There are several ways to determine the cost of a product or service depending on its nature. According to the classification method of accounting, there are two ways to determine cost, which are fixed cost and variable cost.

The difference between fixed and variable costs refers to whether corporate expenses are static or fluctuate in response to changes in production output and sales volume. Fixed costs remain constant regardless of changes in production output or business conditions, while variable expenses fluctuate in response to your business’s activities and revenue.

Key Takeaways

Fixed and variable costs are the two methods to classify business expenses.A fixed cost remains constant regardless of the company’s sales volume, production output, or overall revenue.Some of the examples of fixed costs are rent, lease, insurance, and interest payments.Variable costs vary in proportion to a company’s manufacturing output and sales volume.Some of the examples of variable costs are raw materials and production outputs. Determining fixed and variable costs is important for financial strategies, budgeting, work costing, and pricing.

What is Fixed Cost?

Fixed costs are costs that do not vary with the production scale or the number of units sold in a business. They are constant and are often used in the day-to-day running of the company; they stay the same regardless of the amount of production done.

Fixed costs, on the other hand, are expenses that do not change with the level of production; rather, they will have to be paid regardless of whether a business has produced anything. Therefore, they are more easily predictable over the long term and form a more predictable part of a company’s costs.

Controlling fixed costs is crucial for a business’s long-term financial sustainability since these costs make up its total cost bases.

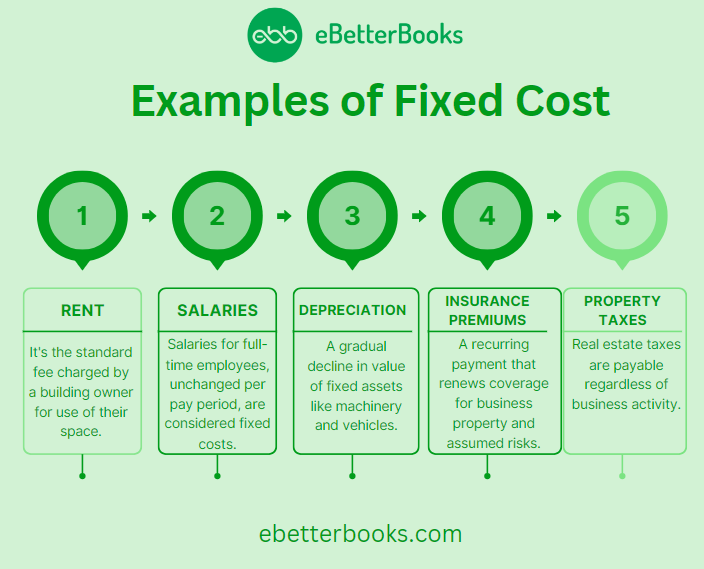

Examples of Fixed Cost

Here are some examples of fixed costs:

- Rent: It is the normal charge by a holder of a building or office space for the use of his building or office space, respectively.

- Salaries: The salaries provided to full-time employees that are not adjusted from one pay period to the next are considered fixed costs.

- Depreciation: A gradual downward change in the value of fixed assets such as machinery, vehicles, etc.

- Insurance Premiums: Periodic payment that renews protection of business property and assumed risks.

- Property Taxes: Real estate taxes can be paid irrespective of activity in the business.

What is the Variable Cost?

Variable costs are costs that vary with the level of operations in an organization, for instance, in relation to the quantity of products produced or services offered. Variable costs, on the other hand, are costs that change with the level of production; that is, they are lower when production is low and higher when it is high.

These include costs associated with producing a good or service. They are directly proportional to the number of goods or services produced and are incurred in the process since they are incurred per unit of production; the total amount increases as more units are produced.

Unlike fixed costs, variable costs influence a business firm’s financial status, especially if the number of units produced fluctuates. Hence, variable costs must be well managed to gain good returns.

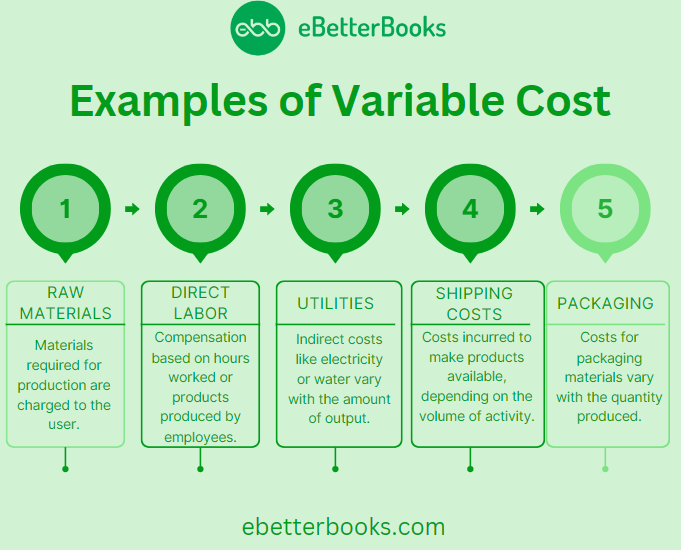

Examples of Variable Cost

Here are some examples of variable costs:

- Raw Materials: Materials needed for the production of goods that are charged to the user.

- Direct Labor: It involves compensation of employees based on the number of hours they have worked or the number of products they have produced.

- Utilities: Indirect costs, such as the rate of electricity or water, are dependent on the amount of output.

- Shipping Costs: These are the costs incurred in making the products available for customers’ use, and they depend on the volume of activity.

- Packaging: Any costs that are directly related to the packaging material tend to vary as the quantity increases.

Differences Between Fixed and Variable Cost

Here are the main differences between fixed cost and variable cost:

| Basis | Fixed Cost | Variable Cost |

| Definition | Expenses remain constant regardless of the production level. | Expenses that fluctuate with the level of production or sales. |

| Behavior with Production | Do not change with a change in production volume. | Increases as production increases and decreases as production decreases. |

| Examples | Rent, salaries, depreciation, insurance, etc | Raw materials, direct labor, utilities, etc. |

| Per Unit Cost | Decreases as production increases | It remains consistent per unit but varies in total with production levels. |

| Impact on Profitability | It affects the overall cost structure but is not influenced by short-term production changes. | It directly impacts profitability, especially with fluctuating production volumes. |

| Predictability | They are easier to predict and budget for, as they are consistent. | They are more difficult to predict, as they depend on production and sales activities. |

Practical Problem with Solution

Let’s consider a simple example to illustrate the concepts of fixed and variable costs:

Scenario

A bakery, Bright Bakers, produces cakes. Its operation has both fixed and variable costs.

Fixed Costs

- Rent: The bakery pays $1,000 per month for the shop space.

- Salaries: The bakery pays $2,000 per month.

- Insurance: The bakery pays $200 per month for business insurance.

Variable Costs

- Raw Materials: Each cake costs $5 to produce, including flour, sugar, eggs, etc.

- Direct Labor: The bakery hires part-time workers who are paid $10 for each hour they work. It takes one hour to bake and decorate each cake.

- Packaging: The packaging for each cake costs $1.

Example Calculation

Let’s calculate the total costs for Sweet Treats when they produce 100 cakes in a month.

Total Fixed Costs

Rent: $1,000

Salaries: $2,000

Insurance: $200

Total Fixed Costs = $1,000 + $2,000 + $200 = $3,200

Total Variable Costs

Raw Materials: $5 per cake × 100 cakes = $500

Direct Labor: $10 per hour × 100 hours = $1,000

Packaging: $1 per cake × 100 cakes = $100

Total Variable Costs = $500 + $1,000 + $100 = $1,600

Total Costs

The formula for calculating total cost is:

Total Costs = Total Fixed Costs + Total Variable Costs

Total Costs = $3,200 + $1,600 = $4,800

Impact on Production Decisions

Fixed and variable costs have a significant effect on the production decisions.

The following points will give you a better understanding:

- Break-Even Analysis: Costs are broadly categorized into fixed and variable costs. The break-even point refers to the level at which total revenue is equal to total costs. This knowledge helps determine the production level that should be made to counterpoint and start making profits.

- Scalability: High fixed costs mean that a firm has to make and sell more to recover these kinds of costs. In contrast, low variable costs enable a company to expand production without necessarily having to deal with high costs.

- Pricing Strategy: The location of cost between fixed and variable has an effect on pricing strategies. The former may force a business to set high prices to recover fixed costs, while the latter relates directly to cost per unit and, hence, the price of the products.

Relationship Between Fixed Cost and Variable Cost

Fixed costs and variable costs are rated to each other in multiple ways:

- Cost Structure: A firm’s total cost structure, which includes fixed and variable costs, determines its economic stability and agility.

- Profit Margins: Producing more copies using the fixed costs over a larger output increases the margin of profit, as the variable costs are constant per copy.

- Risk and Flexibility: More fixed costs involve high financial risk, while more variable costs provide flexibility and can be changed according to production.

- Break-Even Analysis: It is dependent on the volume of fixed and variable costs, which indicate how many units need to be produced to recover expenses.

- Pricing Strategy: This includes high fixed costs, which lead to high prices to cover costs; thus, high variable costs enable more flexibility in the prices to correspond to changes in production.

Importance of Distinguishing Between Fixed Cost and Variable Cost

Here’s the importance of distinguishing between both the costs:

- Financial Planning: This is particularly useful in budgeting and forecasting, hence enabling businesses to anticipate fixed costs and control variable costs depending on levels of production.

- Profitability Analysis: It is important to differentiate between fixed and variable costs to evaluate the extent of profitability and predictors of sales to attain revenues that would meet all costs and create profits.

- Break-Even Calculation: Recognizing fixed and variable costs is necessary when calculating the break-even point or the level of minimum sales requirement.

- Pricing Decisions: Separating the costs helps arrive at usable costs, which can help realize overall pricing policies, which in itself will make the necessary contribution to firm profitability.

- Cost Control: The concept of fixed and variable costs makes it easy for the business to understand which costs are more adaptable to changes in production and which are not, thereby aiding in determining possible changes to production.

Application of Variable and Fixed Costs

Whether an organization is in the process of developing its strategy or is aiming at controlling costs, fixed and variable costs are significant factors. Manufacturing costs are always the same, for example, rent, workers’ salaries, and other expenses that do not change with the product; this makes expenses more predictable. Overhead costs vary in relation to activity, and better COGS allows for the efficient use of material costs and power consumption.

They employ these costs in the formulation of product prices to address demand since prices reflect the fixed and variable costs necessary for business gains. They also make break-even analyses, which are necessary calculations of sales volume for cost coverage. Fixed costs are fixed to help create consistency in the budgeting process, while variable costs are what help to inform the changes based on demand.

Cost control entails direct control of fixed costs, i.e., outsourcing and controlling variable costs, including suppliers. In scaling operations, fixed costs are determined to analyze their effects, and variable costs are controlled to ensure profitability. Such a balance means that proper decision-making processes are followed, as well as proper utilization of resources.

Conclusion

All in all, the distinction between fixed and variable costs must be identified for efficient financial management. A liberal budget affects the fixed cost, which does not change with variations in production capacity and affects a business’s budgeting and long-term planning.

Fixed costs or overheads are an attribute of the firm’s profitability and price determination since they vary with output. These costs have to be distinguished in order to make correct break-even computations, price determination, and cost control. This knowledge helps in improved decision and financial control and propels business growth.

Frequently Asked Questions FAQs

Is salary fixed or variable cost?

Yes, salary is a fixed cost. Employee salaries are considered fixed costs, whereas sales commissions are flexible. However, sometimes fixed expenses change over time, but they are unrelated to production. For example, the salary of an employee may change as he gets an increment annually, but this is unrelated to the number of units created. At the same time, the employee may receive a sales commission that is directly related to production, making it a variable cost.

Is depreciation a fixed or variable cost?

Depreciation is considered a fixed cost only when using any of the depreciation methods since the same amount is set each year, regardless of whether the business activity levels change.

Depreciation expense, which is also associated with an asset, is a fixed cost because it does not change when any sales level or production volumes change.

What are the differences between fixed costs and variable costs?

Fixed expenses are costs with a consistent price and frequency, whereas variable expenses might change regularly. Fixed costs, such as lease and rental payments, insurance, and interest payments, remain the same whether goods or services are produced or delivered, whereas variable costs change based on the output produced.

What is an example of a fixed cost and a variable cost?

Fixed costs are expenses that remain constant regardless of production level, whereas variable costs change depending on production output. Variable costs include raw materials, sales commissions, and packaging, whereas fixed costs include rent, advertising, and administrative expenses.