Choosing a right small business accounting software, for managing task like handling financial transactions, track expenses, and ensuring compliance with regulations could be very difficult. If we go in to details, small business operations seek to maintain accurate financial records which is an important part for growth and success.

In this article, we will go deep into the comparison of two software– QuickBooks and FreshBooks and make it easy for you to decide which is the best accounting software for you.

Contents

FreshBooks is accounting software that caters to small businesses and independent contractors. Apart from offering traditional double-entry accounting and reporting features, It offers time tracking, unlimited invoicing, basic project management, and basic reporting at a low price. Its unique ability to convert estimates and billable hours into invoices swiftly makes it an excellent choice for service-based businesses, especially for those who need to get paid on the go.

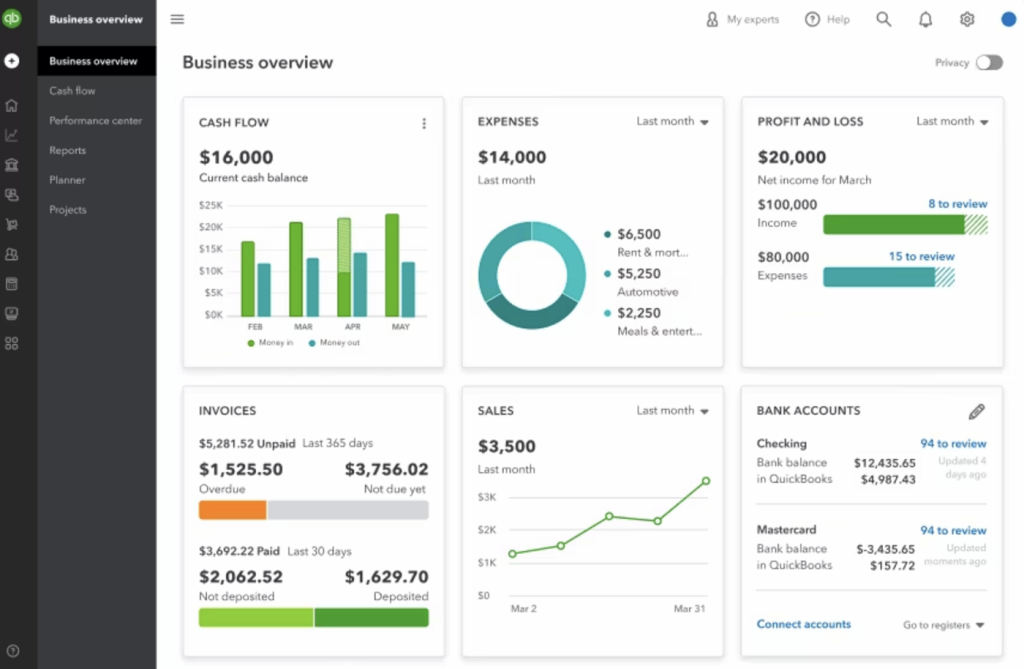

QuickBooks is best for small, medium or large-sized businesses that have plans to grow. It offers more comprehensive accounting and reporting features than FreshBooks, while also providing unique inventory management for those with physical products—as well as lots of automation opportunities. The software is packed with a variety of additional tools that business owners should find useful. These factors make QuickBooks a solid one-size-fits-all choice for small businesses.

FreshBooks and QuickBooks are two accounting software which offer customized accounting system features to meet the needs of businesses. We are comparing the features of both the accounting software platforms so that you can make an informed decision based on your specific requirements:

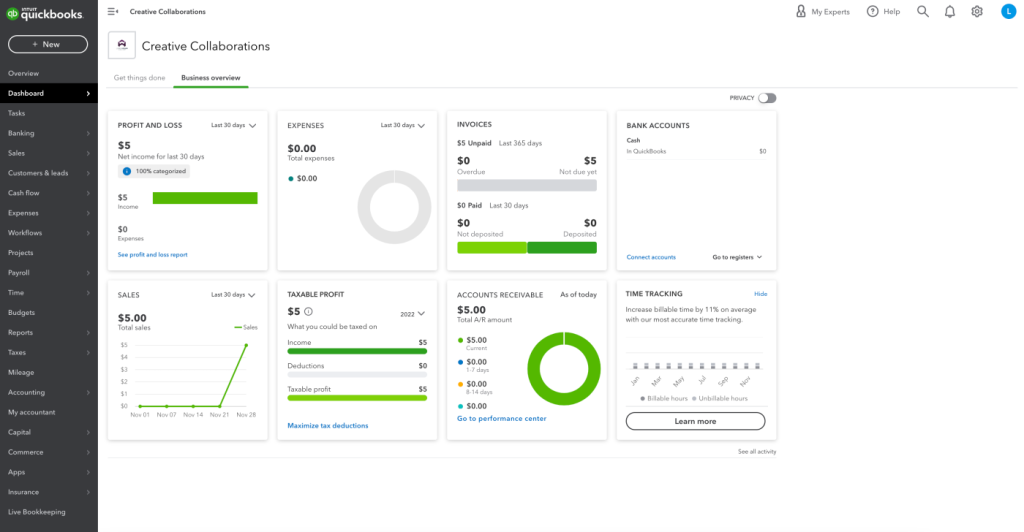

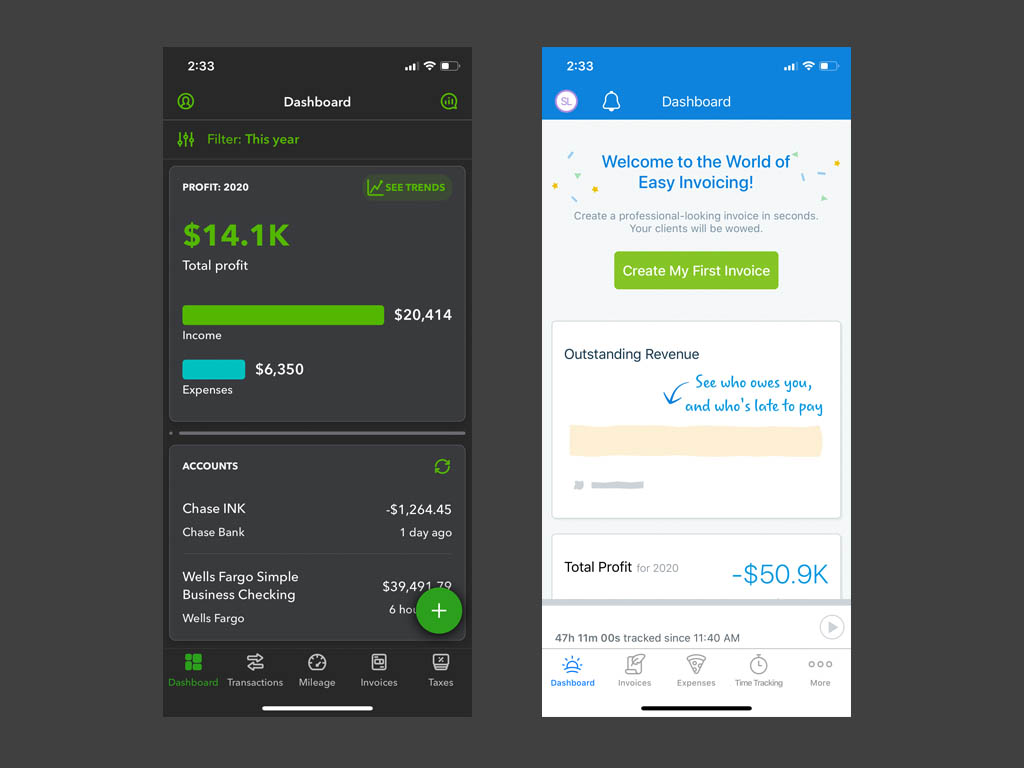

QuickBooks is an accounting software which has a comprehensive, but rather advanced, user interface. Though it may require more training, its complexity makes it possible for a more feature-rich collection of functions, which makes it appropriate for companies with a range of budgetary requirements.

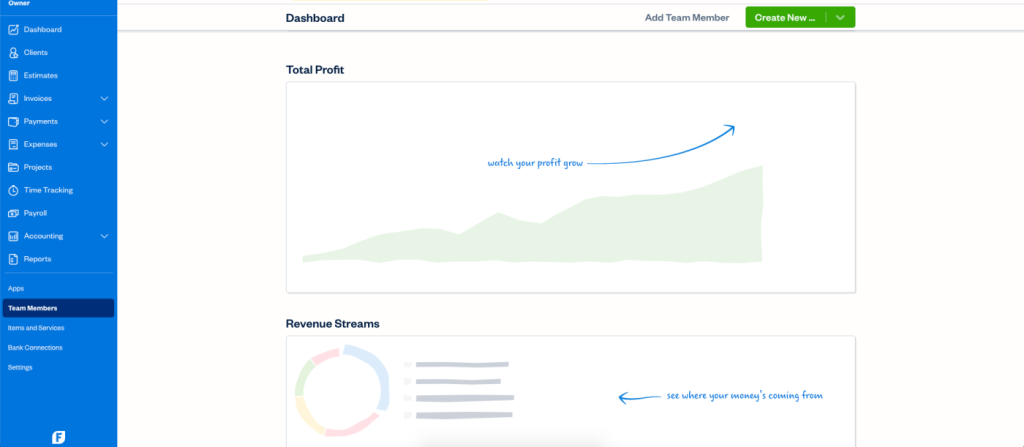

However, FreshBooks is proud of its intuitive user interface. Because of its well-known simplicity, the platform is a great option for small business owners who might not have a lot of accounting experience.

QuickBooks online is the best choice for accounting software. It provides a wide range of features that can help small businesses keep track of their finances, from tracking income and expenses to the accounts receivable, creating invoices and paying bills. It also offers more advanced accounting features, such as automated recurring invoices and advanced customization which makes a better choice for businesses with complicated invoicing requirements.

On the other hand, if you are only looking for some invoicing software and accounting software options, FreshBooks is a better option. It has a simple interface and easy-to-use features that make it perfect for freelancers and small businesses. FreshBooks also integrates with a few other software programs, making it an excellent choice for businesses that need to track their finances in multiple ways. It allows users to create and send professional-looking invoices effortlessly.

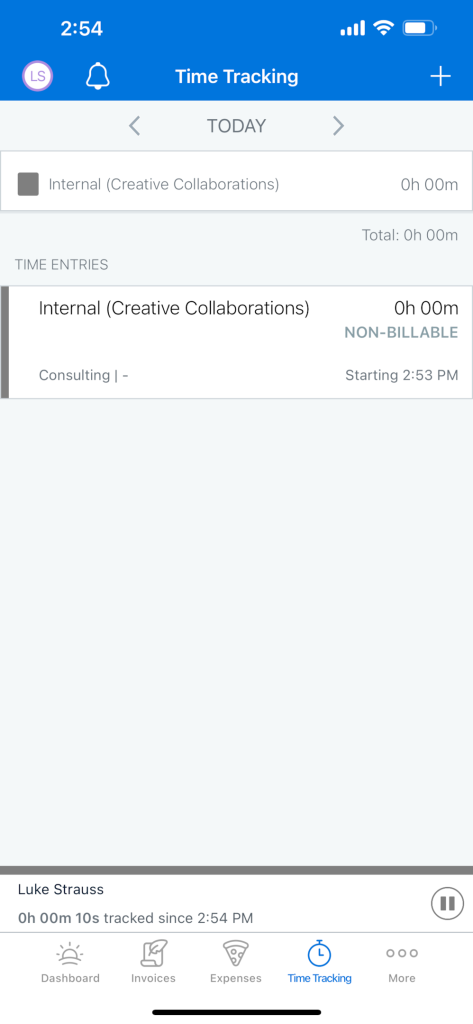

When it comes to time tracking, QuickBooks online as an accounting solution incorporates time tracking functionality which makes it suitable for businesses that bill clients based on hourly work. It seamlessly integrates time data into the invoicing process.

On the other hand, FreshBooks is good in time tracking which offers intuitive features that simplify monitoring billable hours and project management, particularly beneficial for service-oriented small service based businesses.

For companies that handle a lot of spending, QuickBooks online has better options for tracking costs. It is made to effectively handle scenarios involving advanced spending management.

On the other hand, FreshBooks provides an easy-to-use platform for gathering receipts, which streamlines the process of tracking expenses. It guarantees accurate recording of all expenses for efficient financial management.

QuickBooks as an accounting solution is a better option for businesses when it comes to inventory management. Its extensive feature set caters to companies who need to keep close tabs on and manage their goods. It is especially beneficial for quickbooks inventory management for product-based and retail firms.

FreshBooks has fewer capabilities for basic inventory tracking and management and is primarily geared at freelancers and service-oriented firms. It might not be the best option for companies that require a lot of the inventory tracking.

Businesses may create comprehensive financial reports for strategic decision-making with QuickBooks’ rich reporting and analytics tools.

FreshBooks offers crucial reporting features which includes information on revenue, costs, and customer satisfaction. Although it covers the essentials, its reporting features could be seen as being less comprehensive than those of QuickBooks.

With its extensive selection of third-party apps that interact with the platform effortlessly, QuickBooks comes first at integration. Businesses can personalize their accounting software because to this flexibility.

Users can customize their experience and increase functionality by integrating FreshBooks with other applications. In contrast to QuickBooks, the range of integration possibilities could be more constrained.

FreshBooks accounting platform is designed for those who have little or no accounting experience. It is much more accessible for new business owners, freelancers, or solopreneurs. If your business depends on accurate timekeeping to bill for services, FreshBooks includes a native time-tracking tool. This allows you to avoid using third-party alternatives or tracking billable hours manually. But the software lacks some advanced accounting features like profitability and cash flow forecasting.

| Pros | Cons |

| Time tracking is available on all plans to bill clients for service work correctly. | Accounts payable and bank reconciliation aren’t available in its Lite package. |

| Client portals make it easier to pay invoices or view payment history. | Must pay extra to integrate with third-party options for payroll or bookkeeping services. |

| Affordable for freelancers or independent contractors who only need invoicing solutions. | Limited number of users in each plan and the number of clients until the Premium plan. |

QuickBooks is a popular small business accounting platform with essential client invoicing, bill management and bank reconciliation features. It also provides add-ons for more customization such as QuickBooks Payroll, QuickBooks Time, QuickBooks Payments, QuickBooks Checking and QuickBooks Live.

With automatic inventory adjustments, as you sell your products online or invoice your products, you can ensure your stock remains up-to-date. You can also track your product inventory and connect all of your online sales channels, such as eBay, Amazon, or Shopify. It removes the hassle of double data entry in an external inventory management system or spreadsheet and gives you more time to focus on selling quality products instead of tracking them.

| Pros | Cons |

| Scalable price tiers with intuitive features as your needs grow. | Limited native timekeeping features for billable time unless you add on QuickBooks Time. |

| Industry-standard for SMBs, making it easy for your accountant or bookkeeper to monitor your finances. | Higher learning curve due to its advanced accounting capabilities. |

| Hundreds of integrations with human resources (HR), time tracking, and payroll software to facilitate data flow and eliminate double data entry. | Invoice customization in QuickBooks can be less flexible as compared to FreshBooks. |

QuickBooks offers a 30-day free trial for its online accounting software. If you skip the trial, you can avail a 50% discount for the first three months.

Here are the QuickBooks pricing details with four plans:

FreshBooks offers a 30-day free trial, which is followed by a paid subscription.

Here are the pricing details for FreshBooks’ three plans:

| Feature | QuickBooks | FreshBooks |

| Free Trail | 30 days, 50% discount for the first three months if trial skipped. | 30 days, followed by a paid subscription |

| Plan & Pricing | – Simple Start: $30/month (1 user) | – Lite: $13.60/month (5 clients, unlimited invoices) |

| – Essentials: $55/month (3 users) | – Plus: $30/month (50 clients, automated expense tracking) | |

| – Plus: $85/month (5 users) | – Premium: $55/month (Unlimited clients, additional features) | |

| – Advanced: $200/month (25 users) | – Select: Custom pricing based on business needs | |

| – Self-Employed: Starting at $10/month | ||

| What all you get? | – Tools for cash flow, income/expenses, sales tax, and more | – Unlimited invoices, estimates, and expenditure tools |

| – Project profitability and inventory management (Advanced) | – Automated expense tracking and data transmission (Plus) | |

| – In-depth accounting reports and integrations (Advanced) | – Late fees, payment reminders, and email customization (Premium) | |

| – Dedicated account team for on-demand training (Advanced) | – Custom pricing with personalized onboarding (Select) | |

| Self-Employed Package | – Starting at $10/month with basic features | – Three tiers: $10, $15, $20 (Prices double after three months) |

| Mobile Support App | Yes | Yes |

To speed up the online payment processing process and make it more convenient for your customers, businesses can manage their billable clients and accept the online payments by adding a Pay Now button to their invoices.

FreshBooks and both QuickBooks also allow you to take payments through ACH transfers, PayPal, and credit cards. Also, both the software offers smooth interfaces if you take Stripe payments. For a summary of the associated expenses for each of their different payment processing services, see the details that have been described below.

| Payment Acceptance | QuickBooks | Fee | FreshBooks | Fee |

| ACH Bank Transfer | Yes | 1% ($10 maximum) | Yes | 1% |

| Credit card (swiped) | Yes | 2.5% per transaction | Yes | 2.9% + $0.30 per transaction |

| Credit card (invoiced) | Yes | 2.99% per transaction | Yes | 2.9% + $0.30 per transaction |

| Credit card (manually entered) | Yes | 3.5% per transaction | Yes | 2.9% + $0.30 per transaction |

| PayPal (U.S.) | No | N/A | Yes | 3.49% + $0.30 for PayPal accounts; 2.9% + $0.30 for credit and debit cards |

| Stripe (U.S. bank transfer) | No | N/A | Yes | 1% |

| Stripe (U.S. credit card) | No | N/A | Yes | 2.9% + $0.30 |

FreshBooks and QuickBooks both provide mobile apps service for iOS and Android which serves as easy-to-use tool to their online accounting platforms. While the two mobile apps are quite comparable, QuickBooks holds a slight edge in this category due to its inclusion of reporting tools, a feature currently absent in both FreshBooks and’ app.

The QuickBooks mobile app offers users several quickbooks features and the ability to:

With the FreshBooks mobile app, freshbooks users can can effortlessly:

Both the accounting software, FreshBooks and QuickBooks handle integration with other softwar:

FreshBooks accounting software offers features related to expenses, invoicing, estimates, time tracking, and project monitoring.

FreshBooks integrates seamlessly with over 200 apps, including popular ones like Stripe, Gusto Payroll, and Avalara Tax. This extensive integration allows you to enhance functionality in areas such as tax management, online payments, payment acceptance, inventory management, e-commerce, time tracking, and CRM.

Whether you are a consultant, attorney, or self-employed professional, FreshBooks serves your needs by providing features like retainers’ modules and ACH payment acceptance.

QuickBooks Online offers features for managing finances. You can connect with popular apps directly from the application itself. Simply go to the Apps section, where you’ll find a list of recommended apps.

These apps are thoughtfully categorized. For example- Online payment apps like PayPal, Stripe, and Bill Pay are grouped together, allowing you to pay bills through your preferred app within QuickBooks Online.

You can also connect seamlessly to various time-tracking and CRM apps without any hassle. Each platform serves different needs and provides integration options across various categories.

With Freshbooks vs quickbooks comparison, the decision to choose depends on the requirements and circumstances of small business. Both Quickbooks online and Freshbooks serve as an accounting solution for small business owners which comes with features like expense tracking, manage billable clients and mileage tracking and the best one comes down to whether the small businesses sell products or services.

QuickBooks and FreshBooks are competing accounting software. QuickBooks is owned by Intuit, which also owns software like TurboTax and Quicken. FreshBooks is an independent company for solopreneur, freelancer, or small business owners who need accounting software that caters to services rather than products.

Yes of course, small business owners on an average spend less than 30 minutes while getting started in QuickBooks. It also offers unlimited support and access to free training, tutorials, and webinars.

On FreshBooks Payments, you can start accepting credit card payments online right away, even with zero set up required.

QuickBooks keeps your finances organized, providing one place where you can easily manage your business and get real-time insights on how your business is going. Whether your business is just starting out and you need to send your first invoice or you’re an established business and are looking for more insights to grow, QuickBooks has many advanced tools to support your business growth.

QuickBooks is a robust accounting software for small businesses. It offers the most comprehensive feature set that enables business owners, freelancers or entrepreneurs to manage more of their business. While other accounting software offer the basics to manage historical tracking. From automating accounting work and preparing for tax time to proactively managing cash flow, QuickBooks can do it all.

FreshBooks automates lots of your accounting operations so you can spend more time focusing on your work and your clients. You can have invoices automatically generated and sent, expenses automatically tracked and even have your payments automatically recorded, all without you lifting a finger.

FreshBooks is available on any device — desktop, mobile or tablet and even supports both Mac and PC.

Yes, with FreshBooks both you and your team can collaborate and track time towards the same projects and clients. Your team members can also help you with your accounting by creating invoices and tracking their expenses periodically.