What is the Cost of Living?

The cost of living is the expense necessary for the necessities of life, including shelter, food, transport, medical facilities, and taxes, in a given locality. It is among the most significant factors employed for determining just how inexpensive it is to reside in those places.

The cost of living is the income required by people to sustain the same standard in comparison to a region having a low cost of living.

This concept impacts those people’s buying capabilities and quality of life and can even shift the population through migration to areas where their income will go further.

What is the concept of the Cost of Living Index?

The Cost of Living Index (COLI) shows the percentage difference in the price of consumer goods and services between two places. For instance, if the cost of living in one city is 20% higher than in another, it is given an index of 120 in contrast to the city with 100.

The COLI typically includes several categories:

- Shelter (rent, mortgage)

- Other Services (Electricity, water, and gas)

- This area covers Grocery purchases and eating at restaurants.

- Transportation (bus, gas, car loans).

- Medical (insurance, care).

- Other programs (entertainment, clothing, etc.)

Many organizations attempt to quantify the cost of living index; the Council for Community and Economic Research, also called C2ER, is globally accredited for constructing the most familiar index in the United States.

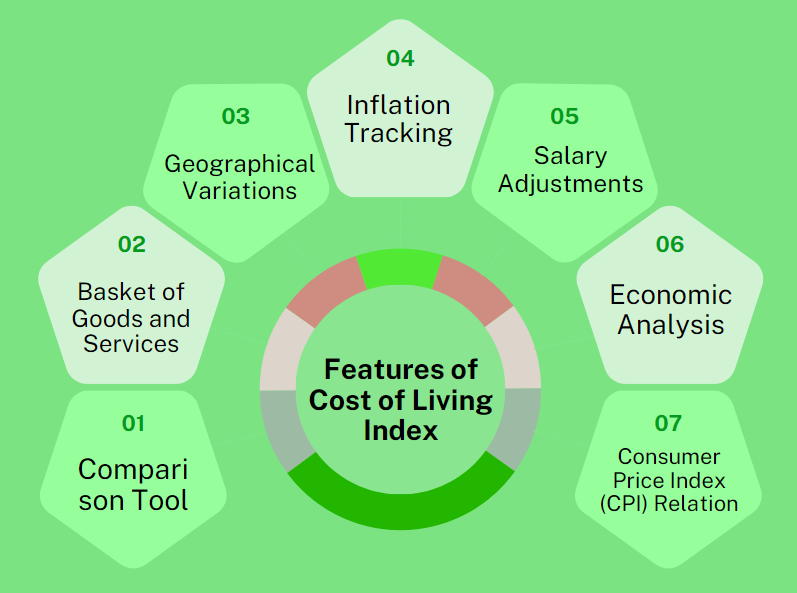

Features of Cost of Living Index

Comparison Tool

The COLI is mainly used to evaluate the cost of living in different regions or cities. It assists individuals and organizations in determining the extent to which it is cheaper or costlier to maintain a certain quality of lifestyle in one location relative to the other.

Basket of Goods and Services

The index is based on a hypothetical basket that constitutes average human consumption patterns of goods and services. These include the bare necessities like food, shelter, transportation, medical care, and other needs required for daily living. The basket selected includes the average consumption in a given location by individuals and households.

Geographical Variations

Another special advantage of the COLI is that it demonstrates how the price of differentiated products varies from one region to another. This aids individuals, firms, and organizations in appreciating regional cost variation and consequently making informed decisions, particularly when it comes to relocation, expansion, or conducting economic analysis.

Inflation Tracking

The COLI is a barometer of inflation because it captures movement in the prices of different commodities in the basket in succeeding periods. By focusing on the index and comparing it with the previous year’s index, it is possible to understand how inflation affects the prices in a certain region.

Salary Adjustments

COLI, for instance, is used by employers to review salary offers when transferring employees to other stations. Regarding the cost of living, employers help employees maintain their previous standard of living in the new place, regardless of whether the living costs are high or low.

Economic Analysis

The COLI is important to economists and policymakers]*. It assists in comparing regions with distinct economic characteristics and guides the formulation of measures that seek to redress regional differences in the cost of living.

Consumer Price Index (CPI) Relation

However, the COLI is quite similar to the Consumer Price Index (CPI), but there are detailed distinctions. While the CPI calculates inflation by comparing the price of an extensive list of consumables, the COLI has a standard and aims to keep a standard living condition. The COLI measures the income needed in two places for an individual to maintain the purchased standards, while the CPI gives an overall trend of price changes.

Factors Influencing Cost of Living

A number of factors determine the cost of living. These may vary regarding specific cities, states, or countries, and they can also vary throughout the calendar year.

Here are the primary drivers:

Housing Costs

Often, housing, whether rent or mortgage, is the biggest single expense on the cost of living index. This means that in regions that are more densely populated or where the amount of free space to build housing is restricted, prices are usually higher.

Location and Geography

Places with attractive locations, such as cities near the sea or places with massive resources, are usually costly. On the other hand, rural or less developed areas usually attract low charges.

Taxes

Own-source revenues, including income tax, property tax, and sales tax, determine the cost of living. For example, whereas Texas has no state income tax, neither does Florida, making the two cheap for most.

Healthcare Costs

Healthcare services are usually available, but their costs differ depending on the area of interest. States with a large number of practitioners and insurance choices are less expensive than those states, and the opposite is true for rural states or medically unfortunate areas.

Food Prices

A general price index for foods, including local production, transportation costs, and the distance to distribution centers. Eating places within dense population regions may charge higher prices due to transport issues, while those situated in rural regions near farming regions may be cheaper.

Transportation

Outside of a metropolitan city, you are likely to live in a car-reliant area, which means extra expenses from maintaining your car, fuel, and car insurance. On the other hand, urban areas with efficient public transport may afford a higher cost of transport but a lower cost of housing.

Wages and Employment

Other Essential factors include location, employment opportunities, and wages in the country or region. An increase in wages often leads to increased traffic in areas where those wages are the highest, directly leading to increased housing costs, among other expenses.

Cost of Living in the USA

The general cost of living in different states of the USA is related to lifestyle and a number of factors. Here are recommendations for how people can easily distinguish between costs of living by state and costs of living by the population.

By State: How Costs Vary Across the USA

As true as they come, it is also true that the cost of living varies greatly from one state to another. Some states are much more costly than others, yet some accommodate persons to a cheaper standard of living. Here’s a breakdown:

High-Cost States

- Hawaii: Because Hawaii is remote, it is much more costly to house, feed, and keep consumers warm, raising the shipping costs of goods.

- California: San Francisco and Los Angeles in this list are among the least affordable cities in the United States in terms of housing, as well as other goods and services.

- New York: New York City’s cost of living includes housing and transportation.

- Massachusetts: Housing, healthcare, and education costs are relatively costly, especially in the Boston area.

- Alaska: The difficulty increases owing to its geographical position with regard to transportation and heating expenses, as well as regarding the prices of the necessary products.

Mid-Cost States

- Colorado: Several states, such as Colorado, Denver, and Boulder, are increasingly costly, but the overall cost of living in Colorado is moderate.

- Washington: While costs are relatively high in cities such as Seattle due to expensive housing, costs in the state as a whole are moderate.

- Florida: Housing costs differ all across the state; Miami, for instance, is more costly than the countryside, but areas in the countryside are cheap to live in.

- Texas: According to the latest data, housing is relatively cheap; however, some cities like Austin are experiencing growing prices. Overall, the cost of living relates to reasonableness in Texas.

- Arizona: The affordability of living costs is well adjusted, with fair and affordable rates on housing and utilities.

Low-Cost States

- Mississippi: Food and especially housing are actually very cheap, making Maryville one of the least expensive places to live in the United States of America.

- Arkansas: As for the other living expenses, the majority of services, such as housing, food, and utilities, are cheap.

- Oklahoma: Both rental and purchase prices for housing are low, and Oklahoma is one of the cheapest states in the country.

- West Virginia: West Virginia also has the lowest housing expenses and low prices for goods and services.

- Kentucky is another state with a relatively low cost of living, particularly in terms of food, shelter, and other consumer amenities.

By Population Group: Ways that Costs Differ Depending on the Lifestyle

Housing costs in the United States are also variable depending on specific requirements and wages of inhabitants, including students, employees, families, and so on.

- Students

As to the cost of living, it is the lowest in the case of students compared to the rest of the groups.

This is largely because:

- Housing: Most students live in dormitories or multiplex apartments and, therefore, can afford most of the accommodations.

- Food: Students sometimes decide to eat at home or follow certain meal plans in order to cut back on expenses.

- Transportation: Because of the efficiencies involved in moving bodies, transport costs are lower for most students who use public transport, bicycles, or walking. However, students have to spend more money on tuition fees, books, supplies, personal use, and entertainment.

- Salaried Employees

Salaried employees tend to have higher living costs, especially for:

- Housing: OnRent or mortgages are among the biggest expenses, and they consume a significant share of people’s income in urban centers.

- Food: Food-related expenditure includes expenditure on fresh foods, processed foods, and eating out.

- Transportation: The cost may include panel or insurance and the fare for taxis, buses, or trains that you use every day to get to work.

- Healthcare: Despite most citizens enjoying health insurance through their employers, medical expenses are still part of the cost of living. This group also pays for the facilities, leisure activities, and other daily needs that the other two groups above enjoy.

- Families of Four

For a family of four, living costs are generally higher due to:

- Housing: As families expand, they require bigger living spaces, thereby incurring high rents, monthly mortgage repayments, and utility bills.

- Food: The costs of food and meals are slightly higher, especially because families are constantly seeing their Children grow.

- Transportation: They always require one or more vehicles to own, which translates to higher expenses such as fuel, insurance, and servicing.

- Healthcare: Doctor visits and children’s medical care, as well as health insurance, can be rather costly.

- Childcare and Education: Households use money for childcare services, stationery and textbooks, sports and hobbies, and college education. However, that money also has to cover the costs of food, shelter, clothing, entertainment, and money set aside for rainy days.

- Urban vs. Rural Living

- Urban Areas: Living in cities usually implies paying more for accommodation, food, and fares. However, urban regions generally provide better employment opportunities, education facilities, and health care services.

- Rural Areas: Overall, rural residents have an advantage in terms of the cost of amenities, especially housing. However, productivity and access to services could be improved, which impacts the standard of living.

Reasons for High Cost of Living

The cost of living can increase due to various causes affecting the general spending by various users.

Here are some of the major factors that contribute to a higher cost of living:

Housing Costs

One of the largest inputs is the great need for housing, especially in large cities or desirable areas. This is evidenced when the demand for homes outstrips the supply and the cost of both renting and purchasing a home goes high.

Inflation

Inflation is almost like an obstacle due to its impact on economic activities. This affects the general price level and reduces the buy’s value since money is now worth less. For this reason alone, people require more money for the same level of living.

Taxes

Federal, state, and local taxes, such as income and property taxes and sales taxes (Phelps, 2007), decrease disposable income, making the expenditure for ordinary necessities a burden. This, they point out, means that high tax rates are a cause for high living standards in certain regions.

Transportation

Transportation costs are an extra expense in everyday life since fuel prices are high, public transport is expensive, or working from home is impossible due to long distances. Sometimes, car ownership has to be sustained, and sometimes, it is necessary to resort to public transportation, and in both cases, affordable movement is not guaranteed.

Healthcare

Insurance and medical charges, for example, differ between states. In counties or states where there is meager subsidized healthcare, out-of-pocket expenses are very high, making the cost of living very high.

Food and Utilities

Primary needs such as food, power, and heating can be costly in some areas because of the distribution network—an extra cost that is incurred where there is congestion, such as in cities.

Wages

In many districts where the cost of living is high, wages are unable to meet the rising costs, even if they are higher, adequate, or increased to cater for the escalating housing, health care, and other expenses.

Effective Ways to Reduce Cost of Living

If you’re looking to cut costs and save money, here are some practical strategies to reduce your living expenses in key areas:

Transportation

- Use Public Transit: Take buses or trains instead of owning a car or taking taxis, which will not only help you save on fuel and parking fees but also lower maintenance expenses.

- Carpool: Reduce travel fuel and car costs by sharing with colleagues or neighbors when working or coming from home.

- Bike or Walk: For short distances, it is advisable to use a bicycle or walk—both are free and have health benefits.

- Live Close to Work: Cutting down the number of trips you make between home and work means living close to where you work, which is economical.

- Reduce Car Ownership: If feasible, try to use as few cars as possible as a family and use more transport services such as buses and trains.

Housing

- Downsize: Staying in lesser-standard housing may cost less in terms of rent or even the monthly installments on the home or apartment, as well as electricity, water, etc.

- Relocate: You should consider moving to an area or state where basic needs are cheaper.

- Rent Out Extra Space: If one has a surplus area, like a room in the house, and other occupants are willing to pay, subleasing will assist in controlling housing expenses.

- Co-living Arrangements: Sublet an apartment with your friends, and you’ll be getting your share of rent and utility bills.

- Energy Efficiency: Electricity and heating are major costs that could be minimized if proper devices and isolation means are used.

Healthcare

- Choose the Right Insurance Plan: Choose health insurance that you can afford and that will suit each member’s needs at some point or another. Try to find one that has good premiums, low deductibles, and good insurance coverage.

- Preventive Care: You need to learn to prevent rather than cure since what may cost a few dollars today can cost thousands of dollars later.

- Use Generic Medications: Choose basic medications instead of their counterparts, which can be more expensive.

- Shop Around: They must compare the prices of the medical services that they will be seeking and the medications.

- In-Network Providers: Do not use the services of doctors that are not in your insurance plan because they will charge you more money.

Food

- Meal Planning: You won’t need to consume foods you didn’t plan or make several fast food orders during the week.

- Cook at Home: Cooking at home is less expensive than dining out or eating in restaurants.

- Buy in Bulk: Buy groceries in large quantities so as to be a cheaper option in the long run.

- Shop at Discount Stores: Minimize food costs by choosing grocery products at some of the lowest-priced universal stores.

- Use Coupons and Sales: Save more on your grocery bill by choosing products that are on sale, in promotion, or on special offer.

- Minimize Food Waste: Pay close attention to portions of your foods as well as how much leftovers are kept in a bid to avoid wasting food and having your groceries expire.

Conclusion

Lifestyle changes are also not necessary to cut living costs. Simple changes can have a great impact on everyday expenses. In fact, choosing your means of transport, owning a less expensive home, choosing the appropriate health plan, and planning your meals can result in awesome savings. If you use the mentioned tactics, managing your expenses, boosting your savings, and improving your quality of life won’t be a problem.