Understanding Payroll

Payroll is defined as the process of paying salaries to employees of a company or organization.

In simple words, the payroll process determines employee payments for each cycle after deducting required amounts like TDS, meal coupons, and PF contributions.

Different teams such as payroll and finance, HR work together in order to process payroll.

Understanding Payroll – what it is?

Payroll refers to the process of keeping track of employees’ hours worked and determining their pay.

For small businesses, payroll is essential to ensure employees get paid correctly and promptly.

It includes recording the hours worked by both full-time and part-time employees and calculating their wages or salaries. This process considers overtime, bonuses, and deductions for taxes or benefits.

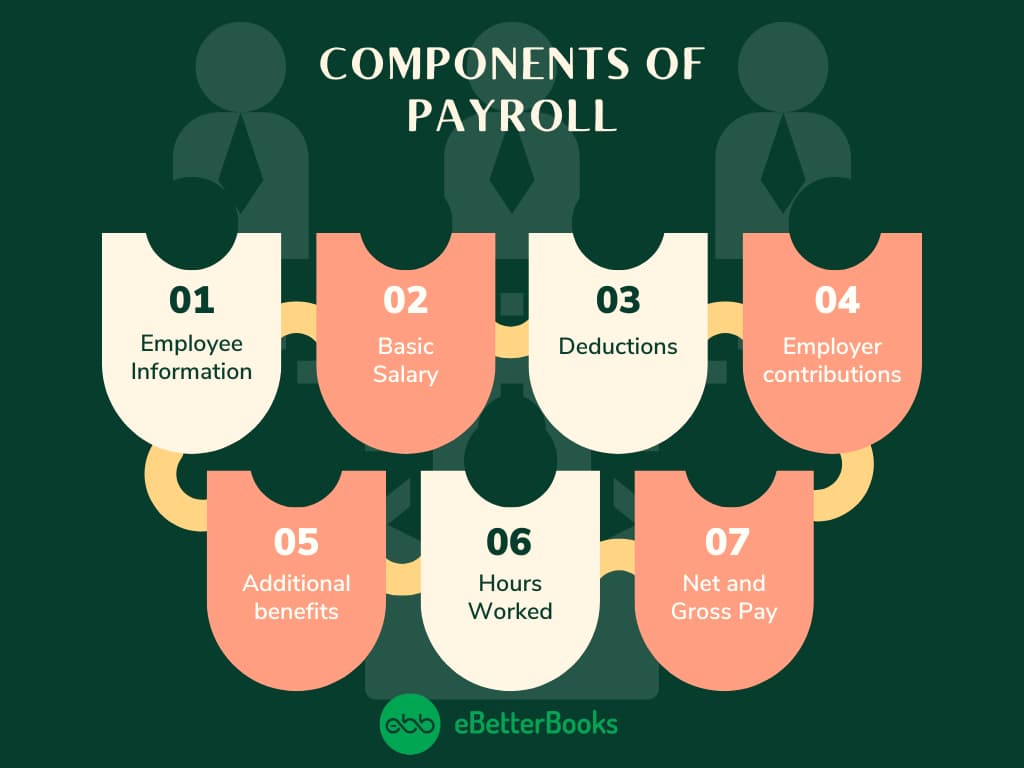

Components of Payroll

Payroll typically consists of several components:

- Employee Information: Before processing payroll, you need to gather essential details from your employees. This includes their names, addresses, Social Security numbers, and other relevant personal information.

- Basic Salary: The total amount an employee earns before any deductions.

- Deductions: This includes federal, state, and local taxes, as well as any voluntary deductions such as health insurance premiums, retirement contributions, and other benefits.

- Employer contributions: This includes contributions to Social Security, Medicare, and unemployment insurance.

- Additional benefits: Some employers may offer additional benefits such as paid time off, bonuses, or other perks, which can also be included in payroll calculations.

- Hours Worked: Tracking the hours worked by each employee is basic. Whether they are full-time, part-time, or hourly workers, accurate records of their work hours are essential for calculating pay.

- Net and Gross Pay: Gross pay is the total amount an employee earns before any deductions. Net pay, on the other hand, is the actual amount they receive after all deductions have been subtracted. It’s what appears in their paycheck.

How Does Payroll Work?

The payroll process typically follows a step-by-step flow:

Step 1: Track Employee Hours

Businesses begin by gathering the hours worked for hourly employees or confirming the salaries for exempt employees. This can be done using time-tracking software or manual timesheets.

Step 2: Calculate Gross Pay

For hourly workers, gross pay is calculated by multiplying the hours worked by the hourly rate. For salaried employees, the gross pay is simply the set wage for the pay period.

Step 3: Apply Deductions

Payroll systems calculate deductions, which may include federal and state taxes, Social Security, Medicare, and any employee contributions to benefits such as health insurance or retirement plans.

Step 4: Classify Employees

Payroll systems classify employees as exempt (salaried employees who aren’t entitled to overtime pay) or non-exempt (those eligible for overtime pay).

Step 5: Net Pay Calculation

After all deductions are applied, the remaining amount is the net pay, which is then delivered through direct deposit, checks, or other payment methods.

Step 6: Payroll Reporting and Tax Filing

The payroll process includes preparing payroll reports and ensuring that tax filings are made to the IRS and other relevant tax authorities.

Benefits of Automating Payroll

An automated payroll system is a platform that automatically handles many of the monotonous aspects of payroll processing, replacing manual human labor. It provides several benefits to an organization, irrespective of the size:

No Human Errors: Automation minimizes errors associated with manual processing, ensuring accurate calculations and compliance with tax regulations.

Cost-effectiveness: It reduces the need to hire dedicated personnel to manage payroll tasks, saving on labor costs.

Compliance: Automated systems stay updated with changing tax laws and regulations, which can minimize the risk of compliance issues.

Enhanced record-keeping: Digital storage of payroll information improves accessibility and organization, which makes it easier to retrieve and analyze data.

Employee satisfaction: Self-service options allow employees to access pay stubs, update personal information, and track hours, which leads to transparency and satisfaction.

Track Employee Hours: The automated system records employee hours worked, which minimizes the risk of errors associated with manual tracking methods such as paper timesheets or manual data entry.

Basic Deductions and Payroll Laws

| Deduction Type | Tax Rate | Definition |

| Federal Income Tax | 10% to 37% (depending on the employee’s taxable income and filing status.) | This is the portion of money taken directly from an employee’s paycheck by their employer. It’s used to cover the taxes owed to the federal government based on the employee’s income. |

| State Income Tax | Rates vary by state, with some states having a flat rate and others using a progressive tax system. | Similar to federal income tax, this is also withheld from an employee’s paychecks by their employer. It’s specifically used to cover the taxes owed to the state government based on the employee’s earnings. |

| Social Security Tax | 6.2% for both employees and employers. | This is the money taken out of an employee’s paycheck by their employer. It’s used to support the Social Security program, which provides benefits like retirement income and disability assistance. |

| Medicare Tax | 1.45% for both employees and employers. | This tax contributes to funding Part A of the Medicare program, which covers hospital insurance for individuals aged 65 or older and those with specific disabilities or medical conditions. |

| FUTA | 6.0% on the first $7,000 of wages paid to each employee in a calendar year. | A federal law that imposes an additional tax on employers beyond their existing federal income and payroll taxes. |

| SUTA | Rates and wage bases vary by state. | A type of payroll tax that states require employers to pay. Its purpose is to fund unemployment benefits for workers who have lost their jobs. |

Payroll tax compliance

At its most basic level, complying with payroll regulations means:

- Accurately calculating wages, including overtime pay.

- Withholding the correct amounts for payroll taxes from wages that are subject to each applicable tax (e.g., Social Security taxes).

- Timely depositing the corresponding tax liabilities with the appropriate federal, state, and local tax agencies.

- Filing payroll tax returns with each of these jurisdictions.

How do we avoid payroll compliance mistakes?

To avoid compliance mistakes, it’s important to keep payroll records organized. Ensure that new hires submit all required documents and review them thoroughly for errors such as inverted numbers, incomplete or missing data fields, and incorrect dates. Once reviewed, file the paperwork so it is easily accessible to both the HR and payroll departments.

What Does a Payroll Software Do?

Payroll software takes care of tasks like calculating wages, handling tax deductions, and creating pay stubs. This helps small business owners spend less time on administrative work. Putting all this information in one place makes complicated calculations easier and ensures everything is accurate while following tax and labor laws.

With payroll software, businesses can save time by automating repetitive tasks, such as calculating hours worked and deductions, reducing the risk of errors associated with manual processing.

Moreover, Payroll software makes things more transparent and accessible for employees. They can easily view their pay stubs, tax forms, and other important documents online. This not only makes employees happier but also reduces the need for administrative questions.

Outsourcing Your Payroll

Payroll outsourcing is when companies in the United States hire specialized firms to handle their payroll tasks. Instead of managing payroll in-house, they transfer these responsibilities to a third-party service provider. This provider takes care of tasks like calculating wages, withholding taxes, and making payments. By doing this, businesses can reduce administrative work, save money, minimize errors, and stay compliant with state and federal rules and regulations.

For small businesses, outsourcing the payroll process allows them to save time and reduce the resource cost of performing payroll tasks in-house. When experts handle payroll, the risk of errors and penalties decreases as they handle the tax aspects of payroll.

Conclusion

Payroll refers to the organized procedure of computing and disbursing employee earnings, taxes, and perks. This comprehensive process includes components like gross wages, deductions, and employer contributions. The choice between handling payroll internally or outsourcing it depends on factors such as the company’s scale, complexity, and financial resources.

FAQ

How do you ensure accuracy in payroll?

Accurately classify workers and maintain detailed payroll records. Stay updated on payroll regulations, automate processes with software, integrate with timekeeping and benefits, and conduct regular audits.

What are the stages of the payroll process?

There are three stages of the payroll process which includes:

- Pre-payroll

- Post-payroll

- The actual payroll processing stage

Conclusion

Payroll refers to the organized procedure of computing and disbursing employee earnings, taxes, and perks. This comprehensive process includes components like gross wages, deductions, and employer contributions. The choice between handling payroll internally or outsourcing it depends on factors such as the company’s scale, complexity, and financial resources. Ultimately, the decision aims to strike a balance between efficiency, expertise, and cos