What Is IRS Form 941: Employer’s Quarterly Federal Tax Return?

The IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return, is used by employers in the US to report taxes withheld from employee salaries, such as federal income tax, Medicare tax, and social security tax.

Federal law requires employers in the United States to withhold a certain amount of tax from an employee’s pay every time they pay a wage.

The IRS Form 941 is essentially a consolidated version of two tax collections brought into effect in 1950:

- Form W-1 (Return of Income Tax Withheld on Wages) used to report federal income withholding

- Form SS-1 for reporting Social Security tax withholding

Who Needs to File IRS Form 941?

Any business in the United States that withholds income tax, Medicare tax, and Social Security tax must file Form 941.

If any of the elements below apply to your business payroll, you must file Form 941.

- Federal income tax withholdings

- Wages paid to employees

- Share of social security and Medicare taxes of both employer and employees

- Any additional Medicare tax withholdings

- Current quarter adjustments like tips, life insurance, sick pay

- Payroll tax credit for small businesses

Although most businesses need to file Form 941, there are exceptions like:

- If the employer has received been notified to file form 944 (Employer’s Annual Federal Tax Return)

- Seasonal businesses don’t need to file it for quarters in which they have no tax liability

- Employers of household employees need to file a Schedule H (Form 1040)

- Employers of farm employees should file Form 943 (Employer’s Annual Federal Tax Return for Agricultural Employees)

- Small businesses that have an annual liability for employment taxes of less than $1000 need to file Form 944

However, businesses that do not fall under these exceptions need to file IRS Form 941 every quarter, whether or not they have paid wages for the quarter.

How Often Does The IRS Update Form 941?

IRS modifies Form 941 annually or whenever there is a change in the tax laws and policies of the employer’s reported information. For instance, the form has changed in the past because of alterations to the base of Social Security Wage, new credit items such as COVID-19 relief measures, or shifts in the payroll tax regulations. These updates can be made based on the frequency that is determined by legislative changes, such as a change in tax or new federal policy.

2024 Revisions

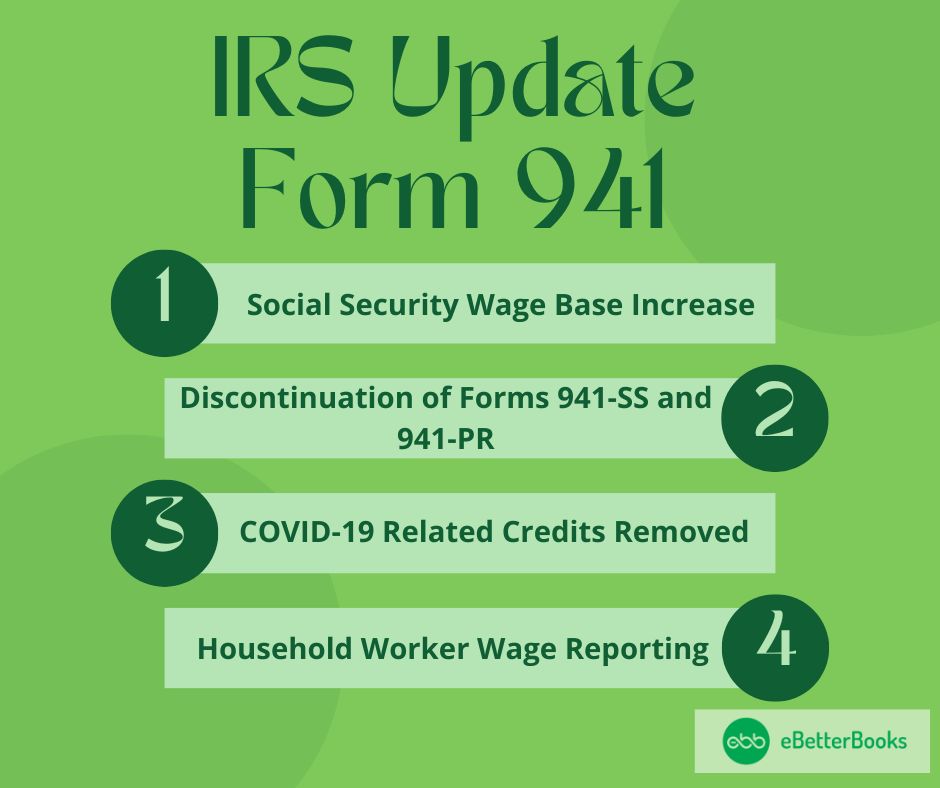

Employers who file quarterly tax returns can expect several changes with the IRS having revised Form 941 for the 2024 tax year, like social security wage base increases, discontinuation of Form 941-PR and 941-SS, COVID-19 related credit removal, etc.

Here are the key changes:

- Social Security Wage Base Increase: The level at which Social Security taxes can be paid has been raised to $168,600 for the year 2024 from $160,200 for the year 2023. Employers and employees pay 6.2% each to Social Security and Medicare taxes.

- Discontinuation of Forms 941-SS and 941-PR: One for employer’s payroll and two for territorial returns previously used to file taxes in U.S territorial areas such as PR and SS, namely forms 941-PR and 941-SS, have been discontinued. Previously, employers in these regions have been filing on the standard Form 941 or using the new, simplified Form 941 (sp), which is in Spanish.

- COVID-19 Related Credits Removed: Employers cannot claim COVID-19-related credits on Form 941, such as those on qualified sick and family leave wages. This analysis is in keeping with the end of the pandemic-related stimulus measures.

- Household Worker Wage Reporting: Since January 1st, 2024, household employees with $2700 or more must complete the SS and Medicare Tax on Form 941.

Where to File the Form 941?

IRS Form 941 can be filled out either electronically or by mail, depending on the method of filing that you choose.

Below are the methods of where to file it:

- Electronic filing (Preferred): The IRS recommends e-filing form 941 using Modernized e-filing (MeF) or using a tax professional or an IRS-approved e-file service. Filing your returns online is easier than the traditional way, and it is secure, besides being accompanied by a receipt. Some others are IRS e-file or third-party providers such as TaxBandits, Tax1099, QuickBooks, or any other online options, depending on the facilities rendered by various tax companies.

- Mail Filing: If you need to file the form through mail, the address you use varies depending on your company’s location and whether you enclose a payment with the form, such as:

- If no payment is included, mail to the Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0005.

- If payment is included, mail to the Internal Revenue Service, P.O. Box 37941, Hartford, CT 06176-7941.

For further mailing details, depending on your location, you are presented by the IRS complete list at the official site or in the instructions form 941. It will be even better if you can verify this information from the most recent data available out there as much as possible.

Requirements to Fill out Form 941

To fill out Form 941, you’ll need the following information:

- Employer Identification Number (EIN)

- Business name and address

- Reporting Quarter

- Number of employees

- The total wages paid

- Total federal tax deducted from employee paychecks

- Social Security and Medicare taxes for both the employer’s and employees’ contributions

- Any adjustments for tips or sick pay

- Tax due or overpayment

Form 941 Filing Due Dates/ Deadlines

It is crucial that businesses report their tax liability within the quarterly deadline and ensure that they report the actual tax liability. The IRS can penalize businesses if the above is not followed and charge 5% of the total tax due for the months the return is not filed, up to 5 months.

The deadlines for filing the IRS Form 941 are:

- April 30 for Q1 (January – March)

- July 31 for Q2 (April – June)

- October 31 for Q3 (July – September)

- January 31 for Q4 (October – December of the previous year)

The deadline moves to the next business day if these dates fall on a federal holiday or weekend.

How to File Form 941?

Form 941, the Employer’s Quarterly Federal Tax Return, consists of 5 main parts. Each part requests information about the business or explains the tax deposit process for employment taxes.

Moving on to the five parts of Form 941 and how to file it.

Part 1

On this page, the employer needs to update information about the total number of employees, total wages paid, and any additional tips and calculate the total federal income tax withheld from employee paychecks.

Line items for Part 1 are listed below:

- Line 1: The sum of the number of employees for the total number of W2 employees respectively for the quarter.

- Line 2: All salaries by wage, tips, and other remunerations that are given to the employees.

- Line 3: Income tax on the federal level, which employers pay for their employees.

- Line 5a-5d: Federal income taxes: Social security and Medicare taxes-employee and employer. These are divided into tabs for wages subject to taxes, tips, and determination of taxes paid.

- Line 6: Combined new social security and medicare taxes rounded/ adjusted appropriately before the computation.

- Line 7: Changes to the current quarter for other smaller amounts, sick pay, tips, and group-term life insurance.

- Line 8-10: To adjust the total tax, add its credits or deposits in this section as it sums up the total taxes.

- Line 11-15: Amounts overpaid, amounts underpaid, and any amount which may be due from or to the other party. This section calculates whether you have more tax to pay or if there’s a tax credit that can be used for the following years or a refund due to you.

If you have overpaid in the previous quarter, you can check the box on Line 15 to specify your preference to apply the excess amount to the next return or get a refund. You should check only one box. If you check both boxes, the IRS generally applies it to your next return.

Part 2

In this section, you disclose the particular quarter’s tax liability and deposit schedule. Your tax liability will either be semi-weekly or monthly.

For monthly depositors (taxes are $50,000 or less unless the next-day deposit rule applies), check the monthly depositor box on Line 16 and detail your monthly tax liability based on wages paid dates. Your total tax liability for the quarter should match the total tax on Line 12.

For semi-weekly depositors (more than $50,000 in taxes), you need to check the third box on Line 16. You should fill out and submit Schedule B (Form 941), not on Line 16, along with your Form 941.

Part 3

Part 3 of Form 941 is all about sharing information about your business. For example, if you’re closing or stopping wage payments, check the box on Line 17 to indicate this is your final return and the last wage payment date.

If you’re a seasonal employer, you should mark the box on Line 18 to inform the IRS that you don’t file quarterly. If you check the box, the IRS will not reach out to you for unfiled returns if you file at least one return yearly. You should check this box every time you file Form 941.

Part 4

In Part 4, you need to authorize an employee or tax preparer to discuss the return with the IRS by saying “Yes” and providing their details like name, phone number, and PIN. You should not enter the name of any firm but an authorized individual.

The authorized employee can then provide missing information, call about the return’s processing, and respond to certain IRS notices but not to represent you fully before the IRS. The authorization expires one year after the filing due date.

Part 5

Part 5 of Form 941 must be signed by an individual authorized to represent the business, such as the sole proprietor, the president or vice-president of a corporation, or a duly authorized partner or member based on the entity type.

Suppose you hire a paid tax preparer (not an employee of your organization) to file Form 941. In that case, the preparer should sign the form and enter other details like Preparer Tax Identification Number (PTIN), address, firm’s name, etc.

Download Latest form 941

Check this link to download the current version of Form 941.

- Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors.

- Schedule D (Form 941), Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or Consolidations.

- Schedule R (Form 941), Allocation Schedule for Aggregate Form 941 Filers.

Taxes Reported on Form 941

The taxes you report in Part 1 of Form 941 are:

- Federal income tax withheld from employee’s wages

- Social Security taxes at a 12.4% rate, split between employer and employee

- Medicare taxes at a 2.9% rate, divided between employer and employee

- Additional Medicare tax of 0.9% on employee earnings over $200,000

You have two options for filling out and submitting Form 941: mailing it to the IRS address in your state or online through the e-file system.

Points to Consider When Filing Form 941

When filing Form 941, consider the following points:

- Identify if you’re a monthly or semiweekly depositor

- Accurately document tax liabilities

- Indicate business closures or seasonal operations as applicable

- Ensure disclosing correct tax liability and on-time submission to avoid penalties

- Small employers with annual taxes ≤ $1,000 may use Form 944, but you need IRS permission

- For corrections, use Form 941-X to amend previously reported wages or taxes

Bottom Line

Form 941 is a key tool for employers to ensure they meet their tax obligations and maintain tax records in compliance with IRS regulations. It makes the reporting process more efficient for the IRS and employers to manage employment taxes.

It’s crucial to submit it accurately and on time to avoid charges and penalties from the IRS. Special rules apply to different types of employers, so it’s important you know which guidelines apply to your business.

FAQs

What is the deadline for filing IRS Form 941?

The deadline to file Form 941 quarterly is by the last day of the month following the end of a quarter.

Do I have to file the IRS Form 941 if I have no payroll?

Yes, even if you have no payroll for a quarter, you still need to file a zero return.

Where can I mail form 941?

The mailing address varies by state. Check your state address here. You can mail your return through an IRS-approved Private Delivery Service (PDS). However, note that tax payments must be made electronically despite mailing the return, ideally via the EFTPS.gov service.

Which types of businesses don’t have to file Form 941?

Businesses that don’t need to file Form 941 are seasonal businesses, employers of household employees, and those who file annually using Form 944 (with IRS permission).

Are there any penalties if I fail to file Form 941?

The IRS will impose penalties if you don’t file Form 941 or delay it. There is generally a 5% charge on the total taxes due for each month the return is late, up to a maximum of 5 months.