Advanced online bookkeeping services help businesses to record business transactions, generate accounting reports, balance sheet, and tax filing support.

Advanced online bookkeeping services are basically outsourced bookkeeping services to either a freelance bookkeeper or an accounting firm. The bookkeepers or accountants use technological tools like accounting software, ERP, cloud based accounting softwares etc., to generate business’s financial reports.

Many small businesses fail to address financial records because of insufficient resources in managing bookkeeping activities. Accurate bookkeeping helps small businesses to have a clear view of their business’s health.

The accounting apps, software and other accounting tools help businesses in boosting efficiency, save time and improve accuracy. These accounting technologies help the accountants to ease their work but cannot replace accountants.

What are Advanced Online Bookkeeping Services?

Advanced Online Bookkeeping Services, also known as virtual accounting service or cloud-based accounting service is a software used by small businesses to track the business finances and keep a balance on financial records remotely.

Advanced bookkeeping services support businesses with accounting features such as asset management, expense tracking, inventory management, invoicing, accounts receivable, reporting and analytics, general ledger and budgeting and forecasting.

Advanced bookkeeping services have many advantages over manual bookkeeping, which are:

- Accurate bookkeeping

- Data privacy

- On-demand generation of financial reports

- Generating trend analysis and forecasting

- Digital accounting records that are easier to audit

- Accounting system that is integrated with various data inputs like PoS, automated ledger, inventory system, etc.

- Tracking invoices

- Tracking and managing accounts payables and receivables.

- Ability to switch between single and double entry accounting

- Generating custom reports

- Affordable and scalable

- Expert support

There are a number of cloud-based accounting software in the modern bookkeeping world such as QuickBooks Online, Xero, Wave accounting, FreshBooks ,etc. Every small business should compare the features and then select the best accounting as per their business needs.

Key Features of Advanced Online Bookkeeping Services

Mobile Accessibility

The mobile accessibility feature in advanced online bookkeeping services offer an improved user experience to small businesses. By making mobile accessibility a priority, small businesses can reduce the risk of facing accessibility-related legal challenges.

Real-time financial reporting

The real -time reporting feature helps the small businesses to get a deeper understanding of their financial records. Businesses can easily monitor and identify the issues like cost overruns, revenue irregularities and potential compliance violations.

Automated Data entry

Small businesses can automate their data entry using simple steps and reduce the risk of errors and mistakes. These features help the businesses in saving time ( while entering large amounts of data), provides high accuracy and helps with decision making.

Integration with third party app

Advanced online bookkeeping services ensure seamless integration with the existing accounting software such as Xero, FreshBooks. Small businesses can easily integrate with payment processors, payroll services and tax tools and make their accounting stress-free. .

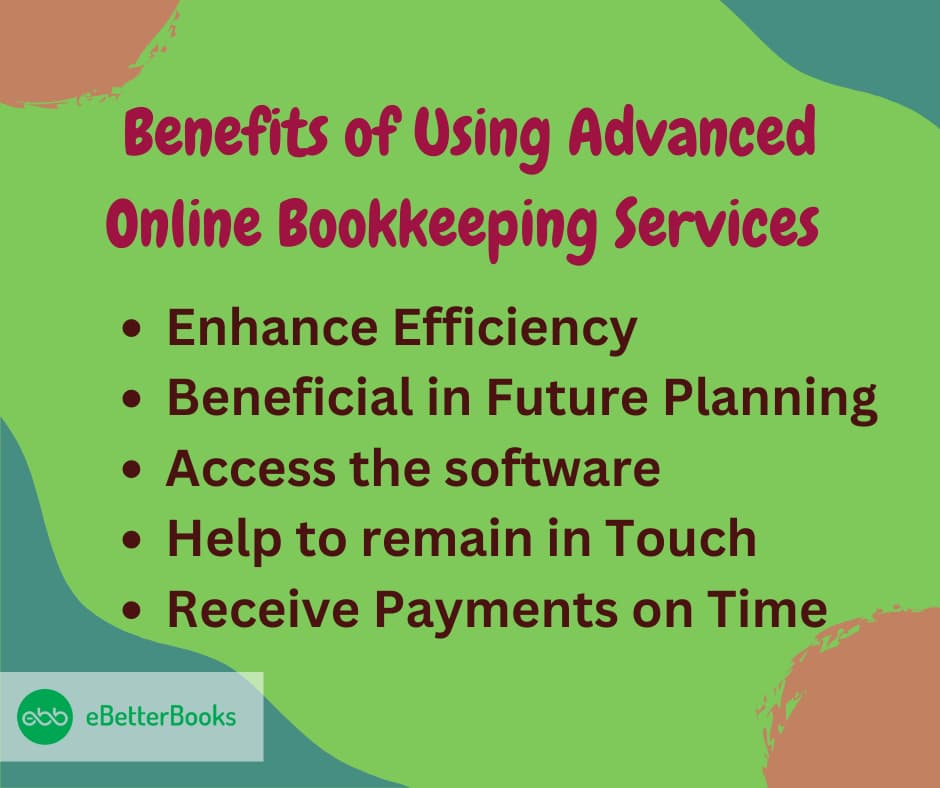

Benefits of Using Advanced Online Bookkeeping Services

Enhance Efficiency

By hiring an online bookkeeping service, you will get relieved of the bookkeeping responsibilities. You can divert the time saved in more productive activities related to the company’s revenue-earning potential.

Beneficial in Future Planning

Through the help of the bookkeeping service, you can easily maintain the records of financial data. Thus, it will help in making better future plans by carefully analyzing the data. Furthermore, advanced online bookkeeping services are immensely reliable and help create blueprints for the business.

Access the Software

Some business owners are not well-versed in using the latest and updated bookkeeping software. Hence, by hiring the bookkeeping service, they will get access without paying for them or learning to use them. Moreover, the bookkeeping software provides many bookkeeping functions on its own, and the user does not have to be an expert in bookkeeping.

Help to Remain in Touch

Online bookkeeping helps business owners stay connected with financial information using a mobile phone or any other digital technology. This feature is beneficial for business managers who spend a significant amount of time away from the office.

Receive Payments on Time

The online bookkeeping service will help you get paid on time from invoicing customers, issuing bill alerts, and setting up monthly payments.

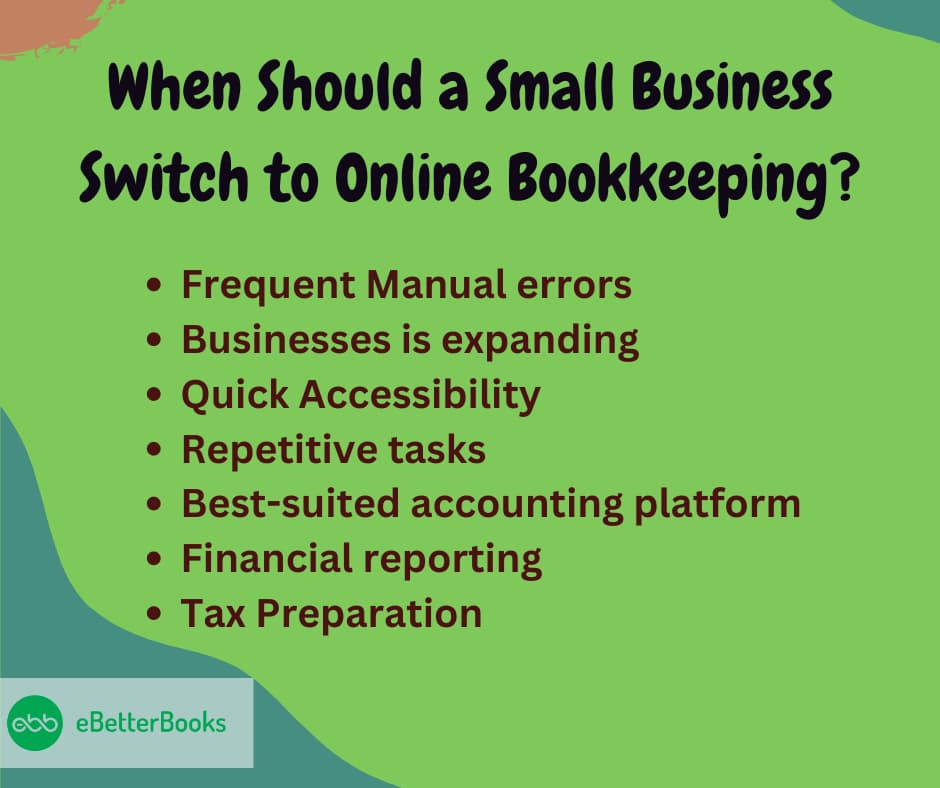

When Should a Small Business Switch to Online Bookkeeping?

Small businesses should switch to online bookkeeping when they face accounting errors and space issues to keep the financial data, experience growth, etc.

Frequent Manual Errors

If your small business constantly faces manual errors that affect its daily operations, then it’s time to switch to an advanced online bookkeeping service. The software minimizes the risk of mistakes by automating calculations and ensuring data accuracy, resulting in more reliable financial records.

Businesses is Expanding

If you see your small business expanding, it’s time to switch to advanced online bookkeeping software before you find manual income tracking, expenses, inventory, and invoices more challenging. Accounting software can easily handle the increased transaction volume and complex financial processes. As a small business owner, you can add more users, integrate additional features, and scale your operations without disrupting your accounting system.

Quick Accessibility

If you have large financial data and need immediate access, then it’s time to switch to an advanced online bookkeeping service. Small businesses can integrate them with accounting software to streamline data transfer, eliminate manual data entry errors, and improve overall efficiency.

Repetitive Tasks

If you feel that as a small business owner, you spend more time on manual bookkeeping tasks, such as data entry, reconciling accounts, or generating reports, then it’s time for you to switch to advanced online bookkeeping software to automate all these tasks and save time.

Best-Suited Accounting Platform

If you find evaluating business performance, making informed decisions, and identifying improvement areas challenging, then it’s time to switch to an advanced online bookkeeping service. Accounting software helps small businesses with comprehensive reports that provide valuable insights into their financial health, such as balance sheets, cash flow statements, profit and loss statements,

Financial Reporting

Cash flow management is important for small businesses. If you find it difficult to track and predict cash flow, then it’s time to switch to an advanced online bookkeeping service. Accounting software can help small businesses monitor incoming and outgoing funds, manage invoices and bills, and generate cash flow reports.

It provided a centralized platform for managing various financial processes, including invoicing, billing, expense tracking, and reconciliation. The platform streamlines these processes, reduces paperwork, and improves efficiency.

Tax Preparation

If you are having trouble organizing your financial information for tax purposes, it’s time to switch to advanced online bookkeeping services. Accounting software eases the taxation process by creating necessary reports, checking deductible expenses, and helping in tax filing.

Hiring Online Bookkeeping Service

Online Bookkeeping service helps small businesses to have a reliable measure of their performance. It includes transactions such as sales, purchases, payments and receipts, other expenses during the financial year.

As a small business owner, there is confusion about whether you should hire or when is the right time to hire bookkeeping services. Ideally, consider hiring a bookkeeper at the initial stage of the business. Otherwise, there would be several month’s receipts, and invoices won’t get recorded. Furthermore, it is always a wise decision to hire trusted and reliable virtual bookkeeping services.

Final Words

Online bookkeeping service will reduce your financial and accounting costs and help you in your tax preparation work and manage your company better. You can get assistance whenever you need it through virtual bookkeeping. There’s no time restriction, and you can get assistance from anywhere; this virtual assistance has no boundary limitation. Increase your quality standard by getting virtual bookkeeping services. Contact us for the best online bookkeeping services.