A debt is the sum one party owes to another. It is a loan with a specific due date and an added interest rate. The lender decides the interest rate completely.

Many companies and individuals use debt to finance their businesses or large investments they can’t afford. The debt must be repaid with interest unless the lender decides to ‘write it off. ‘This concept of ‘writing off’ is a crucial aspect of debt management.

How does debt work?

Debt usually includes loans like mortgages, auto loans, personal loans, and credit cards. Most loans have due dates, but they can be months or years. It’s important to understand that interest is not just an added cost. Interest ensures that the lender gets compensation for taking the risk of lending the loan.

Credit cards and lines offer a different kind of financial flexibility. The bank offers revolving credit, which does not have a set deadline. The borrower gets a credit limit that can be used as long as he/she does not exceed the limit, giving them the power to manage their finances as they see fit.

Types of Debt

Consumer Debt

Consumer debt is a personal loan mainly used for buying homes or goods. The most common examples of consumer debt are credit card debt, mortgages, automobile loans, and payday loans. Other examples of consumer debt are student loans, medical bills, personal loans for home modifications, or other enormous expenses.

Consumer loans are given by banks, credit unions, and the federal government in two types: revolving debt and non-revolving debt. The following table explains the concepts of revolving and non-revolving debt, equipping you with the knowledge to make informed financial decisions:

Revolving vs. Non-Revolving Debt

| Revolving Debt | Non-revolving Debt | |

| Credit Sum | No fixed maximum amount limit | There is a fixed amount that has to be repaid and cannot be used again. |

| Borrowing Period | There is no fixed date for paying the loan as long as the credit limit is not exceeded. | The borrower can’t access the loan after the repayment date has passed. |

| Rigid/Flexible Payment | The credit has a flexible payment plan. | The credit has a rigid payment plan; there may be penalties if not paid on time. |

Secured Debt

Security debt is a loan where one needs to put an asset as collateral in order to get the loan. The asset can be anything, such as property, vehicle, or jewelry. But if the debt is not paid on time, the lender can seize, sell, and take the asset’s ownership.

For example, XYZ needed to buy a car, and he did not have the required funds, so he went to a lender and asked for the money with his property as collateral. In any case, if he can’t pay the debt in time, the lender will seize his car and his property, and he can seize it, take ownership of it, or sell it to get the owed amount. However, when an individual takes a mortgage for his property, the lender will set an interest rate because it is mandatory. When the borrower pays for the property, it will be with interest. But if he doesn’t, the seizing, selling, and ownership follow from the lender’s side.

Business loans are secured when property, funds, equipment, and inventory are used as collateral.

Secured loans carry lower risks for the lender, and their credit requirements are less strict than those for unsecured loans.

Just like with unsecured loans, the higher your credit score, the lower the interest you may be charged or the more money you can advance.

Unsecured Debt

In unsecured debt, one does not have to put an asset as collateral. However, if the borrower does not pay, the lender will have to go legal to recover the loan amount.

According to California Bank and Trust, unsecured loans are only extended when there is merit and promise from the guarantor’s side that they will pay the loan. However, these kinds of loans are costly, and the requirements of the lender’s credit score and debt-to-income standards should match with the borrower.

However, some loan companies do give loans to people with poor credit scores. And even then, one must have an average credit score of 670 to be able to take profitable personal loans.

Unsecured debt also includes gym subscriptions, medical bills, and credit card debt,

Unsecured bonds are more risky than secured bonds since they are guaranteed only by the issuer’s creditworthiness rather than assets. As a consequence, unsecured debts often carry higher interest rates.

Unsecured government debt, such as US Treasury notes, is an exception. Although unsecured, T-bills offer lower rates of interest because the government may print money or levy taxes to pay off its debt, reducing the chance of default.

Mortgage

A mortgage is a secured loan used to buy real estate, such as homes and apartments. The due date for these sorts of loans is usually over 15 to 30 years.

Mortgages, along with education loans, are among an individual’s most important responsibilities. They are classified into two types: mortgages with fixed rates and mortgages with adjustable rates (ARMs). ARM interest rates can fluctuate regularly, often depending on an index.

Corporate Debt

In addition to credit cards and loans, businesses can borrow money through other means, like commercial paper and bonds, which people cannot access.

Bonds allow businesses to raise capital by issuing a pledge to repay investors. Institutions and investment firms can purchase these bonds, which often have a fixed interest rate or coupon. For instance, if a corporation needs to finance $1 million to acquire new gear, it may issue 1,000 bonds worth $1,000 each.

When individuals or companies purchase these bonds, they are guaranteed the face value on a certain date, known as the date of maturity, as well as regular interest payments while the bond is operational.

Bonds are comparable to traditional loans; however, in this instance, the firm is the borrower.

Bonds are comparable to traditional loans, except the corporation is the borrower, and the investors serve as the lenders. Commercial paper is a type of short-term debt that must be paid back within 270 days.

Advantages and Disadvantages of Consumer Debt

| Advantages | Disadvantages |

| One lump sum loan | Interest rates may be more than substitutes. |

| Fast Funding Time | More eligibility requirements |

| No collateral needed | Higher fees and penalties |

| Interest rates are lower. | Additional monthly payments |

| Flexibility and adaptability | Increased debt load |

| Extended-term loans | Higher monthly payments than credit cards |

| Easier to manage | Potential damage to credit |

Advantages and Disadvantages of Corporate Debt

| Advantages | Disadvantages |

| Tax benefits | Interest payments are mandatory |

| Keep the ownership | Increases financial risk |

| Lower cost than equity | May limit future borrowing capacity |

| Improves credit rating | The potential risk of failure of payment |

| Flexible terms and conditions available | May require collateral |

| Improves cash flow management | Interest rate risk |

How do you pay off your debt?

The average individual carries atleast $100,000 in debt only. With an existing debt load, unexpected costs like medical bills or education loans might be the turning point into a financial crisis. When you have too many payments monthly, you tend to stay caught up on the emergency savings or take a vacation.

Where to start? Start by reducing your debt each month and keep progressing. These steps—which include three particular, useful methods to reduce or eliminate your debt—can be helpful.

Step 1: Make a List of all your Loans and Debt

Before you begin paying off debt, calculate how much you owe. Make a list of the details for each bill you owe.

What you ought to know about each debt:

- Debt name/account

- Type of debts (credit card, student loan, etc.)

- Balance

- Interest rate (a few debts have a greater interest rate than others).

- Payment terms and length

- Minimal monthly payment.

Step 2: Set your Monthly Payment Limit

Analyze your budget and respond to these questions:

- What is your estimate of the amount of money you require to spend on basic needs like house rent/house credit, house insurance, electricity, water, and other utilities, as well as taking into consideration meals?

- About how much do you meet monthly payments of any kind on your debt?

- Could you give one or two of those budget expenses a minor cut to contribute even more to debt?

- Additional money, tax return, part-time job, things like that, to apply toward debt?

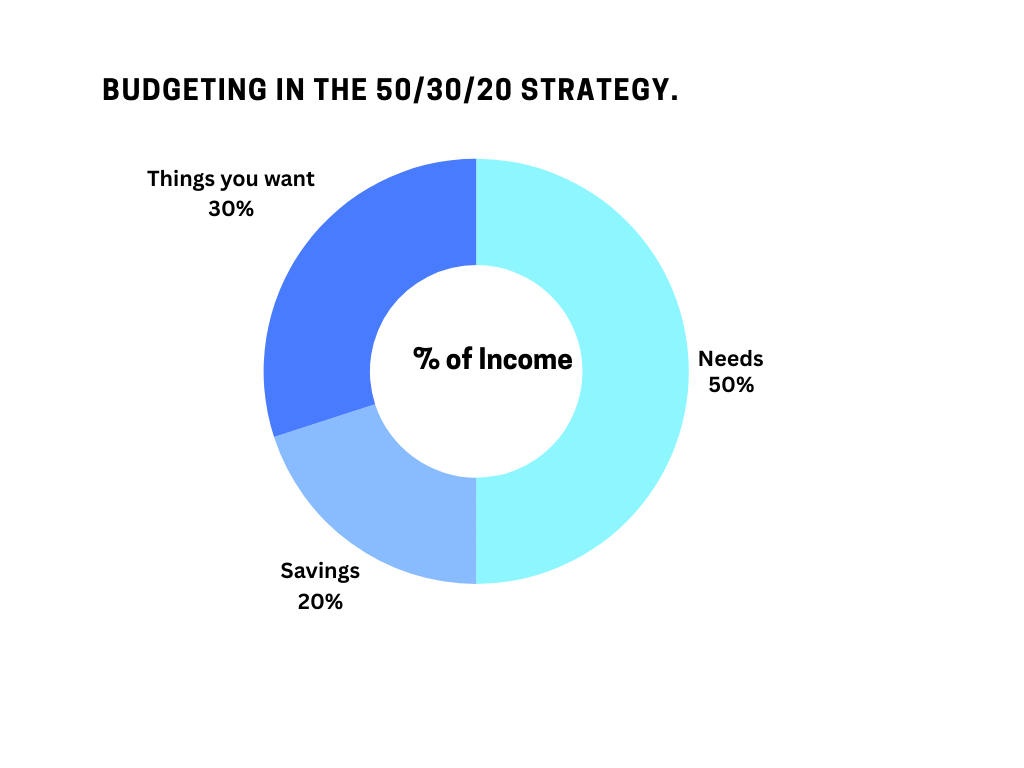

To calculate the amount you may give to debt repayment each month, subtract some from “needs” (a reduced streaming cost) and some from “wants.”

Step 3: The Repayment Plan/Strategy

You can choose your plan or strategy while keeping in mind what is actually best for you.

There are these three strategies that can come in handy:

| Types | How they work | Ways to keep it going | Why do people like it? |

| The Snowball Method | Pay the smallest debt first and pay the minimum on other debts. | Pay that extra on the next largest debt. | Quick payoff and boosts confidence |

| Debt avalanche | Pay the highest interest debt first and pay the minimum on other debts. | Pay that extra on the next smallest debt. | Paying off a big debt can help one be in control. |

| Debt Consolidation | Combine all the debts into a single account. | Avoid any debts until the next payoff. | Possible lower interest and one account increase focus. |

Difference between Debt and Loan

Debt, often synonymous with loan, actually encompasses a wider range of financial transactions. It can be anything that one person lends to another, such as real estate, money, services, or other valuable assets.

Moreover, debt takes on a more specific meaning in corporate finance. It refers to the money that a company has raised through the allocation of bonds, a key concept in the financial world.

Loans, on the other hand, are a subset of debt that traces a financial arrangement. In this setup, one party provides funds to another, with the lender holding the authority to set the repayment terms, the amount to be repaid, and the interest rate on the debt.

Difference between Loan and Credit

Debt or credit refers to the act and state of borrowing money with the promise of paying it back over time with interest, while credit means the ability and willingness of an entity to borrow money and the willingness of an entity to lend money in the same manner.

Debt is the amount of money owed, while credit is the amount of money you have available to sign documents for borrowing. For instance, unless your cards have been fully charged or the amount you owe your creditors is higher than your credit limit, debt is less than credit.

In Conclusion

Loans are vital and, in some branches, indispensable in the modern economy. Companies use debt to finance necessary requirements such as capital investments, while individuals may use it to purchase assets such as a house or to pay for college tuition fees, etc.

However, debt, on the other hand, is also dangerous, more so to firms or individuals who take on many debts.

-

Debt Collection Software: What It Is and Why Your Business Needs It?

Debt collection software is an essential tool for businesses seeking to streamline their debt recovery process, improve efficiency, and enhance financial control. It automates manual…

-

Debt Servicing: Meaning, Calculations and Ratio

This article explains the concept of debt servicing, detailing how individuals, businesses, and governments manage debt payments, including interest and principal. It explores key concepts…

-

Debt Collection Cycle: Meaning, Collection Method, and Regulations?

Debt collection services help businesses recover overdue payments, offering solutions for customers facing financial challenges. By utilizing modern techniques and technology, debt collectors ensure effective…

-

What is Bad Debt Expense: Formula and Preventive Measures?

Bad debt expense impacts businesses by reflecting the amount owed by customers that is unlikely to be recovered. It helps provide a realistic financial picture,…

-

Bad Debt: Write-offs and Provision Method

This article addresses the issue of bad debt, which occurs when loans or credit extended to customers cannot be recovered, impacting a company’s profitability, cash…

-

Account Receivable: A Debt or an Asset?

This article explains accounts receivable (AR), which represents money owed to a business by customers. It details the AR process, from credit extension to payment…