Cash flow is vital for any business, reflecting the movement of money in and out. Knowing how to calculate cash flow is crucial for managing finances and ensuring long-term sustainability.

Whether you’re a small business owner or managing personal finances, understanding cash flow can provide valuable insights.

Types of Cash Flows

Operating cash flows arise from the core activities of the business, such as sales and expenses.

Operating cash flows ensure the company can cover its expenses, such as salaries and supplier payments, sustaining smooth operations.

- Investing cash flow

Investing cash flows involves transactions related to acquiring or disposing of assets like equipment or investments.

Investing cash flows impacts the business’s growth by determining whether it has adequate funds to invest in new projects or equipment.

- Financing cash flow

Financing cash flows represent cash movements related to borrowing, repaying loans, or issuing equity.

Financing cash flows are essential for managing debt levels and attracting investors.

How Can You Calculate a Cash Flow?

A cash flow statement is not very confusing in theory; it merely reflects how your money inflows and outflows in your enterprise. But for small entrepreneurs, it is hard to analyze how to calculate cash flow statements; it is not easy to compute cash flow formulas as it is dissimilar to working out the income and the expenses; it is much deeper than that.

For small scale entrepreneurs and business owners, cash flow is the essential element for running a business.

Let’s understand 3 major cash flow formulas: free cash flow formula, operating cash flow formula and cash flow forecast formula with examples.

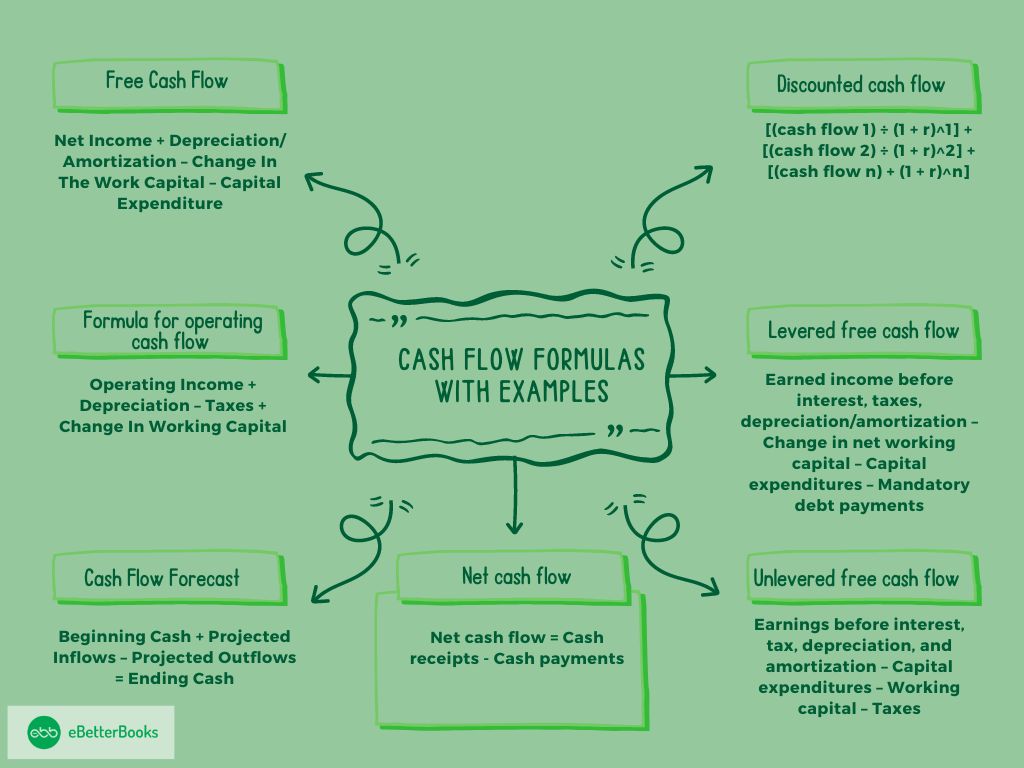

Cash Flow Formulas with Examples

| Free Cash Flow | = Net Income + Depreciation/ Amortization – Change In The Work Capital – Capital Expenditure |

| Operating cash flow | = Operating Income + Depreciation – Taxes + Change In Working Capital |

| Cash Flow Forecast | = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash |

| Net cash flow | = Net cash flow = Cash receipts – Cash payments |

| Discounted cash flow | = [(cash flow 1) ÷ (1 + r)^1] + [(cash flow 2) ÷ (1 + r)^2] + [(cash flow n) + (1 + r)^n] |

| Levered free cash flow | = Earned income before interest, taxes, depreciation/amortization – Change in net working capital – Capital expenditures – Mandatory debt payments |

| Unlevered free cash flow | =Earnings before interest, tax, depreciation, and amortization – Capital expenditures – Working capital – Taxes |

Every person in business needs to understand cash flow statement formulas and its importance for their company’s growth. The cash flow formulas mentioned above make it more comfortable for a business owner to picture its financial inflows and outflows.

1. Free Cash Flow Formula

Free Cash Flow Formula (FCF) is the most general and vital cash flow formula.

This formula provides you a reflection of your company’s funds at a particular time. Still, it does not reflect the actual finances available to you, so it does not help plan the budget as it will not picture the Cash available to you.

Free Cash Flow helps recognize if you can afford certain things like; what software can you afford? Can you afford to get a digital assistant when your bills are due? How many gratitude cards can you manage?

How can you calculate a free cash flow?

You must be thinking that it is quite tough to calculate the free cash flow, but it is pretty straightforward in reality.

Firstly, you need to get accounting software to create your firm’s financial statements.

Let us discuss some accounting terms to calculate free cash flow formula:

- Net Income: The remaining value you receive after deducting your firm’s expenses from the entire Income or sales.

Depreciation / Amortization: Depreciation calculates the decreased value of assets, whereas amortization is a technique to lower down the book value of loans or intangible assets with time. - Working Capital: The contrast between assets and liabilities is your capital used to operate your firm’s daily tasks. You can compute the difference between gross assets and liabilities through the flat sheet of your company.

- Capital Expenditure: Capital expenditure is the money spent on nonliquid assets such as land, machinery, equipment, etc.

Free Cash Flow = Net Income + Depreciation/ Amortization – Change In Working Capital – Capital Expenditure.

We can understand this better with a free cash flow formula example:

Chloe is a web developer; she has to compute her available cash flow to recognize if it is feasible to hire a digital assistant for about twelve hours a month.

Her finances seem like:

- Net Income : $90,000

- Depreciation / Amortization : $100

- Change in Working Capital: -20,000

- Capital Expenditure : $1,500

(Saira bought a new laptop last year)

So Saira’s cash flow is depicted by:

[$90,000] + [$100] – [$20,000] – [$1,500] = $68,600

Hence, $68,500 is Chloe’s available finance to reinvest back into her business.

2. Operating Cash Flow Formula (OCF)

Free cash flow formulas could be good at recording the available funds to re-establish the company. Still, it does not reveal your daily cash flow’s accurate reflection because FCF does not recognize irregular earnings, expenditures, or investments.

The better alternative for the FCF is the Operating Cash Flow Formula (OCF)

How to calculate OCF (Operating Cash Flow)?

Like in the case of free cash flow, you will want your budget worked out; you can use operating cash flow for this.

There is one accounting term you will have to know:

Operating Income: The earning before interests, taxes, surplus, your operating profit deducted by using expenditures from the Total Income

Formula for operating cash flow = Operating Income + Depreciation – Taxes + Change in Working Capital

Applying the Operating Cash Flow formula to the preceding example:

- Operating Income: $95,000

- Depreciation: $100

- Taxation: $8,000

- Variation in venture capital: -$11,000

[$95,000] + [$0] – [$8,000] + [-$11,000] = $76,000

Hence, in a particular year, Chloe generates a $ 76,100 cash inflow from her usual operating activities.

3. Cash Flow Forecast Formula

Free Cash Flow and Operating Cash Flow provide a complete picture of cash flow at a particular time, but the Cash Flow Forecast Formula gives a vision about the cash flow in the coming month.

It is an excellent practice as it allows you to determine what amount of cash flow you might have in the future.

It is very frustrating when you do not have enough funds planned out in the time of need, so it is better to forecast the available and needed funds.

How to calculate your cash flow forecast?

Cash Flow Forecast is the most comfortably calculating formula among the FCF and OCF. There are no complex accounting terms jumbled up.

It is a straightforward computation of the money you anticipate to get in and paid out in the coming thirty to ninety days.

blueprint for the cash flow forecast:

Cash Flow Forecast = Beginning Cash + projected Inflows – projected outflows = Ending Cash

Beginning Cash is the money you have in hand on your current day.

Project inflow is the money you are supposed to get during a specific time phase.

Project outflow is the expenditures you are about to make in a specific time phase.

Let us use Chloe’s example again:

- Beginning cash: $40,000

- Projected inflows for the coming 90 days: $40,000

- Project outflows for the coming 90 days: 5,000

Her cash flow forecast seems like:

[$40,000] + [$40,000] – [$5,000] = $75,000

The cash flow forecast of Chloe’s finances in the coming 90 days would be $75,000.

4. Net Cash Flow

This formula is the one which is regularly used by the business owners. This formula provides you the difference between the money that is coming out of your business for a particular period.

How to calculate net cash flow

If you want to calculate the net cash flow, then you’re required to find the difference between the cash inflow and cash outflow. There are some ways through which you can calculate net cash flow, but let’s continue with the basics of the net cash flow formula:

Net cash flow = Cash receipts – Cash Payments

If you feel the need to go a step further, then you can separate cash flow by category: operating, financial, and investment

Let’s utilize the example of Ekta, who runs a small indie magazine. To find out about her net cash flow for the quarter, she’ll consider the following:

Cash flow from operating activities

- $13,000 came in

- $8,000 went out

Cash flow from investment activities

- $600 came in

- $5,000 went out

Cash flow from financial activities

- $3,000 came in

- $1,000 went out

To calculate the net cash flow, we’ll be using the following formula:

Net cash flow = ($13,000 – $8,000) + ($6,000 – $5,000) + ($3,000 – $1,000)

Net cash flow = $3,000 + $1,000 + $2,000

Net cash flow = $6,000

5. Discounted Cash Flow

As a business owner, it is necessary to keep a record about where you and your finances are. It is not only important for the month ahead, but it helps you to get an idea about where you will be in the next quarter, the next year, or even the next decade!

The discounted cash flow formula tells you the expected value of a business which is based on the future cash flows.

How to calculate discounted cash flow

The formula to calculate the discounted cash flow is:

DCF = [(cash flow 1) ÷ (1 + r)^1] + [(cash flow 2) ÷ (1 + r)^2] + [(cash flow n) + (1 + r)^n]

Let’s break this down:

- Cash flow: Cash flow is known as the money which moves out and in of your business. But we will consider the net cash flow that is the net of inflows and outflows.

- Cash flow 1: It is the cash flow for the first year.

- Cash flow 2: It is the cash flow for the second year.

- Cash flow n: This is the period number, and it can be years, quarters, months, etc.

- r: It is the discounted rate. The discount rate is utilized to search the current value of future cash flows. You’re required to do some research to find out the appropriate discount rate for your calculation- it can’t be lower than the inflation rate.

Let’s assume that you’re the owner of the food shop. You need to calculate your DCF to help you estimate the potential investments and find out if they’ll deliver a positive ROI.

Let’s assume you have $30,000 to invest, and you’re given the opportunity to invest into a company that is anticipated to pay dividends of $5,000 per year over the next 10 years. The discount rate here is 8%, because in this case, it’s the return that you will get if you invest in an index fund.

To calculate the future cash flow, you’re required to use the DCF formula:

DCF = (CF1 / (1 + r)^1) + (CF2 / (1 + r)^2) + … + (CFn / (1 + r)^n)

DCF = ($5,000 / (1 + 8%)^1) + ($5,000 / (1 + 8%)^2) + ($5,000 / (1 + 8%)^3) + ($5,000 / (1 + 8%^)4) + ($5,000 / (1 + 8%)^5) + ($5,000 / (1 + 8%)^6) + ($5,000 / (1 + 8%)^7) + ($5,000 / (1 + r)^8) + ($5,000 / (1 + 8%)^9) + ($5,000 / (1 + 8%)^10)

DCF = ($5,000 / (1.08)^1) + ($5,000 / (1.08)^2) + ($5,000 / (1.08)^3) + ($5,000 / (1.08)^4) + ($50,000 / (1.08)^5) + ($5,000 / (1.08)^6) + ($5,000 / (1.08)^7) + ($5,000 / (1.08)^8) + ($5,000 / (1.08)^9) + ($5,000 / (1.08)^10)

Then:

DCF = ($5,000 / 1.08) + ($5,000 / 1.1664) + ($5,000 /1.259712 + ($5,000 /1.36) + ($5,000 /1.47) + ($5,000 / 1.59) + ($5,000 /1.71) + ($5,000 /1.85) + ($5,000 /1.99) + ($5,000 /2.15)

Next step:

DCF = $4,629.63 +4,286.70 + $3969.16 + $3676.47 + $3401.36 + $3144.65 + $2923.98 + $2702.70 + $2512.56 + $2325.58

Lastly:

DCF = $33,576

6. Levered Free Cash Flow

In small business accounting terms, levered is explained as the business that is funded with borrowed capital, such as small business loans, investors, or any other external funding sources.

Keeping that in mind, the levered free cash flow is defined as how much capital your business has after you’ve accounted for all the payments to both short and long-term financial obligations. It’s the money that is accessible to investors, shareholders dividends, company management, and investments back into the business.

How to calculate levered free cash flow

The formula for calculating levered free cash flow is mentioned below:

Levered free cash flow =

Earned income before interest, taxes, depreciation and amortization – Change in net working capital – Capital expenditures – Mandatory debt payments

Let’s see what’s all these teams mean:

- Earnings before interest, taxes, depreciation, and amortization: It is also known as EBITDA, this is the alternative for simple earnings or net income which you can utilize to calculate the overall financial performance.

- Capital Expenditures: It is also known as CAPEX, it is investments in property, buildings, machines, inventory, and equipment, also accounts receivable and accounts payable.

- Working capital: It is defined as the total working capital which the business has.

- Mandatory debt payments: It is what the business

Let’s suppose you own and operate a landscaping company. When you began your company three years ago, you invested your own money $40,000 and borrowed $20,000. Every month, you owe a minimum of $1,000 on that debt.

In the first year, your EBITDA was around $160,000. This figure increases up to $185,000 in your second year and $300,000 in the third.

In the first year you also purchased all your machinery for $135,000, you also didn’t have any capital expenditure in the second year, and you spent $20,000 in the third.

The first working capital was $40,000, in year 2 it was $120,000, and $250,000 in Year 3.

Look at the table mentioned below:

| Year 1 | Year 2 | Year 3 | |

| EBITDA | $160,000 | $125,000 | $200,000 |

| CAPEX | $135,000 | $0 | $20,000 |

| Working capital | $40,000 | $90,000 (100% change) | $125,000 |

| Mandatory debt payments | $12,000 | $1,200 | $1,200 |

Let’s get back to LFCF formula:

LFCF = EBITDA – Change in net working capital – CAPEX – Mandatory debt payments

Let’s do the calculation for the first year:

LCFC = 160,000 – 40,000 – 135,000 – 12,000 = – $27,000

The second year:

LFCF = 125,000 – 90,000 – 0 – 12,000 = $23,000

The third year:

LFCF = 200,000 – 125,000 – 20,000 – 12,000 = $43,000

7. Unlevered Free Cash Flow Formula

Unlevered free cash flow is known as the cash flow that a business has, without accounting for any interest payments. Basically it’s a business’s financial status which has no debts to pay, that means it’s a bit of an exaggerated number of what the business is actually worth.

This gives the more attractive numbers and the potential investors and lenders that levered cash flow calculation.

How to calculate unlevered free cash flow

There is a very big difference between the levered free cash flow formula unlevered cash flow. The levered cash flow includes debts but the unlevered excludes them. This explains that the unlevered cash flow is higher than levered free cash flow.

The formula of unlevered free cash flow is mentioned below:

Unlevered free cash flow =

Earnings before interest, tax, depreciation, and amortization — Capital expenditures — Working capital — Taxes

For the example, let’s get back to Year 1 and 2 of the landscaping business we have talked about above:

Remember, the time when you started your business three years ago, you invested $40,000 of your own money and purchased all the income and borrowed $20,000. In the second year, you didn’t buy any equipment, and your CAPEX was zero, still you had to pay debt.

But here we’re discussing UFCF, in this situation, so the debts aren’t part of the equation.

| Year 1 | Year 2 | |

| EBITDA | $160,000 | $125,000 |

| CAPEX | $135,000 | $0 |

| Working capital | $40,000 | $90,000 |

| Taxes | $25,000 | $40,000 |

Now that the numbers are available, let’s calculate for year 1:

UFCF = 160,000 – 135,000 – 40,000 – 25,000 = -$40,000

For the 2nd year:

UFCF = 185,000 – 0 – 90,000 – 40,000 = $55,000

If the UFCF is a negative figure, it doesn’t implicate something negative about your business. So, the first year required more CAPEX, such as equipment, but in this case, you recovered during the second year and generated a positive UFCF.

How to Calculate Change in Working Capital on Cash Flow?

Before you begin calculating the change in Net Working Capital, you’re first required to find out your working capital:

- Add Up All Current Assets: You need to add the company’s current assets, that includes cash, accounts receivable and inventory.

- Subtract Current Liabilities: From the total current assets you’re required to subtract the company’s current liabilities, which is accounts payable.

The formula of calculating Net Working Capital is:

Net Working Capital = Current Assets – Current Liabilities

The formula to determine the change in the working capital on cash flow statement is as follows:

Net working capital for the current period – net working capital for the previous period = change in net working capital.

For example: Suppose a company named Raha Pvt Lmt has $805,000 and $890,000 in current assets for the year 2023 and 2024 respectively. And it has $700,000 and $650,000 in current liabilities for the respected year.

Now that both the number are available for the year 2023 and 2024, it easy to calculate the working capital:

| 2023 | 2024 | |

| Current assets | $805,000 | $890,000 |

| Current liabilities | $700,000 | $650,000 |

| Working capital | $105,000 | $240,000 |

Now, subtract the previous years working capital from the current year’s working capital on the basis of the calculations made above in the table:

$240,000 (2022) – $105,000 (2021) = $135,000.

The change in the Net Working Capital is $135,000.

Cash flow formulas: Math to keep your money moving

It might look like a hardship to calculate all these cash flow formulas but facing a cash shortage is worse.

Keeping a record of your regular cash inflow and outflow lets you get a more comprehensive approach towards your financial statements.

With the help of these cash flow formulas, you can now solve the expected problems, and so you can also carry out your operations optimally and keep the cash flow issues in the past.

Conclusion

Understanding cash flow is crucial for business sustainability and growth. Mastering calculations like free cash flow and cash flow forecasts help you assess financial health and make informed decisions. These formulas not only clarify how money moves in and out of your business but also enable you to anticipate future needs, identify opportunities for reinvestment, and attract potential investors.

FAQs

What does cash flow mean?

Cash flow refers to the movement of money into and out of a business, indicating how much cash is generated and utilized over a specific period.

What is an example of a cash flow?

Salary payments, income tax payments, sales of goods and services, and rent payments are examples of cash flow.

Is cash flow good or bad?

Positive cash flow enables a business to cover costs and invest in growth, while negative cash flow indicates a shortage of funds due to expenses exceeding income.

What can cash flow tell you?

A positive cash flow is crucial for a business’s success. It ensures that the company can meet its debt obligations, pay for immediate needs like equipment and staff, and have reserves for investment or downturns. Here’s what you need to know about cash flow statements.

Manage your finances with eBetterBooks

We have helped startups and small business owners with their accounting needs such as a bookkeeping,

tax filing, tax preparation, financial reporting and much more.