In QuickBooks, an Accountant’s Copy is a version of a Company file that a user may use to prepare data changes before starting working. Users may easily and conveniently import the modified QuickBooks Accountant transfer file back into a working business file when they are ready to make adjustments.

This error may occur due to outdated QuickBooks software, long dashes in text files, the QBW file is 200 MB or larger or a slow internet connection. To resolve this issue, read the complete article for a better understanding and relevant solutions.

Due to insufficient space on your drive, yon may see this warning message on the screen when you are not able to create Accountant’s copy:

“Not able to create Accountant’s Copy – to export your company file on the drive (letter of the drive). There must be (number of kilobytes) space on the drive (letter of the drive). There is only (number of space) amount of space available”.

Or

“WARNING: This is an Accountant’s Copy of the company’s data. To prevent conflicts with your client changes, the current action is not allowed.”

Our experts are just a call away to resolve the queries or doubts instantly. Call us at +1-802-778-9005 or send mail at support@ebetterbooks.com.

Key Takeaways: QuickFix

Below are a few quick fixes for some of you who are unable to create an accountant’s copy:

| Causes | Solutions |

| If the user is facing an Unable To Create Accountant’s Copy In QuickBooks Desktop Error due to an outdated version of QuickBooks. | Ensure the software has the updated version for smooth operation. |

| If the company data file is damaged and the user is encountering problems with the accountant’s copy. | Create a portable version of the company file, Create/Restore the portable company file, or Manually save and send QBX/QBY as a process of compressing file size. |

| If the QBW file size is greater than 200 MB and unable to send the file to the Intuit Server. | Solution: Use the QuickBooks File Doctor Tool to fix damaged files. |

| QuickBooks Unable to Create Accountant’s Copy problem can arise If there are long dashes in MS Word. | Before sending the file to the Intuit Server, ensure there are no long dashes in the text. |

| Error Unable To Create Accountant’s Copy In QuickBooks also arises if the file name has special characters. | Users must ensure that the file name does not have any special characters like commas, full stops, etc. |

Common Errors in QuickBooks While Preparing Accountant’s Copy

There are a few common errors that make it unable to create the accountant’s copy.

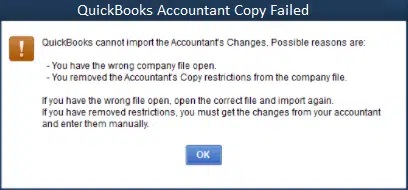

Common errors while using the Accountant’s Copy Transfer Service include:

- Big Red X: Provides a mechanism to signal the inability to transfer the Accountant’s Copy due to network problems or wrong logins.

- Error 3371: Usually due to problems in the licensing data or other files that get damaged.

- Error 179: Signals an issue with the Accountant’s Copy creation or receipt in the sense that none of these two may have been generated.

- Error 15222: Concerns about the problems regarding the update or installation of QuickBooks that hinder service functioning.

- Error 6000: A problem either with the file path or the network gets in the way and stops QuickBooks from opening or creating the copy.

- Error 6123: A network-related problem resulting in the inability to transfer the Accountant’s Copy.

Reasons Behind why can’t i create an accountant’s copy in quickBooks?

QuickBooks Unable to Create Accountant’s Copy due to insufficient space on your system hard drive that prevents the software from making an Accountant Copy used by the accountants.

Below are the several reasons why this error occurs in QuickBooks Desktop:

- Outdated QuickBooks version: This error can be caused if QuickBooks is not updated with the latest version.

- Damaged Company Data File: QuickBooks is unable to create an accountant copy if the Company Data File is damaged.

- QBW file exceeds size limit: QuickBooks Unable to Create Accountant’s Copy problem occurs if the QBW file is 200 MB or exceeds the size.

- Long Dash in MS Word: Users may face this problem by getting a long dash in MS Word and then copying it as it is in Notepad. A long dash is created in Microsoft Word by entering two single dashes between the two hyphenated words.

- Special Characters in File Name: Unable to create an accountant copy issue in QuickBooks can occur if the Company File Name has special characters.

- Free up some space from your hard drive or save the Accountant’s Copy to a different drive with more free space.

How to Fix QuickBooks Unable to Create Accountant’s Copy (.QBX) or a Company File (.QBW) Error

Go through the complete section after reading the actual causes of the problem of why QuickBooks does not create Accountant’s Copy. Here is the complete list of solutions with step-by-step guidance:

Important: Before troubleshooting, ensure QuickBooks Desktop is updated to the latest release. Some steps may require you to remove the Accountant’s Copy Restriction, You can’t undo this.

Solution 1: Check for Possible Data Damage

Here’s how to Check for Possible Data Damage:

- Perform basic troubleshooting on the company file (.QBW) to check for data damage.

- If you need to fix the damaged data, you may have to remove the Accountant’s Copy restriction:

- Go to File > Send Company File > Accountant’s Copy > Client Activities > Remove Restrictions.

- Select Yes to confirm and click OK.

- To re-send the Accountant’s Copy:

- Go to File > Send Company File > Accountant’s Copy > Client Activities.

- Choose Send to Accountant.

This will help resolve any data damage issues.

Solution 2: Update QuickBooks Desktop to the Latest Version

The accountant file transfer service works only with QuickBooks Desktop 2017 (R14), 2018 (R12), or 2019 (R9), and also QuickBooks Desktop Enterprise 17 (R14), 8 (R12), or 19 (R9). Follow the steps mentioned below to update QuickBooks Desktop to the latest version:

- Go to Help and click on Update QuickBooks Version.

- Search for the Update Now tab and ensure that the box is checkmarked for reset updates.

- Click on Get Updates.

- Restart QuickBooks after the download process is completed.

- Perform the on-screen instructions to install the new version.

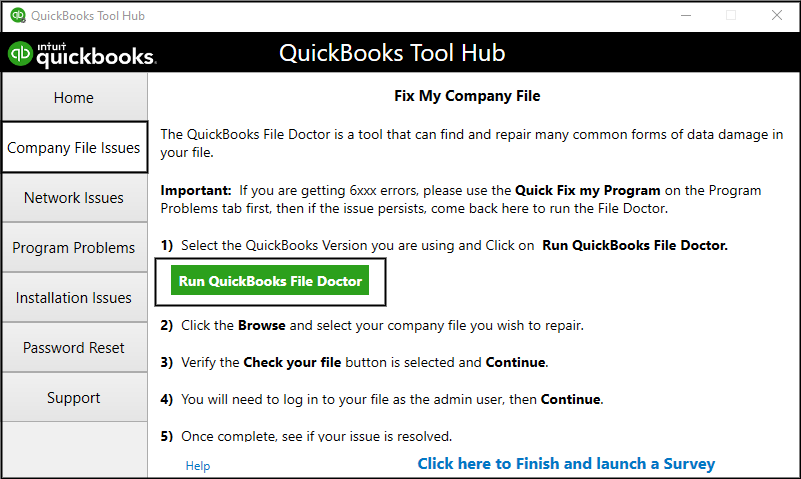

Solution 3: Run QuickBooks File Doctor

Fix Damage Company Data File with the use of QuickBooks File Doctor. Download and Install the QuickBooks Tool hub. Then run the Quick Fix My File in Company File Issue Tab, and finally follow the steps to run the QuickBooks File Doctor:

- Select Company File Issue Tab from the tool hub.

- Select Run QuickBooks File Doctor (It will take up to 1 minute to open the file doctor.)

- Select the Company File from the drop-down in QuickBooks File Doctor. (In case you can’t find your file, make use of the Browse and Search option to find it.)

- Click on Check your File.

- Click on Continue.

- Enter your QuickBooks credentials and click on Next.

(The scan time can take up to 10-15 minutes, depending on the file size. Also, the scanning procedure might say it is unsuccessful even if it fixes the problem.)

Solution 4: Reduce the Company File Size

Reduce the size of the company file if it is greater than 200 MB. This can be done in three ways:

- Create a portable company file version to reduce the file size. It is a compact version of the file which can be sent easily to the Intuit server. Open the company file and press the F2 key to open the Product Information Window.

- Create/Restore the portable company file of QuickBooks.

- Manually save and send QBX/QBY without any accountant service.

Solution 5: Check for Long Dash in Notes

Ensure that there is no long dash in notes before sending the file to the client. Follow the steps mentioned below:

- Avoid using long dashes while entering text in notes.

- Do not use long dashes even while using any Text Editor like- Notepad, etc.

- Send the doc file to the client as QBY file after ensuring the above two steps have been followed.

Solution 6: Remove special characters from the file name and file path

Special characters may cause an error while creating the accountant’s copy. This can be resolved by following the below steps:

- Open Windows Explorer and go to the folder where your company file is located.

- Check the file name and the folder path for any special characters (like @, #, $, etc.).

- If you find any, remove the special characters from both the folder name and file name

- .Try opening the Accountant’s Copy again.

Note: Remove special characters from the file name when prompted to save the file as .QBA.

Solution 7: Free up space on your hard drive

If you’re unable to create the Accountant’s Copy, it might be due to low disk space. Try these steps to free up some space on your hard drive:

- Free up space on your hard drive by deleting or moving unnecessary files.

- Alternatively, save the Accountant’s Copy to a different drive that has more available space.

How to Create an Accountant’s Copy in QuickBooks?

There are two simple ways to create and send an Accountant’s Copy to your accountant in QuickBooks:

Option 1: Create a File for USB or Cloud Sharing

- Open QuickBooks and go to the File menu.

- Hover over Send Company File, then select Accountant’s Copy > Client Activities.

- Choose Save File, then click Next.

- Select Accountant’s Copy, then Next again.

- Enter the dividing date (this separates the period for your accountant to review) and select Next.

- You’ll now have an Accountant’s Copy with a

.qbxextension. You can transfer it via USB, email, or a cloud service like Box.

Option 2: Use the Accountant’s Copy File Transfer Service

- Open QuickBooks and navigate to the File menu.

- Hover over Send Company File, then select Accountant’s Copy > Client Activities.

- Choose Send to Accountant, then click Next.

- Select Accountant’s Copy and click Next.

- Enter the dividing date and select Next.

- Input both your email and your accountant’s email.

- Create a file password—your accountant will need this to open the file.

- When ready, select Send to securely share the file.

Both methods are quick and secure, making it easy for your accountant to access and review your company data.

Points to Consider While Creating an Accountant’s Copy

Consider the following points when creating an Accountant’s Copy:

- File Size: Make sure the Company size is at most 200 MB; otherwise, the user will not be able to send the file to the Intuit Server. Larger files can prevent the software from working properly.

- Data Backup: Always make a backup of data before creating an Accountant’s Copy. It ensures that if any problem occurs, the user can recover the data.

- Dividing Date: It is a point of time up to when a client can make changes to the file. Transactions before this date are locked for an accountant, which ensures data integrity.

- Accountant’s Changes: QuickBooks will display “Accountant’s Changes Pending” in the title bar, and it will keep on reflecting until the user adds the changes from the Accountant’s Copy or removes the limitations/restrictions. Accountants can only make changes to the file after the dividing date.

- Review and Accept: Review and accept the changes to the company file after the accountant has made changes. It will ensure that the financial records are updated.

Bottom Line

QuickBooks Unable to Create Accountant’s Copy issue arises while preparing an accountant’s copy. It is a version of a company file that accountants use to make changes to the data.

This article answers questions like WHAT is QuickBooks Unable to Create an Accountant’s Copy Error, WHY it is caused, and HOW to resolve it. If you still face any problems, call our experts at +1-802-778-9005 for a quick resolution or send mail at support@ebetterbooks.com.

FAQ

What is the significance of the Dividing Date when creating an Accountant’s Copy, and what limitations does it impose?

The Dividing Date is a crucial marker set by the client to split the company file’s activity, allowing both the client and the accountant to work simultaneously without conflict.

- Client’s Role: The client (user) is restricted to making changes (add, edit, or delete transactions) on or after the Dividing Date. All transactions dated before this line are locked to the client.

- Accountant’s Role: The accountant can add, edit, or delete most transactions dated on or before the Dividing Date. They can add new transactions dated after the dividing date, but they cannot edit, merge, or delete existing list items (like accounts) that existed before the date.

- Purpose: The date prevents the accountant’s file and the client’s file from containing contradictory changes to the same historical transactions, which would prevent the final import of the change file.

Why does my QBW file size need to be under 200 MB to use the File Transfer Service, and what is the best alternative for larger files?

The 200 megabyte (MB) limit is a hard technical restriction for the Accountant’s Copy File Transfer Service (ACFT), which uses Intuit’s servers for secure exchange. Files larger than this size will fail to upload or generate an error message during the transfer process.

For files exceeding 200 MB, the following alternatives are recommended:

- Save File Manually: Choose the Save File option instead of the Send to Accountant option. This creates a highly compressed

.QBXfile on your local drive. - Secure Transfer: Manually send the resulting

.QBXfile to your accountant using a secure, third-party method such as:- Securely shared cloud storage (e.g., Dropbox, OneDrive, Google Drive).

- Encrypted external drive or USB stick.

- Condense Data Utility (Advanced): Use the Condense Data utility to remove old, closed transactions or the extensive audit trail, which can significantly reduce the file size below the 200 MB threshold.

I see the message “Accountant’s Changes Pending” in the title bar. What does this mean, and how do I remove it?

The “Accountant’s Changes Pending” message is a restriction marker that confirms a working copy was successfully created and sent to your accountant.

- Meaning: The system is waiting for the accountant’s change file (

.QBY) to be imported. It locks transactions prior to the Dividing Date to prevent the client from making conflicting changes. - Removal: The message is only cleared by one of two actions:

- Successful Import: You successfully import the accountant’s changes file (

.QBY) back into your company file via the Import Accountant Changes function. - Manual Removal: You manually remove the Accountant’s Copy restriction by navigating to File > Send Company File > Accountant’s Copy > Client Activities > Remove Restrictions.

- Successful Import: You successfully import the accountant’s changes file (

What is the difference between Error 3371 and Error 6123, and how do they prevent creating the Accountant’s Copy?

These errors are distinct issues that block QuickBooks functionality necessary for creating or transferring the file.

- Error 3371 (Licensing/Data Integrity):

- Type: A licensing or component file integrity error.

- Cause: It often occurs when the file that stores QuickBooks product registration and license information (

entitlementDataStore.ecml) is damaged or missing, or if a core Microsoft component like MSXML is corrupted. QuickBooks cannot run—and thus cannot create a file copy—until the license is validated. - Fix: Running the 3371 Error Fix tool within the QuickBooks Tool Hub.

- Error 6123 (Network/File Path):

- Type: A company file access or network connectivity error.

- Cause: It indicates QuickBooks cannot open the company file for a necessary task (like creating a copy) because of an issue with the file path, corrupted network data, or if the file is being accessed from a removable or networked drive.

- Fix: Running the QuickFix My Program and QuickBooks File Doctor tools within the QuickBooks Tool Hub.

Why do long dashes in notes or memo fields cause an error when preparing the Accountant’s Copy?

Long dashes (specifically em dashes or en dashes) are considered special text characters.

- Cause of Error: The Accountant’s Copy Transfer Service and older versions of QuickBooks data validation processes can fail to interpret or correctly translate these special characters during the compression or transfer phase. This leads to a file integrity error, halting the copy creation process.

- How to Avoid:

- Use Plain Text: When drafting notes in external programs like Microsoft Word, use a simple text editor (like Notepad) to strip the rich formatting and special characters before pasting the text into QuickBooks fields.

- Single Hyphen: Use a single hyphen (-) instead of the double hyphen that automatically converts to an em dash.

If I have to use Solution 1: Check for Possible Data Damage, will removing the Accountant’s Copy Restriction ruin my accountant’s work?

Yes, removing the Accountant’s Copy restriction will void the current Accountant’s Copy (.QBX) and make any changes your accountant is working on completely unusable.

- Impact: This action is irreversible. The restriction removal essentially tells QuickBooks to discard the expected change file (

.QBY), and the main company file is unlocked for full client access. Any changes made by the accountant in their copy cannot be imported. - Procedure: You must discuss this with your accountant first. If damage necessitates the removal, be prepared to:

- Ask the accountant to discard their current work.

- Send a brand new Accountant’s Copy after the data damage repair is complete.

- Manually re-enter any changes the accountant had already provided (if work was lost).

Besides the 200 MB limit, what other methods can I use to reduce the company file size to ensure the Accountant’s Copy is created successfully?

While QuickBooks Desktop does not have a hard size limit, performance (and transfer reliability) degrades substantially above 500 MB, with the ACFT failing above 200 MB. You can reduce file size by using the following utilities:

- Create a Portable Company File: Creating and then immediately restoring a Portable Company File (

.QBMto.QBW) re-indexes the entire database. This often removes database fragmentation and reduces the file size by optimizing the data structure. - Condense Data Utility (Audit Trail): Use the Utilities > Condense Data tool and select the option to “Keep all transactions, but remove audit trail info to date.” The audit trail often takes up significant space, and removing it (while retaining all transactional detail) can substantially reduce the file size safely.

- Condense Data Utility (Transactions): Use the Condense Data tool to remove old transactions before a specific date, summarizing them into a single journal entry.

Caution: This permanently deletes transaction detail and should only be done with professional consultation.

Disclaimer: The information outlined above for “How to Fix Unable To Create Accountant’s Copy In QuickBooks Desktop Error” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.