Billable hours is defined as the time spent working on the project of client’s and that is billed directly to the client. Understanding the importance of billable hours is necessary for setting your hourly rates of your services, managing your projects, arranging quotes and estimates, and making accurate professional invoices. Many businesses, including legal professionals to freelancers, utilize billable hours to calculate their revenue.

Contents

Billable hours refer to the number of hours spent working on a specific project in the course of rendering out the service required by the project. These hours are billable to a client at the agreed hourly rates. In other words, they are the number of hours a company can legally extract from its clients in order to perform work for them.

It is almost impossible to find a service business that doesn’t adopt billable hours, be it a digital agency, accounting or law firm, consulting company, etc. By knowing about billable hours, they can also realize how many hours employees devote to billing work.

The main difference between billable and non-billable hours is the hours spent working on a client’s project. Many companies, like independent consultants, agencies, and contractors, operate at an hourly rate. They track the time spent on a project and then bill the client.

All these tasks vary by industry or profession but may include:

All these tasks vary based on your industry, but examples include:

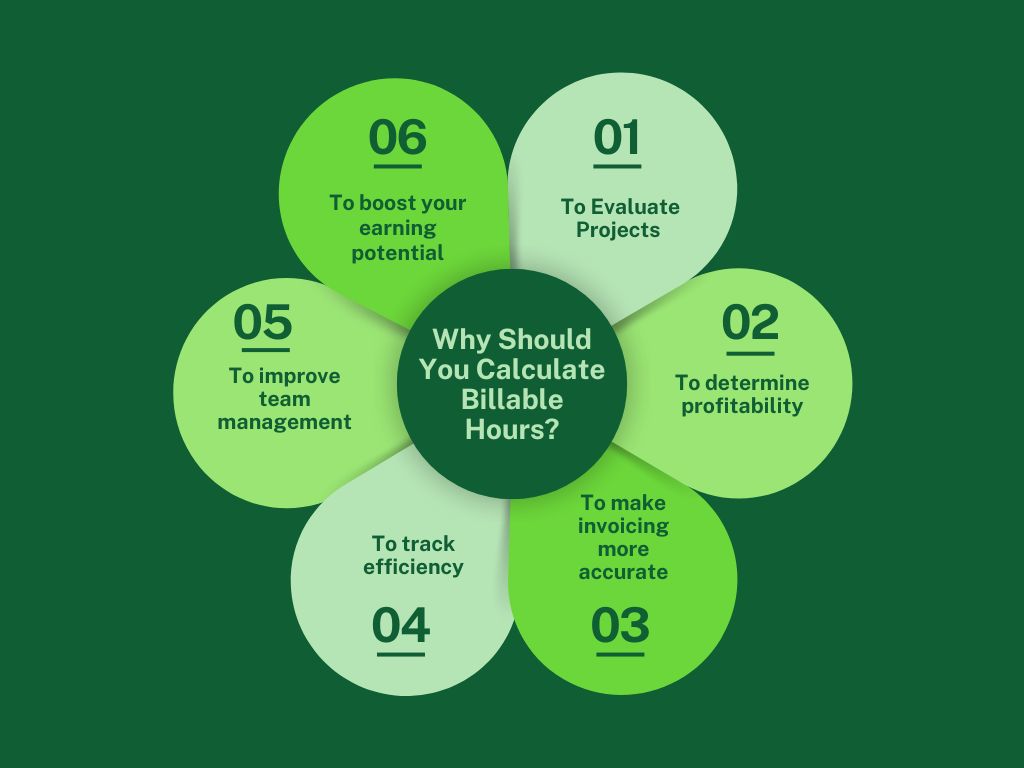

Mentioned below are the reasons why you should calculate billable hours:

With tracking, you will be able to know the amount of time that was spent on a given project and the many activities that consumed much of your time. It will also assist you in developing more valuable estimates for other future projects that will help minimize dissatisfied clients. You will also be able to differentiate which of the clients or the projects consume most of your time and then set appropriate rates.

Billable hours are probably one of the simplest measures that a project manager can use when considering an organization’s or project’s potential. The idea behind billable hours is simple: if you bill more hours than your cost, you are generating revenue for your organization.

Recording billable or non-billable hours will help you bill all your clients without miscalculating or guessing the amount of time you’ve spent working. This means that you will be paid for what is worth and not force yourself to earn low prices in order to attract clients.

Invoices are easily generated when you have recorded the amount of time you spent on tasks for your clients. You will not overcharge your services if you have the precise duration of the cases that are required. As a result, it will allow you to gain your client’s trust so that, in the future, you will be able to attract more potential customers.

You will also be able to provide much better estimates and quotes. Historical timesheets collected from other past projects can be a gold mine when preparing for your bids since they help you offer the right estimates of the time you will require to complete a contract or part of a continuing contract with a client.

Measuring billable hours also makes it easier for organizations to know whether or not their employees are working efficiently. Notably, before workers can adopt the billable hour method, they must constantly keep records of the precise amount of time spent on each of their client’s cases or projects daily. This information also enables measurement of the level of utilization.

When targets are set in terms of the hours to be billed against a project, it becomes possible to know how productive a team is and whether it is meeting, exceeding, or under-achieving its target.

It eliminates inefficiencies by preventing you from knowing how many hours an employee spends on a project and whether they could be working more quickly. It will also assist you in remunerating them when you charge your clients through-the-hour rates.

Recording work hours will let you know about the time your team uses to complete a task. You can distribute tasks before your team burns out because you will know if your team is under too much pressure. You will also realize whether your employee is spending more time on non-billable hours than billable, and you can then highlight this issue.

Recording billable hours will help you and your team to have a clear picture regarding the amount of time spent on each task. In this way, you will have a better understanding of where you and the team can improve and maximize your earning potential.

If you’re an employee who receives a salary or if you spend your time working on projects that aren’t billable, you must show the amount of time you spent on billable work. This information can help you get paid fairly for your efforts when you’re seeking a raise or promotion.

Follow the below-mentioned steps to record your billable hours more effectively:

First, you need to decide how much you want to charge the clients for the hours you work. To set the rate, you can determine the annual salary you want to earn. The base of this salary can be how much you’ve made working as a salaried employee or the amount that the people in your industry earn for this type of work. Do not forget to add personal or professional expenses which you have to cover. Once you’re done establishing your salary, you need to divide it by the number of hours that you plan to work during the year.

Next, you need to figure out when you will send invoices to bill clients for the work that you’ve completed. You can select whichever schedule best suits your needs, but the two very common options are monthly or bi-weekly. You can also set up a payment deadline. Similarly, this depends on the clients or your needs, but creating a payment schedule can help keep clients accountable. You might also want to agree on the preferred payment method. To help you make timely payments, select one which is easy for the client to process.

When logging your time, make sure to track the hours you’ve worked on each project separately. By taking this step, it becomes possible to charge the correct amount for each client every time multiple projects are worked on. You have many different ways to do time tracking, either manually or with the help of special software. For a manual time log, you can make a spreadsheet to track the projects you worked on, as well as the dates and hours you’ve spent on them and the tasks you completed during that time.

However, there are numerous software programs that help you track and organize your time more efficiently and accurately. Sometimes, they allow you to use a punching-in feature and/or set time for particular tasks you do. The programs can vary from very basic to more advanced, and they can give you reports of how many hours you have devoted to each project in a given day.

You’re required to add up the hours you worked on a project at the end of your billing period, which is based on your invoice schedule. Once you’ve discovered the sum of your billable hours, you have to multiply that number by your hourly rate to determine how much is needed to charge the client for the period. Using software will help in automating this process, though you’re required to double-check calculations to ensure you charge the client correctly.

Once you’re done calculating the hours you worked on a project during the billing cycle and the appropriate payment amount, you’re required to send an invoice to the client.

An invoice includes the below-mentioned important information:

Billable hours are defined as the time you invoice a client for, meaning that it should be directly connected to the client’s work. The table below shows the common tasks that are defined as billable hours, as well as some of the non-billable tasks for comparison.

| Task | Billable or Non-Billable Hours? |

| Replying to the emails of client | Billable |

| Replying to any other internal company emails | Non-Billable |

| Attending client meetings | Billable |

| Planning for client projects | Billable |

| Reviewing company performance | Non-Billable |

| Planning strategy for company growth | Non-Billable |

| Doing research for a client project | Billable |

| Researching advertising methods for the company | Non-Billable |

If you’re thinking of boosting your profile, then you should consider increasing your billable hours. However, you need to make sure that you increase the actual time that is spent working on client projects rather than just adding illegitimate time.

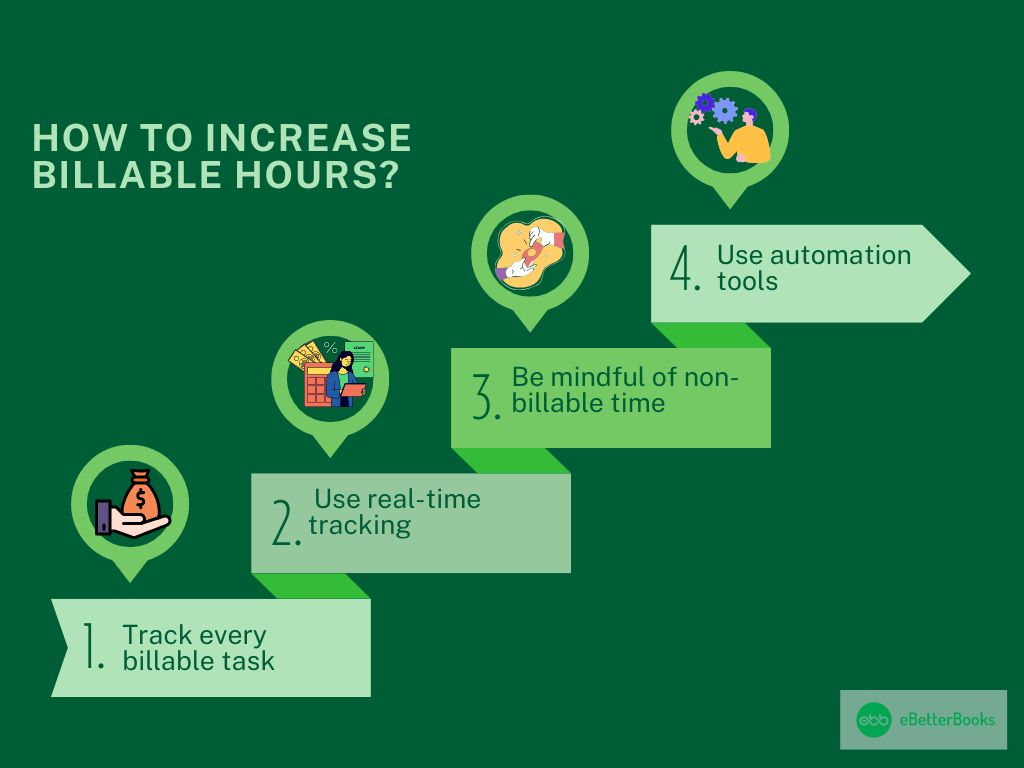

The following tips mentioned below will help you ethically maximize billable hours:

Tasks may require several hours of your time, while others will just demand a few minutes of your time. However, don’t forget to track those shorter tasks because they do add up throughout the billing period. For Instance, record a time log, although a phone call with a client takes less than five minutes. As always, billable time means work done for the project; therefore, a call with a client counts as billable, while a call with another worker from the same project does not.

If you still record your billable hours by hand, be sure to note the start and end times of all tasks accomplished in the day. This method allows you to track the total time spent on work during the day instead of attempting to determine the time you have spent on each particular task. In this case, you may not be able to capture some tasks that are billable the moment you do them if you do not track them in real time.

Try to track the time that you spend on non-billable tasks in addition to billable tasks. Remember to keep the two differences to ensure accuracy. After that, you can review your non-billable time to search for inefficiencies in your workdays.

For example, you may discover that you go more often on coffee breaks than necessary. It is during such breaks that you could engage in some billable work instead of having the coffee break.

Every administrative activity you may perform will not be recorded for billing, yet there is often software to assist with such activities. This method avoids manual work, thereby giving more time to work on other billable activities. It means that even routine tasks could be made easier by automation or that invoices to clients would be sent on time.

Jobs that require employees to work on particular projects usually use billable hours to track their time and charge the client.

The industries and professions that commonly use billable hours when conducting work for clients include:

Hourly rates should be defined within the client agreements, such as which ones are billable and which ones are not, so that both are not taken advantage of. The service provider is usually faced with some non-billable activities that cannot be billed, and such activities soon become overwhelming for the organization.

Implementation is the total hours that you can bill your employees and the number of hours that are available. According to HubSpot research, 85 to 90% of the staff utilization rate is profitable enough.

How you can charge for your non-billable services is simple: that is, make your clients pay sufficiently so that it covers all these organizational and management tasks.

Below are some ways that you can use to optimize your billable hours, and then you can compensate for your inevitable non-billable work hours, too:

The target set for billable hours is typically a 70/30 split—that means 70% of time should be billed to clients, leaving only 30% to be spent on non-billable work. This is also termed a 70—to 80 percent level of resource utilization.

The percentage of billable and non-billable hours is essential for the organization’s revenues and billings, employees, clients, and work.

An unbalanced ratio can lead to:

Billable hours are a concept that helps you optimize processes and extract more business value. It assists you in identifying areas of inefficiency, redesigning work, and better-distributing work to maximize resources.

However, you’ve got to keep things in their right proportions. Never forget that no business should always aim at generating profits only; it needs to offer what is best for its clients.

Because, if you have an approach that is too focused on obsessively optimizing with the aim of achieving high billable utilization rates, many risks can materialize, which will damage your organization in the long run:

Logging time can be stressful in itself, if and only if it is accompanied by a nasty culture where people know what will happen to them if their billable utilization rate is too low.

In some cases, using the clock as a monitoring tool for how one spends one’s working time can also bring about a feeling of being supervised and accounted for. To exclude this, it is important to explain why one needs to register one’s time in the first place.

It’s not intended to keep a check and punish colleagues who are not receiving enough work. Instead, it is used for resource planning and workload forecasting—both of these activities will benefit the teams by enabling a stable, right-sized pipeline of work in the future and creating conditions where projects can progress very smoothly.

The main focus of billable work is increasing profitability, and this is when you can get lost in focusing on the financial gain and ignoring the activities that aren’t billable.

For Instance, having efficiently realized how to create some time in your team’s calendar, you may immediately go ahead and overload the team with more work, maybe on other projects. Rather than that, the opportunity is there to look at upskilling and training initiatives or some of the team attending networking occasions or a conference.

Interestingly, it is possible to remark that obsession with time results in rising burnout rates for your teams because your teams and personnel will think that there is nothing they can do unless they work more to complete tasks that generate direct income for your business. Relationship building and professional development are necessary.

If you focus only on time, this might incentivize inefficiency as you shift from value delivered to time spent.

If you’ve decided to charge your customer per hour, billable work will encourage people, mainly contractors or independent contributors, to extend the time it takes to complete their assigned work. After all, they will be paid more.

This challenge is specifically relevant in environments where enhancing work and increasing billable hours is a criterion of success. Tasks that can be done automatically, for example, might be manually completed to fill the hours that were paid for.

This approach can go wrong when it’s the client’s responsibility. The client might feel frustrated for not receiving the work at the expected time as they charge every minute, especially if they know that the work is not done efficiently.

Billable hours refer to the extent of time of any particular employee’s working period that can be claimed from the client. Employers cost their clients sometimes at different rates depending on which employee.

Billable hours need intentional tracking rather than automating logging. To correctly capture these hours, a structured approach is very important.

The three prevalence methods are mentioned below:

Billable hours is something that is directly related to client work. If you’re not certain whether a particular task is billable, then consider whether or not it’s important for the project and activity advances progress. If you want time to be billable, then it should be spent working on tasks that are mentioned in the project’s contract.

Billing by the hour is common practice in many industries, like law firms, accounting practices, consulting agencies, and advertising. Hourly billing is also very common for many freelancers in the field of graphic design and web development.

Billable hours is defined as the hours worked and for that you can bill the client, alternatively actual hours worked is something which include the time spent on other projects for which you can’t be charged to your client. If you want your time to be billable, it should be the time spent directly on client work.