What is General Business Credit (GBC)?

The general business credit (GBC), therefore, is the total of specific credits a business is entitled to in a given tax year. It is the sum of the cocked-up credits from the earlier years and the total business credit for the year. Since it is a tax credit and not a tax deduction, it directly reduces the tax amount that a person must pay.

To claim multiple business tax credits on your tax return, you must attach Form 3800 General Business Credit and the particular IRS forms of the credit.

General Business Credit is an important component of your business or company’s tax planning system. However, these credits must be claimed based on the tax forms filed, which are computed using the rule natural for individual tax credits.

General Business Credits are accorded in accordance with the First In, First Out (FIFO) rule. So, the order will be:

- CarryForward to that year

- Credits earned in that year

- Carryback to that year

Importance of General Business Credit

General business credit is a vital source of funding for businesses of all sizes, supporting expansion, unforeseen difficulties, and daily operations.

It empowers companies to maintain a consistent flow of cash, allowing them to flexibly pay for things like electricity, wages, and inventory even while their income fluctuates.

It offers the funding required for expansion projects, which are essential for long-term success and include buying new machinery, starting advertising campaigns, and entering untapped markets.

A high credit record can also help businesses obtain better loan terms and interest rates, lowering borrowing costs and boosting profitability.

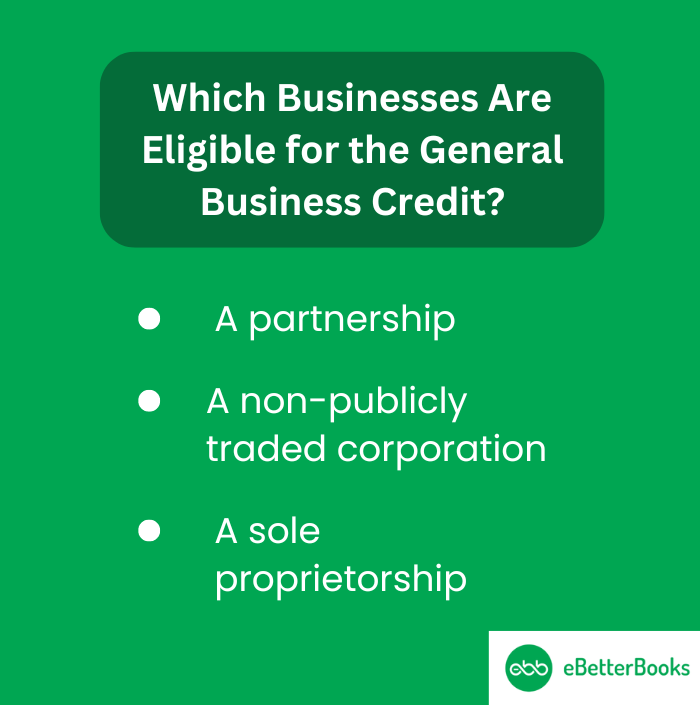

Which Businesses Are Eligible for the General Business Credit?

According to the Internal Revenue Service, the following types of businesses are eligible for the General Business Credit:

A partnership is a professional contract wherein two or more individuals join hands to own and operate a business enterprise. These parties, termed partners, may be single individuals, companies, other partnerships, or legal entities. Partnerships even need to file taxes for the partnership entity.

There are three types of partnerships:

- Limited Partnership (LP)

- General Partnership (GP)

- Limited Liability Partnership Corpuscular (LLP)

Private Business A private business is a business venture whose ownership of its assets or shares is not available in the public domain market. This provides more efficiency and seclusion to the owners. Corporations of such nature are exempt from filing with the Securities and Exchange Commission, or SEC.

Sole trader A sole trader business is an unincorporated business entity owned and managed by a single individual. Owners have a high level of independence, and many of these firms bear the owner’s name, which represents the owner’s persona.

Which Tax Credits Are Included in the General Business Credit?

The general business credit encompasses more than 30 tax credits, each with its unique benefits. For a comprehensive list of these tax credits, you can refer to the official website of the IRS, ensuring you have the most up-to-date and accurate information.

A few examples are:

- Small employer health insurance credit

- Renewable electricity production credit

- New energy-efficient home credit

- Investment credit

- Employer-provided childcare facilities and services credit

- Work Opportunity credit

- Credit for small employer pension plan startup costs

- Disabled access credit

- Alcohol fuels credit

- Credit for employer Social Security and Medicare taxes paid on certain employee tips.

- Employer credit for paid family and medical leave

- Empowerment zone employment credit

- Low-income housing credit

- Orphan drug credit

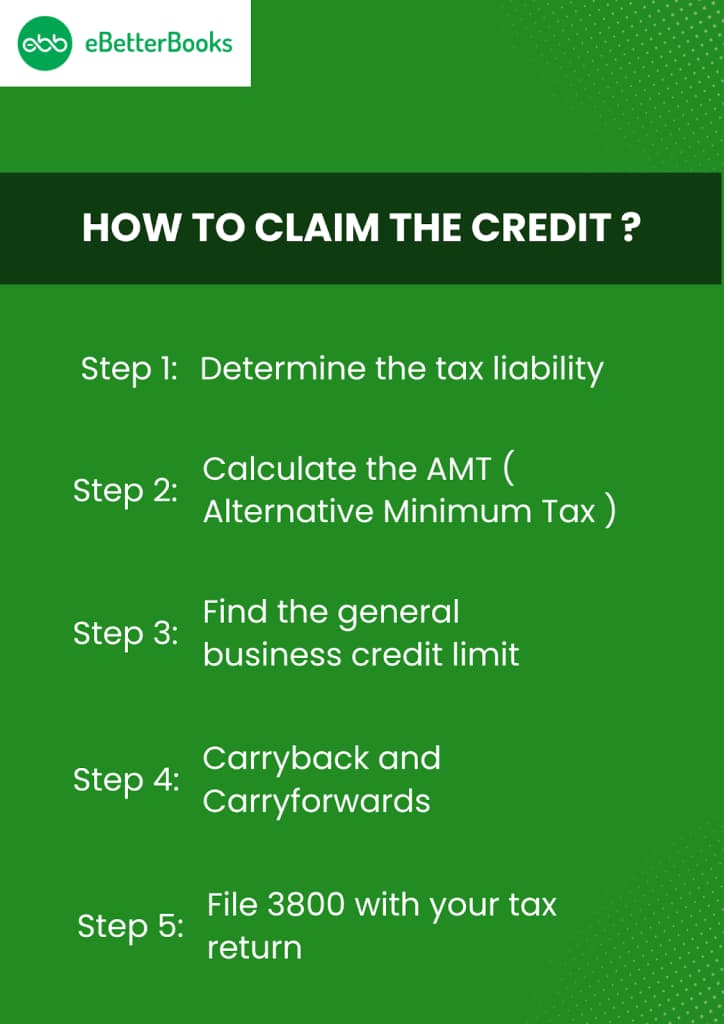

How to Claim the Credit?

You need to file Form 3800 with all the additional information required to submit the form.

A Form 3800 is a form that is used to claim the General Business Credit.

Here are the steps on how to file the Form 3800:

Steps to claim General Business Credit

Step 1: Determine the tax liability

In this step, you have to calculate the total tax liability by considering the taxable income and subtracting the tax deductions.

You can check the below-mentioned forms to determine the tax liability:

- Form 1065 – Partnership or limited liability company

- Form 1120 – C corporation

- Form 1120S – S corporation

Step 2: Calculate the AMT (Alternative Minimum Tax)

The IRS (Internal Revenue Service ) applies AMT rates if the income is higher than a certain level. The range varies from 26% to 28%, depending on the income.

IRS Form 6251 is used by individuals who have an alternative minimum tax. The reason for having AMT is that everyone pays a fair share of taxes, irrespective of deductions.

Step 3: Find the general business credit limit

To know your general business credit limit, follow these steps:

- 25% of the amount of your net regular tax due beyond $25,000 should be calculated.

- Examine the difference between the 25% of the net regular tax liability determined in the first stage and your estimated minimal tax. Identify which is more valuable.

- To establish your general business credit limit, deduct your net income tax from the greater value obtained in step two.

Step 4: Carryback and Carryforwards

- Since most credits can be carried back for a year, you can make changes to your prior year’s return if you didn’t use all of your available general business credit last year.

- It is also possible for you to carry forward tax credits. You can apply for the unused credits from previous years on this year’s return if you haven’t yet used up your entire general business credit limit this year.

Step 5: File 3800 with your tax return

When you file taxes, you’ll also submit Form 3800 and other individual tax credit forms.

- S Corporation

- Sole proprietors

- LLC members

- Partnerships

File your business tax return – Get Assistance

eBetterBooks assists you with certified tax experts to ease your business tax return filing.

For enterprises, eBetterBooks offers complete tax preparation, administration, and filing services. Their committed tax experts handle tax obligations, create income strategies, and assess earnings and revenue.

The services guarantee hassle-free filings, ongoing support, payroll tax filing support, and IRS compliance. Using cutting-edge financial instruments and contemporary online tools, eBetterBooks streamlines tax procedures, expands business prospects, and guarantees timely filings, thereby reducing client stress and increasing efficiency.

Conclusion

General Business Credit is a valuable tax attribute. It offers substantial tax benefits by reducing tax liability dollar-for-dollar for both individuals and corporate taxpayers.

Many taxpayers end up with extra credits that may need to be used. This piece explores how surplus credits can accumulate and how tax professionals can assist their clients in converting specific credits, which would otherwise remain unused, into a tax deduction option to tax liability for individuals and corporate taxpayers alike.