Vehicles represent an expense area that small business owners frequently ignore but treating these costs remains significant even to small business owners. Vehicle expenses qualify for deduction with the IRS allowing business owners to lower their taxable income through these deductions. Business owners who operate small enterprises must effectively manage their business expenses to achieve financial profitability along with decreased tax responsibilities.

This article explains automotive expense deductions, alongside mileage reimbursement, and actionable strategies for small business owners to maximize their deductions.

Introduction to Vehicle and Mileage Expense Deductions

A vehicle used for business functions allows deductions of operating and maintenance expenditures from business taxable income.

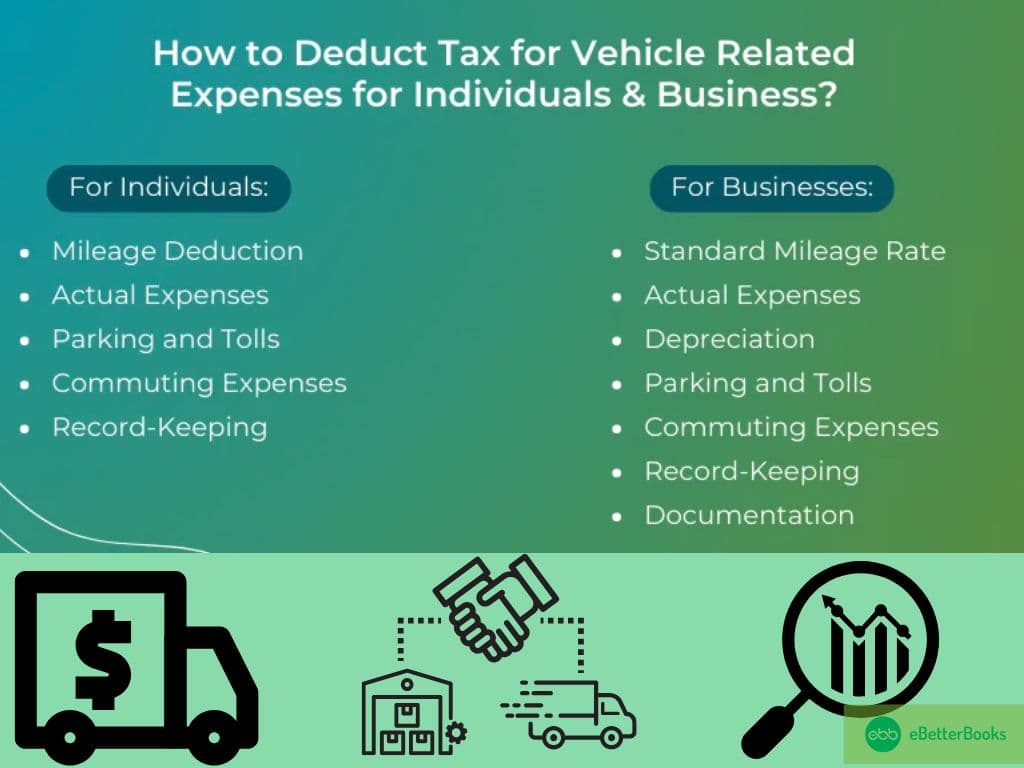

According to the IRS, vehicle expenses can be classified into two categories:

- Business-use expenses and

- Personal-use expenses

The deductible costs relate only to expenses incurred for the business activities. All expenses related to vehicle usage must first be divided between personal and business purposes before removing the business expense total from taxation.

The IRS offers two main methods for calculating vehicle-related deductions:

- Standard Mileage Rate Method

- Actual Expense Method

Simple business owners need to analyze distinctive methods while making decisions about which deduction procedure works best for them. The following segment details both methods for deduction claims alongside explanations of procedural steps for deducting expenses using these methods.

Those who operate small businesses need to handle spending costs as a method of keeping their operations profitable and lowering their tax exposure. Business vehicle use costs typically go unnoticed by entrepreneurs because these expenses represent one of several key expenses that business owners neglect. Business owners who operate vehicles can obtain deductions from the IRS to lower their taxable income through vehicle expense reduction. This guide introduces vehicle expense and mileage deduction rules to small business owners while offering practical tax deduction strategies that adhere to IRS standards.

Business owners have to select the appropriate payment method from available options based on their unique operational demands. The following section details how these deduction methods operate while breaking down the requirements needed to receive these benefits.

1. Standard Mileage Rate Method

You can calculate business-related vehicle deductions easily through the Standard Mileage Rate by tracking your business travel distance. Each year the IRS determines an annual mileage rate that business people can claim. Taxpayers using the standard mileage rate must calculate their deductions at 70 cents for every mile they drive in 2025.

To claim deductions using the standard mileage rate, small business owners must keep track of the total business miles driven during the year. At the end of the year, you multiply the business miles by the IRS-approved mileage rate for that year.

Example of how the Standard Mileage Rate Works

For instance, if you drive 5,000 miles for business and the mileage rate is 70 cents per mile, your deduction would be:

5,000 miles × $0.70 = $3,500

Users can retrieve included expenses when utilizing the standard mileage rate system.

The standard mileage rate covers a wide range of expenses associated with the operation of a vehicle, including:

- Gasoline

- Oil

- Repairs and maintenance

- Tires

- Depreciation

- Insurance

- License fees

- Registration fees

Standard mileage rate deductions exclude parking fees and tolls but enable business owners to claim these expenses as separate deduction items. Record all costs apart from vehicle mileage deductions on your income tax return.

2. Actual Expense Method

When you use the Actual Expense Method you can deduct your actual costs of running your vehicle for business needs. When using this method you must compile entire vehicle spending logs containing costs for fuel and repairs alongside insurance fees and depreciation breakdowns.

Example of how the Actual Expense Method Works

Business owners can calculate deductions for vehicle expenses by applying their business usage percentage to complete expenditures via actual expense allocation. If your vehicle serves business needs 60% of the time and personal purposes 40% then you can claim deductions for 60% of all vehicle operating costs.

Here are some of the expenses you can deduct under this method:

- Gas

- Depreciation

- Repairs

- Lease payments

- Registration and license fees

- Insurance

- Maintenance (such as oil changes)

The cost of leased vehicles must also be included in deductions. Depending on vehicle ownership status either depreciation costs or lease payments would apply.

Depreciation

The actual expense method bases its calculations largely on depreciation values. You can deduct the reduced value of your vehicle with depreciation as a tax deduction. Tax regulations established by the IRS specify how car value depreciation should work by distributing total cost expense over multiple years.

If you use your vehicle exclusively for business purposes you qualify for a Section 179 deduction that enables you to deduct the entire vehicle cost in the year of purchase when the cost fits within defined limits. There are rules limiting tax deductions to the business operational percentage when you maintain your vehicle for both business and personal use.

Documents Requirements

You must track all expenses related to the vehicle, including:

- Gas receipts

- Maintenance and repair invoices

- Insurance statements

- Lease or loan documents

- Registration records

The documentation should include a record of business vs personal usage. To declare actual expenses under the IRS regulations you need to keep a precise log of business-driven miles equivalent to the standard mileage method.

Business owners confront the decision between the Standard Mileage Rate or the Actual Expense Method

When choosing a deduction method small business owners need to select the option which offers them maximum benefit. Small business owners should use the standard mileage rate for automobiles where tracking ease and broader deduction possibilities exist yet the actual expense approach works best for large vehicles with elevated operating expenses.

Factors to Consider

Type of Vehicle: You should select the standard mileage rate for deductible car expenses because it gives you better benefits if driving a fuel-efficient vehicle. When using the actual expense method to deduct costs for SUVs or trucks you might end up with a bigger deduction.

Business Use Percentage: A majority of business engagements require the actual expense method to deliver superior tax deductions. The standard mileage deduction will often deliver more advantages when you use your vehicle for business and personal activities.

Record Keeping: Those who manage their expenses through the standard mileage rate method collect fewer records which simplifies expenses management when one has little time or limited business resources. By applying the actual expense method you must maintain detailed tracking of different business costs but the process may become complicated.

Your choice of accounting method requires commitment throughout the entire year without the possibility of changing it. After using this method for a year you do not need to keep using it since the choice is permanent but optional. The vehicle’s continued business use enables drivers to switch between methods when moving forward into future years.

Special Considerations for Leased and Owned Vehicles

When using your vehicle as a lease you can choose between actual expenses or the standard mileage rate without being able to take both options. Deducting expenses on vehicle leases includes both lease and related payments combined with insurance costs as well as fuel and maintenance while personal usage affects business deduction eligibility.

Business owners are permitted by the IRS to depreciate the value of vehicles they own. Your depreciation deduction amount depends on both the vehicle’s purchase price and the portion of the time you use it for business activities.

Conclusion

Effectively implementing the Vehicle and mileage deduction can help small business owners significantly benefit their total tax payable amount. Diligently record keeping is a major key in both the methods. Small business owners should regularly assess their position in order to determine whether they need to switch the another method to get the maximum benefits.

By ensuring the right requirements and options Small business owners can typically increase their profitability by reducing their tax burden. One needs to make sure that all the IRS guidelines are completely fulfilled.

FAQs!

Can I deduct vehicle expenses if I use my car for both personal and business purposes?

Yes, you can only deduct the portion of expenses related to business use.

Are parking fees and tolls deductible under the Standard Mileage Rate?

Yes, parking fees and tolls are separate deductions and can be claimed in addition to the mileage deduction.

Do I need to keep detailed records for both methods?

Yes, regardless of the method, detailed records such as mileage logs and receipts are essential for substantiating your deductions.