are purchased on credit.

- Working Capital: An indicator of a business’s short-term operational liquidity, defined as the difference between current assets and current liabilities.

- Current Ratio: The current ratio is one of the liquidity ratios used to determine a company’s capacity to meet the immediate payment of its stock through current assets.

- Quick Ratio: A short-term working capital indicator calculated based on a firm’s current capacity to transform its most easily realizable assets into liability payments.

- Collection Process: It refers to the process of recovering an amount due to the business from customers about bills issued.

- Cash Disbursement: The payment of cash for consumptions or other commitments or other necessities or arising from other obligations.

- Cash Forecasting: The activities that look into the future to determine the amount of cash that is expected to flow in and out of an organization.

Understanding Cash and Cash Equivalents in Cash Management

Cash includes physical currency, such as coins and banknotes, along with funds in checking accounts that can be accessed immediately. Cash equivalents, on the other hand, are short-term investments that are highly liquid and can be converted into cash within three months or less.

Common examples of cash equivalents include:

- Treasury bills

- Commercial paper

- Money market funds

- Bank certificates of deposit (CDs)

These assets are characterized by their low risk of value fluctuation and ease of conversion into cash, making them essential for liquidity management.

Its Importance in Cash Management

- Liquidity Management: CCE plays an important role in a company’s liquidity management strategy. It provides the necessary funds to cover immediate operational expenses, such as paying suppliers, covering payroll, and managing other short-term liabilities. A robust CCE balance indicates a company’s ability to meet its financial commitments without delay.

- Financial Stability: Organizations can navigate unexpected financial challenges, such as economic downturns or sudden rise in operational costs by maintaining an adequate level of cash and cash equivalents. This stability allows companies to avoid potential liquidity crises that could jeopardize their operations.

- Investment Opportunities: Companies often invest excess cash in cash equivalents to earn a return while maintaining liquidity. This strategy allows businesses to capitalize on short-term investment opportunities without sacrificing their ability to access funds quickly when needed.

- Compliance and Risk Management: Many lenders require businesses to maintain certain levels of CCE as part of loan agreements. This requirement serves to protect lenders’ interests while encouraging companies to manage their liquidity effectively.

Liquidity Ratio to Measure Cash Efficiency

A Liquidity ratio is a financial ratio used to determine whether a company is able to pay its short-term obligations. This metric helps a company determine whether it can use current or liquid assets to cover its current liabilities.

There are three types of liquid ratios mentioned below:

- Current Ratio: The current liquidity ratio is the easiest one to calculate and interpret. To find it, divide current assets by current liabilities.

- Quick Ratio: The quick liquidity ratio, also known as the Acid test ratio, is used to identify whether a company has enough liquid assets that can be instantly converted into cash to meet short-term dues.

- Cash Ratio: The cash liquidity ratio only considers a company’s most liquid assets—cash and marketable securities. These are considered the most readily available assets for a company to pay its short-term obligations.

What is ACH?

ACH, known as Automated Clearing House, is a method of making payments electronically in the U.S. It is managed by the National Automated Clearing House Association (NACHA). ACH debit and credit transactions initiated through consumer electronics will be cleared on the same day. Organizations that create these transactions are referred to as ACH Originators.

ACH transactions are electronic payments made when the customer authorizes an ACH-originating institution to make direct debit or credit from or to the customer’s checking or savings account. An example of applying utilitarianism is an employer providing the option of payroll Direct Deposit.

Tools to Manage a Business Cash Flow

Various tools, such as automation, APIs, and treasury management software, can assist in this process.

1. Automation

Automation helps businesses to simplify cash flow management by reducing manual tasks and minimizing errors.

Key benefits include:

- Efficiency: Automated systems can handle repetitive tasks such as invoicing, payment processing, and cash flow forecasting, allowing finance teams to focus on strategic activities.

- Real-time Data: Automation provides real-time visibility into cash positions, enabling businesses to make informed decisions quickly.

- Reduced Costs: Automation can significantly lower operational costs associated with cash management processes by minimizing manual effort.

2. APIs (Application Programming Interfaces)

APIs facilitate the integration of various financial systems and applications by enhancing cash flow management capabilities.

Key benefits include:

- Data Integration: APIs allow businesses to connect their treasury management systems with banking platforms, accounting software, and other financial tools, ensuring seamless data flow.

- Customization: Organizations can customize their cash management solutions to meet specific needs by leveraging APIs to integrate functionalities that are most relevant to their operations.

- Real-time Transactions: With APIs, businesses can execute transactions in real-time, improving liquidity management and reducing the risk of cash shortfalls.

3. Treasury Management Software (TMS)

Treasury management software is a comprehensive solution designed to automate and enhance financial operations within a business.

Key features include:

- Cash Management: TMS provides tools for tracking incoming and outgoing payments, ensuring that funds are available when needed.

- Liquidity Management: It enables businesses to monitor their liquidity positions and forecast future cash flows effectively.

- Risk Management: TMS helps identify and manage financial risks such as foreign exchange and interest rate risks.

- Reporting and Analytics: Advanced reporting features allow users to create customizable reports that provide insights into cash flow trends and financial performance.

Is there a difference between cash management and treasury management?

In banking, both Cash Management and Treasury Management are technical names for some services related to cash shuffling. The latter of these two terms is CT; however, it is much more comprehensive and encompasses Treasury Management apart from funding and investments.

The services that can be grouped under cash management when finance professionals are speaking about it are such services as wire transfers, sweep accounts, merchant services, and business credit options.

Managing Cash Through Internal Controls

The following are some of the internal controls applied in a business organization towards the management of efficient business cash flows. It is worth noting that internal controls are many and may include features through which the companies can account for their compliance with the set regulations. Some of these tools, resources, and procedures enhance operations to minimize fraud.

Some of a company’s top cash flow considerations include the following:

- The average length of AR

- Collection processes

- Write-offs for uncollected receivables

- Liquidity and rates of return (RoR) on cash equivalent investments

- Credit Line management

- Available operating cash flow

Cash Management of Working Capital

Working capital is a major component of operating activity cash flows and is influenced by changes in AR and AP. Investing and financing cash flows are typically considered exceptional financial events requiring unique funding techniques.

The difference between a company’s current assets and current liabilities is its working capital. In cash flow management, working capital balances are crucial because they indicate how many current assets a business has available to pay for its current liabilities.

The following are typically included in working capital:

- Current Assets: Cash, inventory, and accounts receivable due in less than a year.

- Current Liabilities: All short-term debt payments due in a year, as well as all accounts payable due in a year.

Example Why Cash Management is Necessary?

In September 2008, the multinational financial services company Lehman Brothers filed for bankruptcy. Inadequate cash management procedures were a major contributing factor in this disaster.

This is how their demise was influenced by poor cash management:

- High Leverage and Illiquid Assets: Lehman Brothers owed a lot of money compared to its equity, which was indicated by its high leverage ratio. They invested a large portion of their money in long-term, illiquid products such as mortgage-backed securities. They were unable to rapidly sell these assets to raise money when their value fell.

- Short-Term Funding: Lehman Brothers’ operations were primarily financed by short-term funding. As market confidence declined, lenders’ reluctance to offer short-term loans resulted in a liquidity crisis.

- Cash Flow Mismatches: Lehman’s cash inflows and outflows were noticeably out of balance. Despite having sizable long-term investments, they were unable to meet their urgent financial needs because those investments could not be sold for a profit fast enough.

- Failure to Maintain Sufficient Cash Reserves: The company did not have enough cash on hand to protect itself from market changes. Even with the option of a cash advance, the severe market conditions and the extent of Lehman’s financial needs made it impossible to stay afloat.

Cash management involves effectively managing cash inflows and outflows. Both consumers and corporations should be aware of this procedure. Effective cash management allows an organization to pay off debt, save for future growth, and maintain cash reserves.

Conclusion:

Adequate cash management is an essential component of a corporation’s success, guaranteeing liquidity, financial stability, and the capability to invest in growth opportunities. By monitoring, analyzing, and controlling cash flows, businesses can guide both challenges and opportunities with confidence. Cash management is not just about balancing the books, it is about strategic planning, optimizing cash reserves, and ensuring that every financial decision supports long-term objectives.

FAQs:

How Can Technology Help in Cash Management?

Technology streamlines cash management by automating processes, providing real-time data, and enhancing decision-making with tools like treasury management systems.

What are the Risks of Poor Cash Management?

Poor cash management can lead to insolvency, inability to meet financial obligations, and lost business opportunities.

How Does Cash Forecasting Benefit a Business?

Cash forecasting helps businesses predict future cash needs and plan accordingly to avoid liquidity issues.