Cash flow statements are considered one of the three fundamental financial statements that financial leaders use. Besides income statements and balance sheets, they provide important financial data that inform organizational decision-making. While all three are known to be important in assessing a company’s finances, some leaders consider cash flow statements to be the most important. Business owners, managers, and company stakeholders use cash flow statements better to understand their company’s value and overall health and guide financial decision-making.

Key Takeaways

- Cash flow statements are essential for understanding liquidity. They help track a company’s cash availability and how well it manages incoming and outgoing cash.

- Cashflow Sections: Cash from operating, investing, and financing activities form the basis of the cash flow statement.

- Forecasting tool: Cash flow statements allow businesses to predict future cash availability, which is crucial for planning.

- Direct vs. Indirect method: Businesses can prepare their cash flow statements using either the direct or indirect method, with small businesses favoring the indirect method.

- Differences from income statements: The cash flow statement focuses solely on cash transactions, while the income statement includes all transactions, cash and non-cash.

What is a Cash Flow Statement, and What Is It Important?

A cash flow statement that tracks the inflow and outflow of cash can easily ascertain an organization’s financial stability and operational effectiveness.

An organization’s ability to generate enough cash to cover its operational expenses and pay off its debt can be evaluated by looking at its cash flow statement. The CFS, one of the three primary financial statements, is a useful tool to supplement the income statement and balance sheet.

Cash flow statements are a crucial component of financial analysis as long as accrual accounting is used for three reasons:

- They display your liquidity. This implies that you are fully aware of your working cash flow in case you require it. You, therefore, understand what you can and cannot afford.

- Cash withdrawals, inflows, and holdings reflect changes in assets, liabilities, and equity. These three divisions are the foundation of business accounting and generate the accounting equation that enables performance measurement.

- It allows you to forecast cash flows and the amount of liquidity your company will have in the future, which is crucial for long-term business planning.

Purpose of Cash Flow Statement

If a business wishes to be successful, it should always have sufficient cash. This helps it pay back bank loans, buy raw materials, or invest to earn profitable returns. A business is considered bankrupt if it doesn’t have enough cash to pay its debts.

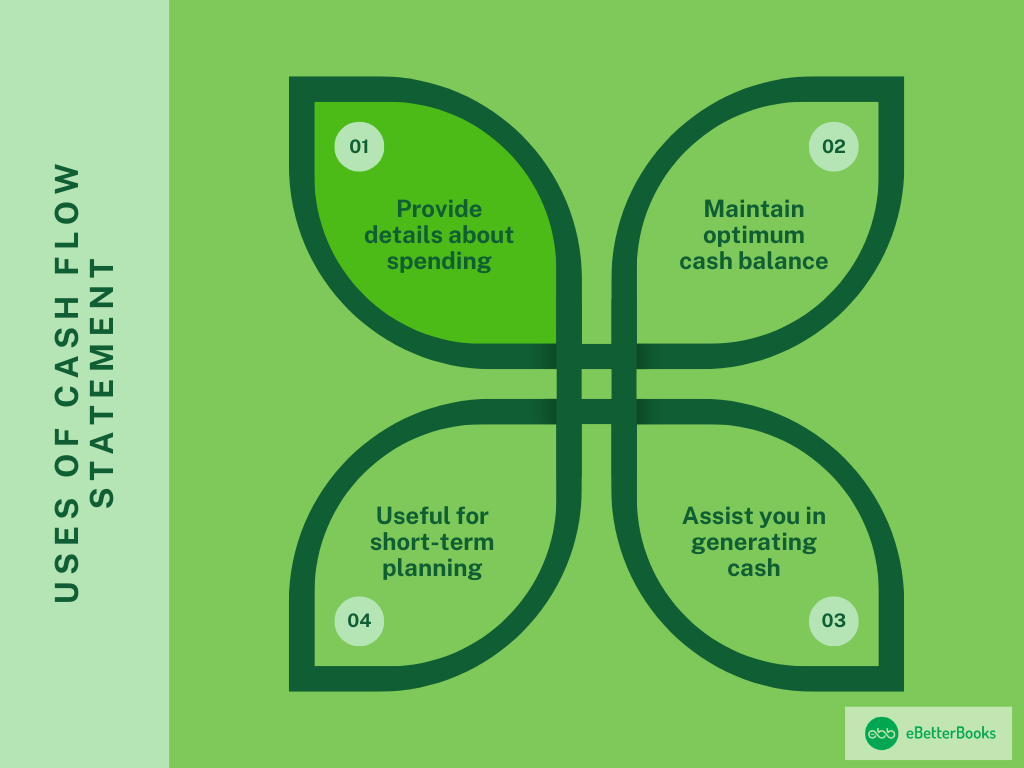

Mentioned below are some benefits of a cash flow statement:

- Provide Details About Spending: A cash flow statement offers a clear understanding of the principal payments the company makes to its creditors. It also displays all the transactions recorded in cash and not shown in the other financial statements. These include purchases of inventory items, increasing customer credit, and buying capital equipment.

- Maintain Optimum Cash Balance: A cash flow statement assists you in maintaining the perfect level of cash on hand. The company must control whether too much of its cash is lying idle or if it needs more funds. If the company has excess cash lying idle, it can utilize it to invest in shares or buy inventory. If there is a shortage of funds, it can search for sources from which it can borrow the funds so that the business can keep going.

- Assist you in Generating Cash: Profit plays a crucial role in a company’s success by generating cash. But there are various other ways to generate cash. For example, when a company discovers a way to pay less for equipment, it is actually generating cash. Every time it gathers receivables from its customers faster than usual, it is gaining cash.

- Useful for Short-Term Planning: A cash flow statement is known to be a very important tool for controlling cash flow. A successful business should always contain liquid cash to fulfill short-term obligations like upcoming payments. A financial manager can examine the incoming and outgoing cash from previous transactions to make important decisions in some scenarios where the decisions are to be made based on the cash flow, including foreseeing a cash deficit to pay off debts or begin a base to request credit from banks.

What is Cash Inflow?

The income that your business receives from its operations or any profit-generating plan is known as cash inflow. The maintenance of a robust cash stream is crucial for the survival of any organization. It enables you to reinvest in growth prospects and address operating costs.

Cash Inflow Includes:

- Proceeds from sales of goods or services

- Returns on investments

- Financial activities

- Interest is built over periods.

Businesses primarily generate cash flow by selling goods or services to their clients and customers, sending them an invoice for the order, and then collecting payment. Many expanding corporations want to make gains on their shares or other investments by investing in other companies.

All of these operations result in cash inflow for the company and contribute to the increase of the total cash balance.

What is Cash Outflow?

The total of all the expenses that your company pays out is known as cash outflow. It covers all obligations, liabilities, and running expenses—that is, any money that leaves your company. A well-run company minimizes long-term debt and keeps operating flows low in order to sustain a positive cash flow.

Numerous variables affect cash outflow, so business owners must maintain an extensive financial record that outlines all of the relevant variables.

The majority of firm profits are required to cover operating costs. Rent, utilities, storage fees, and travel charges are a few examples of expenses that go into running a business. Reducing these costs will help minimize cash outflow.

Components of Cash Flow Statement

Cash from Operating Activities

According to the Cash Flow Statement, the operating activities comprise

Any sources and uses of funds from business operations are included in the CFCs operating activities. Stated differently, it represents the amount of money that a business makes from its goods or services.

These operating activities might include:

- Receipts from sales of goods and services

- Interest payments

- Income tax payments

- Payments that have been made to suppliers of goods and services used in production

- Salary and wage payments to employees

- Rent payments

- Any other type of operating expenses

Receipts from the sale of debt, equity, or loan instruments are also included in a trading portfolio or investment firm because they are related to business activities.

| Important Note: Cash from operations often includes changes in cash, accounts payable, depreciation, inventories, and receivables. |

Cash from Investing Activities

Any source and purpose of funds from an organization’s investments are considered investing activities. This category includes asset purchases and sales, vendor and customer loans, and payments pertaining to mergers and acquisitions (M&A). To put it briefly, adjustments to machinery, assets, or investments impact investment cash.

Since cash is often used to purchase new machinery, real estate, or short-term assets like marketable securities, changes in cash from investments are typically seen as cash-out items. However, for the purpose of determining cash from investing, a company’s asset divestment is treated as a cash-in transaction.

Cash from Financing Activities

The money received from banks and investors, as well as the money distributed to shareholders, is referred to as cash from financing activities. This covers all dividends, repurchase payments for stock, and principal repayments for loans provided by the corporation.

Cash-in occurs when capital is raised, and cash-out occurs when dividends are paid. These are changes in cash from finance.

Therefore, a business that issues bonds to the general public gets funding in cash. However, the corporation uses less cash when bondholders receive their return. Recall that interest is recorded as an operating activity rather than a finance activity, even though it is a cash-out item.

How Cash Flow Statement is Used?

Below are some uses of cash flow statements:

- Cash flow statements make creating strong financial policies for your business incredibly simple. They are also useful for evaluating your current cash situation.

- An organization can plan and coordinate all of its financial operations by using a projected cash flow statement, which can be set up to show the company’s future cash position.

- Loans from banks and other financial organizations are made easier with the use of cash flow statements. And using this, you can comprehend the company’s ability to repay debt.

- It helps management make immediate financial decisions.

- The statement highlights the numerous uses of cash that the company makes, which helps to explain why its cash position is bad despite its significant profits.

- Cash flow statements, both historical and anticipated, can be compared to identify performance variances, gaps, and other issues so that the company can act quickly and efficiently.

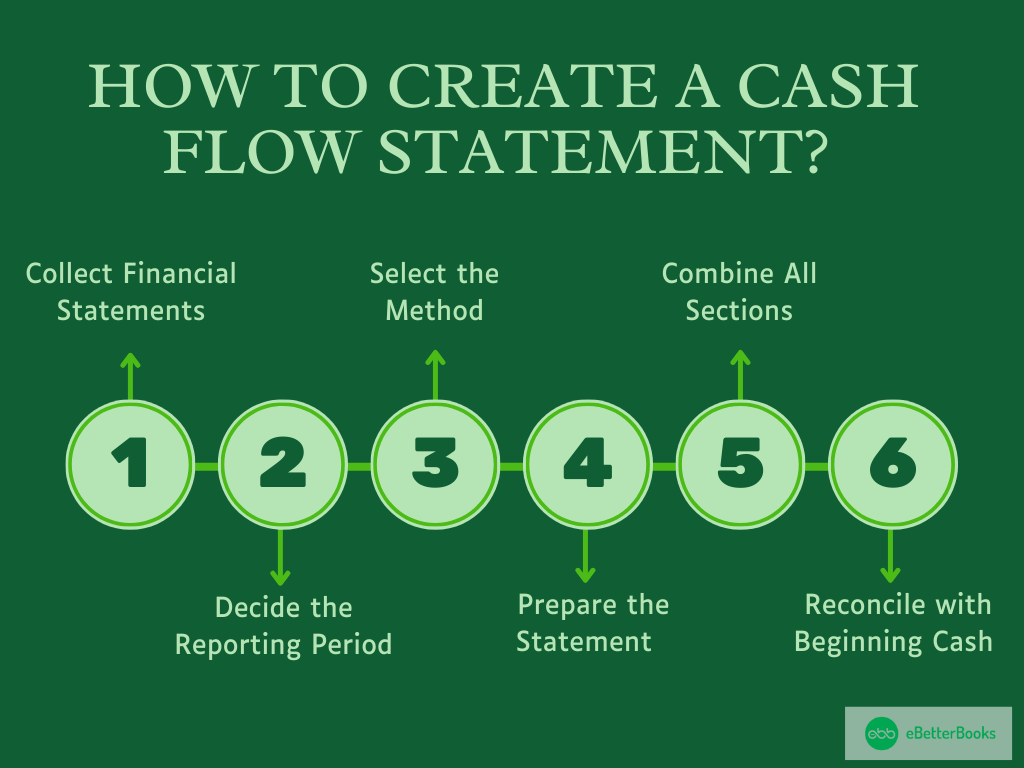

How to Create a Cash Flow Statement?

1. Collect Financial Statements

Before you start, gather the important financial statements:

- Income Statement: Gives information about revenues, expenses, and net income.

- Balance Sheet: Displays the Company’s assets, liabilities, and equity at the start and the end of the period.

2. Decide the Reporting Period

Recognize the period for which you’re preparing the cash flow statement. This can be monthly, quarterly, or annually.

3. Select the Method

Decide which method you will choose to prepare the Cash flow statement:

- Direct Method: The direct method provides a listing of all cash receipts and payments during the reporting period.

- Indirect Method: The indirect method begins with net income and adjusts for changes that occur in non-cash transactions.

4. Prepare the Statement

Cash Flow from Operating Activities

Direct Method:

1. List cash receipts: Add cash collected from customers.

2. List cash payments: Add cash paid to suppliers and employees, interest paid, and income taxes paid.

3. Calculate net cash flow from operating activities Minus total cash payments from the total cash receipts.

Indirect Method:

1. Begin with net income: get this from the income statement.

2. Adjust for non-cash items: Include back depreciation and amortization.

3. Adjust changes in working capital: Account for changes in accounts receivable, accounts payable, inventory, and other working capital accounts.

4. Calculate net cash flow from operating activities: Merge the adjusted net income with changes in working capital.

Cash Flow from Investing Activities

1. Recognize the cash transactions for investments: Add cash used up for purchasing fixed assets, cash received from selling assets, and cash used upon or received from investing in securities.

2. Calculate net cash flow from investing activities Minus cash payments for investments from cash receipts from sales of investments.

Cash Flow from Financing Activities

1. Recognize cash transactions for financing: Add cash received from issuing debt or stock and cash used to repay debt or buy back stock.

2. Calculate net cash flow from financing activities: This is the net cash flow from financing activities minus all the cash payments for financing activities and cash receipts.

5. Combine All Sections

To control the overall change in cash and cash equivalents for the period, including the net cash flow from operating, investing, and financing activities.

6. Reconcile with Beginning Cash

Please include all the changes to the starting cash balance to appear at the ending cash balance; make sure it matches the cash balance on the balance sheet.

Example of Cash Flow Statement

Below is an example of a cash flow statement that offers a thorough understanding of the inflows and outflows of cash from financing, investing, and operating operations. It displays the company’s annual cash management and liquidity.

| Cash flow statement // Year ending December 21, 2024 | Amount |

| Cash flow from operating activities | |

| Net income | $120,000 |

| Adjustments for non-cash items | |

| Depreciation and amortization | $15,000 |

| Inventory write-downs | $3,000 |

| Other | $2,000 |

| Changes in working capital | |

| Decrease in accounts receivable | $5,000 |

| Increase in inventory | ($8,000) |

| Decrease in prepaid expenses | $1,000 |

| Increase in accounts payable | $7,000 |

| Increase in accrued expenses | $4,000 |

| Increase in taxes payable | $2,000 |

| Net cash from operating activities | $151,000 |

| Cash flow from investing activities | |

| Property and equipment purchase | ($25,000) |

| Intangible assets purchase | ($10,000) |

| Income from equipment sales | $5,000 |

| Net cash from investing activities | ($30,000) |

| Cash flow from financing activities | |

| Proceeds from the issuance of common stock | $50,000 |

| Long-term debt repayment | ($20,000) |

| Dividends paid | ($10,000) |

| Net cash from financing activities | $20,000 |

| Net increase in cash and cash equivalents | $141,000 |

| Cash and cash equivalents at the beginning of the year | $60,000 |

| Cash and cash equivalents at the end of the year | $201,000 |

Limitations of Cash Flow Statement

A few limitations of the cash flow statement are mentioned below:

- Income statements and cash flow statements are different. Cash and non-cash items are both included in an income statement. Therefore, a cash fund does not equal the company’s net income.

- The fund flow statement provides a more comprehensive view than the cash flow statement because it encompasses a wider definition of working capital funds.

- A cash flow statement displays only cash inflow and outflow. However, the statement’s cash balance may not accurately reflect the company’s true level of liquidity.

- The cash flow statement does not fully depict the financial status of the corporate entity.

- Making a cash flow statement is merely an analysis done after the fact. This strategy does not provide a cash forecast for the future.

- The balance sheet serves as the foundation for the cash flow statement’s correctness. The cash flow statement is inaccurate if the balance sheet is as well.

Cash Flow Statement VS Income Statement

The cash flow and income statements give stakeholders a clearer view of a company’s financial situation and a better understanding of its performance over the past year. They can also help determine the corrective measures a company has to take to flourish over the long term. These assertions are used in tax audits and internal audits.

Nonetheless, there are certain areas when cash flow and income statements diverge, which are covered in the table below:

| Cash Flow Statement | Income Statement | |

| Definition | The cash flow statement facilitates the recording of an organization’s total cash inflows and outflows for a given accounting period. | An organization uses the income statement to list every item pertaining to earnings, costs, profits, and losses for a specific accounting period. |

| Basis | The cash flow statement is prepared using the cash basis of accounting, which is based on actual cash collections and payments. | The accrual basis of accounting, which is based on income and payments that are either received or due in advance, is used by the income statement. |

| Division | Three activities are identified in the cash flow statement, and they are as follows:OperatingInvestingFinancing | Two activities are identified on the income statement, and they are as follows:OperatingNon-operating |

| Usage | The cash flow statement ascertains a company’s solvency and liquidity and also aids in estimating future cash flows. | The income statement provides insight into a company’s profitability for a specific fiscal year. |

| Preparation | A company’s income statement and balance sheet are used to generate the cash flow statement. | A company’s numerous ledger accounts and records serve as the foundation for the preparation of the income statement. |

| Deprecation | Depreciation is not included in the cash flow statement because it is a non-monetary item. | Depreciation is shown on the income statement. |

Cash Flow Statement VS Balance Sheet

| Parameters | Cash Flow Statement | Balance Sheet |

| Meaning | An all-inclusive financial account of all cash inflows a business receives from external financing sources and ongoing operations, as well as all cash outflows used to cover trade and other expenses over a given period, is called a cash flow statement. | A balance sheet is an accurate depiction of the entity’s equity, liabilities, and assets. Every business, whether it is a partnership, single proprietorship, or other structure, outlines this declaration. It displays the company’s financial stability. |

| Categorized into | 3 sections | 2 sections |

| Significance | Helpful in anticipating and budgeting. | Release the financial status of an enterprise. |

| Data Disclosed | Cash equivalent and moment of cash. | Assets, Liabilities, and Equities. |

| Basis | It is outlined for taking both P&L a/c and balance sheet into observation. | It is outlined that P&L a/c is taken into account during observation. |

What is Negative Cash Flow?

Negative cash flow is something where your business has more outgoing money than incoming money. It is possible to estimate the sales cost and consider that it will be enough to cover all the expenses. Instead, you’ve required your money from investments and financing to make up the difference.

For instance, if you spent $10,000 in the month while you had $5,000 in sales, your cash flow would be negative.

This is common in most start-ups, as most young companies are characterized by negative cash flow. However, a business can only be run with positive cash flows in the long run, as this could greatly affect its profits. Finally, there will only be funds left to use if the business can generate adequate profits to offset expenses.

How to Prepare a Cash Flow Statement Using the Direct and Indirect Method?

If you want to know about your company’s cash flow, you can use one of two methods: the direct method or the indirect method. While GAAP approves both methods, small businesses typically choose the indirect method.

Direct Method of Calculating Cash Flow Statement

By using the direct method, you can keep a record of cash as it comes and goes from your business and use that information at the end of the month to make a statement of cash flow.

In the direct method, more legwork and organization are required than in the red and intangible. You’re required to produce and track cash receipts for every cash transaction. For this reason, smaller businesses opt for the indirect method.

Important Note: If you’re recording cash flows in real time using the direct method, then you’re required to use the indirect method to reconcile your statement of cash flows with your income statement. So, you can expect the direct method to take much more time than the indirect method.

Indirect Method of Calculating Cash Flow Statement

Through an indirect method, you see the transactions recorded on your income statement and change some of them to examine your working capital. You’re particularly backtracking your income statement to remove transactions that don’t display the movement of cash.

Since it is easier than the direct method, many small businesses choose this approach. Also, when utilizing the indirect method, you’re not required to reconcile your statements with the direct method.

A cash flow statement is defined as a valuable measure of a company’s strength, profitability, and long-term future outlook. It helps companies determine whether they have enough liquidity or cash to pay their expenses. A company can utilize a cash flow statement to predict its future cash flow, which helps organizations with budgeting matters.

What Is the Difference Between Direct and Indirect Cash Flow Statements?

The direct method and indirect method are techniques of preparing cash flow statements and are nearly alike in their preparation but the preparation of operating activities is the main difference.

The direct method reports specific cash transactions including cash receipts from customers, cash paid to suppliers, and cash paid to employee wages, etc. It gives a better look at sources of cash and its usage hence giving one a good outlook of the flow of cash. But it needs data in larger detail and thus is not as often used.

The indirect method of arriving at cash flow from operations begins with net income and then adds or subtracts non-cash expenses such as depreciation expenses, change in working capital, and gains or losses arising from the sale of fixed assets. It links net income to the income statement and operating cash flow and relates it to the balance sheet.

These two approaches paint different pictures but yield the same cash flow amounts. The indirect method is favored more as it is easier to implement, and it relies on information that may frequently be found in financial reports.

Conclusion

In conclusion, it may be stated that the cash flow statement is one of the key reports, which enables assessing the value of the organization’s financial performance and generating the cash flows in the operating, investing, and financing activities. It assists in identifying problems and opportunities of liquidity, evaluating business performance, making strategic decisions, and providing essential data for users, stakeholders, investors, and managers.

Frequently Asked Questions

What is the cash flow statement, and what are its uses?

A cash flow statement is a sort of financial statement that summarises all cash inflows from a company’s ongoing activities and external investment sources. It also includes all cash outflows that pay for corporate activities and investments throughout a specific period.

What are examples of cash flow statements?

Examples of cash flow statements include sales of goods and services, salary payments, rent payments, and income tax payments.

What is the importance of the cash flow statement with its example?

A cash flow statement shows how companies spend their money. It tracks the amount of money that comes in and goes out as a result of handling business affairs and provides comprehensive information about a company’s cash inflow and outflow. Having cash on hand is a fundamental necessity for businesses to remain stable and prevent bankruptcy.

What is the main objective of a cash flow statement?

These are the main objectives of cashflow statements:

- Cashflow provides information regarding cash inflows and outflows from operating, investing, and financing activities.

- It also helps determine net changes in cash and cash equivalents.

What is the AS-3 Cash Flow Statement?

AS 3 is the Accounting Standard 3 that provides requirements for preparing a cash flow statement in India. It requires displaying cash flows based on operating activities, investing activities, and financing activities to provide a picture of cash.

What are the 3 Types of Cash Flow Statements?

The three types of cash flows are:

- Operating Activities: Directly resulting from the company’s principal activities.

- Investing Activities: Cash flows as a result of acquiring or disposing of an asset.

- Financing Activities: The movement in share price and borrowings and other similar securities.