A debt collection organization helps organizations recover the debt owed by overdue accounts.

These debt collectors, often seen as problem solvers, are hired by creditors or organizations when a customer or an individual does not pay their invoices. They receive a flat fee or a certain percentage of the amount recovered. Their role is not just to recover the debt but also to provide a solution to the issue, offering a sense of relief in challenging financial situations.

Some debt collectors also operate as debt buyers, which means they buy debt for a small percentage of its actual value and then try to collect as much or all of it back as possible. A collection agency is another name for a debt collector.

Understanding Debt Collectors

When a borrower defaults on a loan, the lender or creditor may transfer the account to a debt collector or collection agency. At this point, the debt is considered to have been sent to collectors.

This typically occurs between three and six months after default, depending on the creditor. Collectors may be responsible for a range of debts, including overdue credit card payments, phone bills, vehicle loans, utility bills, and past-due taxes.

Debt collectors may contact the debtor by phone and email, as well as through the debtor’s personal and work contacts. In rare cases, debt collectors can turn up at the debtor’s home. They can also contact the debtors’ family, friends, and neighbors to verify the debtors’ contact information.

Suppose the debtor agrees to pay the due amount back. Unless there is a fixed fee agreement, the creditor will often give the debt collector a certain decided amount of the money it recovers.

For pennies on a dime, certain firms, including debt collection agencies, may buy overdue debt from creditors and make efforts to recover the debt for their gain. If these collectors are successful, they keep every penny they make.

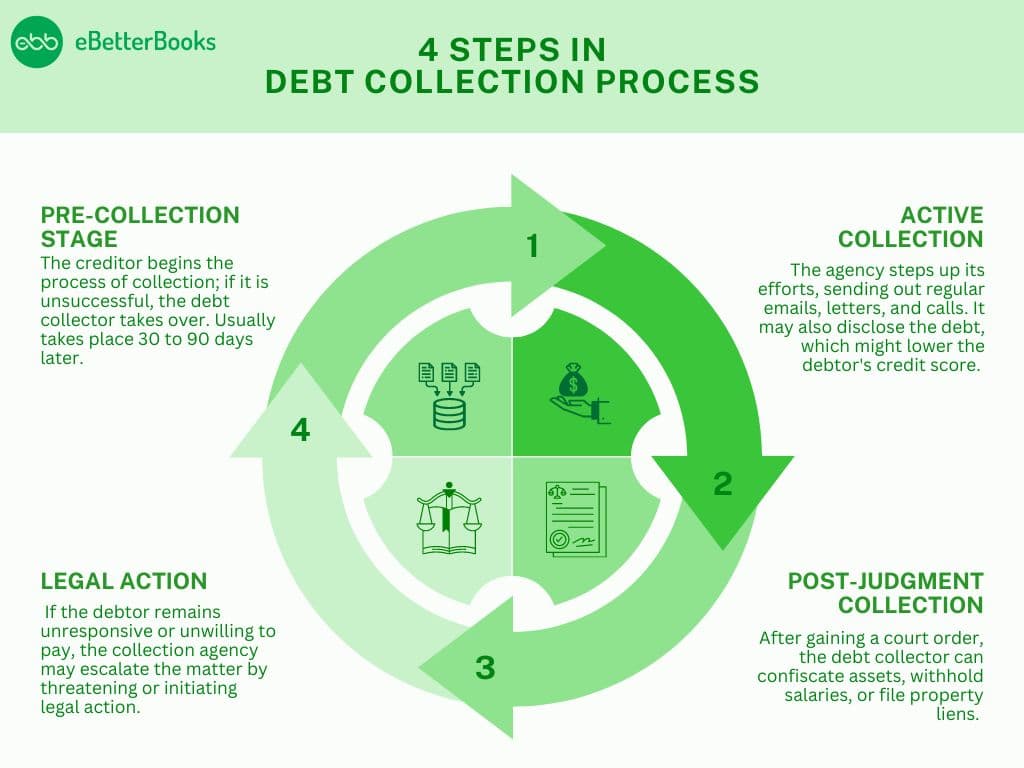

4 Steps of the Debt Collection Cycle

Pre-Collection Stage

This stage commences immediately after a payment has been delayed or has yet to be effected as agreed. Lenders or the business will then send reminders and call the borrower to try to get the money back. The idea here is to stop the debt from rising and being classified as a higher level of risk.

Active Collection

Most often, when the money is not returned or the borrower does not respond to prompts or phone calls, the debt is considered delinquent. At this point, lenders might engage the services of collection agencies or lawyers in an effort to recover the payment. These people are experts in pressuring borrowers to make the necessary payments.

Legal Action

Other methods may include legal proceedings that are taken when all other forms have been exhausted. This means taking the borrower to court in a bid to obtain an order from the court to compel him or her to make the necessary repayments. This is a severe measure generally taken when previous efforts to recover the debt have not yielded favorable results.

Post-Judgement Collection

When the court rules in favor of the lender, the recovery process starts. This could entail seizing property from the borrower, stripping his wages, or other similar actions to recover the dues. Therefore, this stage requires full compliance with all legal processes and the engagement of professional legal personnel for proper handling.

How does the debt collection cycle work?

The process of collecting a debt might differ depending on the company conducting the debt collection. Some agencies are invested in only one type of debt, such as medical or student loan debt.

Others may handle debt that is several years old. Some may not approach it if the statute of limitations has expired where you live, which is unique. Once the debt is a few months old, collection agencies can pursue it relentlessly; in other words, they can pursue it perpetually from then on.

This depends on the company that is after the debt, the amount of money you owe, and the type of debt.

Unpaid past-due debt is communicated to you via written notices and telephone contacts done through the original creditor.

For instance, let us assume you had a student loan that you were paying some time ago but have defaulted on. The lender will try to find you so that they can make the account right.

If it fails to make you pay the debts owed to it, it will cease at some point. It is also widely observed that at that moment, the process of changing the creditor to a collector takes place.

Debt collection agencies and collectors will use this information, including your current address, phone number, and relative contact details, to contact you.

Debt collectors will access savings or investment accounts to determine whether a person has the means to pay the debt. However, some states permit credit collectors to garnish the wages of eligible old debts.

Debt Collection Example

Suppose, for example, Jesse honestly owes $ 15,000 for a credit card that he got from ABC Bank. They again ran into debt and have not been able to make their monthly remittances for the past six months.

The credit card issuer tries to collect the arrears through the company’s internal collection department. However, if all these efforts fail, the bank cancels the card’s services and moves the account to a commercial collection agency.

After the account has been forwarded to the agency, the agency writes to Jesse to inform them of the transfer. The agency then tries to collect the debt by sending other letters or calling the customer.

If the collection efforts are successful, the agency is paid a fee or a proportion of the balance receivable. If the balance is collected, it is paid back to the original credit provider, and Jesse’s file is cut off.

Debt Collection Laws

While collectors have the legal right to try to collect all debts they can legally pursue, the Fair Debt Collection Practices Act has placed several restraints. Congress enacted it in 1977 as an amendment to the Consumer Credit Protection Act of 1968, ensuring fairness and protection for consumers in debt. This act provides a secure framework for debt collection, ensuring that consumers are treated fairly and respectfully.

The FDCPA:

- Prohibits a collection agency from discussing your debt with your family, friends, neighbors, or employer.

- Limits the times of day collectors can call you.

- Prohibits the use of slurs, obscenities, insults, or threats.

- Provides remedies for consumers who wish to stop collection agencies from all contact.

- Requires collectors to verify all debts and end collection procedures if verification is not forthcoming.

On the other hand, all third-party bill collectors and lawyers who practice the art of debt collecting fall under the provisions of the act despite the original creditors needing to be covered.

Also, statutes in many states govern the operations of bill collection agencies, and some of the statutes provide for licensing, registration, and bonding of the agencies.

Some 3,200 of the largest U.S. collection agencies are members of ACA International, the world’s largest nonprofit trade group for agencies, creditors, debt buyers, attorneys, and other service providers. This professional association ensures that these agencies’ operations are m conducted with the highest standards of professionalism, instilling confidence in their practices and the debt collection process.

The laws and regulations covered by the ACA include all laws regulating the practice of counseling and all laws regulating the operation of the organization besides the set code of ethics.

ACA’s code of conduct demands that its members treat consumers with courtesy and consideration, communicate with them with sincerity, and abstain from engaging in dishonorable, unethical, or unprofessional conduct that is likely to deceive, defraud, or harm a consumer.

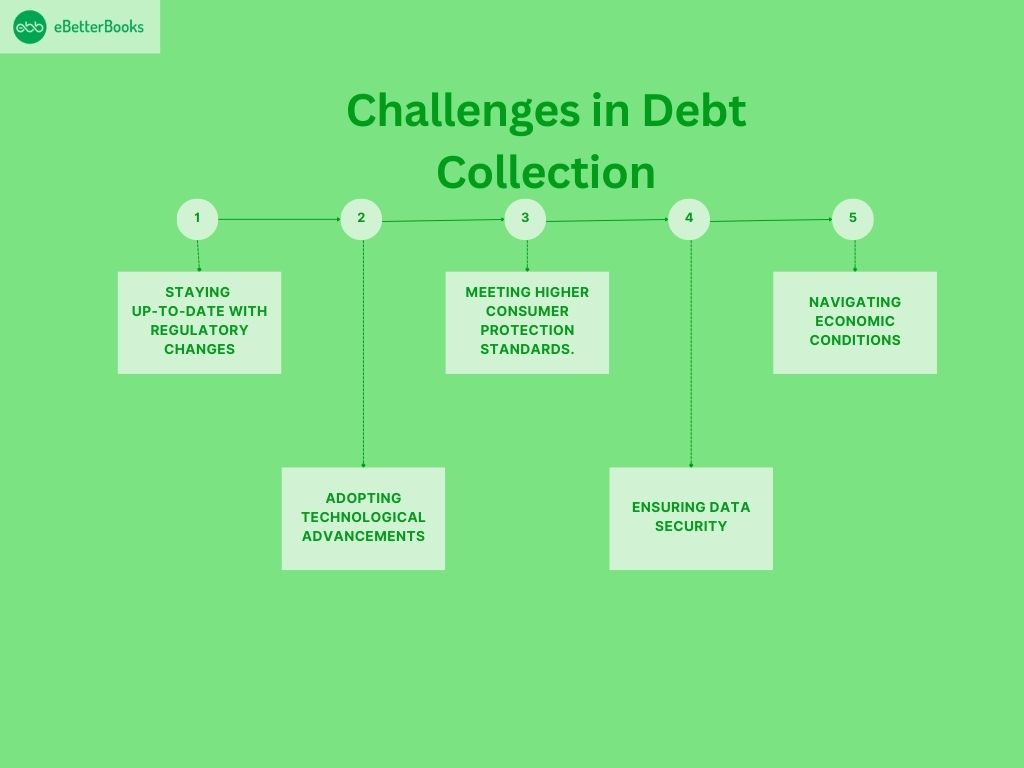

Challenges in the Debt Collection Cycle

Debt collection is an important component of the financial sector that entails chasing outstanding debts from people or organizations.

The debt collection sector confronts a number of issues and developments, including:

Staying up-to-date with regulatory developments

Debt collection is heavily regulated, and changes to laws and regulations can have a considerable influence on debt-collecting tactics. To guarantee compliance, debt collectors must be up to speed on all applicable laws and regulations.

Adopting technological advances

Debt collection companies, like the rest of the financial business, are increasingly employing technology. Debt collectors are now using automation, artificial intelligence, and machine learning to simplify their operations and increase productivity.

Meeting higher consumer protection standards

Nowadays, consumers are more conscious of their rights, and authorities are working to give them additional protection. To prevent legal action, debt collectors must ensure they abide by all applicable rules and regulations pertaining to debt collection.

Ensuring data security

Due to the volume of sensitive data they gather and retain, debt collection organizations are vulnerable to cyberattacks. To secure the data of its customers and consumers, these agencies must have strong data security mechanisms in place.

Economic situations, such as financial crises or recessions, have a big influence on debt collection. During these times, customers may need help making payments, which might raise the amount of debt collected.

In conclusion, the debt-collecting sector is difficult and necessitates constant adjustment to shifting legal requirements, governmental policies, and financial circumstances. Debt collectors must keep current on industry trends and problems to properly pursue outstanding debts while adhering to applicable rules and regulations.

The Evolution of the Debt Recovery Process

As long as people have incurred bills, there have always been customers who default on a particular payment or even give it out. However, business enterprises employ the societal communication channels available to recover the amounts that are due while observing legalities.

Securing repayment has been a restricted activity in the past, including sending letters to customers and calling them.

Sadly, these methods have not progressed with the technology present in consumers’ lives, ranging from the shift from fixed lines to mobile phones as their primary source of call to sophisticated call filtration or call-blocking applications.

There has also been a shift from more acute strategies to an overall friendly approach, which, in fact, better corresponds to how people have treated individual brands over the years.

Reactive (Traditional Approach) and Proactive (Modern Approach)

| Aspect | Reactive (Traditional) | Proactive (Modern) |

| Approach | Reactive responses to late payments. | Preventive actions to avoid late payments |

| Early Stage Collections | Within 90 days, escalating from friendly to aggressive tactics | Multiple channels, personalized efforts, and self-service options |

| Customer Relationship | Often fractured, leading to the loss of the customer | Framed as a partnership, aiming for a mutually agreeable solution |

| Customer solutions | Limited, minimal control, and forced phone communication | Flexible, convenient, and empowering customers to self-cure |

| Communication | Lacks personalization, follows a rigid timeline | Based on customer preferences, includes digital and mobile options |

| Technology Usage | Outdated methods with little regard for customer value | Innovative technology predicts late payments and offers insights |

| Outcome | Loss of customers and reliance on collection agencies | Improved client retention and increased repayments |

Then & Now: Experience as the Differentiator

Sadly, it is not like this, as the industry has failed to adapt to changes in customers’ lives and ways of communication. The CFPB is citing yet another survey, which stated that customer complaints regarding contact through the phone were the most common, at 85%, and another method complained of was through the mail, at 71%, but to be specific, it was letters from creditors and debt collectors.

At the same time, 57% admitted to having received a message on the answering machine or answering the voicemail.

A survey reveals a reduction in the number of phone calls made and letters issued for late bill notifications. In 2022, 46% said they were being called; 27% said they were receiving letters. In 2023, 26% said they were being called; only 20% said they were receiving letters.

While some third-party agencies have broadened their approaches and even have an online mechanism for correcting past-due accounts, this latter is not as efficient as using digital collection methods within 30 days.

Given that about one in four consumers just did not remember that repayment was due, companies have massive opportunities to reach this segment and propose self-cure options.

According to the CFPB, 51% of the ‘communication-related complaints’ were due to repeated calls or calls outside of the FDCPA presumed convenient calling period.

This study established that collection professionals are useful when enhancing the repayment experience to retain/reward customers while righting the company’s inefficiency.

Not only are these tactics still used in the past, but they need to work as they are desired. Collections professionals are better placed to do it earlier on, with strategies that fit the customers’ preferred mode.

Managing your past-due customer journey effectively can assist your organization in improving its early-stage collection results. Also, humane methods and contacting strategies adjusted to your customers offer your brand the possibility of gaining a reputation while avoiding adversarial methods.

How to reshape your stages of collection

With costs having gone up everywhere, the various managers of departments are squeezed to explain costs and search for ways and means of saving some money.

On the same note, your customer experience is only partially confined to your customer service and sales departments. Instead, leaders throughout your company are obsessed with CX objectives, such as ensuring individuals have control over those particular experiences and minimizing friction in those interactions—whether it is a payment or an address change.

Customer-focused centric collection is a strategy that allows an organization to cut operational costs while optimizing its customers’ experience. However, it must also outline how to achieve what management consultants refer to as the quickest return on investment (ROI).

Considering all of the possible benefits of enhancing the work on early-stage debt collection, can your organization still afford to remain ineffective in this sphere? Here are the steps to analyze your process and redesign the stages of collecting debts.

It is important to approach potential improvements in a manageable manner. You can do this by evaluating your starting position.

Historical and Current data are used in the collection, and related KPIs are directed at recognizing trends or similarities, such as a declining customer base and a simultaneously elevated number of DS.

This is because goals are not only more than a snapshot of where you are at on KPIs; almost every CX-supported metric at a granular level is now founded on collection and CX activities at the individual and team levels.

The application of team-specific metrics splits the hours and expenses into one dollar collected and the percentage of activities referring to customer retention implemented by the team.

Reflecting on KPIs can help you discover issues or missing links in your repayment process, but it also can help you discover potential. This is even truer if you divert the attention from mere procedural activities to the application of the early-stage collections as a useful technique of customer retention.

Based on operational and customer journey data, leaders unveil opportunities to interact with customers, build relationships, and outperform rivals in delivering a positive customer experience.

The Bottom Line

Debt collectors help creditors recover all or a portion of the money owed to them. The law also includes consumer protections to prevent debt collectors from being overly pushy or abusive.