Recording S-Corporation distributions in QuickBooks Desktop and Online is a vital process requiring precise accounting to ensure compliance with Internal Revenue Service (IRS) regulations. The core procedure involves debiting a dedicated Shareholder Distribution Equity Account and crediting the cash or bank account, reflecting a reduction in shareholder equity rather than a business expense. Successfully managing this requires setting up a proper Chart of Accounts, utilizing journal entries or checks consistently, and meticulously differentiating distributions from shareholder salaries (W-2 wages) and owner’s draws, which apply to different business structures. Due diligence must be maintained by ensuring distributions are proportional to ownership percentage and do not exceed retained earnings. Following these steps, complemented by rigorous documentation and professional review, significantly mitigates the risk of IRS scrutiny and potential loss of S-Corp status.

Highlights (Key Facts & Solutions)

- Core Transaction: To record a distribution, users debit the Shareholder Distribution Equity Account and credit the Cash or Bank Account. Distributions are adjustments to equity, not expenses, and thus do not impact the Profit and Loss statement.

- Account Setup: A specific account, often named Shareholder Distribution Account, must be created under the Equity account type in the Chart of Accounts for both QuickBooks Desktop and Online.

- Recording Methods: Distributions can be recorded using either Journal Entries or by writing a Check against the designated Shareholder Distribution Equity Account. Do not use both methods for a single distribution to prevent duplication.

- Proportionality Requirement: Distributions must be strictly based on each shareholder’s ownership percentage to maintain the S-Corp’s “single class of stock” status and avoid IRS penalties.

- Tax Compliance: Shareholder salaries must be treated as a W-2 payroll expense (subject to payroll tax), while distributions are non-taxable returns of capital until they exceed the shareholder’s stock basis.

- IRS Forms: S-Corps must file Form 1120-S annually and provide each shareholder with Schedule K-1 for their personal tax filing.

- Audit-Proofing: Best practices include using detailed memos (listing name and purpose), maintaining written board approvals, and quarterly reconciliation of the Balance Sheet’s Retained Earnings and Equity accounts.

- Risk Mitigation: Distributions should not exceed the company’s accumulated earnings and profits; any excess amount can lead to adverse tax consequences for the shareholder.

Before recording any distributions, both versions need a properly structured Chart of Accounts.

For QuickBooks Desktop:

- Step: Navigate to the Chart of Accounts > New to add an account.

- Step: Save the account under Equity.

- Step: Name it something specific, such as Shareholder Distribution Account.

- Step: Choose the appropriate account type to ensure proper financial reporting.

For QuickBooks Online:

- Step: Go to Settings > Chart of Accounts.

- Step: Click on New to add a new account.

- Step: Choose Equity as the account type.

- Step: Under the Detail Type > Partner Distributions.

- Step: Enter Shareholder Distributions as the account name.

- Step: Review the details and click Save to finalize the setup.

How to Record S-Corp Distribution in QuickBooks Desktop?

Users can record S-Corp distributions in QuickBooks Desktop using checks or journal entries.

Follow the below-mentioned steps to set up and record these transactions accurately:

Record the S-Corp Distribution Using Journal Entries in QuickBooks Desktop

Step 1. Access the Chart of Accounts

- Open QuickBooks and navigate to the Chart of Accounts.

Step 2. Create a New Account

- Select “New” to add an account.

- Save the account under ‘Equity.

- Name it something specific, such as “Shareholder Distribution Account.”

- Choose the appropriate account type to ensure proper financial reporting.

These accounts should be classified properly to ensure that distributions are correctly reported on the company’s financial statements and tax reports.

By accurately setting up these accounts, recording distributions for S Corps in QuickBooks becomes more transparent and streamlined.

Step 3: Make Journal Entries

- Go to the Company menu and select Make General Journal Entries.

- In the journal entry screen, complete the following fields:

- Debit the newly created Shareholder Distribution Account with the distribution amount.

- Credit the cash or bank account from which the funds are being distributed.

- Add a memo to describe the purpose of the transaction for future reference.

- Review the journal entry to ensure accuracy, then click Save & Close.

Step 4: Monitor Total S-Corp Distributions

- Regularly check that total distributions do not exceed the company’s accumulated earnings and profits:

- Go to the Reports menu and run the Balance Sheet report to review retained earnings.

- Compare retained earnings to distribution amounts.

- Distributions exceeding profits may lead to negative tax consequences for shareholders. Always consult a tax professional if in doubt.

Step 5: Categorize S-Corp Transactions Consistently

- If recording distributions as an expense or liability on the balance sheet:

- Open the Expense menu and review the list of transactions.

- Update the payee or category to align with “Shareholder Distribution” for consistency.

- Ensure all entries reflect accurate terminology, such as “Shareholder Distribution,” rather than generic terms like “Owner Distribution.”

Record the S-Corp Distribution Using Checks in QuickBooks Desktop

Step 1: Open QuickBooks Desktop

- Open by launching QuickBooks Desktop.

- Navigate to the Banking menu and select “Write Checks.”

Step 2: Enter the Check Details

- Choose the appropriate bank account from which you will issue the distribution.

- Enter the name of the shareholder who is receiving the distribution.

- Select the correct account from your Chart of Accounts.

- Input the amount of the distribution and add a memo to describe the transaction.

- Click Save to record the check.

How Do You Record S-Corp Distribution in QuickBooks Online?

To record S-Corp distributions in QuickBooks Online, you transfer retained earnings to the shareholder’s equity account and then distribute it to shareholders. This process involves writing checks and recording them against the equity account on the “Expenses” tab of the check. Since distributions reduce equity rather than being considered expenses, they won’t affect the Net Income on the Profit and Loss statement.

Step-by-Step Process to Record S-Corp Distribution in QuickBooks Online

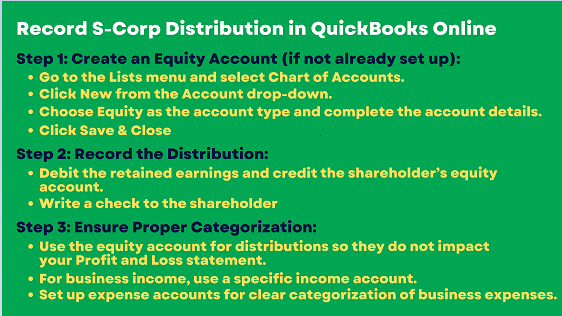

Step 1. Create an Equity Account (If Not Already Set Up)

- Go to the Lists menu and select Chart of Accounts.

- Click New from the Account drop-down.

- Choose Equity as the account type and complete the account details.

- Click Save & Close.

Step 2. Record the Distribution

- Debit the retained earnings and credit the shareholder’s equity account.

- Write a check to the shareholder:

- Go to the “Expenses” tab on the check.

- Assign the shareholder’s equity account for proper recording.

Step 3. Ensure Proper Categorization

- Use the equity account for distributions so they do not impact your Profit and Loss statement.

- For business income, use a specific income account.

- Set up expense accounts for clear categorization of business expenses.

S-Corp Account Setup in QuickBooks: Income, Equity, and Expenses

| Income Account | Equity Accounts | Expenses |

|---|---|---|

| Create a specific income account for the S-Corp’s revenue. Use this account to record your invoiced amounts. | Maintain the Shareholder Capital and Shareholder Distribution equity accounts as you have set them up. | Set up expense accounts to categorize your business expenses effectively. |

Managing S-Corp Transactions in QuickBooks: Income, Salary, and Distribution

| Invoice Entry | Salary Payment | Distribution |

|---|---|---|

| When you receive payments from clients, use the income account designated for the S-Corp’s revenue. | Process salary payments through your ADP service. This transaction will reduce the shareholder Capital equity account and record the salary expense. | Record the transaction directly from the Shareholder Distribution equity account for the shareholder distribution. |

Establishing an income account allows you to generate reports on revenue specific to the S-Corp. The equity accounts monitor the flow of funds between the S-Corp and shareholders.

When running a Profit and Loss (P&L) report, the income from the designated income account, minus salaries and other business expenses, will provide a clear picture of the S-Corp taxable net income.

Problems Faced by Users When Recording S-Corp Distributions

Users often encounter challenges while recording S-Corp distributions, including:

- Shareholder Basis Tracking: Accurately maintaining stock basis records is critical for correct tax computation but often goes overlooked, potentially leading to errors.

- Proportional Distribution: Managing and verifying distributions based on ownership stakes can become complex, particularly with multiple co-owners, requiring careful attention.

- Differentiating Distributions: Confusion between distributions, salaries, and loans can lead to misclassification, impacting tax compliance and potentially triggering audits.

- Software Limitations: QuickBooks, for example, requires manual input or configuration, which increases the likelihood of errors in data entry or calculation.

- Tax Implications: Misreporting distributions can result in IRS audits, penalties, and additional financial burdens, highlighting the importance of precise record-keeping.

Debiting the Shareholder Distributions account and crediting the Cash account is the standard journal entry for documenting a shareholder distribution.

Example of Journal Entry in Shareholders Distributions

Let’s say an S-Corp chooses to give a shareholder $10,000.

The entry in the journal would be:

| Account | Debit | Credit |

|---|---|---|

| Shareholder Distributions Cash | $10,000 | $10,000 |

This entry shows a decrease in the company’s cash and, via the Shareholder Distributions account, a corresponding decline in the equity held by shareholders.

Checks or bank transactions used to pay shareholders are usually utilized to record distributions in QuickBooks instead of requiring a separate journal entry. The transaction’s terms allocate the distribution amount to the shareholder’s equity account.

In order to prevent any tax repercussions, distributions should also be made in line with the ownership proportion of each shareholder. They should not surpass the total earnings and profits of the business.

IRS Requirements of S-Corporation

To qualify for a S Corporation, the IRS requires compliance with specific criteria:

- Eligibility:

- The corporation should be domestic and not possess 101 shareholders.

- All the shareholders should be American citizens or residents of America.

- The company cannot have more than 100 shareholders.

- The shareholders can only be individuals, estates, and certain trusts; the company can have only one type of stock.

- Election: Send Form 2553, “Election by a Small Business Corporation,” executed by all shareholders on or before the 15th day of the third month of the tax year.

- Tax Filing: Every year, corporations file Form 1120-S, which includes income, deductions, and credits. They also prepare Schedule K-1 for shareholders’ tax returns.

- Reasonable Compensation: Employer-shareholders must recognize that they must offer their employees a reasonable wage that is subject to payroll tax only.

- Compliance: To avoid automatically revoking the S Corporation status, it is important to keep record books up to date, meet the state’s tax requirements, and follow the Internal Revenue Service rules.

| Form | Purpose |

|---|---|

| Form 2553 | Election by a Small Business Corporation – Used to elect S-Corp status. All shareholders must file this on or before the 15th day of the third month of the tax year. |

| Form 1120-S | U.S. Income Tax Return for an S Corporation – Filed annually by the corporation to report income, deductions, and credits. |

| Schedule K-1 | Shareholder’s Share of Income, Deductions, Credits, etc. – Prepared with Form 1120-S and given to each shareholder for their personal tax return. |

| Form W-2 | Wage and Tax Statement – Used to report wages paid to employees, including shareholder-employees, subject to payroll tax. |

| Form 941 | Employer’s Quarterly Federal Tax Return – Used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees’ paychecks. |

How to File the S-Corp Taxes?

To file S Corporation taxes, you first need to complete Form 1120-S, which reports the corporation’s income, deductions, and credits. This form is due by the 15th day of the third month (Calendar month) after the close of the tax year, for example, March 15 for calendar-year corporate taxpayers. You can file Form 1120-S online or on paper using the IRS website.

After that, the Schedule K-1 (Form 1120-S) should be provided to each shareholder with the same due dates. It presents the shareholders with their income, deductions, and credits to be declared on the personal tax returns of the corporation. Every single shareholder is required to complete a personal income tax return with respect to his share of the income.

If, in any case, there is an employee, file Form 941 quarterly for payment of payroll taxes and Form 940 annually for federal unemployment tax. Further, check for state tax regulations; some states are known to require S-Corps to meet specific filing standards.

S-Corp Bookkeeping In QuickBooks

S-corp must engage in regular business transactions throughout the year to comply with state and year-end tax reporting obligations. External parties like lenders or investors may also request access to the company’s books for credit assessments. Managing the general ledger is essential, typically requiring monthly updates to manage accounting responsibilities, with frequency adjusted based on business activity levels.

The primary duty of an S-corp involves booking to monitor revenue generation through various means, including:

1. Income

Income accounting is considered the most crucial fundamental task for an S-corp. This includes revenue from service sales, rent, interest, capital gains, and asset sales. Categorizing income by type can enhance marketing strategies effectively.

2. Sale of Company Assets

This section is required to record separately from income and expenditure. When utilizing accounting software, any information about assets and liabilities is reported on the balance sheet. The worth of the asset is confirmed at the time of acquisition, and the worth of the asset is equivalent to the acquisition fees required to secure the property. Record the beginning price of the obligation. Assets are modified according to depreciation, and debt payments are adjusted to liabilities.

3. Cost

This includes any expenses that the company pays because of operational and legal requirements. Goods and services paid to loans, interest rates, suppliers, wages, and taxes are a few examples of items. The company utilizes accounting software, and revenue and expense transactions will be displayed in the income statement.

4. Responsible for their Seats in the Company

Shareholders of an S-Corp are accountable for their ownership stakes in the company. The shareholder basis typically starts with the amount they invest to acquire shares. This basis increases with announced profits and decreases with recorded losses at year-end. The S-Corp aims to inform its shareholders about these accounting obligations.

Advanced Considerations When Recording S-Corp Distributions in QuickBooks

Understanding the basics is just the beginning—mastering S-Corp distribution tracking in QuickBooks requires deeper attention to detail. From correcting errors to audit-proofing entries, these advanced topics help you maintain clean records, ensure tax compliance, and build financial transparency. Explore the following key areas to strengthen your bookkeeping process and avoid costly missteps.

How to Correct Mistaken S-Corp Distributions in QuickBooks?

Mistakes in S-Corp distributions can trigger IRS scrutiny, affect equity accuracy, and distort financials. To fix this in QuickBooks, first identify the incorrect entry using the transaction history (1), then reverse it using a general journal entry (2)—debiting or crediting the Shareholder Distribution account as needed. Next, re-enter the correct amount through Write Checks or Journal Entry (3) to ensure clarity. Always cross-check your Balance Sheet (4) and Equity Summary reports (5) after corrections. Keeping a detailed memo with who, what, and why (6) in each adjustment helps prevent confusion during audits or tax season.

Audit-Proofing Your S-Corp Distribution Entries in QuickBooks

To audit-proof your S-Corp distributions, you need consistency, clarity, and compliance. Start by using a dedicated equity account (1) like “Shareholder Distribution” for every payout—avoid using expense categories. Each entry should include a detailed memo (2) with shareholder name, ownership percentage, and purpose. Use journal entries or checks (3)—never both—for one distribution to avoid duplication. Back every transaction with supporting documents (4) like board resolutions or profit statements. Finally, schedule a quarterly review (5) of your Equity, Retained Earnings, and Cash Flow reports to ensure your books align with IRS standards and minimize red flags.

Reconciling distributions ensures your year-end financials reflect accurate profit sharing, retained earnings, and cash movement. Start by running the Profit & Loss and Balance Sheet reports (1) to verify total net income and distribution entries. Compare each shareholder’s distribution amount (2) against their ownership percentage and declared profits. Use the General Ledger (3) to trace discrepancies between actual payouts and recorded equity movements. Adjust entries using journal corrections if amounts differ or were misclassified. Finally, prepare a year-end equity statement (4) summarizing total capital, withdrawals, and earnings per shareholder for cleaner Schedule K-1 (5) preparation.

Setting Up Alerts and Reminders for Recurring S-Corp Distributions

To stay compliant and timely, set distribution alerts using QuickBooks’ built-in reminders (1) or integrate tools like Google Calendar or Microsoft Outlook (2) for monthly triggers. Define clear distribution dates, such as the 15th of every quarter (3), to align with board approvals and profit evaluations. Automate internal tasks using QuickBooks’ Recurring Transactions feature (4), labeling each entry with the shareholder’s name and percentage. Use email reminders to alert stakeholders of upcoming payouts, required documentation, or missed entries (5). This structured routine avoids delays, maintains accuracy, and keeps you IRS-ready year-round.

Role of Accountant Review in Finalizing S-Corp Distributions

An accountant’s review prevents costly errors, ensures tax accuracy, and validates compliance. Before finalizing distributions, have your accountant verify retained earnings availability (1), check shareholder equity balances (2), and review the ownership ratio for fairness (3). They’ll assess whether W-2 compensation and distributions (4) are proportionate and legally acceptable. Accountants also validate if QuickBooks entries align with GAAP standards and IRS expectations (5), reducing audit risks. Their review strengthens your year-end reports, supports K-1 generation, and adds a professional layer of accountability to your books.

Supporting Insights to Strengthen Your S-Corp Distribution Strategy in QuickBooks

Understanding distributions isn’t enough—how you document, analyze, and present them matters just as much. These supplementary topics help you tackle the overlooked areas that can affect compliance, valuation, and day-to-day bookkeeping accuracy. Dive into these practical insights to elevate your financial handling and future-proof your S-Corp records inside QuickBooks.

Difference Between Owner’s Draw vs. S-Corp Distribution in QuickBooks

Owner’s draw and S-Corp distributions may look similar but function very differently. In QuickBooks, owner’s draw (1) is used for sole proprietors and partnerships, reducing owner equity directly. In contrast, S-Corp distributions (2) apply only to shareholders and must follow ownership percentage rules. Distributions are not taxed as payroll (3), unlike salaries, but must be backed by profits and properly recorded in the equity section. Misclassifying draws as distributions or vice versa can lead to IRS penalties, misreported income, and audit risks (4)—always select the right account type for each business structure (5).

Impact of S-Corp Distributions on Business Valuation

S-Corp distributions directly affect retained earnings, equity balance, and investor perception. A high distribution rate (1) may signal strong profitability, but can also reduce reinvestment capacity (2)—lowering long-term growth potential. In QuickBooks, these transactions decrease shareholder equity (3), which is a critical metric in business valuation models. Consistently overdrawn distributions can distort net worth (4) and complicate loan approvals or sale negotiations. Keeping a balanced payout-to-profit ratio (5) ensures that your books reflect financial strength while maintaining valuation integrity for future deals or audits.

QuickBooks simplifies multi-shareholder distributions with equity tracking, ownership-based allocations, and clear reporting. Start by creating separate equity accounts for each shareholder (1) to track contributions and distributions accurately. Use ownership percentage data (2) to calculate payout amounts fairly, avoiding disproportionate allocations. Record each transaction through individual journal entries or checks (3) tied to the correct equity account. Run Shareholder Equity or Custom Reports (4) to review totals per stakeholder. This structure ensures compliance with IRS guidelines (5) and maintains transparency across all profit-sharing activities.

Best Practices for Documenting S-Corp Distributions for IRS Records

Proper documentation protects your S-Corp from audits, penalties, and financial confusion. Always include written board approval (1) before issuing any distribution, especially for amounts tied to retained earnings. In QuickBooks, attach supporting memos and transaction notes (2) to each distribution entry, specifying shareholder name, amount, and reason. Maintain a distribution log (3) outside QuickBooks that lists dates, ownership percentages, and payouts. Store bank statements or check copies (4) alongside digital entries for traceability. Lastly, reconcile all documents quarterly to ensure clean audit trails and K-1 alignment (5).

Using QuickBooks Custom Reports to Monitor S-Corp Equity Accounts

Custom reports in QuickBooks offer real-time insights into your S-Corp’s equity flow, shareholder activity, and compliance status. Use the Custom Transaction Detail Report (1) to filter by “Shareholder Distribution” account and track payouts. Create a Memorized Report (2) that auto-updates equity changes monthly for review. Apply class tracking or tags (3) if shareholders are managed as separate classes, simplifying multi-owner analysis. Include columns for amount, memo, and balance impact (4) to ensure transparency. Export reports quarterly for CPA review or IRS recordkeeping (5)—a powerful way to stay audit-ready and financially accurate.

Conclusion

Recording S-Corp distributions in QuickBooks is a careful process that must adhere to IRS guidelines. If the distribution is properly classified, the shareholders’ register is well-maintained, and the company has a clear understanding of the legal tax requirements, the firm will be in a strong position to comply with the law.

FAQ

What is the fundamental difference between an Owner’s Draw and an S-Corp Distribution in QuickBooks?

The key distinction lies in the business structure and tax treatment.

1. Owner’s Draw: This term applies to sole proprietorships and partnerships. The draw directly reduces the owner’s equity and is not taxed as payroll.

2. S-Corp Distribution: This applies only to corporations that have elected S-Corp status. These payments must be made to shareholders in proportion to their ownership percentage and must be backed by the company’s accumulated profits (retained earnings). Distributions are not subject to payroll taxes (Form W-2). Misclassifying a payment can lead to significant IRS penalties.Shareholder salaries and distributions must be accounted for separately to maintain compliance and avoid audits.

1. Salary Payment: Process this through a payroll service (like ADP or Gusto). It is recorded as a Business Expense and is subject to payroll taxes. In QuickBooks, this is reflected on your Profit and Loss (P&L) statement.

2. Distribution: Record this directly against a dedicated Shareholder Distribution Equity Account on the Balance Sheet. This is not an expense, does not appear on your P&L, and does not affect your net income. This distinction is critical for establishing “reasonable compensation” required by the IRS.

What is the correct journal entry to record an S-Corp distribution in QuickBooks Desktop?

The standard journal entry for documenting a shareholder distribution records a decrease in the company’s cash and a corresponding decline in shareholder equity.

The entry involves:

1. Debit: Shareholder Distribution Equity Account (for the distribution amount).

2. Credit: Cash or Bank Account (for the distribution amount).Example: For a $10,000 distribution:

A. Debit Shareholder Distributions: $10,000

B. Credit Cash: $10,000The use of a check in QuickBooks automatically performs this journal entry.

S-Corp distributions must be paid out strictly based on each shareholder’s ownership percentage (capital ratio). This is a foundational rule for maintaining S-Corp status.

1. IRS Risk: Disproportionate distributions violate the “single class of stock” rule.

2. Consequence: The IRS can automatically revoke the corporation’s S-Corp status, retroactively converting it to a C-Corporation. This subjects all previous profits (and likely the distributions) to double taxation, incurring severe penalties and back taxes.For S-Corporations, compliance involves specific annual and election forms:

1. Form 2553: Election by a Small Business Corporation. Used to elect S-Corp status. All shareholders must sign this.

2. Form 1120-S: U.S. Income Tax Return for an S Corporation. Filed annually by the corporation to report income, deductions, and credits.

3. Schedule K-1 (Form 1120-S): Shareholder’s Share of Income, Deductions, Credits, etc. Prepared with Form 1120-S and given to each shareholder for their personal tax return.

4. Form W-2: Wage and Tax Statement. Used to report wages paid to employees, including shareholder-employees.How can I “audit-proof” my S-Corp distribution entries in QuickBooks?

Audit-proofing requires consistency, clarity, and documentation to prove compliance with the IRS’s reasonable compensation and proportional distribution rules.

Key best practices include:

1. Dedicated Equity Account: Use a specific account like “Shareholder Distribution Account” for every payout; never use an expense category.

2. Detailed Memo: Include the shareholder’s name, their ownership percentage, and the purpose (e.g., “Q4 2024 Profit Distribution, 50% owner”) in the memo field for every transaction.

3. Supporting Documents: Back every transaction with a written document, such as a Board Resolution or a summary of retained earnings proving the funds were available.

4. Quarterly Review: Run and review your Balance Sheet (Equity and Retained Earnings) and Profit and Loss reports quarterly to ensure alignment.What if my total S-Corp distributions exceed the company’s retained earnings (profits)?

This is a red flag that can have serious tax consequences. Distributions should not surpass the company’s accumulated earnings and profits.

1. Tax Impact: Distributions exceeding earnings are typically treated as a return of capital to the shareholder. This reduces the shareholder’s stock basis.

2. Negative Basis: If distributions exceed a shareholder’s stock basis, the excess amount becomes taxable to the shareholder as a capital gain.

3. Mitigation: You must regularly monitor the Balance Sheet report to compare Retained Earnings against the total distributions. Always consult a tax professional immediately if distributions risk exceeding profits or stock basis.

Disclaimer: The information outlined above for “How to Record S-Corp Distribution in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.