Petty cash is the cash amount that businesses keep on hand for small purchases, such as a box of copies and pens for an office or an emergency block of cheese for a cafe.

What Is Petty Cash?

Petty cash is a small amount of money that a business or organization holds for small daily transactions. This fund is utilized for petty expenses that arise from business undertakings, including the purchase of stationery, refunding employee expenses, and minor daily transactions.

Writing checks for every expense incurred by the organization is laborious and often unachievable. For this reason, using small amounts of cash to pay for tiny things like lunches and office supplies is considerably simpler. Petty cash is useful in situations like this.

A tiny sum of money that a business reserves for petty, incidental costs is known as petty cash. These small contributions cover things like stamps, office supplies, lunches for clients, and stationery. The size of the company may impact the amount of petty cash available.

For example, every department in a large corporation with hundreds of workers will have its petty cash fund.

However, small businesses typically have one person in charge of petty cash. A petty cash management system like Happay is a great choice for companies with several branches and retail locations.

Understanding Petty Cash

Petty cash is used to make small purchases, where preparing a check or a corporate credit card would be appropriate or impractical. The petty cash that a company feels is small will be different, but most companies will keep around $50-$200 as the petty cash balance.

- Employee lunch

- Employee reimbursements

- Office Supplies

- Stationery

- Rent

- Refreshments for clients

- Internet bills

- Repairs

- Postage

- Manual labor payroll

The fund custodians must manage the petty cash fund. The custodial functions normally encompass petty cash control, compliance with the rules and regulations governing petty cash, replenishment, and disbursement.

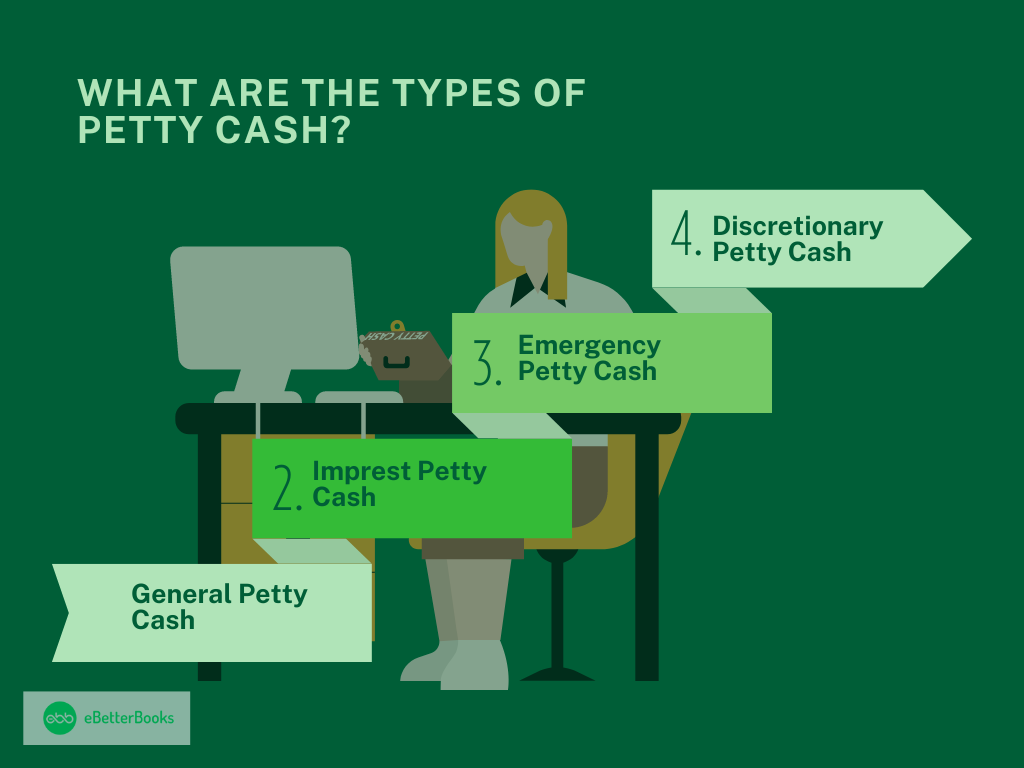

What are the Types of Petty Cash?

Below mentioned are the different types of petty cash:

- General Petty Cash: Money that is kept aside for small, miscellaneous expenses and typically used for office supplies, minor employee reimbursements, and postage.

- Imprest Petty Cash: This money is defined as money that is periodically replenished. It is a fixed amount of money kept aside to reimburse company employees for small expenses related to business travel.

- Emergency Petty Cash: This money is kept aside for emergency purposes.

- Discretionary Petty Cash: This money is kept aside for use at the discretion of a supervisor or manager.

How to Record Petty Cash?

Here’s how to record petty cash simply:

- Step 1: Set Up the Petty Cash Fund: First, determine the amount to be placed in petty cash, such as $200. This amount is then withdrawn from the general company or bank account and kept as petty cash.

- Step 2: Appoint a Petty Cash Custodian: Appoint a petty cash custodian who will look after and distribute the petty cash daily. The custodian will also be responsible for keeping the petty cash box and its receipts safe.

- Step 3: Set Reimbursement Limit: Companies usually maintain a petty cash fund balance, and the amount will vary according to your organization’s needs. Therefore, always set a reimbursement limit to avoid cash leakage and overpay.

- Step 4: Record Expenses: Whenever one has applied for petty cash to purchase items, including stationery, or to balance a delivery bill, then he/she must take a receipt. They have them in order to monitor how much is spent and what is spent through these receipts.

- Step 5: Replenish the Petty Cash: When the petty cash account becomes depleted, the cash is replenished. The number that you shall put should correspond to the total of the receipts collected for the expenses.

- Step 6: Reconcile the Petty Cash: Now and then, compare the remaining petty cash balance with the addition to the receipts, which should be the initial petty cash amount. In its simplest terms, if something doesn’t make sense, you have to find out why, and by doing this, all problems will be solved.

This helps you sum up all the small expenditures and ensure that the petty cash fund is well maintained.

Advantages and Disadvantages of Petty Cash

It is impossible to overlook the incomparable advantages of petty cash. Cash is frequently the quickest, easiest, and most direct method of payment. It is quite helpful in situations that arise on the go. However, the fact that this money is easily accessible does raise questions about currency security and theft. These invoices can occasionally be untraceable, which leads to unintended mistakes in the bookkeeping process.

Here are the advantages and disadvantages of Petty Cash

| Advantages | Disadvantages |

| Employees can make judgments about pressing expenses quickly, thanks to petty cash. | The petty cash system’s informal nature may raise accountability issues, including misuse or misplacement without appropriate records. |

| By tracking every transaction in the petty cash account, businesses can gain trends and insights into how to allocate minor expenses. | Costs associated with petty cash operations include insurance, safe storage, and possible losses due to theft or mishaps. |

| Employee morale and a sense of ownership can be raised by assigning them such tasks. | An atmosphere that is vulnerable to fraud might be created by lax oversight of petty cash transactions. |

How to Reconcile Petty Cash?

- Petty cash needs to be reconciled regularly to ensure an accurate fund balance. The person in charge of petty cash will ask the cashier for more money whenever the balance hits a predetermined threshold.

- The total of all receipts is computed during this period, and it is necessary to make sure that it corresponds with the money taken out of petty cash. The cashier presents the petty cash receipts from the expenses that used up the cash in exchange for writing a fresh check when more money is needed.

- To put it briefly, the process of reconciling petty cash ensures that the residual balance of the funds is equal to the difference between the initial balance and the expenses listed on the invoices and receipts.

- If the remaining balance is less than it should be, there is a shortfall. If the remaining balance exceeds the appropriate amount, it is considered an overage.

- If something doesn’t add up, it’s usually due to fraud, missing receipts, or other issues. Implementing stronger internal controls can avoid such inconsistencies.

Petty Cash Example

Here’s a practical example of how petty cash is used in a small business setting:

Scenario: The marketing agency’s petty cash fund has limited costs of $200, which are incidental expenses for the business’s everyday functioning.

Usage:

1. Office Supplies Purchase:

Date: March 10

Transaction: The office manager has to place an order for the printer paper and pens.

Amount: $30

Documentation: Recording the petty cash transactions: The office manager fills out the petty cash voucher and keeps the receipt from the local office supply store with it.

2. Staff Lunch:

Date: March 15

Transaction: The working lunch during the meeting is taken, and $50 is spent on takeout.

Amount: $50

Documentation: The employee buys lunch with petty cash, completes a voucher, and attaches the cash register receipt to it.

3. Taxi Fare:

Date: March 20

Transaction: An employee moves to a client meeting through a taxi transport and has to spend $20.

Amount: $20

Documentation: To support the reimbursement of the cost incurred, the employee completes a petty cash voucher, which includes the taxi receipt.

4. Minor Office Repair:

Date: March 25

Transaction: The office light fixture needs to be replaced; the pieces will cost $25 each.

Amount: $25

Documentation: In this case, the employee buys the parts using petty cash and prepares a voucher documenting the expense. The receipt is kept.

Replenishment: Suppose the petty cash balance for several purchases is $75. The office manager checks the vouchers and receipts for the expenses, amounting to $125. To restore the fund back to $200, the manager completes a money transfer worksheet from the business account to the petty cash fund, which is $125.

This example shows that petty cash funds are employed in making small, ordinary expenditures and usually allow prompt payment without going through complex purchasing procedures. It emphasizes keeping proper records for the purpose of audit and control.

What are the Requirements for Petty Cash?

Petty cash reserves are very adaptable and useful for reasonable and compliant business costs. However, this does not imply that anyone can use the money for anything.

Businesses need stringent internal regulations and procedures to manage petty cash, and many use internal controls to do so. Authorization and approval of petty cash disbursements are often assigned to a small group of people known as petty cashiers in most organizations.

The petty cashier is in charge of maintaining the petty cash drawer and accurately entering accounting transactions. The petty cash custodian is also in charge of disbursing the cash and gathering invoices and receipts for every expense incurred with petty cash.

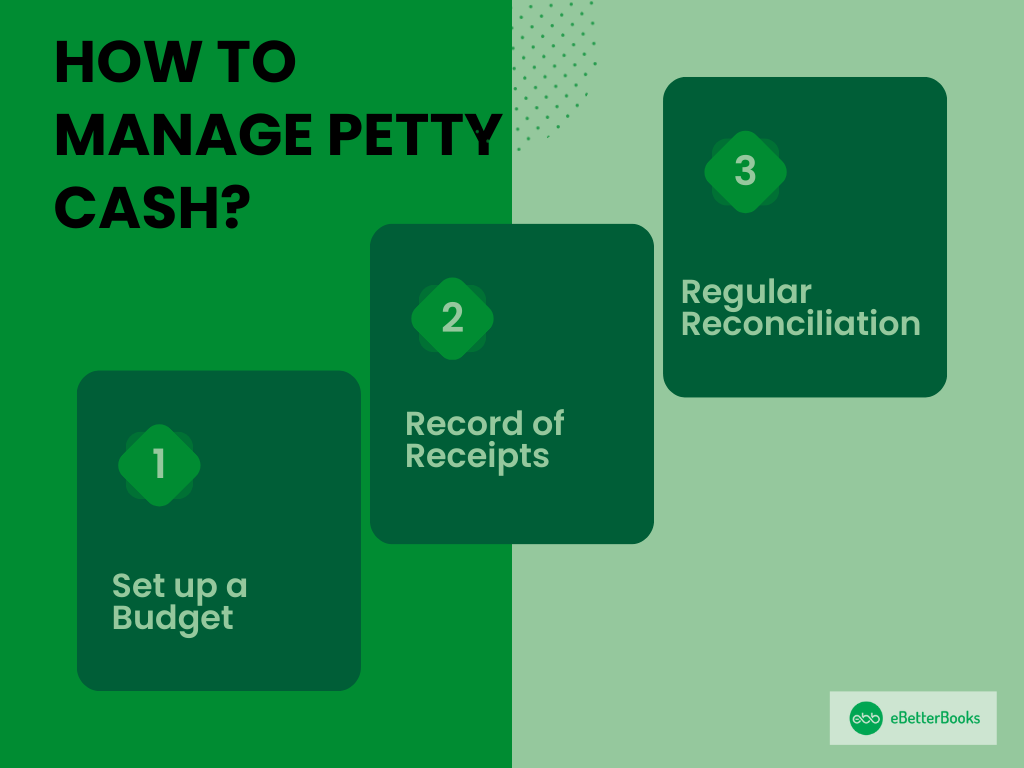

How to Manage Petty Cash?

If you don’t record your petty cash carefully, you can easily waste your firm’s money, which will affect the company’s financial health.

By following the steps mentioned below, you can control excessive petty cash spending:

1. Set up a Budget

Setting up a budget can help you avoid immediate expenses by your employees. Notice your employees’ spending patterns. Observe the items they’re spending on, how much they spend, and how regularly they spend. This will help you set up a budget.

2. Record of Receipts

Give the employees petty cash slips or vouchers every time they use the petty cash funds. The petty cash slips should have the price along with the date and amount mentioned on them. Ensure to record the name of the employee, the name of the service provider or vendor, and the person name who authorized the cash.

3. Regular Reconciliation

By frequently reconciling the petty cash funds in your organization, you can avoid inefficiencies and unauthorized use. For some organizations, monthly reconciliation works for small businesses, whereas for large organizations, weekly reconciliation can get the job done for others. Therefore, choose a reconciliation system that works for your firm.

Internal Control

Effective petty cash internal control is crucial to avoid theft, fraud, or accounting errors. Of these controls, the petty cash voucher plays a significant role, as it provides a receipt for every petty cash transaction.

Key internal controls for petty cash include:

- Petty Cash Custodian: It will be recommended that the management of the petty cash fund be given to one person, whom we shall refer to as the custodian. This person will disburse and record petty cash transactions.

- Receipts and Documentation: Ensure that every petty cash transaction involves a receipt and a petty cash voucher. Every receipt should indicate for what purpose the money has been spent.

- Regular Reconciliation: The petty cash fund should also be balanced regularly, weekly or monthly, depending on business traffic. To ensure cash accuracy, the custodian should ensure that the sum of these vouchers/ worksheets and the cash remaining equals the balance of the fund.

Petty Cash Voucher

A petty cash voucher is an essential internal control instrument adopted to record and approve every single expenditure from the petty cash fund. It is the proof of the amount paid out, the reason for the payment, and when the cash payment was made to whom. Small expenses for which it is difficult to issue a receipt must be paid using a voucher to meet the accountability needs. The appearance of these vouchers with receipts also avoids abuses possibly committed in the management of petty cash since work-related documents are attached to every spending. The voucher system is used to control expenditures as well as to minimize the abuse of the petty cash fund, where every employee is supposed to complete a voucher for each request made, which will go a long way in ensuring that petty cash control is accurate.

Petty Cash VS Cash on Hand

It is important to note, however, that petty cash and cash on hand are not the same term.

Here’s a detailed difference between the two terms:

Petty cash is the portion of working capital that is in the form of coins or bills meant for making small payments since using cash is more convenient than using a cheque or a credit card.

Cash on hand comprises the accessible amount of cash in the business, which is also referred to as liquid funds. This may include the cash that you have yet to deposit in the bank or the small change that you have in the cash register pending to serve a customer. In this sense, the distinction is between where the money is and how it will be used—petty cash being for internal business uses/expenses reimbursed by employees and cash in hand indicating funds received from or to be paid back to customers.

Indeed, cash on hand implies something larger when referring to accounting. In financial management, it is also used to mean an organization’s current assets, which include cash in a checking account or any other bank account, money market funds, short-term debt securities, and any other cash-like instruments. Although it is not actual money, it is money that can be obtained with less effort and in a short period, and therefore, it is on hand.

In short, They indicated that all petty cash is a form of cash on hand. However, only some cash on hand is petty cash.

Pros and Cons of Petty Cash

Petty cash has multiple advantages, such as being easily accessible. But, it also has its fair share of disadvantages.

Below mentioned are some pros and cons of petty cash:

Pros of Petty Cash

- It is the fastest and easiest way of payment for small and minor expenses in your organization.

- Petty cash is easily available. In many cases, you don’t require any authorization or permission for the cash.

- Petty cash is very helpful for emergency expenses.

- There is no need to wait for the money to be credited to the main account.

- Petty cash is much quicker than checks.

Cons of Petty Cash

- Petty cash funds are highly vulnerable to fraud and theft.

- Large corporations need to have petty cash management software; tracking and record-keeping are arduous tasks, and many discrepancies have roots in this area.

- Handwritten petty cash payments are traditional and need to be clarified. They also usually contain errors.

Tax Deductions on Petty Cash

The allowances of petty cash expenses on taxes can be substantially reduced or increased business taxes. Petty cash expenses, which form part of business operations, are acceptable tax deductions when incurred. Typical examples of such expenses are costs incurred on items such as stationery, repair, and transportation.

For a business to be in a position to enjoy these deductions, it must ensure that all petty cash transactions are acknowledged, documented, and compliant with the tax laws. This means that receipts and petty cash vouchers should accompany expenses to support the expenditures during tax audits.

Documentation should be accurate to allow any business to claim a rebate on petty cash expenses successfully. There is also the need for organizations to develop proper record retention and documentation procedures in which expenses are documented, and every business transaction must be evidence appropriately.

In cases where the records are not well kept, tax authorities may disallow deductions in a bid to raise revenue and might even penalize taxpayers. Business owners can avail themselves of the highest possible allowable tax deductions while keeping themselves on the right side of the law by adhering to the elements that maintain sound petty cash control and detailing records for every penny received and spent with pinpoint accuracy.

Challenges for Petty Cash Management in Accounting

Here are the challenges of managing petty cash:

- Risk of Misuse or Theft: Petty cash is at high risk of misuse or theft since it is always handy and easily accessible. This means that in the ordinary course of business, employees may be tempted to take some cash for, say, private use or for expenses not authorized.

- Lack of Documentation: Documenting all petty cash transactions is sometimes difficult. Employees may need to produce receipts in their accounts or complete vouchers, making it difficult to track the money and its utilization.

- Human Error: When using bank accounts, there may be inaccuracies in writing transactions or in calculating balances, which can cause the physical money to differ from the accounting records. This can lead to confusion, especially when it comes to the crucial management of funds in any organization.

- Poor Internal Control: In the absence of good internal controls, the management of petty cash usually involves many errors and may also be an avenue for fraud. For instance, if many people have control of petty cash without supervision, unlawful spending is likely to occur.

- Administrative Burden: The administration of petty cash is always an arduous task, as many organizations worldwide attest to it, especially large companies that are experiencing many transactions. The frequency of tracking, recording, and balancing petty cash can take much of the executive’s time and focus away from other important financial chores.

- Inconsistent Use: Employees or departments may apply dissimilarities in managing petty cash, causing incongruity. Such non-uniformity can add confusing elements to the tracking and reporting processes.

- Limited Amount: The small quantity of money normally found in petty cash may often need to be revised to meet emergent necessities, which means that replenishment is frequently needed, which in turn results in unnecessary shuffling.

- Compliance Issues: Failure to meet tax rules on petty cash issues will lead to business owners incurring bad smells for disallowed expenditures and penalties towards their audit, meaning that expenditure issues are not good news in the business area.

Softwares for Petty Cash Management

There are a number of solutions in the market that can be employed for petty cash management in order to have better control, tracking, and reporting.

Some popular options include:

- QuickBooks: Comes with petty cash functionalities that enable businesses to control expenditures, capture transactions, and balance the petty cash account quickly.

- Zoho Expense: A software tool that allows companies to streamline and often even eliminate the process of petty cash expense documentation and reconciliation.

- Xero: It is an easy method for tracking petty cash, as well as an enabling way of entering expenses, receipt vouchers, and balances in harmony with the general Ledger facets.

- Expensify: This program concentrates on expense tracing to keep a record of petty cash. It supports the scanning of receipts, classification of transactions, and recreation of momentary returns.

- FreshBooks is accounting Software for petty cash that enables users to monitor their small business expenditures through well-designed interfaces and reports.

These tools improve the reconciliation of petty cash, minimize inconsistencies, and simplify petty cash, thus improving its management.

Recommendations for Better Petty Cash Management

To enhance petty cash management, consider implementing the following recommendations:

- Establish Clear Policies: Always standardize petty cash usage with comprehensive and proximate policies such as acceptable expenditures, caps on the monetary value of transactions, petty cash receipts, and vouchers.

- Use a Petty Cash Log: Adhere to a petty cash book where records of all expenditures and other transactions are recorded with the date, amount, purpose, and person involved. This will also assist in performing the fund reconciliation and creating a good audit trail.

- Regular Reconciliation: Reconcile the petty cash fund often enough, maybe weekly or monthly, to check that the total cash in the fund and the receipts equal the set fund amount. Any discrepancy should be stamped out on the same day.

- Limit Access: Separate physical control over petty cash by allowing only a specific person or a limited number of people with full access to the fund to minimize the possibility of embezzlement.

- Implement Digital Tools: Expense management with the help of particular software and applications must include petty cash management and provide options for real-time tracking, record-keeping, and reporting.

- Conduct Surprise Audits: Conduct impromptu checks on the petty cash to see whether the established standards regarding the fund are being followed or whether there is any problem.

- Provide Training: Promote education of employees on the right use and documentation of petty cash since they need to be aware of the measures put in place.

- Utilize Petty Cash Vouchers: Ensure that petty cash vouchers are filled out for every transaction recorded to capture the use of petty cash and get approval for expenses made.

If these recommendations are followed, organizations will be in a better position to manage petty cash without a lot of misuse occurring while correct tracking of the monies will be done.

Conclusion

The management of petty cash is helpful in striking a balance between integrity in the provision of cash-related services and the prevention of embezzlement. Organizations can thus improve control by developing policy in this area, using a petty cash log and vouchers, performing reconciliation on a regular basis, and adopting a digital strategy.

FAQs!

What is Petty Cash, and What is its Use?

Petty cash is a relatively small amount of cash that is available and used to meet minor business expenses. It is for petty expenses like stationary, stamps, minor expenses through the post, or expenses at the discretion of any employee where having to go for a cheque or a credit card may be cumbersome. Petty cash has endless advantages in managing small purchases and allowing money to be obtained without involving an accountant.

Provide Some Examples of Petty Cash in Accounting?

Some examples of petty cash include

- Office Supplies: Buying products such as pens, papers, and other products that may be needed to run an office.

- Staff Refreshments: We will purchase contingencies such as coffee and snacks for meetings and other related group activities.

- Transportation Costs: Expenses incurred with public transportation or with taxis for business purposes.

- Courier Services: Remunerating for the closer delivery services of vital papers.

- Minor Repairs: Stopping extra expenses, including mending a printer or buying new light bulbs.

How Much Petty Cash is Allowed in Accounting?

The range of petty cash in accounting and the sum of which generally is allowed to be $50 to $200. The specific limit is set depending on the organization’s requirements and the flow of such little expenditures.

Having a petty cash fund within this bracket ensures that there is a form of control and supervision to meet fixed running needs. It may, therefore, be necessary to perform periodic checks to determine the appropriate readjustment of the amount.