To fix QuickBooks payroll liabilities not showing in the Pay Taxes section, verify that the liability accounts are active and check that the date range is correct. Running QuickBooks as an administrator, installing program updates, and applying the newest payroll tax table version stabilize liability calculations. The adjustment tools in QuickBooks Desktop restore accurate mapping between payroll items and liability accounts.

QuickBooks Payroll Liabilities visibility depends on correct payment schedules, active Chart of Accounts categories, and validated payroll item configurations. Incorrect frequencies, inactive accounts, or mismatched mappings interrupt liability displays in the Pay Taxes window. Alignment of these attributes ensures consistent tracking across taxes, deductions, and employer-based contributions.

Data-integrity processes influence liability accuracy in QuickBooks Desktop. The Verify and Rebuild utilities correct damaged records, remove calculation inconsistencies, and reestablish proper links between payroll items and liability totals. Liability reports reveal imbalances that require adjustments through the Adjust Payroll Liabilities function.

System-level factors can influence liability visibility, including outdated installations, incomplete payroll updates, or incorrect prior tax entries. Payment records, agency messages, and liability schedules require validation to ensure that the Pay Taxes section displays the complete and accurate set of outstanding payroll obligations.

What Gives Rise to QuickBooks Payroll Liabilities Not Showing? TL:DR

QuickBooks Payroll Liabilities visibility depends on active liability accounts, accurate payroll dates, and updated tax table data. Incorrect mappings, inactive accounts, or outdated payroll components interrupt liability calculations in the Pay Taxes section. These configuration issues alter how QuickBooks interprets payroll items and prevent the system from generating complete liability records.

Data-file inconsistencies can remove liability entries when the company file contains damaged lists or unsynchronized payroll items. Upgrades performed without data repair procedures can disrupt liability references and create missing or displaced liability records. Updated payroll tables, validated payment schedules, and corrected mappings restore stable visibility of all payroll liabilities.

The following table presents the primary causes of missing payroll liabilities in QuickBooks and outlines the required corrective actions for each condition.

QuickBooks Payroll Liabilities Not Showing Error with Solutions

| Error Cause | Reason | Solution |

|---|---|---|

| Inactive QuickBooks Payroll Liability Account | It could be possible that your liability account is not active. | You need to ensure that your liability account is active. |

| Wrong Payroll Dates | The incorrect date range has been selected while making the payments. | It is required to check the date range before making payments. |

| Lost or Missing QuickBooks Payroll Liabilities | It may occur due to lost or missing liabilities after upgrading QuickBooks software. | Locating and viewing the missing QuickBooks Payroll Liabilities . |

| Outdated Payroll Tax Table | If your QuickBooks account or payroll tax table is not updated to the most recent release. | Update your QuickBooks Payroll Tax Table to the most recent version. |

| Uncategorized QuickBooks Payroll List | You may have damaged the company file. | Re-sort your QuickBooks list and make it organized. |

| Payroll Factor is Inaccurately Set Up to Another Liability Account | If the QB payroll is not properly set to another Liability Account | You must edit all the payroll items to properly set up payroll factors to another liability account. |

Step-by-Step Guide: Fixing QuickBooks Payroll Liabilities not Showing

QuickBooks Payroll Liabilities visibility depends on accurate account configurations, active payroll lists, and updated system data. Each case below addresses a specific condition that interrupts liability calculations.

These conditions alter how QuickBooks processes payroll items and prevent liabilities from appearing in the Pay Taxes section. The corrective steps restore stable mappings and accurate liability displays.

Case 1: When Your Liability Account is Not Active

An inactive liability account prevents QuickBooks from generating liability entries. The Pay Taxes section displays liabilities only when the linked account remains active in the Chart of Accounts. Incorrect deactivation or list re-sorting can remove the account from payroll calculations. The following steps activate the account and restore liability visibility.

Step: Access the Chart of Accounts

- For this, hit the Lists menu option. Now, choose the Chart of Accounts from the drop-down menu.

2. Step: Check for Inactive Accounts

- Must check that the inactive is selected from the list.

3. Step: Activate the Liability Account

- Choose the Edit option if your liability account has a large X marked on its left side. After this, hit the Make Account Active tab..

4. Step: Complete the process

- To finish, select the Chart of Accounts.

Note: If you fail to click the Inactive option, do not proceed, as there are no inactive accounts. However, if you can select Inactive, then proceed.

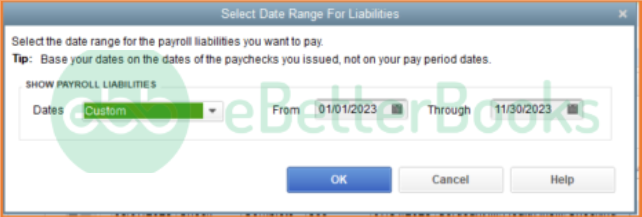

Case 2: When QuickBooks Payroll Liabilities Dates are Incorrect

Incorrect date ranges interrupt liability generation and hide upcoming payroll obligations. QuickBooks calculates liabilities based on the Paid Through Date and the selected reporting period. Misaligned dates shift liabilities outside the visible window in the Pay Taxes section. The steps below ensure accurate date alignment.

- Step: Open the Payroll Center

- To begin with, navigate to the Employees menu in the QuickBooks account and then choose the Payroll Center.

2. Step: Access Liability Transactions

- Now, hit the Transaction tab. You need to select the Liability checks.

3. Step: Set the Correct Date Range

- Choose Date and also, edit the range to This Calendar Year from the drop-down menu.

4. Step: Verify and Edit the Paid Through Date

- Thereafter, check the Paid Through Date. If editing is required, click on the line with the liability check twice to open it.

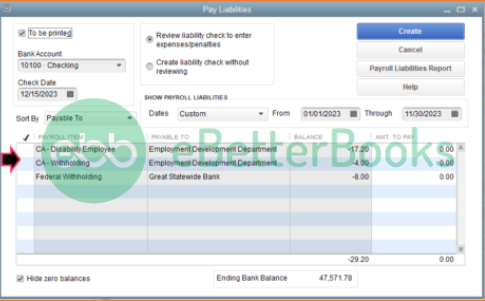

Case 3: When QuickBooks Payroll Liabilities are Missing or Lost

Missing liabilities occur when list data is damaged or when payroll updates alter internal references. QuickBooks may misplace liability records when the company file contains structural inconsistencies. Custom liability payment tools help regenerate missing entries. These steps restore visibility through targeted review and data correction.

- Step: Access Payroll Taxes and Liabilities

- Head to the Employees menu and choose the Payroll taxes and liabilities option.

2. Step: Create Custom Liability Payments

- After this, click Create Custom Liabilities Payments. Select the liability period and then press OK.

3. Step: Review Liabilities

- A new window will open up and show the liabilities that you have to pay.

4. Step: Address Potential Data Damage

- In case of any data damage, you are recommended to run the Verify and Rebuild Data in the QuickBooks account.

Case 4: When your QuickBooks Payroll Tax Table is Not Updated

Outdated tax table data prevents QuickBooks from calculating payroll liabilities accurately. Updated tax codes and statutory rates ensure correct liability generation for each pay period. Liability entries may not appear until the system applies the current tax table version. Follow the steps below to install the most recent release.

- Step: Initiate the Update Process

- The initial step is to click on Update QuickBooks from the Help menu. Navigate to the Update Now icon.

2. Step: Download Updates

- After this, choose the Get Updates option. Hit File and then press Exit.

3. Step: Restart QuickBooks

- At last, restart your QuickBooks Desktop.

Case 5: When the QB Payroll List is Not Categorized

Unsorted or inconsistent payroll lists affect liability mapping and reporting. List order determines how QuickBooks references payroll items during calculations. Damaged list structures prevent the system from locating linked items. Re-sorting the list corrects display order and restores stability.

- Step: Choose the Payroll List

- Firstly, choose the list under the Lists menu you need to re-sort.

2. Step: Include Inactive Items

- Now, tickmark the “Include Inactive” checkbox. If it’s greyed out, there are no inactive names.

3. Step: Re-Sort the List

- Hover over the View menu and then select Re-sort Lists; now, click OK.

4. Step: Finalize the Changes

- In the end, close and reopen your company file.

Case 6: When the Payroll Factor is Improperly Set to Another Liability Account

Incorrect mapping of payroll items redirects liability amounts to unintended accounts. QuickBooks displays liabilities only when each item points to the correct liability category. Editing the payroll item restores the required mapping and ensures proper liability calculations.

- Step: Access the Payroll Item List

- Go to the List menu and then select the Payroll Item List option.

2. Step: Choose and Edit the Item

- Now, you must choose the item added and then right-click on it. Hit the Edit Payroll Item icon.

3. Step: Update the Liability Account

- Press the Next button and change the account for the liability.

4. Step: Save Changes

- Once done, click Next again and then Finish.

Case 7: When Payment Method for New Employees is Not Displayed, the Payroll Liabilities in QuickBooks is Not Visible

Missing payment methods for new employees interrupt liability scheduling. Items such as child support and benefits must be assigned valid schedules. New employee profiles require complete mapping to generate correct liability entries. The steps below establish accurate schedules.

- Step: Access the Payroll Center

- Go to the Payroll Center

2. Step: Change Payment Method

- Click on the Change Payment Method option under the Pay Liabilities tab.

3. Step: Navigate to Benefits and Other Payments

- Go to Benefits and Other Payments, then Continue.

4. Step: Edit Child Support

- Highlight the Child Support, then click Edit.

5. Step: Assign the Correct Payment Schedule

- Assign the correct payment schedule.

6. Step: Finalize the Changes

- Click Finish to save your changes.

Case 8: When the Payroll Liability Payment Frequency is Incorrect

Incorrect payment frequencies cause liabilities to fall outside the visible schedule. QuickBooks requires defined deposit frequencies to generate due-date reminders and liability entries. Correcting the frequency restores alignment between the payroll item and the Pay Taxes section.

1. Step: Access the Payroll Center

- Go to Employees and select the Payroll Center.

2. Step: Manage Payment Methods

- Click Manage Payment Methods.

3. Step: Select Payment Schedule

- Tick the Schedule Payments box.

4. Step: Edit Payroll Liability

- Select the payroll liability you wish to update, then click Edit.

5. Step: Set the Correct Payment Frequency

- Choose the correct frequency in the Payment (Deposit) Frequency field.

6. Step: Save Changes

- Click Finish to apply the changes.

Conclusion

To fix payroll liabilities not showing in QuickBooks Desktop under the ‘Pay Taxes’ section, start by verifying the payroll setup and employee information, then proceed by checking account settings and ensuring transactions are properly categorized. Regularly updating to QuickBooks and payroll can help prevent these issues in the future. By following these steps, you can maintain accurate payroll liabilities and ensure smooth financial management for your business.

Still have questions? Explore our detailed FAQs.

Disclaimer: The information outlined above for “Fix QuickBooks Payroll Liabilities Not Showing in the Pay Taxes” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.