Form 1065 (U.S. Return of Partnership Income) is an income tax return filed by partnerships and LLCs classified as partnerships in the U.S. The IRS issues it and declares the income, profits, losses, deductions, and credits of the entity.

But no taxes are paid directly through this form. Instead, it informs the IRS of the partnership’s financial position over the tax year.

Purpose of Form 1065

The purpose of Form 1064 is to disclose the gains, losses, income, deductions, credits and other details related to the operation of a partnership.

For partnerships, the firm as a whole does not pay income taxes. The profits or losses of the partnership are “passed through” to the partners, who then report their share on their tax returns using Schedule K-1, which accompanies Form 1065.

Partnership

A partnership is a business venture agreed upon by the Internal Revenue Service, whereby two or more participants contribute capital in cash or otherwise, labour, or skills to carry out a business enterprise and intend to share losses and profits. The IRS employs Form 1065, the U.S. Return of Partnership Income, to reflect all the financial information relating to the partnership.

- Filing Requirement

Every domestic partnership must file Form 1065, regardless of the amount of income and the presence of losses, to report income, gains, losses, deductions, and credits from business operations.The partnership is expected to be filed by the fifteenth of the third month of the partnership fiscal year.

- K-1 Forms

A Schedule K-1 is prepared and issued for each partner, showing the partnership’s income, deductions and credit distributed among all partners. The partner must report this information on their personal or business tax return. The Schedule K-1 enables each partner to determine their distributive share of partnership income.

- Pass-Through Taxation

In the following partnerships: There is no payment of taxes by the partnerships. However, for all the business transactions, profits and losses are shared among the partners. Every partner pays taxes on their portion of partnership earnings whether or not they have physically received such an amount. This implies that partners could be taxed on the earnings of the partnership that are retained in the business, not those issued to the partners.

- Deductible Expenses and Credits

On Form 1065, the partnership can show and deduct business costs of their partnership, such as employee wages, rent or interest, and some capital costs.Some of the credits developed by the partnership may also be transferred to the partners as they can be used on their income tax returns.

- Partnership Agreement

The partnership agreement becomes important when filing Form 1065 because it clearly defines how the profits, losses and income distribution will be split among the partners.

- Due Diligence and Penalties

Entities failing to file Form 1065 by the due date or issue Schedule K-1 to their partners face penalties. The penalty for failure to file Form 1065 timely is usually charged on a monthly partner basis.

- Penalties

If a partnership doesn’t timely file Form 1065 or omits necessary information, it incurs a penalty of $235 for each month or part of a month the oversight continues, capped at 12 months. The penalty is multiplied by the total number of partners in the partnership for any part of the tax year the return applies to.

Form 1065 is crucial in filing a partnership’s financial transactions to track the distribution of profits, losses, and credits among partners. It provides for accurate tax treatment and partner-level compliances due to pass-through taxation.

Who Should File Form 1065?

Businesses that need to file tax Form 1065 are domestic partnerships, LLCs, non-profit organizations ( Section 501(d)), and foreign partnerships.

- Domestic partnerships: Form 1065 must be filed by every partnership in the US. A partnership is defined by the IRS as a commercial arrangement involving two or more people.

- Certain LLCs: LLCs that have two or more members but do not file their tax returns as corporations are required to file Form 1065 and do so as partnerships.

- Section 501(d): These non-profits may be religious or apostolic in nature.

- Foreign Partnerships: Form 1065 must be completed by foreign partnerships having a gross annual income of more than $20,000 that comes from US sources or with more than 1% of their income coming from US sources.

Unless there is no income or expenditure in a financial year, all domestic partnerships in the U.S. need to file Form 1065.

As per the IRS, a partnership is when two or more people do business where each partner contributes money, skill, labor, and property. Partners split the company’s profits and losses, with or without a formal partnership agreement.

The following businesses are considered partnerships:

- Limited partnership

- Joint venture

- Syndicate

- Any unincorporated organization through which financial operations are carried out

Sole proprietorships, estates, trusts, and corporations are not considered partnership businesses.

As mentioned above, partnerships themselves do not pay income taxes. It is passed on to the partners of the company, who report and pay their taxes. The partners should include all partnership items in returns.

Foreign partnerships earning income in the U.S. are required to file Form 1065, regardless of their main location of operation being abroad and their members being foreign nationals.

Foreign partnerships that generate income from the U.S. must file Form 1065 even if the principal place of operation is outside the U.S. and the members are foreign nationals.

Documents to File Form 1065

To file Form 1065, partnerships must prepare key financial documents, including the profit and loss statement and balance sheet. Partners must also include information like their Tax ID, number of partners, and the stake of every partner in the business.

Partnerships also need to include information about the following:

- Form 4562: Depreciation and Amortization

- Form 1125-A: Cost of Goods Sold (if applicable)

- Form 4797: Sales of Business Property (if applicable)

- Copies of any Form 1099 issued by the partnership

- Form 8918: Material Advisor Disclosure Statement (if applicable)

- Form 114: Report of Foreign Bank and Financial Accounts (if applicable)

- Form 3520: Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts (if applicable)

- Individual tax return Form 1040 for farming partnerships (if applicable)

When to File Form 1065?

All domestic partnerships need to file Form 1065 by the 15th day of the 3rd month after their tax year ends, as indicated at the top of the form.

For partnerships following the calendar year, the due date is March 15th.

Partnerships can file the return the next day if the deadline to file Form 1065 falls on a federal holiday or on weekends.

If any partnership needs an extension to file the form, you can request it by filing Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

However, you need to file Form 7004 by the original due date of the partnership return to be eligible for the extension. It can be filed electronically.

You can also use certain Private Delivery Services (PDSs) approved by the IRS to mail your return on time. Check the current list of approved services and how to get proof of the mailing date. Also, note that PDSs can’t deliver to P.O. boxes, you must always use the U.S. Postal Service.

How to File Form 1065?

Other than compiling all the necessary financial documents like a balance sheet for the beginning and end of the year and a profit and loss statement, partnerships also need to disclose information like the percentage stake of each partner in the business, the date of inception, the total number of partners in the business, and the Employer Identification Number (EIN) or Tax ID.

If your partnership business deals in physical goods, you have to provide information for calculating the cost of goods sold, such as beginning and ending inventory values.

You should also indicate the accounting method your business entity uses and report any profits paid to partners beyond their standard payments or payments over $600 to contractors.

The easiest way to file Form 1065 is online. Or, you can file by mail, sending the form to the IRS center address for your state.

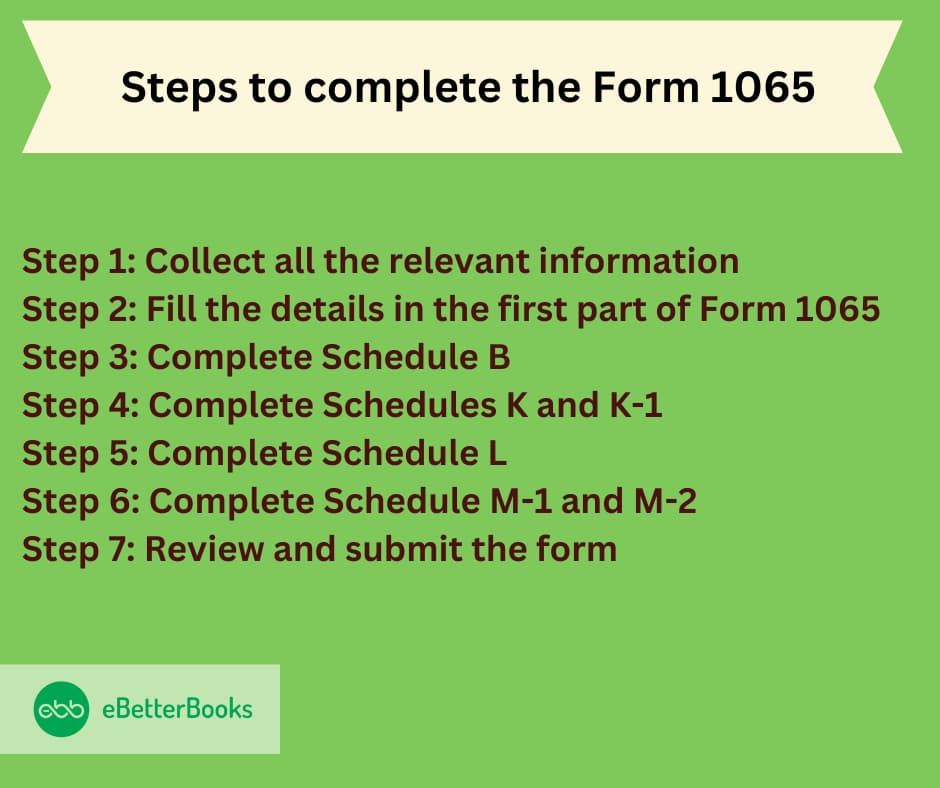

Steps to complete the Form 1065

Step 1: Collect all the relevant information

At the end of the year, you’ll need data from all of your financial statements, so be sure to have the following on hand:

- Profit and loss statement

- Employer Identification Number (EIN)

- Business code number

- Balance sheet

- Cost of goods sold

- Deductible expenses

- The accounting method used by your business

Step 2: Fill the details in the first part of Form 1065

Start by completing the first page of the five-page form, which asks for some basic information about your partnership.

Step 3: Complete Schedule B

Schedule B is a crucial component that asks about the percentage of each partner’s shares, debts, and investments in any partnerships.

You are exempt from filling out Schedules L, M-1, and M-2 if you provide a negative response to each of the four questions in Part 4. Complete all essential information in this schedule before advancing to the next.

Step 4: Complete Schedules K and K-1

You have to fill out Schedule K on page 4. The income of the partnership and other general details regarding partnership holdings are inquired about in this area of the form.

As an addition to Schedule K, Schedule K-1 lets partners report their capital gains, dividends, income, and losses immediately.

Each partner must submit a separate Schedule K-1 to the IRS. Therefore, you must gather each partner’s completed Schedule K-1 and attach it to Form 1965.

Step 5: Complete Schedule L

Carefully complete the Schedule L on Form 1065. It’s a balance sheet that details your company’s financial situation. Fill out the 22 questions to document your capital, obligations, and assets.

Step 6: Complete Schedule M-1 and M-2

Any bookkeeping differences between the income shown on your records and the income on your tax return are described and explained in Schedule M-1. Even if there are no such inconsistencies, you will still need to file this if you meet the requirements.

Schedule M-2, the final component of Form 1065, notifies the IRS of any modifications to partners’ capital accounts. So, make sure to verify that any updates reported here match the data in the corresponding Schedule K-1s.

Step 7: Review and submit the form

Make sure to review each item after completing it to make sure there are no mistakes. Using an IRS-approved tax filing system is the most straightforward method for submitting this form online.

Form 1065 is compatible with many accounting and tax software packages. If you have any doubts regarding how to fill out any section of Form 1065, make sure you read the 61-page instruction manual.

Where to Find Form 1065?

You can find Form 1065, also known as the U.S. Return of Partnership Income, on the official website of the Internal Revenue Service (IRS).

Here’s a quick guide to locating it:

- Go to the official website of the IRS

- Hover to the ‘File’ page and click on ‘Businesses and Self-Employed’

- From the list on the left side of the screen, select ‘Businesses and Self-Employed’

- And then click on ‘Partnerships’ from the dropdown on the left

Form 1065 and other related forms and instructions should be listed there.

When is Form 1065 Required?

Form 1065 is required for domestic or foreign partnerships that don’t meet exceptions for filing. Generally, it must be filed by the 15th day of the 3rd month after the end of the tax year. For calendar year partnerships (January to December), the due date is March 15.

IRS Form 1065 Reports

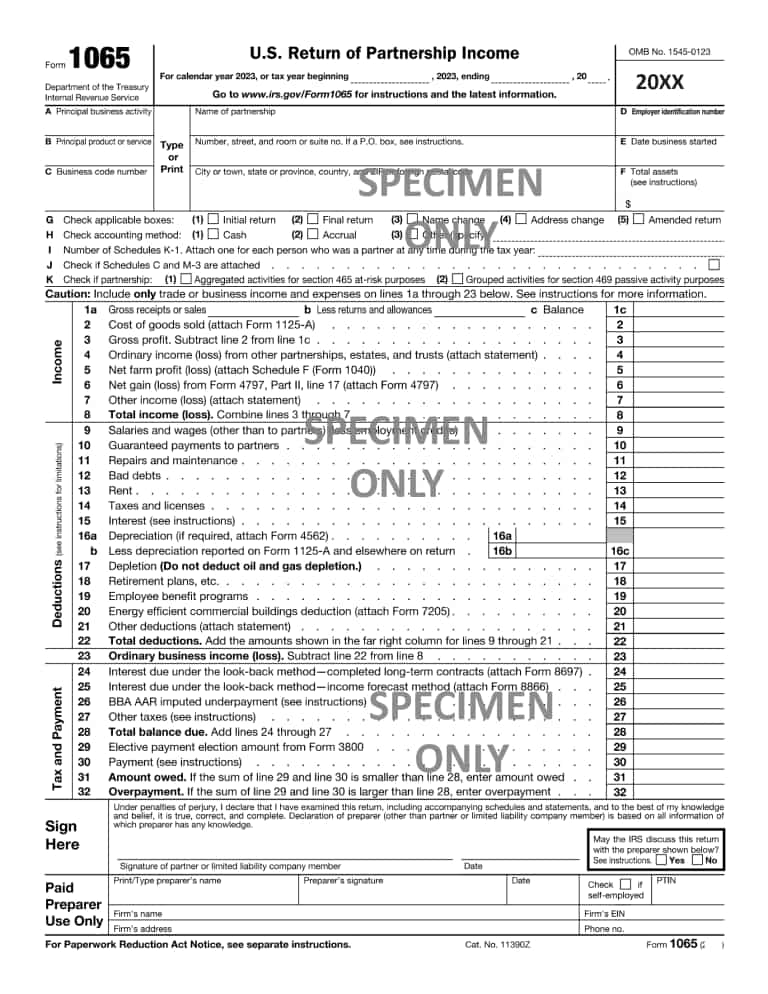

The top 5 pages of Form 1065 says:

Page 1

It displays the basic information about the partnership, such as name, address, employer, business activity, date that the business started), identification number is at the top of the 1065 form.

After that, the partnership shows whether the return is special (e.g., final, amended, reflecting change of name or address), the accounting method, and the number of Schedule K-1s that are attached.

The income section then lists the partnership’s trade or business’s mixed income items, such as net gain or loss on the sale of business assets and gross sales receipts.Some items require special treatment on shareholders’ returns, and these are referred to as separately stated items.

Similarly, although certain trade or business deductions for partnerships are shown on page one of Form 1065, other deductions, such as charitable contributions and Sec. 179 deductions, are reported in another place so that partners can use their limitations for these write-offs.

Payroll and employee wages are included in the deductions on page 1 of Form 1065, together with any guaranteed payments to partners.Ordinary business income profit or loss is the difference between the partnership’s total income and its total deductions. Partners receive this net sum as well as other stuff.

If the return is submitted on paper, the bottom of page one is where you sign and date the form (electronic signatures are used for e-filed forms). You also use this space to note any information regarding a paid preparer.

Pages 2 and 3

A series of yes/no questions on the partnership are included in Schedule B, Other Information.

Schedule B also includes information on the Tax Matters Partner, who is appointed by the partnership to sign the return and communicate with the IRS regarding return-related issues.

Audits involving more than ten partners must be carried out at the partnership level to avoid the IRS’s bother of auditing each partner regarding the treatment of a partnership item.

Page 4

The distributive share of things among the partners is listed in Schedule K. All of these products’ partners receive allocations based on this schedule; the amounts allotted are documented on Schedule K-1, which includes sections for:

- income (loss)

- alternative minimum tax items

- self-employment

- credits

- deductions

- foreign transactions

- other information

Page 5

This page consists of several distinct schedules:

The net income (loss) analysis presented on Schedule K is broken down by the kind of partnership (corporate, individual (active), individual (passive), etc.). It further divides profits and losses between limited partners and general partners.

Schedule L is the balance sheet. The partnership’s books are used to populate its entries for assets and liabilities. The partner’s capital accounts, or partnership equity, are essentially reflected in the difference between the assets and liabilities, just like in any other balance sheet.

Income or loss per return is reconciled with income or loss per books in Schedule M-1. This reconciliation is required since tax laws don’t always reflect the economic realities of partnership operations.

Schedule M-2 examines the partners’ capital accounts. Every year, this equity stake is adjusted to account for partners’ contributions, the partnership’s profit or loss, partner distributions, and other activities.

What happens if you do not file Form 1065?

If you don’t file Form 1065, you receive a penalty from the IRS. If the IRS sends a penalty notice, you can explain why you didn’t file, and the IRS will decide if it’s a valid reason.

Also, failing to provide Schedule K-1 (and K-3, if applicable) to partners on time can result in penalties. For each failure during the 2023 tax year, a $290 penalty may be imposed per Schedule K-1 (and K-3, if applicable), up to a maximum penalty of $3,532,500 for all failures during the year.

If the failure is intentional, the penalty increases to $580 per Schedule K-1 (and K-3, if applicable) or 10% of the total items required to be reported, whichever is greater, with no limit to the penalty amount for intentional disregard.

Bottom Line

While Form 1065 doesn’t involve direct tax payments, it serves to inform the IRS about the financial position. All domestic partnerships, regardless of their income or loss for a tax year, need to file Form 1065. If you fail to file Form 1065 or provide Schedule K-1 on time, it can lead to penalties from the IRS.

FAQs

What is the difference between a K-1 and Form 1065?

The Schedule K-1 reports a partner’s share of the partnership’s income, while Form 1065 is the partnership’s tax return filed with the IRS, summarizing its financial position for the year.

Do partners need to file a Form 1065?

No, partners don’t file Form 1065. Instead, partnerships file Form 1065 to report their income, deductions, credits, and other financial information to the IRS. The partners receive Schedule K-1, which they use to report their share of the partnership’s income on their individual tax returns.

Do you need to file a 1065 if your partnership did not have income?

Yes, even if a partnership did not have income, it still needs to file Form 1065 with the IRS.

What is the IRS Form 1065 Deadline?

Form 1065 must be submitted by March 15th of the following year for partnerships that use the calendar year as their tax year. You can also file for a 6-month extension which would make September 15th the new date.You have until the fifteenth day of the third month following the end of your tax year to file your form if you do not use the calendar year as your tax year.