What is Debt Collection Software?

Debt collection software, a tailored IT solution, is a powerful tool for businesses. It accelerates collection, minimizes non-payment, saves time, enhances business reach, and, most importantly, boosts Promise-to-Pay leverage, giving you more control over your finances.

Good collections software features include payment reminders, summaries of customer phone calls, the first level of inquiries through chatbots, dunning 2.0, and several others. Such types of debt collection products are popular with creditors, collection agencies, and businesses that monitor customer payments.

Integration of Debt Collection Software in Accounting Systems

Debt collection software can often be integrated into broader accounting software solutions. This integration allows businesses to simplify their financial processes by combining debt management with overall accounting functions.

Users can manage invoices, track payments, and handle collections all from a single platform, which simplifies operations and reduces the need for multiple systems. This functionality is particularly beneficial for small to medium-sized enterprises that may not have the resources to invest in separate systems for accounting and debt collection.

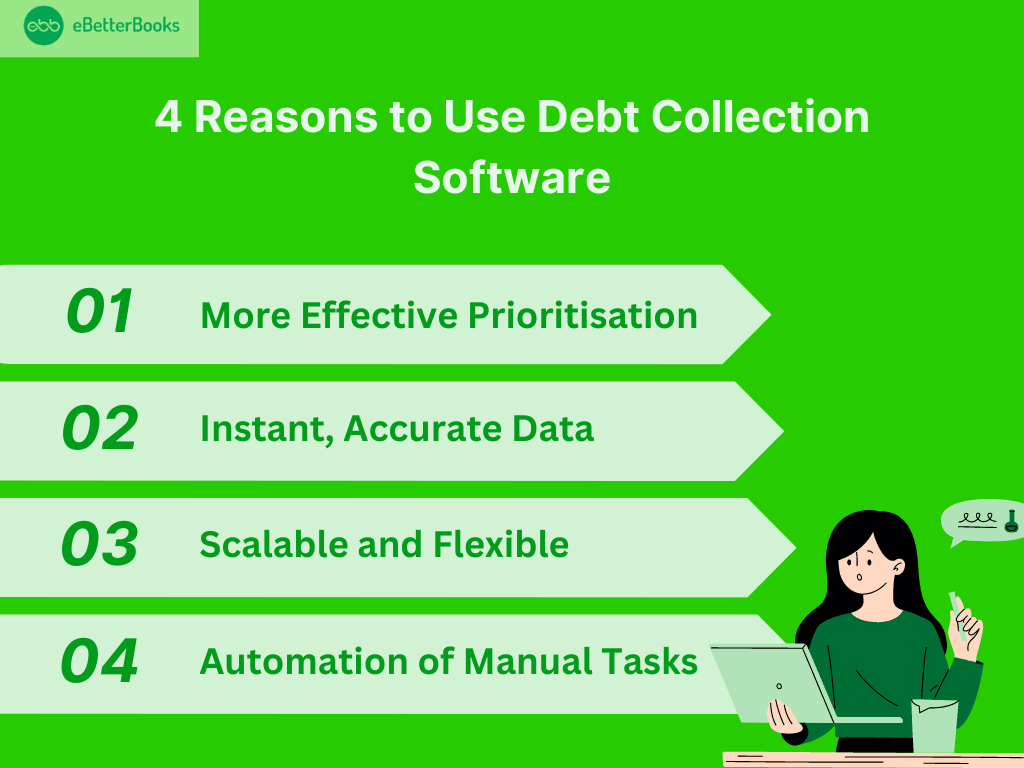

4 Reasons Why Businesses Should Use Debt Collection Software

- Enhanced Prioritization

Don’t spend too much time on low-value, unimportant debtors; instead, give your attention to the important issues that need to be addressed. It plays a large role in determining the efficiency through which you can sort out needful information from accurate and easily searchable data, which is usually located in central places.

It means you can run the reports at any time and based on some key criteria, such as total outstanding amount or total number of days of debt, which will help you be more operational and efficient, especially when working with thousands of customers.

- Instant, Accurate Data

What is more, the data one has access to when using automated debt recovery software is always fresh and correct. It gives you confidence that the information that you are using is accurate, thus enabling you to give accurate information to the management without necessarily having to confirm its accuracy.

- Scalable and Flexible Solution

Good debt collection software is also adaptable to the company’s expanding size. It’s flexible in terms of usage in your organization and can easily be modified to suit the growing needs of the business.

- Automation of Manual Tasks

The biggest plus of using software is the ability to save time, especially through repetitive tasks. The system deals with small routine activities automatically and informs you when some actions require sign-off, thus saving time.

In other words, the objective is effective debt collection, and debt collection software has a strategic role in enabling efficient debt collection processes with minimal losses.

- Bottom Line

Choosing the most appropriate collection software is a very important decision that can affect your organization’s productivity, efficiency, and revenue.

When using the tools and functionalities of the most effective debt collection software products, companies receive tactical advantages, increase the effectiveness of interactions with the debtors, conform to the regulations, and strengthen their potential in terms of recovering unpaid debts.

For any company, big or small, getting debt collection software is an effective way of managing your debt recovery and improving your financial results.

Debt collection software has turned out to be a crucial ally in the current modern world of commerce in the course of debt recoveries with flexibility. It is crucial to make assessments to differentiate as well as measure requirements because numerous vendors and products are available in the market that allows for the selection of social media management tools, which include elements such as scalability, ease of use, flexibility, compatibility, security features, and pricing policy.

Identifying the most suitable debt collection software solution is going to contribute to the enhancement of the efficiency of operations in your company and the collection rates depending on the type of requirements and goals that you have in mind.

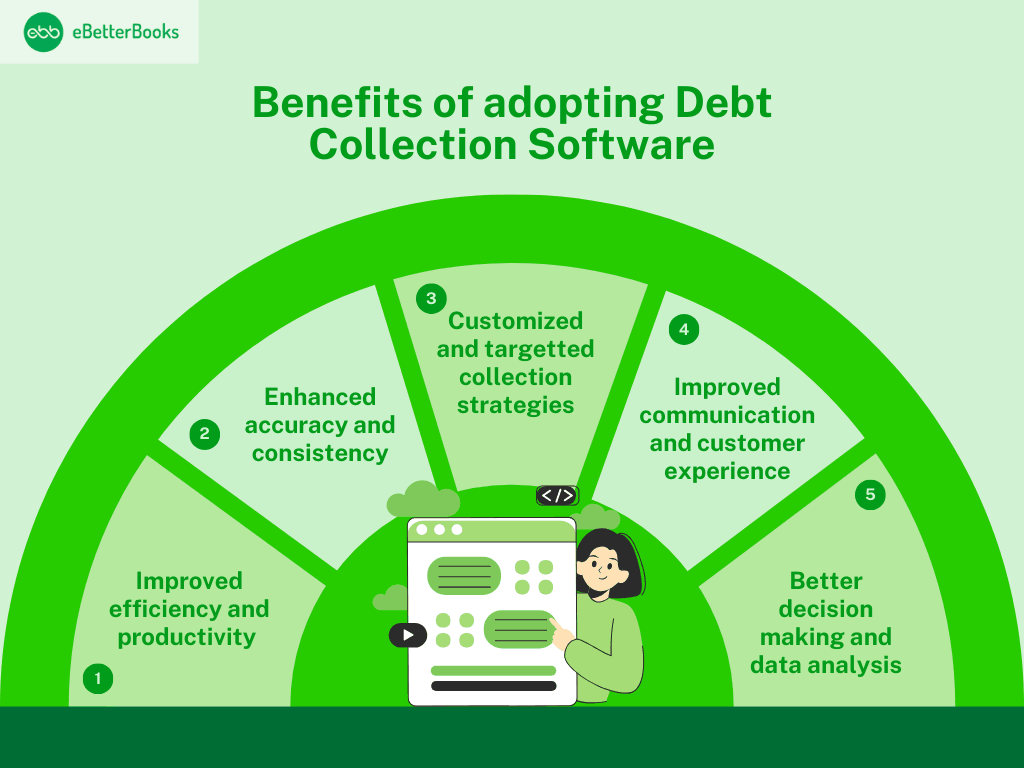

Importance of Debt Management and Collection Software in Businesses

Recovery from debt is generally cumbersome, tiring, and expensive for organizations, particularly those with higher day sales outstanding (DSO). As highlighted earlier, incorporating debt management system software also assists in controlling bad debts; it has the following advantages.

Implementing debt collection software brings a host of advantages. It improves efficiency and productivity, enhances accuracy and consistency, enables customized and targeted collections strategies, and enhances communication and customer experience.

1. Improved Efficiency and Productivity

The process of debt collection calls for recalling collection days, making acknowledgements of payment manually, taking many hours calling customers, and managing papers, making it a very tiresome task.

A debt collection solution liberates you from the burden of manual collection processes, accomplishing repetitive functions and freeing collections personnel time for high-value work such as customer relationship management or strategic debt recovery planning. This results in increased efficiency and productivity, giving you more control over your operations and facilitating faster recovery of debts.

2. Enhanced Accuracy and Consistency

Debt collection software significantly reduces the risk of wrong customer details, incorrect calculations, and erroneous information on the ERPs that can gravely affect collections. Automating the process decreases the number of errors and possible disparities, providing a clear and accurate platform for analyzing customer data for collection, thereby instilling confidence in your collection strategies.

3. Customized and Targeted Collections Strategies

Debt collection software offers a level of customization that ordinary methods of debt collection cannot match. It allows businesses to sort customers according to their unique characteristics, such as payment rates, outstanding amounts, or creditworthiness, enabling more efficient and targeted collections strategies. This empowerment allows you to tailor your strategies to your unique business needs.

4. Improved Communication and Customer Experience

The communication strategy is crucial for the effective accomplishment of the task of debt collection. Nevertheless, an exclusively document-based approach may cause the following problems: time loss, misunderstanding, and inconsistency in messages.

Debt collection management systems provide different communication methods, such as email for formal communication, short messaging service (SMS) for quick reminders, and Interactive Voice Response (IVR) for automated phone calls, thereby enhancing the customer experience.

5. Better Decision-Making with Data Insights

Depending on manual procedures, it is impossible most often to analyze data and take advantage of them. Global systems for the automation of debt collection make use of data to organize detailed information on customers, payments, and the performance of departments and agencies that are involved in the collection of debts.

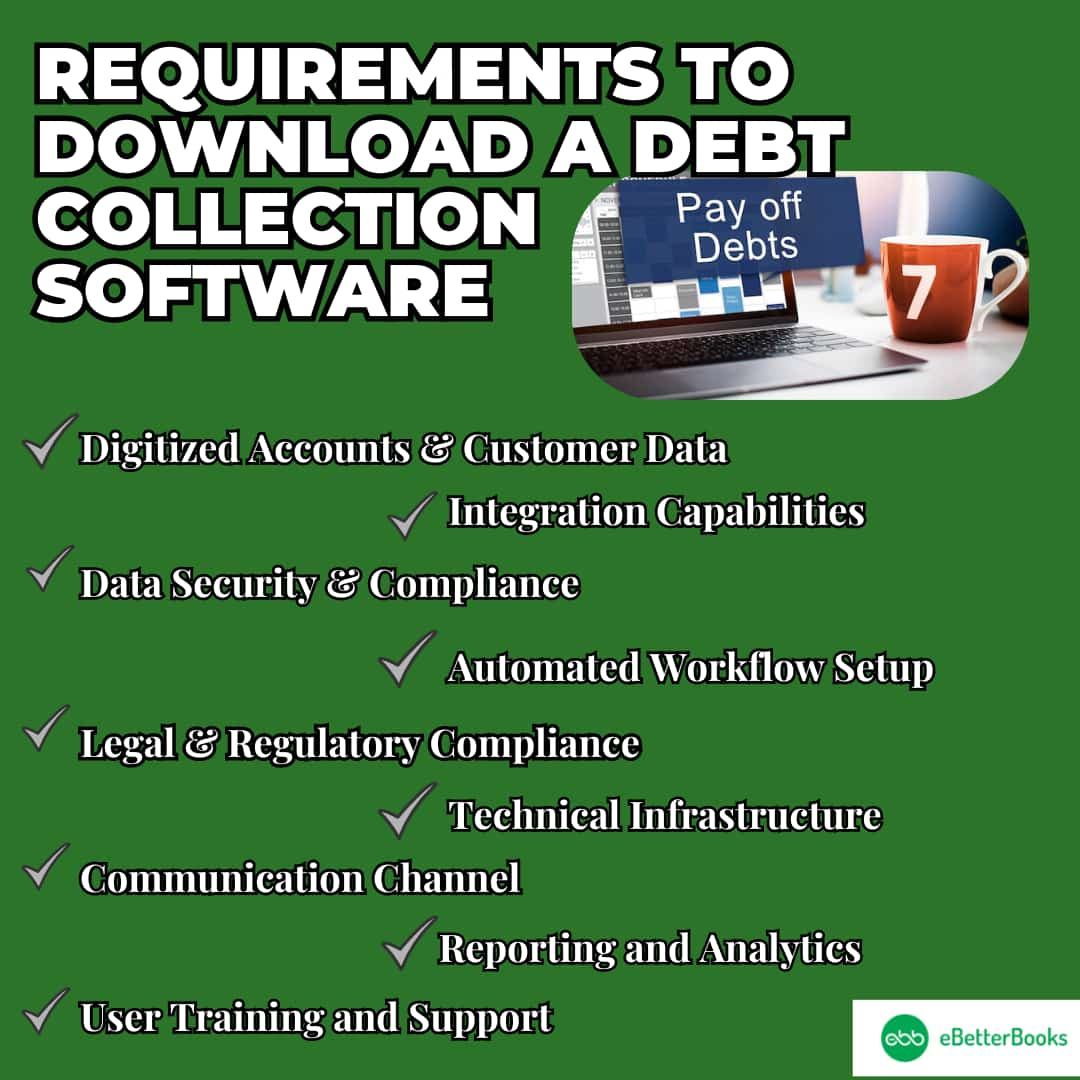

Requirements To Download A Debt Collection Software

Effective download and implementation of debt collection software requires several key requirements:

Digitized Accounts and Customer Data

- All customer-related information, such as account details, invoices, payment histories, and correspondence, needs to be digitized. This ensures that data is easily accessible and manageable within the software.

- The information must be organized in a structured format, such as CSV, XML, or SQL databases, to be compatible with the software’s data import functions.

- Maintaining accurate and up-to-date customer information is essential to prevent errors during collection activities.

Integration Capabilities

- The debt collection software should integrate seamlessly with existing Customer Relationship Management (CRM) or Enterprise Resource Planning (ERP) systems.

- Integration helps the software to synchronize data across platforms and enhances operational efficiency.

- Compatibility with accounting tools such as QuickBooks or Xero is essential for synchronizing financial data, ensuring that all monetary transactions are accurately recorded and tracked.

Data Security and Compliance

- Compliance with regulations such as GDPR (General Data Protection Regulation) or CCPA (California Consumer Privacy Act) is necessary to protect sensitive customer information from breaches.

- The software must support strong encryption methods and authentication protocols to safeguard against unauthorized access to sensitive data.

Legal and Regulatory Compliance

- The software must comply with federal and state debt collection laws, such as the Fair Debt Collection Practices Act in the U.S., to avoid legal repercussions.

- Organizations must ensure that they possess the necessary licenses and certifications to operate as debt collectors in their respective jurisdictions.

Technical Infrastructure

- Organizations need to decide whether the software will be cloud-based or hosted on-premises based on their IT capabilities and data security policies.

- The software should meet specific technical requirements, including operating system compatibility, network bandwidth, and storage capacity. These factors are critical for optimal performance.

- The availability of APIs for custom integrations with third-party applications is essential for enhancing functionality and ensuring seamless operations across different platforms.

Communication Channels

- The software should support multiple communication channels for effective interaction with debtors. This flexibility helps in reaching out through preferred methods of communication.

- It should also provide capabilities for storing and managing important documents such as payment agreements, letters, and legal notices efficiently.

Automated Workflow Setup

- The software must be able to customize workflows based on specific collection processes, such as payment reminders or legal actions, to meet organizational needs.

- Automated notifications for reminders, missed payments, or new actions required can significantly enhance efficiency in the debt collection process.

Reporting and Analytics

- The software should include financial reporting features that allow tracking revenue, aging reports, and collection success rates. This capability is crucial for informed decision-making.

- Advanced analytics capabilities enable tracking of agent performance, debtor responsiveness, and overall collection efficiency.

User Training and Support

- Implementing training programs for users is vital to ensure they fully understand the software’s features and functionalities.

- Access to technical support from the software provider is necessary for troubleshooting issues that may arise during operation or updates. Reliable support can minimize downtime and maintain productivity.

The Best Solutions For Debt Collection Software

When it comes to selecting good and efficient debt collection software, there are several leading solutions that have numerous features, good interfaces, and a track record to rely upon. Here are some of the top debt-collection software solutions available in the market.

Here are some of the top debt-collection software solutions available in the market:

- Experian

Experian Debt Management and Collection System is an intelligent debt collection software that is well appreciated for its effectiveness and versatility of its features. It provides integrated debt collection features such as client relations, accounts, correspondence, and compliance.

Experian Collections features an intuitive dashboard with advanced analytics and reporting to help businesses enhance the effectiveness of their collection and achieve better recovery rates.

- Cogent

Debt Collection Software Cogent Collections: Business markets feature the best debt collection software that companies can use in their operations.

Based on the cloud, Cogent Collections designed this solution to be agile, modular, and easy to use. It provides options for the creation of multiple workflows, options for automated communication, and the ability to connect to other systems.

Cogent Collections also integrates real-time dashboards and analytics to track key performance indicators and outcomes and support businesses in making decisions and getting results.

- Nortridge

Best Debt Collection Software Northridge is the software that can be used to collect debtors’ details most efficiently.

Nortridge Software is a complete tool for managing the lending business; it is a debt collection software. It also features rich account management capabilities, flexible payment processing options, and compliance management tools. Nortridge Software also offers tools for automating the business process customer areas and better analyzing the results for higher customer satisfaction.

- Quantrax

Best Debt Collection Software Quantrax Corporation

Quantrax Corporation has provided a debt collection software solution that is more effective, efficient, and intelligent than any other software solution in the market. They are useful in their predictive dealer, skip tracing tools, and decision engines to facilitate collections processes and increase collections.

Quantrax Corporation has also offered both installation types and the ability to choose between on-premises and cloud programs depending on the businesses’ needs.

- CollectMax

The Top Debt Collection Software, JST CollectMax

CollectMax is a simple debt collection solution for businesses of various sizes ranging from small to medium-sized. It includes flexible workflow capabilities, a framework for letter production, and payment-received facilities that help in the consolidation of debt recovery activities.

CollectMax also offers features such as compliance checks, audit trails, and security features that can monitor compliance with every regulation, as well as security features that can protect the data being collected.

- DAKCS

DebtCollect Software DAKCS Software Systems

At DAKCS Software Systems, we have a software solution that provides all the required debt collections, ranging from healthcare collection agencies to healthcare and financial services.

There are client management, automated tasks, compliance instruments, and performance metrics among its inherent possibilities. Another feature that DAKCS Software Systems offers is reports and interfaces, which enable integration with other systems.

Debt Collection Software Features

In this case, it is crucial to note that debt collection software comes with numerous features that are all designed to make the process of retrieving outstanding debts seamless and reduce the general time spent working.

Let’s explore some of the key features in more detail:

Client Management

In this respect, it is imperative to identify that adequate client management levels are a key component for efficient debt collection processes. Client management information is consolidated in one convenient location, and thus, debt collection software minimizes its retrieval.

Here’s a deeper look into client management features:

- Centralized Database: It provides an extensive working platform that can help accumulate numerous data about the clients, their addresses, modes of payment, and records of communication too. This allows for readily available client data that enhances your team’s decision-making and ability to take the necessary actions.

- Segmentation: It breaks down clients in the clients’ list into several segments, following payment status, account balance, among others, and priority levels. Debt collection can be simplified by segmenting the clients by categorizing them into various groups depending on their requirements or situations to enhance efficiency.

- Notes and Comments: Including note-taking and commenting options in the client profile is useful for team members when exchanging information. Whether it is taking notes of critical briefings with the clients or from discussions that can be useful in the future, these notes are useful to enhance the collection efforts.

Account Management

Good account management helps in controlling and monitoring accounts receivables by ensuring that all are collected as soon as possible. Debt collection software offers wonderful features for account management, which means that everything can be noticed.

Here’s a closer look at account management features:

- Debtor Profiles: Accomplishing profiles for individual debtors facilitate the record of pertinent and personal details about each client and their standing of debts, as well as the current repayment agreement.

These profiles act as topic profiles, which are detailed records that enable customized interaction and appropriate action to be taken.

- Payment Tracking: The arabesque payment tracking feature enables you to track receivables, balances, and payment records from various accounts.

When financial accounts are documented properly, trends can be noticed, future cash flows forecasted, and collection efforts allocated properly.

- Automated Reminders: Organization of the daily reminders for the payment due dates, follow-ups, and overdue notices aids in debtor response management. These are all time-consuming activities.

As such, outsourcing can save time and money for the organization, allowing it to focus more on the important issues of credit collection, such as credit risk analysis and portfolio management.

Automated Communication

One of the most important factors includes appropriate and accurate communication, which allows engaging debtors and ensuring the rapid settlement of outstanding amounts.

Debt collection software contains communication flows, which can be adjusted based on the best practices for further enhanced interaction.

Here’s a closer look at automated communication features:

- Email Templates: Auto-generated messages allow sending personalized e-mail messages to debtors with no need for much effort due to the templates provided.

These templates include letters of reminding the payment, settlement letters, or any legal notice that you wish to write to the recipient.

- SMS Integration: Another function is the integration of SMS options that enable the sending of automatic text messages to the debtor informing him/her of the outstanding amount, amongst other things.

This is because SMS messages are normally quicker and can easily be accessed compared to emails, especially when there is a need to pass important information, such as reminders or even emergencies.

- Call Logging: Phone call logs are completed and documented, keeping an account of all the communication made with the debtors.

This way, you are able to capture the call details, including its duration, outcome, and follow-up actions, so you are able to analyze it or even scrutinize the results with the purpose of improving the method applied during subsequent conversations.

Reporting and Analytics

Among the benefits, using data to support decision-makers is crucial when making strategic decisions and managing debts.

Another advantage of using debt collection software is that the reporting and analytic tools it provides are very well developed, which equips it with the possibility to monitor vital performance metrics and their tendencies.

Here’s a closer look at reporting and analytics features:

- Custom Reports: Custom reporting enables one to make amends according to the market, clients, or any targeted goal or plan. Tracking recovery rates, aging receivables, or collection efficiency, as well as having custom reports, gives you actualized information you can strive to meet and work upon.

- Visual Dashboards: Think of such tools as scorecards, which are real-time and, as the name suggests, provide a visual view of the key performance areas.

It is for this reason that these dashboards give an on–the–go view of collection activities where one is able to review trends and identify distortions in addition to making required decisions in the process.

- Trend Analysis: Identifying various trends and patterns among debtors and their payment insight allowed for the forecast of future results and changes that can be made.

Benefiting from the trend analysis, it is possible to see some recurring problems, the possible forecast of cash flows, and some more problems that can be solved on the stage of their anticipation.

Compliance Management

There is added pressure in the debt collection industry in that one has to ensure that they meet a number of legal stipulations as well as professional benchmarks.

Some of the components of debt collection software are to help avert any violation of law and regulation regarding collection operations.

Here’s a closer look at compliance management features:

- Regulatory Compliance: From a feature/protection perspective, debt collection software contains general compliance mechanisms to adhere to task-oriented rules, such as FDCPA in the United States.

These features assist in defeating non-compliant practices and avoid legal consequences related to debt collection operations.

- Audit Trails: In a bid to minimize internal fraud and to meet customer expectations, financial institutions should follow properly documented records and documentation on every activity related to debt collection through credit references.

Some of the content of an audit trail includes a log of communications, payment information, and legal action taken. Within an organization, an audit trail serves as a source of review and monitoring for internal purposes or external auditing.

- Data Security: Strong data security prevent and contain leakage of client data by using physical, human, and technical precautions against intruders, hacking, and any other kind of cyber threat.

Security measures top the list with the possibility of data encryption, control of access to data, and storage laws, making the data super secure, thereby reassuring the clients and other stakeholders.

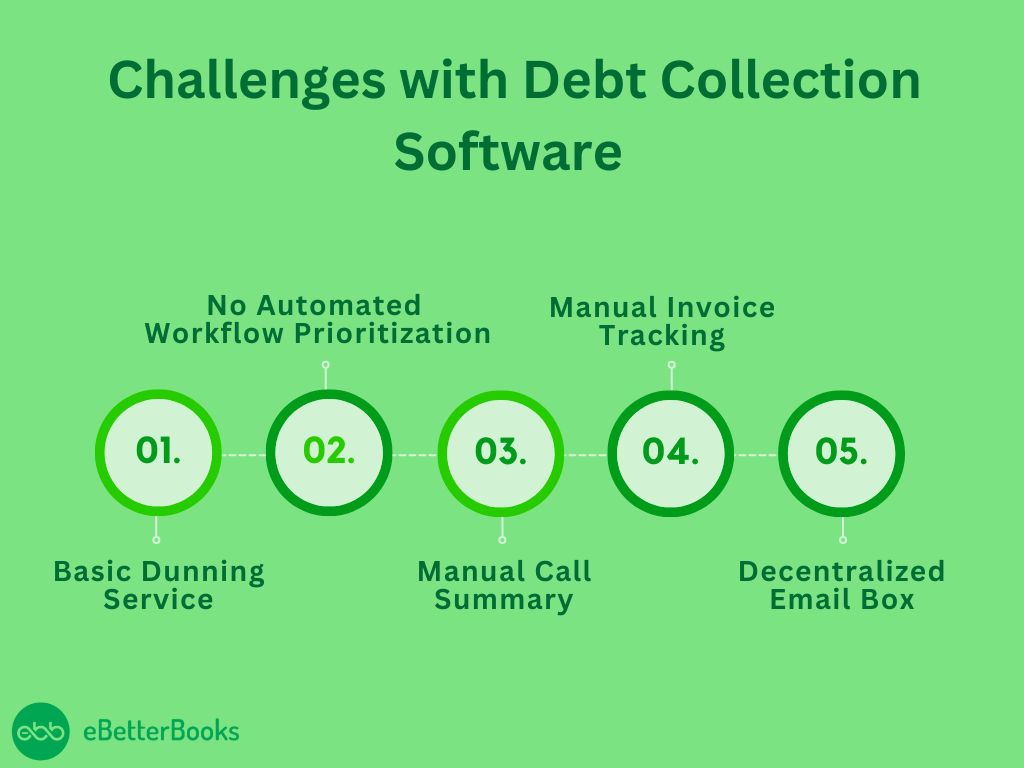

Challenges Faced by Most Debt Collectors

While debt collection management software is a powerful tool, it does come with its own set of challenges. Understanding these challenges can help you prepare for potential issues and make the most of the software’s features.

Provides Only Basic Dunning Services

Almost all debt collection software can accommodate only rudimentary running procedures because it relies on aging analysis with collection bins of 30, 60, 90, and 120 days only. For functionalities such as trigger-based dunning or incorporating payment gateways, businesses will require the intervention of IT personnel or third-party developers to set up these automated aspects.

However, some collections software provides advanced dunning features to schedule emails with smart payment links for long-tail customers and enhance outreach by ten times. Collections analysts can select from over 100 email templates to follow and use for payment reminders, past due notices, and account statements, among other emails; smart payment links in emails also show the real-time balance of a customer. Analyzes can use over 50 + rules to address event-based triggers.

The feature also permits the team to make bulk correspondences to pass on changes and to create auto-draft correspondence letters with attachments. They are also useful, especially when the analyst has gone through all the reports they intend to present to their customers.

For instance, if there is an invoice of $1000, then the system will automatically generate an email correspondence for the customer, a copy of the invoice, and proof of delivery (POD).

Lack of Automated Work-List Priority

Nonetheless, most of the debt management software available in the global markets includes merely elementary work lists with parameters such as ageing and past due sums, which are not sufficient to decrease DSO.

Moreover, they do not employ AR-specific AI for the collections use case and do not consider dynamic changes in either customer behaviour or the workload of collection analysts.

Use Of Writing Own Log Calls And The Summary Of The Calls

A significant drawback of traditional collections software is that analysts still have to make manual calls ‘going outside’ from traditional systems such as Cisco, Phone Ava ya, etc.

Such businesses have to take manual call logs and call transcriptions, as well as summarize customer communications that slash productive time that could be put into practices that make a difference.

Manual Invoice Tracking

In most of the popular debt management software, there needs to be support for AQ portal integration or any pre-existing support for e-invoicing. To create those UIs, businesses have to install third-party RPA bots such as UiPath, Blue Prism, OpenText, and many others that can be easily affected even by simple changes on the front end.

Worse still, it takes nearly $15,000 per bot to tailor and $3 to maintain. Considering different forces of nature, it is estimated to cost $5k per year to keep it running. A company needs at least 15 such bots, which would have a build cost of $150,000 and an annual maintenance cost of $50,000.

Decentralized Email Inbox

While there are usually other automated debt collection applications that can send simple dunning emails, the replies reach the collections inbox. Collectors will need to use both the software and the mailbox while carrying out various activities.

However, analysts must complete tasks such as generating promises-to-pay and solving disputes manually, which can cause them to miss vital mail.