The IRS does not generally tax personal injury settlements for sickness or injuries. Tax liability arises on a portion of the settlement for punitive damages, emotional distress not from physical injury, lost wages, etc.

Taxation is subjected to a personal injury settlement basis and not to the amount of compensation.

Under federal law, settlements directly related to sickness, such as physical injuries, medical expenses, and pain and suffering, are typically exempt from taxable income.

Component classification of personal injury settlement is necessary to decide how much you owe to the IRS in taxes.

What is a Personal Injury Settlement?

A personal injury settlement is a monetary compensation paid to an individual who has been harmed by another’s negligence or deliberate misconduct.

The settlements are typically settled out of court and serve to compensate the injured party for multiple losses such as:

- Medical expenses

- Lost income

- Pain and suffering

- Damage to property

- Care expenses in the future

- Punitive Damages

Personal injury claims may occur as a result of car accidents, on-the-job injuries, faulty products, slips and falls, and medical malpractice. The IRS looks at what the settlement is for rather than how much is being received to determine if it is taxable.

Understanding the IRS Code on Injury Settlements

The IRS specifically addresses personal injury settlements through Section 104(a)(2) of the Internal Revenue Code.

The law specifically indicates that damages paid on account of physical injury or physical disease are exempted from gross income. This means compensation is paid via court judgments or out-of-court settlements.

Nevertheless, the IRS draws significant differences:

- The harm must be physical. Simply emotional or reputation damage is not tax-exempt.

- If emotional distress is a result of physical injury, it is still not taxable.

- Interest earned and punitive damages, even though part of a personal injury action, are always taxable.

Knowing how your compensation fits into these guidelines makes sense when deciding whether to report some of the settlement as income on your tax return.

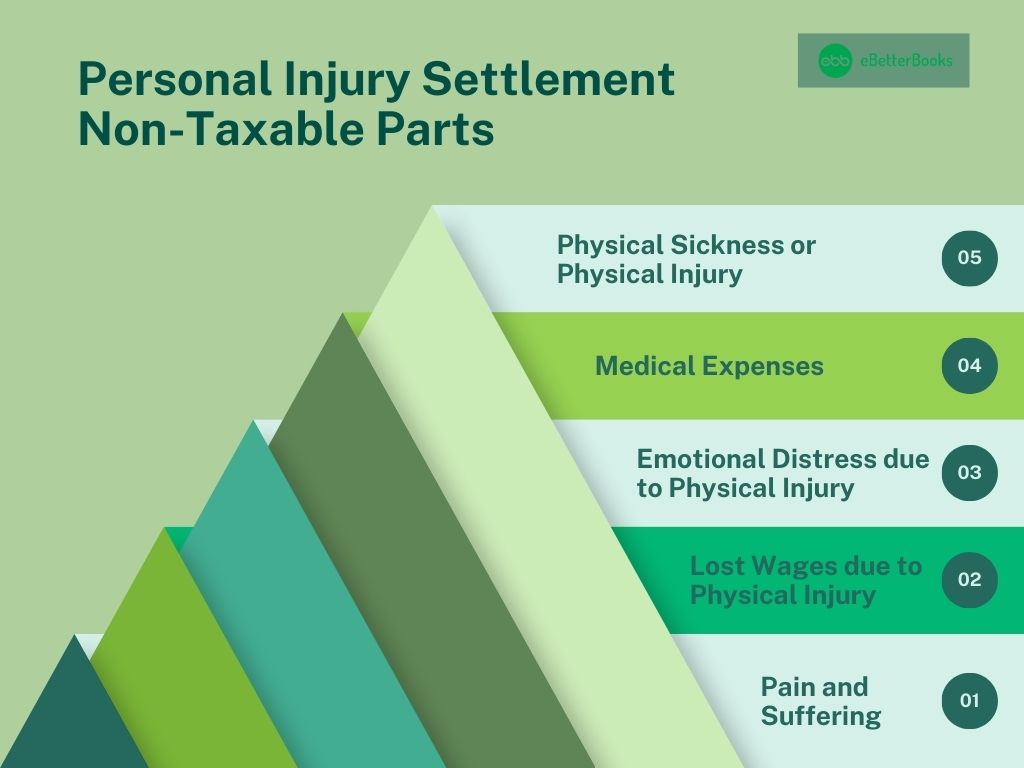

What Parts of a Personal Injury Settlement Are Not Taxable?

Under Section 104(a)(2) of the Internal Revenue Code, some forms of compensation are exempt from gross income and thus not subject to federal income tax.

Medical Expenses

If you were reimbursed for medical expenses paid out of pocket and did not claim a tax deduction for such expenses in past years, the compensation is non-taxable.

Physical Sickness or Physical Injury

Money recovered for physical injury, pain, or illness is completely tax-free. Examples of this are bone injuries, head concussions, or even long-term diseases due to injury.

Pain and Suffering

The IRS will not tax them unless they arise immediately from physical disease or injury.

Lost Wage (Resulting from Physical Injury)

Generally, wages are subject to taxation. However, if your lost wages fall within a settlement based on physical injury, then they are not taxable.

Emotional Distress or Mental Aguish

Such damages are not taxed if they arise out of physical injury or disease. For instance, shock due to an auto accident resulting in physical injury is not subject to taxation.

Although you’re not required to report these non-taxable amounts on your tax return, keeping documentation is still recommended in case of future IRS inquiries.

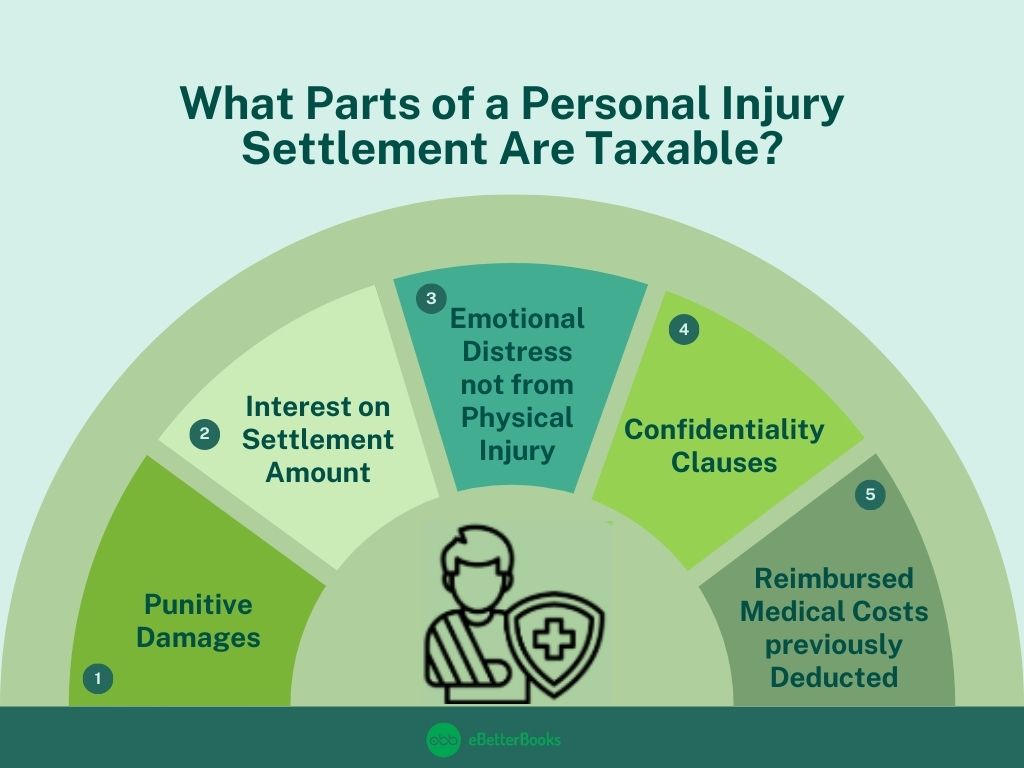

What Parts of a Personal Injury Settlement Are Taxable?

While much of a personal injury settlement may be tax-exempt, certain elements are clearly taxable under IRS rules:

Punitive Damages

They are intended to punish the offender, not to pay you back for what you lost. The IRS treats them as taxable income, even if your lawsuit is for physical injury.

Interest on Settlement Amount

If you’re delayed in receiving your compensation and interest accumulates over time, that interest is taxed. For instance, if you make 5% interest on a delayed payment of $100,000, that $5,000 is taxable.

Emotional Distress (Not Arising from Physical Injury)

If your distress results from an event such as discrimination or harassment that does not result in physical harm, the award is subject to taxation.

Confidentiality Clauses

In case a portion of your settlement is actually dedicated to confidentiality in keeping the case details confidential, the money should be counted in your taxable income.

Reimbursed Medical Costs (Previously Deducted)

If you claimed tax deductions for medical expenses related to your injury in prior years and then received a settlement reimbursing those costs, you must report that reimbursement as income.

Understanding how your settlement is structured can make a major difference in how much you keep and how much goes to the IRS.

Structured vs. Lump-Sum Settlements: Tax Impact

When it comes to paying your settlement, whether in a lump sum or payments made over a while, this can influence the tax treatment as well:

| Lump-Sum Settlements | Structured Settlements |

|---|---|

| The money is paid all at once. Insofar as the payment is for physical damages or medical bills, the tax treatment does not change the result, which is not taxable. | Payments made periodically over a number of months or even years. The payments may consist of both non-taxable and taxable elements (such as interest or investment earnings added to these periodic payments). |

It’s crucial to identify how the payments are broken down to report (or not to report) the income correctly.

Tax Reporting Requirements and Documentation

If your personal injury settlement is tax-free, you do not have to report it on your return. But if there is any taxable portion, report the applicable amounts as income.

Here’s the way to handle reporting:

- Form 1040: Taxable components, including interest or punitive damages, are reported as “Other Income.”

Paperwork to Save:

- Settlement contract

- Court ruling (if any)

- Medical expense invoices

- Legal fee details

- Form 1099-INT (Interest earned)

Careful records can shield you in the event of an audit and explain why a specific percentage was not listed as income.

Common Mistakes to Avoid

Tax compilation can result from confusion regarding the way your settlement is composed.

These are some common mistakes:

Expecting the Whole Settlement to be Non-Taxable

Forgetting taxable components such as punitive damages or previous deductions may result in IRS penalties.

Failure to Report Interest Income

Most people forget that interest on late settlement payments is taxable.

Overlooking Previous Tax Deductions

If you deducted injury-related medical expenses in past years and received reimbursement through the settlement, it is taxable.

Failure to Consult a Tax Professional

Settlements are complicated, and incorrect reporting can result in audits or penalties.

Avoiding these mistakes ensures compliance and protects your finances.

Conclusion

The majority of personal injury settlements are tax-free, particularly when damages pay for physical injuries, medical bills, or pain and suffering. But punitive damages, interest, or emotional distress based on non-physical harm might be taxable.

Knowing the IRS code and how your settlement is classified is key. Whether you get lump-sum or structured payments, being informed and seeking the advice of a tax advisor when necessary can help you get the most out of your compensation and prevent tax issues.

Frequently Asked Questions

Is a personal injury settlement taxable?

In most cases, no. Personal injury settlements that pay for physical injuries, medical bills, or pain and suffering are generally not taxable. However, some components, such as punitive damages, accrued interest, or compensation for emotional distress not related to a physical injury, are taxable.

How do I report lawsuit settlements to the IRS?

If your settlement contains taxable components (e.g., interest or punitive damages), you are required to report those figures on your Form 1040 under “Other Income.” Non-taxable figures for physical injury or sickness do not have to be reported. Maintain all settlement documents and breakdowns to substantiate your reporting.

Are medical damages tax-free?

Yes, medical damages are tax-free provided that:

- They are related directly to an illness or injury that is physical, and

- You did not deduct the same medical expenses on a prior year’s return.

If you deducted them earlier and are now reimbursed, that amount may be taxable.

Can the IRS take my personal injury settlement if I owe back taxes?

Yes, the IRS can levy a portion of your personal injury settlement if you have outstanding federal tax debt. While the settlement itself may not be taxable, the money does qualify as being used to pay for overdue taxes.