What is Depreciation?

Depreciation in accounting is the process of allocating the cost of a fixed asset over the useful life of the asset through systematic reduction due to wear and tear, age, or obsolescence. It captures the level of erosion on an asset’s value since it is used for business activities. It enables firms to spread out the costs of an asset over its useful life with the aim of presenting the financial statement in the most accurate way possible. Typical write-off techniques include straight-line, declining balance method, and units of production. However, it is not a cash payment and is listed as an expense on the income statement, thus minimizing the taxable income of the company.

What is an Operating Expense?

Operating expenses are general expenses a business must incur to effectively and efficiently meet its customers’ needs. Such costs include the rental of the premises, costs of electricity, water, and other utilities, salaries of workers, advertising expenses, stationery, and other administrative overheads such as the rates and taxes of the premises. Expenses are subtracted from sales to arrive at operating income, the most important indicator of a company’s profitability.

Depreciation: An Operating Expense or Not?

Depreciation involves reducing the value of fixed assets, which are essential for business operations. Even though depreciation expenses are recorded monthly, quarterly, or yearly, the assets are being used and consumed continuously.’

Operating Expenses include depreciation when it is associated with a firm’s core operations, such as equipment used in production. It is statutory that operating expenses are essential in a company’s day-to-day operations. If the depreciated assets are used in essential operations, then the depreciation is likely to be categorized as an operating expense. Depreciation is marked as an “expense” on the income statement that impacts a company’s finances.

However, depreciation affects items that are peripheral to the business, such as investment properties or obsolete equipment that has been written off. In that case, it will be considered a non-operating expense. In other words, depending on the use of the asset, depreciation is really an operating expense or is charged against the revenue as a non-operating expense.

Businesses normally purchase fixed assets for long-term use. When a company acquires an asset, it has two options: it can either immediately deduct all direct costs during replacement or depreciate the entire value throughout the item’s useful life.

Companies prefer using the depreciation process because it reduces the initial cost of the asset and helps transfer its value from the balance sheet to the income statement. In this process, accumulated depreciation becomes part of the business’s operating expenses. Depreciation doesn’t have any outgoing cash flow.

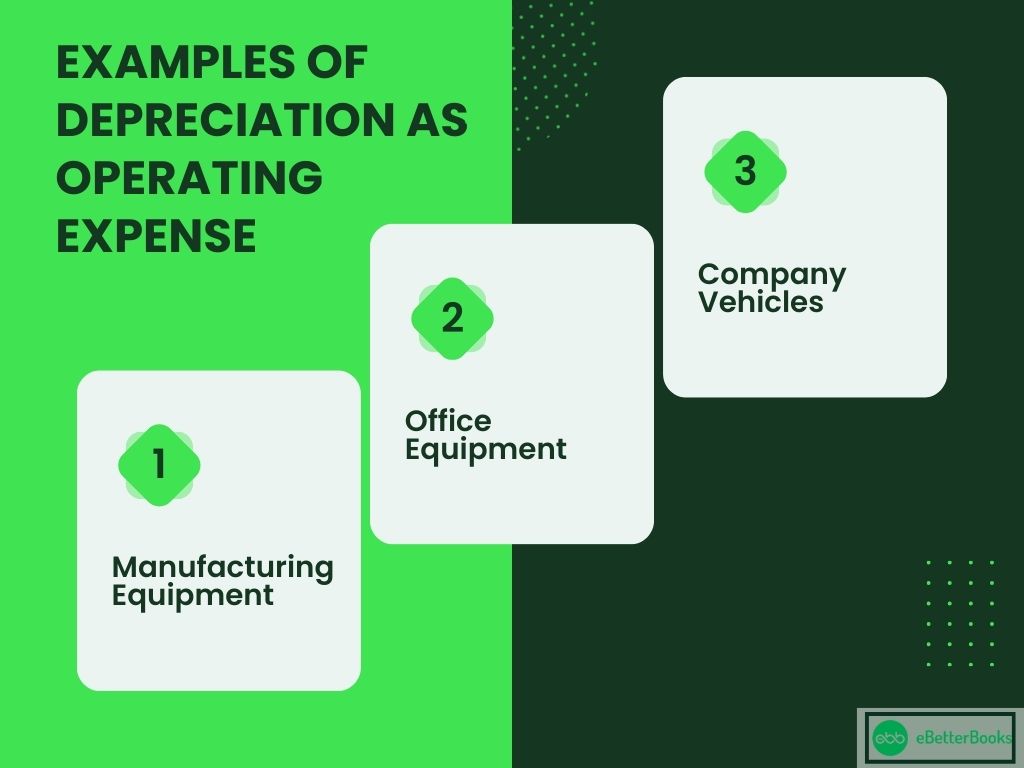

Examples of When Depreciation is an Operating Expense

Depreciation is considered an “ operating expense” by a business when the fixed asset is depreciated and used for the business’s main operational activity.

Examples when the deprecation is considered as “operating expense”:

- Manufacturing Equipments: Depreciation expense incurred on tangible assets that are directly involved in the manufacturing of goods. This expense is a direct allocation to the cost of goods sold and is typically the largest allocation on the business owner’s financial statement.

- Office Equipment: Depreciation expenses are recorded for tangible assets utilized in the business owner’s sales and administrative departments. These costs are considered part of the SG&A expenses within the operating expenses.

- Company Vehicles: Depreciation of assets used in sales and administrative equipment, such as warehouse equipment and delivery trucks, is also included in operating expenses.

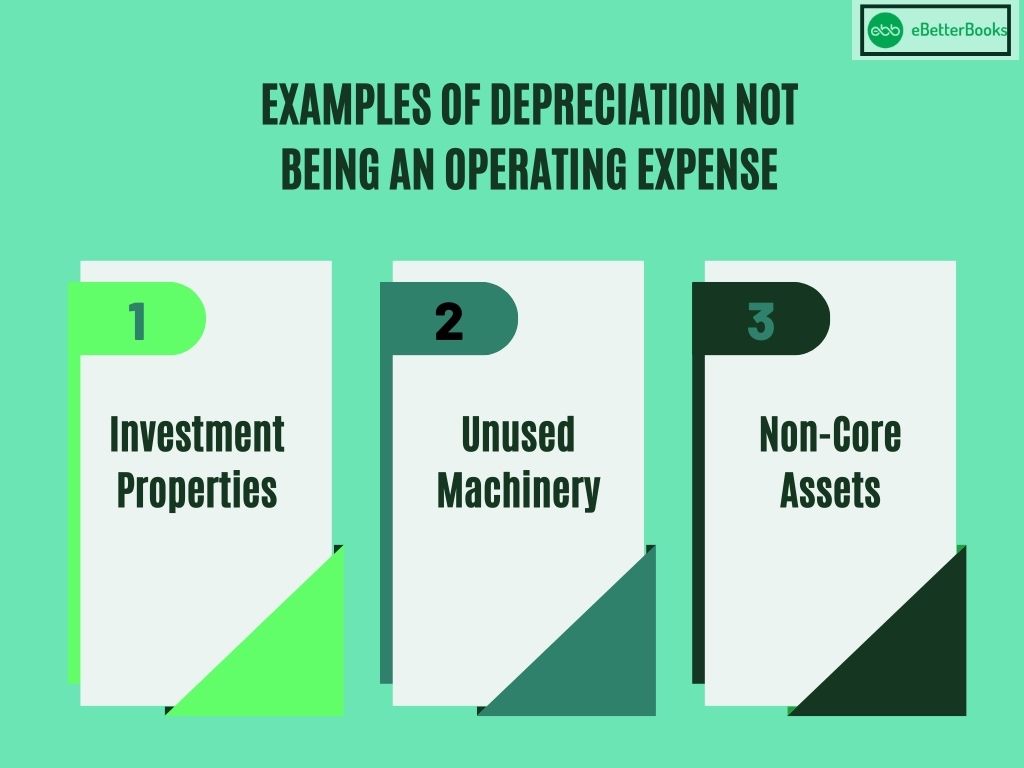

Examples of When Depreciation is not an Operating Expense

Depreciation is considered a “non-operating expense” by the business when the fixed assets are depreciated and are used by the business in an incidental activity.

Here are examples of when depreciation is classified as a non-operating expense:

- Investment Properties: Amortization of an asset, such as a building in which a company may lease out the property for business operations, is considered a non-operating cost.

- Unused Machinery: The realization of loss through impairment on equipment that is decommissioned or held for disposal is reckoned as non-operating, as it is not part of ongoing operations.

- Non-Core Assets: If artwork, furniture, or luxury vehicles not relevant to any business activities are used in the company, then the depreciation on these assets is placed under the non-operating expenses.

Is Depreciation Tax Deductible?

According to the IRS, depreciation is an income tax deduction that allows a taxpayer to recover the purchase price or a different basis for specific assets. The tax deduction enables the company to spread the cost of tangible fixed assets over their useful economic lives in relation to the amount of wear they may receive during use in production or within the business.

When a business buys an asset for use in its operations, e.g., a machine, owned or leased vehicles, buildings, etc., it rarely deducts the full cost in the year the asset was purchased. However, it is apportioned to several years of use with the help of depreciation. This method matches the expense to the revenue realized by using the asset, thus giving a better picture of the company’s performance.

There are various methods to calculate depreciation for tax purposes, including:

- Straight-Line Depreciation: This method spreads one-fourth of the total expended amount of the asset throughout the useful life of that asset.

- Declining Balance Method: This actually involves taking larger deductions in the early period of the asset’s useful life, which is advantageously suitable for business organizations that want to offset a higher amount of tax in this period.

- Modified Accelerated Cost Recovery System (MACRS): This one is used in the U.S. to give definite depreciation rates for each class of assets on which businesses can claim maximum tax allowances.

Businesses can claim depreciation on their accounts, which reduces taxable income and, hence, taxes. This tax saving improves the company’s cash position and future cash flows. It can be recovered for various uses, such as reinvestment in the business, improvement of plant and equipment, or payoff of outstanding liabilities.

Is Depreciation an Asset?

No, Depreciation could not be an asset because assets are recorded at a higher amount throughout their useful life. Depreciation is a technique employed in ascertaining the systematic allocation of the depreciable amount of a tangible asset to its expected useful life. It highlights the depreciation of the asset due to impairment, use, or being out of fashion.

On the balance sheet, the real amount is recorded, while on the income statement, the value of depreciation is indicated by charging it against the asset account. This account subtracts from the caring amount of the asset but is not an asset itself. Rather, it represents only the proportion of the asset’s value that has been recognized in the expense line over time.

Is Depreciation a Fixed Cost?

Yes, depreciation is normally considered as a fixed cost. This is because depreciation expense is known to be a constant and continuous expense that is not related to production or sales level. The depreciation expense for an asset, whether it is machinery or buildings, does not change, with the volume of production remaining constant over the useful life of that asset. For example, where a company adopts the straight line of depreciation, this expense is expected and occurs in equal portions throughout the useful life of the asset. Whereas variable cost changes with the level of production, depreciation remains constant and makes it an integral part of overhead cost.

Difference Between Depreciation and Accumulated Depreciation

The key difference between depreciation and accumulated depreciation lies in how they are recorded and what they represent:

- Depreciation: This is the regular cost acknowledged in the income statement to illustrate the depreciation of a plant asset over a particular period. It represents the proportion of the total cost of the asset that relates to the current period and is recognized as an expense.

- Accumulated Depreciation: This is the sum of all accounts created for an asset throughout its life up to the current date. It is reported in the equity section of the balance sheet as a contra-asset account in the same line item as the associated asset.

Hence, depreciation is the expense of a particular period, while the total depreciation at a certain point in time is called accumulated depreciation.

Conclusion

Depreciation is considered both an operating expense and a non-operating expense in accounting, even though it is a non-cash item. By classifying depreciation as an operational expense, businesses can more accurately show their financial performance and reflect the ongoing costs of using and maintaining their assets.