Working capital management is recognized as a business process that can improve the use of current assets and the control of cash. Its focus is on managing short-term cash demands and costs and supporting long-run strategic goals. The main objective of working capital management is to enhance operational efficiency.

What is Working Capital Management?

A business strategy called working capital management is intended to control a company’s working Capital. Working Capital is the money that remains in a business after current liabilities are deducted. Working capital management ensures that a business runs smoothly by keeping an eye on and making the most use of its current assets and obligations. Ratio analysis is a useful tool in quantifying the effectiveness of working capital management.

The formula of working Capital is:

Working Capital = current assets – current liabilities

Current assets involve assets like cash and accounts receivable and current liabilities like accounts payable.

Why is Working Capital Management Important?

Businesses need working Capital on a daily basis because they need money to pay bills on time, cover unforeseen expenses, and buy supplies to manufacture products.

Effective working capital management can enhance a company’s profitability and earnings while also assisting in the maintenance of seamless operations. Inventory control, accounts payable and receivable management, and accounts receivable management are all included in working capital management. The primary goals of working capital management are to maximize the return on current asset investments, minimize the cost of Capital spent on working Capital, sustain the working capital operating cycle, and ensure its orderly functioning.

Since working Capital is related to a person’s cost of living, it may be comprehended on a more personal level, making it an easily understood concept. People must recover the money owed to them and keep aside a specific amount each day to pay bills, other routine expenses, and daily living costs.

One common indicator of a company’s effectiveness, liquidity, and general health is its working Capital. It represents the outcomes of numerous business operations, such as revenue collection, debt management, inventory control, and supplier payments. This is because it comprises short-term accounts such as inventories, cash, accounts payable and receivable, and portions of debt that are due within a year.

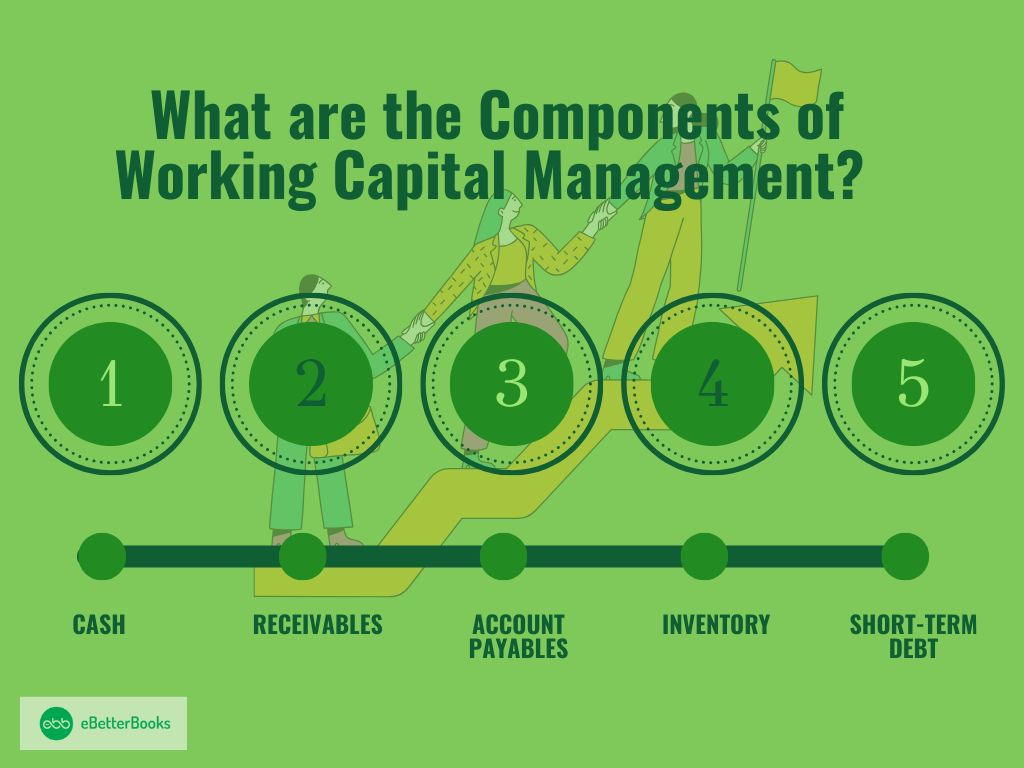

What are the Components of Working Capital Management?

Some balance sheet accounts are crucial when considering working capital management. Although working Capital often involves all current assets to current liabilities, a few accounts are more creative to track.

Cash

The basics of working capital management are tracking cash and cash needs. This includes managing the company’s cash flow by forecasting needs, observing cash balances, and improving cash flows (inflows and outflows) to ensure that the company has sufficient cash to meet its obligations.

Receivables

Companies should be aware of their receivables when managing Capital. This is crucial in the short term as they wait for the credit sales to be completed.

This involves:

- Managing the credit policies of the company

- Monitoring the payments of the customer

- Improving collection practices

- Completing a sale only matters if the company has collected the payment on the sale.

Account Payables

Accounts payable is referred to as the money that is due and owed by the company to its vendors, displayed as an obligation on the company’s balance sheet.

Managing managed accounts payable is crucial for maintaining effective working Capital. Late payments result in penalties and fines and damage the company’s credit ratings. In some cases, non-payment can lead to the necessary liquidation of assets to pay off creditors.

Managing accounts payable and ensuring that payments are made on time is an important component of working capital management.

Inventory

Companies most importantly consider inventory during working capital management as it is known as the most risky aspect of managing Capital. When the inventory is sold, a company is required to go to the market and rely on the preferences of the consumers to convert inventory into cash.

If this can be completed quickly, the company might be able to keep its short-term resources illiquid. On the other hand, the company might be able to sell the inventory quickly, but only with a high price discount.

Short-Term Debt

Managing short-term finance, like liquidity management, should focus on ensuring that the company has sufficient liquidity to monetize short-term operations without taking great risks.

The efficient handling of short-term financing entails selecting the appropriate financing mechanism and sizing the funds made accessible throughout.

Types of Working Capital Management?

Working Capital can be explained as the difference between current assets and current liabilities. However, different types of working Capital might be necessary for a company to best understand its short-term needs.

Permanent Working Capital

Permanent working is known as the amount of resources that the company will always require to operate its business without any interruption. It is the minimum amount of short-term resources that is important for the company’s operations.

Regular Working Capital

Regular working capital is defined as the amount of funds that the business requires to fund its day-to-day operations. For example, the cash needed to pay wages, raw materials, and salaries comes under regular working capital.

Reserve Working Capital

In addition to conducting day-to-day activities, a business might require some Capital to face unwanted events. Reverse margin working capital is money kept aside from regular working capital. These funds are kept aside for emergency situations like floods, natural calamities, storms, etc.

Fluctuating Working Capital

Companies might be interested in knowing about their variable working capital. For example, companies might choose to pay for inventory as it is a variable cost. Moreover, the company might have a monthly liability relating to insurance if it does not have the option to decline. Fluctuating working Capital considers only the variable liabilities over which the company has complete control.

Gross Working Capital

Gross working is defined as the total value of the company’s current assets. Current assets like cash, receivables, short-term investments, and mainly market securities. The Gross working capital does not show the current liabilities. Gross working capital can be implemented by calculating the difference between the existing assets and current liabilities. The difference remaining is the actual working capital that the company needs to meet its obligations.

Net Working Capital

Net Working capital can be defined as the difference between the organization’s current assets and current liabilities. If the organization’s assets are more than its current liabilities, this indicates positive working Capital and the organization can meet its obligations.

Moreover, if the assets of the company are less than current liabilities, then it shows a negative working capital, and the company is facing a financial situation.

What is the Objective of Working Capital Management?

Working capital management aims to balance capital levels, lower capital costs, maximize revenue by managing inventory and receivables, and ensure sufficient cash for uninterrupted operations.

Some objectives of working capital management are mentioned below:

- Maintain ideal working capital: The basic goal of working capital management is to preserve an ideal working capital balance that is neither too high nor too low. While having little working Capital can make it easier to fund expansion prospects and short-term commitments, having too much working Capital can result in idle resources.

- Reduce the cost of Capital: By maximizing returns on investments in current assets and streamlining short-term financing, working capital management seeks to reduce the cost of Capital.

- Increase revenue as much as possible: Effective By controlling inventory, accounts receivable, and accounts payable, working capital management guarantees that a company makes the most profit possible.

- Maintain uninterrupted operations: The goal of working capital management is to make sure that a company has adequate cash on hand to run its operations smoothly.

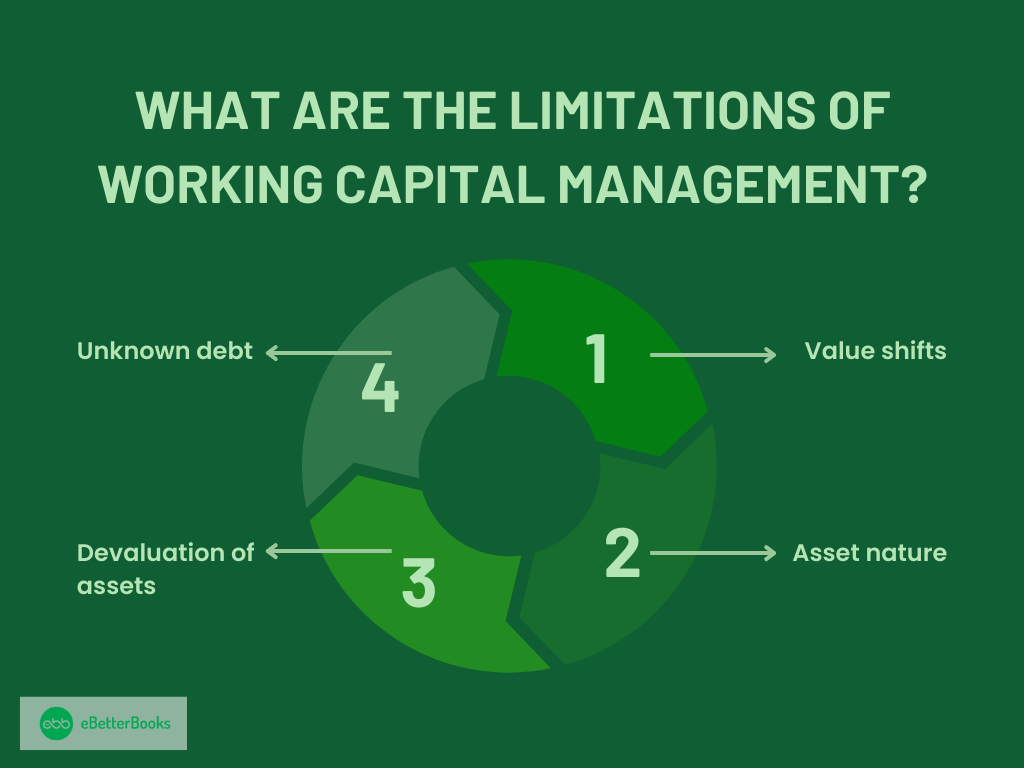

What are the Limitations of Working Capital Management?

Working Capital can be very insightful in determining a company’s short-term health. Moreover, some downside to the calculation can make the metric sometimes need to be more accurate.

Here are four limitations of working Capital:

- Value shifts: Working Capital is a dynamic concept. Many, if not most, of a company’s current asset and current liability accounts will alter when it is fully operational. Therefore, it’s likely that the company’s working capital situation has altered by the time financial data has been gathered.

- Asset nature: Working Capital does not take into account the particular kinds of underlying accounts. For instance, if clients miss payments, a business with positive working capital but all of its current assets being accounts receivable may experience liquidity problems.

- Devaluation of assets: Similarly, assets can lose value very fast. This could occur as a result of uncontrollable circumstances, including a customer’s bankruptcy impacting accounts receivable or stolen or outdated merchandise. Working Capital may be impacted by theft of physical currency.

- Unknown debt: When calculating working Capital, it is assumed that all debt has been paid in full. Working capital metrics might be distorted by overlooked agreements or improperly processed invoices in hectic work environments or during mergers.

Working capital management is one of the most crucial aspects of business management. A lack of Capital on hand means the company cannot meet its obligations, pay its employees, or make funds available to expand its operations. Companies can understand their working capital structure by preparing liquidity ratios and ensuring that short-term cash requirements are always available.