SBA loans are financing solutions for businesses made partially by the U.S. Small Business Administration and issued by partnered lenders, such as banks.

Such loans have relatively low-interest charges and can be paid back in easy instalments, making them suitable for small businesses.

However, approval of an SBA loan is not easy because of the eligibility rules, which include credit scores and business plans, among other aspects of financial credibility.

Still, SBA loans remain one of the top funding types for small businesses because they offer better terms and are less expensive than traditional loans.

What Are Small Business Administration (SBA) Loans?

SBA loans are business loans administered through SBA-approved lenders like banks or credit unions.

They come with a partial guarantee from the SBA, which lowers the risk the lender has to take to recover their money. Thus, it is easy for small businesses to secure a loan.

SBA loans are intended to provide funding for business expansion, working capital, or disaster recovery.

Some common characteristics include low interest rates, long repayment periods, and more relaxed loan qualification criteria.

Although there are some drawbacks, the main one is the need for a credit check, financial statements, and an appropriate business plan for the applicant.

Types of SBA Loans

The U.S. Small Business Administration (SBA) offers several loan programs tailored to different business needs.

Here’s a simplified overview of the most common types of SBA Loans for Small businesses:

SBA 7(a) Loans

The SBA 7(a) loan serves many purposes, but it is suited for working capital, business acquisition, and equipment purchases.

- Loan Amount and Interest Rates: Each borrower is eligible for up to $5 million, and the interest rate is between 7% and 9.5%.

- Application Process: Applications are made through SBA-affiliated financial institutions such as banks and credit unions. For larger loans, the business plan, records of financial health, and security are needed.

SBA Express Loans

This is for faster financing and operating expenses to purchase real estate or equipment.

- Loan Amount and Interest Rates: SBA Express loans offer up to $500,000, while loan interest rates can be slightly higher than 7(a) loans. Approvals usually take 36 hours at most.

- Application Process: SBA applications are processed through SBA lenders, and they require personal tax filings, credit reports, and business records.

SBA 504 Loans

These loan facilities are designed to provide credit for permanent working assets such as land, buildings, or machinery.

- Loan Amount and Interest Rates: Borrowers can get anywhere from $5 million to $5.5 million for specific projects with fixed interest rates between 3% and 6%.

- Application Process: SBA applications involve a CDC and a private lender. They require project information, financial statements, and a down payment.

SBA Microloans

SBA Microloans are useful for small businesses and other startups.

- Loan Amount and Interest Rates: They offer loans of up to $50,000 for inventory, supplies, or equipment. Interest rates range between 6% and 13%.

- Application Process: These are available through non-profit third parties; usual requirements include a business plan, credit history, and related paperwork.

Intended for short and fluctuating working capital requirements of various enterprises.

CAPLines include four programs:

- Seasonal Line of Credit: Partial insurance expense that relates to business activities being seasonal.

- Contract Line of Credit: This Means funds purchases of direct labor and materials for contracts.

- Builders Line of Credit: Used in construction or when a renovation project is to be embarked on.

- Working Capital Line of Credit: General support for day-to-day operational needs.

- Loan Amount and Interest Rates: Loan amounts reach up to $5 million, with interest rates varying by the specific program.

- Application Process: Applications are processed through SBA-approved lenders, who require financial projections and details about the specific working capital need.

SBA Disaster Loans

SBA Disaster Loans are necessary financial aid for companies affected by natural disasters. These loans can help rebuild damaged structures, settle inventory or equipment losses, and meet working expenses until business recovery.

- Loan Amount and Interest Rates: The SBA Disaster Loans provide up to $2,000,000 to fix damages and working capital. For applicants with no other credit recourse, interest rates are fixed at 4%.

- Application Process: Applications are filed online through the SBA Disaster Loan Site or from the concerned SBA Field Offices. They require substantiating loss or damage.

SBA Export Working Capital Loans

Export working capital loans are particularly for exporters.

- Loan Amount and Interest Rates: The loan amount includes up to $5 million for production, shipping, or other export costs. Interest rates are variable and competitive.

- Application Process: Applications are submitted under SBA export lender programs that require export contracts and financial statements.

SBA Export Express Loans

Aimed at businesses seeking quick funding for export-related growth.

- Loan Amount and Interest Rates: These loans offer up to $500,000. Interest rates are slightly higher, but claims processing takes only several days.

- Application Process: Applications are made through the SBA Export Express lenders, and they are processed with little paperwork.

SBA International Trade Loans

They can help businesses increase export sales or upgrade to maintain international competitiveness.

- Loan Amount and Interest Rates: Loan amounts range up to $5 million, and the interest rates offered are lower than those of most global financing sources.

- Application Process: Applications are processed through SBA lenders, provided they include export plans and financial forecasts.

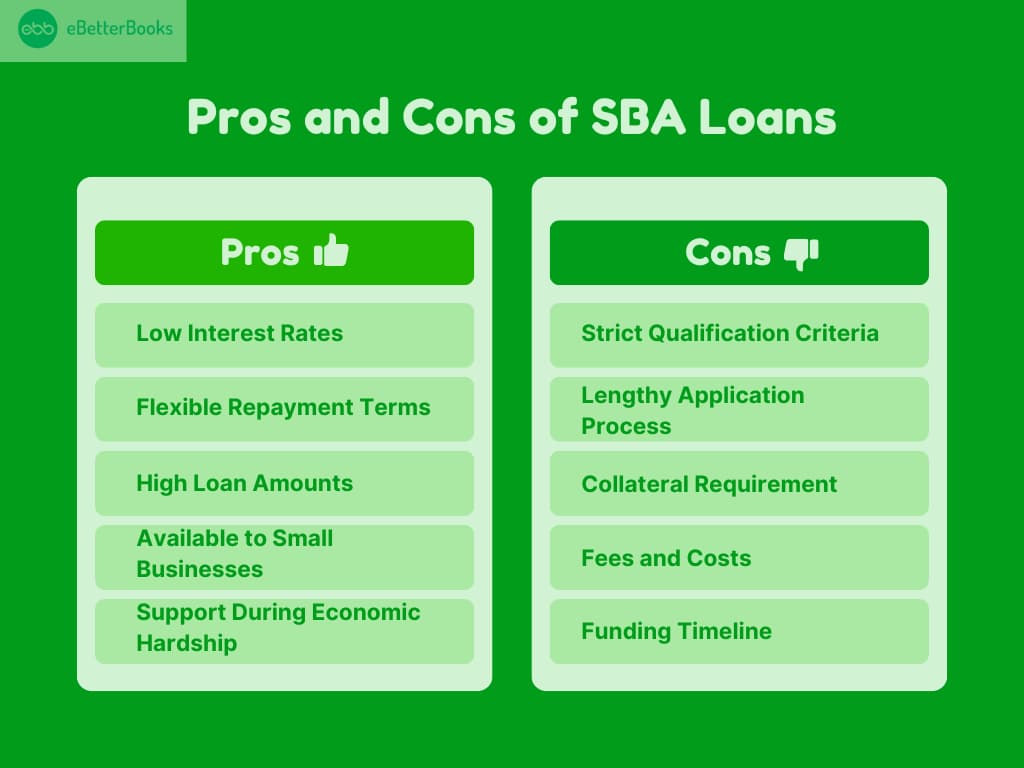

Pros and Cons of SBA Loans

Pros:-

- Low Interest Rates: The interest rate on SBA loans is also reasonable, making them cheaper than most standard bank loans.

- Flexible Repayment Terms: Borrowers can benefit from increased tenure, so repayments are made monthly.

- High Loan Amounts: SBA loans offer many funding options, such as expansion or stock, that a business may require.

- Accessible to Small Businesses: These loans are for enterprises that may not qualify for conventional products such as lines of credit or term loans.

- Support During Economic Hardship: SBA loans regularly contain exceptional programs to support businesses during disasters or recessionary periods.

Cons:-

- Strict Qualification Criteria: To qualify for the loans, you must have good credit, a sound business plan, and an accounting record.

- Lengthy Application Process: Navigating the documentation and obtaining the necessary approvals for an FP&A function can take a long time.

- Collateral Requirement: The majority of SBA loans come with a loan guarantee, which involves the use of personal or business property.

- Fees and Costs: SBA loans have upfront charges, such as guarantee fees, that increase the cost of borrowing.

- Funding Timeline: Since application review is done frequently, receiving the funds might take weeks or months.

How to Apply for an SBA Loan?

- Make Sure Your Company Qualifies

Certain standard requirements must be met for a business to qualify for an SBA loan.

Typically, lenders seek a business with a two-year history, consistent annual income, and a credit score of at least 690.

However, you cannot qualify if your business is not in a healthy financial state or if the business type is prohibited (e.g., gambling or political lobbying).

- Choose the Right Lender

The SBA also offers a tool called the Lender Match that can help you connect with the right lenders within two days. If you’re applying through a bank, it’s best to work with one that has experience handling SBA loans.

Here are some key questions to ask potential lenders:

- On how many SBA loans have you managed to work?

- Of what frequency do you fund SBA loans?

- How aware and knowledgeable is your staff with SBA loans?

- What loan ranges do you provide the loan amount at?

Lenders who have experience with SBA loans can better help you navigate and understand your probability of success.

For example, Newtek Bank in Florida and Huntington National Bank have been some of the most active SBA 7(a) lenders. Newtek leads in loan volume, and Huntington excels in loan approvals. Both banks are SBA Preferred Lenders, which indicates that they can approve these loans independently of SBA approval, which can affect loan approvals.

- Assemble Your Necessary Papers

Every type of SBA loan will require different papers and documents, though your mortgage loan company will help in compiling them.

Here’s a list of common documents you’ll likely need:

- Federal financial report.

- Personal history statement.

- Personal financial statement.

- Corporate financial reports (tax returns, balance sheets, income statements of the company’s business).

- Personal income tax returns.

- Business tax returns.

- Business license.

- Loan application history.

- Resumes for business owners.

- Lease agreement (where applicable).

- One-year cash flow projection.

- Complete the Application Form and Wait

Again, the time it takes for a loan to be approved differs depending on the lender. For a traditional bank, it will take about one to a few months from the time the application is made to approval and even funding.

If you need funding within a shorter period, SBA Express loans are preferred as they are processed faster. This loan can be extended to a maximum of $500,000, where SBA guarantees up to 50% of the proposed loan, thus providing a faster way to access smaller funding.

FAQs!

What are the Requirements for a SBA 504 Green Loan?

Small businesses qualify for an SBA 504 Green Loan if they operate for-profit, meet SBA size standards, and use funds for eligible green projects like energy-efficient upgrades or renewable energy installations. The project must achieve at least a 10% energy savings or generate 15% of the property’s energy from renewables.

How Do you Get a Down Payment for an SBA Loan?

The down payment for an SBA loan typically ranges from 10% to 30%, depending on the borrower’s qualifications, loan type, and financial health. Some SBA loans, like microloans and disaster loans, do not require a down payment in SBA loan.

What is Economic Injury Disaster Loan (EIDL)?

The Economic Injury Disaster Loan (EIDL) is a program by the U.S. Small Business Administration (SBA) that provides low-interest loans of up to $2 million to small businesses, agricultural cooperatives, and private nonprofits facing economic hardship due to disasters like droughts, hurricanes, or other emergencies. These loans help cover operating expenses, payroll, and other essential costs to keep businesses afloat.

What is Loan Refinancing?

Loan refinancing is the process of replacing an existing loan with a new one that offers better terms, such as a lower interest rate, extended repayment period, or debt consolidation. It helps borrowers reduce monthly payments, decrease overall interest costs, or access equity in their assets.

Why should small businesses consider SBA loans as an option for their equipment financing needs?

Small businesses should consider SBA loans for equipment financing due to their low-interest rates, longer repayment terms, and lower down payments. These loans offer flexible eligibility requirements, enabling startups and growing businesses to access essential equipment while preserving cash flow, fostering expansion, and maintaining financial stability with manageable monthly payments.

Can you Refinance an SBA 504 Loan?

Yes, you can refinance an SBA 504 loan through the SBA 504 Debt Refinance Program, which allows businesses to refinance qualified debt, such as commercial mortgages and equipment loans, with favorable fixed rates and long repayment terms. Recent regulatory changes have expanded refinancing options, enabling businesses to refinance up to 90% of their property’s value and even cash out up to 20% for working capital. Read more about SBA 504 loan refinancing guide.

What is an SBA CAPLine?

An SBA CAPLine is a revolving or short-term line of credit offered by the U.S. Small Business Administration (SBA) to help small businesses manage working capital and operational expenses. It includes four programs: Seasonal, Contract, Builders, and Working Capital CAPLines, each tailored to specific business needs, such as covering contracts, construction costs, or seasonal cash flow gaps.

What is a Business Loan with Bad Credit?

A business loan with bad credit is financing offered to business owners with a low credit score (below 669 FICO), often with high interest rates, small loan amounts, and short repayment terms. Despite less favorable conditions, these loans help businesses cover expenses, maintain operations, or expand. Read more about business loans with bad credit.

Bad Credit Business Loans – Types, Terms, and How to Qualify

Business owners with poor credit scores (300-669) often struggle to secure traditional loans, but there are alternative lending options available. Bad credit business loans come…

What is SBA CAPLines Program – How It Works and Types?

SBA CAPLines provide flexible short-term working capital solutions for small businesses facing seasonal, contract, or operational funding challenges. These lines of credit allow businesses to…

14 Types of Business Loans for Small Businesses

Finding the right business loan can be crucial for small business growth or continuity. This article explores various loan options tailored to specific needs such…

Loan Refinancing for Small Businesses – A Step-by-Step Guide

Loan refinancing helps businesses reduce monthly payments, secure better loan terms, and improve cash flow by replacing existing debt with a new loan. This can…

SBA 7(a) Loan Program: Definition, Eligibility & Types

The SBA 7(a) loan helps small businesses secure financing for working capital, real estate, equipment, and more, offering competitive interest rates and flexible repayment terms.…

SBA 504 Green Loans: For Energy Efficiency and Green Projects

The SBA 504 Green Loan Program helps small businesses access financing for energy-efficient and renewable energy projects, promoting environmental sustainability. It supports investments in energy-saving…

SBA 504 Loans for Equipment Financing: A Comprehensive Guide

The SBA 504 loan helps small businesses finance the purchase of essential, long-term equipment with lower upfront costs. By combining contributions from private banks and…

SBA 504 Loans to Refinance Business Debt

The SBA 504 Debt Refinance Program offers a solution for small businesses to refinance commercial mortgages and other business loans at lower interest rates with…

SBA Microloan Program: A Comprehensive Guide for Requirements for Startups?

The SBA Microloan program provides small businesses, startups, and nonprofit childcare centers with loans up to $50,000 to support growth and daily operations. These loans,…

SBA Loan Down Payment – How Much to Pay?

The article provides an in-depth guide on SBA loan down payment requirements, explaining how the down payment varies based on factors like loan type, credit…

Mortgage Help and Home Repair Loans after a Natural Disaster

If you’ve been affected by Hurricane Helene, financial relief options are available to help you recover. Federal aid programs, like SBA disaster loans and FHA-backed…

Financial Relief for Businesses Affected by Natural Disasters

This article guides businesses and homeowners through the process of securing financial relief following natural disasters. It highlights the importance of SBA Disaster Loans, including…

SBA 504 Loan Program: A Definitive Guide

SBA 504 loans provide small businesses with long-term, fixed-rate financing for property and equipment purchases, with amounts up to $5 million. These loans, backed by…

Economic Injury Disaster Loan (EIDL)

The U.S. Small Business Administration (SBA) provides Economic Injury Disaster Loans (EIDL) to help businesses impacted by disasters like droughts, hurricanes, and other economic injuries.…