Debt servicing is an important financial concept that directs to the process of handling and paying off debt. The process includes both the interest and principal repayments. For businesses, individuals, and governments, effectual debt servicing guarantees that borrowed funds are settled on time, controlling all defaults and conserving financial stability.

Debt servicing assesses all the key factors of an entity’s ability to meet its financial obligations. It generally involves regular payments made for bonds, loans, or any other form of debt. Comprehending debt servicing is important for possessing a healthy financial position, controlling cash flow, and securing long-term fiscal responsibility.

How does debt service work in a business?

Every time a company needs a commercial loan or is about to set the interest rate of a new bond, it must first compute for the DSCR. It involves the computation of the current net operating income of the company to the current amount necessary to service the existing debts, both the interest and principal included.

If a given lender feels that the company cannot generate adequate revenues to pay new and previous credit facilities, then the lender will not provide credit to the company.

The level of gearing, which can be defined as the way in which debt is used to finance assets, also matters to the lenders and the bond investors. If the company is to expand the level of debt it employs in the financing of its operations, then it has to possess better profit to meet the required interest rates.

This implies that in order for the specific firm to manage large amounts of debts, the firm has to earn a large amount of profit every year if it is to be in a position to manage and pay for the debts. When a company has debts, but it cannot manage them, then the company is considered over-leveraged.

Are Loan Servicing and Debt Servicing is Same?

Loan servicing is not the same as debt servicing although they may sound the same; they are two different words. Loan servicing deals with the administrative tasks related to a loan that any lender or third-party company usually performs, such as writing monthly statements to the borrower for payment processing. Debt servicing, however, refers to when the borrower makes payments toward a loan or other form of debt, which includes principal repayment and interest repayment.

Types of Debt Service

Interest

Interest refers to the cost of borrowing in terms of a rate for a given period, which is most frequently used as an annual rate on the principal amount of the loan.

Interest payments are one of the major subcategories which fall under the ambit of debt service. In different forms of loans, the borrower can meet either simple interest or compound interest.

The simple interest is computed without any addition of the other amounts, such as the interest earned in the remaining balance amount of the principal.

However, compound interest is charged on both the principal amount and the interest that has been earned in the earlier periods. These costs should be estimated for and paid as when due since this affects their credit status.

Principal

The principle is initial capital borrowed or invested in an activity. Typically, principal refers to the amount of money that the borrower reimburses to the lender on undertaking the service of a debt.

The principal amount is normally redeemed with interest over the term of the loan through the Amortization Schedule. Every installment that the borrowers make would consist of the proportion of both the principal and the interest.

Sinking Fund Payments

Sinking fund payments are, therefore, an important category of debt service instruments, although they are used mostly in corporate bond issuances.

A sinking fund is a financial reserve that the issuer accumulates over time and uses to pay off bonds or debentures—this is done through regular installments towards the sinking fund.

Such payments assist firms in reducing the load of a huge payment of the entire bond on its maturity date. Payments to sinking funds should not be made arbitrarily but rather in a way that should align with the cash availability or the company’s overall strategies.

Lease Payments

To the same degree, lease payments are the other type of service with regard to leasing property, equipment, or other facilities. They entail the payment of rent for the facilities and equipment by the lessee to the lessor for a specified period.

In finances, leases come in two basic types: an operating lease and a capital lease, with the two having different payments and recording mechanisms. Lessees have to set aside and make these payments in order to avoid incurring penalties and maintain a good relationship with the lessor.

Every type of debt service has its characteristics and tasks that need to be fulfilled. All these obligations or costs must be met financially, and this will require efficient management of finance, which includes the processes of budgeting, cash flow forecasting, and credit.

How to Calculate for Debt Service?

Debt service is established by determining the amount that a company has to pay regularly in order to make the loan payment of both interest and principal. For this, the interest rate of the loan, as well as the period within which it is to be repaid, has to be determined.

To find out how much cash is required for these duties, the calculation of debt service is helpful, one of which is debt service on an annual basis and the other as the company’s annual net operating income.

Practical Examples

Bond Example

A firm floats a bond of $500,000, which is at a 5% interest rate. The company undertakes to pay the $75,000 interest every year and the $500,000 principal upon expiry of seven years.

In the first year, the company will pay:

$500,000 x 0. 05 = $25,000

In the seventh year, the company will pay:

($500,000 x 0. 05) $500,000 = 525,000

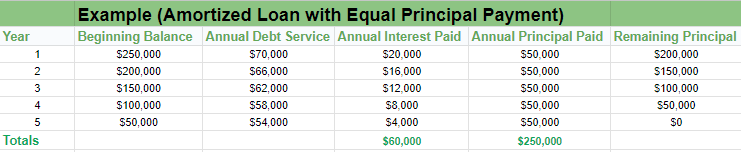

Loan Example

A company applies for an interest-bearing loan of $250,000 and receives the money at 8% for 5 years. The loan is fully amortized, and the company will pay equal instalments of principal each year for the loan term, together with 8% annual interest on the outstanding balance.

After five years, the company will have paid the total of the original principal balance and the interest accrued. If payments are made once a year, the debt service for each year would be: If payments are made once a year, the debt service for each year would be:

- Year 1: $70,000

- Year 2: $66,000

- Year 3: $62,000

- Year 4: $58,000

- Year 5: $54,000

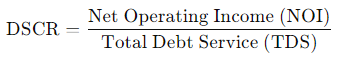

What is the Debt Service Coverage Ratio (DSCR)?

The Debt Service Coverage Ratio is useful in assessing the ability of the operating income of a company to fund its mandatory cost on the debt (interest and Both). This helps the consumer, especially the lenders, investors, and creditors, to have a depiction of how much cash the company generates in a fiscal year to enable the repayment of loans.

How to Calculate DSCR:

DSCR is calculated using the formula:

Where:

- Net Operating Income (NOI): Net operative revenue: sum of all the organization’s gross revenues derived from the sale of goods and services and value-added activities, but before taxes, before interest, and before other revenue sources.

- Total Debt Service (TDS): Schedule of interest and the repayment of the amount borrowed accumulated, which gives the total sum that a borrower has to make by accessing a credit facility.

How It Works

- DSCR > 1: As it was earlier described, a DSCR of more than 1 indicates the company gains more in revenue than the monthly obligations for loans enough to pay for the loans.

- Example: A DSCR of 1, for instance, means that for every $1 invested in the property or project, $1 of cash flow will be generated. 5 Another formula ascertaining the efficiency of the company is expressed by the ratio of value 5, meaning that the company earns one dollar for each dollar spent for the debt service—50 in operating income.

- DSCR = 1: If it is equal to 1, it is an indication that the total income earned by the company is just enough to service the amount of debt that has been taken. This is often very dangerous because the company cannot have an extra amount to cover any other incidents.

- DSCR = Debt/Assets: A value less than one indicates that the company is unable to meet its financial obligations and thus has a high likelihood of default.

DSCR is also often employed by lenders as one of the primary filters for selecting loan requests. This is why a company with a high DSCR has low credit risk; hence, the capacity to secure credit facilities is high.

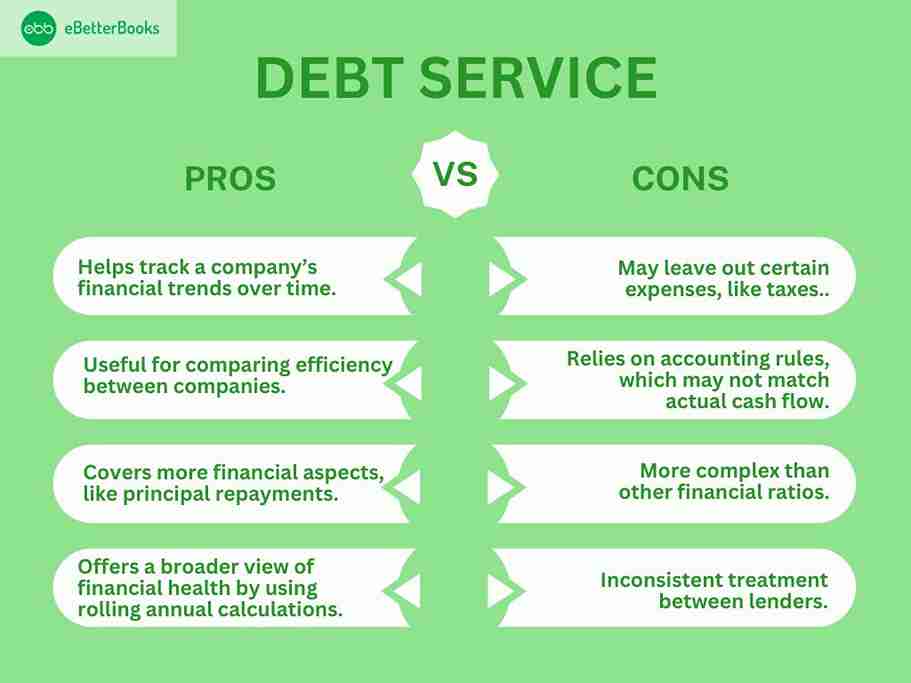

Advantages and Disadvantages of DSCR

The DSCR is a typical statistic for loan negotiations, but it has both advantages and disadvantages.

Advantages

- The DSCR is useful when measured consistently over time, much like other ratios. A corporation can use the monthly DSCR to examine the average trend and forecast future ratios.

- A falling DSCR may be an early warning indication of a company’s financial downfall, or it can be utilized extensively in budgeting and strategic thinking.

- The DSCR might also be comparable between firms. Management may utilize DSCR estimations from rivals to evaluate its performance in comparison to others. This might entail examining how well other firms use loans to achieve business growth.

- The DSCR is a more complete analytical approach for measuring a company’s long-term financial health. The DSCR is a more cautious, comprehensive estimate than the interest coverage ratio.

- The DSCR additionally represents an amortized ratio that frequently refers to a rolling 12-month period. Other financial measures often represent a single picture of a company’s health. The DSCR may be a more accurate depiction of a company’s activities.

Disadvantages

- Earnings before interest, taxes, depreciation, and amortization (EBITDA) or net operating income (EBIT) can be used as a basis for DSCR calculations. Depending on the conditions set by the lender.

- When operational income, EBIT, or EBITDA are employed, not all expenditures are taken into account, which might lead the company’s profits to be inflated. In each of these three instances, income does not include taxes.

- Reliance on accounting advice is another drawback of the DSCR. Obligatory cash payments are the foundation of debt and loans; nevertheless, accrual-based accounting guidelines are used to compute the DSCR partially.

- A study of a loan arrangement with fixed cash payments and a set of financial statements prepared in accordance with generally accepted accounting standards (GAAP) reveals several things that could be improved.

Pros and Cons

Strategies for Handling Debt Service

Restructuring Finances

One important tool that helps firms maintain their debt service is financial restructuring. Reorganizing a company’s assets and liabilities is frequently a part of it.

The aim is to reduce the financial hardship a business faces as a result of not being able to pay its debts on time.

Financial restructuring often refers to a company’s liquidation process or the rearrangement of its existing liabilities.

In the former, in order to prevent or overcome financial trouble, management, creditors, and other shareholders freely consent to reorganize the business’s operations or finances.

In the second case, the business could have to liquidate its assets in order to satisfy its debts if it is unable to make payments on time.

Refinancing

Another useful tactic for handling debt service is refinancing. It basically entails taking out a fresh loan with better conditions to replace an old debt.

Businesses frequently refinance in order to benefit from lower interest rates. They may cut their debt service expenses by doing this, which frequently translates into reduced monthly payments.

Reduced payments may free up financial flow for other company requirements. However, refinancing is not something that should be done carelessly, and companies must take into account things like refinancing expenses and the possibility of extended debt payback terms.

Your financial situation may be tight if your DSCR is low. Examine the accounts of Main Street Legal Services, a different fake business:

Cash flow of Main Street Legal Services

June 30 was the conclusion of the quarter.

- Revenue from legal services: $300,000.

- Running costs: – $150,000

- $150,000 is the net operating income.

- Principal payments on loans: $150,000

- Interest payments on loans: $50,000

- $200,000 is the total amount owed.

- DSCR = $150,000 ÷ $200,000 = 0.75 (Net operational income ÷ Total debt service).

Due to its inability to pay off its obligations in full, Main Street Legal has a tight DSCR of 0.75, which is below the 1.00 safety threshold. As a result, the company has needed help to obtain the funding it needs to grow. It is 25% too short.

Interest Coverage Ratio vs. Debt Service Coverage Ratio

The two important ratios that are used to assess the capacity of a company to service its debts are the Interest Coverage Ratio (ICR) and the Debt Service Coverage Ratio (DSCR). As with the current and quick ratio, it gives an estimate of the business’s financial strength but measures somewhat different aspects of the ability to meet debt obligations.

Interest Coverage Ratio (ICR)

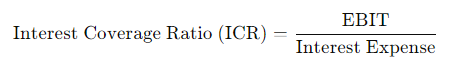

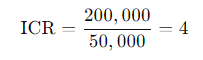

The Interest Coverage Ratio indicates the number of times that the interest on the debt has been covered. It established the ratio of earned EBIT against the interest expenses incurred by the firm.

Formula:

Example:

- EBIT: $200,000

- Interest Expense: $50,000

In other words, the business can absorb interest charges more than fourfold. A higher value of the ratio means that the firm’s operating income is strong enough to repay the debt interest easily, a sign of good financial health, while a lower value shows that the firm may struggle to meet the interest on the borrowed capital.

Debt-Service Coverage Ratio

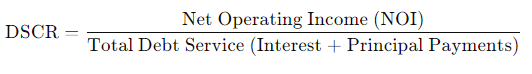

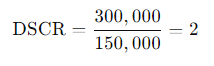

DSCR is the measure of the extent to which annual operating income can meet the annual expenses of debt.

The Debt Service Coverage Ratio analyses the agility of a company in relation to satisfying its obligations on the interest and the principal of the borrowed amount. DSCR compares the company’s operating income or net operating income (NOI) to total debt service, that is, the interest expense plus any lease payments on outstanding loans.

Formula:

Example:

- NOI: $300,000

- Interest Payment: $50,000

- Principal Payment: $100,000

- Total Debt Service: $150,000

A DSCR of 2 capital structure suggests that the firm makes two times the amount that is required to meet its total debt cost, interest, and other fees.

A value of DSCR above 1 means that the company is in a position to meet the interest on the debt, while a figure below 1 means that the company may be in a position to meet the interest on the debt.

Here’s a table that shows the clear key differences between ICR and DSCR:

| Key Differences | Interest Coverage Ratio (ICR) | Debt Service Coverage Ratio (DSCR) |

| What it Measures | Ability to pay interest on debt | Ability to cover total debt service (interest + principal) |

| Formula | EBIT / Interest Expense | NOI / (Interest + Principal Payments) |

| Focus | Only on interest payments | Includes both interest and principal payments |

| Scope | A more narrow focus on short-term liquidity | A more narrow focus on short-term liquidity |

| Application | Used to assess interest payment risk | Used to assess overall debt repayment risk |

| Healthy Ratio | Used to assess overall debt repayment risk | A DSCR of above 1 is considered healthy |

| Risk Indicator | Signals risk of interest payment default | Signal risk of default on total debt payments |

The Final Word

The money required by an individual, organization, or government to make loans or other debt payments for a specific duration is referred to as debt service.

By contrasting its available revenue with the amount it is already spending to service its obligations, a company’s debt-service coverage ratio determines how well-equipped it is to handle new debt. Clarify, simplify, and add details to it.

FAQs

What is Debt Servicing?

Debt servicing refers to the process of making regular payments to cover the interest and principal of borrowed funds, such as loans, bonds, or other forms of debt.

Why is Debt Servicing Important?

Debt servicing is vital for maintaining financial stability, preventing defaults, and ensuring that an individual, business, or government can meet its debt obligations on time.

What are the Components of Debt Servicing?

Debt servicing consists of two main components: interest payments and principal repayments. The interest is the cost of borrowing, while the principal is the original amount borrowed.

How Does Debt Servicing Affect a Business?

For businesses, effective debt servicing ensures smooth cash flow management and helps maintain a good credit rating, which can be crucial for securing future financing.