What is EIN?

EIN stands for Employer Identification Number. It is a nine digit unique number which is assigned to the business entity. The EIN is also known as a Federal Tax Identification Number.

EIN is formatted as XX-XXXXXXX.

This number is assigned to the company by the Internal Revenue Service and it includes information about the state in which the company is registered.

Partnership firms, LLC and corporations must get their EIN to file their business income tax return. The different types of organizational structures that require EIN’s are:

- Real estate mortgage investment conduits.

- Businesses with a Keogh plan.

- Farmers’ cooperatives.

- Nonprofit organizations.

- Estates.

- Plan administrators.

- Businesses that pay excise, alcohol, tobacco or firearm taxes.

- Certain types of trusts.

Note: In case of sole proprietors or single member LLC with no employees, they have the option to use the Social Security number instead of EIN, while filing business tax.

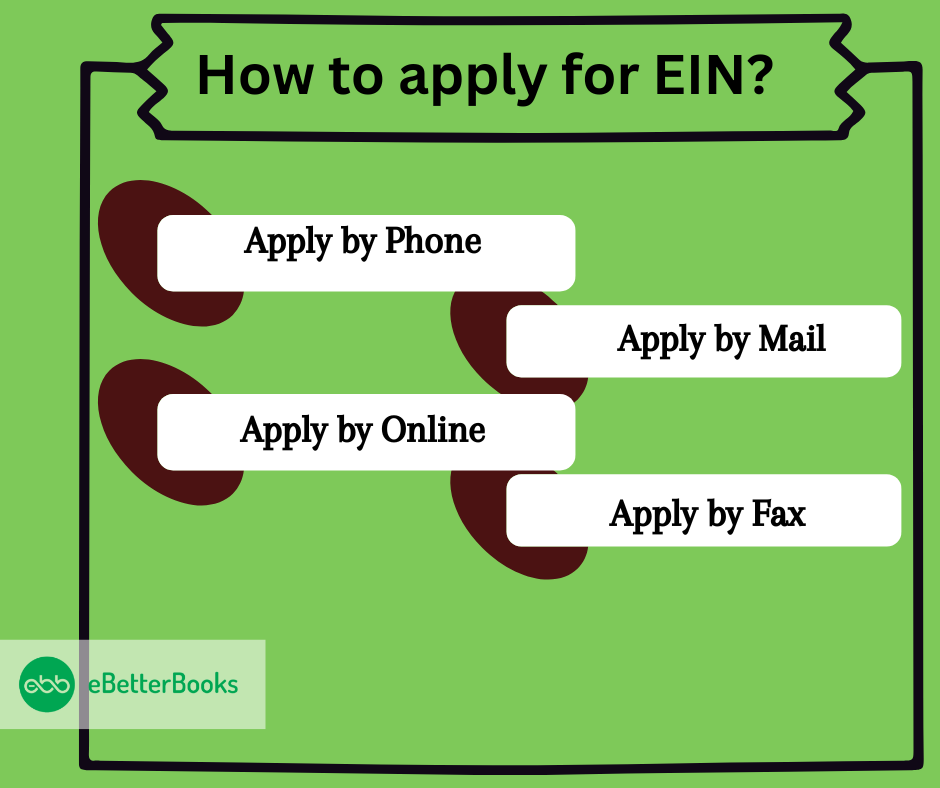

How to apply for EIN?

You get the EIN at free of cost by the Internal Revenue Service. IRS allows the business entity to apply for EIN through various mediums. The application process is simple and easy to perform.

Applicants need to fill out the Form SS-4, available on the IRS official website. The different ways to apply for EIN are:

1. Apply by Phone

This option is generally available for those who are not in the United States but their business is in the country. The caller should be authorized to receive the EIN and able to answer the questions concerning the Form SS-4.

Phone Number: 267-941-1099 ( 6 a.m. to 11 p.m )

Completing the Third Party Designee section is crucial if you wish to authorize a specific individual to receive your entity’s EIN and answer any questions regarding the completion of Form SS-4. The designee’s authority will cease once the EIN is assigned and released to them. Remember, your signature in the designated area is essential for the authorization to be valid.

2. Apply by Mail

If you want to apply through mail, then the designated processing timeframe is four weeks. You need to ensure that all the information is there in the Form SS-4.

If in case, the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and reliably mailed to the taxpayer.

3. Apply by Fax

In order to apply through fax, the taxpayer needs to make sure that the Form SS-4 contains all the required information. Then, the taxpayers can fax the completed Form SS-4 application to the appropriate fax number.

If in case, the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type. If the taxpayer’s fax number is provided, a fax will be sent back with the EIN within four business days.

4. Apply by Online

In order to apply for EIN online, customers must follow the below- mentioned steps:

Step 1: Determine your eligibility

All those can apply who have:

- Their business is located in the United States or its territories.

- Have a valid taxpayer identification number ( SSN, ITIN,EIN)

- Limited to one EIN responsible party per day.

Note: A responsible party is a person who controls the ultimate effective control over the entity.

Step 2: Understand the online application

The online application has the one session format so you cannot save the form and come back again to check it. The session also expires after 15 minutes of inactivity.

Step 3: Submit your application

Your EIN will be issued, once all the validations are completed. So, you can download, save and print your EIN confirmation notice.

EIN Format

EIN is written in the form of XX-XXXXXXX. There are EIN Decoders on the web that help in determining in which state the company registered the EIN.

| Location/ Campus | Valid EIN prefixes |

|---|---|

| Andover | 10, 12 |

| Atlanta | 60, 67 |

| Austin | 50, 53 |

| Brookhaven | 01, 02, 03, 04, 05, 06, 11, 13, 14, 16, 21, 22, 23, 25, 34, 51, 52, 54, 55, 56, 57, 58, 59, 65 |

| Cincinnati | 30, 32, 35, 36, 37, 38, 61 |

| Fresno | 15, 24 |

| Kansas City | 40, 44 |

| Memphis | 94, 95 |

| Ogden | 80, 90 |

| Philadelphia | 33, 39, 41, 42, 43, 48, 62, 63, 64, 66, 68, 71, 72, 73, 74, 75, 76, 77, 82, 83, 84, 85, 86, 87, 88, 91, 92, 93, 98, 99 |

| Internet | 20, 26, 27, 45, 46, 47, 81 |

| Small Business Administration (SBA) | 3 |

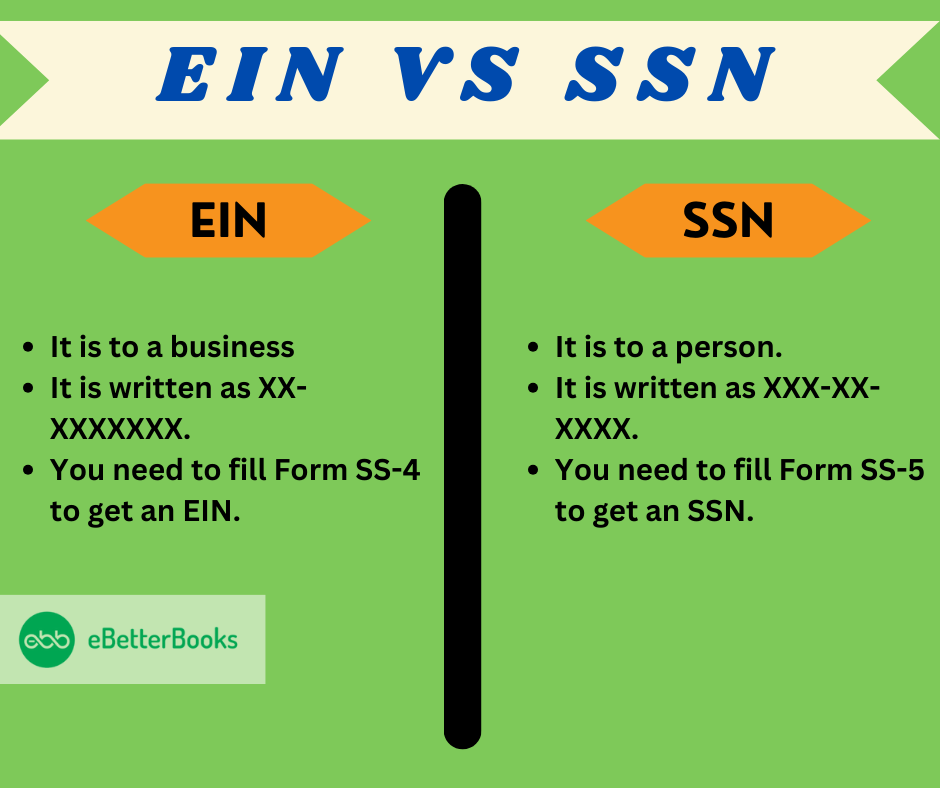

EIN vs SSN

| Employer Identification Number (EIN) | Social Security Number (SSN) |

| It is to a business | It is to a person. |

| It identifies a business in the US. | It identifies US citizens and permanent residents. |

| It is written as XX-XXXXXXX. | It is written as XXX-XX-XXXX. |

| The IRS uses EIN to keep track of the business filings. | The IRS uses EIN to keep track of personal tax filings. |

| You need to fill Form SS-4 to get an EIN. | You need to fill Form SS-5 to get an SSN. |

When EIN is not needed?

A sole proprietor without employees who aren’t required to file any excise tax return and hasn’t established a pension, profit-sharing, or retirement plan doesn’t need an EIN. They still can go ahead and apply for EIN.

Get expert help for all your accounting and bookkeeping needs

Whether you need tax planning, preparation, consultation, online filing support, or VAT return submission, eBetterBooks will ensure that you are well taken care of.

Seek tax assistance from eBetterBooks and benefit from our affordable plans and the expertise of industry-leading specialists.

Our dedicated professionals offer comprehensive tax services, including accurate document generation, adherence to IRS guidelines, income and expense classification, and tax credit tracking.

Conclusion

Always double-check the accuracy of your application and understand the legal responsibilities associated with your EIN for a smooth process.

FAQs

Q 1. Who issues EIN?

Ans. Employer Identification Number ( EIN ) is issued by the Internal Revenue Service.

Q 2. In how many days, EIN is issued?

Ans. The time duration to get the EIN depends upon the medium through which you have applied for.

If you have:

- Apply by Mail: You will get the EIN number in four weeks.

- Apply online: You will get the EIN immediately.

- Apply by Fax: You will get the EIN in about one week, but if you have not included the fax number, then it might take up to two weeks.

Q 3. Does EIN have an expiration date?

Ans. No, EIN doesn’t have an expiration date. Once the EIN has been created and assigned to an entity , it will never expire, even if the entity disappears.

Q 4. Is EIN for individuals or businesses?

Ans. EIN is for the business entity in the United States. You need to have EIN in order to run your business.

Q 5. Does getting an EIN cost money?

Ans. No, EIN is a free service provided by the Internal Revenue Service.