Bookkeeping for beginners is not challenging. We’ve covered basic yet helpful tips in this blog to help you get started, including what is bookkeeping, types of bookkeeping, the Importance of bookkeeping, bookkeeping vs accounting, bookkeeping services, and much more.

What Is Bookkeeping?

Bookkeeping is the process of arranging, categorizing, and maintaining a company’s financial records. It entails recording transactions and keeping financial documents to monitor an organization’s financial health. Most firms employ electronic bookkeeping, whether a simple spreadsheet or more complicated, specialized software.

The systematic recording and monitoring of the data related to a company’s financial operations is essentially what bookkeeping entails. While it is important for businesses, it also has advantages for individuals and nonprofits.

The person(s) in charge of a company’s bookkeeping would note all related transactions, including but not restricted to:

- Payments to suppliers for expenses

- Loan payments

- Invoice payments from customers

- Monitoring asset depreciation

- Making financial reports

Keeping track of a general ledger is an important aspect of bookkeeping. This is the fundamental document in which bookkeepers keep all costs, records, and receipts. Posting is the act of recording information on a ledger. As a result, the more sales or expenditures there are, the more often the ledger is updated.

The complexity of bookkeeping software is entirely determined by the person in charge and their tastes, but it may also be influenced by the size and demand of the organization.

Types Of Bookkeeping

The various types of bookkeeping systems are available for business entities to select from. Single-entry and double-entry bookkeeping are the two main forms.

Any form of bookkeeping system is available for business organizations to select. Some organizations mix the two categories. Your company has to pick which approach to use before you start accounting.

Let’s go through each of them in further depth.

Single-entry system of bookkeeping

The primary technique for documenting daily revenues is the single-entry bookkeeping system, which may be used to provide a daily summary of a company’s cash flow. In the single-entry system of bookkeeping, each financial transaction or activity is represented by a single entry.

Only one side of a transaction or activity is recorded using the single-entry bookkeeping approach. It keeps track of purchases, cash receipts, payments, and sales. Small firms, which conduct few transactions, are the major users.

Advantages of Single-Entry Bookkeeping

- Even those employees who have a basic understanding of bookkeeping may easily understand and use the procedure.

- For small businesses, single-entry accounting is advantageous since it removes the need to employ a third party to do bookkeeping.

Disadvantages of Single-Entry Bookkeeping

- The system suffers from a lack of precision in numbers.

- This approach might not accurately represent your company’s earnings and losses.

- Financial fraud is possible with single-entry accounting.

Double-entry system of bookkeeping

In contrast to single-entry, this approach makes two entries for each transaction the business performs. This kind of accounting is often quite strong and effective. For reliable data, large corporations and companies use this technique.

According to this method’s general rule, the debit amount must always match the credit amount. The moment the company reaches this point, it is considered balanced.

Advantages of Double Entry Bookkeeping

- Reduction in financial frauds.

- The trial balance approach is used in this method, which greatly simplifies the process of bookkeeping.

- Businesses can analyze their performance from one quarter to the next.

- This strategy estimates the profit and loss data more precisely and thoroughly.

Disadvantages of Double Entry Bookkeeping

- It is somewhat complicated and often has a longer learning curve.

- Each transaction requires a significant amount of time from the bookkeeper to be recorded.

Most firms use the aforementioned two methods of bookkeeping. However, additional bookkeeping types are used in accounting, such as cash-based or accrual-based approaches.

Cash-Based Method of Bookkeeping

Cash-based accounting typically records the transactional information whenever money enters or leaves the firm accounts. When the company gets or pays cash, only then are they documented.

Accrual-Based Method of Bookkeeping

In contrast, the accrual method is a means of documenting the company’s earned income. Coupled with dual-entry bookkeeping, it performs excellently.

Experts advise using single or double-entry books of accounting that are cash-based, accrual-based, or both. If you want to use the accrual method, dual-entry accounting works well. Additionally, single-entry accounting permits the adoption of a cash-based approach.

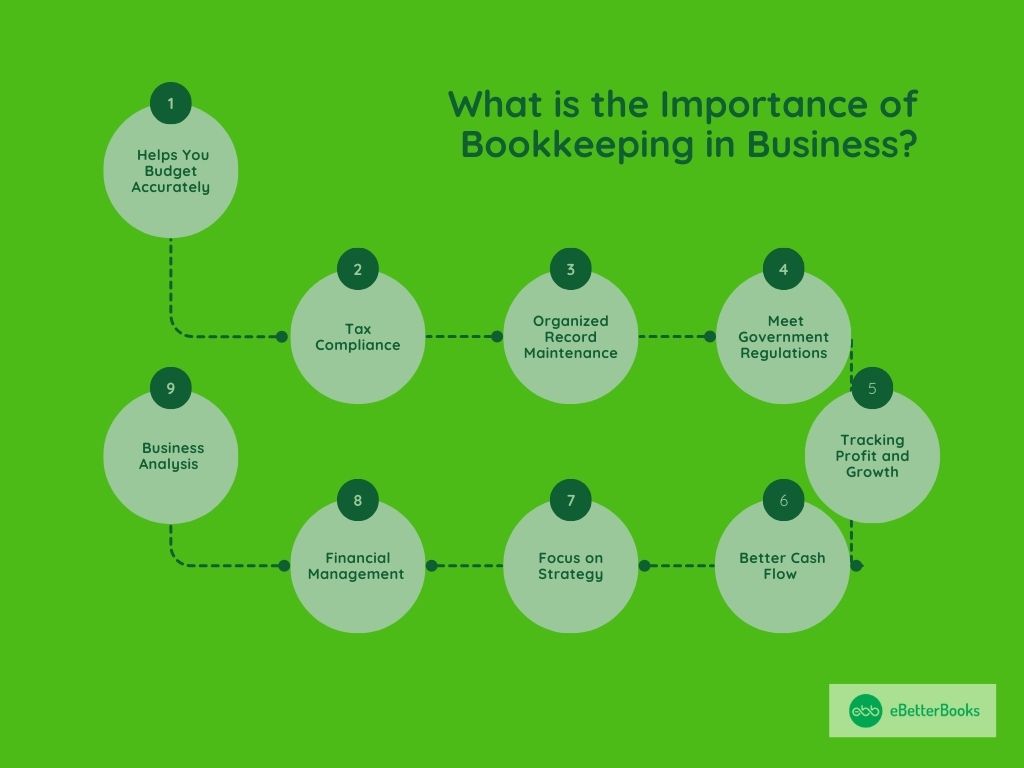

What is the Importance of Bookkeeping in Business?

Accurate bookkeeping enables precise measurement of a company’s success. It also acts as a benchmark for the company’s income and revenue goals and a source of data for making broad strategic decisions. In other words, once a business is operating, it becomes even more important to devote more time and money to preserving correct records.

Let’s understand the Importance of bookkeeping for business:

Budgets are crucial for businesses because they provide the necessary financial direction. You may monitor revenue vs. costs and evaluate your financial resources with the help of bookkeeping.

1. Helps You Budget Accurately

Bookkeeping is important to any business as it makes the budget so much easier. It keeps your income and expenses properly organized, so that you can simply review your financial resources and costs.

A budget makes a financial roadmap for your business. If your budget is in place, you can decide your future expenses for your business to help with growth. If your books are not correct and up-to-date, it becomes hard to get the correct budget because it’s all mainly guesswork.

2. Tax Compliance

This is another important aspect of bookkeeping meeting tax compliance standards the Internal Revenue Services (IRS) set. If the financial transactions are not maintained accurately or the bookkeeping practices are poor then there can be some serious repercussions. In this underpayment or overpayment of taxes are included that can result in hefty fines or a possible audit.

3. Organized Record Maintenance

Bookkeeping lets the business owners organize their financial records. Through this the process of filing financial statements, tax reuters, financial audits, etc gets easy.

For example, businesses can utilize the organized records to resolve any issues in their operations that might be causing high costs and low profitability. They can make strategies to enhance their financial health and profitability.

4. Meet Government Regulations

Bookkeeping is very important for businesses to comply with government regulations, like the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

If you’ll not follow these guidelines, it might result in fines, legal repercussions, or even the loss of licenses.

5. Tracking Profit and Growth

Bookkeeping allows the businesses to track their profit and growth. It ensures that the businesses assess their income and expenses, take advantage of potential opportunities, recognize patterns, and make some decisions which can increase their growth.

For example, bookkeeping can specify the area where investments can increase profitability or growth.

6. Better Cash Flow

If you do accurate bookkeeping it will also help you in maintaining your business’s cash flow. Having a better understanding of cash inflows and outflows, you can make the correct decisions regarding when to invest, where to invest, how to manage bills, etc.

For example, bookkeeping lets you recognize late-paying customers and tries to improve your payment collection process.

7. Focus on Strategy

Bookkeeping also assists you in making strategic planning by providing up-to-date and relevant financial data.

For example, through bookkeeping business owners can track the success of different activities, and also it compares the profitability of many product lines and more. All this data allows them to make business strategies and move toward success.

8. Financial Management

Booking is an important tool for financial management. It allows the business owners to get a comprehensive understanding of their financial health.

For example, bookkeeping allows owners to track their cash flow, inventory, and other important aspects of their operations. As a result, they can make decisions related to tax planning, debt management, and investments in their business.

9. Business Analysis

Accounting is an essential subprocedure in the study of business. It provides financial data in which growth sectors can be identified as well as measuring the effectiveness of many endeavors.

Bookkeeping can be useful in assessing company performance by business owners. They can identify trends in income, expenditure and profit margins for business.

For example, you can decide to use bookkeeping to determine suppliers who require high quantities of funds so that you can discuss better budget conditions to enhance profitability.

How to Record Entries in Bookkeeping

Generating financial statements like income statements, balance sheets, and cash flow statements helps you to get a better understanding about where your business stands and you calculate its performance. If you want these reports to illustrate your business accurately, then you’re required to have proper documented records of your transactions. It is suggested to keep the records as current as possible, as it will be helpful when you ‘re reconciling your accounts.

Recording transactions begin with source documents such as purchases and sales orders, invoices, bills, and cash register tapes. Once you collect all these documents, you can begin recording the transactions by using journals, ledgers, and the trial balance. If your company is very small you might only require a cash register. All this information then will be consolidated and turned into financial statements.

1. Cash Registers

A cash register is defined as an electronic machine which is utilized to calculate and register transactions. Generally, these are used to record cash flow in stores. The cashier collects the cash from the sale and returns a balance amount to the customer. The cash that is collected and balance which has been returned are recorded in the register as single-entry cash accounts. It also stores transaction receipts, so that you can smoothly record them in your sales journal.

You can find cash registers in businesses of all sizes. Although, it is not considered as the primary method to record transactions as they use the single-entry, cash-based system of bookkeeping. This makes them suitable for very small businesses but very simplistic for enterprises.

2. The Journal

The journal is defined as the book of the original entry. In a journal a business chronologically records its transactions for the very first time. A journal can be both physical (in the form of a book or diary), or digital (stored as spreadsheets, or data in accounting software). Journal specifies the date of every transaction, the accounts debited or credited, and the amount connected. Although, the journals don’t get checked for balance at the end of fiscal year, but each journal entry affects the ledger. As we know that it is important that the ledger is balanced, so it is necessary to keep an accurate journal. It is a useful form for double-entry bookkeeping.

3. The ledger

A ledger can be defined as a book or a compilation of accounts. It is also known as the book of second entry. Once you enter the transactions in a journal, they are divided into separate accounts and then it is transferred into the ledger.

These records get transcribed by accounts in the following order:

- Assets

- Liabilities

- Equity

- Income

- Expenses

The ledger can also be both physical or electronic spreadsheets like the journal. A ledger includes a chart of accounts, that is the list of all the names and number of accounts in the ledger. Generally, the charts occur in the same way of accounts as the transcribed records.

Ledgers get investigated by auditors, so that they’re always balanced at the end of the fiscal year. If there is a situation like the total bidet is more than the total credits, it’s called a debit balance. If the total credits is greater than the total debits, then there is a credit balance. The ledger is necessary in double-entry bookkeeping where every transaction is changed at least two sub-ledger accounts.

4. Trial Balance

The trial balance is made from the compiled and summarized ledger entries. The trial balance is as similar as a test to see if your books are balanced. It lists the accounts completely in the following order mentioned below with the ending account balance:

- Assets

- Liabilities

- Equity

- Income

- Expenses

The trial balance is generated by the accountant to see in what position your business is in, and how well your books are balanced. Then it is crossed-checked against ledgers and journals. The imbalances between debits and credits are very easy to notice on the trial balance. Although, not every time it is error-free. If there is any miscalculated or wrongly-transcribed journal entry in the ledger will lead to incorrect trial balance. Instead of waiting for the trial balance at the end of fiscal year, it is suggested to correct the errors on the ledger early.

5. Financial Statements

This is probably the most important step in bookkeeping to generate the financial statements. These statements are made by combining information from the entries that are recorded on a day-to-day basis. They give an insight about your company’s performance over time, telling about the areas you need improvement on. The three major financial reports that every business should be aware about and understand are balance sheet, cash flow statement, and income statement.

6. The Cash Flow Statement

The cash flow statement is a financial report which tracks incoming and outgoing cash in your business. It provides you (and investors) all the necessary details regarding how well your business handles debt and expenses. By summarizing this data, you can have information if you’re making enough money or not to run a profitable, sustainable business.

7. The Balance Sheet

The balance sheet records liabilities, business assets, and shareholder’s equity at specific point in time. It provides you details about what your business owes, owns, and the amount that is invested by the shareholders. Although, the balance sheet is only the screenshot of the business financial position for a specific date. Ift might get compared with other periods of the balance sheet as well. The balance sheet memes you understand about the financial and liquidity structure of your business via analytics such as asset turnover ratio, current ratio, inventory turnover ratio, and debt-to-equity ratio.

8. The Income Statement

The income statement is also known as profit and loss statement, it takes care of the revenue gained and expenses incurred by business over time. There are two parts available in a typical income statement. The upper half mention the operating income while the lower half mention expenditures. The statement records these over a period, like the last quarter of the fiscal year. It displays how the net revenue of the business is changed into net earnings that results in either profit or loss. The income statement does not give attention towards cash details and receipts.

9. Bank Reconciliation

Bank reconciliation is defined as the process of searching congruence between the transactions in your bank account and the transactions in your bookkeeping records. In bookkeeping, reconciling your bank accounts is very important because after everything else is logged, it is necessary to find discrepancies in your books. Bank reconciliation makes sure that there is nothing wrong when it comes to your money.

What is an Example of Bookkeeping?

Example – Organizing Expenses into Budget categories (Housing, Insurance, Personal Spending, Saving, Investing, & Debt Payments, ect.)

Case– Most modern accounting software connects to a company’s bank account and automatically downloads transactions into the software; nonetheless, the software occasionally has trouble categorizing such transactions.

Solution– Expenses such as fees given to independent contractors, advertising and marketing costs, utilities, and office supplies are among the expenses that a bookkeeper will categorize after reviewing the transactions taken from the bank feed. Additionally, they’ll include receipts or other proof of each transaction to ensure the company has the necessary records in case it ever undergoes an IRS or state tax authority audit.

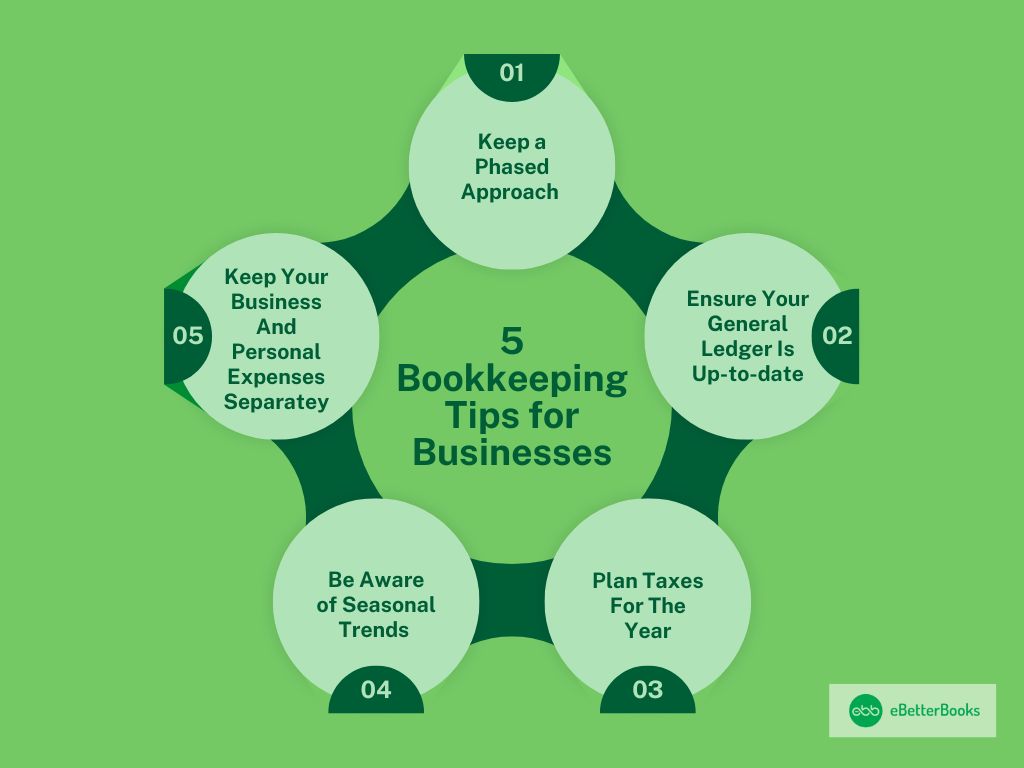

5 Bookkeeping Tips for Businesses

Keeping good attention to detail is the key for better booking. Mentioned below are some bookkeeping tips that should be followed by business owners to stay on top of their finances.

1. Keep a Phased Approach

If you’re in between the process of switching from manual bookkeeping to a digital system, take a step-by-step approach. Quickly converting all at once can get overwhelming for the employees and can also disappoint them.

Taking one step at a time ensures that you’re in control of your organization as they shift to a new system.

2. Ensure Your General Ledger Is Up-to-Date

A general ledger contains all the information that is needed for a company’s financial transitions. It adds the balance sheet (equity, assets, and liabilities), and income statement accounts.

General ledger accounts include the following:

- Assets such as cash, land, accounts receivable, inventory, and investments.

- Liabilities such as customer deposits and accounts payable.

- Stockholder accounts such as common stock, treasury stock, and retained earnings.

3. Plan Taxes For The Year

Keeping track of your business’s financial records and expenses throughout the year will make sure that you’re prepared during the time to file taxes. You will be able to enter tax season confidently, without the normal hiccups or last-minute runs.

4. Be Aware of Seasonal Trends

There is no work in the world which does not have seasonality. So for bookkeepers, seasonality refers to the periods of time that are characterized by increased amount of received payments – it just means that the completed job is not an option, but a necessity.

It becomes imperative to plan for such moments in advance or else there could be an enhanced backlog before the pressure period sets it.

5. Keep Your Business And Personal Expenses Separate

It might look fascinating to not keep lines between business and personal expenses when you go deep into your bookkeeping process, but this is not suggested. If you will avoid this then it will reduce the risk of triggering an IRS audit as it provides a correct representation of your finances.

Some common solution to keep your personal and business finances separate are mentioned below:

- Utilize a business credit card for all your business expenses.

- Have a separate checking accounts

- Keep the receipts of personal and business expenses separate.

What is the difference between bookkeeping and accounting?

Even though the phrases bookkeeping and accounting are sometimes used synonymously, accounting refers to the general process of managing a person’s or a business’s finances, while bookkeeping is more precisely used to describe the responsibilities and procedures involved in documenting financial operations.

Tracking and documenting a business’s daily financial activities is called bookkeeping. Companies later use this data to create financial statements, submit tax returns, and gather the knowledge necessary to make wise financial decisions.

There are no particular licenses, certificates, or training qualifications for bookkeepers. While some bookkeepers obtain certifications, such as those for QuickBooks ProAdvisor, to show that they are knowledgeable about the software they use, most bookkeepers develop their abilities through on-the-job training. To learn more about QuickBooks ProAdvisor Training and certifications

In contrast, at the very least, accountants often hold a bachelor’s degree in accounting. They could also pursue certifications to broaden their skills and show off their knowledge.

Although the job of a bookkeeper may at first glance appear to be similar to (or identical to) that of an accountant, this resemblance is only surface-level. All financial transactions for a business are documented by a bookkeeper, and it is the job of the accountant to comprehend and process the information.

Let’s examine bookkeeping vs accounting with the key distinctions in the following table:

| Bookkeeping | Accounting | |

| Definition | In bookkeeping, only financial transactions are identified and documented. | Accounting is collecting, analyzing, and expressing an organization’s financial data. |

| Decision making | The information offered by bookkeeping is insufficient for making decisions. | The information received from accounting may be used by management to make critical choices. |

| Financial Statement Preparation | When it comes to bookkeeping, this is not done. | As part of the accounting process, financial statements are produced. |

| Analysis | The bookkeeping requires no analysis. | Accounting evaluates the information and produces business-related insights. |

| Persons Involved | The term “bookkeeper” refers to the person who handles accounting. | An accountant is a person who is interested in accounting. |

| Determining Financial Position | Bookkeeping does not reflect a company’s financial situation. | Accounting aids in providing a comprehensive picture of a company’s financial situation. |

| Level of Learning | No advanced knowledge is necessary. | Understanding and comprehending accounting principles require advanced knowledge. |

Financial Analytics Market Report

According to Global Market Insights Inc. report published on 30 Aug, 2022, the financial analytics market will be worth $43 billion by 2030.

The market dynamics for cloud deployment are changing due to the quickly developing automation and digitalization trends and the rising need for modern, scalable, time-saving, and cost-effective Bookkeeping services.

Best Bookkeeping Services

Choosing Best online bookkeeping services may be the best choice if you want to save time and money. If your company wants to save time and money, you should think about using a bookkeeping service.

By outsourced bookkeeping services, you can keep your finances under control and your company healthy. Your company’s needs will determine the solution you use, which may also include other services like payroll or tax preparation.

eBetterBooks could even save you money because you and your team won’t have to waste time on these tasks. Instead, focus on running your business as effectively as possible.

The Bottom Line

All businesses need to keep books, no matter how big or small. It is the process of monitoring financial activities inside a business. You must be aware of the different types of bookkeeping systems to select the one that is appropriate for your company.

Bookkeepers may assist firms by ensuring that all financial operations are recorded and that the financial procedures are properly defined. To simplify bookkeeping operations, consider using ebetterbooks.

FAQs

How do I start bookkeeping for beginners?

You may use the procedures below to manage bookkeeping for your small business:

- Firstly, please familiarize yourself with your chart of accounts and set it up.

- Then, start keeping track of your financial transactions.

- Reconcile your bank accounts right away.

- Lastly, Run financial statements once the month is closed.

Can I teach myself to be a bookkeeper?

Yes, you can learn bookkeeping on your own. A person can use various high-quality online tools to acquire all the skills and information required to become a bookkeeper. Enrolling in courses that include fundamental bookkeeping and advanced accounting is crucial.

What is the main purpose of bookkeeping?

Bookkeeping is the process of routinely documenting a business’s financial activities. With the use of efficient accounting, businesses can keep track of all the information on their books to make crucial operational, investment, and finance decisions.

What do bookkeepers do daily?

Many of a business’s daily financial responsibilities are handled by bookkeepers, including setting up bank deposits, checking receipts, sending payments, processing payroll, making purchases, issuing invoices, keeping track of past-due accounts, and more.

Do bookkeepers do Payroll?

Sometimes, bookkeepers also handle payroll and human resources duties. Your accounting services could include payroll processing among its services, or they might just assist you with tax payments and form filling.