Learn the best ways to resolve the QuickBooks Error PS033 like a Pro.

The QuickBooks Payroll Update Error PS033 is a payroll-related issue. Here the user faces difficulty while updating or opening the company file. With this blog, we will learn how to fix QuickBooks Error Code PS033 apart from learning about its causes.

QuickBooks is a user-friendly bookkeeping and accounting software used by millions of business owners worldwide. It helps them prepare many financial statements and tax reports. However, the users have to deal with bugs, also known as QuickBooks Error.

What is QuickBooks Payroll Update Error PS033?

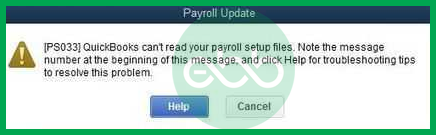

A user faces Error PS033 while they try to download a payroll update. Damage in the CPS folder is another reason why users deal with this error. Also, while trying to access the company file, some of you may go through this error message:

QuickBooks can’t read your payroll setup files. [Error PS033]

Why Does QuickBooks Payroll Update Error PS033 Happen?

Some of the common reasons behind QuickBooks Payroll Error PS033:

QuickBooks Payroll update error code PS033 happens when the users face problems while downloading or updating the Payroll. This error invalidates QuickBooks’ ability to confirm or open the company file because of several issues. Below are some common reasons behind this error:

- Corrupt CPS Folder or Files: The CPS folder, a subfolder of the Payroll Services folder, or any files in the CPS folder are corrupted, a condition that slows down the rate of performing payroll updates.

- User Account Control (UAC) Settings: UAC settings are still enabled, which should disable the payroll update.

- Outdated QuickBooks Desktop Version: Running an older version of QuickBooks can be dangerous because it may create compatibility problems with payroll updates.

- Damaged Company File: When a company file or its entries are corrupt, QuickBooks cannot process payroll updates, regardless of the software’s version and patches.

- Background Program Interference: This may cause bottlenecks, such as other programs running at the same time and intercontinental, causing a delay in the payroll update process.

- Damaged or Invalid Tax Tables: The payroll tax tables are filled with corrupted or invalid data that make updating them challenging.

- Incomplete or Incorrect Billing Information: If some billing detail is incorrect, it may contribute to discrepancies in the payroll update.

- Invalid Service Key, EIN, or PSID: Sometimes, the employer makes a mistake when supplying identification or service keys, causing payroll to not run correctly.

- Payment or Subscription Issues:Payroll subscriptions might be suspended, or there may be some pending payment problems with QuickBooks.

Fixing QuickBooks Error Code PS033: The Solutions

To resolve QuickBooks Payroll Update Error PS033, follow these solutions:

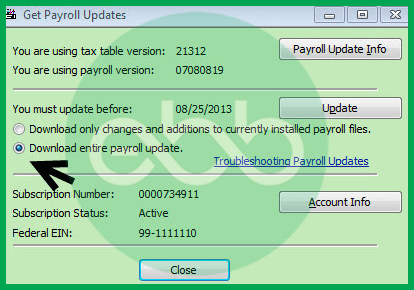

Solution 1: Updating to the Latest Payroll Tax Table

- Open QuickBooks Desktop and navigate to Employees > Get Payroll Updates.

- Select the option to Download the entire payroll update.

- Click Update.

Check if the error persists after the update.

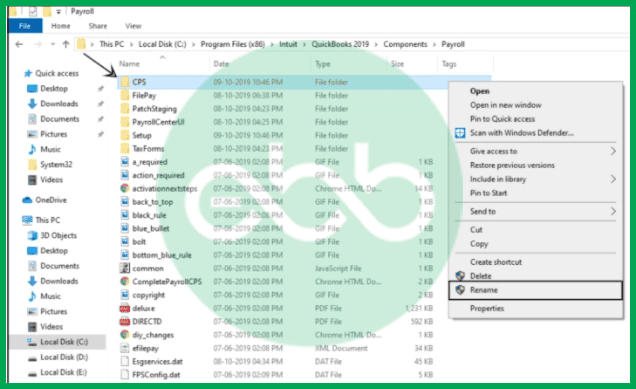

Solution 2: Rename the CPS Folder

- Navigate to the CPS folder using this path:

C:\Program Files\Intuit\QuickBooks 20pp\Components\Payroll\CPS

(Replace “20pp” with your QuickBooks version, e.g., 2018, 2020). - Rename the CPS folder to CPSOLD.

- Reopen QuickBooks and attempt to update the payroll tax table again.

Lastly, check if QuickBooks Payroll Error PS033 is resolved or not. Finally, update the payroll tax table.

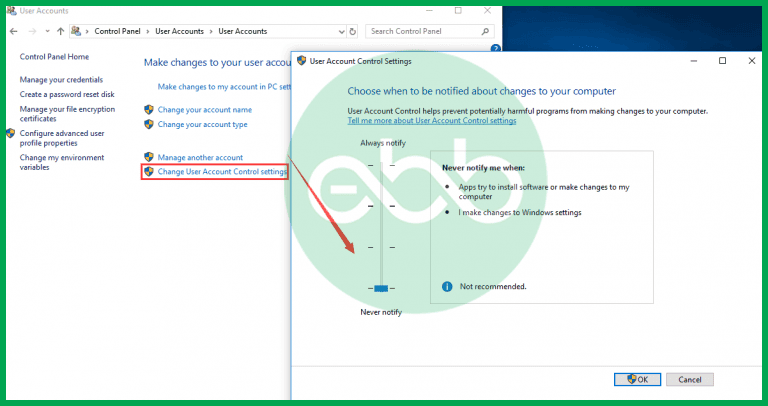

Solution 3: If your computer is infected with the virus, turn off the User Account Control (UAC).

The UAC stands for User Account Control. Whenever a user performs unauthorized changes in the OS, it restricts the activity. Hence, it can also impact the activities of QuickBooks.

- Go to Start > Control Panel > User Accounts.

- Select Change User Account Control Settings.

- Drag the slider Never to Notify and click OK.

- Restart your system and try updating payroll again.

At last, restart the system and redownload the updates. Note that UAC is important for the system’s security. Hence, once the installation completes, switch the UAC back to the Always Notify option.

Solution 4: Troubleshoot in Safe Mode

- Open QuickBooks and go to File > Utilities > Rebuild Data. Follow the prompts to verify and rebuild the company file.

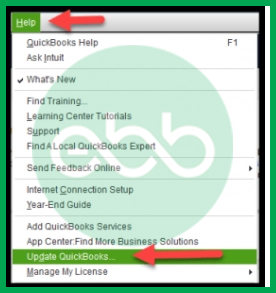

- Update QuickBooks Desktop to the latest version.

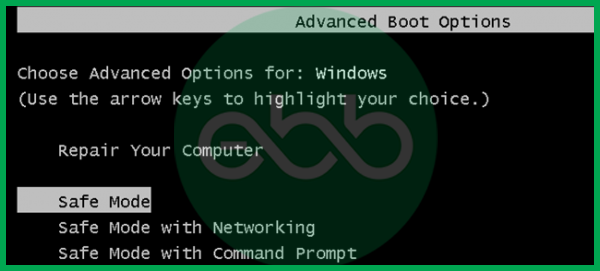

- Restart your computer in Safe Mode:

- Press and hold the Shift key while restarting your system.

- Select Safe Mode from the options.

- Update the QuickBooks payroll tax table.

- Restart the system in normal mode and verify if the error is resolved.

- Once again, enter normal mode by restarting the system and checking whether the problem is fixed or not.

Wrapping Up!

With this blog, we tried to list down all effective methods to solve QuickBooks Error PS033. Our support team keeps updating blogs for all other QuickBooks Errors. The solutions mentioned above will help you solve the issue. In case you cannot fix this error or are unable to understand the issue, reach out to us on our Error Support contact number +1-802-778-9005 for immediate support.

Disclaimer: The information outlined above for “How to Fix QuickBooks Error PS033 – QB Can’t Read Payroll Setup Files?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.