Non-cash transactions are those recorded in income statements but don’t involve actual cash. You can also understand this with the example of depreciation, which is debited in the income statement, and the profit will be low, but there are no cash transactions for this entry.

Non-cash costs are one typical item that has an impact on a business’s net income, which is essential for drawing in prospective lenders and investors as well as deciding how much dividends to pay out to owners on a regular basis. You may produce accurate financial statements by having a thorough understanding of non-cash expenses and how they affect businesses.

Key Takeaways

- Non-cash expenses are expenses that don’t require any cash transactions or cash outflows.

- Some of the common examples of Non-cash charges are depreciation, amortization, and depletion.

- Non-cash expenses can also include some accounting services, such as bad debts, advertising costs, and research and development.

What are Non-Cash Expenses?

Non-cash charges are charges under accounting rules whereby an expense is recorded even though no cash payment is made in the process. They can be associated with important changes in a company’s financial position while having no bearing on working capital whatsoever. Some of the most well-known non-operating and non-cash expenses include depreciation, amortization, depletion, stock-based compensation, and asset impairments.

Examples of Non-Cash Transactions:

Here are some of the common examples of non-cash transactions:

- Depreciation

- Unrealized loss

- Impairment expenses

- Stock-based compensation

- Amortization

- Unrealized gain

- Provision for discount expenses

- Deferred income taxes

- Asset write-downs

- Provisions for future losses

Understanding Non-Cash Expenses

Non-cash expenses are defined as the charges which do not involve cash outflow. Now-cash expenses are generally a reduction in value attributed to an asset that has already been purchased. These assets are regularly written down to reflect wear and tear or declining value.

As the product continues to depreciate and no further cash transactions arise, the depreciation expenses are recorded as non cash expenses. In some cases, non cash expenses can also be defined as non cash expenditures or non cash transactions.

Below is an example of how a non-cash expense occurs:

- On July 11, 2017, a company named Stone Pvt Ltd purchased a computer worth $2,500 with cash. The estimated life of the computer is five years, so the annual depreciation expense of $500 is made for the next five years.

- In the year 2017, the company will record the depreciation expense of $500 on the income statement and an investment of $2,500 on the cash flow statement.

- In 2018, the company will record a depreciation expense of $500 on the income statement, and no investment will be recorded on the cash flow statement.

- This will continue till 2022 when the depreciation from the computer will be $0 because it is fully depreciated.

As you can see, the depreciation, except $500, is a non-cash item, and the capital cost is recorded only once on the cash flow statement.

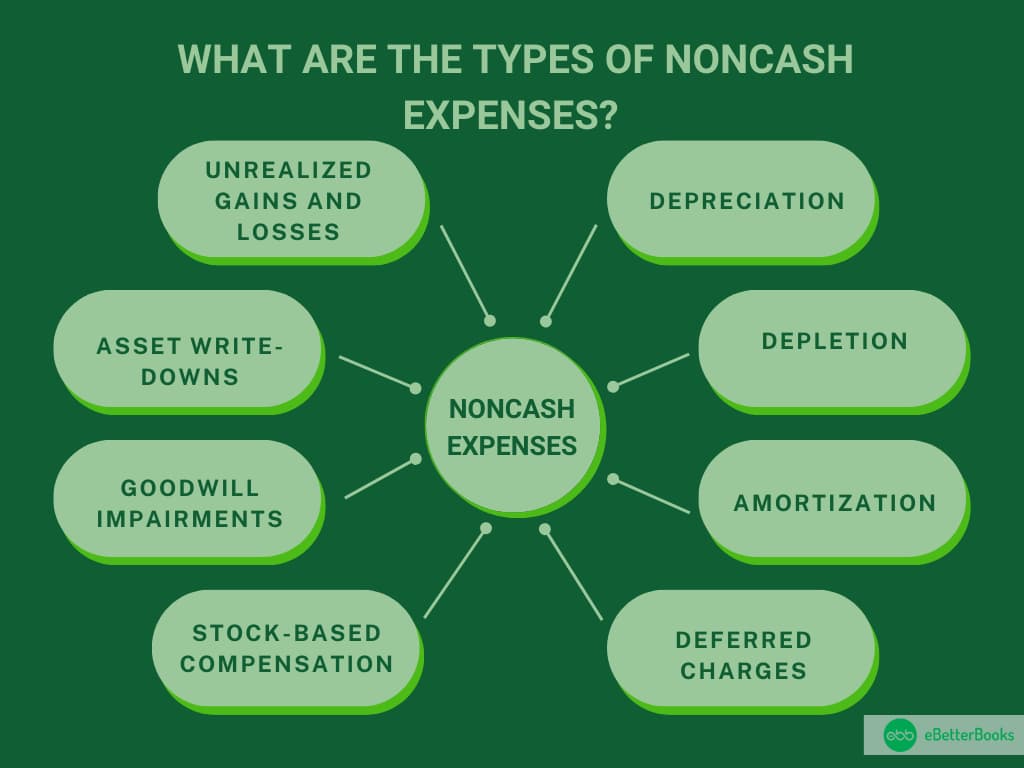

What are the Types of Non-cash Expenses?

Small businesses should be aware of four common types of non-cash expenses: depreciation, depletion, amortization, and deferred charges.

1. Depreciation

Depreciation is that process that aims at allocating a part of the cost of property, plant & equipment spread over the periods that it is useful. Depreciation is considered an allowance for taxes with regard to some general rules set by the IRS.

2. Depletion

This is an accounting way of reflecting the use of certain assets, such as mineral rights or oil fields, over a particular period.

3. Amortization

Amortization is a mechanism that is applied to arrive at the annual expense for intangible assets and spread it out from the balance sheet of account balances.

4. Deferred Charges

These charges are expenses that will not be actually paid at some time in the future in the real sense but will be balanced against revenues. Deferred charges of common small businesses include prepaid rent.

5. Unrealized Gains and Losses

Unrealized gains and losses are fluctuations in the asset or investment value of a business that has yet to be liquidated for cash. Any anticipated value gain or decrease that the business anticipates may also be included. You can decide not to sell with the hope that the price will rise to your purchase price or beyond, retain assets longer for capital gains, or declare unrealized losses as capital losses.

6. Provisions or Contingencies for Future Losses

Businesses can estimate future revenue losses and make an effort to calculate the overall loss. They can then put money aside to offset these losses—what they refer to as provisions or contingencies. You can record the potential cost as a noncash item because it’s a hypothetical expense that entails the uncertainty of an event’s chance of happening.

7. Asset Write-Downs

Asset write-downs are the process of lowering an asset’s book value to reflect its impairment when its fair market value falls short of its carrying book value. Unlike write-offs, which eliminate all sums, write-downs reduce the carrying value of assets to smaller amounts. Take into account putting the lower carrying amount on the balance sheet and the entire asset write-down charge on the income statement.

8. Goodwill Impairments

When a company’s goodwill incurs a loss because its carrying book value is higher than its fair market value, this is known as goodwill impairment. If the gains from its intangible assets don’t meet the company’s expectations, these impairments may occur. Goodwill can be applied to intangible assets such as a company’s client base, brand name, or intellectual technology.

9. Stock-Based Compensation

Stock-based pay is when an organization gives employees and managers ownership in the company as a form of remuneration rather than cash incentives and wages. Stock options or restricted shares, which must vest before they can be earned or sold, are two possible forms of equity. Because it doesn’t entail cash transfers, you can figure out the value of the stock they get and record it on the income statement.

What is the Importance of Non-cash Expense?

Companies create income statements, which provide investors with information on the amount of money earned and the amount of money lost by the company. On the other hand, the accrual basis of accounting includes items in the income statements that affect the company’s cash flow but not its earnings.

Recognizing items that do not require cash payments is a method that helps achieve this goal and provides a more accurate view of the company’s financial status in accordance with the accruals accounting foundation.

What are the Advantages of Non-Cash Expenses?

By keeping track of non-cash expenses, you might learn more about a company’s real funds available for operations. Additionally, non-cash expenses are not included in the cash flow statement; instead, it documents the movement of cash into and out of the business. Including non-cash items in the income statement provides a clearer picture of a company’s financial visibility and long-term prospects. Reducing taxable income is another advantage of disclosing non-cash expenses for a business.

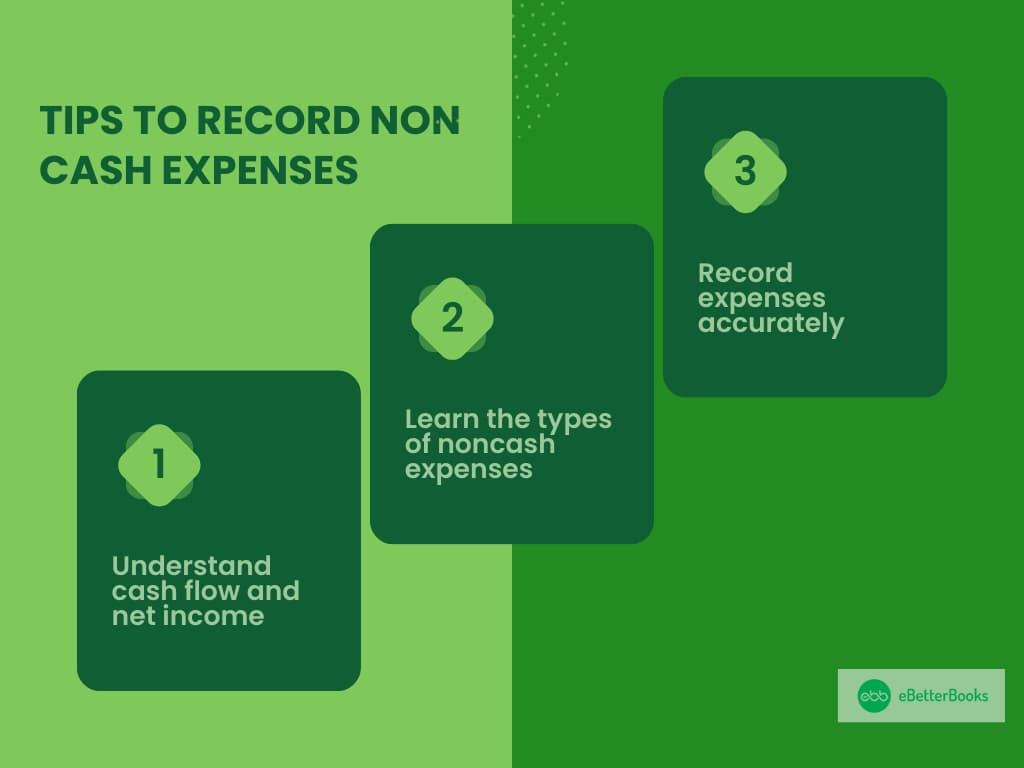

Tips to Record Non-Cash Expenses

Mentioned below are the best practices for recording non-cash expenses:

1. Understand cash flow and net income

Understanding the distinction between total income and cash flow is crucial. While net income assesses the company’s overall profit after taxes, costs, and interest, cash flow analyzes the quantity of money that a business receives and spends. Since non-cash expenses don’t involve a monetary outlay, they have an impact on your overall revenue.

2. Learn the types of non-cash expenses

Being aware of the various kinds of non-cash expenses that you can come across when creating financial statements might be beneficial. Small enterprises may not incur costs like amortization and depreciation. Deferred income taxes, unrealized gains and losses, contingencies, and stock-based compensation are just a few examples of the wider range of non-cash expenses that larger businesses frequently face.

3. Record expenses accurately

Accurately recording non-cash expenses in the income statement is crucial. Revenue, expenses, profits, and losses are all documented in the income statement. The net income value and net taxable income of a business are decreased when non-cash expenses are recorded. This can guarantee that you have a precise grasp of the company’s financial health and that you can provide any regulatory agencies with reliable information.

How do you Account for Non-Cash Expenses?

In financial statements, non cash expenses are usually considered as assets. Given their importance to corporate operations, it’s critical to be able to place a value on them and distinguish them from other kinds of expenses like cash or credit card transactions. A business’s financial soundness depends on having a clear understanding of how much money it brings in compared to what it spends. This will help with that.

The process of giving in-kind items and services a value is known as non-cash expense reporting. Businesses should take this action since it facilitates the comprehension of the company’s genuine financial picture. You must compute the entire cost of the item’s depreciation, amortization, and depletion for that year in order to report non-cash expenses on taxes. Next, you take this figure and put it in your tax return as an addition to your gross income.

When we include non-cash expenses in the income statement, they become valuable. Keeping track of non-cash expenses may determine our net income. For investors, however, a company’s net income could be more helpful. They are curious about the true value of the company. We must, therefore, value a business. A business’s cash flow must be examined in order to determine its value. Additionally, in order to determine the actual cash inflow and outflow, we will add the non-cash expenses to the free cash flow calculation.

Frequently Asked Questions

What is a non-cash expense?

Non-cash expenses or no-cash charges are expenses recorded in the income statement but don’t involve cash transactions or cash outflow activity.

What is an example of a non-cash transaction?

Some examples of non-cash transactions are acquiring property, plant, or equipment by assuming directly related liabilities, such as a mortgage or loan.