What is a Capital Lease?

A Capital lease is a long-term financial agreement in which the lessor agrees to transfer ownership of the asset to the lessee (the company or individual renting the asset) after the lease period ends. This allows the lessee to choose to buy an asset at a bargain price rather than its fair market value. A capital lease is noncancellable in nature.

Under a capital lease agreement, the lessee records the leased asset on their balance sheet and the lease payments as interest expenses and liability reductions. A capital lease provides the company with the option of using an asset (such as equipment, machinery, or vehicles) without having to purchase it outright.

It can be beneficial for businesses that need to use the asset but don’t have the cash to buy it upfront. With a capital lease, the business makes regular payments over a period, and at the end of the lease term, it can buy the asset for a nominal amount or return it to the lessor.

If the lease is canceled for any reason, the lessee will have to bear any resulting loss. At the end of the lease term, the lessee becomes the owner of the asset and can claim finance and depreciation charges. A capital lease can be used for both a property and an asset.

For example, a manufacturing company can obtain a piece of production machinery for their operations through a capital lease. Companies use capital leases for land, buildings, ships, aircraft, engines, and very heavy machinery.

Example of Capital Lease

Let’s understand the concept of capital lease with an example:

Let’s take a manufacturing company as an example of a capital lease. A company has entered into a capital lease agreement to lease production machinery from another company. Below, we’ve discussed the example that defines a capital lease agreement.

Monthly payment and annual interest will be charged on the basis of:

Present Value of manufacturing equipment = $11,000

The asset’s scrap value at the end of useful life = $0

Monthly lease payment (end of every month) = $200

Interest rate = 12%

The lease period is less than the usable life of the production machinery. For example:

Lease term = 6 year

The usable life of the machinery is = 7 years

When the lease term ends, the lessee becomes the legal owner, or they can transfer their ownership from one company to another.

The lessee has the option to purchase the underlying asset at a price lower than its current market value, as there’s a bargain price option with no salvage value specified.

When Does a Lease Qualify as a Capital Lease?

Capital leases must meet at least one of the following criteria defined by Generally Accepted Accounting Principles (GAAP) in the United States:

- The duration of the lease is equal to roughly 75% or greater for the asset’s useful economic life.

- The lessee has the option to buy the asset at the end of the lease term at a bargain purchase price that is less than the fair market value.

- The ownership of the asset must be transferred to the lessee at the end of the lease period.

- The present Value of the lease payments must be more than 90% of the asset’s fair market value.

If the lease meets any of the above criteria, it is classified as a capital lease.

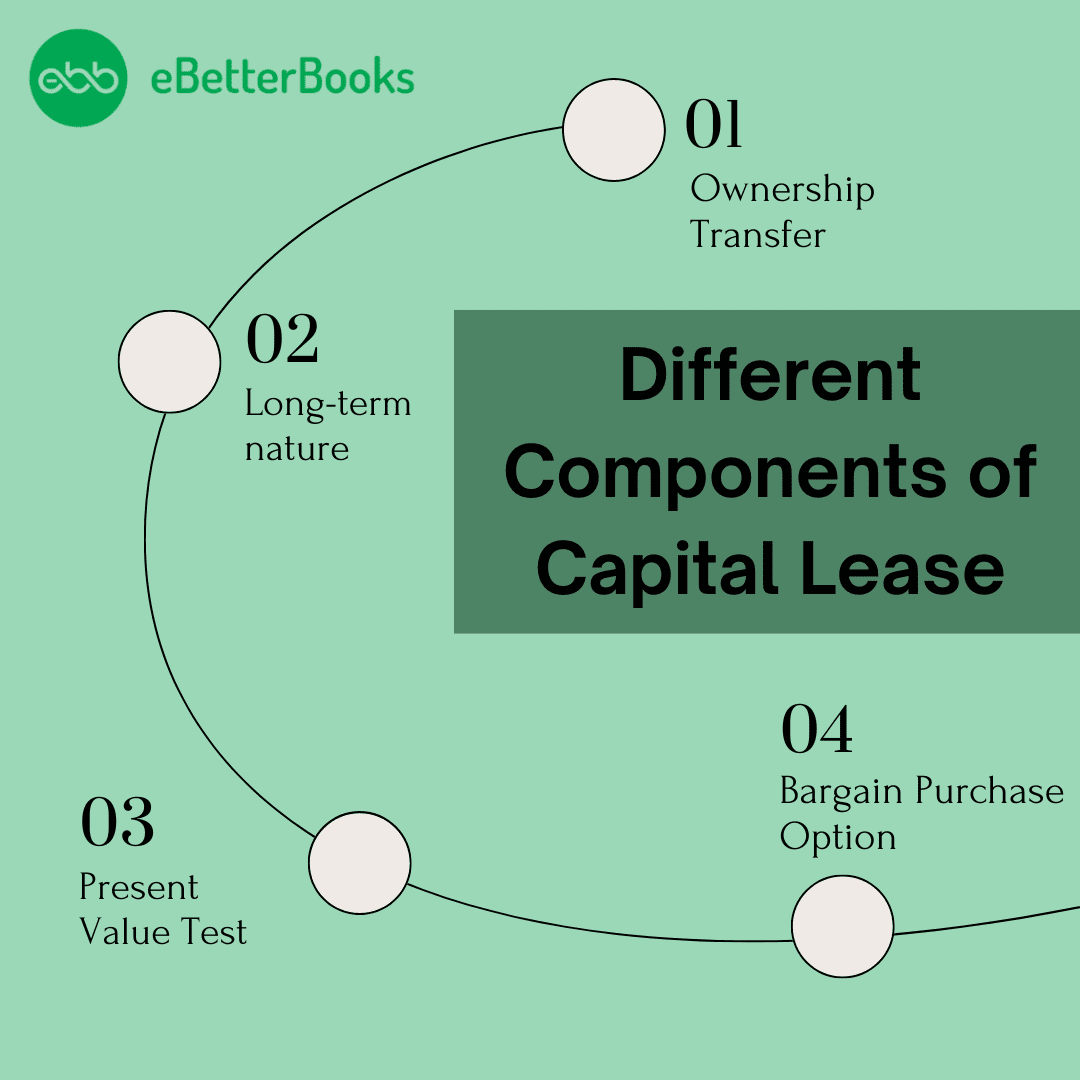

Different Characteristics of Capital Lease

A capital lease, or finance lease, is a long-term contractual agreement in which a lessee rents a non-current fixed asset (PP&E) from a lessor for a predetermined period in exchange for periodic interest payments. This type of lease agreement allows the lessee to own the characteristics of an owner, along with the associated risks and rewards. The lessee treats the leased asset as if they purchased and financed it through the lease agreement.

Below are some key features of a capital lease which include:

- Ownership transfer: At the end of the lease term, the lessee has the option to transfer the ownership of the asset/property when the lease period ends.

- Long-term nature: Capital leases usually have a long duration that covers around 75% of the asset’s useful life. In some cases, the lease term may extend to the entire economic life of the asset.

- Bargain purchase option: The lease agreement usually includes a provision for the lessee to buy the asset at less than its fair market value.

- Present value test: To qualify as a capital lease, the lease contract must meet specific accounting criteria, such as the present value of lease payments exceeding a certain threshold (usually 90%) of the asset’s fair market value at the inception of the lease.

Capital Lease vs. Operating Lease

An operating lease is a contract that allows for the use of an asset but does not convey any ownership rights of the asset. It is similar to a short-term rental agreement where the lessee periodically pays the lessor to utilize an asset. The lessor maintains ownership, and the lease payments are viewed as operating costs. Assets commonly leased under such agreements involve commercial vehicles and properties (like office spaces, retail outlets, and storage facilities).

A capital lease is longer-term in which the lessee has some ownership rights related to the asset taken on rent at the end of the lease period. It is recorded as both an asset and a liability on the lessee’s balance sheet. Also, lease payments are divided into principal and interest components, similar to loan payments.

Below is a list of differences between a capital lease and an operating lease:

| Criteria | Capital Lease | Operating Lease |

| Ownership Transfer | Ownership can be transferred to the lessee. | Ownership typically remains with the lessor. |

| Bargain Price | It often includes a bargain purchase option. | Does not include a bargain purchase option. |

| Balance Sheet Representation | The asset is treated as owned by the lessee. | The asset is treated as rented by the lessee. |

| Risks and Rewards | The Lessee bears significant ownership risks and rewards | Minimum significant ownership risks and rewards for the lessee. |

| Lease Duration | Longer lease term, covering a major part of the asset’s useful life. | Usually, lease terms are shorter than the asset’s useful life. |

| Accounting Treatment | It is considered more like the purchase of the asset using debt financing | Handled as a rental agreement under accounting standards. |

| Present Value (PV) | The preset Value of lease payments is usually close to the asset’s cost. | The present value of lease payments is typically lower than the asset’s fair market value. |

Advantages & Disadvantages of Capital Lease

There are several advantages and disadvantages to capital leases, which are as follows:

Advantages of Capital Leases

- Lower upfront costs as compared to purchasing the asset outright.

- Asset ownership at the end of the lease term.

- Fixed lease payments for easier budgeting.

- Potential tax benefits (e.g., depreciation expense and interest expense deductions).

- Better capital expenditure (CapEx) management due to the long duration of a capital lease.

Disadvantages of Capital Leases

- Very long-term commitment for the asset or property.

- Limited flexibility in terms of modifying or ending the lease early.

- Risk of depreciation and obsolescence if the asset becomes outdated before the end of the lease term.

- This is a more complex accounting treatment, with additional costs such as interest, residual value, balloon payments, and disposal costs related to the lease.

- The lessee is responsible for the asset’s maintenance, insurance, and other ownership costs, which increases the business’s operational and administrative burdens.

What is a Capital Lease Obligation?

Capital Lease Obligation is the amount the company is obliged to pay in the future for using the asset under a capital lease. It is the current value of future lease rentals during the lease period. This obligation is reported under the financial statement as current and long-term liabilities, depending on each of its parts.

Let’s understand the capital lease obligation with an example:

Assume a firm signs up a capital lease of equipment with a lease cost of $120000 over 5 years. The actual value of such payments at present is $ 100,000. On the balance sheet, the company leased equipment as an asset of $100,000 under property plant and equipment. At the same time, the company will recognize a capital lease liability of $100 000 as an obligation, with some of the liability presented in the current (part of it – part of the capital lease which will be paid during the next twelve months) and non-current (the rest of the capital lease, due after twelve months). If lease payments are made, the liability line is decreased, and interest expenses are recorded in the income statement.

Accounting for Capital Leases

A capital lease is an example of accrual accounting’s inclusion of economic events, which requires a company to calculate the present value of an obligation on its financial statements. For instance, if a company estimated the present value of its obligation under a capital lease to be $100,000, it then records a $100,000 debit entry to the corresponding fixed asset account and a $100,000 credit entry to the capital lease liability account on its balance sheet.

Just because a capital lease is a financing arrangement, a company must break down its periodic lease payments into an interest expense based on the company’s applicable interest rate and depreciation expense. Suppose a company makes $1,000 in monthly lease payments, and its estimated interest is $200. In that case, this produces a $1,000 credit entry to the cash account, a $200 debit entry to the interest expense account, and a $800 debit entry to the capital lease liability account.

A company must also depreciate the leased asset, which is a factor in its salvage value and useful life. Let’s say an asset has a 10-year useful life and no salvage value based on the straight-line basis depreciation method; the company records an $833 monthly debit entry to the depreciation expense account and a credit entry to the accumulated depreciation account. When the leased asset is disposed of, the fixed asset is credited, and the accumulated depreciation account is debited from the remaining balances.

The accounting treatment on financial statements for capital leases is very different from how operational leases are accounted for. When you account for an operating lease, only the lease payment is recorded in the accounting records. It is an operational expense, and the payment affects the profit and loss account. In an operational lease, the company does not own the asset. It is not included on the balance sheet, so no depreciation has been calculated for it.

However, a capital lease involves the transfer of the asset’s ownership to the lessee. So, the present market value of the asset is included on the balance sheet. The depreciation value is also affected by the company’s income statement. A capital lease helps to increase the company’s total assets and total liabilities and provides some tax benefits to the lessee.

Accounting Treatment for Capital Lease

The following process can do the accounting treatment for the capital lease:

Recognition on the Balance Sheet

- Lease Asset: The lessee recognizes the leased asset as a “Right-of-Use” (ROU) asset in non-current assets.

- Lease Liability: The lessee also records a lease asset under property plant and equipment and a lease liability, which is the present value of the future lease payments, under liabilities.

Initial Measurement

- Right-of-Use Asset: Initially defined as the amount of the lease liability, discounted by the present value of any lease payments made at or before the commencement date, plus expenditure borne by the lessee on any initial direct costs.

- Lease Liability: Defined as the value of the leased asset in the present value of the lease payments in the lease term at the interest rate of the lease (if it is available) or by the lessee’s incremental borrowing rate.

Subsequent Measurement

- Right-of-Use Asset: Write down using the shorter lease term and the remaining useful life, commonly adopting the straight-line method.

- Lease Liability: As lease payments are made, the amount of this lease liability decreases and is expensed over the useful lease term of the asset. Amortization of lease assets and liabilities includes the interest expense on the lease liability, which is recognized on the income statement using the effective interest rate method.

Income Statement Impact

- Depreciation Expense: As will be discussed later, the depreciation of the ROU asset is recognized on the income statement as an expense.

- Interest Expense: While these lease payments are charged to the income statement, only the interest element is charged to the income statement as interest expense.

Cash Flow Statement

- Operating Activities: The lease payment, except for the interest expense, is recognized as an operating activity.

- Financing Activities: The first part of the lease payment occupies the leased asset and is recognized under operating activities. In contrast, the second part offsets the lease liability and is classified under financing activities.

Below is a tabular representation of the steps with a journal entry for better understanding:

| Steps | Account | Debit (Dr) | Credit (Cr) |

| Initial Recognition | Right of Use Asset | Dr | |

| Lease Liability | Cr | ||

| Cash (for initial payments) | Cr | ||

| Subsequent Measurement | Depreciation Expense | Dr | |

| Accumulated Depreciation | Cr | ||

| Lease Liability (Principal Reduction) | Dr | ||

| Interest Expense | Dr | ||

| Cash (Lease Payment) | Cr | ||

| Income Statement Impact | Depreciation Expenses | Dr | |

| Interest Expense | Dr | ||

| Cash Flow Statement Impact | Interest Expense (Operating Expense) | Dr | |

| Lease Liability (Financing Activities) | Dr |

What are the Four Criteria For a Capital Lease?

The four criteria for a capital lease are:

- Ownership Transfer: The asset is demised to the lessee by the termination of the lease period of time.

- Bargain Purchase Option: It also contains a clause of renewal with obliged offer of the asset at a price lower than the fair market value.

- Lease Term: The lease term is between more than 75 percent of the estimated useful life and 90 percent of the asset.

- Present Value of Payments: This has been done where the present value of lease payments is 90 percent or more the fair value of the asset taken on lease.

If any of the above-stated criteria is fulfilled, then the lease is regarded as a capital lease.

When to Capitalize a Lease for Tax Purposes?

A lease is capitalized for tax purposes where it meets certain factors attached to it. Generally speaking, it is consistent with the criteria for a finance lease (or capital lease) as opposed to an operating lease. From the aspect of taxation, the ownership of the asset can be transferred to the lessee: the lessee can, in turn, both depreciate the asset and deduct interest on the lease receipts.

A lease is generally capitalized if it meets one or more of the following conditions (based on IRS and accounting standards like GAAP and IFRS):

- Transfer of Ownership: In the case where the lessee is the beneficiary of the lease scheme by getting the ownership of the asset by the end of the lease term.

- Bargain Purchase Option: If the lease contains a provision for the purchase of the asset at a lower cost than its market value (purchase option).

- Lease Term: If the lease period is comprised of the greater of 75 % of the estimated useful life of the asset or more.

- Present Value of Payments: If the present value of the lease payments is equal to or exceeds a certain percentage of the asset’s fair value (in most cases, 90%).

Capitalization Impact on Taxes

- Depreciation: After capitalization, the lessee can write off this asset over its useful economic life, which gives the company a tax shield each period.

- Interest Deduction: Only the interest part of the lease payment is allowed as a business expense.

- Asset on Balance Sheet: When it comes to taxation, the lessee takes the leased asset on the organization’s balance sheet and uses it for accounting and taxation.

One should refer to specific tax laws or contact an accountant because tax legislation is often divergent by location and can have certain requirements concerning the capitalization of leases.

How Does Capital Lease affect the Financial Statements?

According to the U.S. GAAP (generally accepted accounting principles) reporting standards, the Present Value (PV) of the future lease payments associated with the arrangement represents the carrying value of the fixed asset (PP&E).

From a lease accounting perspective, a capital lease is treated as if the lessee has purchased the asset using debt financing. The asset and the associated lease liability are recorded on the lessee’s balance sheet. Each lease payment is allocated between the reduction of the lease liability and interest expense.

Capital leases impact the lessee’s financial statements in the following ways:

Balance Sheet

The Present Value (PV) of the lease payments is recognized as a long-term fixed asset, with the offsetting entry being a “credit” to the capital lease liability account. The Value of the leased asset is recorded in the assets section, and the capital lease of equal Value is recorded in the liabilities section. Hence, the accounting equation remains true (i.e. assets = liabilities + equity).

Let us understand how capital lease is shown on the balance sheet with an example:

If a company leases machinery with a fair value of $100,000 in a capital lease, this amount is initially recognized as $100,000 in PP&E as an asset on the balance sheet. The former gives rise to a lease asset of $100,000 recognized under the operating lease right and a lease liability of the same amount recognized under long-term liabilities. In the course of constructive obligation, the asset will be depreciated. At the same time, liability is being amortized in proportion to the lease payment, where the portion that represents the interest or principal is being deducted. For example, if the annual lease payment is $20,000, the lease amount is written off, and the machine is amortized over its useful life. Also, if any interest charge on the lease is incurred it is expensed on the income statement.

Income Statement

The lessee will report interest expense on the lease liability and depreciation expense on the leased asset. The lessee recognizes a depreciation expense throughout the leasing term, which will be embedded within the cost of goods sold (COGS) or operating expenses line item, as well as the implied interest expense. The depreciation expense reduces the carrying Value of the fixed asset on its balance sheet. By the end of the lease term, the balances of the fixed asset and offsetting lease liability account must be zero.

Cash Flow Statement

Lease payments are classified as a combination of both principal (reduction of lease liability) and interest payments (interest expense) as the depreciation is a non-cash expense. It is treated as an add-back on the cash flow statement.

Thus, it’s important for the business owners to differentiate between capital leases and operating leases, as the accounting treatment can significantly affect a company’s financial ratios and overall financial position.

Bottom Line

A capital lease, or finance lease, provides several ownership benefits and risks to the lessee, generally recorded on the balance sheet. This type of lease helps businesses stay competitive and grow over time.

By leasing equipment instead of purchasing it outright, companies can conserve their cash reserves and invest in more sustainable practices. It allows you to access the latest and most advanced equipment, which will make your operations more efficient and profitable. For example, you can lease new machinery that is more energy-efficient or implement environmentally friendly processes, reducing waste and improving productivity.

Maximizing Efficiency and Sustainability Through Leasing

Leasing is a better option in terms of cost savings and optimum utilisation of business resources. Thus, it reduced high levels of fixed-cost investment, which means that businesses can wisely invest their money and, at the same time, get access to new technologies that will aid in the optimization of their business operations. It is flexible, makes it easier to scale up and down, and guarantees that the assets acquired are relevant to the needs of the organization and predictable expenses that assist in budgeting.

From the sustainability point of view, leasing is effective since it helps in the use of assets instead of reproductions and comes with an incentive to refurbish existing assets instead of replacing them. Many businesses cannot afford to own the more efficient technologies significantly but can lease them where the latter takes care of end-of-life responsibilities. By doing so, this strategy effectively aligns the operational goals and the environmental objectives of institutions in its sustainable development mission.

FAQs

What Do you Mean by Capital Ease?

A capital lease is a type of lease where the lessee is bestowed with most of incidentals of owning an asset: capitalizing the asset and recognizing an obligation on his balance sheet.

Is Capital Lease a Current Asset?

No, a capital lease is not considered as a current asset. This is under the balance sheet tenure as a long-term asset or lease asset and corresponding liability.

What is the 90% Rule in Leasing?

According to the 90% rule, a lease qualifies as a capital lease where the present value of lease payments is equal to or exceeds 90 percent of the fair market value of the asset.