A contractor invoice template is a document that helps independent contractors bill their clients for services rendered or products provided.

Contents

An independent contractor invoice template serves as a standardized form for billing clients for services or products provided.

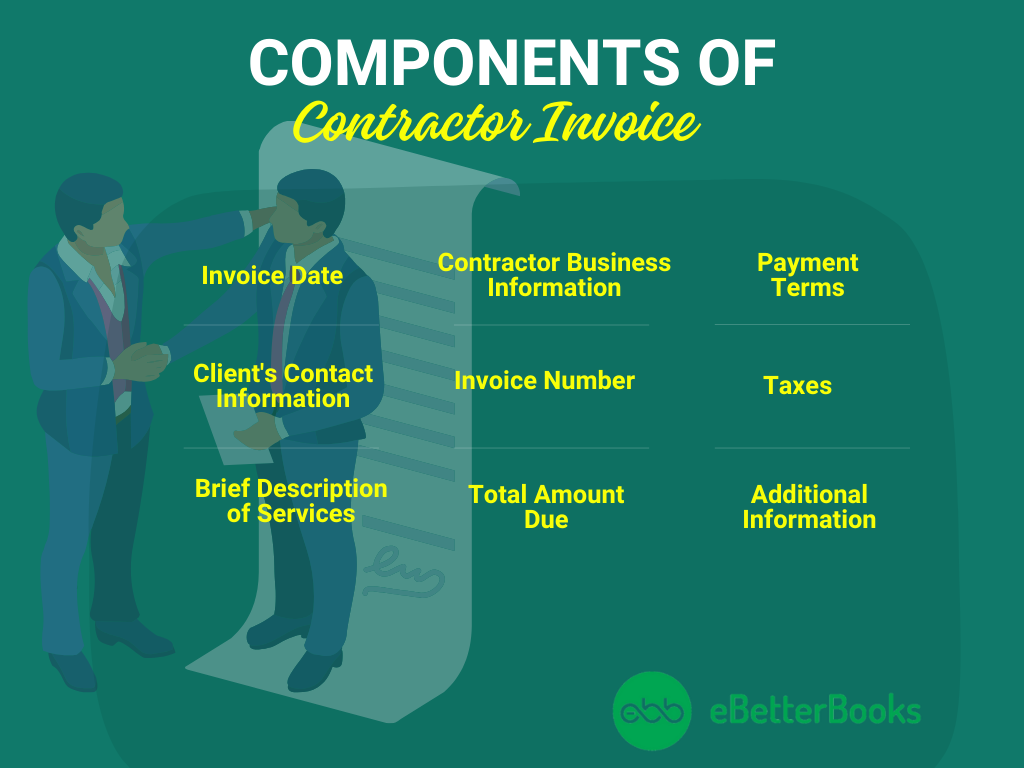

It typically includes information such as the independent contractor’s and client’s contact details, description of the job, materials used, time spent, and total cost for the work.

The contractor invoice template may also include other payment information, like payment methods accepted and taxes.

Using a contractor invoice template can save time by providing a consistent format that can be easily customized for each job.

An independent contractor invoice should include several key pieces of information to ensure it is clear and professional and facilitates prompt payment.

Here’s what you should include:

Choosing the right format for a contractor invoice depends on what your client prefers and the nature of your work.

The most common formats are PDF, Word, and Excel. PDF works the best because it retains the formatting across multiple devices, even if you need to print the invoice.

Microsoft Word format might be better if you want easy customization, as you can easily edit it. If your invoice involves a lot of calculations, use Excel or Google Sheets.

Other than these, you can also use Google Docs and online invoicing software for free contractor invoice templates to create or customize your independent contractor invoice.

When deciding on a format, consider how you plan to send the invoice (email, mail, or hand-delivery, how you want to receive payments, and whether you need to track your invoices for accounting purposes.

Most independent contractors follow the timelines below:

Some contractors send invoices immediately after delivering a project. It is common for one-time services or short-term projects.

Payment is made a certain number of days (15 or 30) after the invoice is issued.

Sometimes, you might receive payments in advance, especially for larger projects or new clients. It can include receiving a portion of the payment upfront and the rest upon completion.

For longer projects, you can create a split payment invoice where you receive part of the payment at the start and the remainder after delivery.

Some contractors prefer to send invoices at the end of the month, regardless of when the work was completed. It is the most common method, and it simplifies bookkeeping and ensures a regular billing cycle.

But, the best payment structure or timeline may also depend on other factors like the urgency of payment, the relationship between you and the client, and access to credit.

The main difference between the two is their role in tax reporting.

Form 1099, specifically Form 1099-NEC, is used by businesses to report payments made to independent contractors who are paid $600 or more per year for their services.

It is important for independent contractors as it documents their income from various clients, which they must report on their tax returns.

An invoice is a document issued by a seller to a buyer detailing the goods or services provided, their quantities, and the agreed-upon prices. It is a request for payment from the buyer.

Unlike Form 1099, an invoice is not a tax document and is not submitted to the IRS.

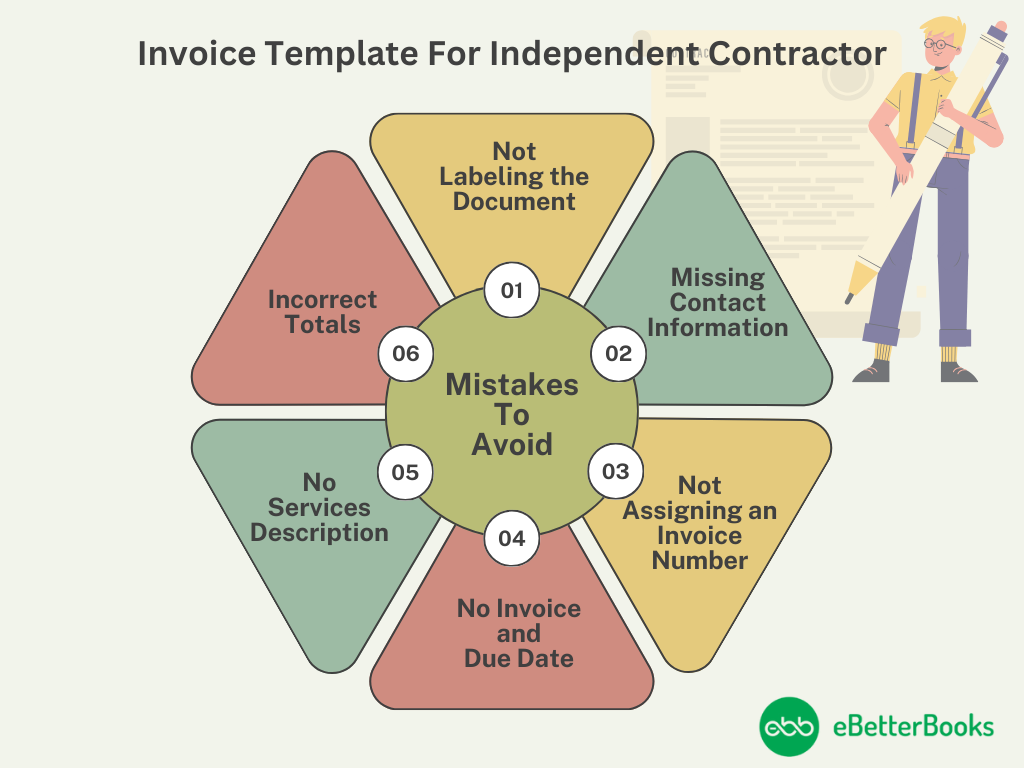

To avoid these mistakes, double-check your invoices for accuracy and completeness before sending your future invoices.

Not clearly labeling the document as an invoice can lead to confusion and delayed payments.

Leaving out important details like company and client contact information can result in invoices being sent to the wrong place or not being processed at all.

Without a uIt’strack invoices and payments.

Not specifying the invoice or due date can cause misunderstandings about payment terms and result in late payments.

Failing to include a clear breakdown of services can lead to disputes over what was agreed upon and what is being charged.

Mistakes in totaling up the invoice or excluding taxes can lead to undercharging or overcharging, both of which are your business relationship with the client.

To make invoicing as efficient and error-free as possible, you can use invoicing software that offers contractor invoice templates and features like automatic reminders, recurring invoices, and a centralized place to store all your invoices.

It can save you time, reduce errors, help you get paid faster, and maintain a steady cash flow.

For more information on billing tips for contractor invoicing, visit the Akounto blog. And if you’re looking to streamline your invoicing process even more, consider signing up with Akounto to manage your finances easily.