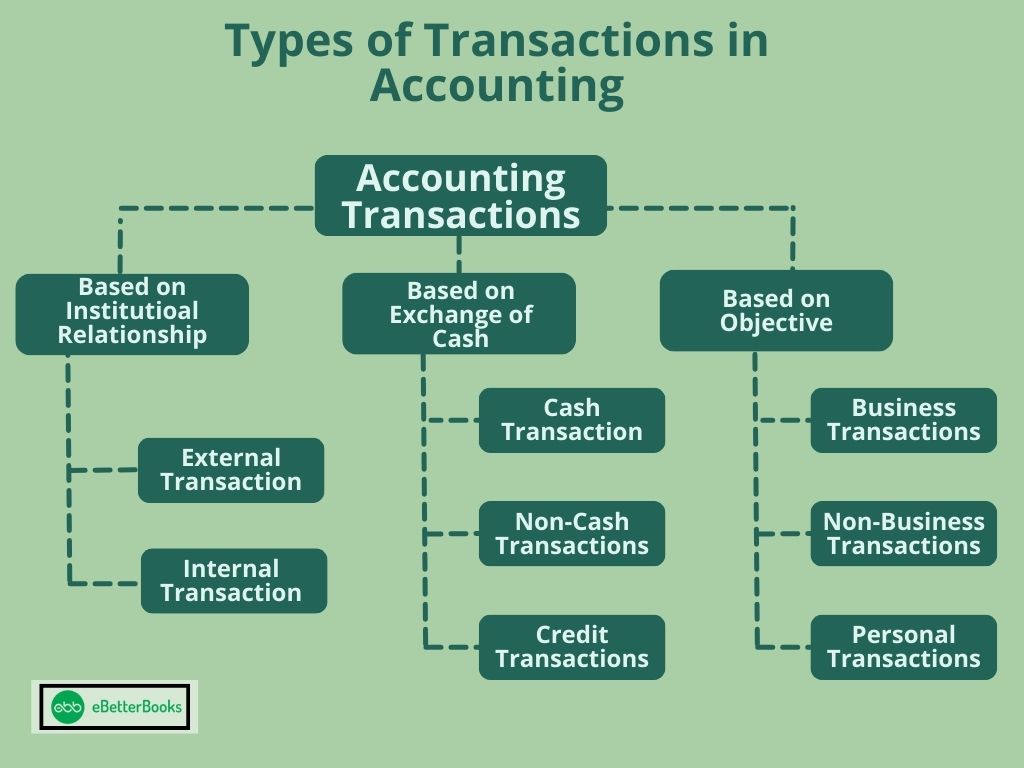

Accounting transactions are business events that have a monetary impact on business finance. They are recorded as journal entries in the accounting records. These transactions are essential for tracking the financial health of the business. Accounting transactions can be classified into three main categories: Institutional Relationships (interactions with external parties like customers or suppliers), Cash Movements (transactions involving cash payments or receipts), and Objectives (transactions related to the business’s core operations).

All these classifications help document the changes in the accounting equation: Assets = Liabilities + Equity.

| Assets = Liabilities + Equity |

This formula reflects the core principle that every transaction balances the business’s financial structure. Accurately recording these transactions provides valuable insights into a company’s financial status, aiding in better financial planning and informed decision-making.

What is a Transaction in Accounting?

An accounting transaction is any business or financial event that affects the organization’s current monetary situation and is recorded in the accounting statements. It involves an exchange that affects the business’s assets, liabilities, equity, or any other financial statement components. Transactions are recorded systematically in accounting books using a method called double-entry bookkeeping, where every transaction affects at least two accounts to maintain balance.

Accounting transactions are foundation usually maintained by double-entry bookkeeping, where each transaction affects at least two accounts. From the perspective of institutional relationships, accounting transactions are classified as internal or external, regarding cash movements as cash transactions, non-cash, or credit transactions; according to objectives, they may be business transactions, non-business, or personal. These transactions have many forms, including institutional relationships, cash movement, and objectives.

Correct identification and documentation of transactions serve the rightful purpose of creating accurate and reliable financial accounts as well as financial statements that provide an evaluation of the general health of the business entity. They also ensure compliance with accounting standards and regulations and offer valuable insights into business performance. If businesses start keeping proper records of accounting transactions, they can even make more informed decisions, ultimately bringing to the success and sustainability of the business.

This article aims to compare these types, classify them, and describe their place in the accounting process.

Need for Recording Transactions in Accounting

Recording transactions is important for knowing a company’s income and expenses, where the company is heading, the efficiency of using resources, spotting any gaps or inefficiencies, and reporting the company’s financial position to investors, creditors, shareholders, lenders, the government, etc. A company’s financial statements depict its financial health, and the accuracy of these statements depends upon the accuracy with which the transactions are recorded.

How Many Types of Transactions are there in Accounting?

There are different types of transactions in accounting, such as external, internal, cash, non-cash, credit, etc.

Here is the breakdown on a different basis:

Based on Institutional Relationship

External Transactions

These include relations between the organization and other groups of people or firms, including customers, suppliers, and bankers. Examples include purchasing stocks or raw materials, selling goods and services, or taking a loan.

Internal Transactions

These are the transactions that occur internally in the business between the units of the business. Some examples are book depreciation, changing the allocations of assets, or shifting of funds between the various departments.

Based on the Exchange of Cash

Cash Transactions

These take place when payment is made in cash at the time the transaction takes place. For instance, a company that has bought capital goods gets an invoice to pay immediately, or a client that buys a commodity pays cash promptly.

Non-Cash Transactions

These are actual exchanges where it is rare to get involved in a direct barter system. Some examples include swapping viable assets, using equity as a method of payment for services, or even using shares as forms of remuneration. These activities take place without necessarily having a direct effect on the business’s cash flow.

Credit Transactions

These arise when the payment is made after purchasing the goods or receiving the services. However, in a credit transaction, goods and services are also exchanged, but the payment is made after some time. For instance, a business invests in supplies on a span or sells a product, and the buyer pays after some time.

Based on Objective

Business Transaction

These are straightforward transactions involving the firm’s various operations, such as sales, purchases, or investments. Such transactions impact the business house’s finances and creditworthiness.

Non-Business Transactions

Although they are important and affect the business’s financial position, they are not revenue-generating transactions and, therefore, are reflected in the financial statements. A charitable donation made by the business is an example of another type of expense.

Personal Transactions

These are the personals of the individuals or owners in aspects that have implications for the business. For instance, when the owner takes money for his or her use, it is considered a personal transaction and recorded in the business ledgers.

Accounting Transactions Examples

External Transactions

- A construction company buys steel and concrete from an external supplier for a new project.

- A clothing manufacturer is acquiring fabric and textiles from an external supplier for production.

- A company purchases supplies from a local vendor.

Internal Transactions

- The IT department transfers computer equipment to the customer support department.

- The marketing team is reallocating budget resources to support a new advertising campaign.

Cash Transactions

- A customer purchasing groceries with cash at a local supermarket.

- A business owner pays monthly rent in cash to the landlord.

- An individual withdrawing cash from an ATM for personal expenses.

Non-Cash Transactions

- A tech company acquires a software firm through the exchange of company stocks.

- A real estate developer obtaining a prime location for a new project by offering shares in the development company.

- An energy company acquires a competitor through a non-cash deal involving the exchange of assets.

Credit Transactions

- An advertising agency providing marketing services to a client with payment due 60 days after service delivery.

- A consulting firm extending credit terms to a corporate client for strategic planning services.

- A software company selling licenses to a startup on credit, with payment scheduled for a later date.

Business Transactions

- A retail store is selling 100 units of a popular product to customers.

- A manufacturing company distributing finished goods to wholesalers.

- An e-commerce platform processing online orders and shipping products to customers.

Non-Business Transactions

- An employee using the company credit card for a business trip’s hotel accommodation.

- An executive charging dinner expenses at a business meeting to the corporate credit card.

- A team member purchasing office supplies using the company credit card.

Personal Transactions

- When personal money is spent on personal groceries, including household products.

- I am using my funds from an individual account for one’s own needs.

- I am renting a room or house in the form of a home from income earned by the person.

Categories of Transaction

Here are the four main categories of a transaction:

- Sales: Any business processes, operations, or activities that involve the exchanging of products for cash from customers.

- Purchases: Purchases made for business and resale purposes or services that would be used in daily business.

- Receipts: Resources, merchandise, and other receipts from different activities carried out by Sacco, such as sales or loans.

- Payments: Payments made to discharge sundry expenses or/and obligations due or when procuring goods or services.

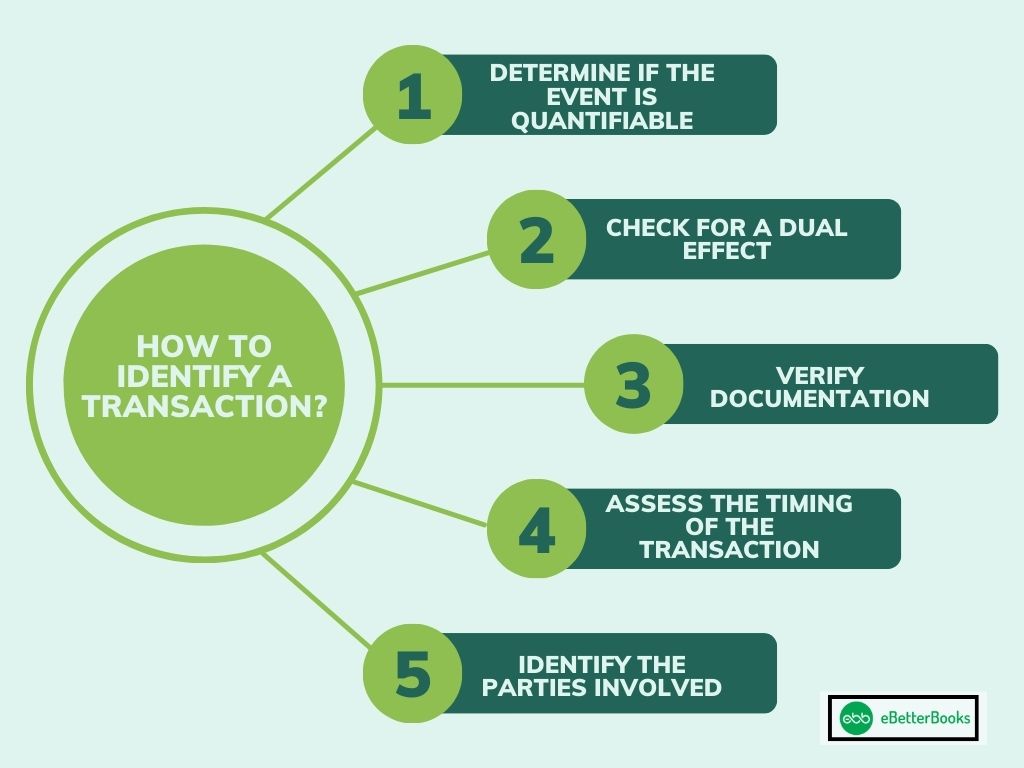

How to Identify a Transaction in Accounting?

Defining transactions in accounting entails identifying events or exchanges that have a contractual impact on the business.

To correctly identify and record accounting transactions, follow these steps:

- Step 1: Determine if the Event is Quantifiable: For an event to be transformed into an accounting transaction, it has to be quantifiable in terms of money. For instance, the sale of merchandise or purchase of equipment can be measured; perhaps the morale levels of the employees or the satisfaction levels of the customers cannot.

- Step 2: Check for a Dual Effect: Every transaction changes two accounts in the accounting system, which is why it is called a double-entry system. For instance, acquiring inventory affects cash (or accounts payable) and inventory accounts.

- Step 3: Verify Documentation: In order for a transaction to qualify as valid, official documentation should support it. Examples are invoices, receipts, contracts, or bank statements, among others. These documents prove that a financial exchange or event has taken place.

- Step 4: Assess the Timing of the Transaction: An event should be recorded at the time it occurs, not when the payment is made or received. This is referred to as the accrual basis of accounting. For instance, revenue is recorded when goods are sold, regardless of whether the amount is received at a later date.

- Step 5: Identify the Parties Involved: Consider whether the transaction is intra-organizational or inter-organizational. In exchange transactions, the parties interact with an outside party, such as customers or suppliers, while internal exchange transactions include recording depreciation.

Process of Recording Transactions

- Step 1: Identify the Transaction: Identify a financial transaction or event that affects the company’s financial statements, such as a sale, purchase, payment, receipt, or any other business activity involving monetary value.

- Step 2: Analyze the Transaction: Determine how the transaction impacts the accounting equation (Assets = Liabilities + Equity). Identifying affected accounts and increase or decrease.

- Step 3: Determine Debit and Credit Entries: Based on the double-entry accounting system, every transaction affects at least two accounts. One account is debited (increased or decreased, depending on the account type), and another is credited (also increased or decreased, depending on the account type). The total debits must equal the total credits for each transaction.

- Step 4: Prepare the Journal Entry: Record the transaction in the accounting journal as a journal entry that includes the date of the transaction, the accounts involved, and the amounts to be debited and credited, along with a brief description.

- Step 5: Post to the General Ledger: Transfer the entries from the journal to the general ledger, where transactions are categorized and recorded in individual accounts.

- Step 6: Trial Balance: At the end of an accounting period (like a month or a quarter), prepare a trial balance to ensure that total debits equal total credits in the general ledger.

- Step 7: Adjusting Entries: Don’t forget to make any necessary adjusting entries to account for accrued expenses, accrued revenues, prepayments, and other adjustments that need to be made before preparing financial statements.

- Step 8: Prepare Financial Statements: Use the adjusted trial balance to prepare the financial statements, including the income statement, balance sheet, and cash flow statement.

- Step 9: Closing Entries: After preparing the financial statements, you must close entries to clear out temporary accounts (like revenues and expenses) and transfer their balances to permanent accounts (like retained earnings).

- Step 10: Post-Closing Trial Balance: Prepare a post-closing trial balance to ensure that the accounts are balanced and ready for the next accounting period.

Conclusion

Accurately recording transactions is the backbone of your business’s financial management and helps to evaluate the organization’s financial performance.

Businesses can use accounting software like Akounto to record income, other expenses, financial transactions related to funds, loans, flow of capital, appreciation of property, and other complex issues. The software gives businesses the option to choose and switch between the accrual method and the cash-based method. It handles everything from setting up charts of accounts, invoice generation, sending payment reminders, and generating financial statements.

Frequently Asked Questions

How do accounting transactions impact financial statements? (h4)

Accounting transactions directly impact financial statements by altering the company’s assets, liabilities, and equity through cash and non-cash transactions. These changes are reflected in income statements, balance sheets, and cash flow statements.

What role do accounting transactions play in maintaining financial transparency?

Accurate recording of accounting transactions ensures transparency by providing a clear and honest depiction of a company’s financial activities to stakeholders, investors, and regulatory bodies.

How do errors in transaction recording affect the trial balance?

Errors in transaction recording can cause imbalances in the trial balance, where total debits may not equal total credits. This indicates mistakes that need to be corrected before preparing financial statements.

Explain the difference between external transactions and internal transactions.

Below is the tabular difference between both types of transactions:

| Basis | External Transactions | Internal Transactions |

| Resource Exchange | External transactions involve the exchange of resources as they are related to a third party. | Internal transactions do not involve the exchange of resources as they relate to an organization’s departments. |

| Cash Flow Impact | Impact the cash flow of the business more. | Impact the cash flow if the business rarely. |

| Number of Parties Involved | Two or more parties are involved involved | Only one party is involved, which is the organization itself. |

If a company purchases supplies from a local vendor, is this classified as an external or internal transaction?

Purchasing supplies from a vendor involves two parties: the organization and the local vendor. Therefore, it will be categorized as an external transaction.

What is a financial transaction? Provide examples of financial transactions in accounting.

A financial transaction usually involves transferring cash, goods, and services and affects an individual’s or organization’s financial situation.

Examples of Financial Transactions:

- Sales: Offering goods or services to the consumers.

- Purchases: Purchasing all of the items that might be needed in the production, such as the raw materials.

- Loans: Loan extensions or making a loan.

- Wage Payments: Compensating its employees for services rendered to the organization.